Introduction: Understanding Amazon Fashion

Amazon’s expansion into apparel is one of the hottest topics in US retail—not least because many commentators link the ongoing woes of major department stores to shoppers shifting more of their apparel spending to Amazon Fashion. Yet hard data on Amazon’s share of the clothing and footwear markets is scarce, given the company’s limited disclosure on category sales.

In this report, we showcase the findings of our recent online survey of US consumers, a sizable proportion of whom had bought clothing or footwear on Amazon during the past 12 months. We explore how many US consumers are buying apparel on Amazon, which retailers these shoppers have switched their spending from, what clothing and footwear brands and categories they are buying on Amazon, their attitudes toward Amazon Fashion and its offerings, and where else, besides Amazon Fashion, they shop for apparel. Throughout this report, “apparel” refers to both clothing and footwear.

This report forms part of our

How the US Shops series, in which we share insights into shopper behavior from original consumer research. Our most recent US consumer survey was carried out online among 1,699 adults between January 18 and January 24, 2018. Notes on our survey methodology can be found at the end of this report.

The main body of this report discusses our survey findings, question by question. We have also provided an appendix that aggregates various third-party research firms’ estimates of Amazon’s US apparel sales in order to give readers a more complete picture. First, though, we bring together data points from various questions in our survey as we discuss six major themes that emerged from our research.

