albert Chan

Amazon Prime Day this year will likely be held in October instead of July, with the postponement likely to be due to supply-chain pressures.

Since the outbreak of the coronavirus pandemic, Amazon has been facing challenges in meeting the sudden surge in demand, leading to delivery delays and logistics bottlenecks at its warehouses. The e-commerce giant is now reportedly experiencing a new wave of demand amid rising coronavirus cases across the US. In light of this, Amazon is seemingly postponing its Prime Day this year to allow itself more time to shore up its fulfillment capabilities during the pandemic.

In lieu of the regular event in July, Amazon launched a fashion summer sale, the “Big Style Sale,” which began on June 22 and featured deals from both established and smaller fashion brands. The event was designed as an opportunity for apparel brands to clear their spring and summer merchandise that remained unsold amid soft demand.

Base: 411 US respondents surveyed on June 24, 2020

Base: 411 US respondents surveyed on June 24, 2020

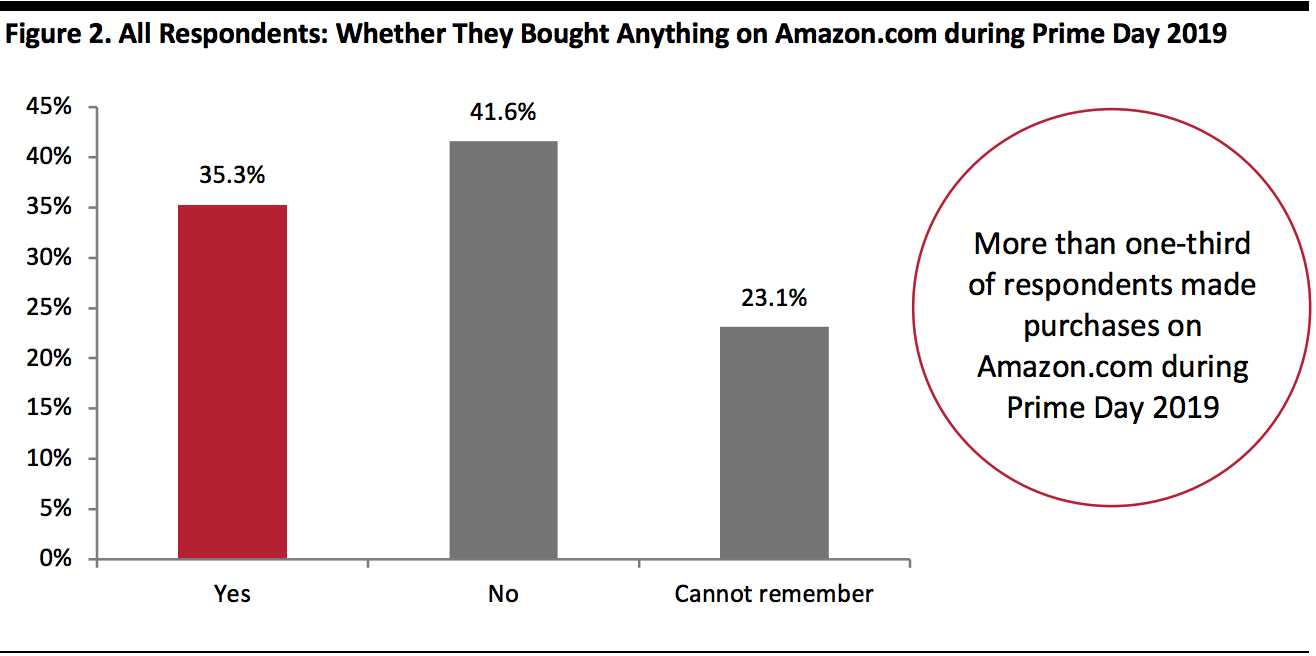

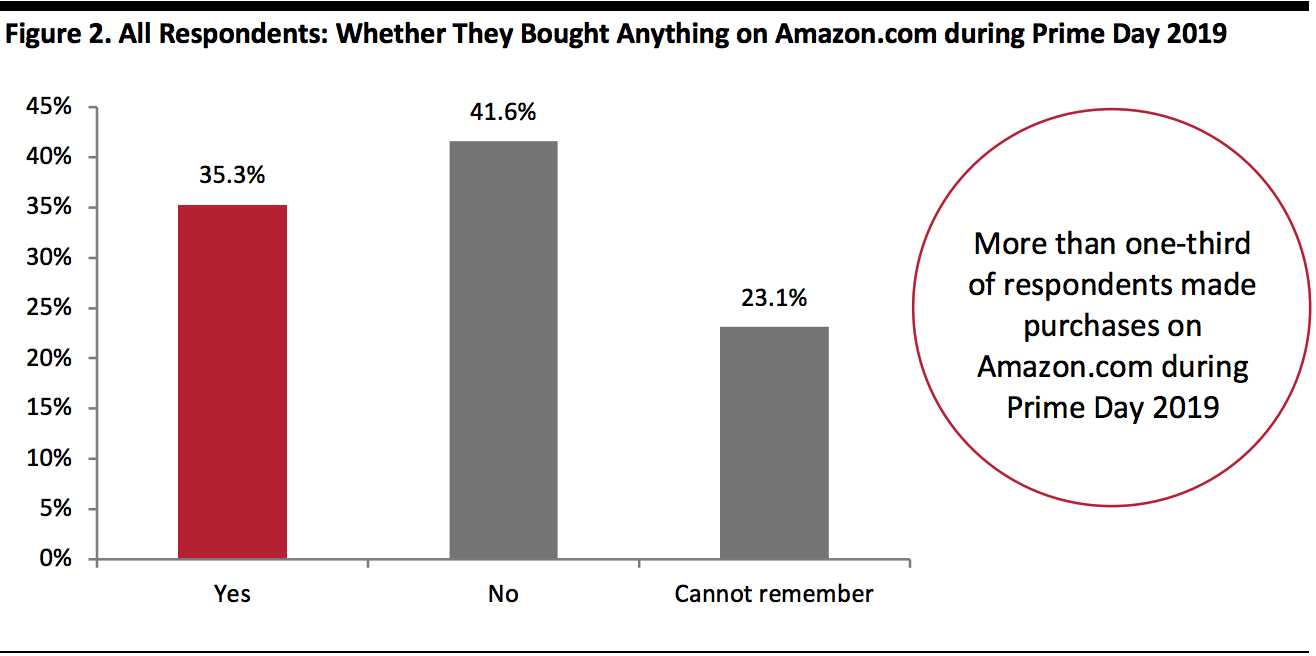

Source: Coresight Research[/caption] The expected level of participation for the 2020 event is significantly higher than confirmed participation last year: Some 35% of respondents said that they had made purchases on Amazon.com during Prime Day 2019 (see Figure 2). However, as almost one-quarter could not recollect their purchasing activity, actual buying rates could be higher than that 35%. [caption id="attachment_112900" align="aligncenter" width="700"] Base: 411 US respondents surveyed on June 24, 2020

