Nitheesh NH

Amazon Prime Day Discount Overview

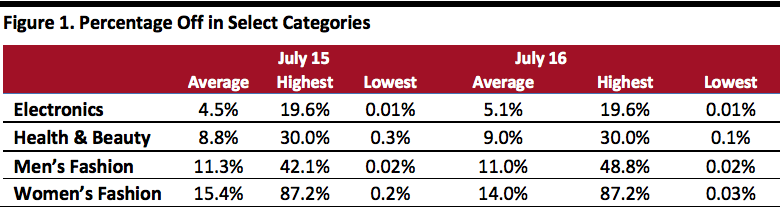

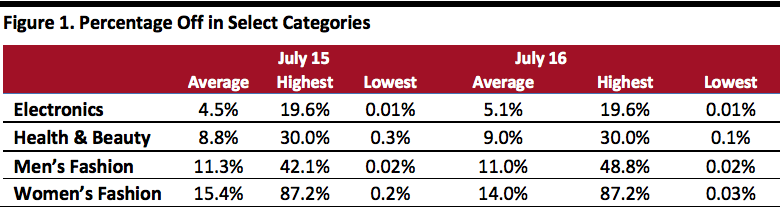

Amazon Prime Day 2019 began in the US at midnight Pacific Time on July 15. This year, the event ran 48 hours, up from last year’s 36 hours, making it the longest Prime Day sale so far. Amazon had deals in more than 14 categories, from home improvement to baby products. We analyzed discounts in four categories on Amazon’s US site: electronics, health and beauty, men’s fashion and women’s fashion. We used each product’s price on July 8th as the base and analyzed price differences on July 15 and 16.

Overall, women’s fashion offered the highest average discount on both days and electronics the lowest. Men’s fashion had the highest percentage of goods on sale and the highest percentage of products that continued to lower prices from the first day.

[caption id="attachment_93950" align="aligncenter" width="700"] Source: Amazon/Coresight Research/DataWeave[/caption]

Electronics

We analyzed the prices of 106 products, selected from top-featured goods across different electronics subcategories.

On the first day, 23.6% of products were offered at lower prices, but 13.2% were offered at higher prices than on July 8. The discounts ranged from 0.01% to 19.6%, with an average of 4.5%. None of the discounted products continued to decrease prices on day two.

On day two, 28.3% of products were offered at lower prices but 14.2% were offered at higher prices than on July 8. The average discount was 5.1%, with a range from 0.01% to 19.6%.

Between July 15 and 16, only 3.8% of products had a price difference that was greater than one dollar.

Health & Beauty

We analyzed the prices of 134 products, selected from top-featured goods across different health and beauty subcategories.

On the first day, 18.7% of products were offered at lower prices, but 14.9% at higher prices than July 8. The discounts ranged from 0.31% to 30.0%, with an average of 8.8%. Only 2.2% of discounted products continued to decrease prices on day two.

On the second day, 18.7% of products were offered at lower prices but 19.4% were higher than on July 8. The discounts ranged from 0.1% to 30.0%, with an average of 9.0%.

Over the two days, just 8.2% of products had a price difference greater than one dollar.

Men’s Fashion

We analyzed the prices of 166 products, selected from top-featured goods across different men’s fashion subcategories.

On the first day, 30.1% of products were offered at lower prices and 17.5% at higher prices than on July 8. The discounts ranged from 0.02% to 42.1%, with an average of 11.3%. Some 7.8% continued to cut prices, while 9.6% raised prices on day two.

On the second day, 28.9% of products were offered at lower prices than on July 8, while 24.1% were higher. The discounts ranged from 0.02% to 48.8%, with an average of 11.0%.

Over the two days, 27.1% of products had a price difference greater than one dollar.

Women’s Fashion

We analyzed the price of 155 products, selected from top-featured goods across different women’s fashion subcategories.

On the first day, 18.7% of products were offered at lower prices while 13.5% were higher than on July 8. The discounts ranged from 0.2% to 87.2%, with an average of 15.4%. Only two products continued to decrease price, while 4.5% increased price on day two.

On the second day, 15.5% of products were offered at lower prices while 12.9% were higher than on July 8. The discounts ranged from 0.03% to 87.2%, with an average of 14.0%.

Over the two days, only 8.4% of products had a price difference greater than one dollar.

