Introduction

In this report, we continue our coverage of one of the hottest topics in retail—Amazon’s ventures into apparel. Here, we offer an exclusive analysis of Amazon’s US clothing offering on its Amazon Fashion site. In collaboration with competitive intelligence provider DataWeave, we aggregated data on almost 1 million women’s and men’s clothing products listed on the site.In the sections that follow, we cut and slice that data by brand, product category and type of seller (first party versus third party).

- This report complements our recent consumer survey deep dive on Amazon apparel.

In Brief: How We Got Our Data

Our data cover women’s and men’s clothing on the US Amazon Fashion site.We aggregated data in two stages. First, we identified brands with a meaningful presence in Amazon’s clothing offering by finding all brands included in the top 500 featured product listings for

each product type in the Women’s Clothing and Men’s Clothing sections on Amazon Fashion (e.g., the top 500 product listings for women’s tops and tees, the top 500 product listings for men’s active wear, etc.).This returned a total of

2,798 unique brands.

Second, we aggregated data on

all product listings within the Women’s Clothing and Men’s Clothing sections for each of the 2,798 identified brands. This returned a total of

881,269 individually listed products, which are the basis for the analysis in this report.

We begin with a summary of our top takeaways from the data and then present more detailed findings by brand, clothing category and type of seller.

Answering Five Hot Questions

1. How much of the clothing available on Amazon Fashion is offered for sale by Amazon, and how much do third-party sellers account for?

Amazon remains heavily reliant on third-party sellers in the clothing category. In total, just 13.7% of women’s and men’s clothing products on Amazon Fashion are listed for sale by Amazon itself (first-party sales), while third-party sellers account for 86.3% of listings. In womenswear, third-party sellers account for 85.7% of listings; in menswear, they account for 87.1% of listings.

We think the retailer’s reliance on third-party sellers underscores its opportunity to grow apparel sales by bringing more inventory in-house:

- If Amazon held more first-party clothing inventory, it would mean that more products would be eligible for Prime delivery, boosting the appeal of such items among Prime members.

- We think that shoppers feel greater reassurance on issues such as product authenticity, shipping and returns charges, and returns policies when they buy direct from Amazon than when they buy from (often-unknown) third-party sellers. And findings from our recent consumer survey support this: 38% of Amazon apparel shoppers surveyed said that they prefer to buy directly from Amazon rather than from third-party sellers on the site.

- Moreover, greater first-party inventory would imply a strengthening of relationships between Amazon and brands—in other words, brands would be more willing to sell to Amazon Fashion if the company itself, rather than third parties, sold their products on the site.

Our research suggests that Amazon Fashion may be focusing its first-party clothing inventory on higher-value categories. In womenswear, for example, the company’s own first-party offerings account for a greater share of listings in activewear, jeans, and suiting and blazers than they do in the more basic tops and tees category.