Our Top Six Takeaways

1) Amazon Apparel Shopping Is Dominated by Prime Members

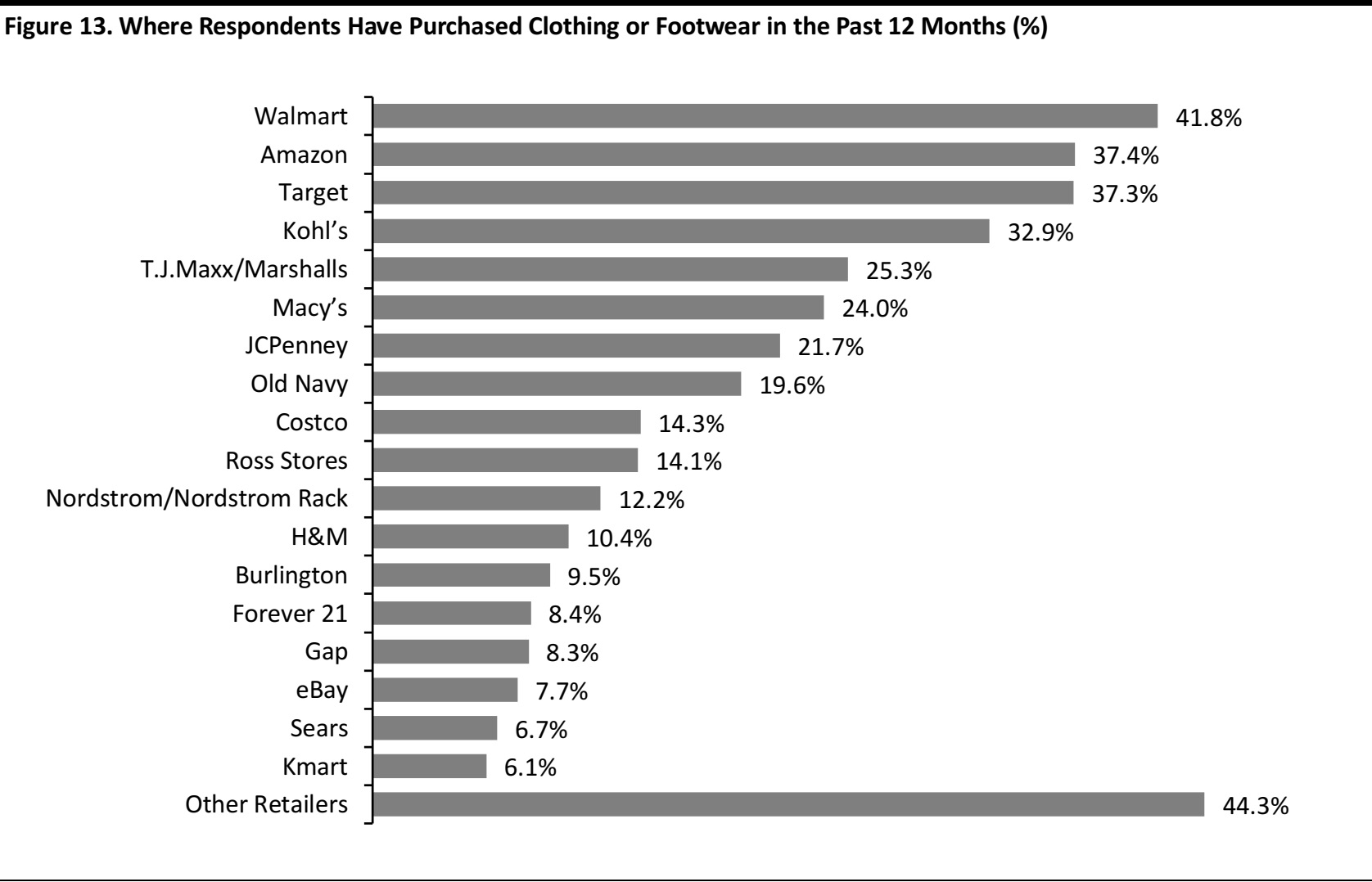

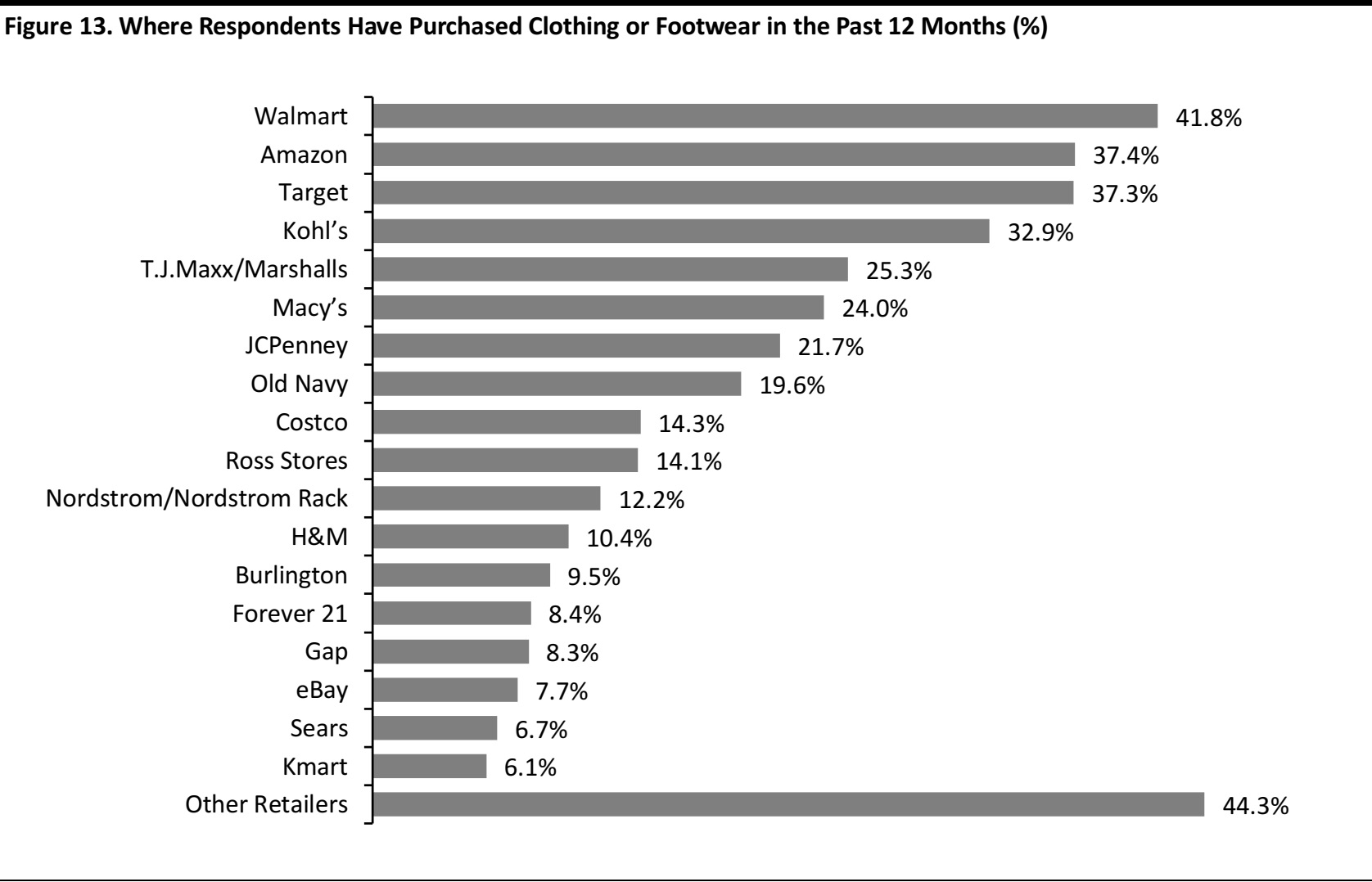

Of the apparel consumers we surveyed, 46% said that they had shopped for clothing or footwear on Amazon in the past 12 months, and the retailer currently runs neck and neck with Target as the second-most-shopped apparel retailer in the US, as measured by number of shoppers. Only Walmart has more apparel customers.

Prime members have pushed Amazon into this strong position:

- Almost two-thirds of Prime members surveyed said that they had bought clothing or footwear on Amazon in the past year, meaning that Amazon is comfortably the most-shopped retailer for apparel among Prime members.

- Among those who are not Prime members, Amazon plummets to seventh place in terms of retailers shopped for apparel.

This implies that growth in Prime membership will underpin Amazon’s expansion into clothing and footwear. However, Prime membership levels are already high in the US, suggesting that they could plateau in the coming years. Some 43% of those surveyed said that they already have a personal Prime membership and a further 21% said that they have access to Prime benefits through someone else in their household. So, Amazon may need to focus on driving up purchase frequency and average spend in order to support its market share gains.

