DIpil Das

[caption id="attachment_98651" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

Amazon.com reported third quarter earnings, with profit falling for the first time in more than two years.

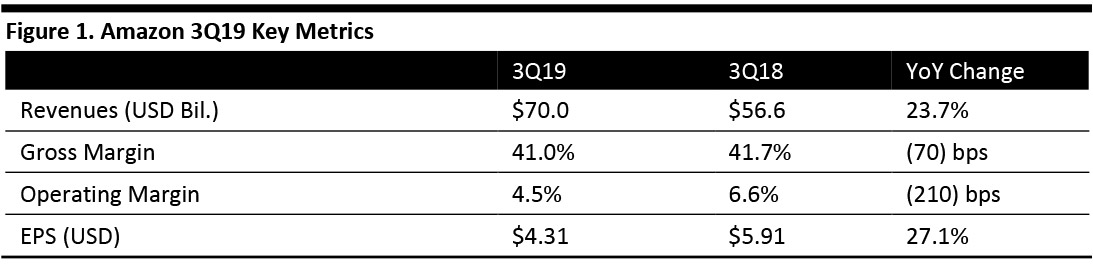

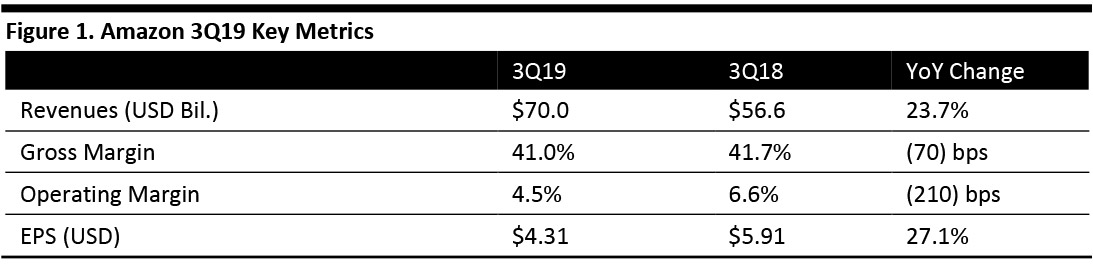

Amazon.com reported 3Q19 revenues of $70.0 billion, up 23.7% year over year and above the consensus estimate of $68.8 billion.

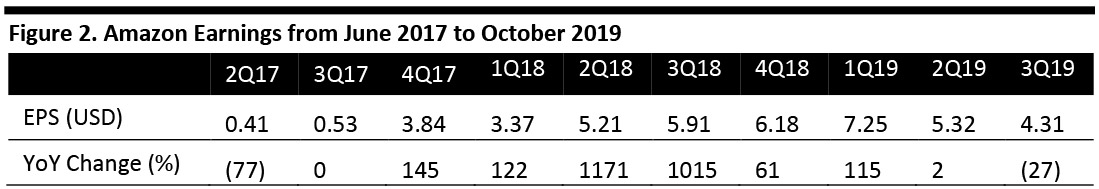

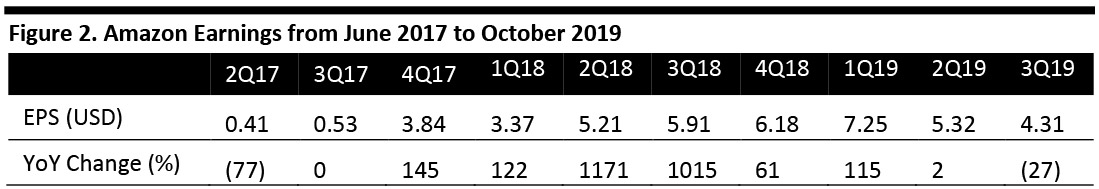

But earnings per share (EPS) declined from $5.91 to $4.31 a share, the first time Amazon earnings have shrunk year-over-year since June 2017, and below the consensus of $4.59 a share, according to FactSet.

[caption id="attachment_98648" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Amazon.com reported third quarter earnings, with profit falling for the first time in more than two years.

Amazon.com reported 3Q19 revenues of $70.0 billion, up 23.7% year over year and above the consensus estimate of $68.8 billion.

But earnings per share (EPS) declined from $5.91 to $4.31 a share, the first time Amazon earnings have shrunk year-over-year since June 2017, and below the consensus of $4.59 a share, according to FactSet.

[caption id="attachment_98648" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

By segment, North America revenues were $42.6 billion, up 24.1% year over year, posting operating income of $1.3 billion, compared to $2.0 billion in the year-ago quarter. North America business continues to drive net sales, but operating income declined due to significant investments in one-day shipping.

