Nitheesh NH

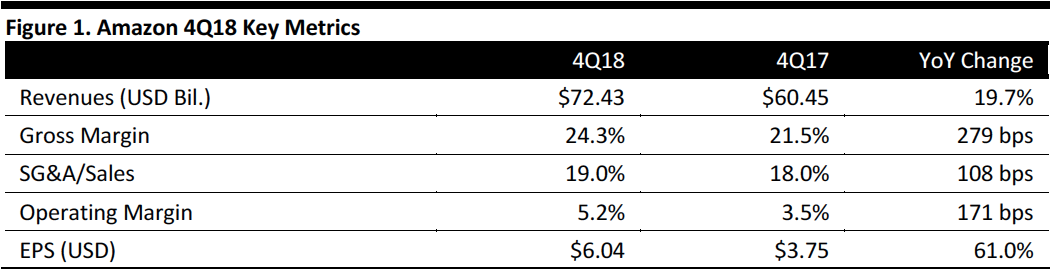

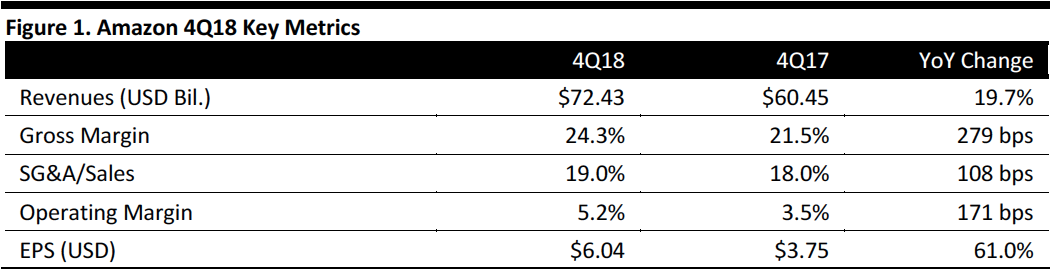

[caption id="attachment_70065" align="aligncenter" width="600"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

Amazon.com reported 4Q18 revenues of $72.43 billion, up 19.7% year over year and beating the consensus estimate of $57.1 billion.

EPS was $6.04, beating the $5.65 consensus estimate and up 61% year over year.

FY18 Results

Amazon reported FY18 revenues of $233.89 billion, up 30.9%.

Full-year EPS was $20.14, up 227% from the prior year.

4Q18 Results by Segment

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Amazon.com reported 4Q18 revenues of $72.43 billion, up 19.7% year over year and beating the consensus estimate of $57.1 billion.

EPS was $6.04, beating the $5.65 consensus estimate and up 61% year over year.

FY18 Results

Amazon reported FY18 revenues of $233.89 billion, up 30.9%.

Full-year EPS was $20.14, up 227% from the prior year.

4Q18 Results by Segment

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Amazon.com reported 4Q18 revenues of $72.43 billion, up 19.7% year over year and beating the consensus estimate of $57.1 billion.

EPS was $6.04, beating the $5.65 consensus estimate and up 61% year over year.

FY18 Results

Amazon reported FY18 revenues of $233.89 billion, up 30.9%.

Full-year EPS was $20.14, up 227% from the prior year.

4Q18 Results by Segment

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Amazon.com reported 4Q18 revenues of $72.43 billion, up 19.7% year over year and beating the consensus estimate of $57.1 billion.

EPS was $6.04, beating the $5.65 consensus estimate and up 61% year over year.

FY18 Results

Amazon reported FY18 revenues of $233.89 billion, up 30.9%.

Full-year EPS was $20.14, up 227% from the prior year.

4Q18 Results by Segment

- North America revenues were $44.1 billion, up 18.3% year over year, posting operating income of $1.7 billion, compared to a profit of $1.7 billion in the year-ago quarter.

- International revenues were $20.8 billion, up 15.5% year over year, posting an operating loss of $0.6 billion, compared to a loss of $0.9 billion in the year-ago quarter.

- AWS revenues were $7.4 billion, up 45.3% year over year, posting an operating profit of $2.2 billion, compared to $1.4 billion in the year-ago quarter.

- Online store revenue was $39.8 billion, up 12.5%.

- Physical store revenue was $4.4 billion, down 2.7%.

- Third-party seller service revenue was $13.4 billion, up 27.2%.

- Subscription service revenue was $4.0 billion, up 24.6%.

- Other revenue was $3.4 billion, up 95.3%.

- Tens of millions of customers worldwide signed up for Prime free trials or paid memberships during the holiday season, and a record number of customers signed up for Prime memberships in 2018.

- More than 50% of units sold in Amazon stores during the holiday season came from small and medium-sized businesses. More than 2,000 small and medium-sized businesses recorded sales exceeding $100,000 in Amazon stores in 2018.

- The company launched pop-up stores in Europe during the holiday season, with more than 136 events and workshops featuring 2,000 products.

- The fourth quarter was a record for Ring, with millions of units sold globally. The Ring Video Doorbell 2 was the unit’s best-selling product during the holiday season, and the indoor/outdoor Ring Stick Up cam began shipping.

- The Key by Amazon platform supported new products, including Schlage Encode Smart Wi-Fi Deadbolt for Key and was integrated with the Ring app. Other new offerings include Key for Garage and Key for Business.

- The number of devices supporting Alexa built-in more than doubled in 2018, with the number hitting 150 different products, from headphones and PCs to cars and smart home devices.

- Amazon launched Echo and Alexa experiences built from the ground up for Italy, Spain, and Mexico, with locally-relevant services, features, and skills from local brands.

- More than one million customers requested an invitation for Echo Auto, with automotive partners including BOSS Audio, iOttie, and Jensen, and software and service providers such as HERE Technologies, Luxoft, P3, Qualcomm, and Telenav.

- Alexa customers can now access Apple Music’s library on their Echo devices.

- Amazon announced further expansion in Brazil, with free delivery on hundreds of thousands of in-stock items sold and shipped by Amazon. Customers can now shop from 12 categories, with products shipped across Brazil from a new Amazon fulfillment center.

- Amazon Fashion launched Prime Wardrobe in Japan and the U.K., allowing Prime members to order clothing, shoes and accessories and pay only for what they keep.

- Amazon expanded free grocery delivery and pickup from Whole Foods Market through Prime Now, allowing customers to place orders via the Prime Now app and choose delivery in as little as an hour or pickup in as little as 30 minutes.

- Grocery delivery is available in more than 60 U.S. metros and pickup service is available in more than 20 U.S. metropolitan regions with plans for continued expansion.

- Net sales of $56–$60 billion (up 10%–18%), below the consensus estimate of $60.8 billion. This figure includes a 210-wbps impact from foreign exchange.

- Operating income of $2.3–$3.3 billion, compared to $1.9 billion in the year-ago quarter.