DIpil Das

Introduction

What’s the Story? Amazon’s Prime Day will be held on July 12–13 this year in Austria, Australia, Belgium, Brazil, Canada, China, France, Germany, Italy, Japan, Luxembourg, Mexico, the Netherlands, Portugal, Singapore, Spain, the UK, the US and, for the first time, Poland and Sweden. A separate Prime Day will be scheduled for later summers in India, Saudi Arabia and the United Arab Emirates, plus in Egypt for the first time. Ahead of the promotion, we present five key insights into Prime Day 2022, covering sought-after product categories; the implications of back-to-usual Prime Day timing; the impact on Prime membership growth; Amazon boosting its brick-and-mortar presence; and an emerging new competitive trajectory in retail informed by Prime Day 2022 Why It Matters The eighth Prime Day features two noteworthy firsts: the introduction of year-round brick-and-mortar discounts on groceries and the piloting of buy now, pay later (BNPL). This year's event comes against a competitive backdrop as Amazon’s brick-and-mortar rivals use the same tactics: Target will host a sales event coinciding with Prime Day and Walmart held one in early June. According to our June 20, 2022, US consumer survey, 37.2% of respondents bought on Amazon.com during Prime Day 2021 (plus a further 21.3% cannot remember if they did)—illustrating the breadth of consumer participation in the event.Amazon Prime Day 2022—Preview: Coresight Research Analysis

