DIpil Das

What’s the Story?

Amazon’s Prime Day sales event will be held on June 21–22 this year in Australia, Austria, Belgium, Brazil, China, France, Germany, Italy, Japan, Luxembourg, Mexico, Netherlands, Portugal, Saudi Arabia, Singapore, Spain, Turkey, the UAE, the UK and the US. We present five key insights into Prime Day 2021 in advance of the event, covering popular product categories, advantages of the June timing for Amazon, Prime membership rates, support for third-party businesses and competing retailers’ sales events.Why It Matters

Amazon’s annual Prime Day is a multibillion-dollar sales event. We estimate that Amazon generated sales of approximately $6 billion (GMV) on Prime Day 2020, with an estimated $2.5 billion generated through first-party sales. In a press release dated June 2, 2021, Amazon revealed that Prime Day 2021 will feature over 2 million deals across all product categories, including fashion, home, beauty, toys, sporting goods, pet supplies and electronics, with further exclusive offers across Prime Video, Amazon Music and Prime Gaming. Coresight Research’s survey of US consumers, conducted on May 24, 2021, found that Prime Day is impacting consumers’ spending behaviors, with 20.5% of respondents reporting that they planned to delay some of their purchases until Prime Day to take advantage of the event’s discounts. This will have affected rival retailers such as Target and Walmart, which are looking to compete against Prime Day with their own sales events in the same period.Amazon Prime Day 2021: Preview