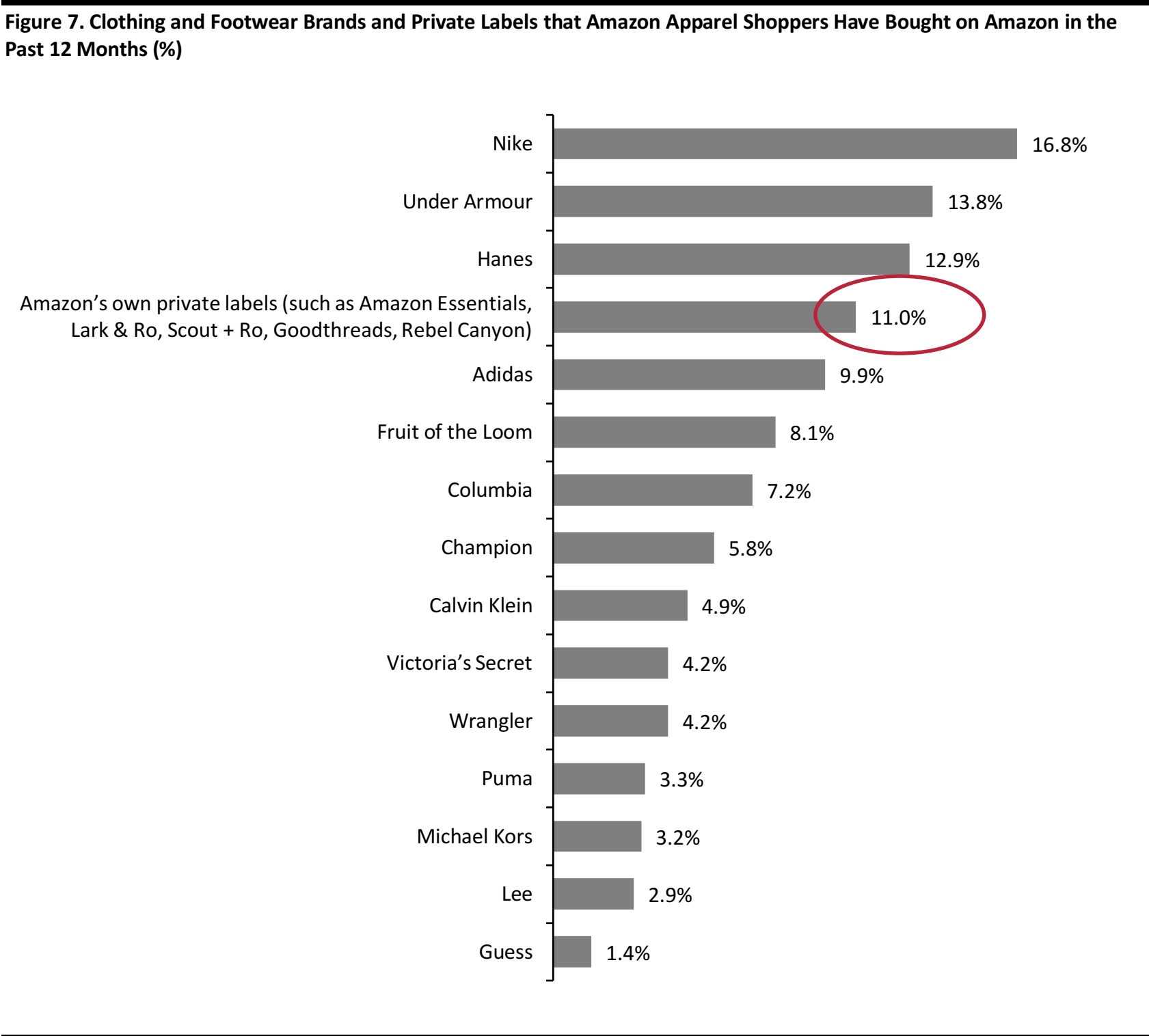

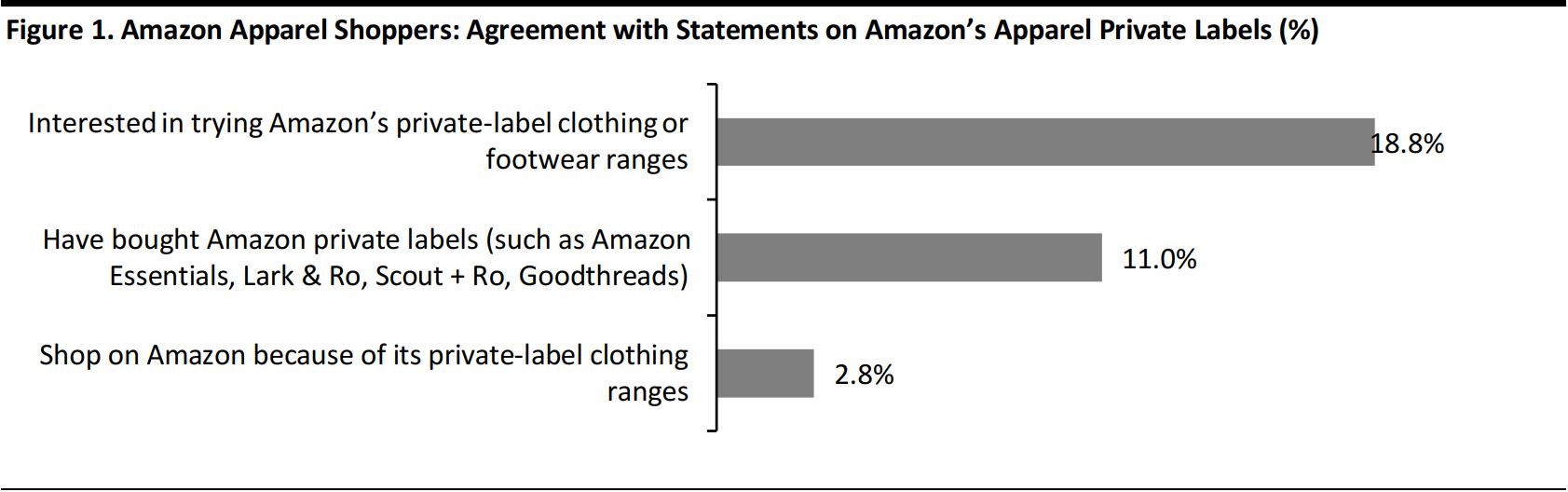

2) One in Nine Amazon Apparel Shoppers Say that They Have Already Bought Amazon Private-Label Clothing or Footwear

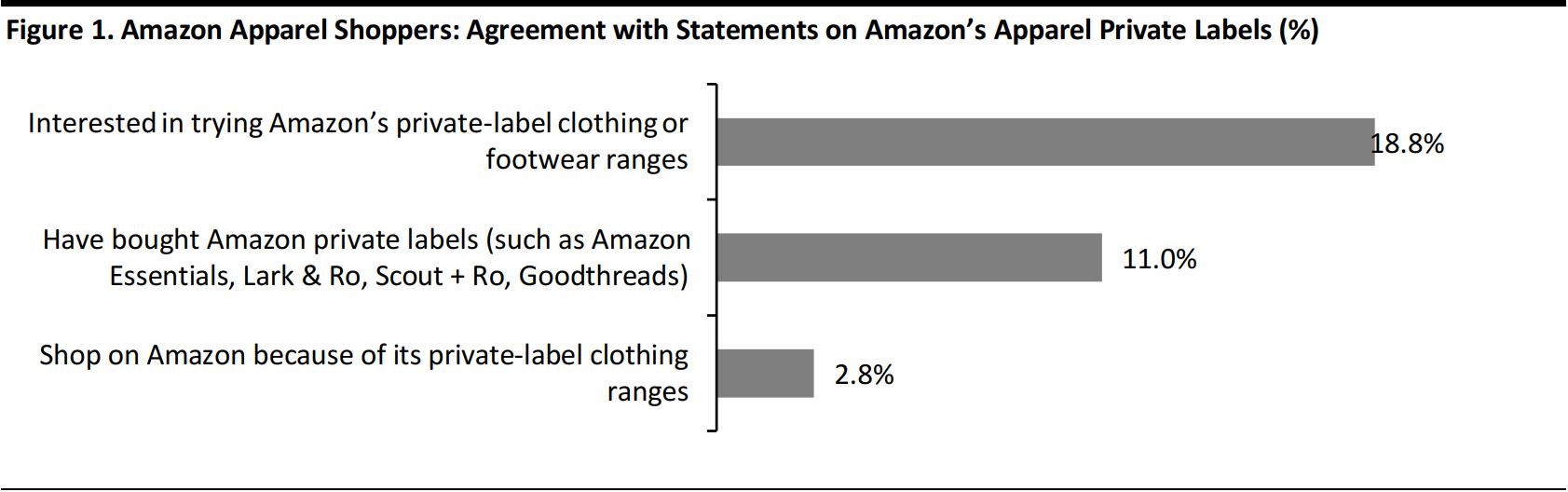

Amazon’s launch of several apparel private labels over the last couple of years is one sign that it is serious about growing its share of the fashion market. Our survey found that a significant number of Amazon Fashion shoppers have already bought something from one of its still-new private-label ranges and that even more shoppers are interested in trying those ranges:

- Amazon’s private-label ranges are the fourth-most-bought clothing or footwear “brand” on Amazon.com. Among the brand options we asked respondents to choose from, only Nike, Under Armour and Hanes ranked higher than Amazon’s private labels.

- One in nine Amazon apparel shoppers surveyed have already bought items from Amazon’s private-label clothing and footwear ranges.

- Almost one in five Amazon apparel shoppers are interested in trying the retailer’s apparel private labels, although only a very small proportion of those we surveyed said that those labels were what specifically attracted them to shop on Amazon.

Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Source: Coresight Research

3) Amazon Versus Target Is the Big Battle in Apparel Retail

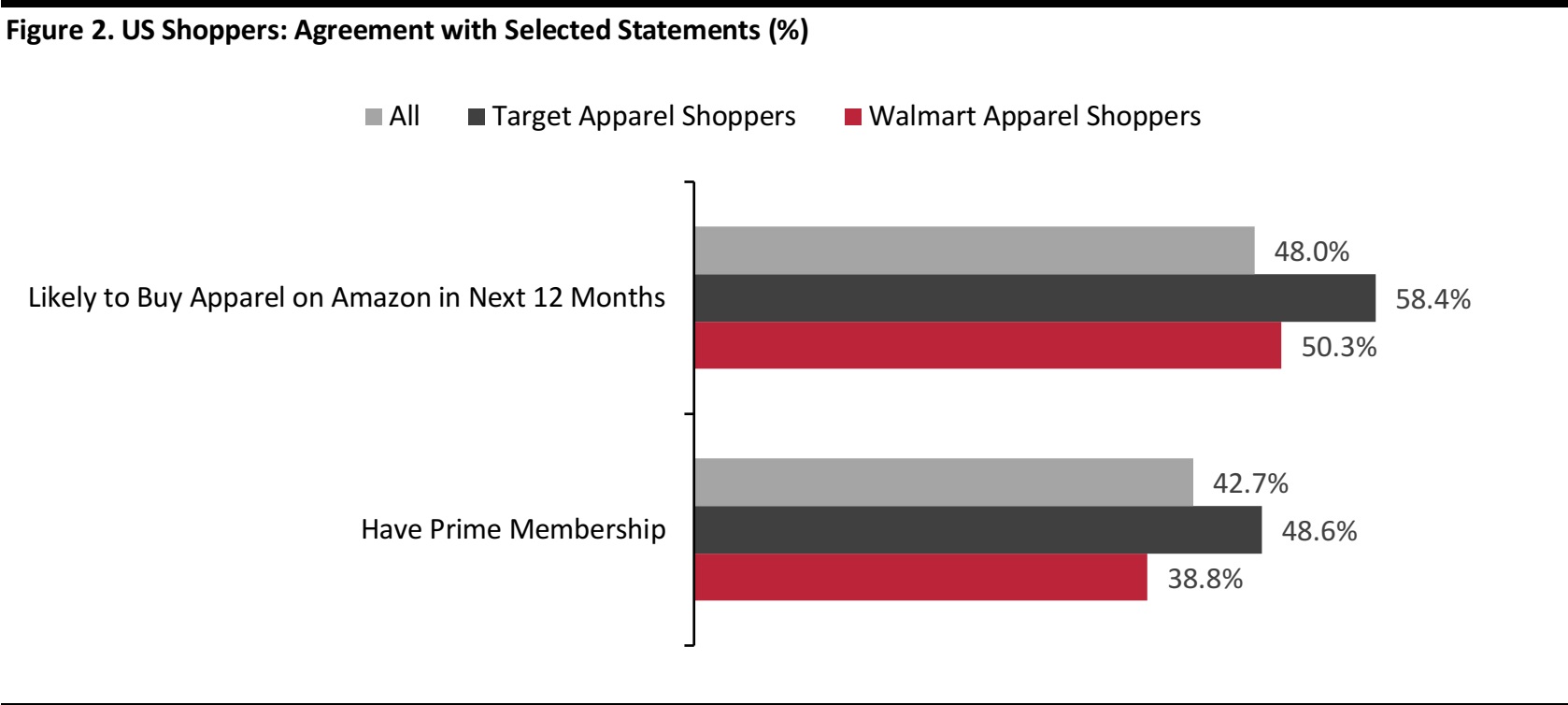

The biggest battles in US retail are often characterized as Amazon versus Walmart and Amazon versus the department stores. However, our research suggests that Amazon versus Target may actually be the bigger battle, at least in apparel:

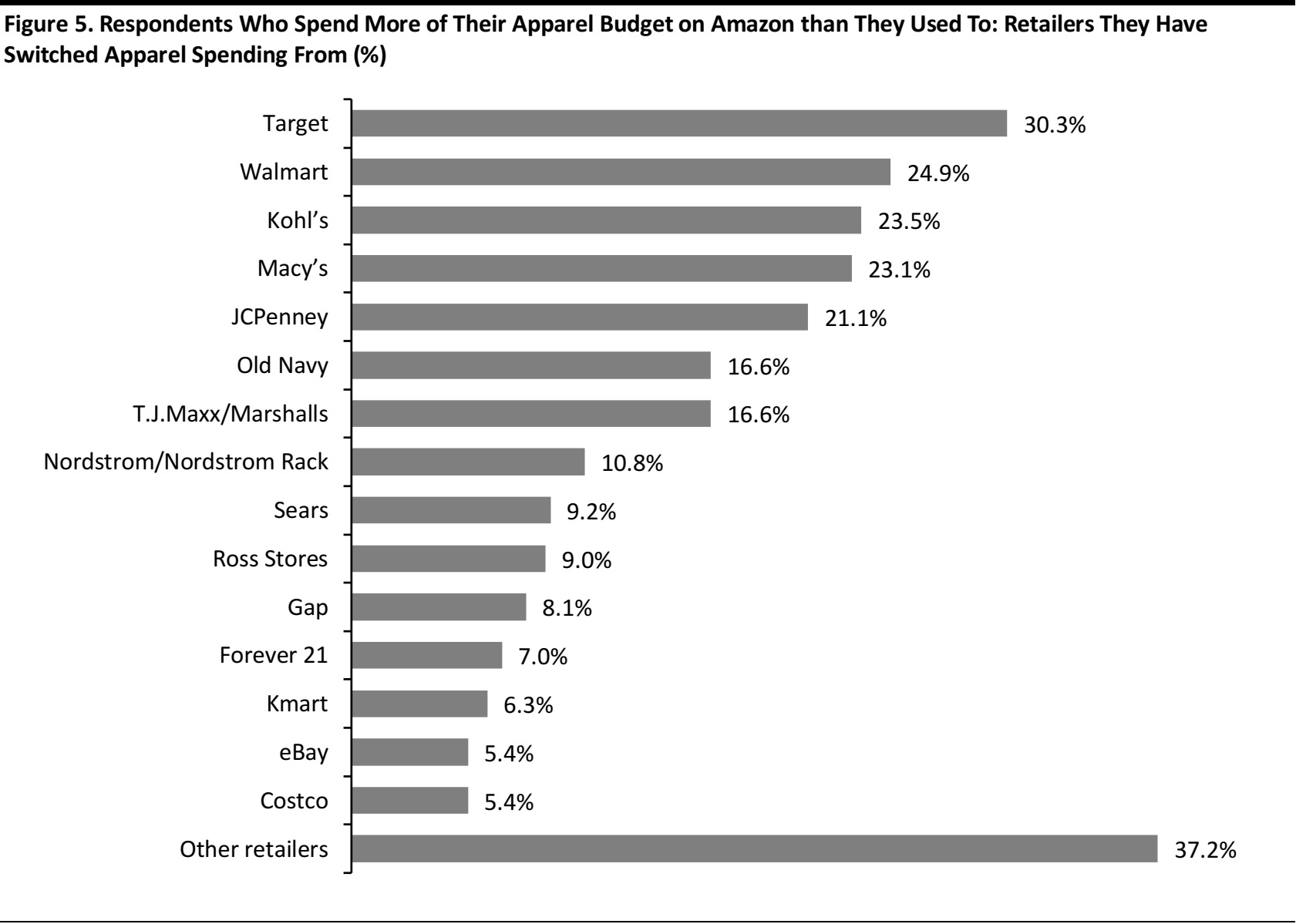

- When we asked Amazon clothing and footwear shoppers which retailers they had switched apparel spending from, the number one answer was Target.

