Introduction

From drone delivery to Dash buttons, we frequently read about Amazon’s innovations and incremental changes that deliver greater convenience to customers. Yet these “good news” stories are countered by some shoppers’ perceptions that the company’s delivery services and, in some cases, addition of extra charges, are disappointing.

In the UK, the bad news about Amazon has been piling up in recent months. This past holiday season in the UK, we saw a number of press reports detailing Prime members’ complaints about late deliveries, even as Amazon slapped new charges on some same-day Prime Now orders. These reports followed news of Amazon’s steady slippage in UK customer satisfaction rankings.

So, what, if anything, is going wrong? And is Amazon’s UK performance any indication of what may happen elsewhere, including in the US?

Satisfaction with Amazon Declines in the UK

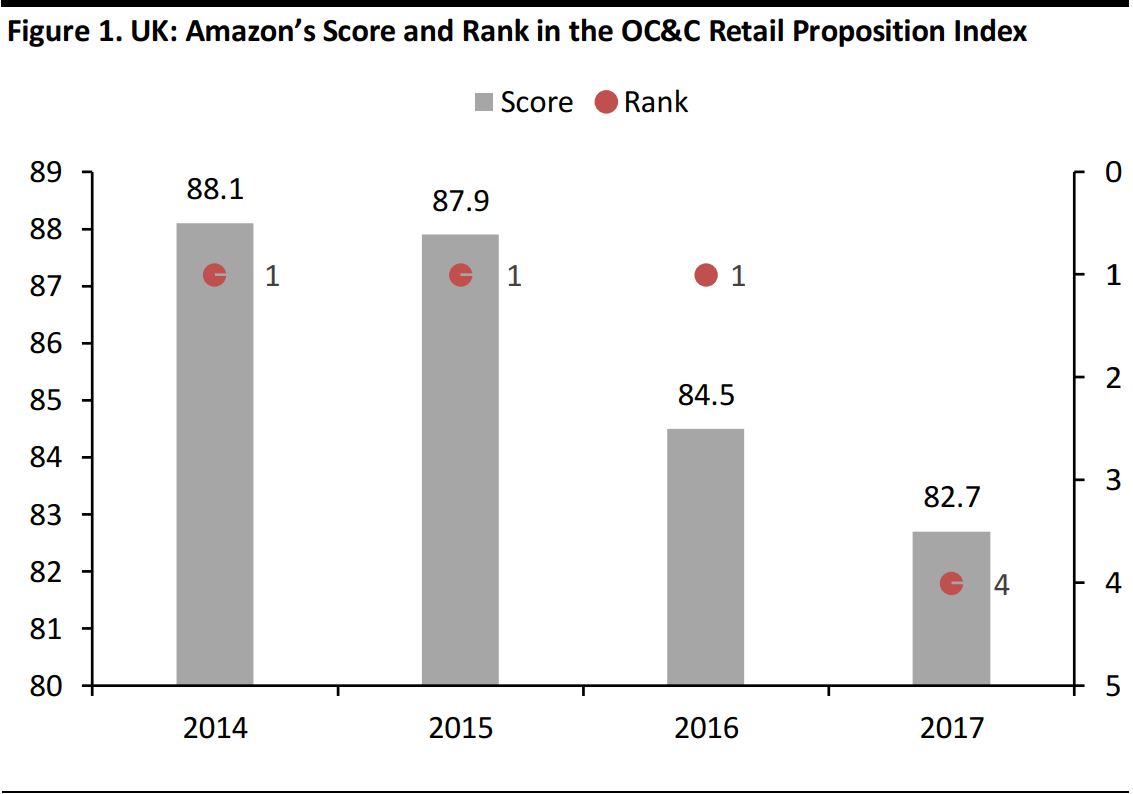

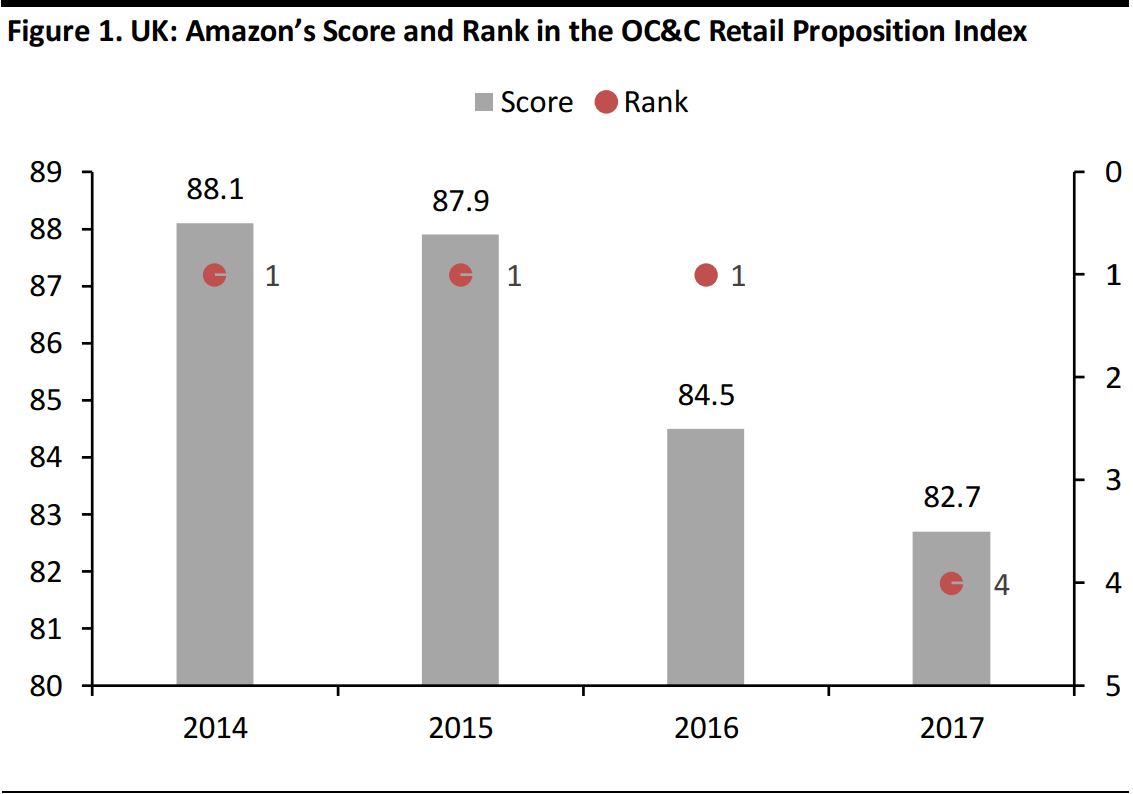

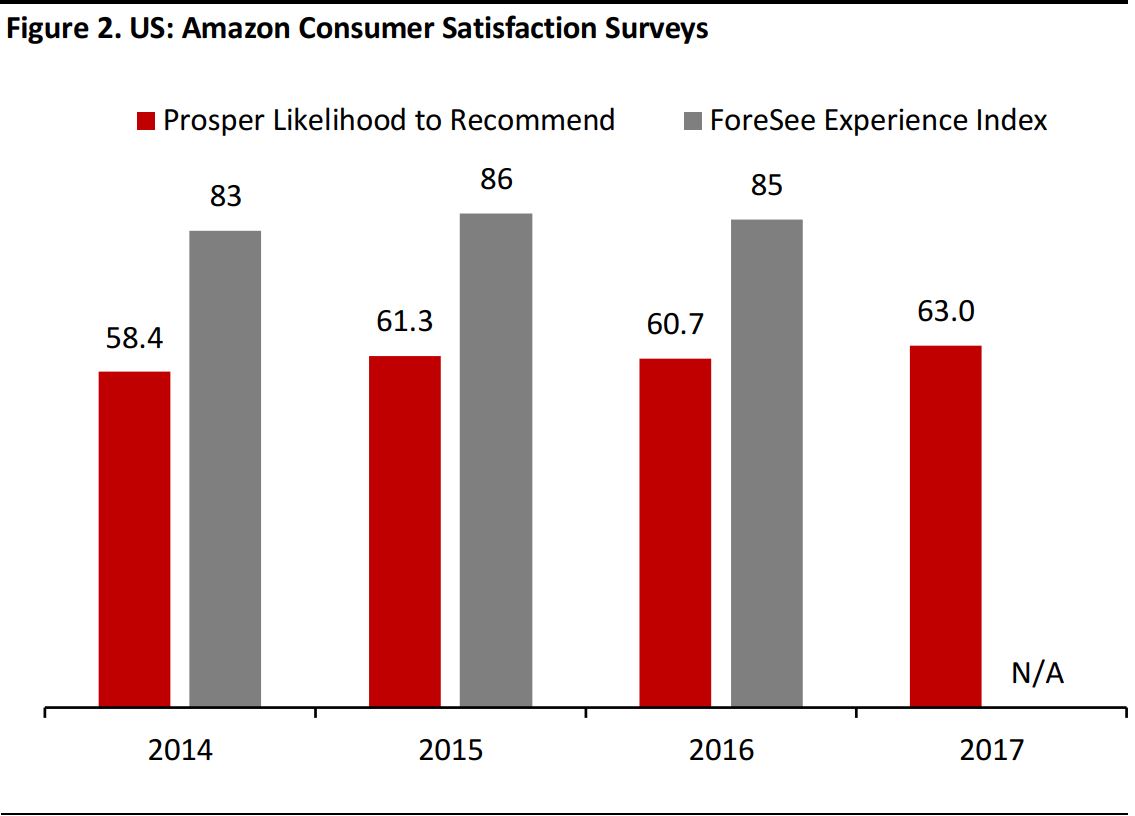

Amazon routinely leads rankings of favorite retailers in the US and Europe. In the UK, however, surveys suggest a steady decline in Amazon customer satisfaction in recent years, even while satisfaction levels have held up in the US.

In 2017, OC&C Strategy Consultants reported in its annual ranking of the UK’s favorite retailers that Amazon had lost its long-held first place. Amazon UK fell sharply to fourth place last year, behind Marks & Spencer Simply Food, John Lewis and Lush. Amazon had topped the list for a number of years previously.

OC&C’s Retail Proposition Index is based on an annual consumer survey that asks respondents to score the retailers they shopped during the year on a number of metrics, including price, range and service.

Source: OC&C Strategy Consultants

Customer experience firm ForeSee has recorded a similar medium-term decline in Amazon UK customer satisfaction. In 2016 (latest), Amazon UK scored 81 on ForeSee’s Experience Index, level with 2015 but down from 84 in 2013, 86 in 2012 and 85 in 2011 (there is no UK figure for 2014). ForeSee’s Experience Index is based on surveys of consumers who are asked to score retailers on a number of e-commerce metrics, using a 0–100 scale.