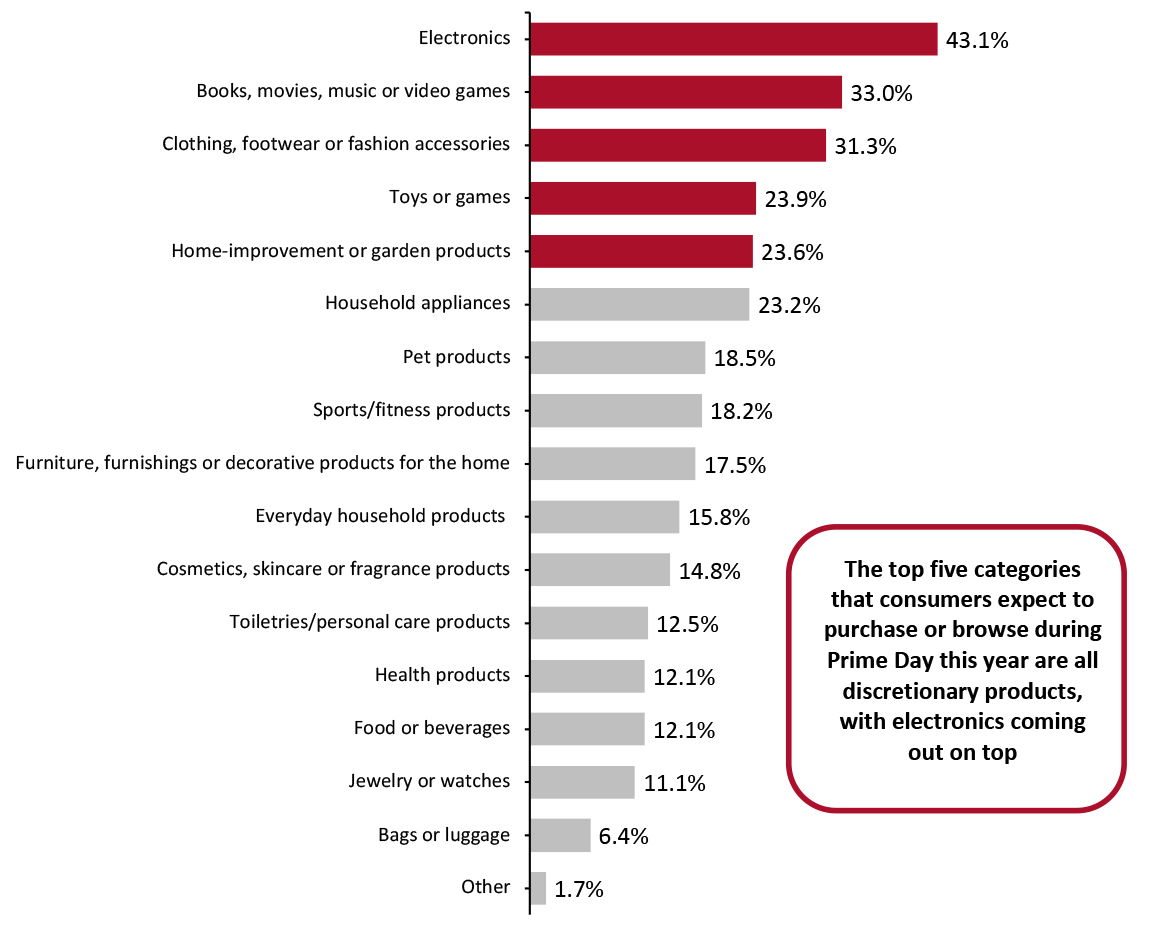

1. Top Categories for Prime Day Sales: Electronics, Entertainment and Apparel Our US consumer survey found that 48.4% of respondents expect to browse Prime Day deals this year, and 24.2% expect to make a purchase. (Read our US Consumer Tracker report for more on US consumers’ Amazon Prime Day shopping plans.) The electronics category is the topmost category in which consumers expect to make purchases or browse Prime Day deals (see Figure 1). This may be partly driven by the discounts on Amazon’s own consumer-electronics products and the benefits of owning Amazon devices, such as the “Shop with Alexa” $5 credit being awarded to new US Prime members who sign up for Prime using an Echo device. We may well see a repeat of last year, when electronics were some of the bestselling products; the category had the highest percentage of goods available through promotions. Other popular categories among the survey respondents expecting to shop during Prime Day include books, movies, music or video games, clothing and footwear and toys or games—all discretionary products. This aligns with the trend we are seeing of entertainment products experiencing a pandemic-led boost in consumer spending: Our US consumer survey on May 24 found that 31.3% of all respondents are purchasing more in the books, movies, music or video games category than they did before the Covid-19 outbreak, and 18.3% are purchasing more toys or games.Figure 1. US Consumers Who Expect To Shop on Amazon Prime Day: Categories They Expect To Purchase or Browse (% of Respondents) [caption id="attachment_128767" align="aligncenter" width="725"]

Base: 297 US respondents aged 18+ who expect to make purchases or browse promotions during Prime Day on Amazon.com, surveyed on May 24, 2021

Base: 297 US respondents aged 18+ who expect to make purchases or browse promotions during Prime Day on Amazon.com, surveyed on May 24, 2021 Source: Coresight Research [/caption] Nearly one-third of US consumers that plan to browse or make purchases on Amazon.com during Prime Day expect to do so in the apparel category, according to our survey. This is likely supported by pent-up demand accumulated amid the pandemic. As we noted in our latest US Apparel and Beauty Spending Tracker report, US consumer spending on clothing and footwear has been rebounding in recent months. On a two-year basis (comparing to pre-crisis), sales growth in the sector totaled 12.3% in March 2021 and 8.0% in April 2021 (the latest data available). Amazon looks to be capitalizing on apparel demand with Prime Day. On Instagram, the company has been teasing its “Big Style Sale” deals, which were first launched in June 2020 amid the postponement of Prime Day. Amazon appears to be folding its Big Style Sale into Prime Day this year, thus boosting the fashion appeal of the latter event. [caption id="attachment_128768" align="aligncenter" width="460"]

Source: Instagram/Amazon Fashion [/caption]

2. Advantages of the June Timing for Amazon: Maintaining Growth Momentum

Source: Instagram/Amazon Fashion [/caption]