Base: 411 US respondents surveyed on June 24, 2020

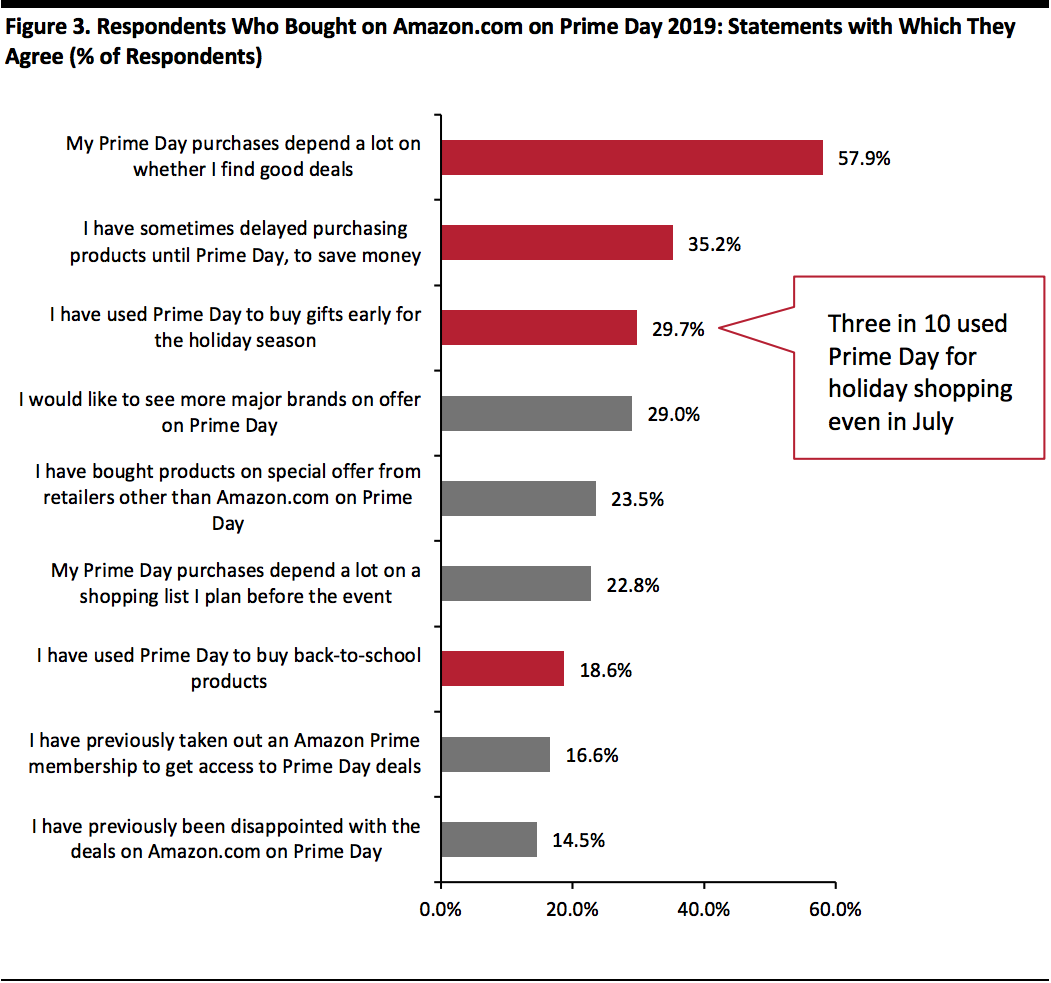

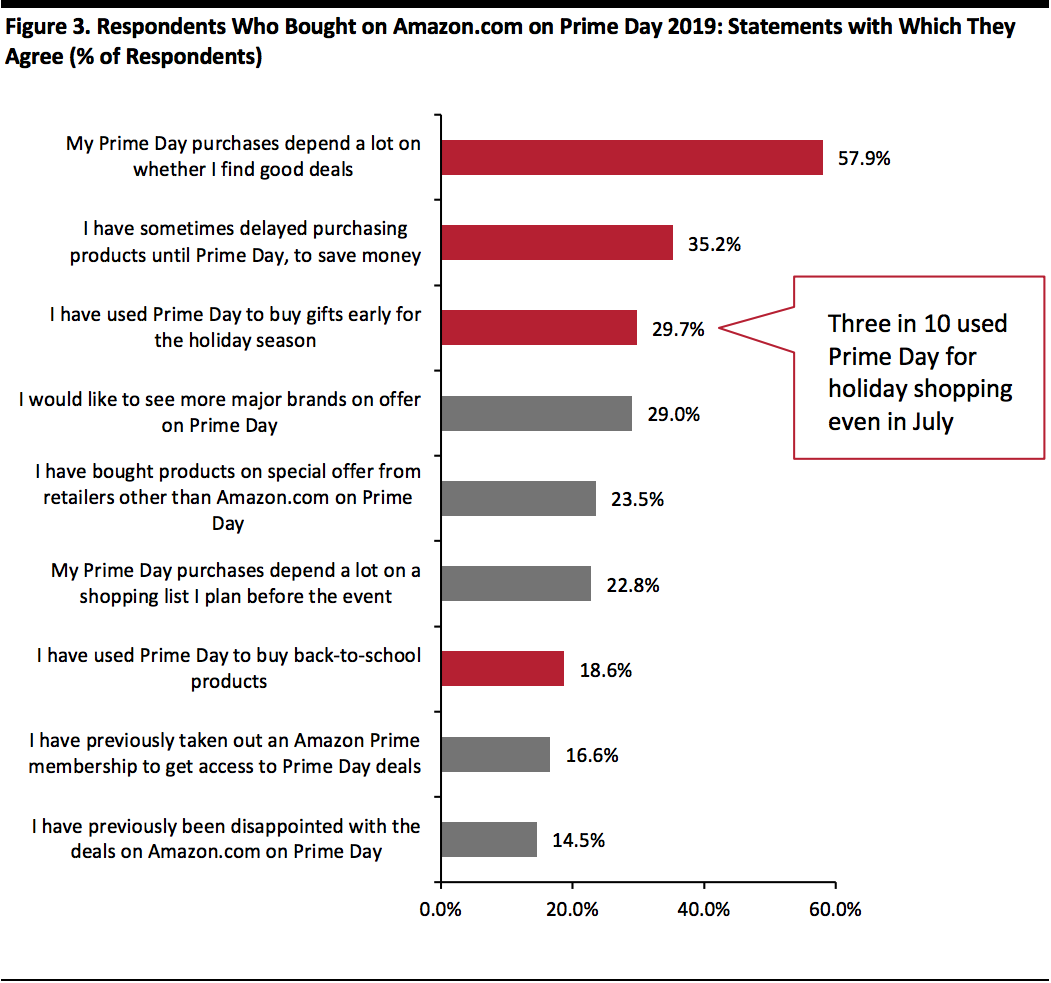

Source: Coresight Research[/caption] We asked those respondents who had purchased on Prime Day 2019 whether they agreed with various statements relating to Prime Day: Respondents could select multiple options

Respondents could select multiple options

Base: 145 US respondents who said they had shopped on Prime Day 2019, surveyed on June 24, 2020[/caption] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Prime Day 2020: What Can We Expect?

