Nitheesh NH

Introduction

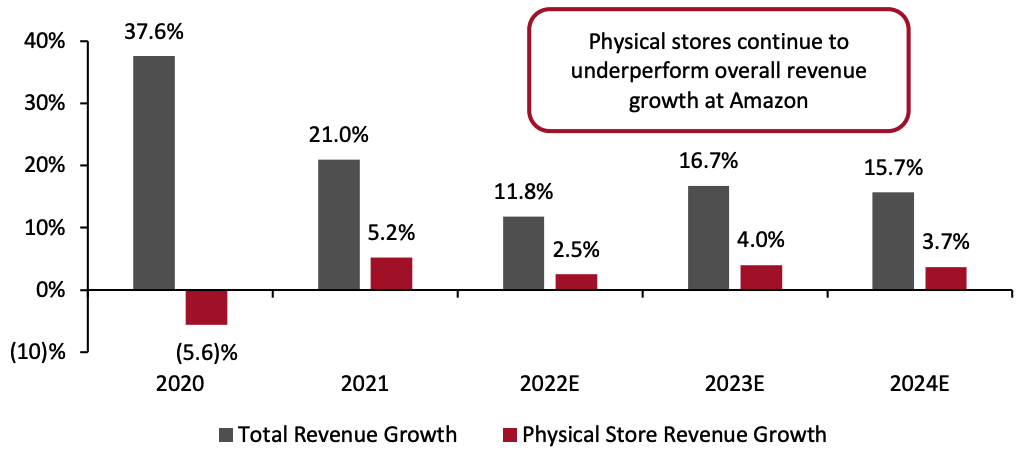

What’s the Story? A closer look at what Amazon Fresh stores have achieved in the past two years will offer clues as to its plans to expand its brick-and-mortar footprint. In August 2020, Amazon Fresh, an online grocery platform to date, opened its first physical store in Woodland Hills, California. Amazon hoped that its digital tools would finally disrupt the brick-and-mortar grocery retail scene. It was a three-pronged initiative by the US’s largest e-commerce platform to become a go-to grocery hub, with Amazon Go and Whole Foods Market respectively aimed at urban and discretionary shoppers in cities and suburban areas. Amazon was attempting to enter a competitive market at a time when pandemic restrictions and lockdowns limited access to physical grocery stores. With these restrictions now lifted, Amazon Fresh now has the opportunity to fulfill its disruptive ambitions—but its once-exclusive technological and marketing advantage has become ubiquitous across the grocery industry. Why It Matters Two years ago, Amazon Fresh stores were widely considered a wild card that could transform the industry. The impact of the pandemic has not only complicated the rise of Amazon Fresh in the brick-and-mortar space, but also accelerated the pace of change among legacy retailers: US grocery retailers have increasingly become hybrid platforms, blurring the line between digital and online sales in a solidly expanding market. For Amazon, the brick-and-mortar scene remains hard to crack: All three Amazon grocery outlets (Amazon Fresh, Amazon Go and Whole Foods) remain urban and suburban niche players. While Amazon does not disclose performances for the three outlets separately, its revenue growth for physical stores continues to underperform overall revenue growth at Amazon.Figure 1. Amazon: Physical Stores’ Revenue Growth vs. Total Revenue Growth (YoY % Growth) [caption id="attachment_150964" align="aligncenter" width="700"]

*The fiscal year ends December 31

*The fiscal year ends December 31Source: Company reports/Coresight Research[/caption]

Amazon Fresh—Unlocking the Potential of Physical Stores in Grocery: Coresight Research Analysis