2. Advantages of the June Timing for Amazon: Maintaining Growth Momentum

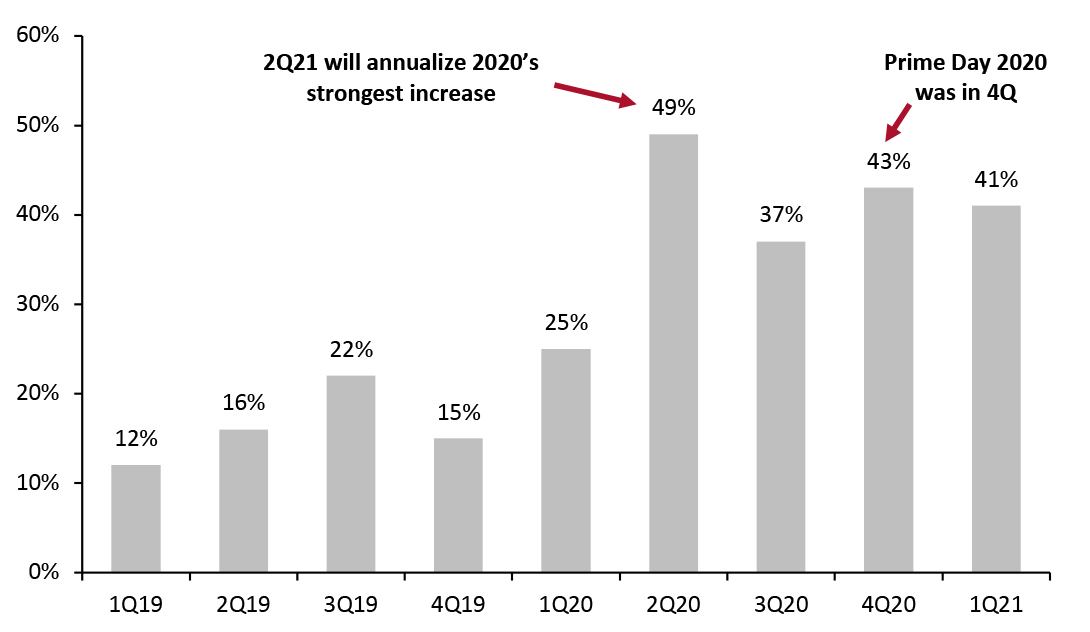

Although Amazon has not explained its decision to hold Prime Day 2021 in June, which deviates from its traditional July date (marking the company’s anniversary) and 2020’s pandemic-impacted October Prime Day, we see advantages in terms of revenue momentum for the company in holding the event earlier this year.

- We expect that Amazon is looking maintain top-line growth as it begins to annualize the e-commerce jump seen in the second quarter of 2020, which was Amazon’s strongest quarter of the year (as shown in Figure 2).

- The estimated $2.5 billion Amazon made through first-party sales on Prime Day 2020 equates to 5.5% of “Online Stores” sales reported by the platform in the second quarter of 2020 (i.e., one year before Prime Day 2021), demonstrating the magnitude of the potential uplift versus Prime Day not occurring in that quarter.

- However, the earlier start date is likely too early to capitalize meaningfully on back-to-school spending compared to the previous July date. Coresight Research’s survey data suggest that only 8.4% of US Prime Day shoppers plan to purchase back-to-school products this Prime Day.

Figure 2. Amazon: Online Stores Segment Sales (YoY % Change at Constant FX) [caption id="attachment_128769" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

3. Prime Membership Rates: Boosting Customer Engagement

As it does each year, Amazon will aim to boost its Prime membership rates through Prime Day, by attracting customers through exclusive offers and benefits during the event.

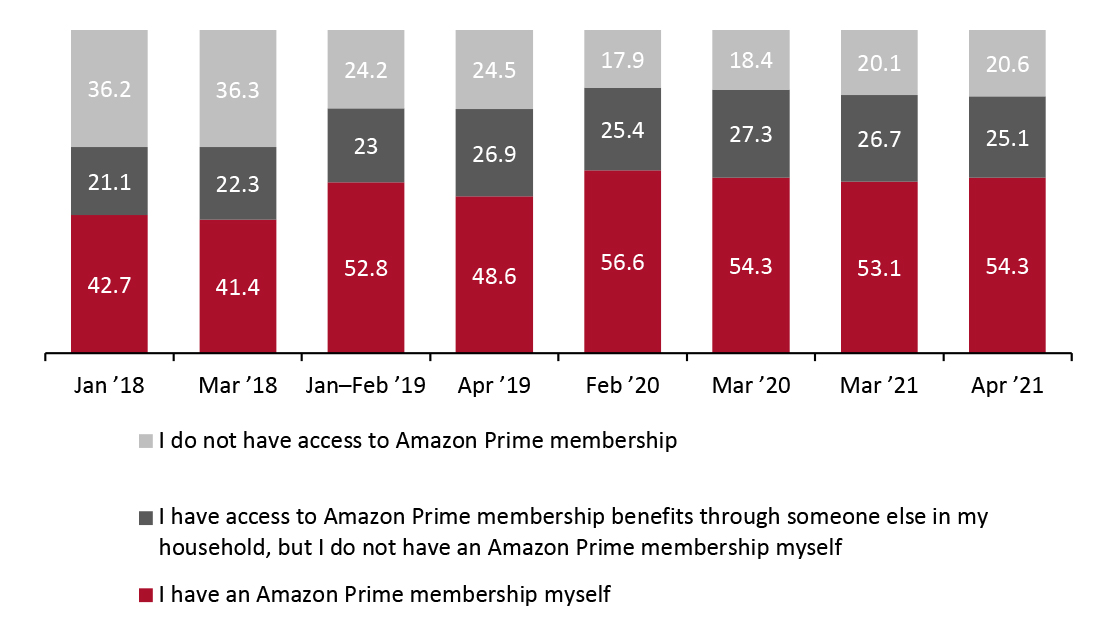

Multiyear data from Coresight Research US consumer surveys suggest that Prime membership has broadly leveled off, with around 54% of US adults personally having a Prime membership. Around 79% of Americans have access to Prime membership (see Figure 3).