International revenues were $18.3 billion, up 18.0% year over year, posting an operating loss of $386 million, compared to a loss of $385 million in the year-ago quarter.

AWS revenues were $9.0 billion, up 34.7% year over year, with operating income of $2.3 billion, compared to $2.1 billion in the year-ago quarter. AWS revenue growth slowed, to 34.7% from 37.3% the prior quarter, but still accounted for 71.6% of Amazon’s corporate operating income. (Microsoft similarly reported 59% growth in Azure revenue, catching up to Amazon’s AWS).

Other Segment Data

Source: Company reports/Coresight Research[/caption]

By segment, North America revenues were $42.6 billion, up 24.1% year over year, posting operating income of $1.3 billion, compared to $2.0 billion in the year-ago quarter. North America business continues to drive net sales, but operating income declined due to significant investments in one-day shipping.

International revenues were $18.3 billion, up 18.0% year over year, posting an operating loss of $386 million, compared to a loss of $385 million in the year-ago quarter.

AWS revenues were $9.0 billion, up 34.7% year over year, with operating income of $2.3 billion, compared to $2.1 billion in the year-ago quarter. AWS revenue growth slowed, to 34.7% from 37.3% the prior quarter, but still accounted for 71.6% of Amazon’s corporate operating income. (Microsoft similarly reported 59% growth in Azure revenue, catching up to Amazon’s AWS).

Other Segment Data

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Amazon.com reported third quarter earnings, with profit falling for the first time in more than two years.

Amazon.com reported 3Q19 revenues of $70.0 billion, up 23.7% year over year and above the consensus estimate of $68.8 billion.

But earnings per share (EPS) declined from $5.91 to $4.31 a share, the first time Amazon earnings have shrunk year-over-year since June 2017, and below the consensus of $4.59 a share, according to FactSet.

[caption id="attachment_98648" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Amazon.com reported third quarter earnings, with profit falling for the first time in more than two years.

Amazon.com reported 3Q19 revenues of $70.0 billion, up 23.7% year over year and above the consensus estimate of $68.8 billion.

But earnings per share (EPS) declined from $5.91 to $4.31 a share, the first time Amazon earnings have shrunk year-over-year since June 2017, and below the consensus of $4.59 a share, according to FactSet.

[caption id="attachment_98648" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

By segment, North America revenues were $42.6 billion, up 24.1% year over year, posting operating income of $1.3 billion, compared to $2.0 billion in the year-ago quarter. North America business continues to drive net sales, but operating income declined due to significant investments in one-day shipping.

International revenues were $18.3 billion, up 18.0% year over year, posting an operating loss of $386 million, compared to a loss of $385 million in the year-ago quarter.

AWS revenues were $9.0 billion, up 34.7% year over year, with operating income of $2.3 billion, compared to $2.1 billion in the year-ago quarter. AWS revenue growth slowed, to 34.7% from 37.3% the prior quarter, but still accounted for 71.6% of Amazon’s corporate operating income. (Microsoft similarly reported 59% growth in Azure revenue, catching up to Amazon’s AWS).

Other Segment Data

Source: Company reports/Coresight Research[/caption]

By segment, North America revenues were $42.6 billion, up 24.1% year over year, posting operating income of $1.3 billion, compared to $2.0 billion in the year-ago quarter. North America business continues to drive net sales, but operating income declined due to significant investments in one-day shipping.

International revenues were $18.3 billion, up 18.0% year over year, posting an operating loss of $386 million, compared to a loss of $385 million in the year-ago quarter.

AWS revenues were $9.0 billion, up 34.7% year over year, with operating income of $2.3 billion, compared to $2.1 billion in the year-ago quarter. AWS revenue growth slowed, to 34.7% from 37.3% the prior quarter, but still accounted for 71.6% of Amazon’s corporate operating income. (Microsoft similarly reported 59% growth in Azure revenue, catching up to Amazon’s AWS).

Other Segment Data

- Online store revenue was $35.0 billion, up 20.6%.

- Physical store revenue was $4.2 billion, down 1.3%.

- Third-party seller service revenue was $13.2 billion, up 27.1%.

- Subscription service revenue was $5.0 billion, up 34.0%.

- Other revenue was $3.6 billion, up 43.7%.

- Net sales of $80.0-86.5 billion (up 11-20%), below the consensus estimate of $87.39 billion. This figure includes an unfavorable 80 basis point-impact from foreign exchange.

- Operating income of $1.2-2.9 billion versus $3.8 billion and below the $4.2 billion consensus estimate.