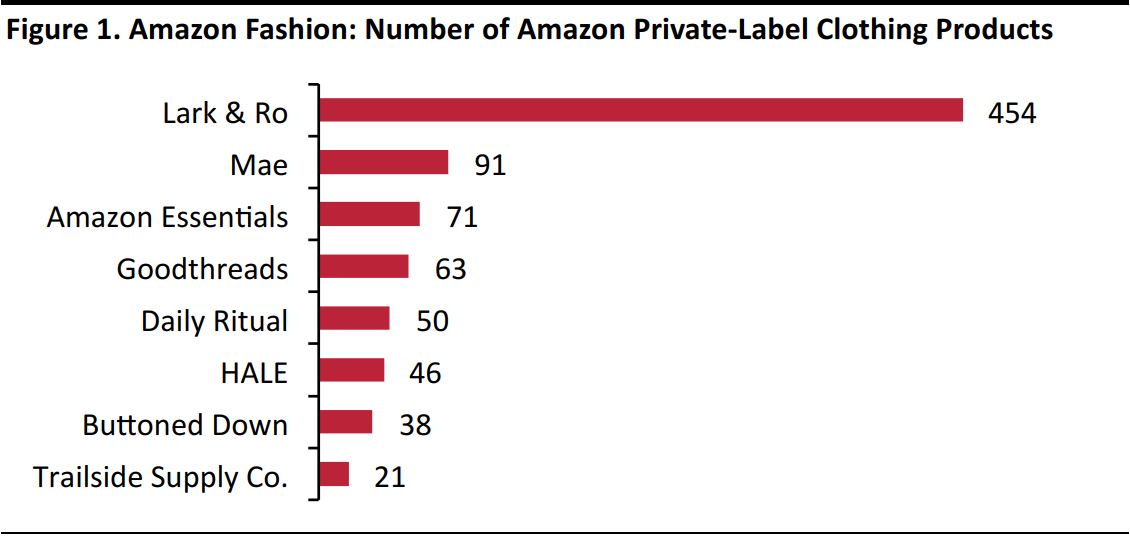

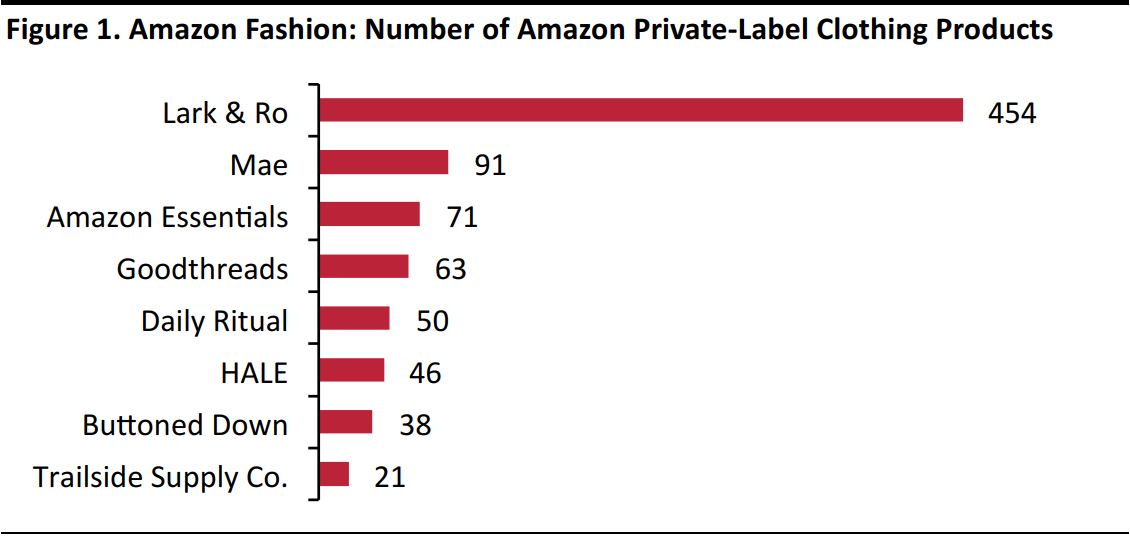

2. How many Amazon private-label clothing products are listed on Amazon Fashion?

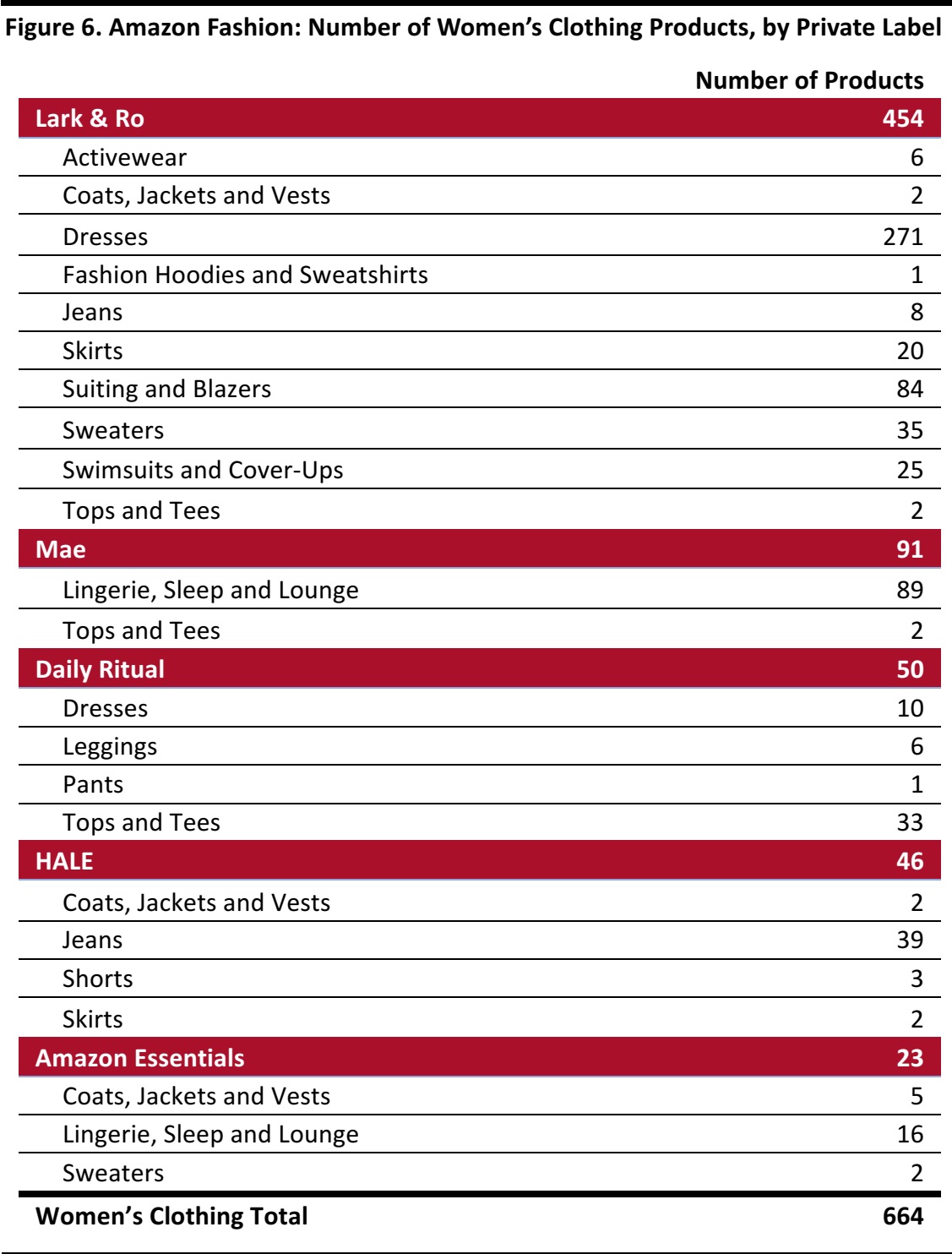

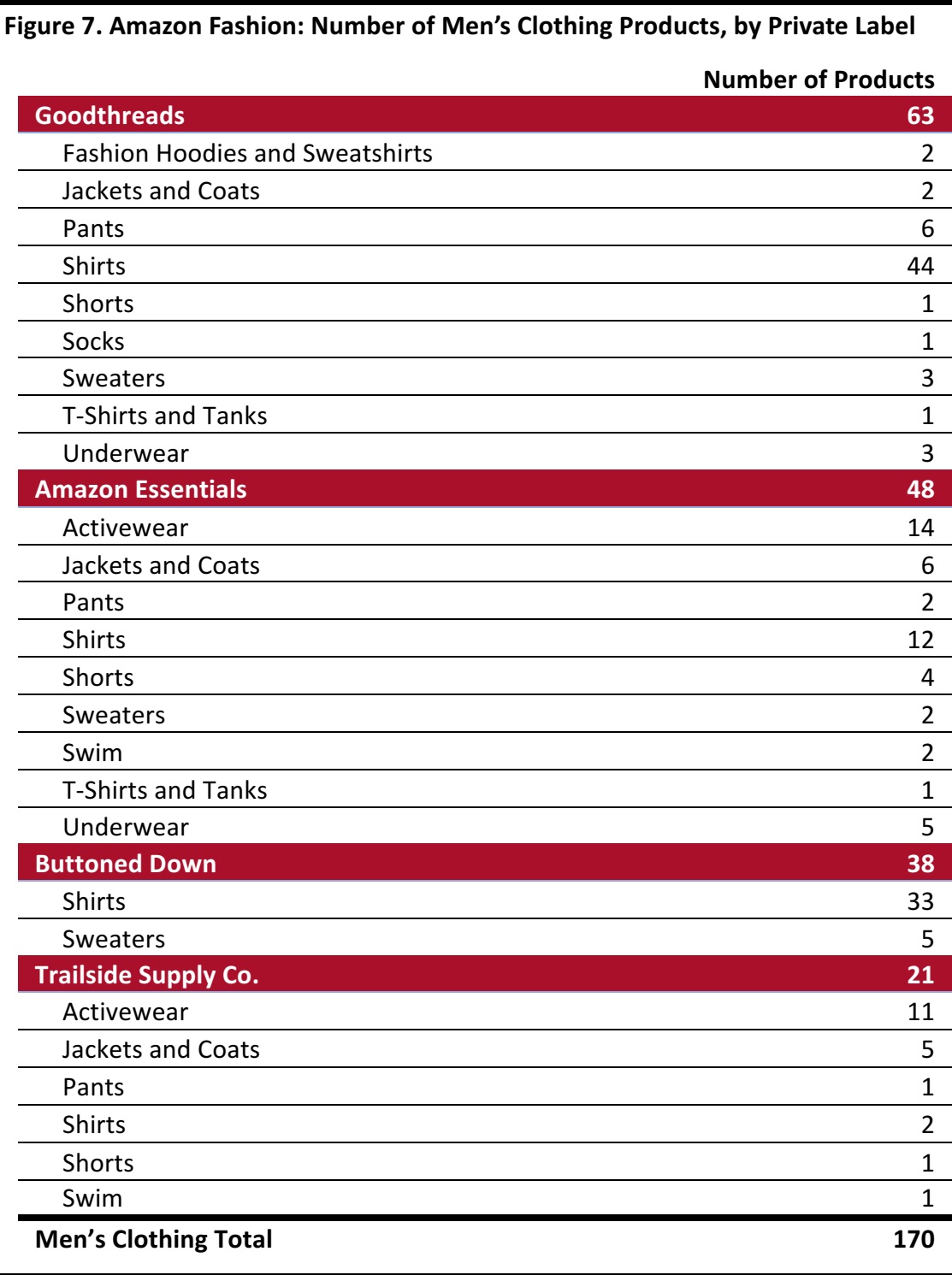

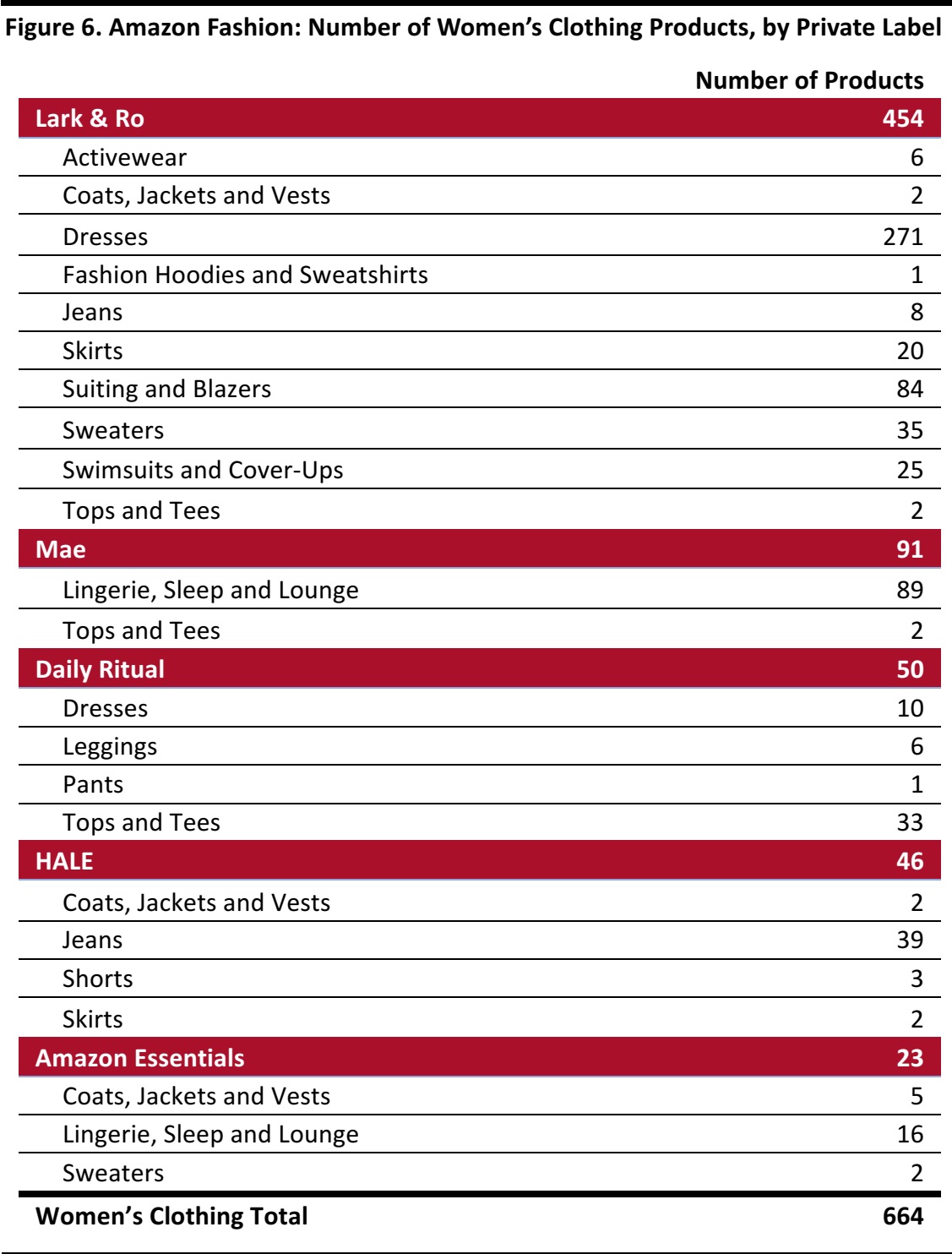

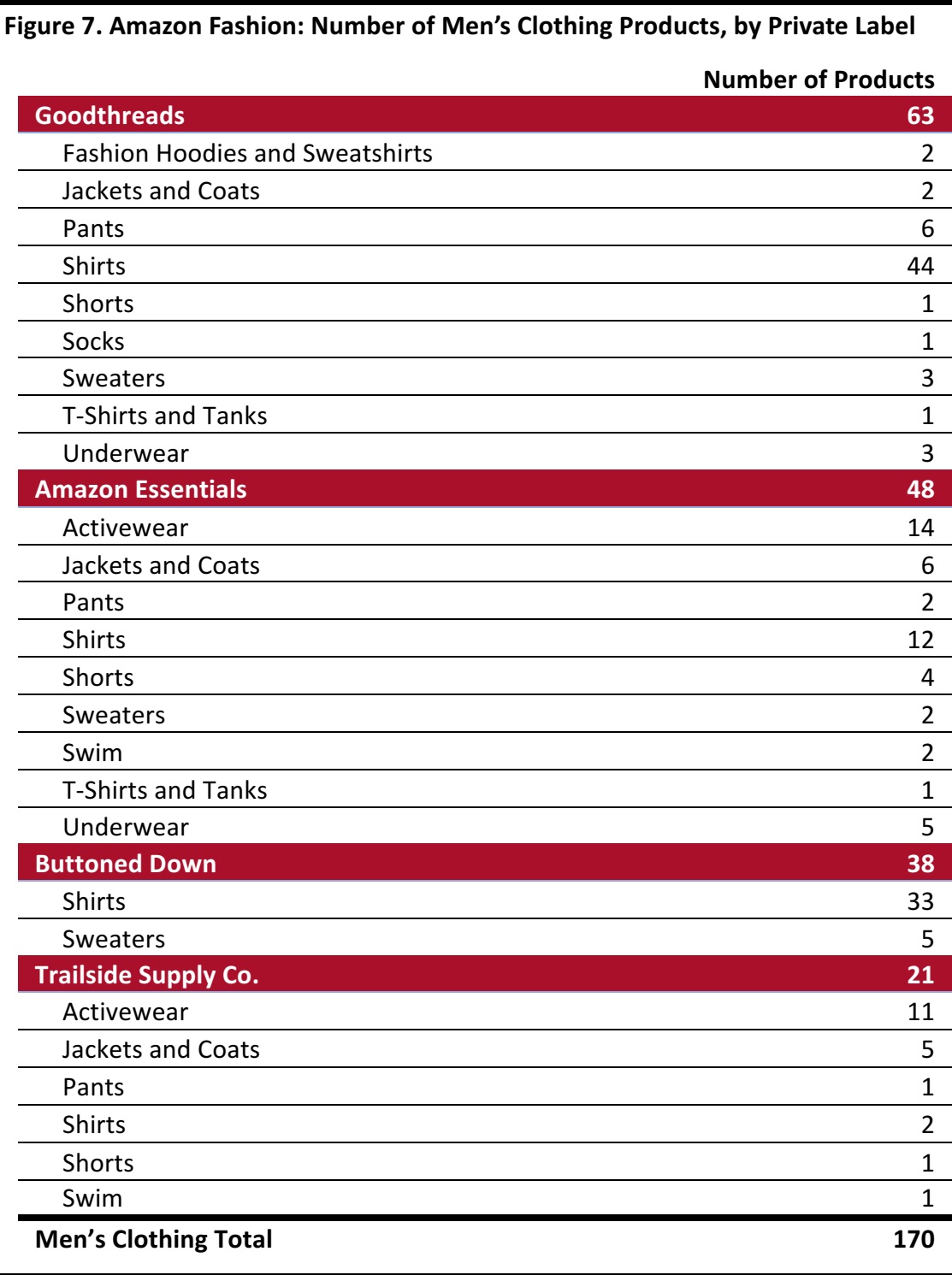

Just 834 of the 881,269 clothing products we identified on Amazon Fashion are Amazon private-label products. This is equivalent to just under 0.1% of clothing inventory on the site. Womenswear accounts for 80% of Amazon’s private-label clothing offerings.

Womenswear brand Lark & Ro is by far the biggest of Amazon’s apparel private labels, as measured by number of items. Some menswear brands, such as Buttoned Down and Trail side Supply Co., have much more limited offerings, and most of the private labels tend to be clustered in specific clothing categories. For example, Lark & Ro is heavily skewed toward dresses, while Good threads is focused on men’s shirts.

The sometimes-limited ranges reflect the segmented approach that Amazon is taking toward its private labels: with the exception of Amazon Essentials, the company’s own brands tend to be targeted by type of consumer or specialized by category.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

Our recent survey found that one in nine Amazon apparel shoppers had bought Amazon private-label clothing in the past year, making it the fourth-most-purchased clothing “brand” on the site.

3. What are the most-listed clothing brands on Amazon Fashion?

Activewear is an important category for Amazon Fashion, and this is reflected in the prominence of sportswear brands on the site. Nike is the most-listed brand on Amazon Fashion, with 16,764 products listed across women’s and men’s clothing. Sportswear peer Adidas is the 10th-most-listed brand on the site. The second-most-listed name, Interstate Apparel, is an athletic-themed brand.

Value-positioned brands that have traditionally wholesaled to retailers, such as Gildan and Hanes, also rank very highly in terms of number of product listings. Sport-Tek, Port Authority and ZeroGravitee, three other brands that are prominent on the site, traditionally wholesaled plain, unbranded product for buyers to embellish themselves. Sport-Tek and Port Authority are both owned by SanMar.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