Source: Company reports/Coresight Research[/caption]

3. Prime Membership Rates: Boosting Customer Engagement

As it does each year, Amazon will aim to boost its Prime membership rates through Prime Day, by attracting customers through exclusive offers and benefits during the event.

Multiyear data from Coresight Research US consumer surveys suggest that Prime membership has broadly leveled off, with around 54% of US adults personally having a Prime membership. Around 79% of Americans have access to Prime membership (see Figure 3).

Figure 3. US Consumer Survey: Prime Membership (% of Respondents) [caption id="attachment_128770" align="aligncenter" width="725"]

Base: US respondents aged 18+

Base: US respondents aged 18+ Source: Coresight Research [/caption] Our Prime Day survey on May 24, 2021, found that 8.8% of respondents plan to sign up to Prime for Prime Day. Should this be realized, it would represent a meaningful uptick in Prime membership; however, our historical data suggest that gains from any previous Prime Day uplifts in memberships have been lost through churn in subscriptions.

- Prime benefits will continue to drive enrollment in Prime membership, which improves Amazon’s sales in the long term.

- Prime Video has been especially attractive amid the pandemic; members have spent a record number of hours watching Prime Video, with streaming hours up 70% year over year over the past four quarters, according to Amazon. The company has also reported that members who watch Prime Video have higher free trial conversion and renewal rates.

- Prime members in the US spend, on average, 2.3 times more than their non-Prime counterparts, according to a 2019 MarketWatch survey.

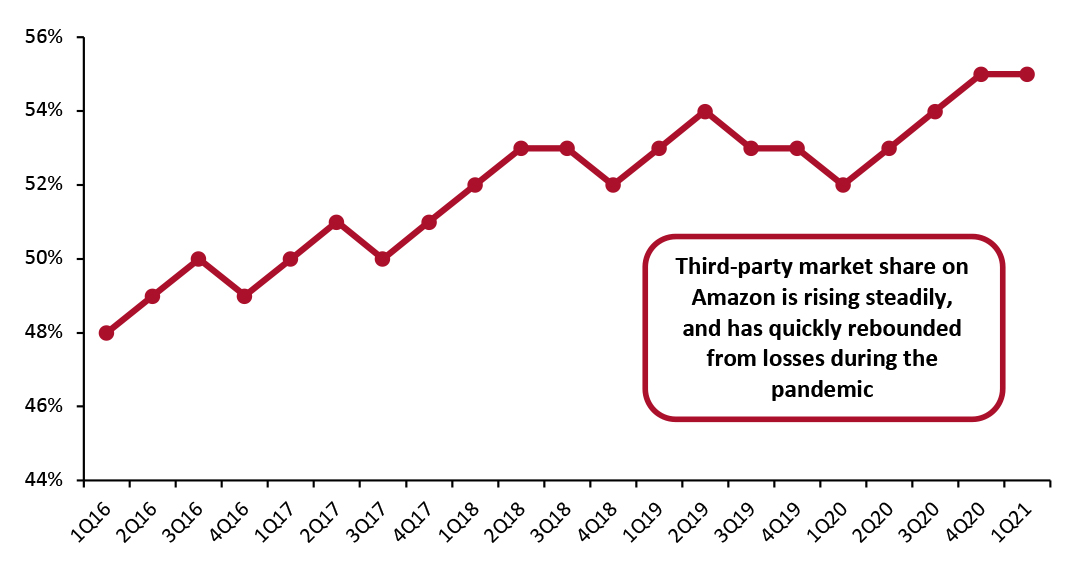

Figure 4. Third-Party Sellers’ Share of Amazon’s Market (% of Total Units Sold) [caption id="attachment_128771" align="aligncenter" width="725"]

Source: Coresight Research [/caption]

5. Competing Retailers’ Own Sales Events

In the US, rival retailers plan to host their own sales around Prime Day. Many of these events appear to capitalize on consumer appetite for electronics and appliances.

Source: Coresight Research [/caption]

5. Competing Retailers’ Own Sales Events

In the US, rival retailers plan to host their own sales around Prime Day. Many of these events appear to capitalize on consumer appetite for electronics and appliances.

- Best Buy’s Bigger Deal sale is being held on June 14–22, with discounts on TVs, laptops, headphones and small appliances.

- Target’s Deal Days will be held on June 20-22, withdiscounts on electronics, home essentials, beauty items, toys, and food and beverages.

Source: Target[/caption]

Source: Target[/caption]

- Walmart’s “Deals for Days” will be held on June 20–23, with discounts on TVs, Chromebooks, Android phones, robot mopping vacuums and kids’ fitness trackers.

Source: Walmart[/caption]

Source: Walmart[/caption]