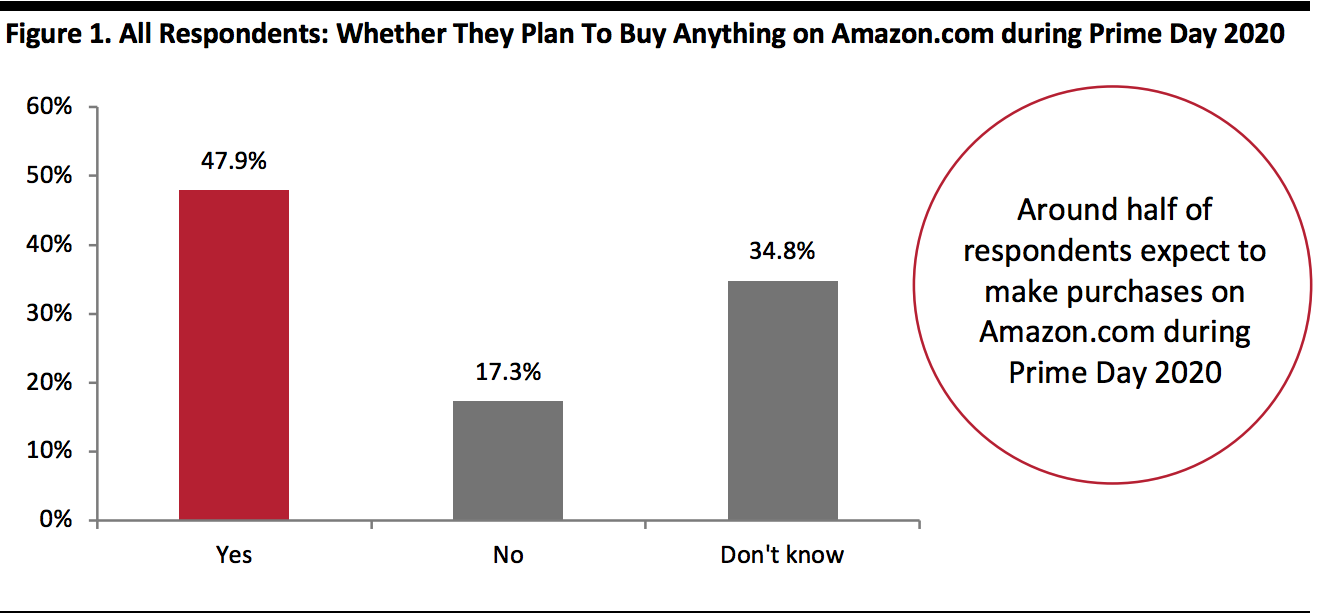

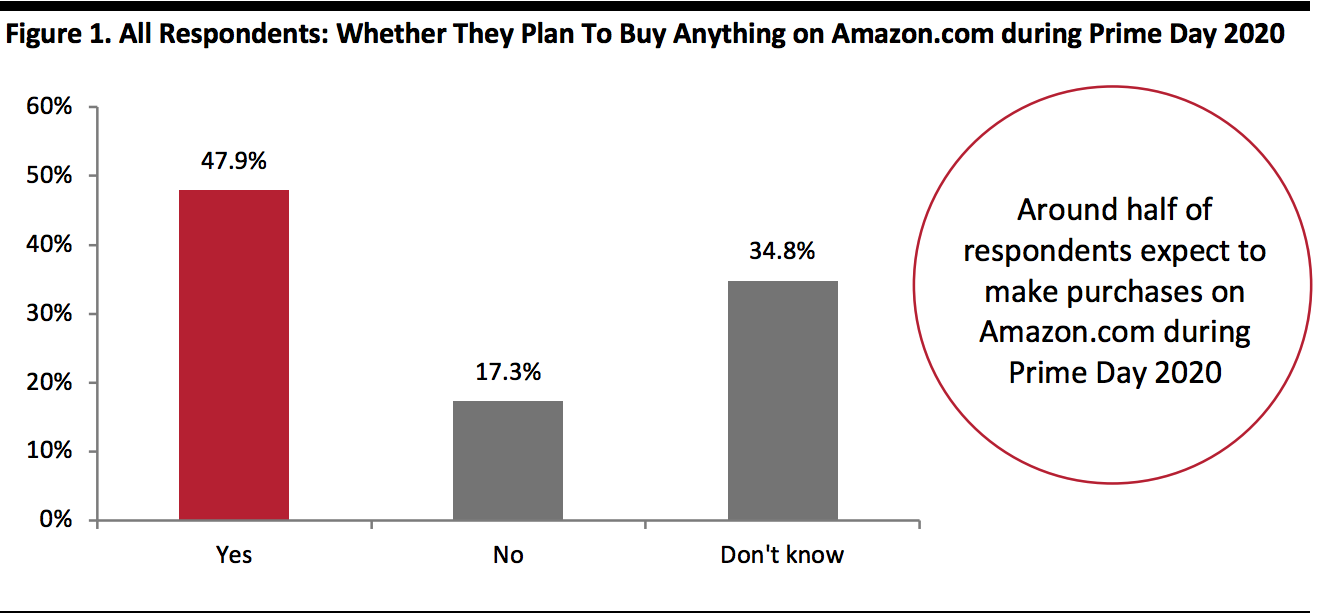

Coresight Research conducted a proprietary survey on June 24 to ask US consumers about Prime Day. Close to half of respondents reported that they expect to buy on Amazon.com during Prime Day in fall 2020 (at the time of our survey, reports indicated Prime Day would be in September, and this is what we asked respondents to think about). Less than one-fifth of respondents said that they have no plans to make purchases during the event. Just over one-third said that they do not know if they will buy anything during the event—aligning with our separate finding, discussed later, that many shoppers’ Prime Day purchases are opportunistic. [caption id="attachment_112898" align="aligncenter" width="700"] Base: 411 US respondents surveyed on June 24, 2020

Base: 411 US respondents surveyed on June 24, 2020Source: Coresight Research[/caption] The expected level of participation for the 2020 event is significantly higher than confirmed participation last year: Some 35% of respondents said that they had made purchases on Amazon.com during Prime Day 2019 (see Figure 2). However, as almost one-quarter could not recollect their purchasing activity, actual buying rates could be higher than that 35%. [caption id="attachment_112900" align="aligncenter" width="700"]

Base: 411 US respondents surveyed on June 24, 2020

Base: 411 US respondents surveyed on June 24, 2020Source: Coresight Research[/caption] We asked those respondents who had purchased on Prime Day 2019 whether they agreed with various statements relating to Prime Day:

- Opportunistic shopping: Close to 58% of Prime Day 2019 shoppers said that their purchase decisions are highly dependent on being able to find good deals. The best deals on offer during the Prime Day event will likely be for Amazon’s own-brand devices, such as Echo speakers, Fire tablets, Fire TV Sticks, among others. One can also expect good deals on electronics and gadgets, including television sets, fitness trackers, instant pot cookers, power tools, robot vacuums, smart lighting, smart watches and wireless headphones.

- Postponed purchases: Around 35% of shoppers had delayed purchases until Prime Day in prior years so as to save money, which is clearly a favorable trend for Amazon. This year, that trend would result in purchases being delayed from September or early October. The timing will also likely pull forward demand from the holiday peak.