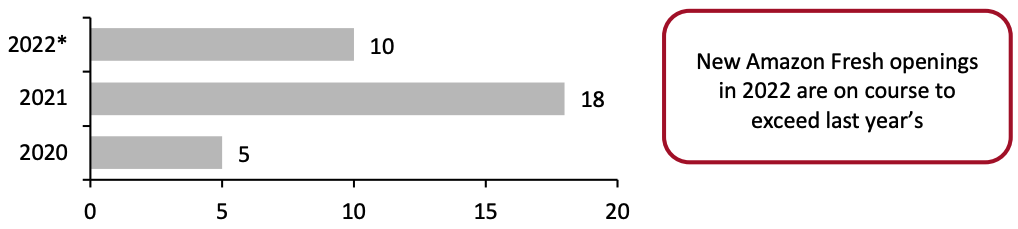

Amazon Fresh stores represent an important leg in a long, multi-pronged journey by the e-commerce platform into the brick-and-mortar grocery space. The stores themselves were an extension of Amazon Fresh, its grocery delivery service launched in 2007 and followed the launch of the Amazon Go “Just Walk Out” convenience stores. Amazon Go has only 26 stores in the US, aimed at busy urban shoppers with checkout-free transactions—although before the pandemic, Amazon was reported to be planning to open up to 3,000 stores, according to Bloomberg. Even with Whole Foods Market, which it acquired in 2017, Amazon has been struggling to secure its place in competition with such brick-and-mortar stalwarts as Kroger, Target and Walmart. While the numbers of new openings remain stagnant for Amazon Go and Whole Foods, Amazon Fresh has embarked on an opening spree. In the past 12 months, its stores doubled in number to 33, with two more under way as of June 10, 2022, creating clusters in high-income suburban areas in California, New York and Virginia.Figure 2. Amazon Fresh Store Openings [caption id="attachment_150965" align="aligncenter" width="700"]

*As of June 24, 2022

*As of June 24, 2022Source: ChainXY/Coresight Research[/caption] Amazon Fresh: A Disruptor? A year ago, in June 2021, we predicted that Amazon Fresh stores would concentrate on densely populated suburban areas to create a hybrid platform meant to serve both online and in-store needs. We expected—and continue to expect—Amazon’s use of technology to galvanize other retailers to trial similar solutions at their stores in the near to medium term. Traditional grocery retailers’ vast networks and human resources have helped them to compete strongly in the omnichannel space, while there are some hints that Amazon Fresh has lagged in cross-channel services. As of June 2022, curbside pickup, which the pandemic made a key service, is available at only a selected number of Amazon Fresh locations, while it is available at most Walmart stores. One advantage enjoyed by Amazon Fresh is the company’s capability in checkout-free technology. According to the company, 16 of its 33 Amazon Fresh stores are now equipped with Just Walk Out technology, as of June 13, 2022. The technology, first featured in Amazon Go, enables shoppers to bypass checkout lines by scanning the in-store QR code in their Amazon app, using the Amazon One palm payment solution or inserting their Amazon account-linked payment cards to unlock the Just Walk Out gates.