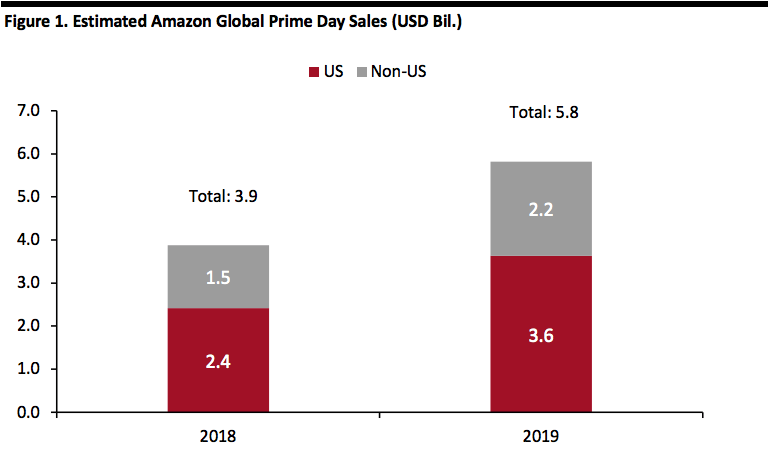

Prime Day Sales Estimates: $5.8 Billion This Year

Amazon does not disclose figures for revenues generated during Prime Day, but our estimates show Amazon sold approximately $5.8 billion globally during this year’s Prime Day event, up around 50% compared to the estimated $3.9 billion in sales last year.

Supporting this growth was this year’s bigger event, with more promotions and initiatives over a longer period: Prime Day 2018 was 36 hours, 2019 was 25% longer at 48 hours.

Our figures reflect estimated product sales online and exclude revenues from additional Prime membership sign-ups during Prime Day.

Our estimated split by region, shown below, is based on Amazon’s 2018 segmentation of its online retail revenues, and suggests the US accounted for 62% or around $3.6 billion of estimated 2019 Prime Day sales.

[caption id="attachment_93951" align="aligncenter" width="700"]

Source: Amazon/Coresight Research/DataWeave[/caption]

Electronics

We analyzed the prices of 106 products, selected from top-featured goods across different electronics subcategories.

On the first day, 23.6% of products were offered at lower prices, but 13.2% were offered at higher prices than on July 8. The discounts ranged from 0.01% to 19.6%, with an average of 4.5%. None of the discounted products continued to decrease prices on day two.

On day two, 28.3% of products were offered at lower prices but 14.2% were offered at higher prices than on July 8. The average discount was 5.1%, with a range from 0.01% to 19.6%.

Between July 15 and 16, only 3.8% of products had a price difference that was greater than one dollar.

Health & Beauty

We analyzed the prices of 134 products, selected from top-featured goods across different health and beauty subcategories.

On the first day, 18.7% of products were offered at lower prices, but 14.9% at higher prices than July 8. The discounts ranged from 0.31% to 30.0%, with an average of 8.8%. Only 2.2% of discounted products continued to decrease prices on day two.

On the second day, 18.7% of products were offered at lower prices but 19.4% were higher than on July 8. The discounts ranged from 0.1% to 30.0%, with an average of 9.0%.

Over the two days, just 8.2% of products had a price difference greater than one dollar.

Men’s Fashion

We analyzed the prices of 166 products, selected from top-featured goods across different men’s fashion subcategories.

On the first day, 30.1% of products were offered at lower prices and 17.5% at higher prices than on July 8. The discounts ranged from 0.02% to 42.1%, with an average of 11.3%. Some 7.8% continued to cut prices, while 9.6% raised prices on day two.

On the second day, 28.9% of products were offered at lower prices than on July 8, while 24.1% were higher. The discounts ranged from 0.02% to 48.8%, with an average of 11.0%.

Over the two days, 27.1% of products had a price difference greater than one dollar.

Women’s Fashion

We analyzed the price of 155 products, selected from top-featured goods across different women’s fashion subcategories.

On the first day, 18.7% of products were offered at lower prices while 13.5% were higher than on July 8. The discounts ranged from 0.2% to 87.2%, with an average of 15.4%. Only two products continued to decrease price, while 4.5% increased price on day two.

On the second day, 15.5% of products were offered at lower prices while 12.9% were higher than on July 8. The discounts ranged from 0.03% to 87.2%, with an average of 14.0%.

Over the two days, only 8.4% of products had a price difference greater than one dollar.

Prime Day Sales Estimates: $5.8 Billion This Year

Amazon does not disclose figures for revenues generated during Prime Day, but our estimates show Amazon sold approximately $5.8 billion globally during this year’s Prime Day event, up around 50% compared to the estimated $3.9 billion in sales last year.

Supporting this growth was this year’s bigger event, with more promotions and initiatives over a longer period: Prime Day 2018 was 36 hours, 2019 was 25% longer at 48 hours.

Our figures reflect estimated product sales online and exclude revenues from additional Prime membership sign-ups during Prime Day.

Our estimated split by region, shown below, is based on Amazon’s 2018 segmentation of its online retail revenues, and suggests the US accounted for 62% or around $3.6 billion of estimated 2019 Prime Day sales.

[caption id="attachment_93951" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Other Retailers’ Activities

Just as last year, other retailers continued to jump on the Prime Day bandwagon, offering their own promotions to coincide with the Amazon event. In men’s and women’s fashion, Target offered an average of 26.5% in additional discounts, while Walmart offered 16.6% off, according to DataWeave. In addition, 6.7% of Target’s fashion category products were on sale, versus Walmart’s 3.8%.

Source: Company reports/Coresight Research[/caption]

Other Retailers’ Activities

Just as last year, other retailers continued to jump on the Prime Day bandwagon, offering their own promotions to coincide with the Amazon event. In men’s and women’s fashion, Target offered an average of 26.5% in additional discounts, while Walmart offered 16.6% off, according to DataWeave. In addition, 6.7% of Target’s fashion category products were on sale, versus Walmart’s 3.8%.

Source: Amazon/Coresight Research/DataWeave[/caption]

Electronics

We analyzed the prices of 106 products, selected from top-featured goods across different electronics subcategories.

On the first day, 23.6% of products were offered at lower prices, but 13.2% were offered at higher prices than on July 8. The discounts ranged from 0.01% to 19.6%, with an average of 4.5%. None of the discounted products continued to decrease prices on day two.

On day two, 28.3% of products were offered at lower prices but 14.2% were offered at higher prices than on July 8. The average discount was 5.1%, with a range from 0.01% to 19.6%.

Between July 15 and 16, only 3.8% of products had a price difference that was greater than one dollar.

Health & Beauty

We analyzed the prices of 134 products, selected from top-featured goods across different health and beauty subcategories.

On the first day, 18.7% of products were offered at lower prices, but 14.9% at higher prices than July 8. The discounts ranged from 0.31% to 30.0%, with an average of 8.8%. Only 2.2% of discounted products continued to decrease prices on day two.

On the second day, 18.7% of products were offered at lower prices but 19.4% were higher than on July 8. The discounts ranged from 0.1% to 30.0%, with an average of 9.0%.

Over the two days, just 8.2% of products had a price difference greater than one dollar.

Men’s Fashion

We analyzed the prices of 166 products, selected from top-featured goods across different men’s fashion subcategories.

On the first day, 30.1% of products were offered at lower prices and 17.5% at higher prices than on July 8. The discounts ranged from 0.02% to 42.1%, with an average of 11.3%. Some 7.8% continued to cut prices, while 9.6% raised prices on day two.

On the second day, 28.9% of products were offered at lower prices than on July 8, while 24.1% were higher. The discounts ranged from 0.02% to 48.8%, with an average of 11.0%.

Over the two days, 27.1% of products had a price difference greater than one dollar.

Women’s Fashion

We analyzed the price of 155 products, selected from top-featured goods across different women’s fashion subcategories.

On the first day, 18.7% of products were offered at lower prices while 13.5% were higher than on July 8. The discounts ranged from 0.2% to 87.2%, with an average of 15.4%. Only two products continued to decrease price, while 4.5% increased price on day two.

On the second day, 15.5% of products were offered at lower prices while 12.9% were higher than on July 8. The discounts ranged from 0.03% to 87.2%, with an average of 14.0%.

Over the two days, only 8.4% of products had a price difference greater than one dollar.

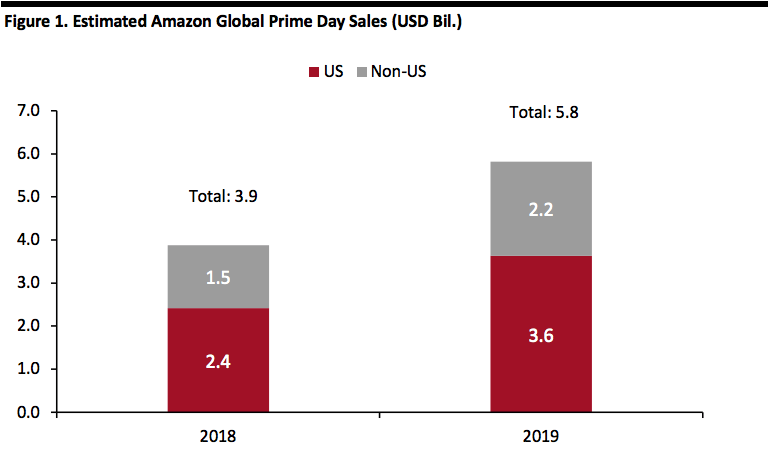

Prime Day Sales Estimates: $5.8 Billion This Year

Amazon does not disclose figures for revenues generated during Prime Day, but our estimates show Amazon sold approximately $5.8 billion globally during this year’s Prime Day event, up around 50% compared to the estimated $3.9 billion in sales last year.