- Holiday shopping: Around three in 10 Prime Day 2019 shoppers have previously used Prime Day to buy gifts in advance of the holiday season, even when the event was held in July. Given the expected October timing in 2020, holiday shopping is set to play a much greater part in Prime Day this year.

- Back-to-school shopping: Even when held in July, consumers shopped on Prime Day for the holiday more than for back-to-school products—with almost one in five Prime Day 2019 shoppers reporting that they have shopped for back-to-school products during Prime Day. By being held in October this year, Prime Day will miss out on start-of-term shopping.

Respondents could select multiple options

Respondents could select multiple optionsBase: 145 US respondents who said they had shopped on Prime Day 2019, surveyed on June 24, 2020[/caption]

Amazon Prime Day over the Years

Prime Day was launched in 2015. The event has had a huge global impact over the years with billions of dollars in global sales and a huge influence on not just Amazon itself, but also other marketplaces, channels, search engines and online stores. Prime Day features promotional deals aimed at driving traffic and conversion, as well as Prime membership subscriptions:- Lightning Deals: Amazon’s “Lightning Deals” are limited-time and limited-stock deals on a range of offerings—from tech accessories to shoes—that the company offers throughout the year. However, while these deals are typically available for all shoppers, only Prime members can access them during the Prime Day event.

- Deep discounts and bundled offers: Amazon offers deep discounts on its private-label brands as well as on various other products from third-party sellers. It also provides bundled offers, which include cashback offers, additional discounts with select payment methods, and exchange offers.

- Website glitches and crashes: Owing to the surge in consumer traffic on the platform during Prime Day each year, website crashes and glitches have been a recurring theme. Although not faultless, Prime Day 2019 pulled through relatively unscathed compared to the widespread technical issues that affected the 2018 event.

- Overburdened fulfillment network: The huge volume of transactions on Prime Day also inevitably causes huge strain on the company’s fulfillment network, which sometimes leads to delayed orders.

