Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

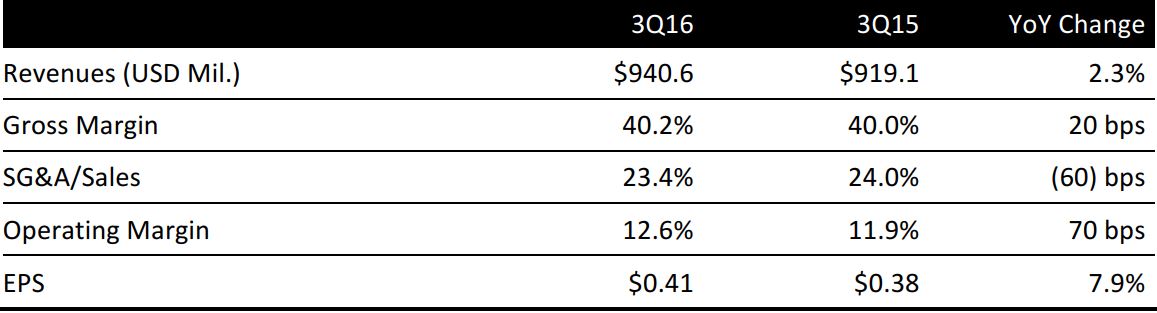

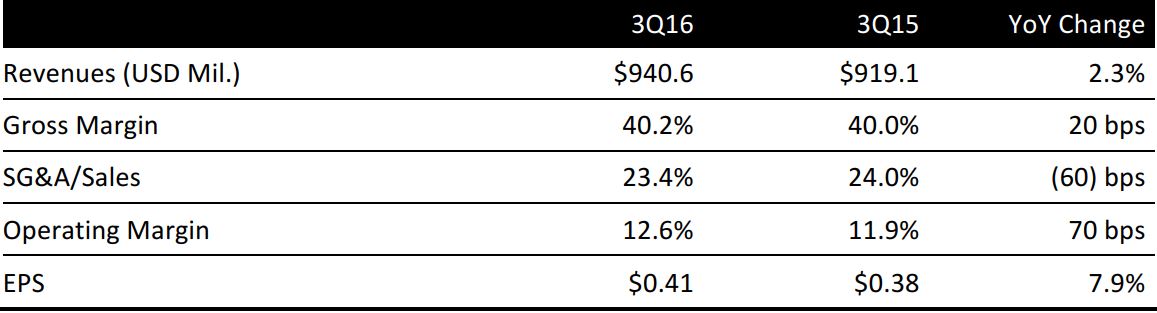

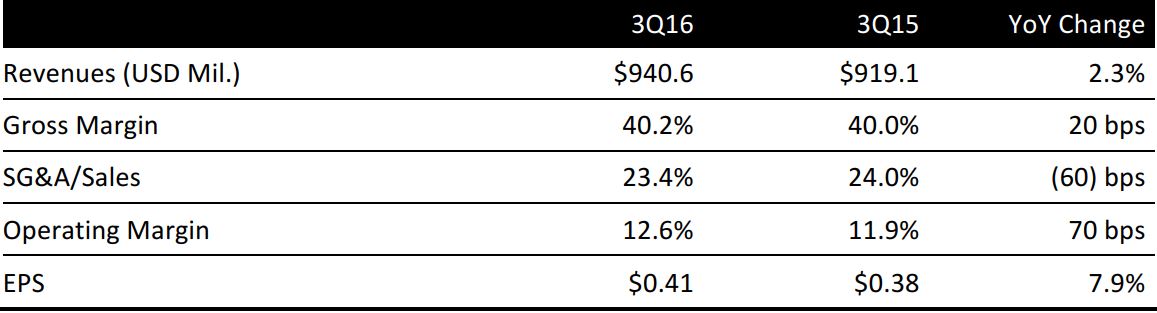

American Eagle Outfitters reported 3Q16 EPS of $0.41, in line with the consensus estimate.

Total revenues were $940.6 million versus expectations of $939.6 million. Comps were up 2%, but came in below expectations of 2.9%. AE brand comps were up 0.4%, while Aerie comps were up 21%, marking the sixth consecutive quarter in which Aerie posted comps above 20%. The company noted strength in the digital channels in the period.

Aerie’s competitors were highly promotional during the quarter, but the company held prices at Aerie and saw momentum, with customers appreciating the value proposition.

The company was pleased with results over the Thanksgiving weekend. Traffic improved over the holiday, with a lesser decline, which management attributed to the quality of the product, which is trend-right and offers perceived value. The holiday season performance to date is encouraging, and customers are embracing gift items. The company is planning a robust spring transition floorset in mid-December—earlier than last year—to drive excitement during the peak holiday selling season.

Management was optimistic about trends in women’s apparel and commented on some of the silhouettes changing.

2016 OUTLOOK

Management provided 4Q16 EPS guidance of $0.37–$0.39 versus consensus of $0.46. Comps are expected to range from flat to up low single digits versus consensus of 3.8%.

Average unit retail is expected to be higher in 4Q16, similar to what the company saw in 3Q16, and the trend is expected to continue into 2017 as well.

Management noted that it is taking a cautious view because the retail climate, particularly in malls, is tough, and the pace of traffic choppy.