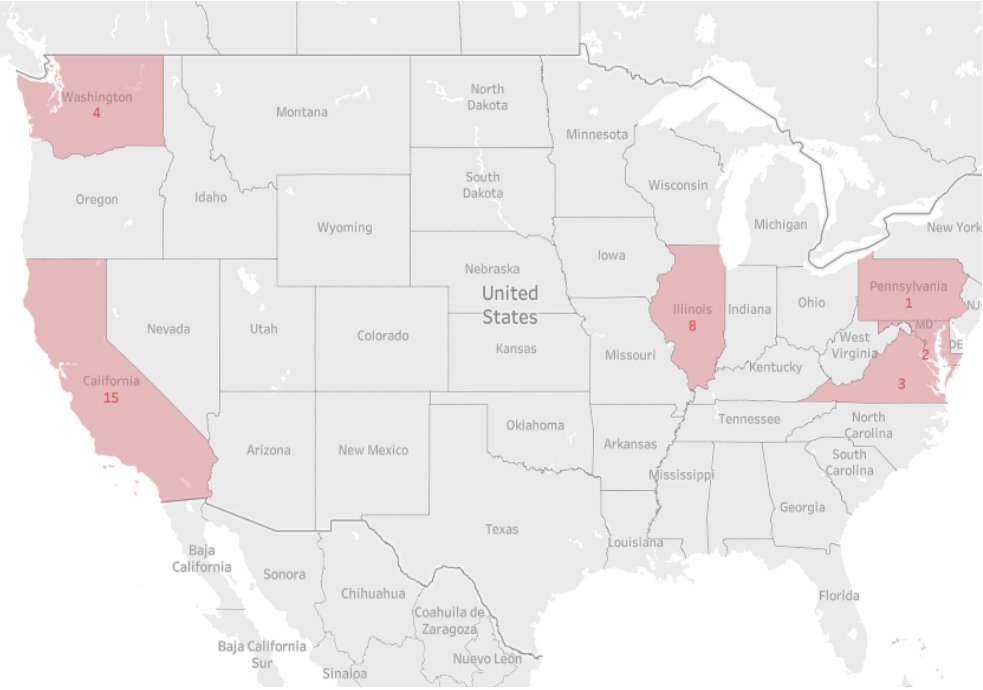

Figure 3. Amazon Fresh: US Store Locations [caption id="attachment_150966" align="aligncenter" width="700"]

Source: ChainXY/Coresight Research[/caption]

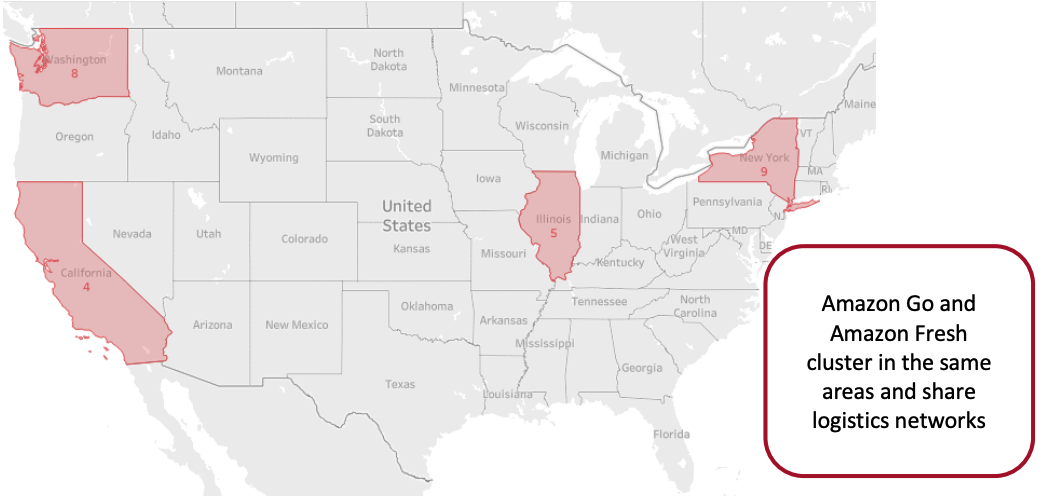

Amazon Go and Amazon Fresh stores are generally located in the same regions—only recently, in June 2022, Amazon Fresh launched three stores in Virginia. Generally, Amazon Go and Amazon Fresh focus respectively on urban and suburban areas. However, Amazon Go appears to have begun testing Amazon Fresh’s territory, opening a 6,150-square-foot store in a Seattle suburb, Mill Creek, Washington, in April 2022. The new store is over twice the size of the largest Amazon Go to date, but still smaller than the smallest Amazon Fresh. This is indicative of Amazon’s apparent trial-and-error approach to grocery, and suggests that Amazon could be in the process of mixing the Amazon Go and Amazon Fresh formats and concepts.

Source: ChainXY/Coresight Research[/caption]

Amazon Go and Amazon Fresh stores are generally located in the same regions—only recently, in June 2022, Amazon Fresh launched three stores in Virginia. Generally, Amazon Go and Amazon Fresh focus respectively on urban and suburban areas. However, Amazon Go appears to have begun testing Amazon Fresh’s territory, opening a 6,150-square-foot store in a Seattle suburb, Mill Creek, Washington, in April 2022. The new store is over twice the size of the largest Amazon Go to date, but still smaller than the smallest Amazon Fresh. This is indicative of Amazon’s apparent trial-and-error approach to grocery, and suggests that Amazon could be in the process of mixing the Amazon Go and Amazon Fresh formats and concepts.