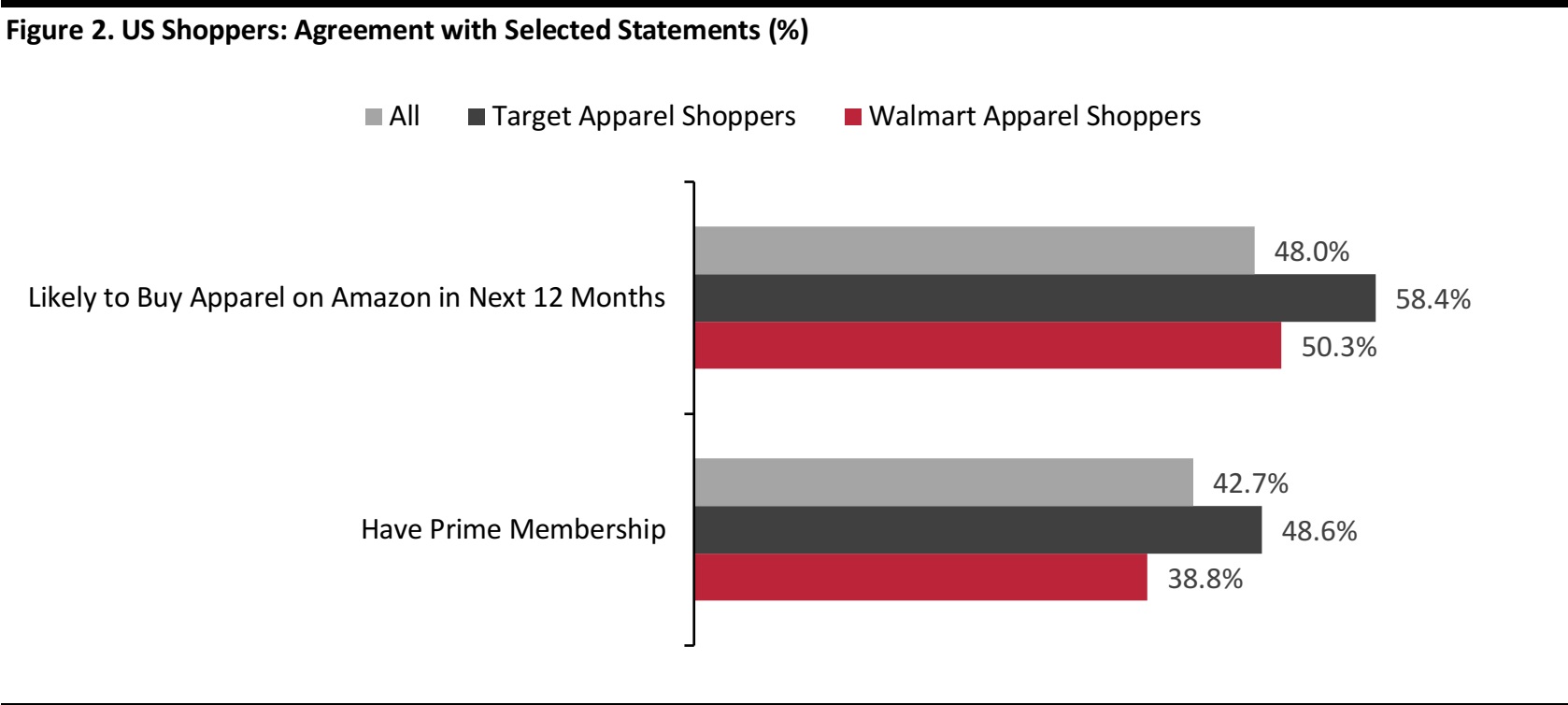

- As we chart below, Target apparel shoppers overindex versus the average in terms of expecting to buy clothing or footwear on Amazon in the next 12 months.

- Target apparel shoppers are also more likely than average and more likely than those shopping for apparel at most other major retailers to have an Amazon Prime membership—and our survey confirms that Prime membership drives shopping, including apparel shopping, at Amazon.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months

Source: Coresight Research

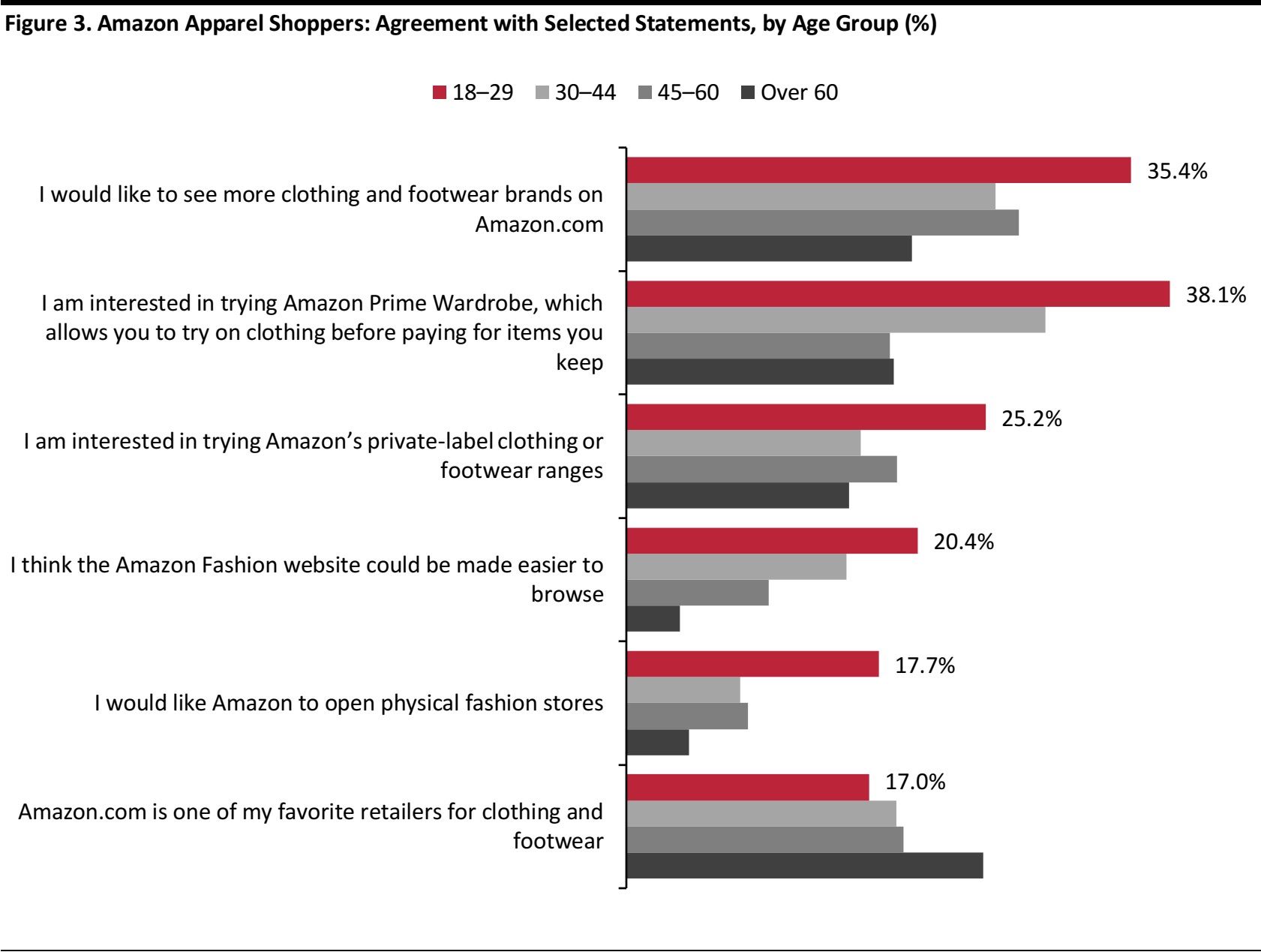

4) Younger Shoppers Are Looking for an Amazon Fashion Experience

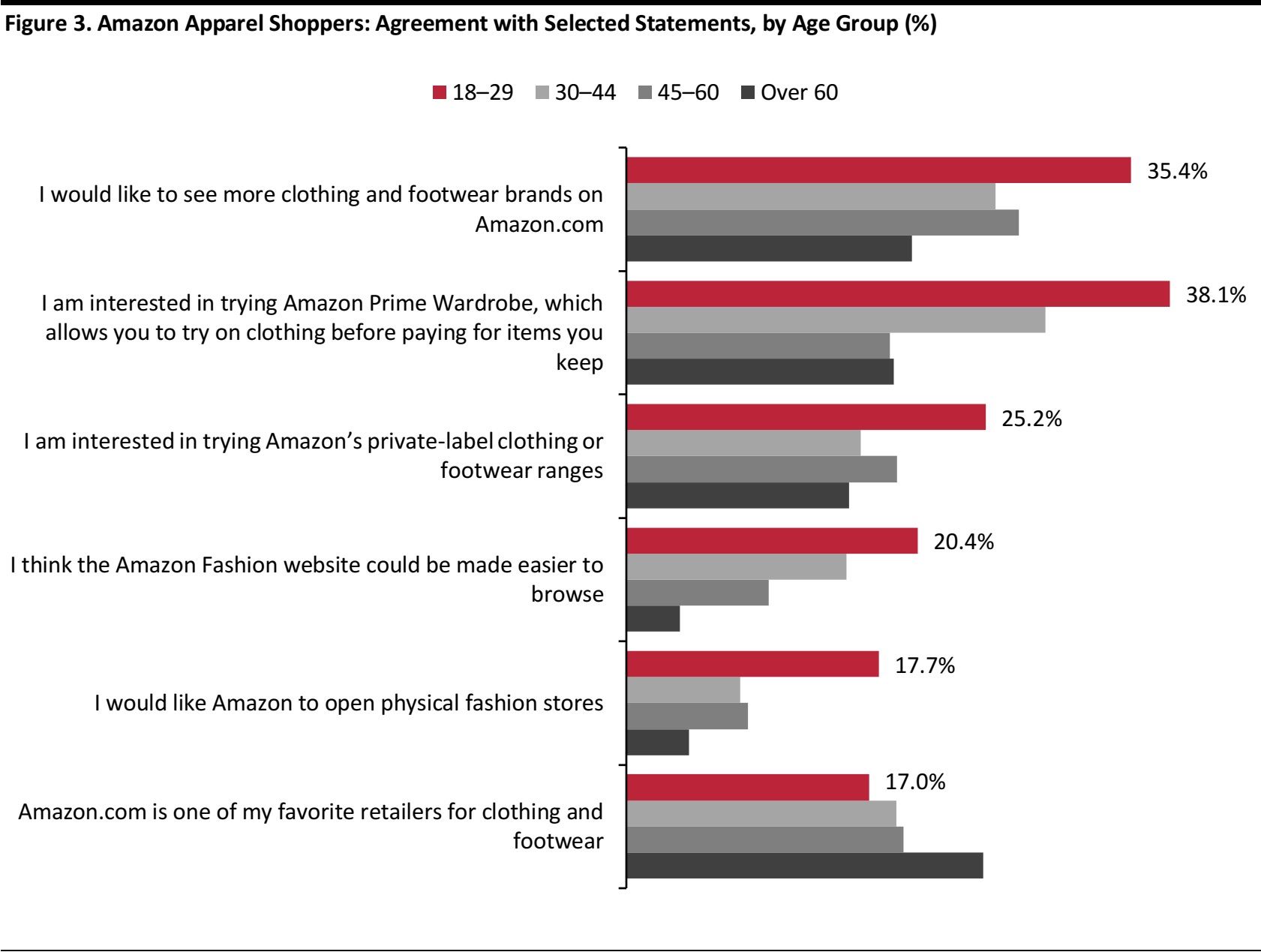

Many younger shoppers are ready to embrace a full Amazon Fashion experience. Survey respondents ages 18–29 registered much higher interest than older shoppers in Amazon’s private labels, its Prime Wardrobe service and even the possibility of Amazon opening physical fashion stores.

But this is not simply a reflection of younger consumers being more avid Amazon shoppers: as the responses to the final statement in the graph below show, younger shoppers are actually

less likely than older shoppers to say that Amazon is one of their favorite clothing and footwear retailers.

Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Source: Coresight Research

5) Apparel Shoppers Are Happy with the Amazon Fashion Website

Some commentators have argued that the Amazon website is not equipped to provide a quality experience for browsing, searching and discovering fashion ranges. After all, Amazon established its position by serving as a kind of catalog for products that shoppers buy based mostly on specifications, such as books and electronics—but fashion shoppers tend to browse and buy differently.

Nevertheless, our survey found that Amazon apparel shoppers are highly satisfied with the Amazon Fashion shopping experience. In fact, 65% cited the ease of browsing and searching Amazon Fashion as a reason for buying clothing or footwear on the site, ahead of factors such as choice and price. Moreover, only 12% of Amazon apparel shoppers said that they thought the site could be made easier to browse.

These figures represent the views of current Amazon apparel shoppers only, but they suggest that the need for an overhaul of the Amazon Fashion proposition has been overstated by some industry commentators.

6) Many Shoppers Continue to View Amazon as a de Facto Off-Pricer

We have long considered Amazon akin to an off-price retailer, with a product offering that is heavy on out-of-season ranges that are typically sold below full price. Our research confirms that Amazon still has a ways to go before consumers perceive it as a full-price, full-line retailer:

- Fully 48% of Amazon apparel shoppers agree that they always expect to pay less than full price when buying clothing or footwear on the site.

