Source: Company reports

2Q 2016 RESULTS

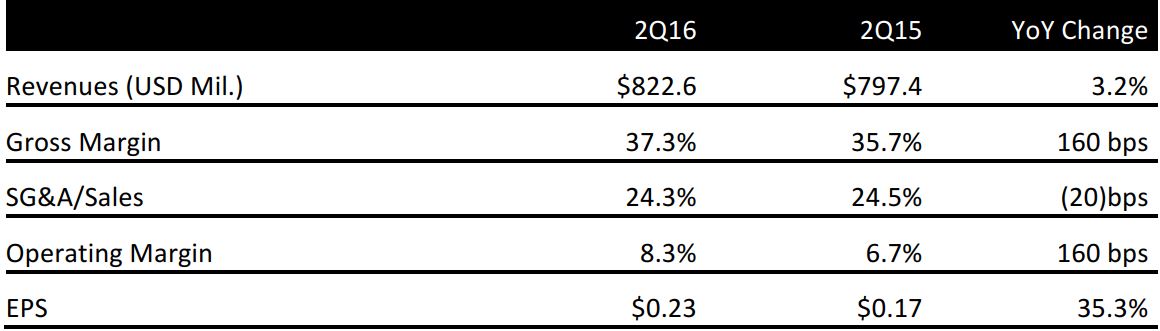

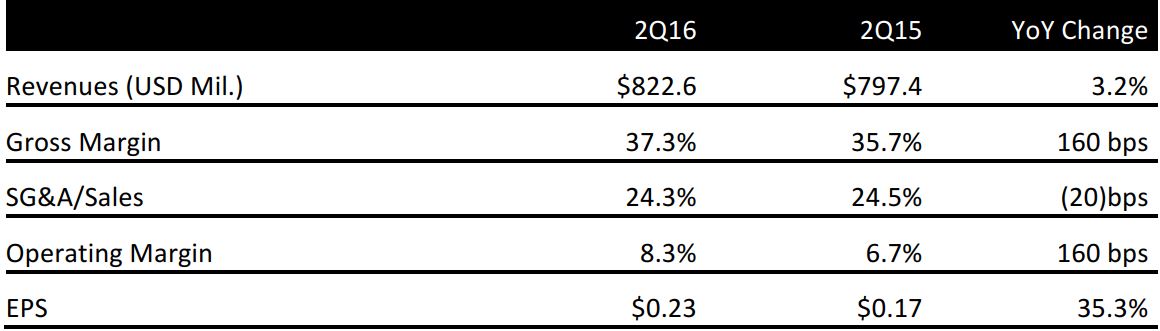

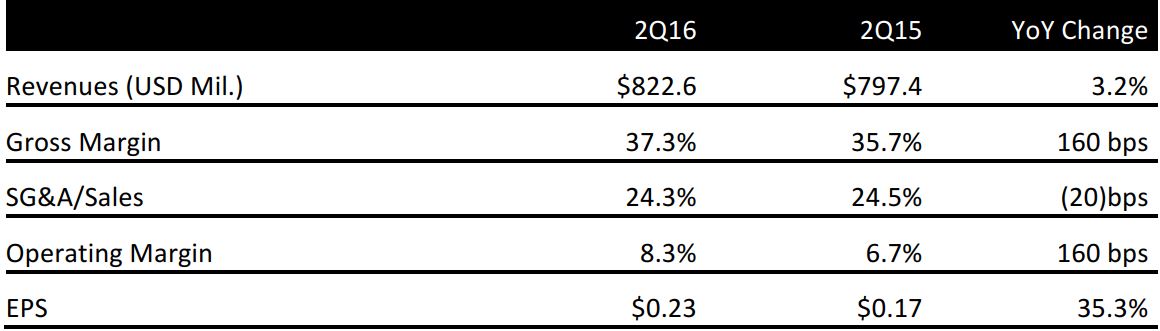

American Eagle Outfitters reported 2Q 2016 EPS of $0.23, up 35% compared to $0.17 a year ago, exceeding expectations of $0.21. This marks the eighth consecutive quarter of profit improvement for American Eagle. Total comps were up 3% driven by a mid-single-digit average unit retail price and more units per transaction.

Total revenues were $822.6 million, up 3.2% from last year and beat the consensus of $820.2 million. Management is pleased to see the investments in merchandise innovation and technology are paying off.

Gross margin improved by 160 basis points to 37.3%. The improvement is driven by lower cost and higher realized selling prices, which was partially offset by increased delivery costs from rising e-commerce sales. The omni-channel evolution is a priority for American Eagle, as the teen-retailer consistently saw higher spending from cross-channel shoppers. Total inventory as of 2Q 2016 grew at the same pace as total sales at 3%, partially due to increased receipts to support its marketing programs.

American Eagle brand comps were up 1% and missed the consensus of 1.8%. Sales growth at American Eagle was driven by strong online sales, higher selling prices and increased transaction size. Women’s at American Eagle posted positive mid-single-digit growth. Strong performing categories included denims, shorts, dresses, and woven tops. Comps of men’s categories at American Eagle were down low single-digits with denim, shorts, woven shorts and underwear the better performing categories.

Sales at Aerie saw strong momentum and reported the fifth consecutive quarter of comps above 20%, driven by an increased number of transactions and larger order sizes. Strong performing categories were intimate swim, accessories and apparel. The brand plans to launch a new sports and yoga line this fall.

In terms of overall promising categories, the company’s bottoms business has never been stronger. It expects to see these categories benefit from the back-to-school season this year. The tops business was not as strong.

3Q 2016 OUTLOOK

Management guided for a low-single-digit comps increase and EPS to be between $0.40–$0.41.

Given the $61 million capital expenditure year-to-date, the company now expects capital expenditures for the year to be $160 million, or at the lower end of the prior guidance of $160–$170 million.

Management said inventory at cost is expected to rise in the single-digits in Q3 2016 and inventory management will be a key area of focus for the company.

For store count, the company guided for a total of 1,045–1,050 stores for fiscal year 2016, similar to the current level of 1,047. In particular, the Aerie brand plans to open about 65 stores in the next 18 months in under penetrated markets. About 55–65 stores will be remodeled by the end of the year, of which 37 have been completed. International license locations are expected to reach 181, up from the current 158. The company picked up one or two points of comps at locations where its competitors closed stores. This will likely benefit American Eagle over time.