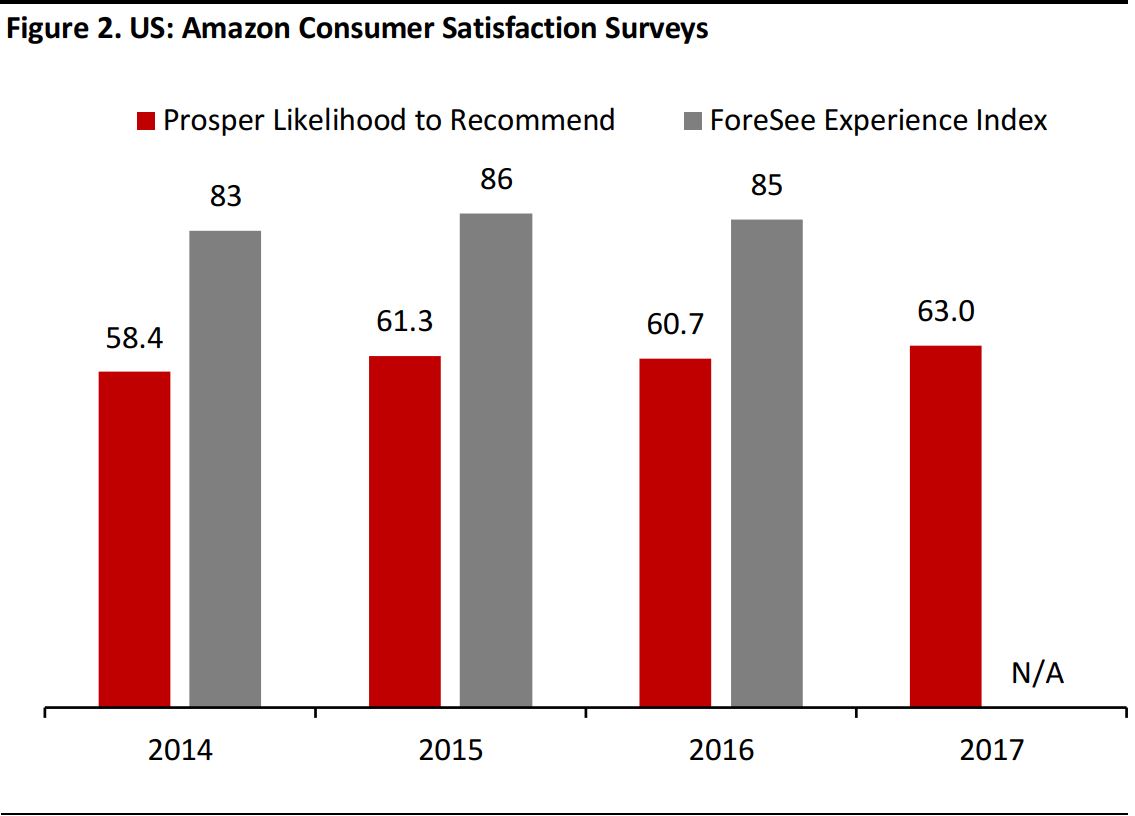

The declines in Amazon customer satisfaction metrics in the UK stand in contrast to the sustained satisfaction scores the company has seen in the US. As shown below, ForeSee recorded steady customer experience satisfaction levels for Amazon US up to 2016 (latest), and Prosper Insights & Analytics registered an uptick in the number of US consumers who said they are likely to recommend Amazon in 2017.

Prosper likelihood to recommend is an annual average of quarterly surveys.

Source: Prosper Insights & Analytics/ForeSee

Germany is Amazon’s largest market outside the US, and the company retained its crown as best online retailer in the country in 2017, according to a survey by business newspaper

Handelsblatt and ServiceValue Consulting. However, the proportion of respondents rating Amazon as Germany’s best online retailer slipped from 47.3% in 2016 to 40.4% in 2017, while a number of established multichannel retailers increased their share of the vote.

Where Has Amazon UK Slipped?

OC&C’s 2017 survey found that Amazon UK saw lower scores for value for money, quality, low prices, store look and feel, and customer service year over year. However, it recorded an increase in Amazon’s scores for the metrics of online offering, trust, mobile offering, choice and “suited to me” year over year.

Amazon UK’s biggest declines in scores were for the low prices and customer service metrics, per the OC&C survey. Below, we suggest some developments that may have impacted UK respondents’ perceptions of Amazon’s offering, particularly in the areas of value and customer service.

- Failing to meet delivery expectations: In December, the UK’s Advertising Standards Authority (ASA) announced that it was considering investigating Amazon’s promise of free next-day delivery for UK Prime members. This followed what the ASA said was “a handful of complaints about Amazon parcel deliveries.” In a report about the ASA news, the BBC noted that it had been “inundated” with comments from Prime members reporting problems with deliveries. Although the complaints to the ASA came after the annual OC&C survey was conducted, we think these complaints probably represent ongoing dissatisfaction with the quality of some Amazon delivery services.

We think one likely reason for these complaints is that Amazon UK has been using some delivery firms that appear to provide lower quality services: certain UK courier services the company uses have poor reputations for delivery standards.

- Slapping on extra charges: A long-standing gripe among Amazon customers is that the company charges them to return some purchases. Anecdotal evidence suggests that these charges take many shoppers—including Prime members—by surprise, because it is not clear to them under what circumstances Amazon levies return fees and under which it offers free returns. Prime members accustomed to enjoying unlimited next-day delivery may be particularly aggrieved to discover that they must pay to return some of those orders.Additionally, in November, Amazon generated negative publicity by imposing a £3.99 fee and a £2 tip for Prime Now orders worth less than £40. Previously, deliveries were free for orders of £20 or more.

We think that the increased complexity of Amazon’s offering heightens the risk that customers will be surprised by delivery or return costs or by return policies. The increased presence of third-party sellers on Amazon creates this complexity, as their orders can be fulfilled by either the sellers themselves or by Amazon on their behalf. In addition, some third-party sales are not eligible for Prime delivery.