- Just 11.5% buy apparel on Amazon because its ranges are up to date. This compares with 32% who buy apparel on Amazon because it offers the lowest prices and 49% who buy because it offers good value for price paid.

Amazon appears to be tackling these perceptions already: its work in building out its private-label ranges and bringing brands such as Nike on board should support its move into the mainstream as a full-line fashion retailer.

Survey Findings in Detail

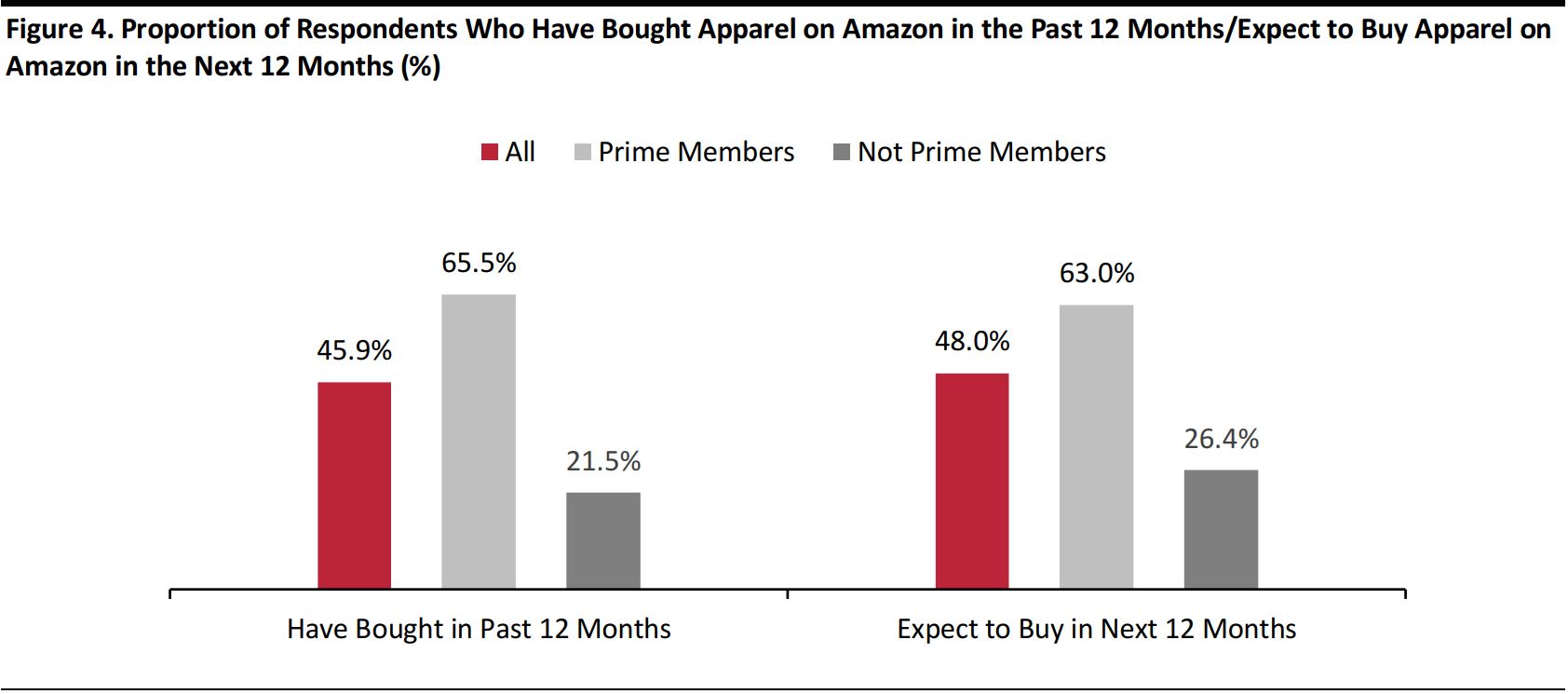

Almost Half of US Shoppers and Two-Thirds of Prime Members Buy Apparel on Amazon

Key findings:

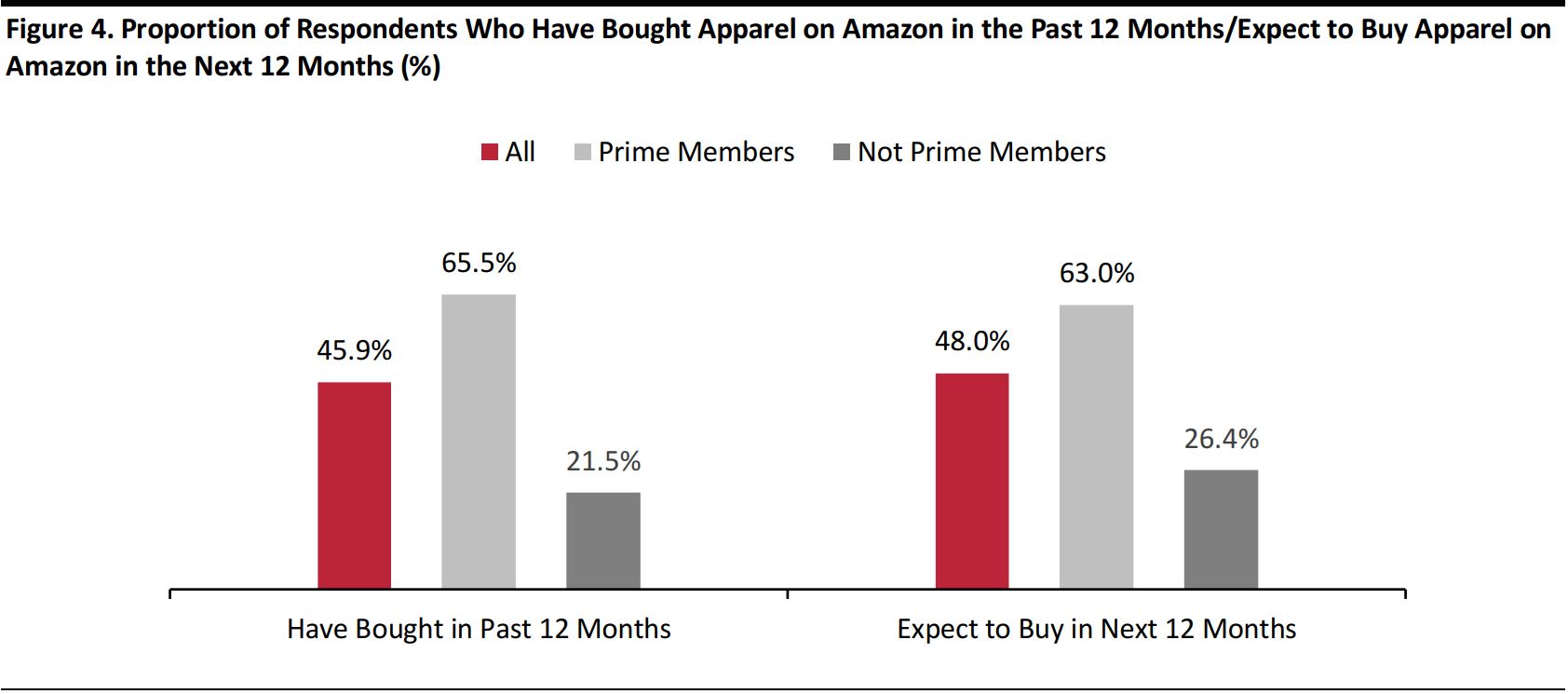

- Some 45.9% of all survey respondents said that they had shopped for apparel on Amazon in the past 12 months.