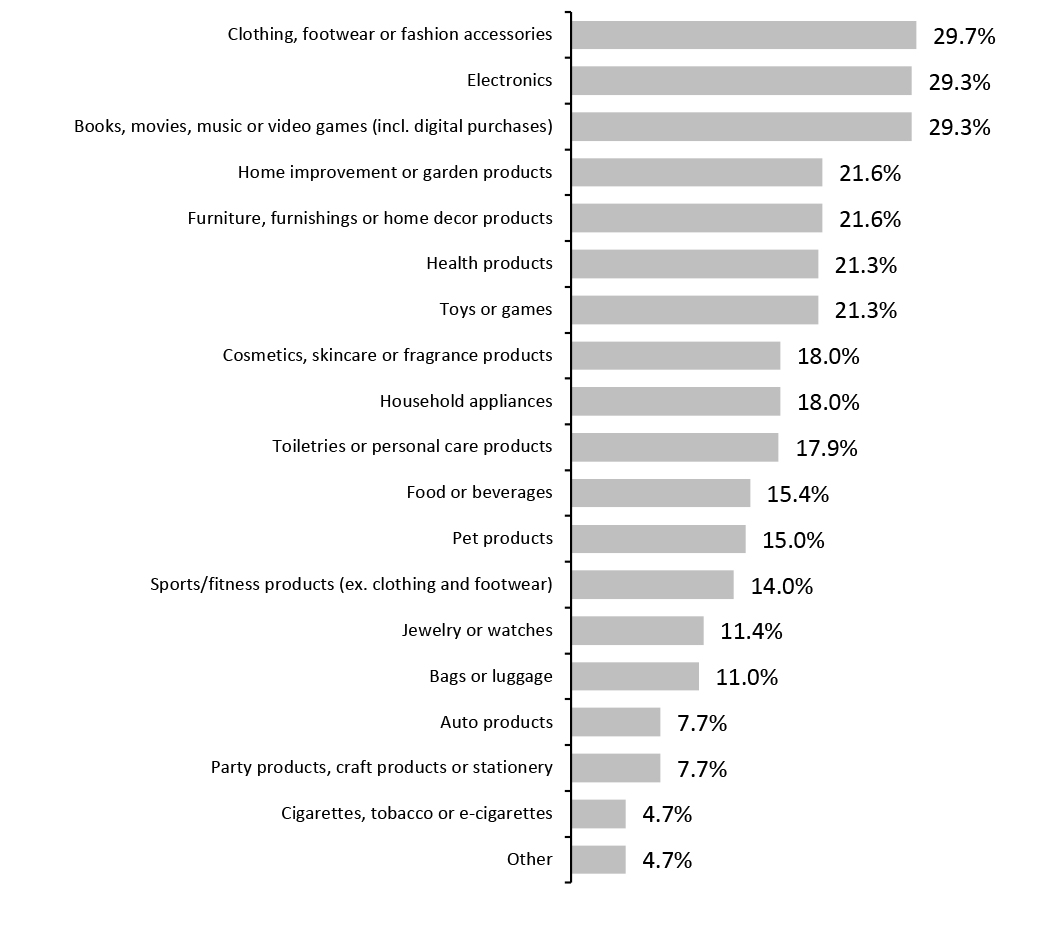

Top Categories for Prime Day Sales In a Coresight Research US survey conducted on June 20, 2022, 22.5% of respondents said that they expect to purchase on Amazon.com during Prime Day; a further 42.2% of US consumers said they expect to browse for deals during Prime Day but do not know whether they will buy. Clothing, footwear and fashion accessories; electronics; and books, movies, music and video games are the top three categories consumers expect to purchase or browse within. Underlining the rise of Amazon as an apparel retailer, clothing, footwear and fashion accessories is the category that the highest proportion of consumers expect to browse or purchase within—which also corroborates the findings of our February 2022 Amazon apparel survey. Amazon is aiming to further capitalize on this trend with sellable livestream events. Electronics jumps to second place for Prime Day—this compares to its typical position of fifth-most-shopped category on Amazon, according to our non-Prime Day US consumer surveys undertaken in 2021 and 2022. This in part reflects the emphasis that Amazon places on sales of its own electronics brands, such as Echo, during the event. Categories such as beauty, health and food products fall down the ranking versus their non-Prime Day positions.Figure 1. US Consumers Who Expect to Shop on Amazon Prime Day 2022: Categories They Expect to Purchase or Browse Within (% of Respondents) [caption id="attachment_150552" align="aligncenter" width="700"]

Base: 273 US respondents aged 18+ who expect to make purchases or browse promotions during Prime Day on Amazon.com, surveyed on June 20, 2022 [/caption]

A Return to Traditional Timing—but not Growth

Although the last two Prime Days were held in October 2020 and in June 2021 due to the Covid-19 pandemic, Amazon has traditionally scheduled Prime Day for July in order to better satisfy consumers’ back-to-school and summer vacation needs. In a Coresight Research survey conducted on June 20, 2022, one-third of US consumers said they expected to browse or purchase on Amazon.com during Prime Day. In our separate back-to-school survey of US parents, conducted on June 24, 2022, almost half (48.8%) of respondents said they would look out for promotional events such as Amazon Prime Day and Target Deal Day in order to make back-to-school purchases.

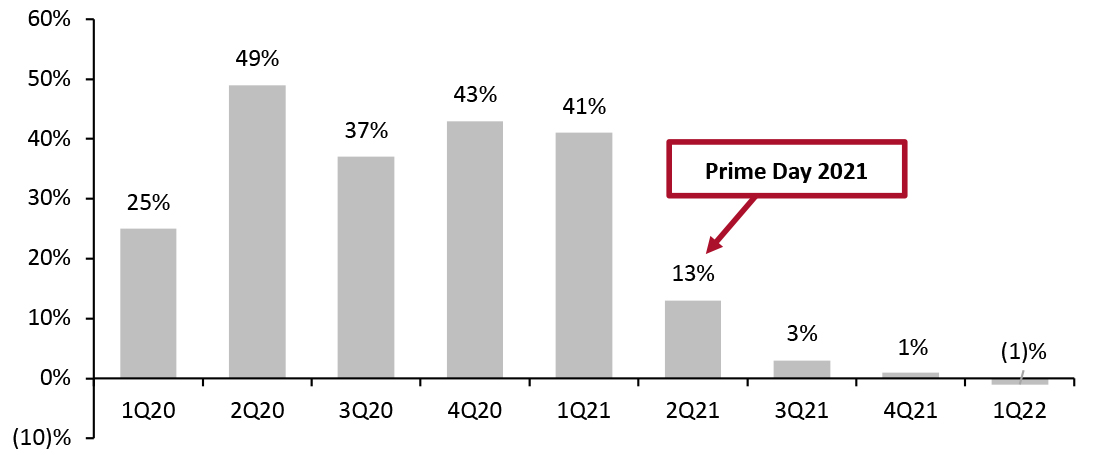

Prime Day 2022 comes at a critical time for Amazon. In 2021, during its second quarter, Prime Day contributed about 0.4% to a 2.7% year-over-year increase in revenue, according to Amazon CFO Brian T. Olsavsky, on an earnings call on April 28, 2022. From that quarter on, online-store sales declined for three quarters in a row (as shown in Figure 2). Online store sales—which include online orders for delivery as well as BOPIS—are now in negative territory for the first quarter of fiscal 2022, in which Amazon posted its first losses in seven years, of $3.8 billion.