4. What are the most-listed clothing categories on Amazon Fashion?

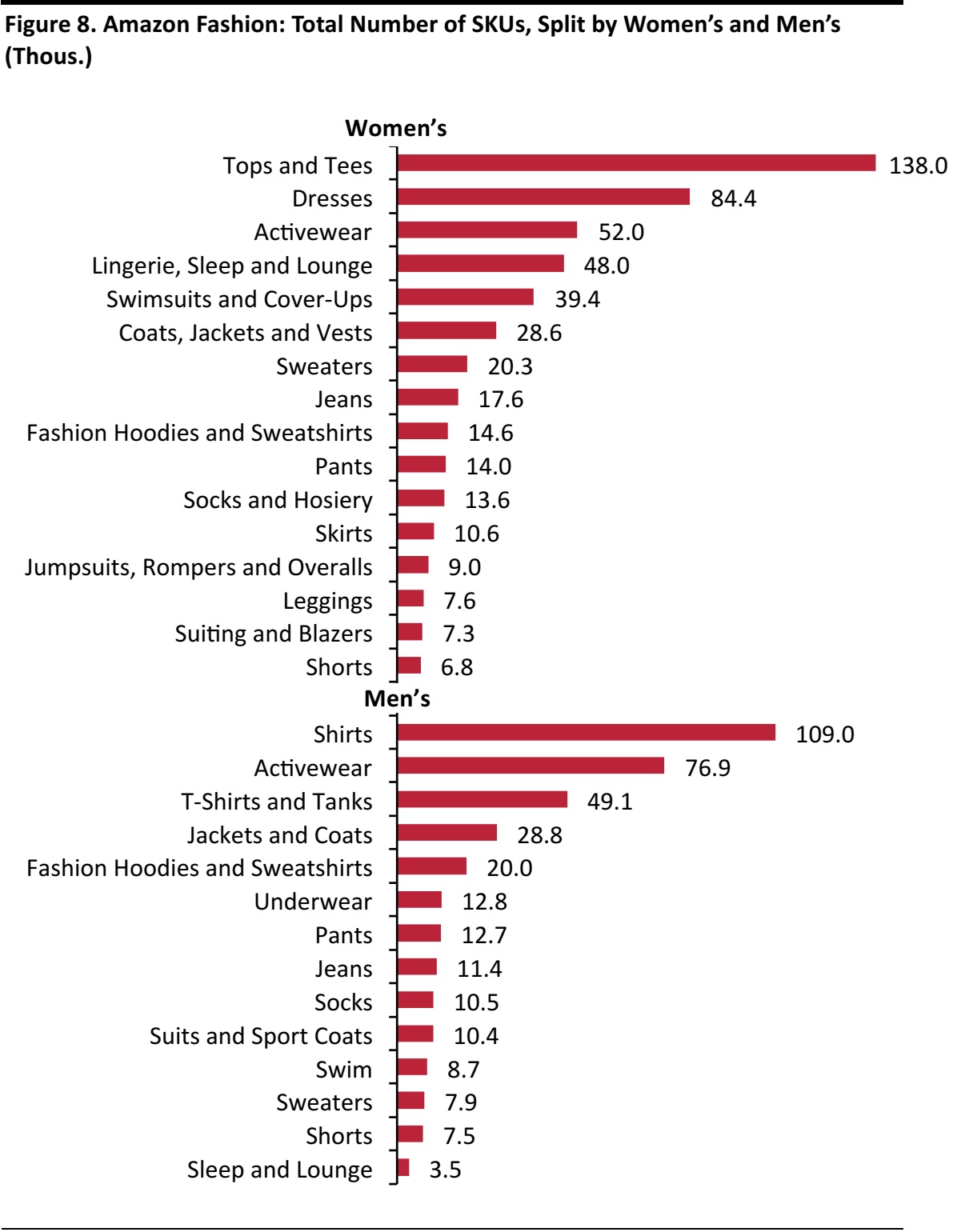

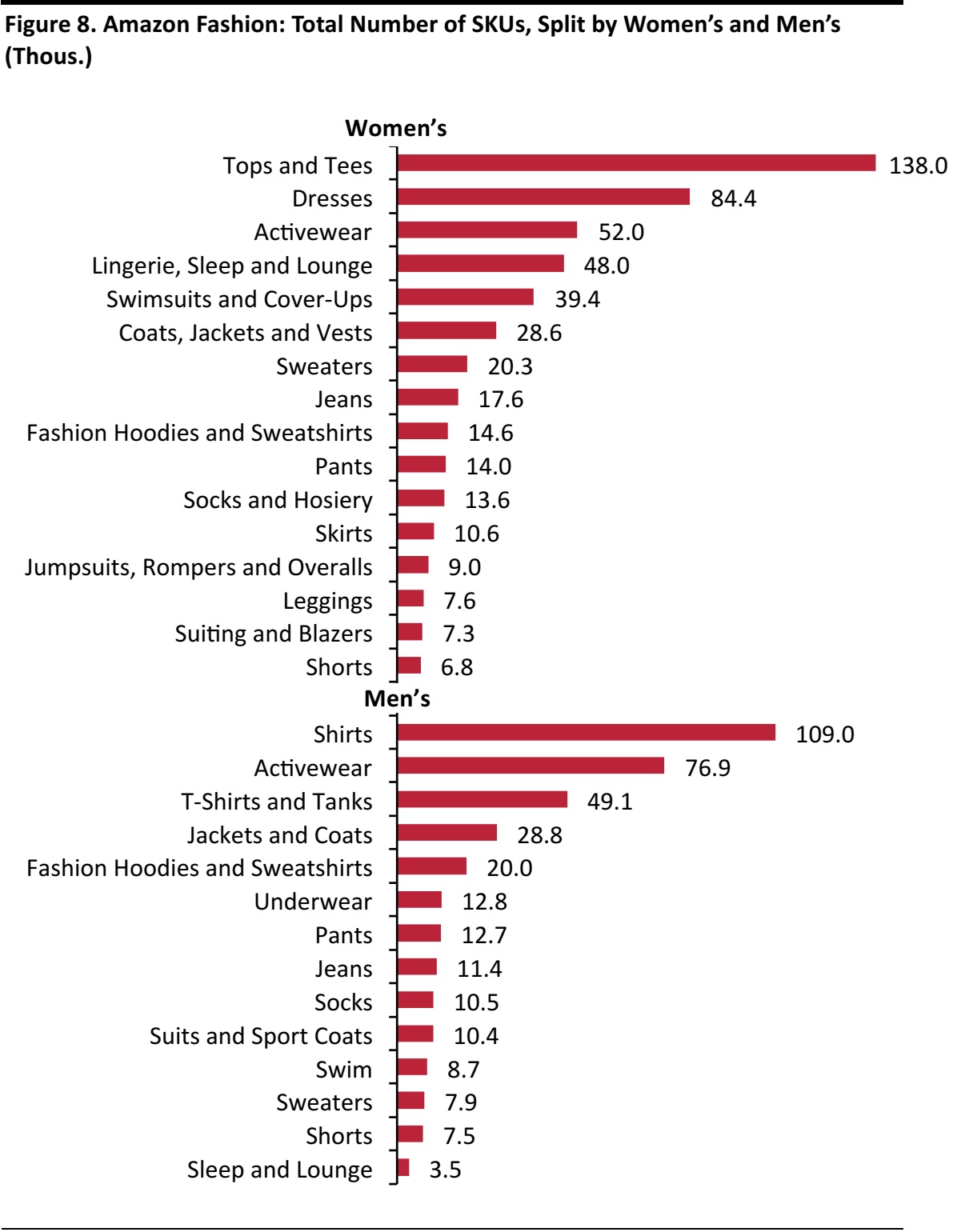

Casual wear and activewear lead the category rankings. Women’s tops and tees is the most-listed clothing category on Amazon Fashion, with 138,001 products listed. Men’s shirts, which includes an abundance of casual shirts as well as polo shirts and some T-shirts, is second, with 109,043 products listed.

Echoing the prominence of Nike and Adidas on the site, activewear accounts for a large number of listings:there are 76,930 men’s activewear products and 51,992 women’s activewear products listed on the site. In both womenswear and menswear, many more products are listed under activewear than are listed under staple categories such as jeans and sweaters.

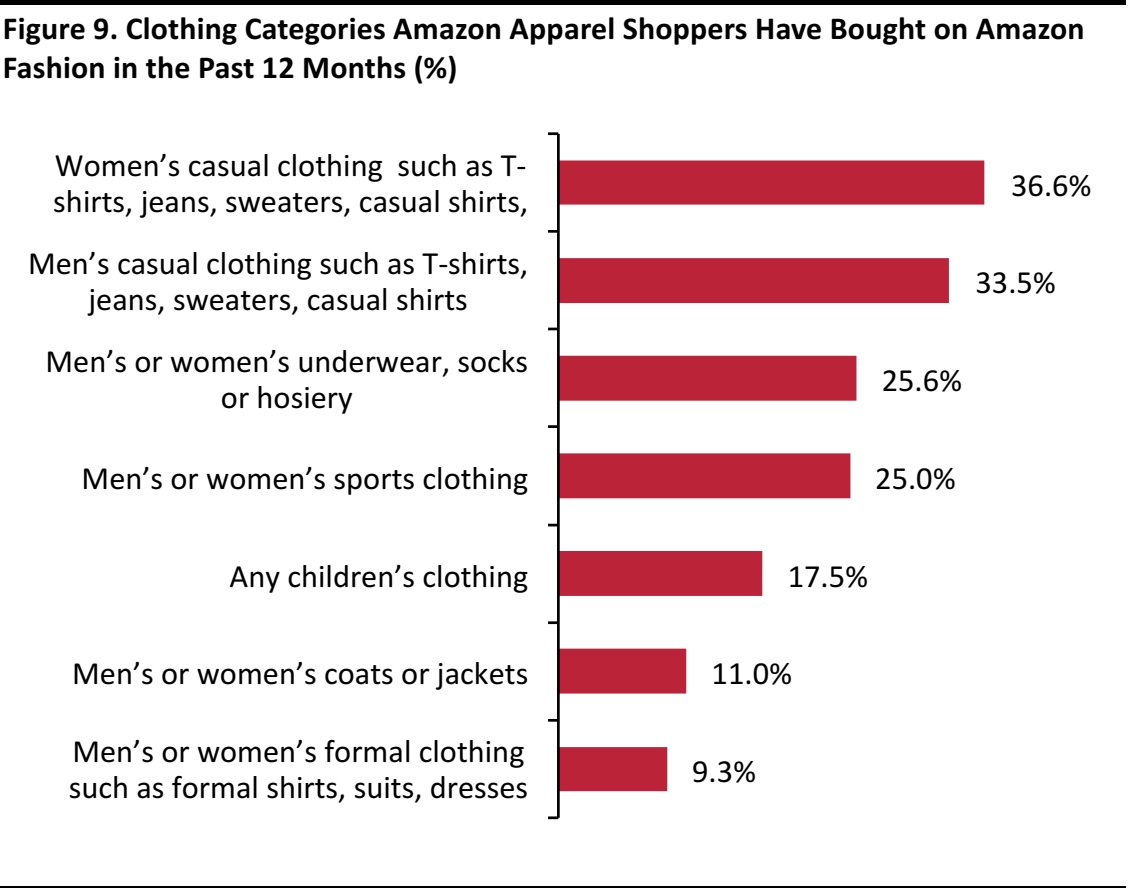

The prominence of activewear on the site bears out another finding from our recent Amazon apparel survey: sportswearis a highly popular purchase category among Amazon Fashion shoppers.One-quarter of Amazon apparel shoppers surveyed said that they had bought sportswear on the site in the past year.

