Executive Summary

Amazon, which endeavors to offer everything from A to Z, has been expanding its product offering for year, from books and DVDs initially to media content to, most recently, groceries, clothing, events and even new cars.

A funny thing happened on the way to retail domination, though. Amazon was one of the early pioneers of the “Buy It Now” button (click

here to read FGRT’s report on buy buttons), but the company realized at some point that it had created a payment platform by saving customers’ preferred payment methods and that this platform could be used by other e-commerce vendors.

Thus, Amazon Pay was born, and more than 33 million users and more than 130 retailers have already signed up to use the platform. The idea is insanely simple and good for Amazon: as shoppers became accustomed to purchasing more and more goods and services from Amazon, it made sense to just combine items from other vendors into one Amazon account.

While mobile payments are ubiquitous in China, they are not used as widely in the US due to missteps by early vendors and market limitations. PayPal has the largest number of users, but it was under eBay’s umbrella for several years until eBay spun it off in July 2015 and, although it is viewed as a payment platform for some e-commerce transactions, many likely still think of it as part of eBay.

Apple Pay is consumer-friendly and easy to use. However, Apple’s hardware is still a closed system and only recent-model iPhones have the necessary NFC chip that enables Apple Pay to work, so the penetration of Apple Pay is limited by Apple’s market share (about 15% worldwide, according to market intelligence firm IDC). Still, many major retailers do not support Apple Pay, and others, such as Walmart and Target, have started to develop their own payment platforms. Among the wreckage of multiple failed payment platforms, Amazon possesses a huge installed base, with more than 310 million active customer accounts worldwide and more than half of US households holding a Prime membership.

Amazon Pay Places could easily fill the vacuum. What is Amazon Pay Places? It is a platform for effecting payment on a smartphone using Amazon’s billing infrastructure. Since it uses Amazon’s device-agnostic app, it is not limited to iPhones (as is Apple Pay) or Samsung phones (as is Samsung Pay). In addition, Amazon is a well-known and trusted brand. At present, the platform can be used only to make payments for orders at TGI Fridays restaurants in Boston; Philadelphia; Baltimore; Washington, DC; Richmond, VA; and Wilkes-Barre, PA. However, it is likely to be rolled out to an expanded geographical footprint once testing is complete.

With many of us having become accustomed to the ease of clicking our mouse or tapping the screen a couple times to place an order with Amazon—rather than taking the time to comparison shop—Amazon is likely to deploy its convenience and ease of use to physical commerce in general, thus dominating the payment process and expanding its reach to engulf the physical businesses it has not already disrupted. It is an Amazon world, and we should just get used to living in it.

Market Size

According to the most recent study by the US Federal Reserve, Americans completed 33.8 billion credit card transactions in 2015, for a total value of $31.6 trillion (compared with 3.1 billion transactions totaling $0.61 trillion in 2012).

