Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

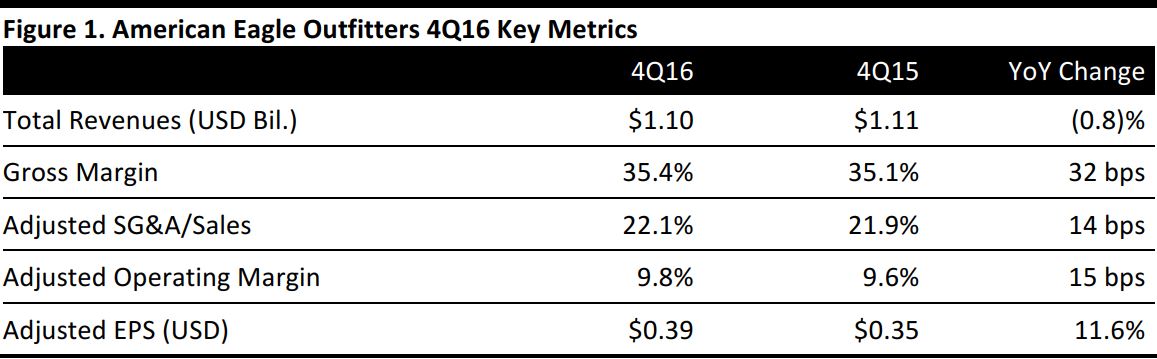

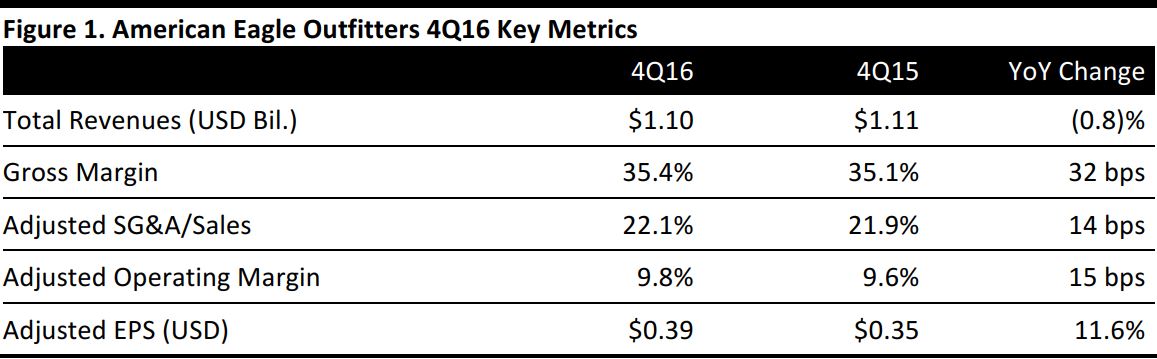

4Q16 Results

American Eagle Outfitters reported 4Q16 total revenues of $1.10 billion, down 0.8% year over year and slightly below the consensus estimate. Total comps were up 0.4%.

Adjusted EPS was $0.39, versus $0.35 in the year-ago quarter and beating the consensus estimate by a penny. GAAP EPS, which includes asset impairment and restructuring charges, was $0.30, versus $0.42 in the year-ago quarter.

Highlights from the quarter include:

- Women’s apparel, men’s and women’s, jeans and bottoms continued to grow.

- American Eagle jeans gained market share, ranking number one among 15–25-year-olds, with a 33% share of specialty store brands.

- Aerie maintained strong momentum, posting double-digit growth and gaining market share.

- Core intimates and apparel showed particular strength, and the company’s customer base continued to grow.

- Since early 2014, the company’s priorities have centered on superior merchandise infused with innovation, quality fabrics and outstanding value, and its omnichannel strategy, in which it has invested significantly.

Performance by Segment

- American Eagle total brand comps declined by 1%, compared with a 3% increase in the year-ago quarter. Comps increased by 1% for the full year, compared with a 7% increase the prior year.

- Aerie total brand comps were up 17%, compared with 25% in the year-ago quarter. Comps increased by 23% for the full year, compared with 20% the prior year.

FY16 Results

American Eagle Outfitters reported FY16 total revenues of $3.61 billion, up 2.5% year over year. Total comps were up 3% for the year.

Full-year adjusted EPS was $1.25, versus $1.01 in the previous year and beating the consensus estimate by a penny. GAAP EPS, which includes asset impairment and restructuring charges, was $1.16, versus $1.11 in the prior year.

During the coming year, management plans to:

- Further strengthen the brick-and-mortar fleet with select store closures, marketing consolidations and efforts to improve store productivity.

- Conduct deeper analytical reviews to position its brands better.

- Work to better leverage its omnichannel tools to deliver the best customer experience along with strong financial returns.

- Expand its marketing campaigns and launch a new loyalty program aimed at customer acquisition and retention.

- Fuel the growth of Aerie with investments in products, marketing, digital and store growth.

Outlook

For 1Q17, the company expects:

- Comparable store sales to be flat to down by low single digits.

- Adjusted EPS of $0.15–$0.17, compared with $0.22 in the year-ago quarter and consensus of $0.21.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology