Executive Summary

Amazon’s revamped affiliated Visa card represents a highly competitive offering—particularly for Prime members who make frequent purchases on Amazon.com. However, it is hardly the “Costco killer” that some in the industry have suggested it will be. The Costco card offers superior benefits in certain categories, and there are a host of other cards with competitive offerings. More importantly, the card represents yet another service that Amazon offers its Prime members, thereby increasing the value of the service and providing consumers with another incentive to join the Prime program.

Details About the New Card

On January 11, Amazon (in partnership with Chase) announced its new Prime Rewards Visa Signature Card, which offers the following benefits:

- 5% back on all Amazon.com purchases

- 2% back at restaurants, gas stations and drugstores

- 1% back on all other purchases

- No cap on rewards earned

- Rewards never expire and are redeemable on hundreds of millions of products at Amazon.com

- No foreign transaction fees when traveling abroad or for cross-border shopping

- No annual credit card fee

- Zero fraud liability

- Benefits including travel and purchase protections, as well as 24/7 concierge service, through Visa Signature

The card’s interest rate (APR) on revolving balances ranges from 14.74%–22.74%.

The card is primarily targeted at Prime members, who receive 5% cash back on Amazon.com purchases. Non-Prime cardholders will receive 3% off at Amazon.com and the other benefits. Amazon is currently offering a $70 gift card to approved applicants, which goes a long way toward offsetting the $99 annual Prime membership fee. The card is also made of metal, like the Chase Sapphire Reserve card, so as to give it a more substantial feel. Amazon still offers its previous card, the Amazon Prime Store Card, which provides 5% back at Amazon.com; the new card replaces the Amazon Rewards Visa Card.

Source: Amazon.com

Source: Amazon.com

Analysis

The new Amazon Prime Rewards Visa Signature Card represents yet another valuable service that Amazon is providing to encourage customers to become Prime members. As of the third quarter of 2016, there were 65 million Prime members, according to Consumer Intelligence Research Partners, representing about half of all US households.

Amazon Prime members receive the following benefits, among many others:

- Free two-day shipping

- Free same-day shipping and Prime Now

- Restaurant delivery

- Prime Video, Music, Unlimited Photos, Pantry and Dash

- Kindle Owners’ Lending Library and Kindle First picks

- Amazon Elements for everyday products

- Use of the Echo and Dot intelligent appliances

The new card compares fairly well with other types of cards. The best card for everyday spending is the Blue Cash Preferred Card from American Express, which offers 6% cash back on groceries and 3% back at gas stations and department stores, according to NerdWallet.com. Target’s REDcard offers 5% back on purchases at Target stores and on Target.com, as well as an extra 30 days for returns and free shipping on most items purchased on the company’s website.

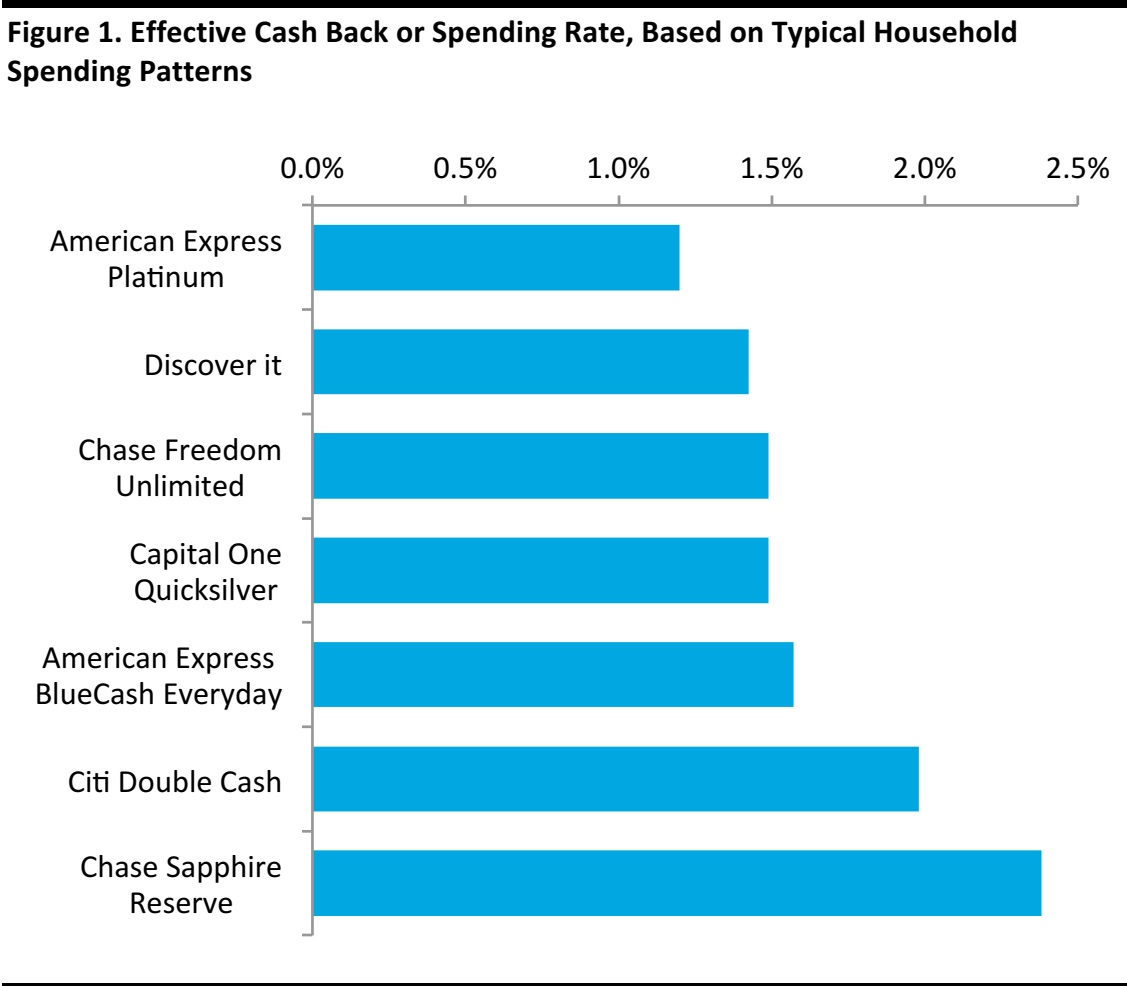

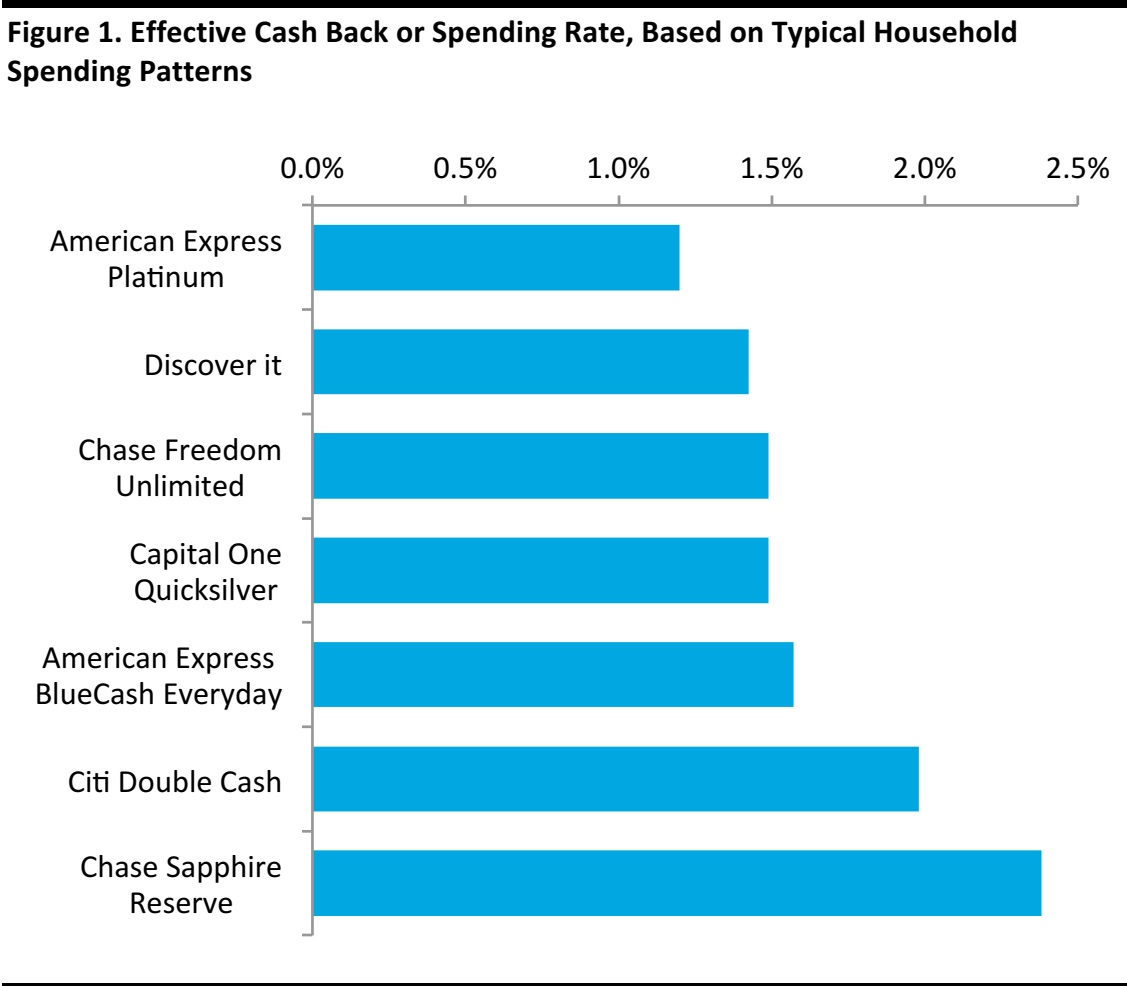

Barclays analyzed the rebate rate a typical household should expect to receive, based on typical spending patterns, for various cards.

Source: Barclays/The Wall Street Journal

Source: Barclays/The Wall Street Journal

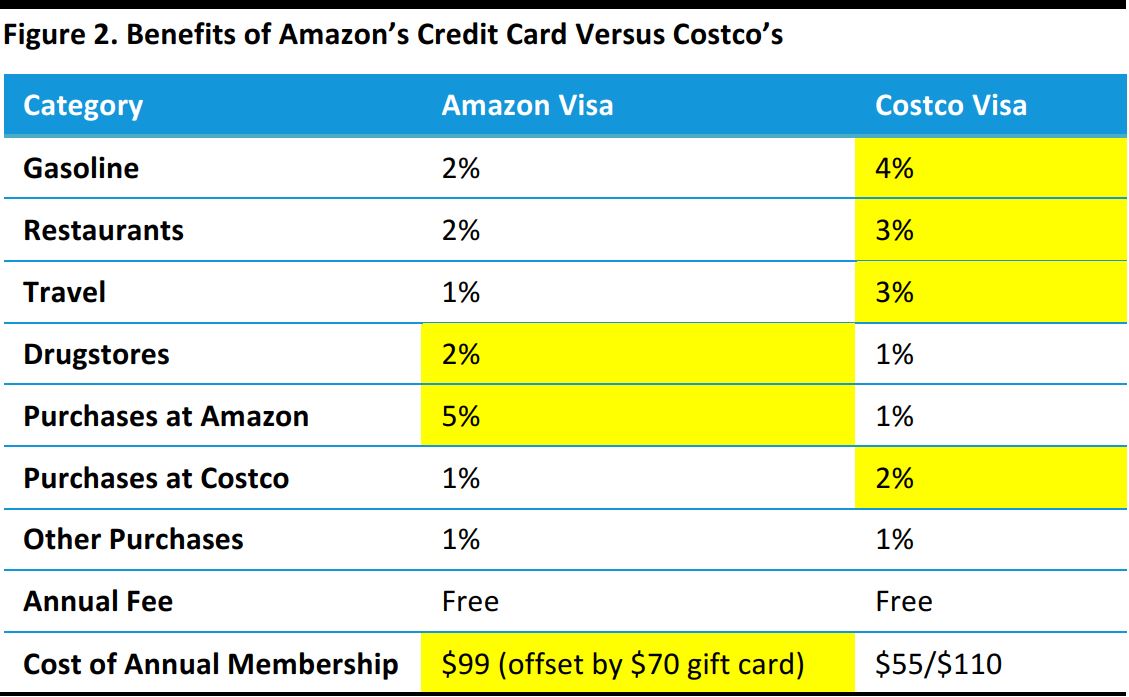

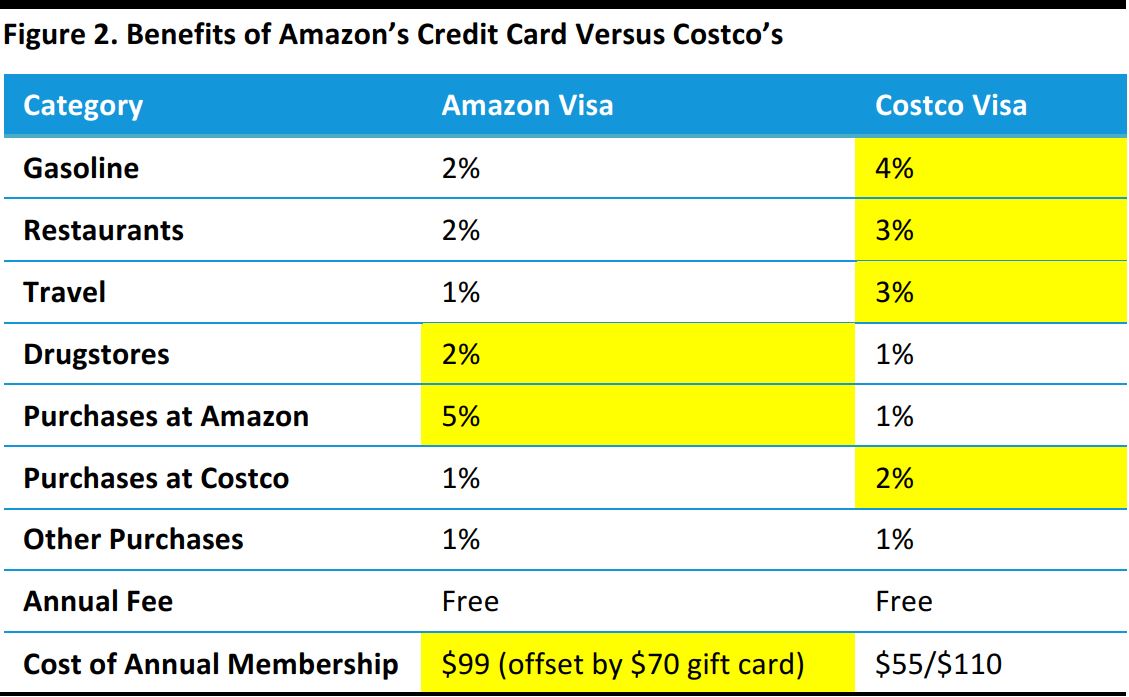

The Amazon Prime Rewards Visa Signature Card’s 5% cash back on Amazon purchases makes it the best card for purchases made on the site, and its other category rebates of 1%–2% make it competitive with other cards. The table below compares rebate categories for Amazon’s and Costco’s respective cards, with the superior card highlighted for each category. As the table shows, Amazon’s card is superior for purchases from Amazon, but the Costco card is superior for purchases in most other categories (especially gasoline), except for drugstore purchases.

Source: Company reports

Source: Company reports

Cards Can Have a Financial Impact

Credit cards can have a large impact on a company’s earnings. Costco transitioned from an affiliated American Express card to an affiliated Visa card in early 2016, which led to a negative impact of $11 million, or $0.02 per share, on Costco’s earnings in its fiscal third quarter. Reported net income and EPS were $545 million and $1.24, respectively, so the transition reduced net income by about 2%.

Conclusion

Amazon’s new Visa card represents another valuable service that the company is offering its Prime members. It also serves as another enticement to encourage nonmembers to sign up for Prime membership, though nonmembers receive many benefits through the card, too. The card is particularly attractive in terms of purchases made on Amazon.com, but it represents a solid offering overall in a sea of competitive card offerings.

Source: Amazon.com

Source: Amazon.com Source: Barclays/The Wall Street Journal

Source: Barclays/The Wall Street Journal Source: Company reports

Source: Company reports