Source: pay.amazon

Source: pay.amazon

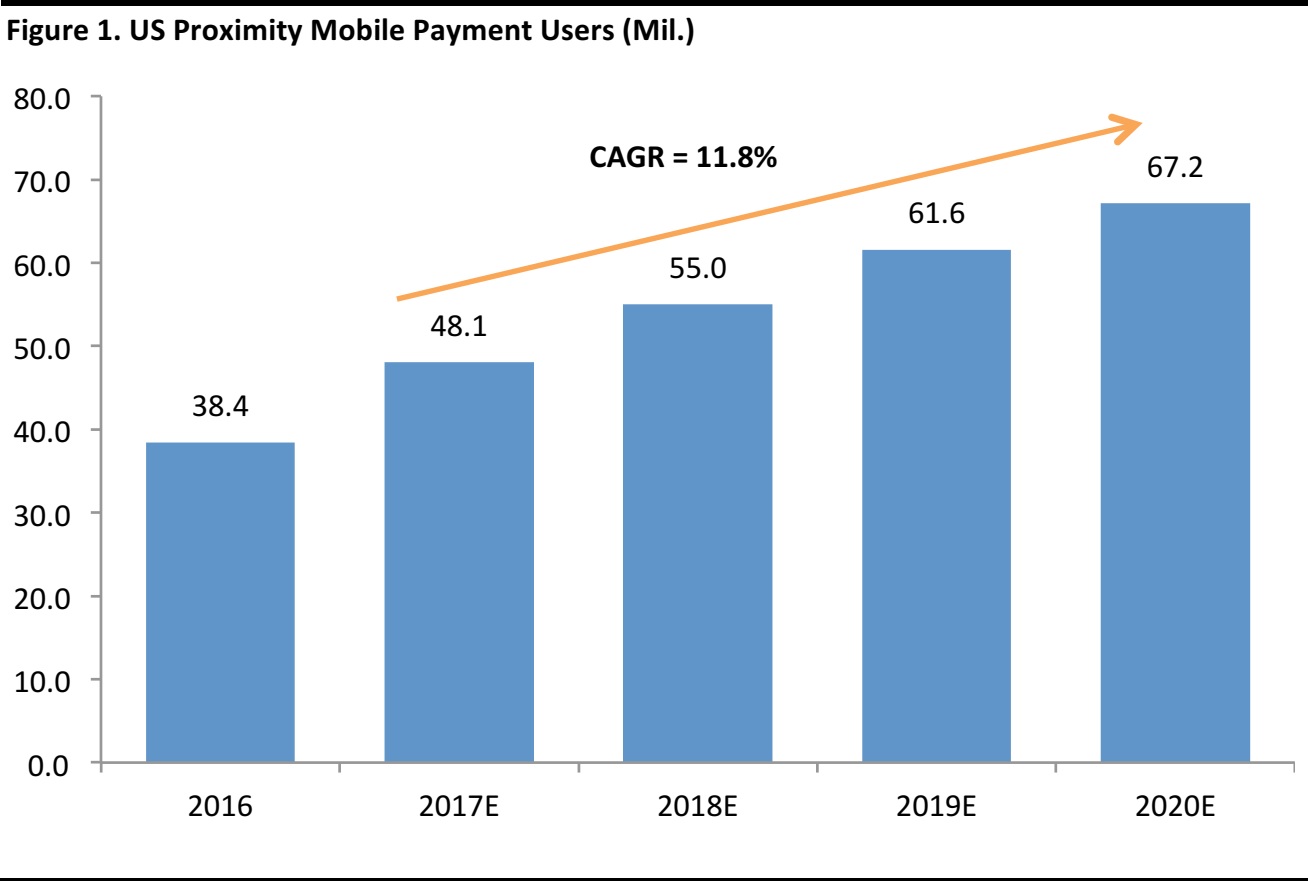

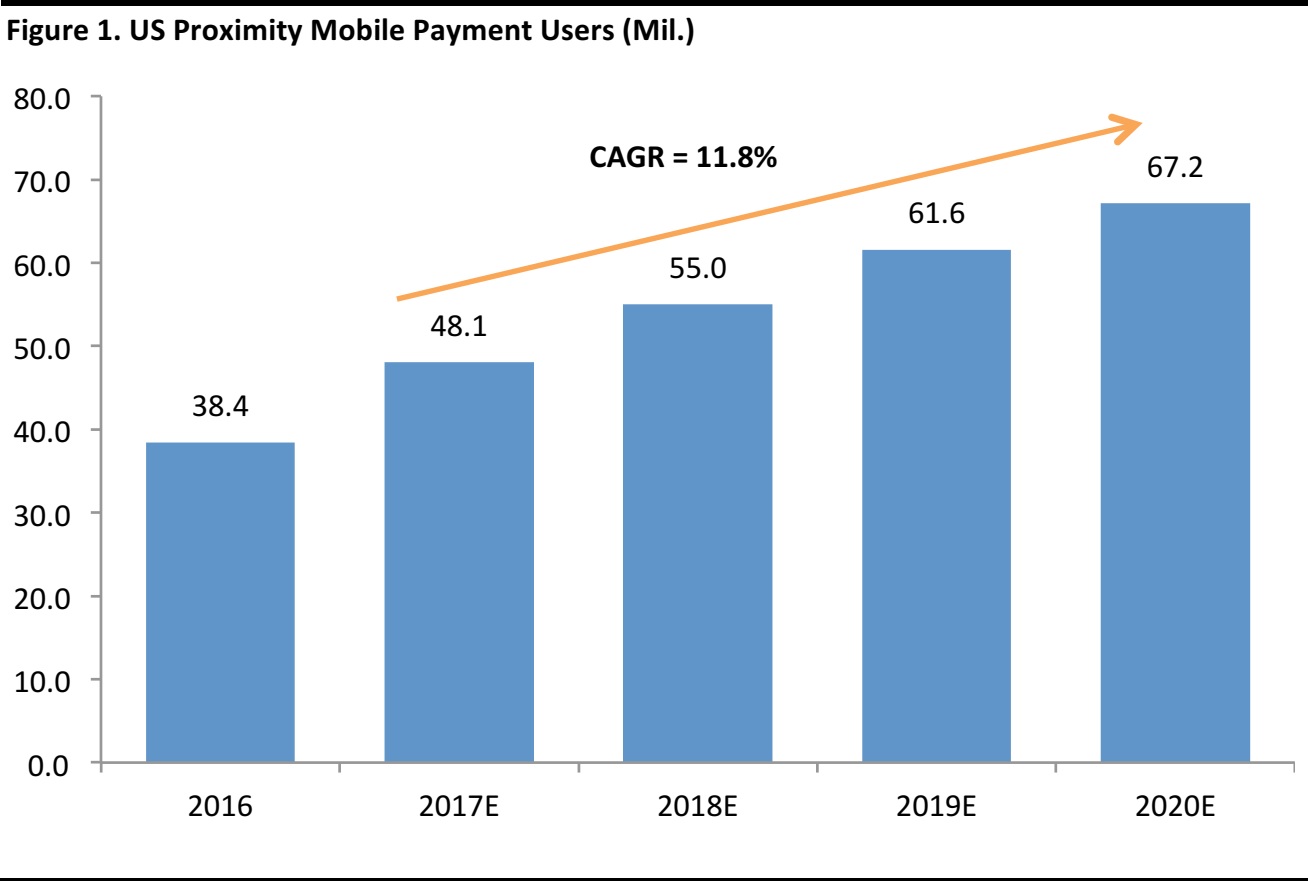

A recent study by eMarketer forecasts that 48.1 million peer-to-peer mobile payment users will generate total payments of $49.29 billion this year, or more than $1,000 per person. The graph below shows the number of mobile payment users, which eMarketer expects to grow at an 11.8% CAGR through 2020. eMarketer further estimates that, this year, 63.5 million adults in the US, representing about one-third of smartphone users, will use a peer-to-peer payment app at least once per month.

Source: eMarketer (as of July 2017)

Source: eMarketer (as of July 2017)

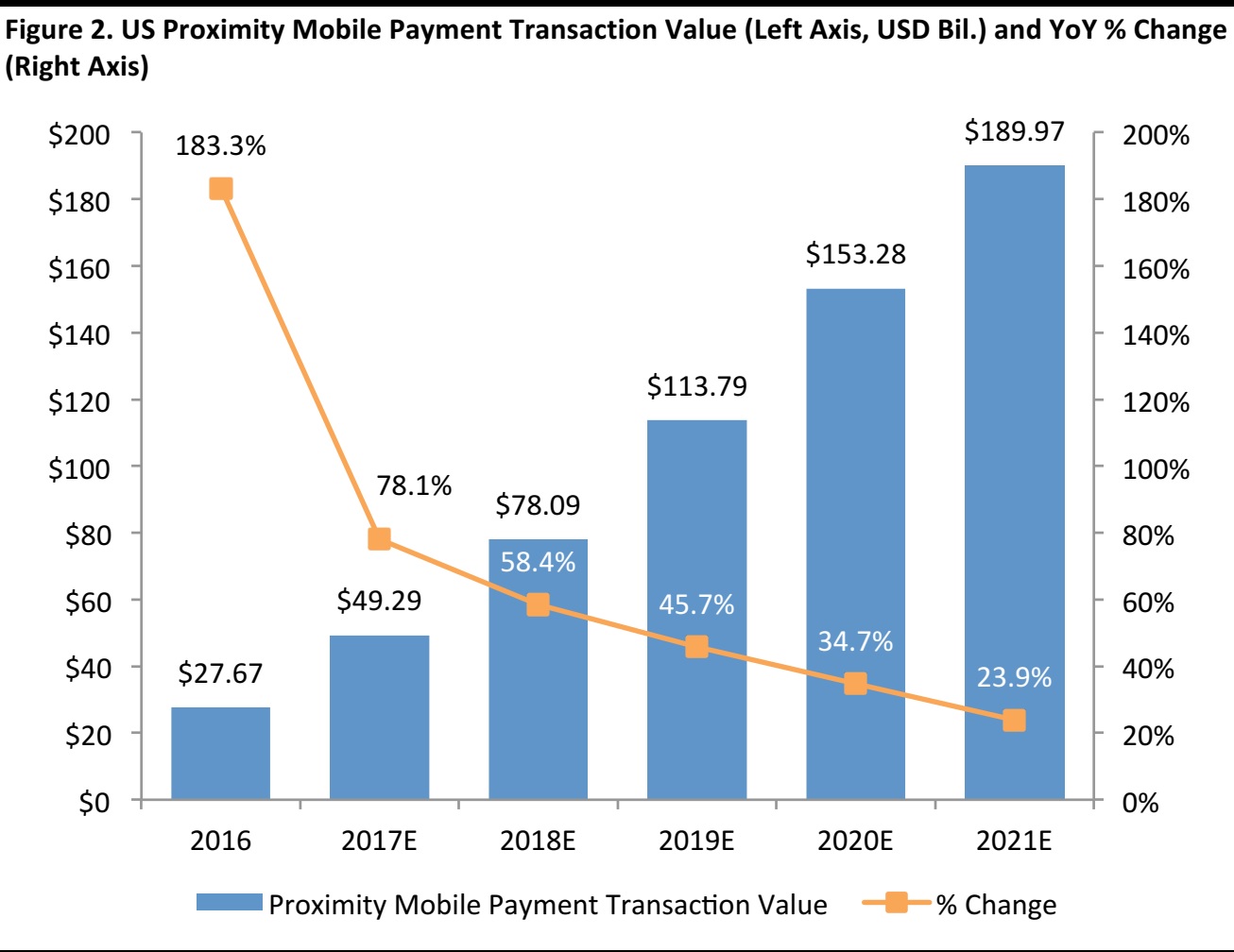

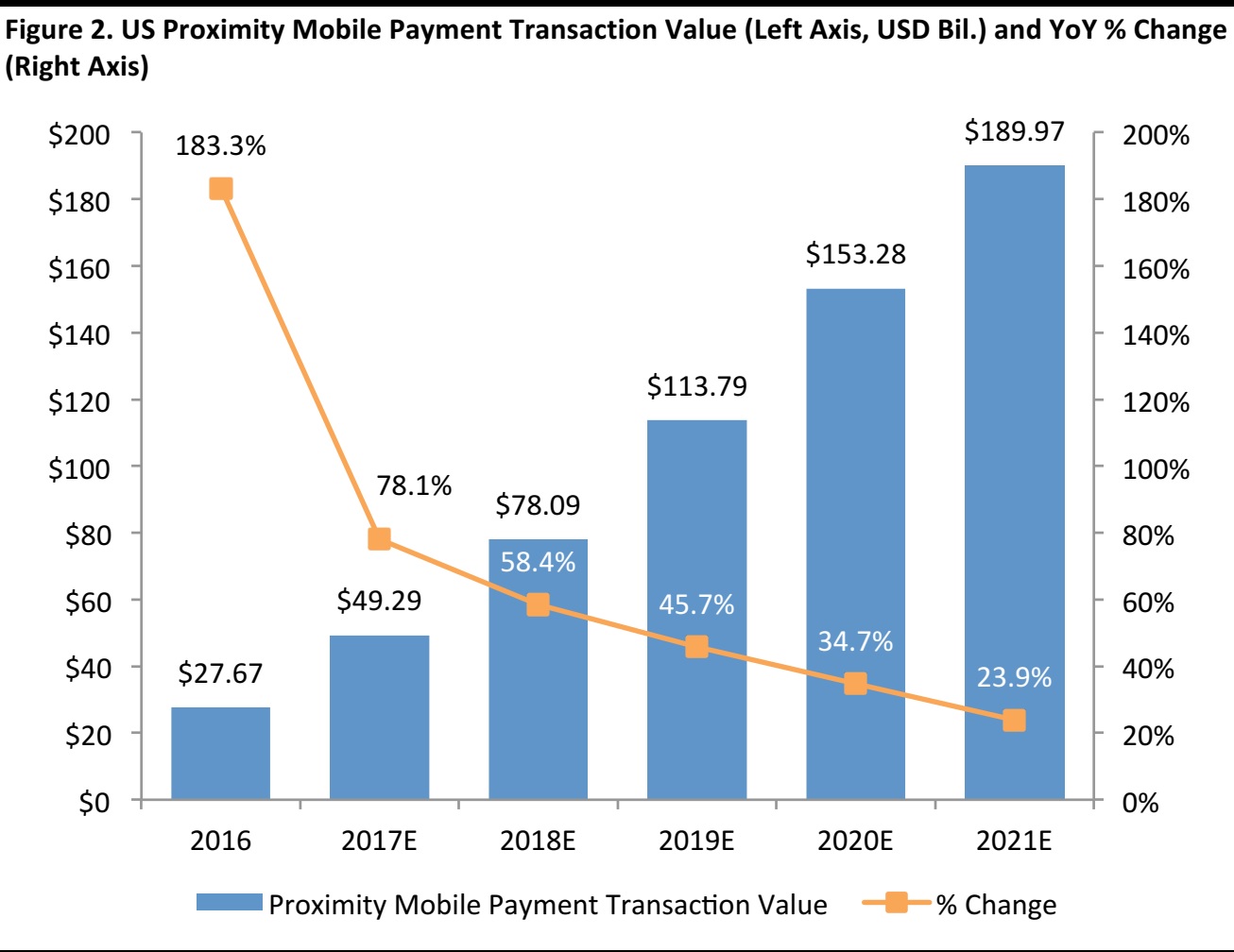

eMarketer further estimates that mobile payment transaction value will grow by 78.1% this year, with the rate slowing to 23.9% in 2021, as seen in the graph below.

Source: eMarketer (as of July 2017)

Source: eMarketer (as of July 2017)

What Is Amazon Pay?

Amazon Pay (or Amazon Payments) is a payment platform for funding the purchase of goods and services bought online or offline. Buyers’ financial information (such as their credit card numbers) is stored safely on Amazon’s server, similar to the way information is stored on other platforms such as Visa Checkout, Verified by Visa, PayPal and Apple Pay.

The benefit to the consumer is that he or she does not have to provide payment information at the time of purchase and can effect a purchase by simply pressing a button on the vendor’s checkout page. Amazon covers all purchases with the same buyer protection plan offered on its website.

Amazon had 310 million active customer accounts as of the first quarter of 2016 (which was the last time it disclosed this figure), and all of those customers are potential Amazon Pay users. According to an article on Forbes.com

, more than 75% of US smartphone users have the Amazon app on their phone.

Source: pay.amazon

Source: pay.amazon

Source: Amazon

Source: Amazon

Once a customer clicks the button on a vendor’s checkout page, Amazon processes the payment and the purchase is billed to the customer’s credit card or account on file. Amazon charges $0.30 plus a processing fee of 0.29% per transaction for domestic purchases. For international purchases, the processing fee is 3.9%.

How Big Is Amazon Pay?

In February 2017, Amazon announced that more than 33 million customers had used Amazon Pay to make a purchase and that payment volume had doubled in 2016. In addition:

- Customers used Amazon Pay in more than 179 countries.

- More than half of Amazon Pay customers are Prime members.

- 32% of payments were made on a mobile device.

- The average purchase was $80; the largest purchase was $40,000.

- Amazon Pay is (naturally) accepted in Amazon’s physical bookstores.

Merchants that Accept Amazon Pay

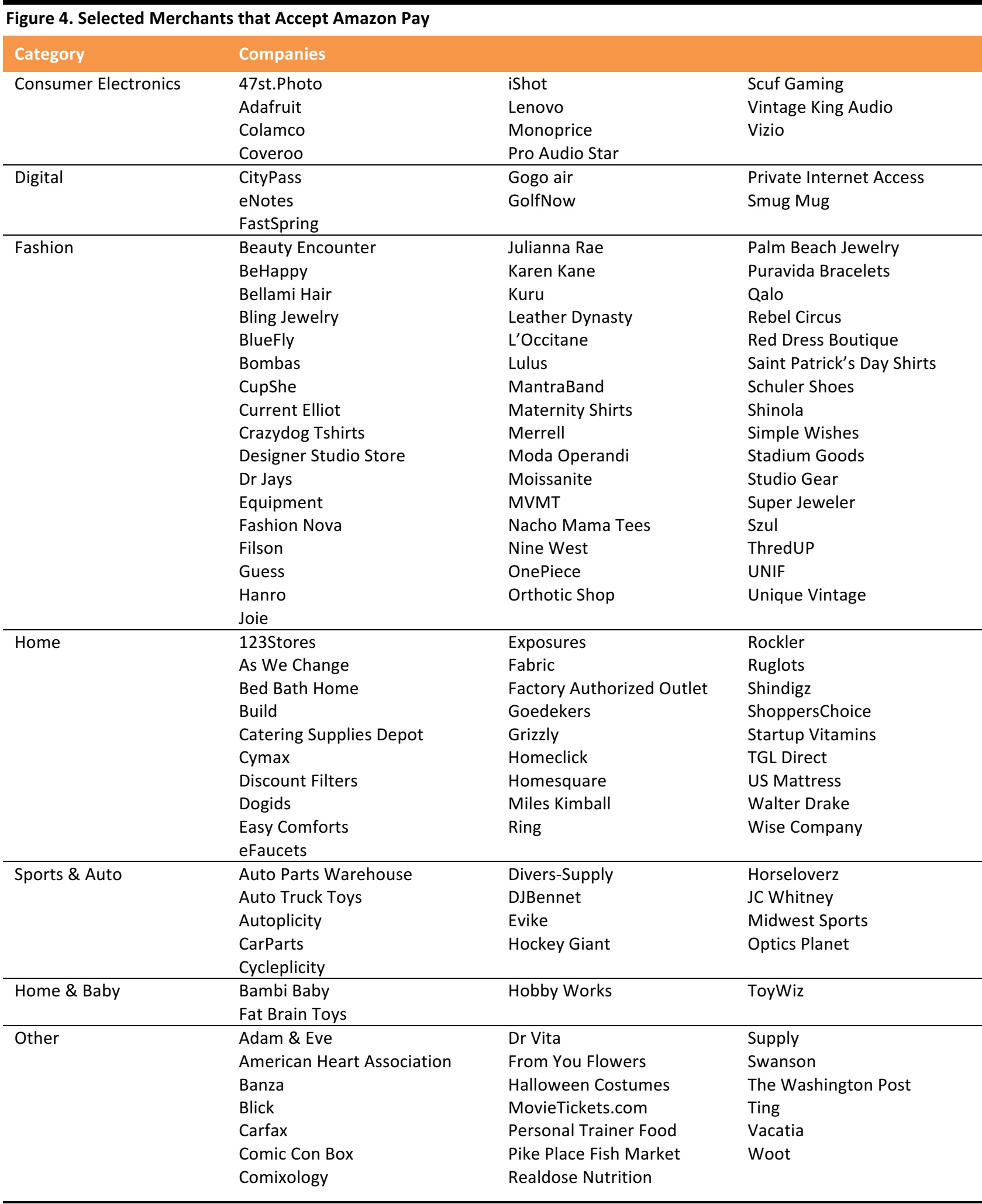

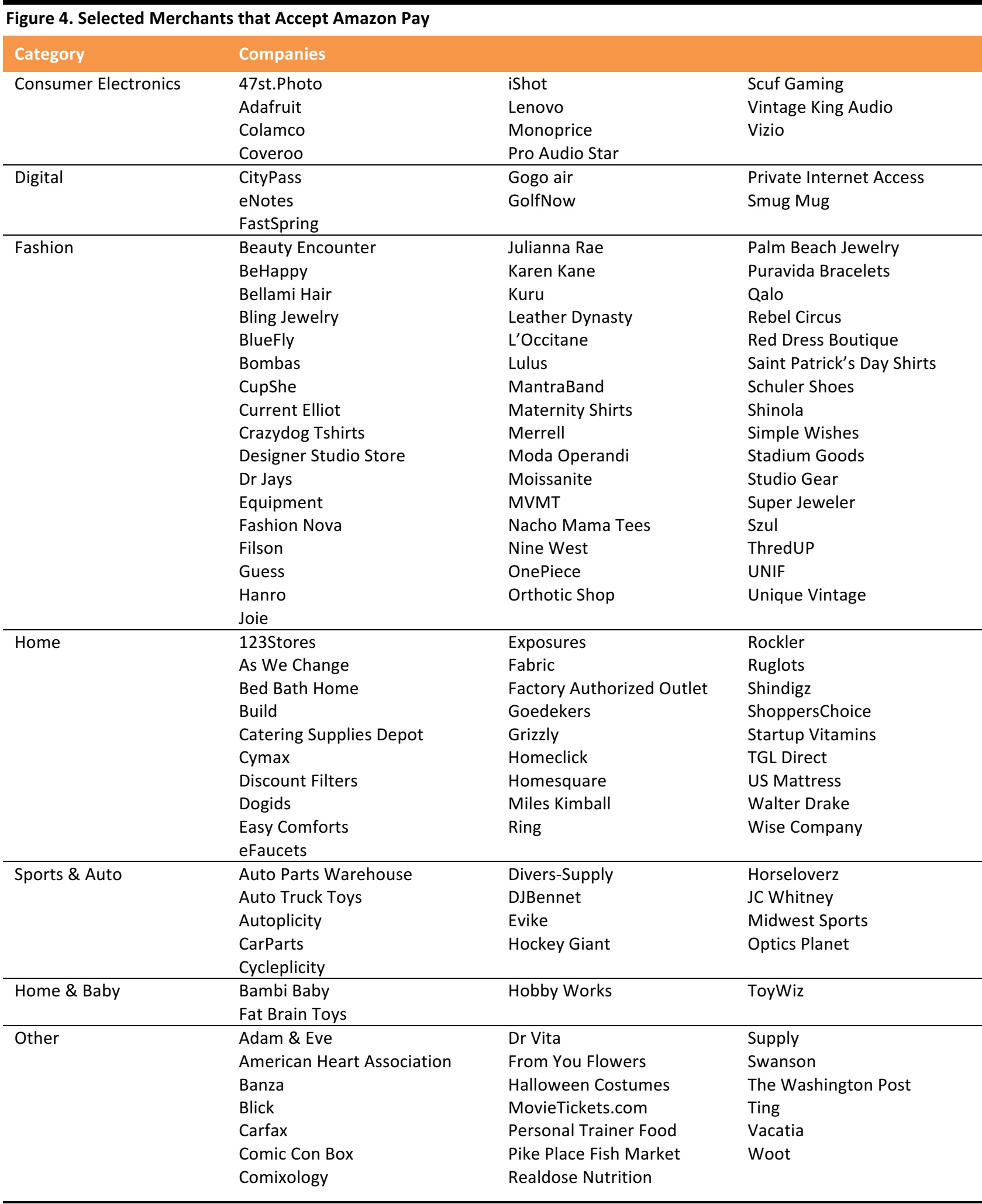

More than 133 merchants across a wide variety of companies in a wide variety of segments accept Amazon Pay, including those listed in the table below.

Source: Amazon

Source: Amazon

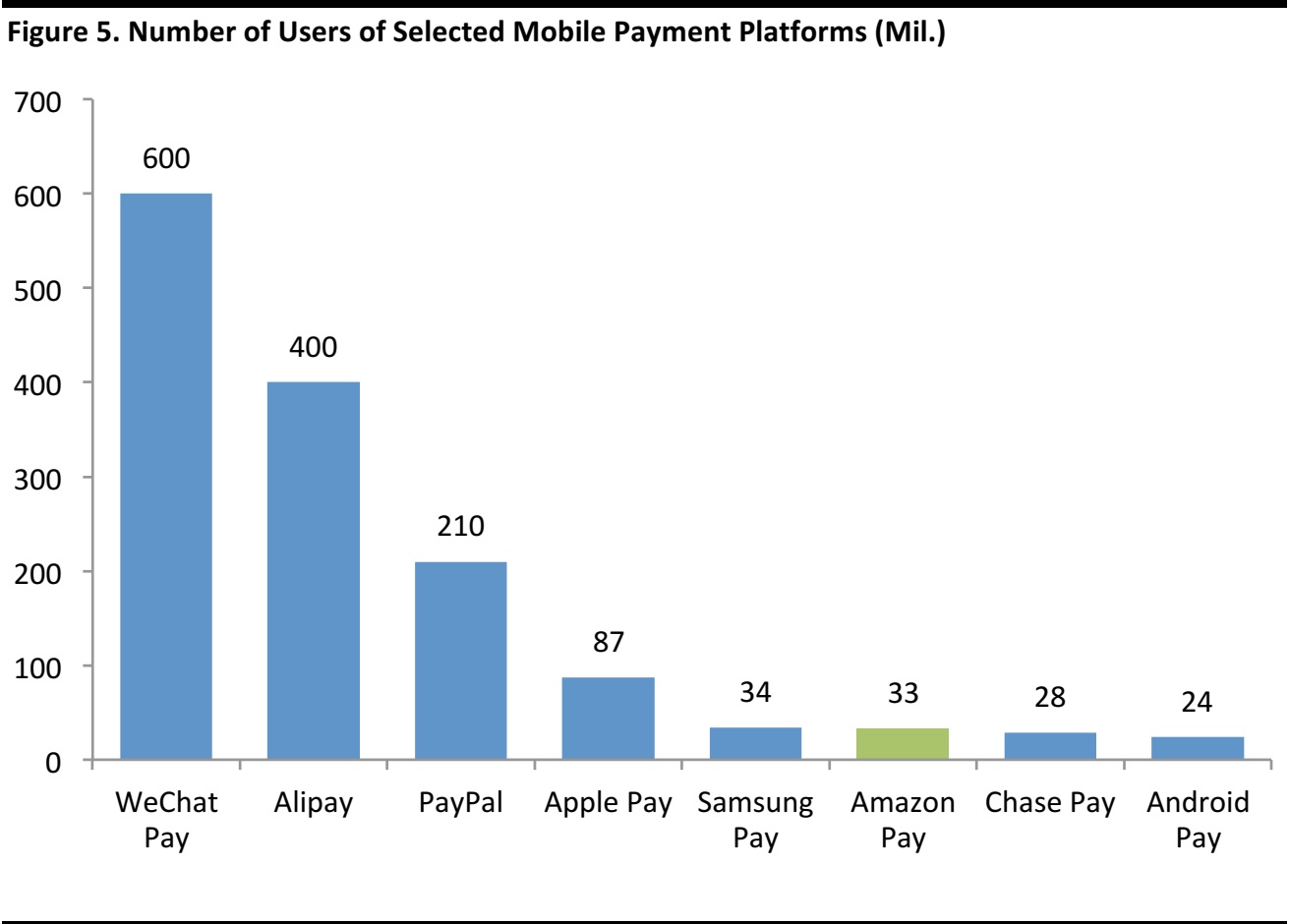

Other Payment Platforms

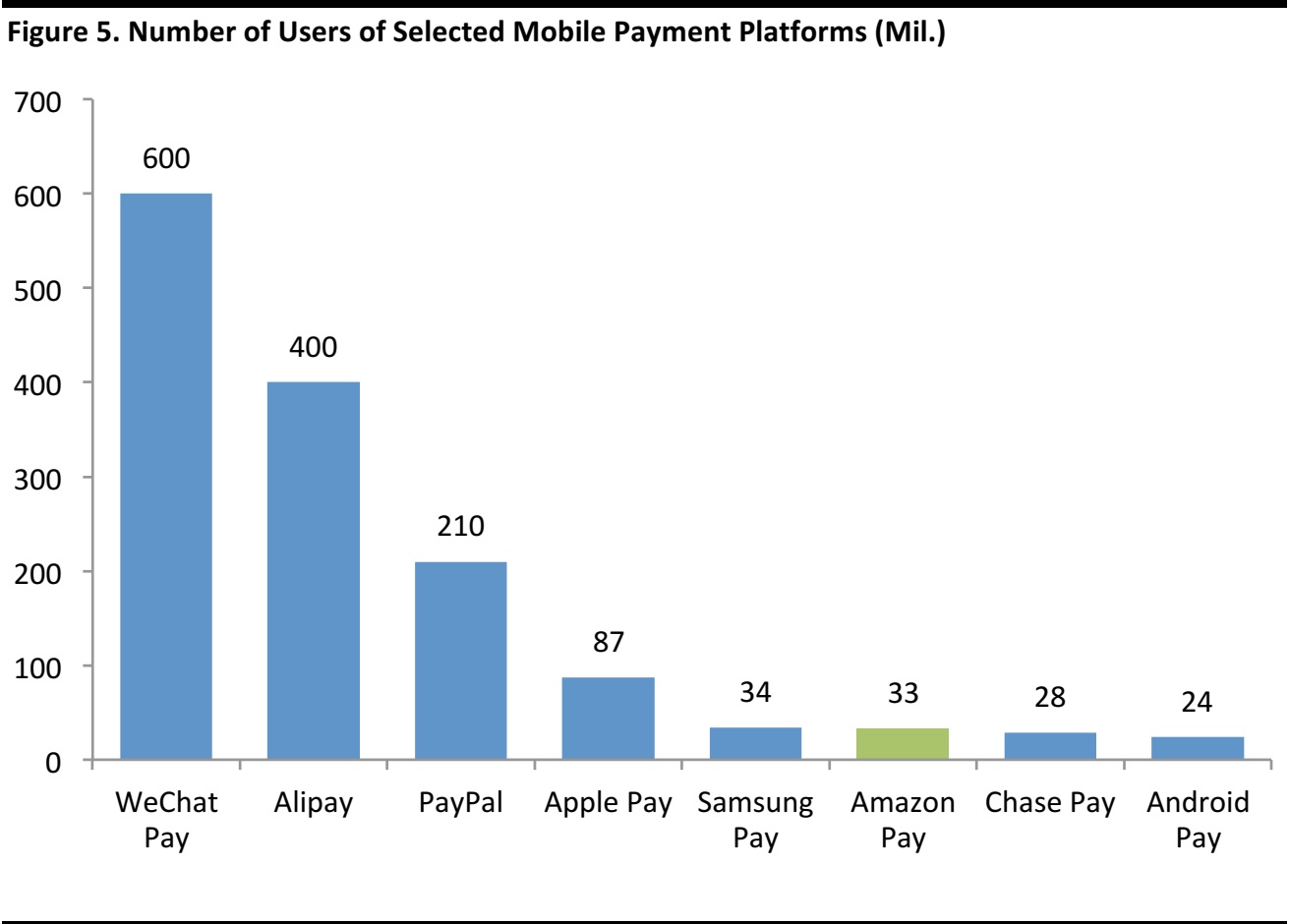

The graph below shows the number of users of selected mobile payment platforms and provides an indication of potential market sizes. China’s WeChat Pay and Alipay have user bases several times larger than the other platforms shown, as China has a much larger population than many other countries and relatively less legacy banking infrastructure, which enabled it to leapfrog Western countries in terms of mobile payment growth. Still, it is possible that Amazon Pay could achieve a user count such as that enjoyed by PayPal and by Apple Pay.

*Represents Chase mobile payment customers

Source: CNBC.com/company reports/Juniper Research

*Represents Chase mobile payment customers

Source: CNBC.com/company reports/Juniper Research

The Amazon Credit Card

In January 2017, Amazon introduced an upgraded version of its Amazon Prime Rewards Visa Signature Card, which offers a 5% rebate on all Amazon.com purchases and a 2% rebate on purchases made at restaurants, gas stations and drugstores, plus a 1% rebate on all other purchases made by eligible Prime members. Non-Prime members who use the card receive a 3% rebate at Amazon.com, a 2% rebate at restaurants, gas stations and drugstores, and a 1% rebate on all other purchases.

Source: Amazon

Source: Amazon

Conclusion

Amazon’s convenience and customer service have enabled it to win customers in the retail sphere, and the company has expanded beyond its initial offerings of books and DVDs to address additional markets, including, recently, groceries, apparel and even automobiles. Despite the ubiquity of smartphones, the mobile payments market is a nascent, fragmented one in the US, divided by technology platforms, closed systems and consumers’ reluctance to transition from a well-established system based on credit and debit cards. It is logical that Amazon would eventually turn its focus to this market, as it has huge advantages in terms of customers’ comfort using its retail platform, its platform-agnostic technology and its enormous installed base of existing customers.

Source: pay.amazon

Source: pay.amazon Source: eMarketer (as of July 2017)

Source: eMarketer (as of July 2017) Source: eMarketer (as of July 2017)

Source: eMarketer (as of July 2017) Source: pay.amazon

Source: pay.amazon Source: Amazon

Source: Amazon Source: Amazon

Source: Amazon *Represents Chase mobile payment customers

Source: CNBC.com/company reports/Juniper Research

*Represents Chase mobile payment customers

Source: CNBC.com/company reports/Juniper Research Source: Amazon

Source: Amazon