What Amazon Says

“Thank you to the hundreds of thousands of new members who signed up on Prime Day, and our tens of millions of existing members for making our first ever Prime Day a huge success,” said Greg Greeley, Vice President of Amazon Prime, at the conclusion of Amazon’s inaugural Prime Day 24-hour super sale.

The company (perhaps unsurprisingly) crowed that the event was a huge success. “Customers worldwide ordered an astonishing 398 items per second and saved millions on Prime Day deals,” said Greeley. Here are some more stats that Amazon released after the event:

- Worldwide order growth increased by 266% over the same day last year and was up 18% from Black Friday 2014.

- Customers ordered 34.4 million items across Prime-eligible countries.

- More new members tried Prime worldwide than on any other single day in Amazon history.

- Third-party merchants enjoyed sales growth near 300%.

- It was the largest device sales day ever worldwide.

- It’s set to become a yearly event. “Going into this, we weren’t sure whether Prime Day would be a onetime thing or if it would become an annual event,” said Greeley. “After yesterday’s results, we’ll definitely be doing this again.”

What Other Sources Say

Right now, one of the best third-party sources of data on Prime Day is ChannelAdvisor, which gathers data from companies that sell on Amazon Marketplace. ChannelAdvisor doesn’t record sales made directly by Amazon, but its data can be used as an indirect measure of sales volumes on the site.

ChannelAdvisor reported the following stats for third-party merchant sales on Prime Day:

- Amazon US sales grew by 93% year over year (same-store sales, i.e., stripping out vendors that have joined or left Amazon’s Marketplace within the past year).

- Amazon EU sales grew by 53% year over year.

- The US growth rate for Prime Day was approximately four times the 25% baseline estimate by ChannelAdvisor, which indicates significant spillover to third-party sellers. The EU growth rate was three times the rate of ChannelAdvisor’s baseline.

- Black Friday: ChannelAdvisor’s customers achieved 97% of the sales on Prime Day that they had on last year’s Black Friday, on a same-store sales basis.

- Cyber Monday: ChannelAdvisor’s customers achieved 60% of the sales on Prime Day that they had on last year’s Cyber Monday, on a same-store sales basis.