5. How long is the “long tail” of products on Amazon Fashion?

Amazon Fashion offers huge choice in clothing, but a limited number of brands account for the bulk of this choice. In fact, the top 30 brands account for 30% of all clothing products listed on Amazon Fashion—implying that there are opportunities for other brands to scale up.

Just 72 of the 2,798 clothing brands we identified on the site list more than 2,000 products apiece. And just 189 brands list more than 1,000 products apiece.This leaves a long tail of very many brands listing very few products on Amazon Fashion.Almost 1,400 brands on the site list fewer than 50 products each.

This long tail underlines Amazon’s positioning as the “everything store,” and it suggests opportunities for Amazon Fashion to grow its offering even further.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

Brands and Private Labels on Amazon Fashion

Nike Is the Most-Listed Brand on Amazon Fashion

Below, we rank the top 30 brands available on Amazon Fashion by the number of products listed under each brand. The group of 30 broadly coincides with those brands listing 5,000 or more products on the site.

- Nike is the most-listed brand on Amazon Fashion: we identified 16,764 Nike products on the site, equivalent to approximately 2% of all Amazon Fashion listings. Sportswear peer Adidas ranks highly in terms of number of listings, too.

- Lower-price brands that have traditionally relied on wholesale distribution to mass merchandisers and other stores are also well represented on Amazon Fashion, as reflected by the prominence of Gildan, Hanes and Next Level.

- In total, the top 30 of the 2,798 identified brands available on Amazon Fashion account for just under 30% of all listings on the site, indicating just how long the tail of apparel brands is on the platform.

- A number of the most-listed brands, such as ZeroGravitee and NisabellaLTD, sell unbranded product. But premium brands such as Ralph Lauren, Tommy Hilfiger and Hugo Boss are also prominent.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

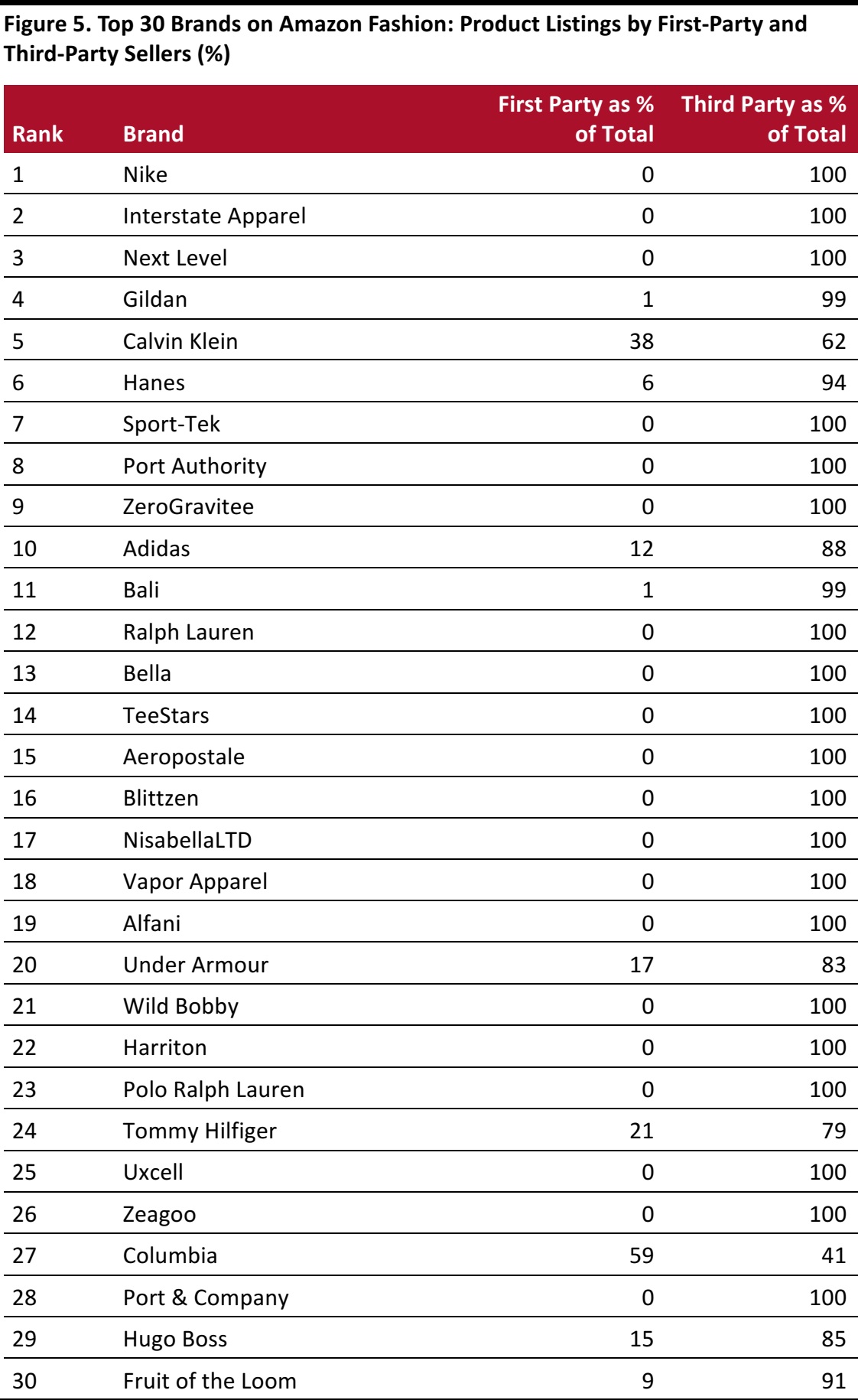

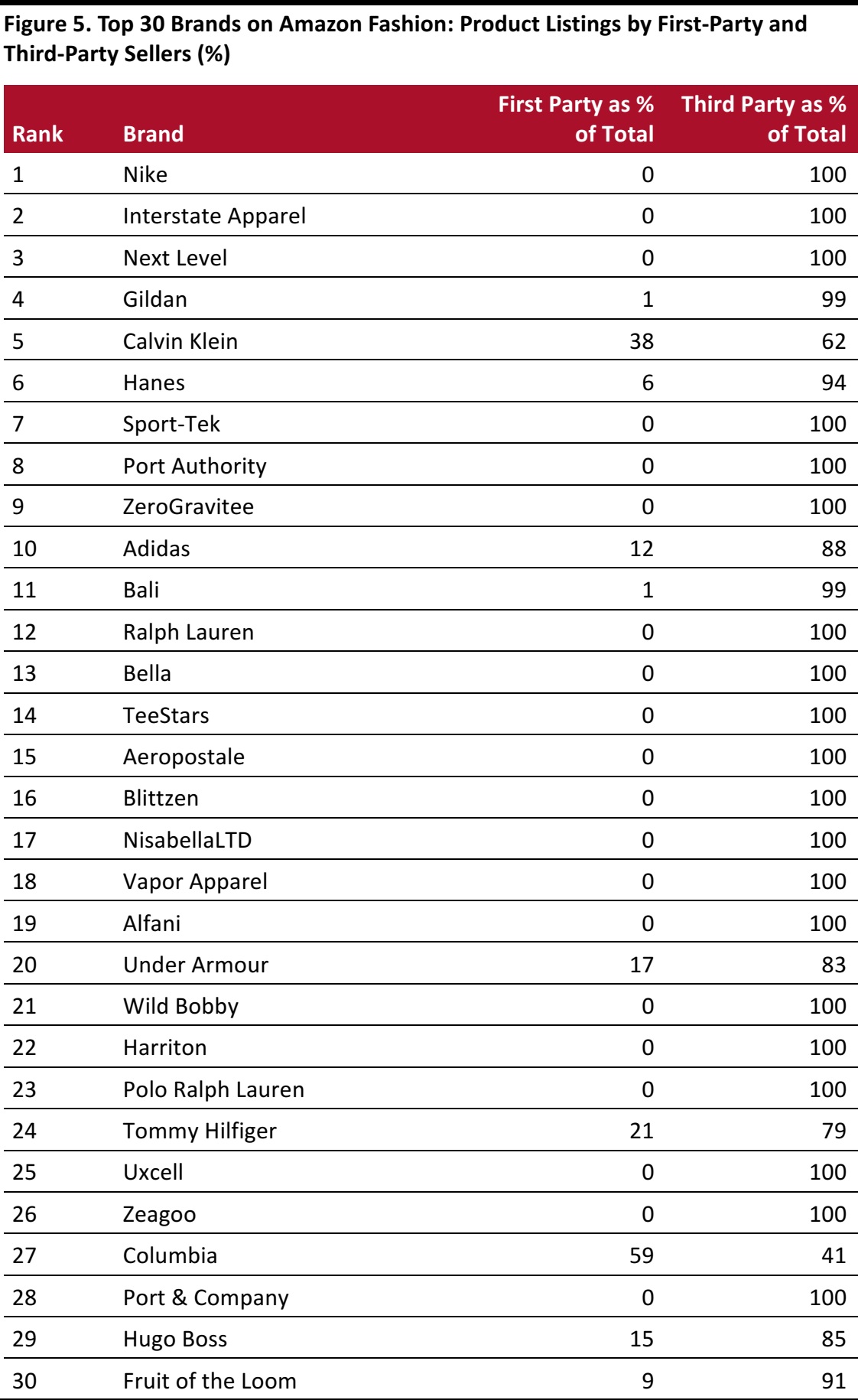

Several of the most prominent brands on Amazon Fashion recently announced that they would either sell to Amazon or strengthen their presence on the site. In June 2017, Nike announced that it would pilot selling directly on Amazon with “a small product assortment across footwear, apparel and accessories.” Calvin Klein, the fifth-most-listed brand on the site, announced in November 2017 that it would offer an expanded selection of underwear and jeans on Amazon Fashion as part of a campaign for the 2017 holiday season. Gildan, the fourth-most-listed brand on the site, made its full range of men’s underwear available on Amazon Fashion in January 2018. Unlike Nike, Calvin Klein and Gildan are not listed as third-party sellers on the site. Calvin Klein appears to wholesale inventory to Amazon for it to resell.