Supporting this growth was this year’s bigger event, with more promotions and initiatives over a longer period: Prime Day 2018 was 36 hours, 2019 was 25% longer at 48 hours.

Our figures reflect estimated product sales online and exclude revenues from additional Prime membership sign-ups during Prime Day.

Our estimated split by region, shown below, is based on Amazon’s 2018 segmentation of its online retail revenues, and suggests the US accounted for 62% or around $3.6 billion of estimated 2019 Prime Day sales.

[caption id="attachment_93951" align="aligncenter" width="700"]

Source: Amazon/Coresight Research/DataWeave[/caption]

Electronics

We analyzed the prices of 106 products, selected from top-featured goods across different electronics subcategories.

On the first day, 23.6% of products were offered at lower prices, but 13.2% were offered at higher prices than on July 8. The discounts ranged from 0.01% to 19.6%, with an average of 4.5%. None of the discounted products continued to decrease prices on day two.

On day two, 28.3% of products were offered at lower prices but 14.2% were offered at higher prices than on July 8. The average discount was 5.1%, with a range from 0.01% to 19.6%.

Between July 15 and 16, only 3.8% of products had a price difference that was greater than one dollar.

Health & Beauty

We analyzed the prices of 134 products, selected from top-featured goods across different health and beauty subcategories.

On the first day, 18.7% of products were offered at lower prices, but 14.9% at higher prices than July 8. The discounts ranged from 0.31% to 30.0%, with an average of 8.8%. Only 2.2% of discounted products continued to decrease prices on day two.

On the second day, 18.7% of products were offered at lower prices but 19.4% were higher than on July 8. The discounts ranged from 0.1% to 30.0%, with an average of 9.0%.

Over the two days, just 8.2% of products had a price difference greater than one dollar.

Men’s Fashion

We analyzed the prices of 166 products, selected from top-featured goods across different men’s fashion subcategories.

On the first day, 30.1% of products were offered at lower prices and 17.5% at higher prices than on July 8. The discounts ranged from 0.02% to 42.1%, with an average of 11.3%. Some 7.8% continued to cut prices, while 9.6% raised prices on day two.

On the second day, 28.9% of products were offered at lower prices than on July 8, while 24.1% were higher. The discounts ranged from 0.02% to 48.8%, with an average of 11.0%.

Over the two days, 27.1% of products had a price difference greater than one dollar.

Women’s Fashion

We analyzed the price of 155 products, selected from top-featured goods across different women’s fashion subcategories.

On the first day, 18.7% of products were offered at lower prices while 13.5% were higher than on July 8. The discounts ranged from 0.2% to 87.2%, with an average of 15.4%. Only two products continued to decrease price, while 4.5% increased price on day two.

On the second day, 15.5% of products were offered at lower prices while 12.9% were higher than on July 8. The discounts ranged from 0.03% to 87.2%, with an average of 14.0%.

Over the two days, only 8.4% of products had a price difference greater than one dollar.

Prime Day Sales Estimates: $5.8 Billion This Year

Amazon does not disclose figures for revenues generated during Prime Day, but our estimates show Amazon sold approximately $5.8 billion globally during this year’s Prime Day event, up around 50% compared to the estimated $3.9 billion in sales last year.

Supporting this growth was this year’s bigger event, with more promotions and initiatives over a longer period: Prime Day 2018 was 36 hours, 2019 was 25% longer at 48 hours.

Our figures reflect estimated product sales online and exclude revenues from additional Prime membership sign-ups during Prime Day.

Our estimated split by region, shown below, is based on Amazon’s 2018 segmentation of its online retail revenues, and suggests the US accounted for 62% or around $3.6 billion of estimated 2019 Prime Day sales.

[caption id="attachment_93951" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Other Retailers’ Activities

Just as last year, other retailers continued to jump on the Prime Day bandwagon, offering their own promotions to coincide with the Amazon event. In men’s and women’s fashion, Target offered an average of 26.5% in additional discounts, while Walmart offered 16.6% off, according to DataWeave. In addition, 6.7% of Target’s fashion category products were on sale, versus Walmart’s 3.8%.

Source: Company reports/Coresight Research[/caption]

Other Retailers’ Activities

Just as last year, other retailers continued to jump on the Prime Day bandwagon, offering their own promotions to coincide with the Amazon event. In men’s and women’s fashion, Target offered an average of 26.5% in additional discounts, while Walmart offered 16.6% off, according to DataWeave. In addition, 6.7% of Target’s fashion category products were on sale, versus Walmart’s 3.8%.