Base: 273 US respondents aged 18+ who expect to make purchases or browse promotions during Prime Day on Amazon.com, surveyed on June 20, 2022 [/caption]

A Return to Traditional Timing—but not Growth

Although the last two Prime Days were held in October 2020 and in June 2021 due to the Covid-19 pandemic, Amazon has traditionally scheduled Prime Day for July in order to better satisfy consumers’ back-to-school and summer vacation needs. In a Coresight Research survey conducted on June 20, 2022, one-third of US consumers said they expected to browse or purchase on Amazon.com during Prime Day. In our separate back-to-school survey of US parents, conducted on June 24, 2022, almost half (48.8%) of respondents said they would look out for promotional events such as Amazon Prime Day and Target Deal Day in order to make back-to-school purchases.

Prime Day 2022 comes at a critical time for Amazon. In 2021, during its second quarter, Prime Day contributed about 0.4% to a 2.7% year-over-year increase in revenue, according to Amazon CFO Brian T. Olsavsky, on an earnings call on April 28, 2022. From that quarter on, online-store sales declined for three quarters in a row (as shown in Figure 2). Online store sales—which include online orders for delivery as well as BOPIS—are now in negative territory for the first quarter of fiscal 2022, in which Amazon posted its first losses in seven years, of $3.8 billion.

Figure 2. Amazon: Online Stores Segment Sales (YoY % Change, Ex. FX) [caption id="attachment_150553" align="aligncenter" width="700"]

Source: Company reports/Coresight Research [/caption]

Prime Day 2022 must also be seen in the context of consumers’ concerns over inflation and willingness to spend. According to our back-to-school survey, 76.6% of US parents expect inflation to limit their back-to-school spending. Some 48.8% intend to seek out promotional events such as Prime Day to make their money stretch further. The success of Prime Day 2022 thus hinges on whether its deep discounts and deals, and not those of its rivals, attract inflation-weary shoppers.

How Amazon Prime Membership Has Grown

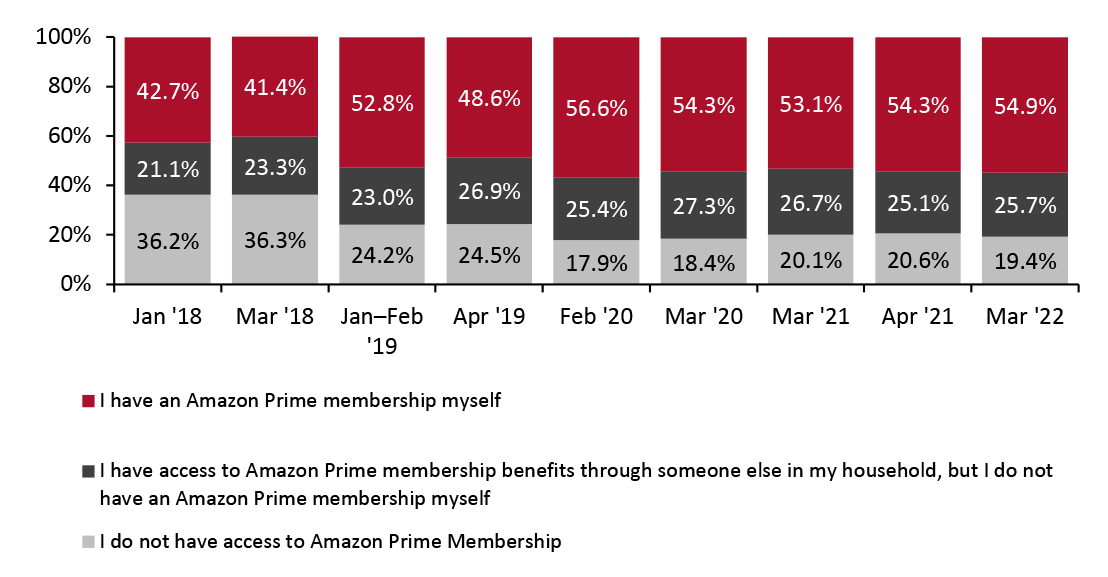

Multiyear data from Coresight Research US consumer surveys show Prime membership has broadly leveled off, with 54.9% of US adults currently having a Prime membership—suggesting that February 2022’s 15% membership fee increase hike had only a limited impact. Some 80.6% of US consumers currently have access to Prime membership. Historically, Amazon has used Prime Day to lure new members with member-exclusive discounts—but is now forced to focus on retention. Amazon continues to increase Prime benefits to retain members—as seen in the launch of one of its latest benefits, Buy with Prime, which enables members to shop on non-Amazon sites with Prime’s usual benefits, such as free delivery.