What Shoppers Say

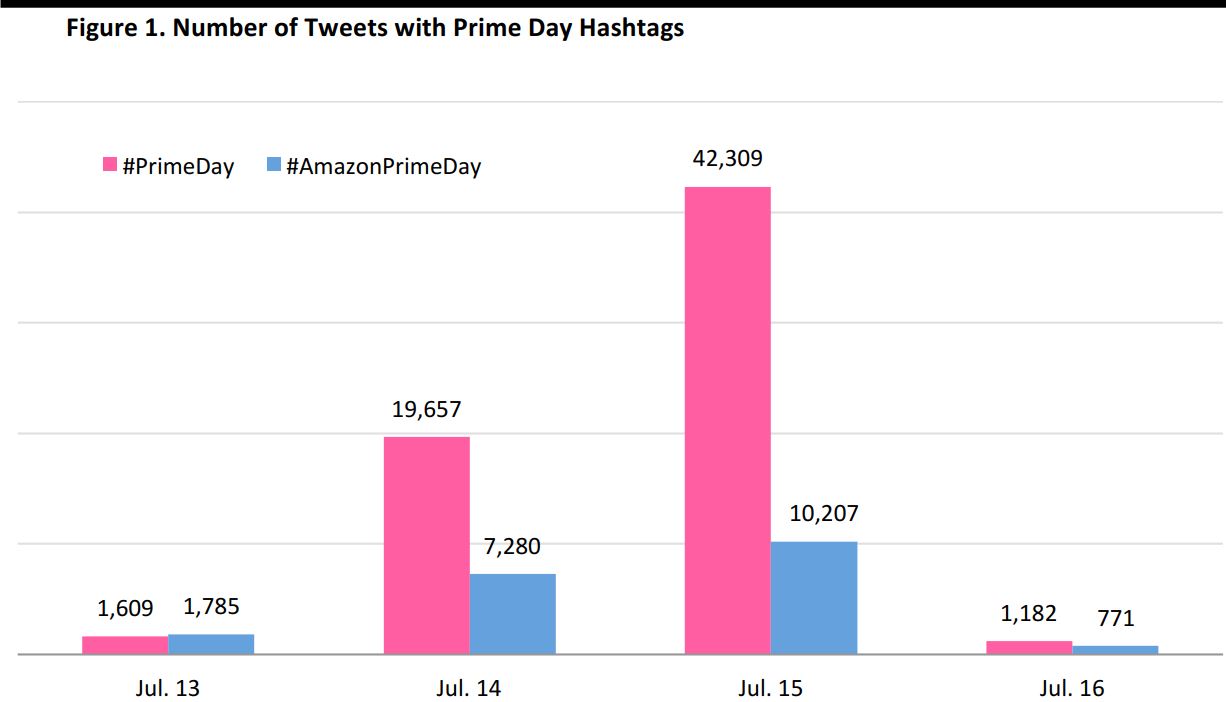

As the event unfolded, customers started to slam Amazon with hashtags like #unhappyPrimeDay, #AmazonFail and even #PrimeDayFail. As of 6:30 p.m. EDT, #PrimeDayFail had replaced #PrimeDay as one of themost popular trends on Twitter.

Customers complained that the product mix was somewhat esoteric, the deals were too mundane and the website was difficult to navigate.