Figure 4. Amazon Go: US Store Locations [caption id="attachment_150967" align="aligncenter" width="700"]

Source: ChainXY/Coresight Research[/caption]

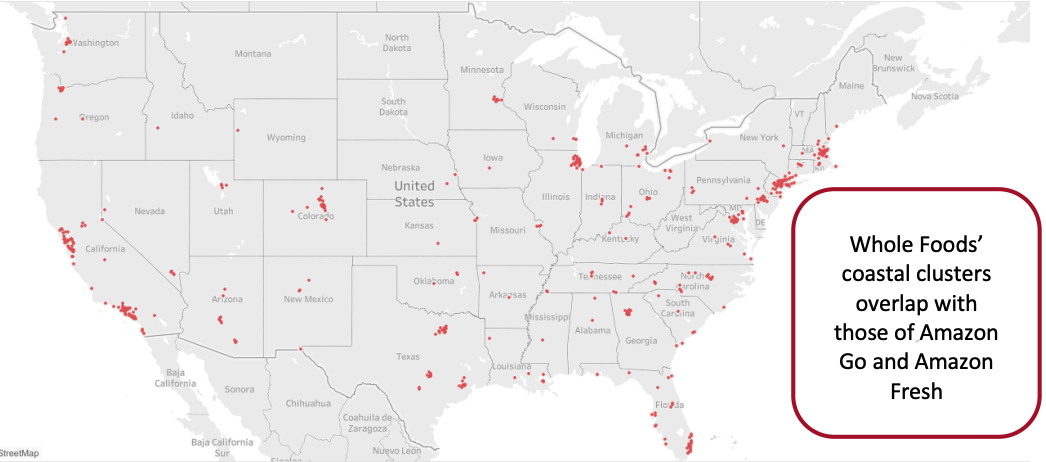

Meanwhile, Whole Foods Market has a sprawling network of 510 stores, as of June 6, 2022, with strong clusters in the same regions where Amazon Fresh are taking hold, which likely ties together much of the future of Amazon’s grocery business, enabling coordination in logistics and marketing.

Source: ChainXY/Coresight Research[/caption]

Meanwhile, Whole Foods Market has a sprawling network of 510 stores, as of June 6, 2022, with strong clusters in the same regions where Amazon Fresh are taking hold, which likely ties together much of the future of Amazon’s grocery business, enabling coordination in logistics and marketing.

Figure 5. Whole Foods Market: US Store Locations [caption id="attachment_150968" align="aligncenter" width="700"]

Source: ChainXY/Coresight Research[/caption]

A New Battle Line over Smaller-Format and Data-Driven Platforms

We continue to see a move to tailored, often-smaller formats and faster services in US retail. Urban- and suburban-specific store formats and speed characterize the post-pandemic shift across the grocery retail space, exemplified by Amazon Fresh’s openings.

With their omnichannel advantages and their own appetite for new digital tools and smaller store formats, Amazon Fresh’s peers are advancing a hybrid grocery model. Walmart, the brick-and-mortar arch-rival to Amazon, has expanded its grocery delivery pilot with Instacart to include much of New York except Manhattan. During the first quarter of 2022, Target opened seven stores, which are all smaller formats located in urban centers or suburban areas, with a renewed focus on grocery pickup and drive-up. Even warehouse clubs have entered the fray: In addition to its same-day delivery partnership with Instacart, Costco has begun to pilot its own in-house same-day grocery delivery service in certain areas. Since April 2022, BJ’s has been piloting a small-format store in Warwick, Rhone Island, targeting busy urban professionals.

Amazon Fresh’s Tech Edge

All this means that Amazon Fresh must capitalize on its strengths in digital and data tools to stay competitive in an increasingly fast-moving, traditionally low-margin grocery market. Amazon, the digital leader in the retail industry, still has a lot to offer, although what it introduced to the industry two years ago has become a universal trend.

Just Walk Out and the new Dash Cart—Amazon’s smart shopping carts featuring checkout functionality—are time-saving tools in busy urban life and remain a competitive advantage for Amazon. Both these technologies are also embedded with machine learning functions that detect and analyze individual shopping patterns and collect valuable shopper data.