Below, we show the distribution of each of the top 30 brands’ total listings, broken out by first-party (Amazon) and third-party sellers.

- The data show that Amazon is heavily reliant on third-party sellers for most top apparel brands, perhaps reflecting challenges in striking supply deals with brands.

- In the top tier, Calvin Klein stands apart as a brand with a relatively high share of first-party listings on Amazon Fashion:some 38% of Calvin Klein items listed for sale are listed by Amazon itself. This likely reflects the above mentioned collaboration between Amazon and Calvin Klein.

- A higher proportion of first-party sales may imply that Amazon has stronger supply deals with brands than where it is dependent on third-party sellers.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

Amazon’s Private-Label Apparel Offering Nears 1,000 Products

Amazon Fashion offers almost 1,000 private-label clothing products, but that is in the context of total inventory of almost 1 million products.

- Weidentified 834 Amazon private-label products across eight private labels on the site. This is equivalent to just under 0.1% of all clothing inventory on Amazon Fashion.

- Amazon’s private-label offerings are skewed toward womenswear, which accounts for 664, or 80%, of the 834 total private-label products on the site.

- Womenswear brand Lark & Ro accounts for more than half of Amazon’s private-label clothing products.

- Several Amazon private labels have limited offerings. We found only 23 womenswear product listings under the Amazon Essentials brand. In menswear, we recorded 21 product listings under the Trail side Supply Co. brand and 38 under the Buttoned Down brand.

Although all of Amazon’s private labels are offered under multiple types of products, they tend to be concentrated within specific categories. We think that this reflects Amazon’s highly segmented approach to private labels: the company tends to focus each of its own brands on a particular consumer type or product category.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

Amazon Fashion Listings, by Clothing Category: Casualwear and Activewear Account for the Highest Number of Listings

Womenswear is better represented than menswear on Amazon Fashion, as it is in the overall clothing market. And there are more listings under the casual clothing and activewear categories than under other categories.

- We identified 511,832 women’s clothing products on the site, compared with 369,437 men’s clothing products, which translates to a 58%/42% split.

- Casual clothing leads the offering. Women’s tops and tees is the clothing category with the most listings on the site, at 138,001. Men’s shirts is second, with 109,043 listings.

- Mirroring the prominence of sportswear brands on Amazon Fashion, activewear ranks highly in terms of number of products listed on the site: it represents76,930 men’s products and 51,992 women’s products. Across womenswear and menswear, activewear comfortably outranks mass-appeal categories such as jeans, pants and sweaters.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

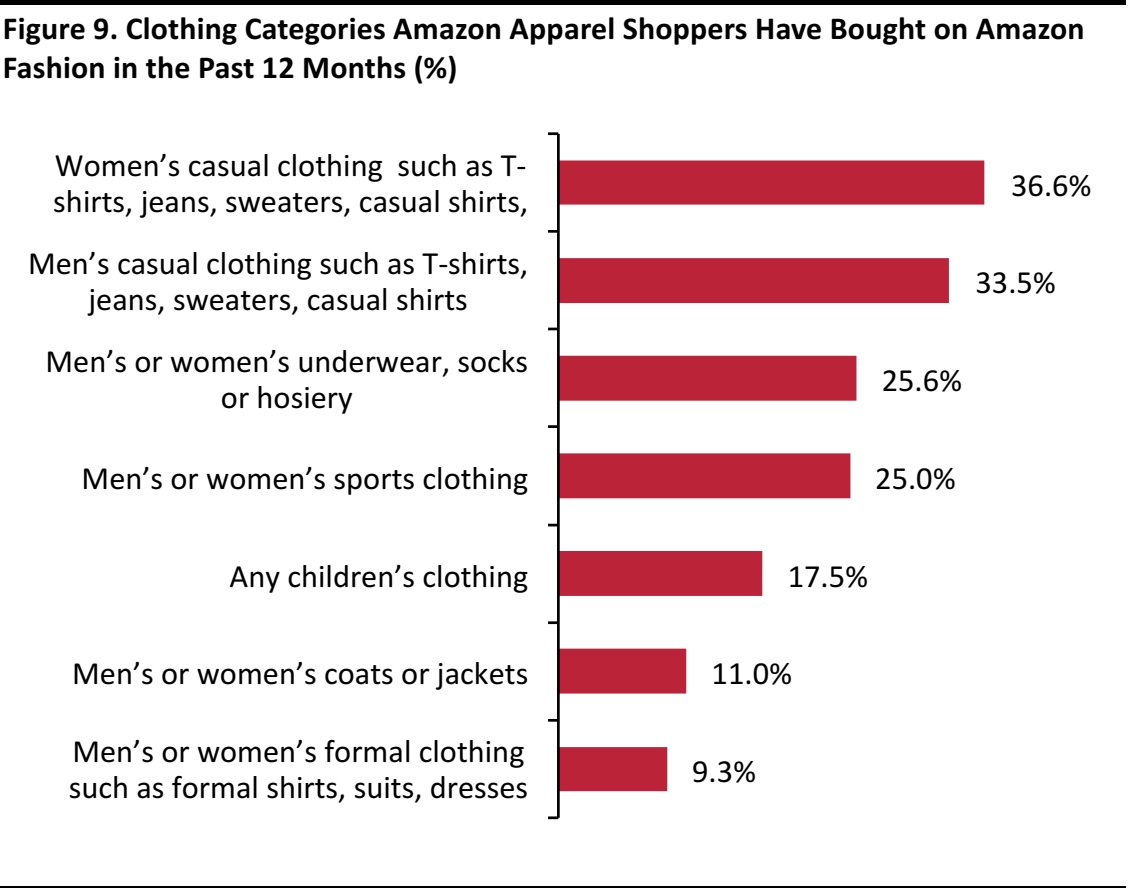

For comparison, the graph below shows what Amazon apparel shoppers told us they had bought on Amazon in the past 12 months when they responded to our recent consumer survey. Together, these two data sets confirm the strength of casual clothing and activewear on Amazon Fashion. They also imply that underwear, socks and hosiery over index in shopper numbers relative to the number of products listed under those categories on the site.

Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Which of these categories have you bought on Amazon.com in the past 12 months?

Source: Coresight Research

Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Which of these categories have you bought on Amazon.com in the past 12 months?

Source: Coresight Research

Amazon Fashion Clothing Category Listings, by First-Party vs. Third-Party Sellers