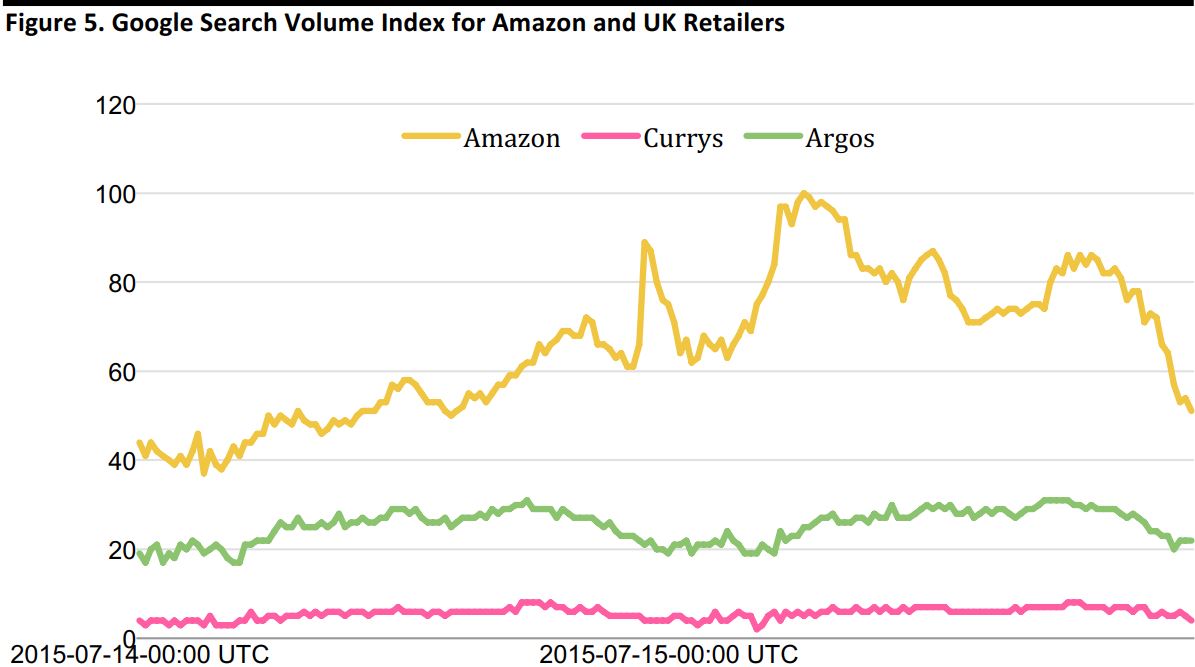

Source: Topsy

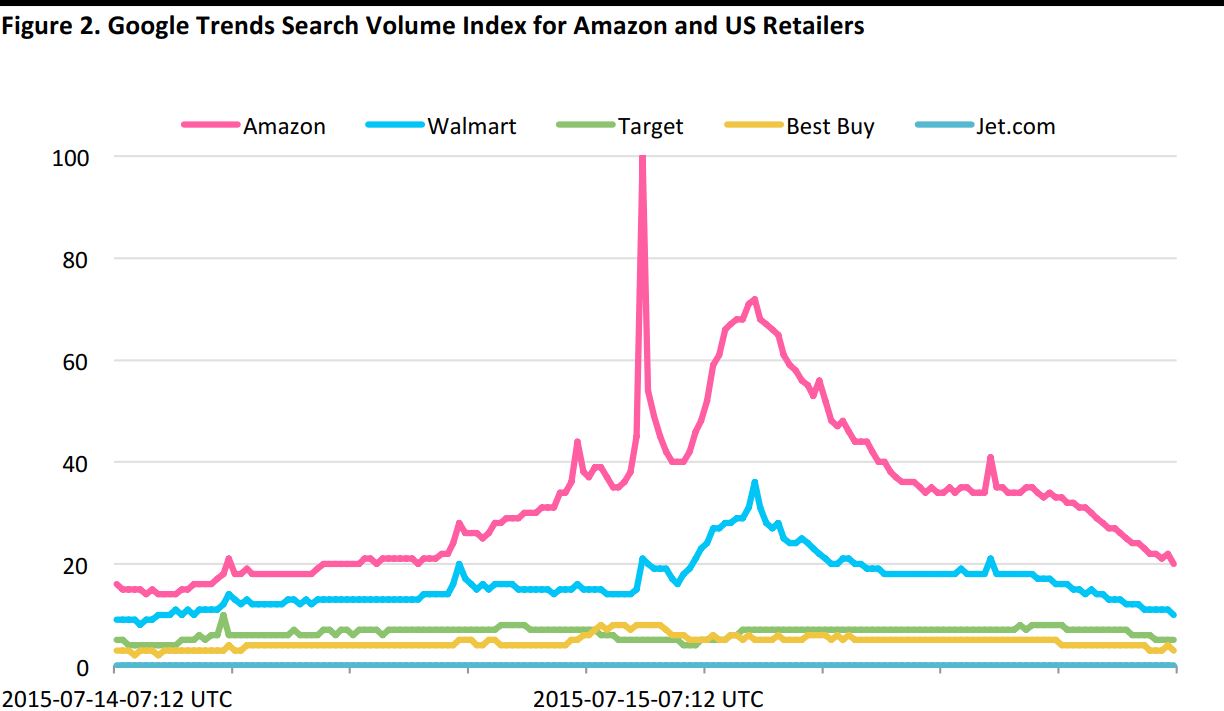

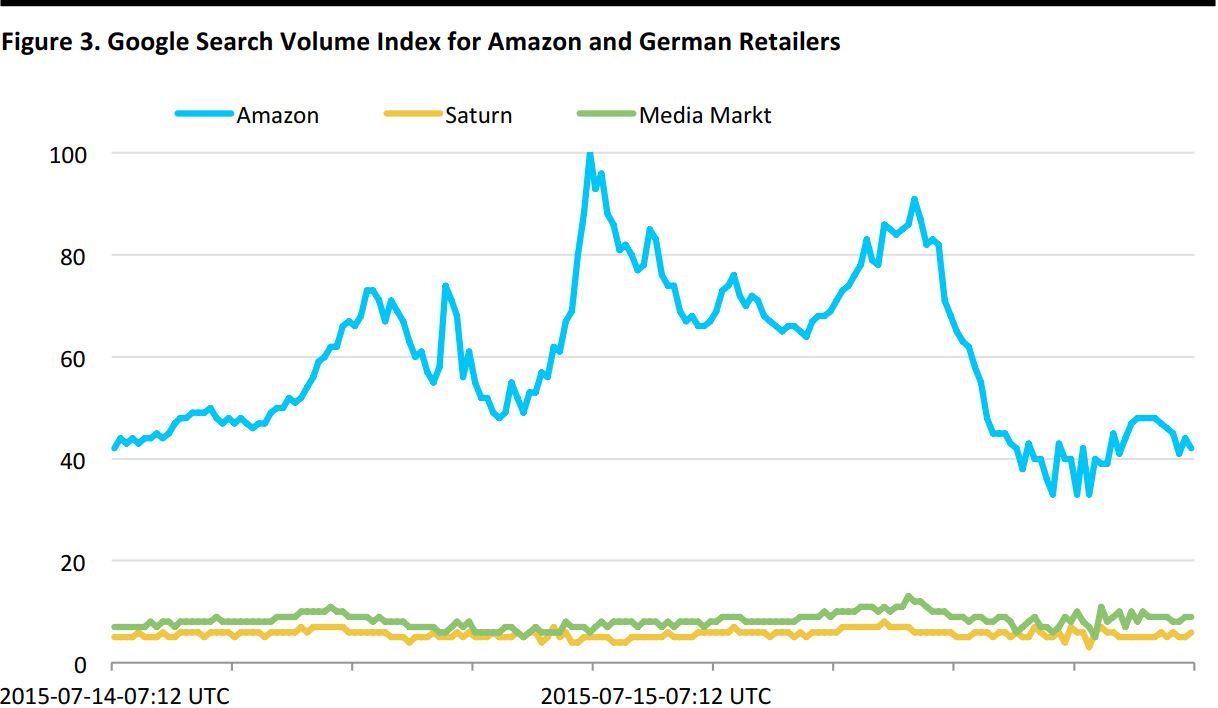

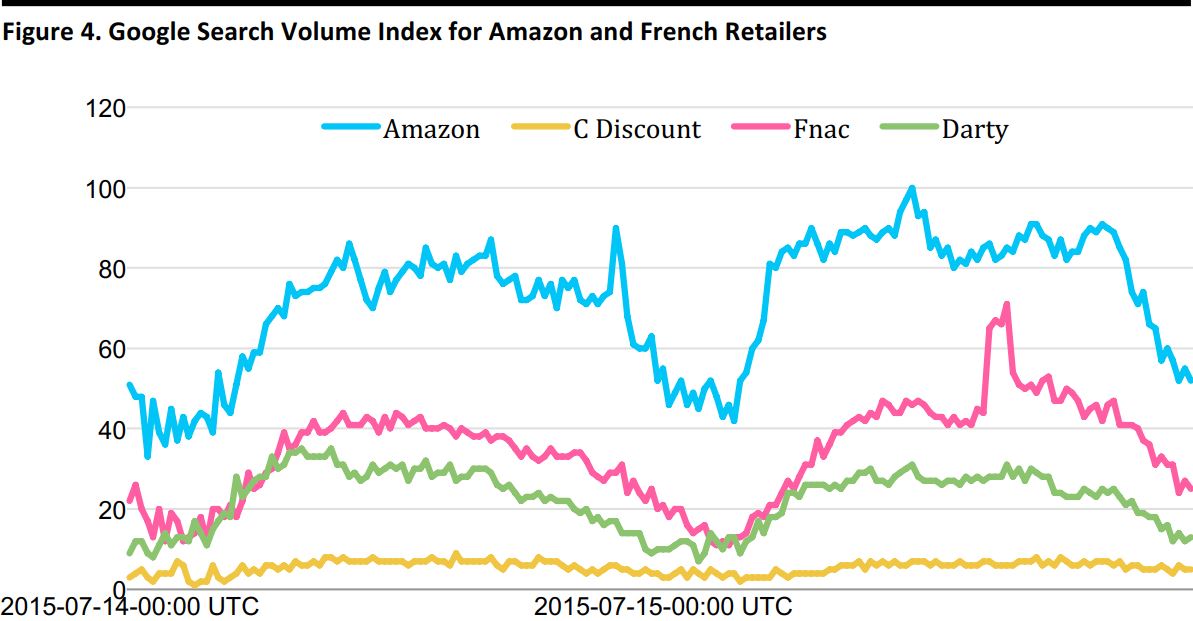

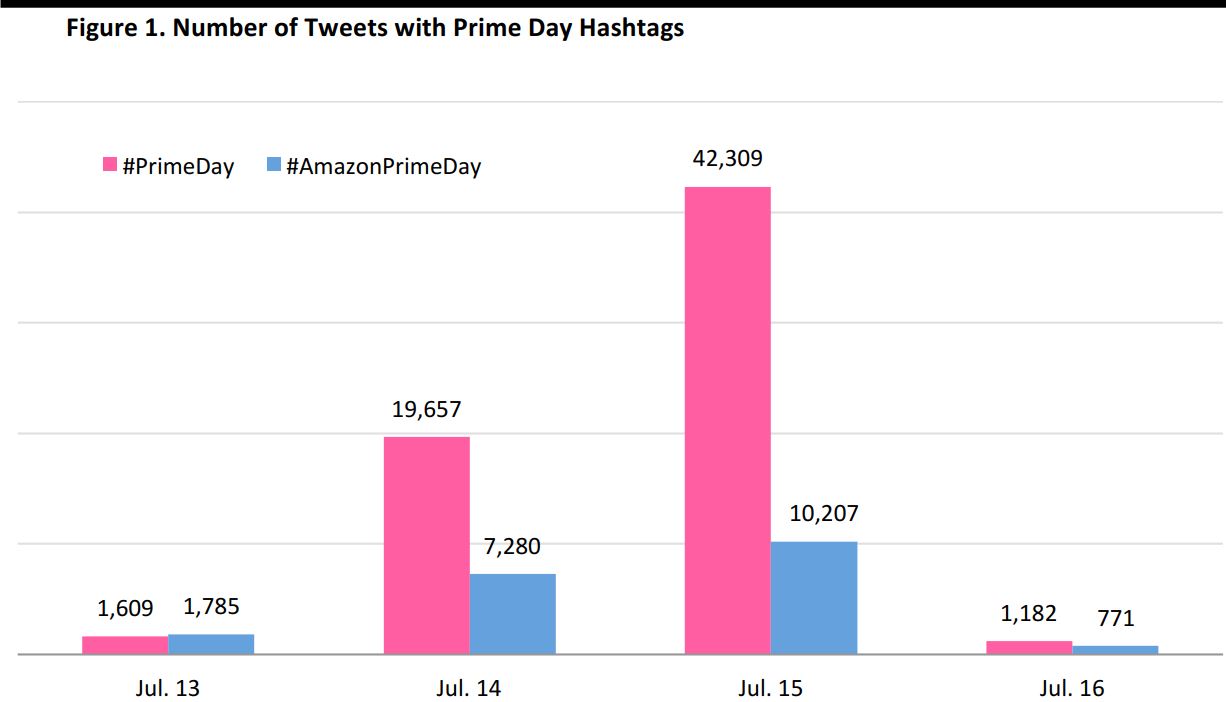

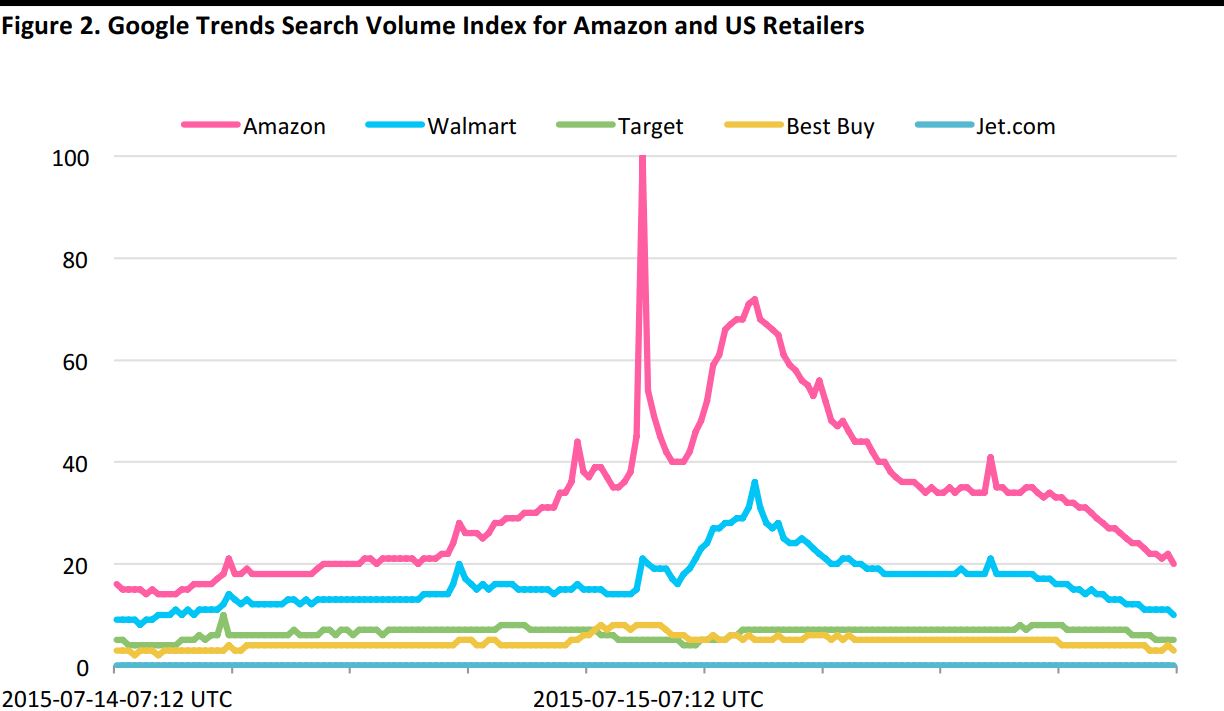

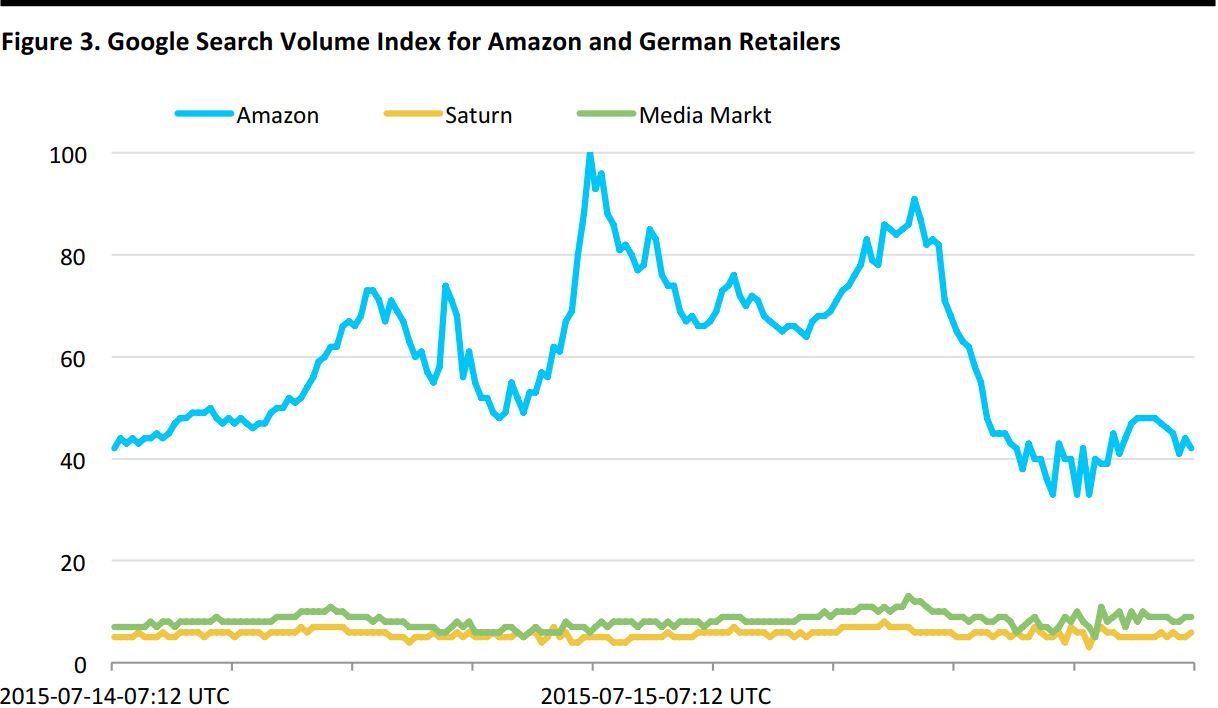

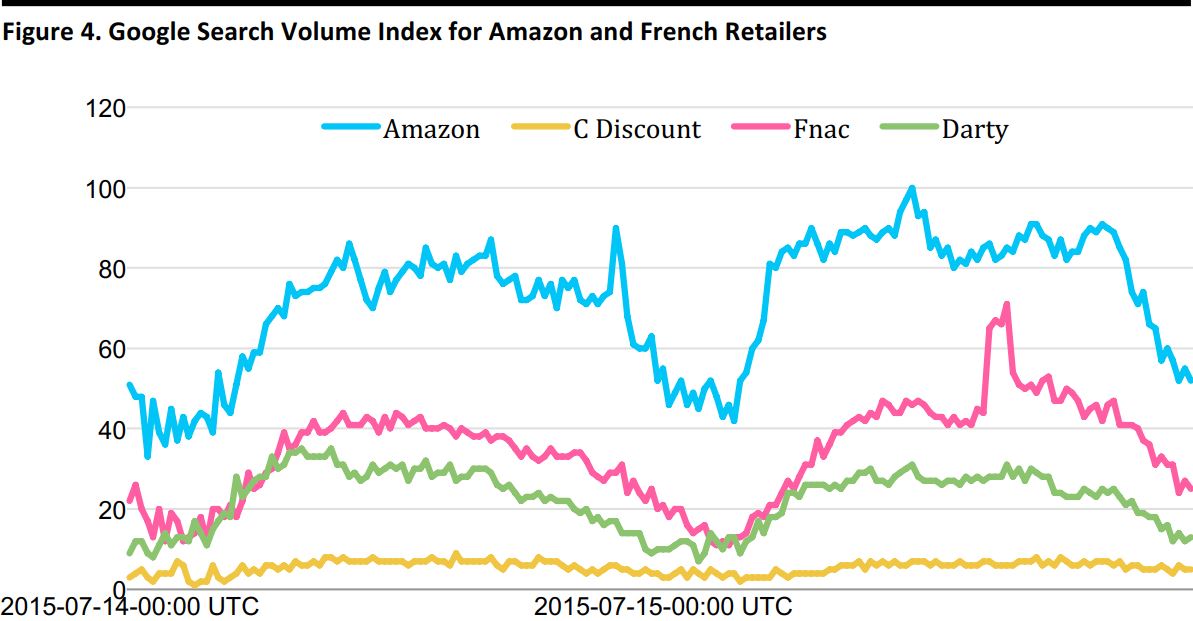

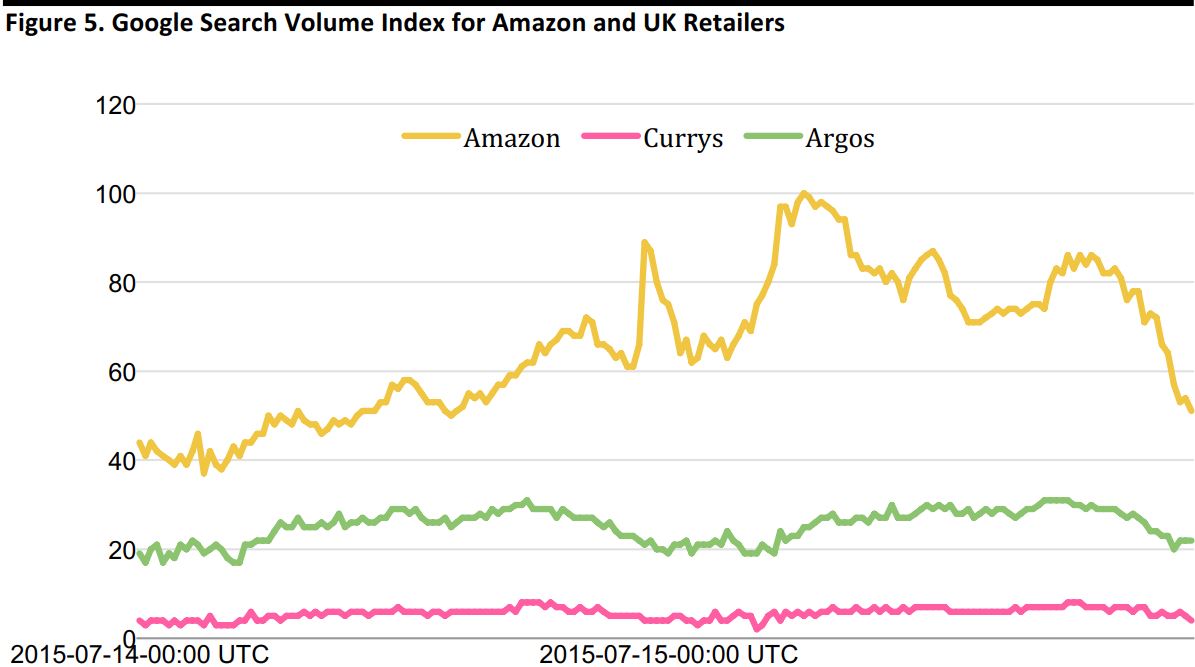