In June 2022, Amazon stepped up its efforts in data gathering and analysis with the introduction of Store Analytics. This new physical-store analytics tool enables brands to track shopper interest in items sold at Amazon Go and Amazon Fresh stores embedded with Just Walk Out and Dash Carts. Store Analytics helps improve merchandising strategies and promotions and can even determine the ratio of shoppers taking items off the shelf to those actually purchasing them.

The new platform offers a window into what Amazon’s frictionless checkout technology and data intelligence can offer. However, given its niche presence in a competitive market, coupled with the limited availability of Just Walk Out at Amazon Fresh locations, such advantages have yet to be fully unlocked.

[caption id="attachment_150969" align="aligncenter" width="700"]

Source: ChainXY/Coresight Research[/caption]

A New Battle Line over Smaller-Format and Data-Driven Platforms

We continue to see a move to tailored, often-smaller formats and faster services in US retail. Urban- and suburban-specific store formats and speed characterize the post-pandemic shift across the grocery retail space, exemplified by Amazon Fresh’s openings.

With their omnichannel advantages and their own appetite for new digital tools and smaller store formats, Amazon Fresh’s peers are advancing a hybrid grocery model. Walmart, the brick-and-mortar arch-rival to Amazon, has expanded its grocery delivery pilot with Instacart to include much of New York except Manhattan. During the first quarter of 2022, Target opened seven stores, which are all smaller formats located in urban centers or suburban areas, with a renewed focus on grocery pickup and drive-up. Even warehouse clubs have entered the fray: In addition to its same-day delivery partnership with Instacart, Costco has begun to pilot its own in-house same-day grocery delivery service in certain areas. Since April 2022, BJ’s has been piloting a small-format store in Warwick, Rhone Island, targeting busy urban professionals.

Amazon Fresh’s Tech Edge

All this means that Amazon Fresh must capitalize on its strengths in digital and data tools to stay competitive in an increasingly fast-moving, traditionally low-margin grocery market. Amazon, the digital leader in the retail industry, still has a lot to offer, although what it introduced to the industry two years ago has become a universal trend.

Just Walk Out and the new Dash Cart—Amazon’s smart shopping carts featuring checkout functionality—are time-saving tools in busy urban life and remain a competitive advantage for Amazon. Both these technologies are also embedded with machine learning functions that detect and analyze individual shopping patterns and collect valuable shopper data.

In June 2022, Amazon stepped up its efforts in data gathering and analysis with the introduction of Store Analytics. This new physical-store analytics tool enables brands to track shopper interest in items sold at Amazon Go and Amazon Fresh stores embedded with Just Walk Out and Dash Carts. Store Analytics helps improve merchandising strategies and promotions and can even determine the ratio of shoppers taking items off the shelf to those actually purchasing them.

The new platform offers a window into what Amazon’s frictionless checkout technology and data intelligence can offer. However, given its niche presence in a competitive market, coupled with the limited availability of Just Walk Out at Amazon Fresh locations, such advantages have yet to be fully unlocked.

[caption id="attachment_150969" align="aligncenter" width="700"] Amazon’s Dash Cart, with built-in checkout functionality

Amazon’s Dash Cart, with built-in checkout functionalitySource: Amazon.com[/caption]

What We Think

After two years of turns and twists amid the pandemic, the impact of which still reverberates through the grocery market, online and in-store, Amazon Fresh is set to expand its physical networks and further hone its data and technological strengths. All these will intensify competition within the industry and help reshape urban commercial real estate scenes. Implications for Brands/Retailers- Retailers must respond to Amazon Fresh’s tech and data advantages, although it still remains a minor player in its urban and suburban niches.

- With rivals already launching smaller-format stores and integrating digital and physical channels, we identify Just Walk Out as Amazon’s key competitive advantage. Major rival grocery retailers must prioritize trialing or rolling out in technologies such as smart checkout systems to keep up with the competition and improve the shopping experience in their brick-and-mortar stores.

- Amazon will continue to branch out into urban and suburban areas, galvanizing commercial real estate scenes.