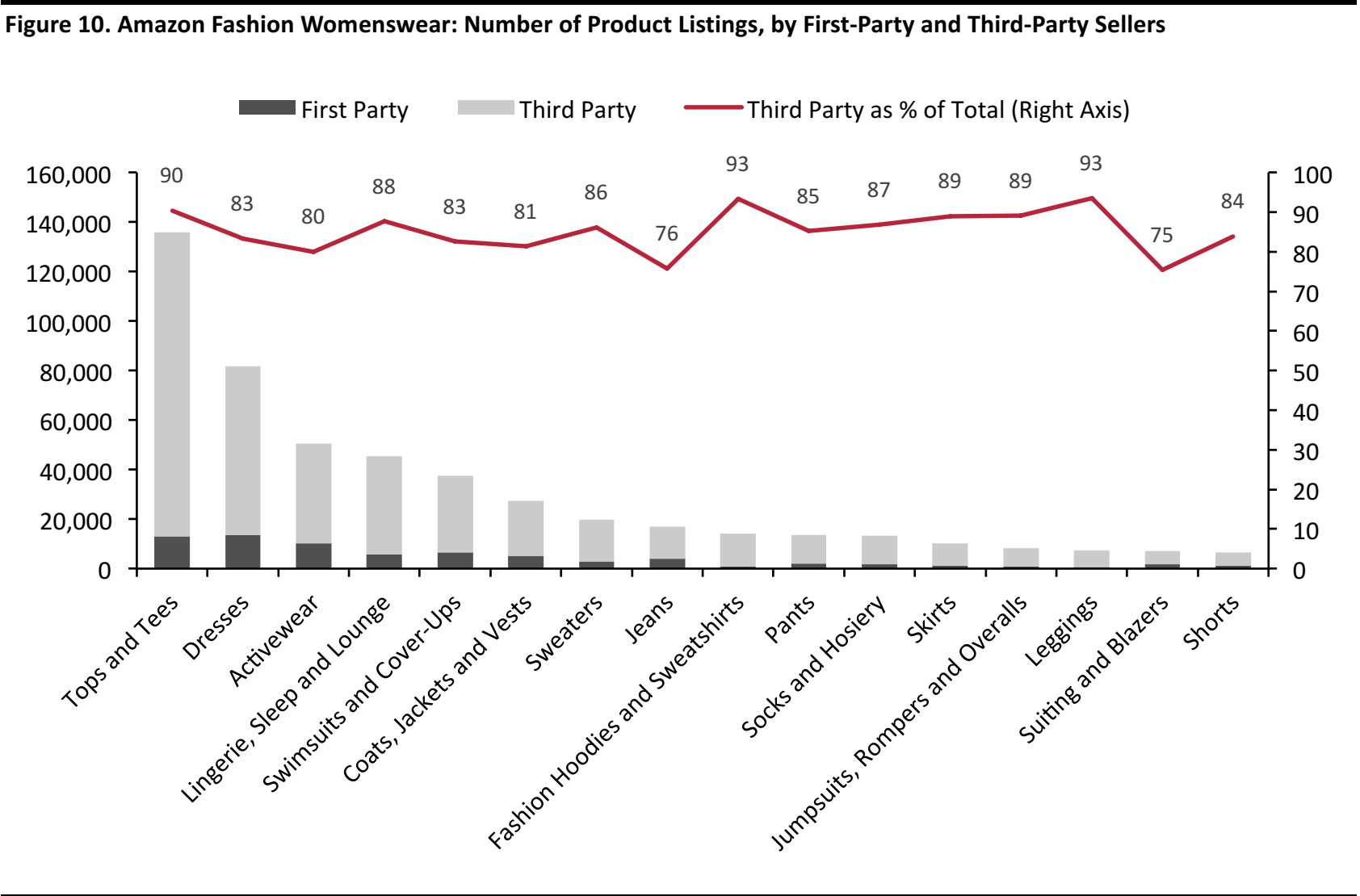

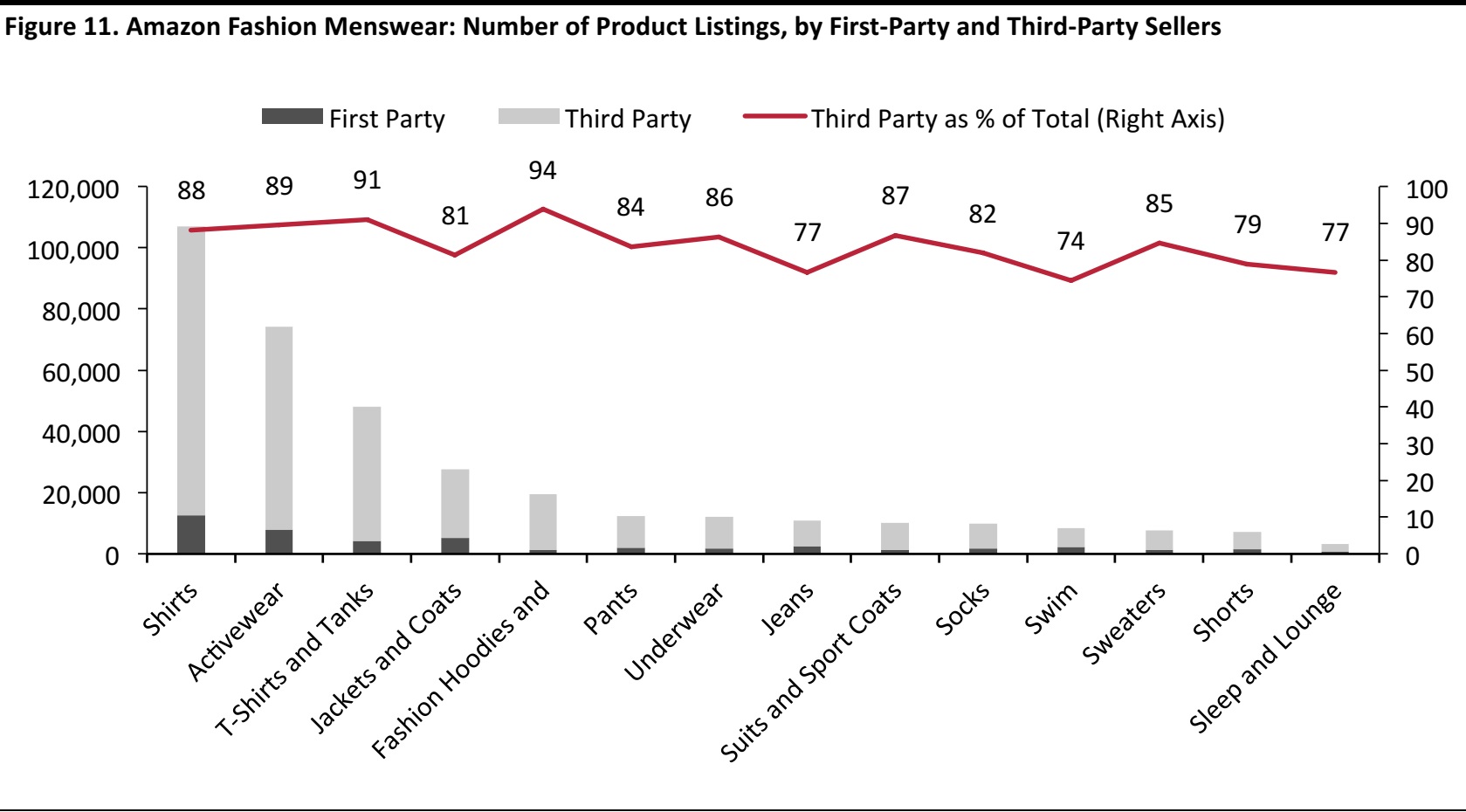

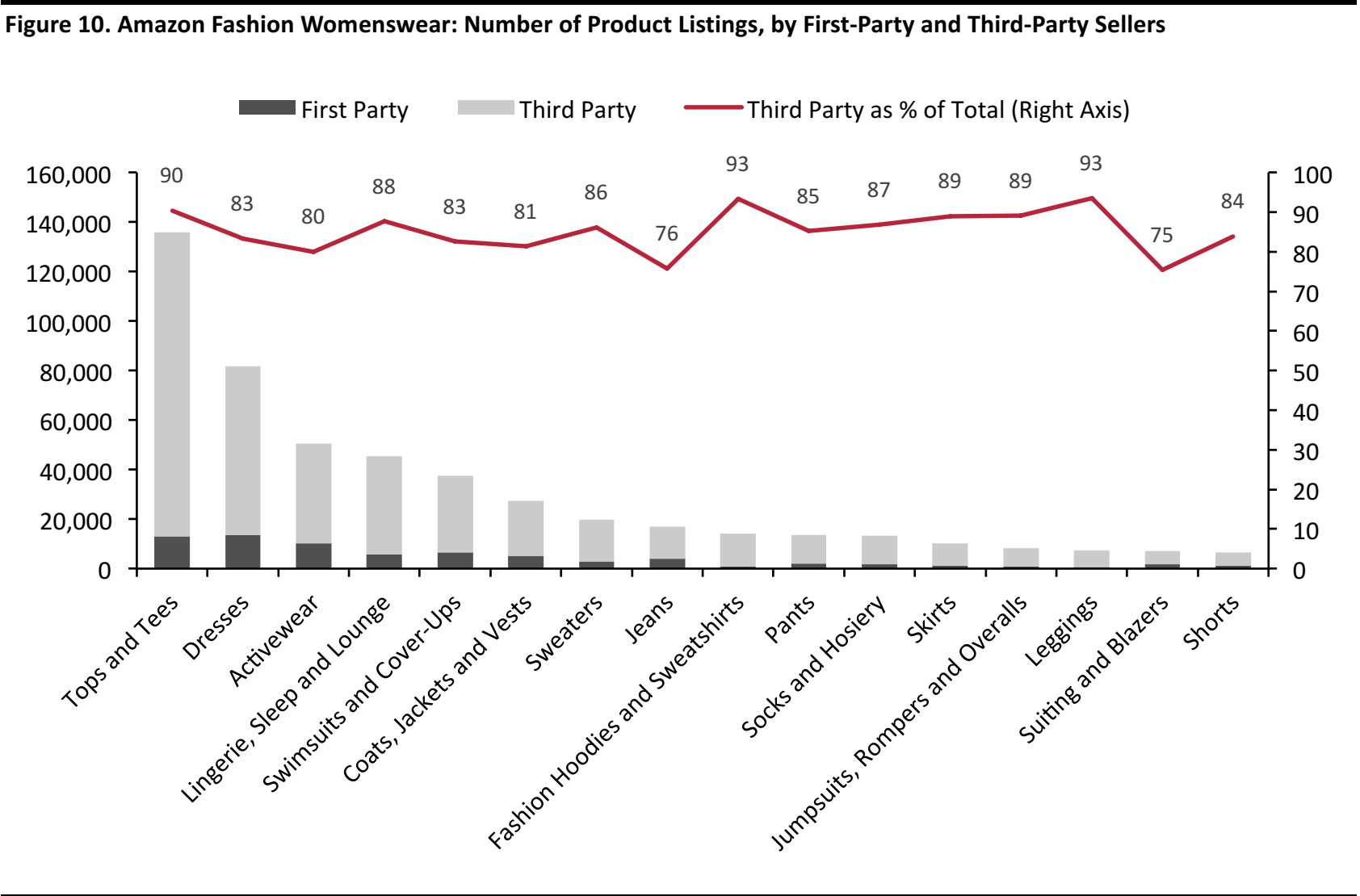

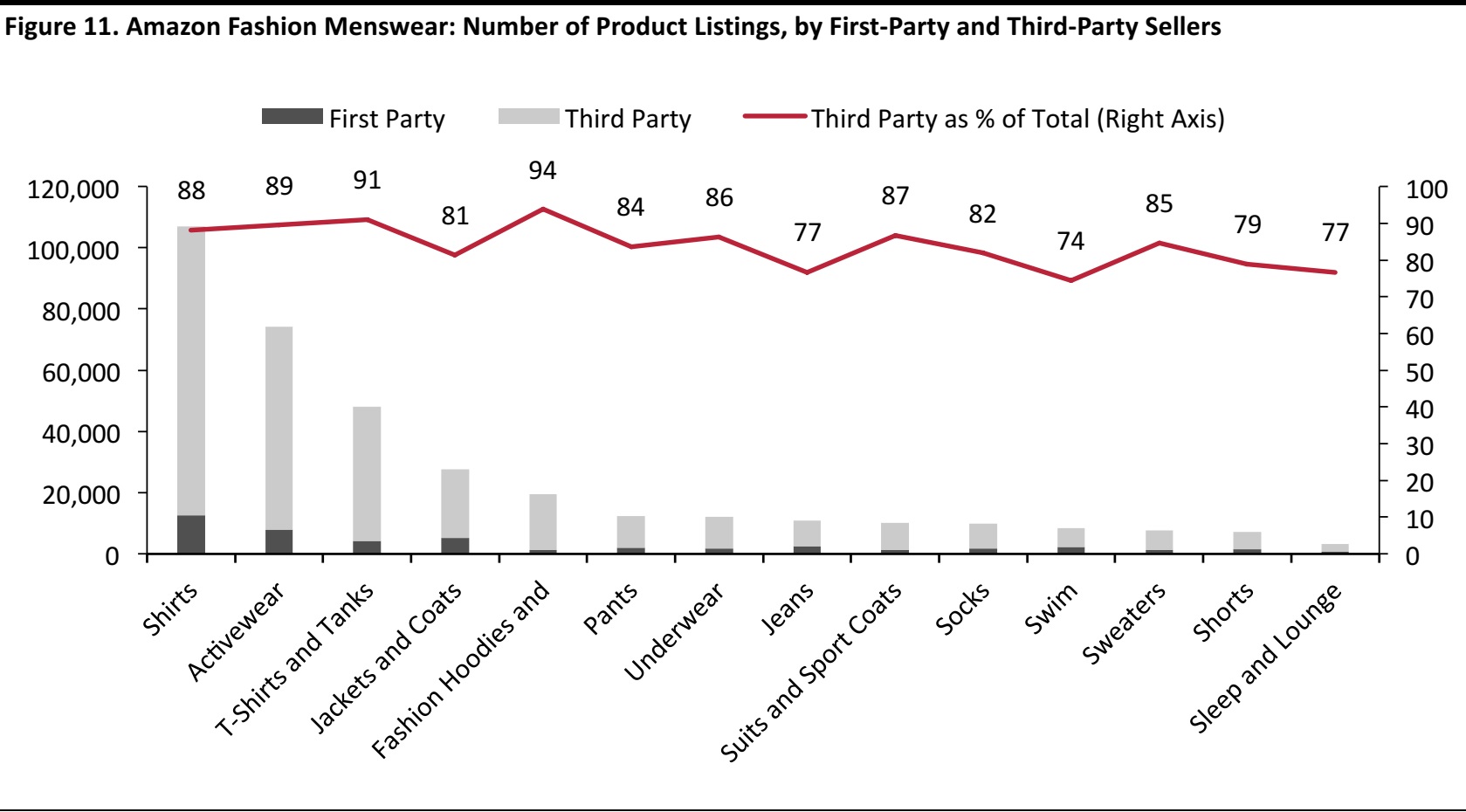

Third-party sellers dominate the clothing offering on Amazon Fashion. As we noted earlier, fully 86.3% of all clothing products available on the site are listed by third-party sellers. In the charts below, we break out the split by product type within womenswear and menswear.

Within womenswear, we see a general correlation between selling price and type of seller: basic categories with low average selling prices see the highest representation of third-party seller units. This suggests that Amazon is opting to focus its first-party distribution on higher-margin clothing categories.

- Tops and tees, which tend to be lower-value items, are predominantly supplied by third-party sellers:such sellers account for 90% of product listings in the category.

- Third-party sellers are somewhat less prominent in categories that typically have higher selling prices, such as activewear and jeans, where product complexity and premium brands lift average selling prices.

- Third-party sellers’ share of listings drops further in the suiting and blazers category. This is another indication that Amazon builds its own inventory in higher-value categories.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

The correlation between selling price and type of seller is more sporadic in menswear than in womenswear.

- In the men’s T-shirts and tanks category, which tends to see low selling prices,third-party sellers have a heavy presence on Amazon Fashion.

- The jackets and coats category and the jeans category, which tend to have higher average selling prices than T-shirts and tanks,see greater first-party inventory on Amazon Fashion.

- Activewear remains heavily skewed toward third-party listings, however, while the lower-value swim and sleep and lounge categories see a strong representation of first-party listings.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research

Key Takeaways

Amazon is already a major player in US fashion retailing, but a number of data points showcased in this report under score its potential for further growth.

- Amazon Fashion is still heavily reliant on third-party sellers. We think more first-party listings would encourage shoppers, and especially Prime members, to buy more apparel on the Amazon Fashion site—not least because we think shoppers feel greater reassurance on delivery and returns policies when buying from Amazonitself. We expect to see more first-party listings flow through to the site as Amazon continues to strengthen its relationships with major brands.