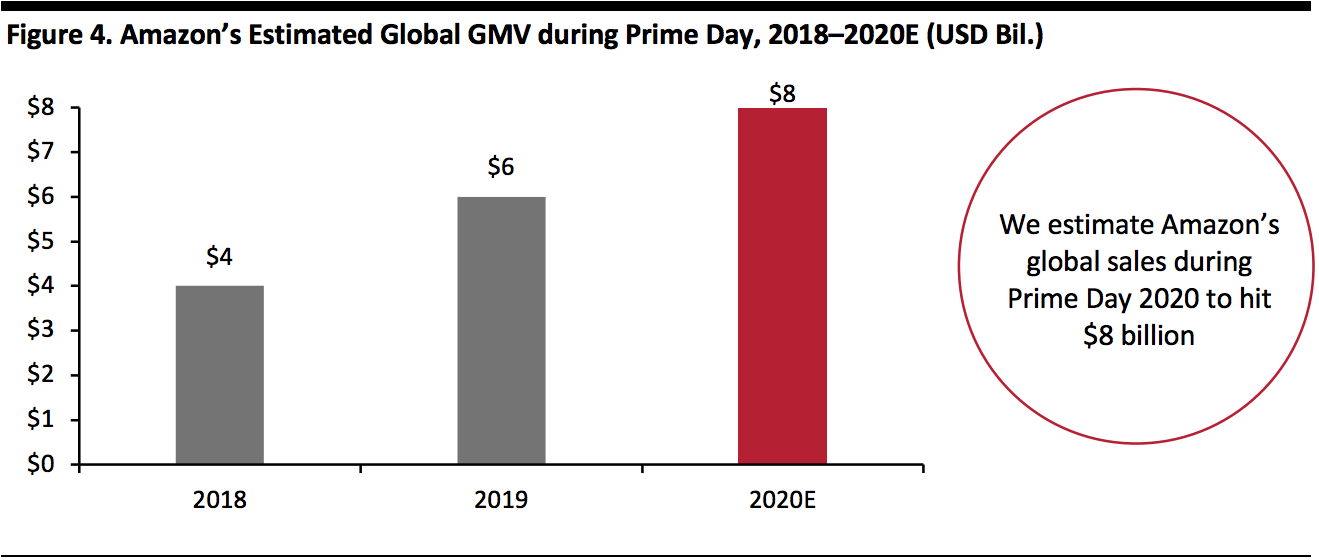

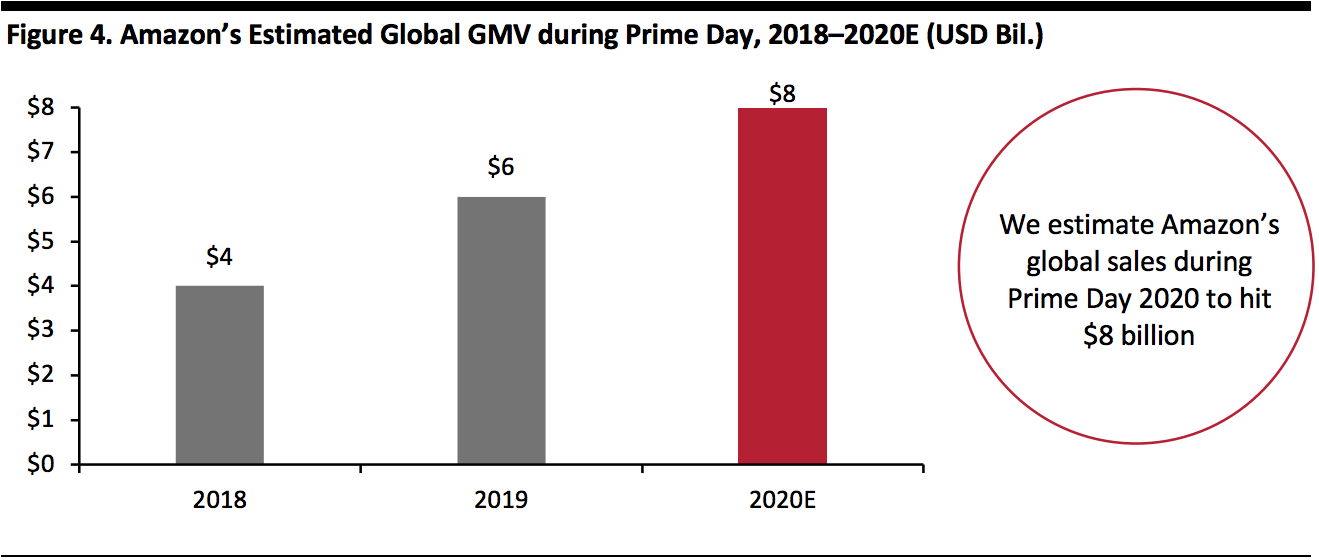

- Approximately $6 billion in global sales over 48 hours, according to Coresight Research estimates—up from an approximate $4 billion in 2018, which was a 36-hour event. This 2019 estimate for a 48-hour Prime Day represents around 3.4 times Amazon’s average two-day gross merchandise volume (GMV) in 2019 overall, based on Coresight Research estimates of the company’s annual GMV for online product sales.

- 175 million items sold, compared to 100 million in Prime Day 2018.

- Over 100,000 laptops, 200,000 televisions, 300,000 headphones, 350,000 luxury beauty products and over 1 million toys sold on Amazon.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Our 2020 Event Outlook: Three Tailwinds for Prime Day 2020 in October

We see three potential supports to Prime Day this year:- Shoppers will be looking for deals. The economic downturn will prompt consumers to seek out discounts, even while it is likely to soften demand for many discretionary categories. That softened demand will likely be the major headwind this year.

- Greater e-commerce adoption. The pandemic and associated lockdowns have prompted shoppers to shift some of their shopping from stores to e-commerce, and we expect this trend to persist through the remainder of the year. Our weekly surveys of US consumers confirm shoppers’ expectations of a long-lasting migration of spending to the online channel. In addition to benefiting the online channel in general, this is disproportionately providing gains for online pure-play retailers such as Amazon: Our July 1 survey found that three in 10 US consumers had switched some of their apparel spending to online-only retailers.

- The October timing provides Amazon with greater opportunities to capture early holiday season demand, likely providing a substantial boost to the event’s appeal. In turn, we expect this to distort the patterns of holiday trading. Traditionally, the holiday shopping season began with Black Friday, which this year falls on November 27. Prime Day could become the de facto start to the holiday season this year, pulling forward peak spending from late November and December into October. This also implies a more promotional holiday season; we have already seen Black Friday creep into an extended promotional period.