Google Trends’ search volume index showed that Prime Day boosted search interest in Amazon and its major US competitors, with search volumes peaking on July 15. However, Amazon’s overseas competitors did not enjoy a similar surge in search interest on Prime Day.

Source: Google Trends

Source: Google Trends

Source: Google Trends

Source: Google Trends

What We Say

- Prime Day Inspired by Singles’ Day? Amazon’s main Chinese competitor, Alibaba, launched its first Singles’ Day promotion on November 11, 2009, as a celebration of China’s singles. Last year, Alibaba achieved $9 billion in sales on Singles’ Day, up from $5.8 billion in 2013. Will Amazon Prime Day, the newest online shopping holiday, top Alibaba’s Singles’ Day sales record? Is Amazon going to make Prime Day a truly global event? It might be difficult if the e-commerce giant excludes the world’s second-largest consumer market, China.

- Escalation of Global Retail Competition: When a retailer like Amazon offers new services, its competitors often follow suit. Consumers are the ultimate beneficiaries of the increasingly competitive retail landscape. They are becoming accustomed to a highly promotional retail environment and first-class customer experiences at low prices. Prime Day just escalated the competition again. Following a strongly worded press release earlier this week, Walmart featured the taglines “Low Prices Every Day for Everyone” and “Dare to Compare” on its home page on Prime Day, and promoted over 2,000 online exclusive “rollbacks” in addition to lowering its free shipping requirement to $35 from $50. On the same day, Target extended its “Black Friday in July” sale through July 18. Last but not least, the emerging e-tailer Jet.com will open up its membership to the public in a week (its membership is currently private, by invite only). Jet.com aims to challenge Amazon by combining the low prices of warehouse clubs and the ease of e-commerce.