- Amazon’s private-label ranges are another lever for growth.We identified only 834 private-label apparel products on the site, out of almost 1 million product listings, indicating that the retailer has much room yet to run in private-label apparel.

- The 30 most-listed brands on Amazon Fashion make up 30% of all clothing products listed on the site, and just 189 brands have more than 1,000 products each listed on the site. Almost 1,400 brands list fewer than 50 products each, suggesting that Amazon Fashion has further opportunity to grow its already substantial brand offering.

A Note on Methodology

- We defined our universe of brands by aggregating data on the top 500 featured product listings for each product type within Women’s Clothing and Men’s Clothing on Amazon Fashion, Amazon’s US apparel site.For example,we aggregated data on the top 500 product listings for women’s tops and tees, the top 500 product listings for men’s activewear and the top 500 product listings for women’s jeans.

- This returned a total of 2,798 unique brands featured on Amazon Fashion.

- We then aggregated data on all product listings for each of those 2,798 brands, by product type within Women’s Clothing and Men’s Clothing.

- We identified a total of 881,269 individually listed products. Different clothing sizes for an identical product were not counted separately.

- Product listings were checked against publicy available lists of known Amazon private labels,such as those published by Loose Threads and L2, to identify which product listings fell under one of the retailer’s own labels.

- We conducted our research between February 1 and February 27, 2018.

About DataWeave

Powered by proprietary AI, DataWeave provides actionable competitive-intelligence-as-a-service to retailers and consumer brands in near real time by aggregating and analyzing data from the web. While retailers use DataWeave’s Retail Intelligence product to make smarter pricing and merchandising decisions and drive profitable growth, consumer brands use DataWeave’s Brand Analytics product to protect their brand equity online and optimize the experience delivered to shoppers on e-commerce websites. For more information, visit

www.dataweave.com.

Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Which of these categories have you bought on Amazon.com in the past 12 months?

Source: Coresight Research

Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Which of these categories have you bought on Amazon.com in the past 12 months?

Source: Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research Source: DataWeave/Coresight Research

Source: DataWeave/Coresight Research