Source: Company reports/Coresight Research [/caption]

Prime Day 2022 must also be seen in the context of consumers’ concerns over inflation and willingness to spend. According to our back-to-school survey, 76.6% of US parents expect inflation to limit their back-to-school spending. Some 48.8% intend to seek out promotional events such as Prime Day to make their money stretch further. The success of Prime Day 2022 thus hinges on whether its deep discounts and deals, and not those of its rivals, attract inflation-weary shoppers.

How Amazon Prime Membership Has Grown

Multiyear data from Coresight Research US consumer surveys show Prime membership has broadly leveled off, with 54.9% of US adults currently having a Prime membership—suggesting that February 2022’s 15% membership fee increase hike had only a limited impact. Some 80.6% of US consumers currently have access to Prime membership. Historically, Amazon has used Prime Day to lure new members with member-exclusive discounts—but is now forced to focus on retention. Amazon continues to increase Prime benefits to retain members—as seen in the launch of one of its latest benefits, Buy with Prime, which enables members to shop on non-Amazon sites with Prime’s usual benefits, such as free delivery.

Figure 3. US Consumers: Access to Amazon Prime (% of Respondents) [caption id="attachment_150554" align="aligncenter" width="700"]

Base: US respondents aged 18+

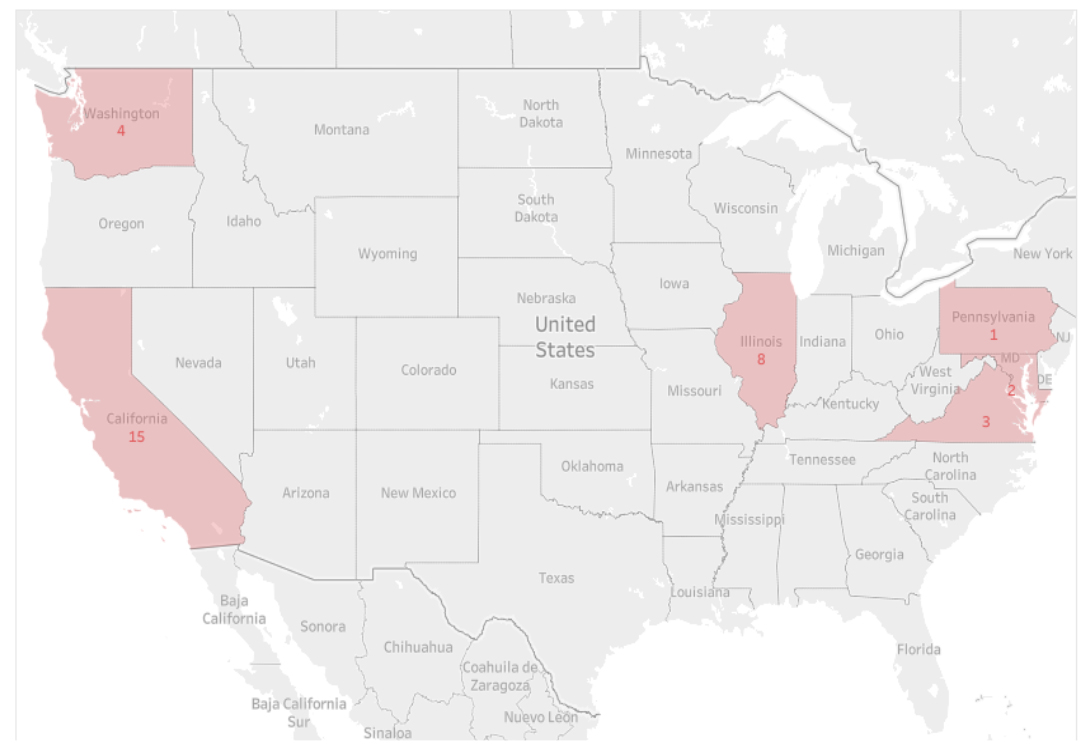

Base: US respondents aged 18+ Source: Coresight Research [/caption] Spreading the Benefits into Brick-and-Mortar Amazon’s grocery ambitions have helped shape the focus of Prime Day 2022. Amazon Prime members will get 20% off select everyday essentials year-round at Amazon Fresh stores from June 29, the company said in a press release announcing Prime Day 2022. Amazon’s expansion into brick-and-mortar grocery culminated in the 2017 acquisition of Whole Foods and the 2020 launch of Amazon Fresh stores. In previous years, Amazon has sought to boost its brick-and-mortar grocery sales in conjunction with Prime Day: since 2019, Prime Day has matched $10 in purchases at Whole Foods with $10 in Prime Day credit, plus cashback for Amazon credit-card holders. The new Amazon Fresh perk is more generous than the Whole Foods equivalent, offering an additional 10% off storewide non-alcohol sales. The introduction of year-round Prime discounts as part of Prime Day promotion is a sign of Amazon seeking to further integrate Amazon Fresh stores into the Prime membership ecosystem, although the stores are currently only a small piece of the Amazon empire, with 33 locations in the US. We expect the new discount to accompany continuing rapid expansion: In 2021 alone, the company more than tripled the number of new openings to 18 from five a year previously. In the last six months, Amazon Fresh opened ten locations, clustering in urban and suburban areas. With member-only discounts and other Prime benefits, Amazon Fresh will capitalize on niches in suburbia and urban cores, where shoppers may be less inclined to compromise on the quality and value of their purchases despite increasing inflationary pressures.

Figure 4. US Amazon Fresh Store Locations [caption id="attachment_150548" align="aligncenter" width="701"]

Source: ChainXY /Coresight Research [/caption]

Prime Day Becomes a Showdown with Mass Merchandisers

This year’s Prime Day brings with it a new form of competition, as Amazon’s mass retail rivals attempt to jump on the Prime Day bandwagon—or even preempt it.