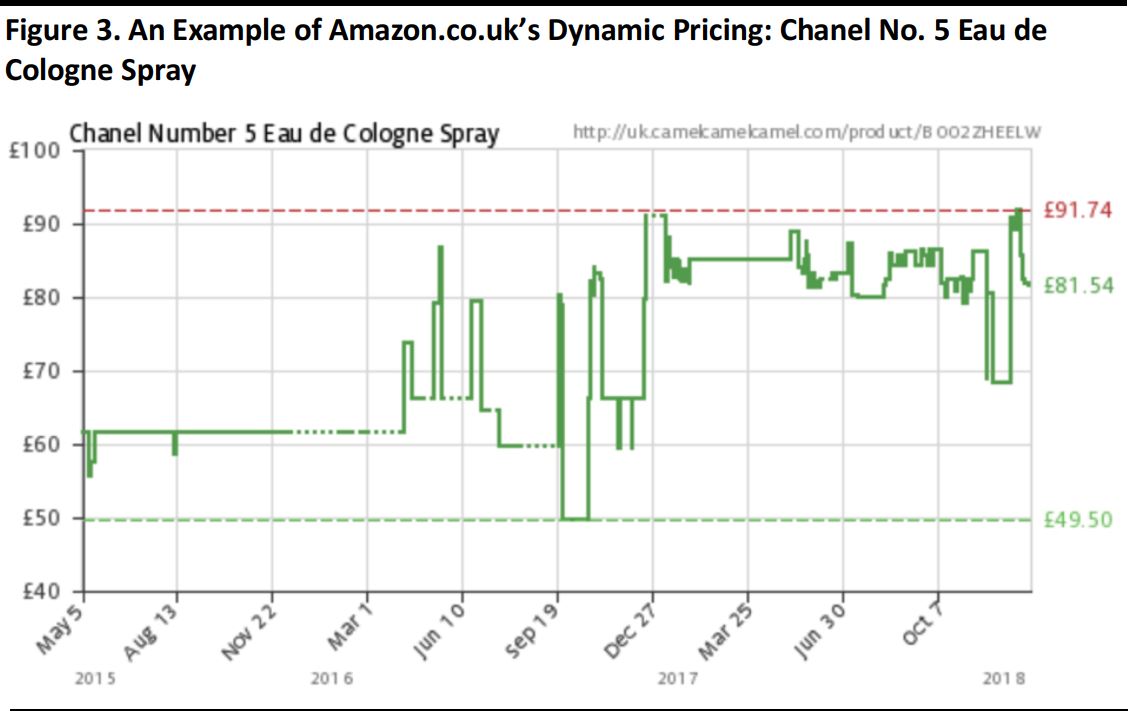

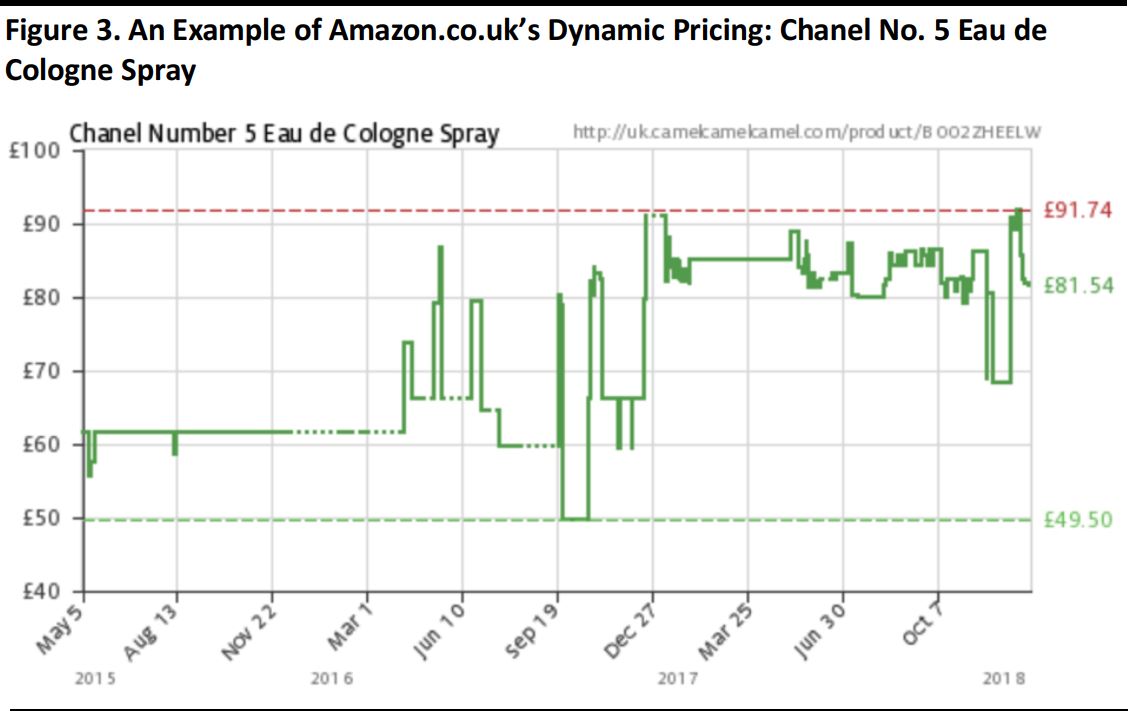

- Greater awareness of variable pricing: OC&C suggested that consumers’ value perceptions of Amazon may have declined as shoppers became more aware of how often the retailer changes its prices. Dynamic pricing may leave consumers feeling less confident that they are getting the best price, especially given the speed and scale of price changes.

Source: CamelCamelCamel/Amazon.co.uk

- Heightened competition: Amazon faces ever-strengthening competition from UK retailers, especially in terms of rapid delivery and collection services. In 2017, Tesco, Sainsbury’s and Marks & Spencer launched one-hour grocery delivery services that compete with Amazon Prime Now. Also in 2017, fashion pure play ASOS and leading electronics chain Currys PC World launched same-day delivery services. Other major retailers such as general merchandiser Argos had already rolled out same-day delivery services. In addition, next-day click-and-collect services are commonplace in UK retail, with major names such as Next and House of Fraser having cutoff times as late as midnight for next-day collection.This context yields two effects: first, Amazon’s promise of next-day delivery for Prime members is not in itself special (although it is, of course, free, once members have paid for Prime) and, second, consumers who have been spoiled by choice are likely to be more demanding and less forgiving of delivery failures.

ForeSee suggests that British consumers tend to have higher expectations regarding the digital customer experience than American consumers do. The company believes that this explains the gap between the Experience Index score of 85 that US customers gave Amazon in 2016 and the 81 awarded by UK customers.

Finally, it is possible that tax controversies have dented UK consumers’ trust in Amazon. The company is one of a number of tech firms whose low corporate tax payments have generated headlines in the UK. Moreover, in October 2017, the European Commission found that Luxembourg had given illegal tax benefits to Amazon, and it ordered the company to repay the amount in question. Despite these stories, OC&C reported that Amazon UK’s score on trust actually improved in the 2017 survey.

Is the UK a Canary in the Mine for Amazon Worldwide?

Could the reported reductions in Amazon customer satisfaction in the UK be an indication of what is to come in other countries, including the US? We think that is unlikely, as a number of factors make the UK situation distinct:

- Different postal and courier services: In the US, Amazon has traditionally used large, blue-chip carrier services such as the US Postal Service, FedEx and UPS, although it has recently been developing its own delivery capabilities. In the UK, Amazon uses a larger number of companies, including some less-prestigious courier services that appear to have poor reputations among consumers. Amazon’s US site lists just five major “common carrier” firms used for its deliveries, while its UK site lists 15 UK couriers and collection firms.

- Stronger omnichannel offerings: As we noted above, Amazon faces strong competition in delivery and collection services in the UK, where major brick-and-mortar retailers tend to have more developed omnichannel offerings than their counterparts do in the US. This likely leads UK consumers to make more comparisons among retailers and switch among them more frequently on the basis of fulfillment offerings and their own customer experiences.

- A different Prime proposition: In the UK, Prime promises next-day delivery, compared with two-day delivery in the US. This potentially increases British shoppers’ expectations and piles pressures on logistics in the UK.

- Lower Prime membership levels: According to trade publication Retail Week, 30% of UK adults were Prime members in June 2017, compared with 44% of US adults in July 2017, per Prosper Insights & Analytics.

So, the UK situation is different, although some of the factors we identified as possibly contributing to reduced satisfaction, such as increased complexity, are not unique to the UK. Also, as US brick-and-mortar retailers continue to refine their omnichannel services—including in-store collection and mobile offerings—Amazon may see some of its competitive advantages eroded and find that it does not always exceed rivals when shoppers take time to compare service offerings.

Key Takeaways

High-profile complaints about delivery failures underline the reputational risk companies face when using lower-quality service providers. Online retailers must continue to weigh the financial benefits of using such services with the cost in terms of customer experience and, so, customer loyalty.

One risk to Amazon’s customer satisfaction levels looks to be the increasing complexity of its offering: the mix of third-party sellers, first-party and third-party fulfillment, and Prime eligibility means that its customers now need to put in extra effort to understand delivery and returns policies and costs.

The case of the UK suggests that Amazon may face challenges in sustaining customer satisfaction levels elsewhere as omnichannel competition.

increases. As more retailers offer rapid delivery and free rapid collection services, Amazon’s fulfillment advantages diminish.

Finally, we must not exaggerate Amazon’s challenges in the UK market. While the retailer has slipped from first place in the OC&C Retail Proposition Index, it still ranks highly in that index, and it retains the top spot in other surveys, such as ForeSee’s Experience Index. Amazon is the biggest online retailer in the UK, as it is in the US, and it continues to enjoy very high customer satisfaction ratings.