Walmart has yet to announce how it will hold a Deals for Days event in conjunction with Prime Day this year. Typically, the event begins one day earlier than Amazon Prime Day and lasts a day longer. However, on June 2–5, 2022, Walmart hosted its first-ever Walmart+ Weekend exclusively for members of Walmart+, the mass retailer’s answer to Amazon Prime, in an apparent move to weaponize its vast brick-and-mortar presence against Amazon.

Target also remains bold in taking on Amazon. The brick-and-mortar stalwart has scheduled its Deals Day promotion for the same period as Amazon Prime Day. This bustling competitive scene has emerged out of the retailers’ needs to address the same problems:

Source: ChainXY /Coresight Research [/caption]

Prime Day Becomes a Showdown with Mass Merchandisers

This year’s Prime Day brings with it a new form of competition, as Amazon’s mass retail rivals attempt to jump on the Prime Day bandwagon—or even preempt it.

Walmart has yet to announce how it will hold a Deals for Days event in conjunction with Prime Day this year. Typically, the event begins one day earlier than Amazon Prime Day and lasts a day longer. However, on June 2–5, 2022, Walmart hosted its first-ever Walmart+ Weekend exclusively for members of Walmart+, the mass retailer’s answer to Amazon Prime, in an apparent move to weaponize its vast brick-and-mortar presence against Amazon.

Target also remains bold in taking on Amazon. The brick-and-mortar stalwart has scheduled its Deals Day promotion for the same period as Amazon Prime Day. This bustling competitive scene has emerged out of the retailers’ needs to address the same problems:

- Addressing Inventory Excesses—All three retailers need to wind down inventory in such segments as electronics and home furnishings as consumers shift toward grocery and essentials amid rising inflation. Amazon offers up to 44% discounts on its generic big-screen TVs, and up to 52% off some private-label items—which calls into question the retailer’s commitment to third-party vendors, which often have to compete with its private labels during the promotion. Target’s discounts vary from 35% to 70% on categories popular during the pandemic, such as kitchen appliances, home items and electronic gadgets. Walmart offers similar discounts on the same pandemic-boosted categories, ranging from gardening tools to big-screen TVs.

- Focus on Groceries—Food-at-home prices were up 11.9% year over year in May 2022, according to the US Bureau of Labor Statistics. The rise in family grocery bills helped groceries to take center stage in retail promotions. As discussed, Amazon plans to use Prime Day to boost its Amazon Fresh stores by introducing year-round discounts on essentials. During Deal Days, Target shoppers will get a $10 gift card with same-day services on the first $50 they spend on food and beverages. Groceries made up about 59% of all orders during the Walmart+ Weekend, although the mass retailer did not offer any extra discount or deal on such items.

- Strengthening Payment Infrastructures—With stimulus on the wane and inflation on the rise, Amazon, with Affirm, will make BPNL (buy now, pay later) available to shoppers who make at least $50 purchases of eligible items from June 28. BNPL will continue beyond Prime Day until July 11, suggesting that Amazon will eventually make BNPL an Amazon Prime or Amazon Pay perk. Amazon Prime Reward Visa card holders can earn 6% back at Amazon and Whole Foods Market on Prime Day and 5% back year-round. During its promotion, Target.com is offering 5% off gift cards up to $500. Both Walmart and Target already have BNPL in place through their websites and apps.