- Some 48.0% said that they expect to buy apparel on Amazon in the coming 12 months.

Amazon discloses few metrics on its performance in apparel. Since one indicator of that is number of shoppers, we asked survey respondents who had bought clothing or footwear in the past 12 months if they had bought apparel on Amazon during that time. We also asked apparel shoppers if they think they are likely to buy clothing or footwear on Amazon in the next 12 months. Respondents were required to choose either “yes,” “no” or “cannot remember” (“don’t know” for the next-12-months question) as their answer..

Prime Members Account for a High Percentage of Apparel Shoppers on Amazon

Amazon registers very high shopper numbers for clothing and footwear: some 45.9% of all clothing and footwear shoppers we surveyed said that they had bought apparel on the site in the past 12 months. With regard to respondents’ current expectations, our survey findings suggest that Amazon Fashion’s total shopper numbers will increase modestly in the next 12 months, and that the number shoppers who are not Prime members could increase at a faster pace than the number of shoppers who are Prime members.

Prime members underpin Amazon’s very strong shopper numbers:

- Nearly two-thirds of Prime members surveyed said that they had bought clothing or footwear on Amazon in the past 12 months.

- Based on that finding, we estimate that slightly more than 60% of Amazon apparel shoppers have their own Prime membership (as opposed to having access to Prime benefits through some other member of their household).

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months Survey questions: In the past 12 months, have you purchased any clothing or footwear on Amazon.com?/Looking ahead, do you think you are likely to purchase clothing or footwear on Amazon.com in the next 12 months?

Respondents were required to choose either “yes,” “no” or “cannot remember” (“don’t know” for the next-12-months question).

“Prime Members” have a personal Prime membership; “Not Prime Members” have no access to Prime benefits, including through a membership of someone else in their household.

Source: Coresight Research

In the US, Amazon is tied with Target as the second-most-shopped clothing and footwear retailer, as measured by number of shoppers, as we discuss in more detail later in this report.

Which Retailers Amazon’s Clothing and Footwear Shoppers Have Switched Spending From

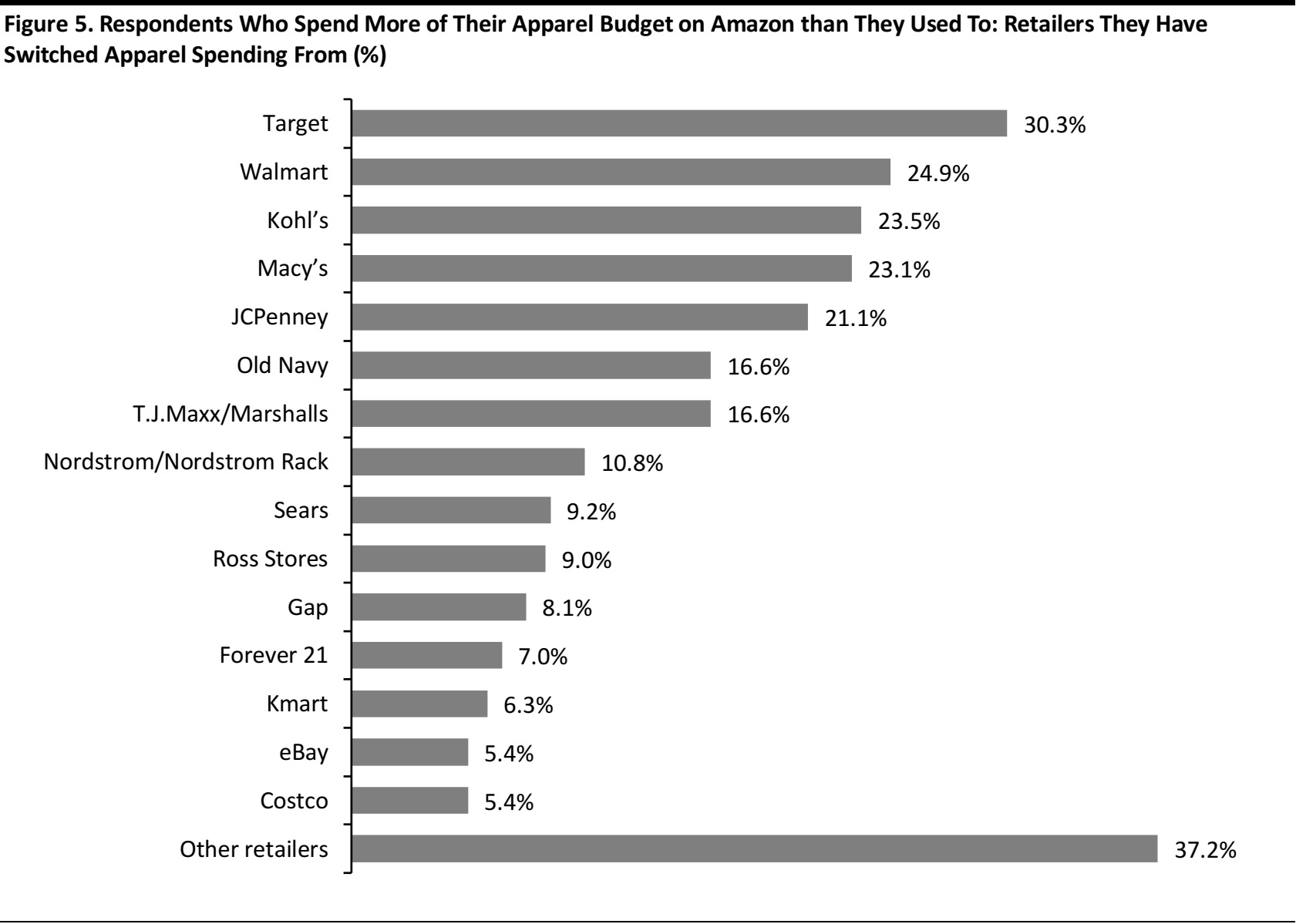

Key findings:

- Target is the top retailer that Amazon apparel shoppers have switched some or all of their apparel spending from.

- Macy’s and JCPenney overindex in terms of switching spending to Amazon, relative to their scale.

To find out which retailers have lost spending to Amazon, we asked respondents if they now spend more of their apparel budget on Amazon than they did about three years ago (this includes if they started shopping for apparel on Amazon in that time). We then asked those shoppers who had increased their apparel spending on Amazon which retailers they had switched some or all of their spending from.

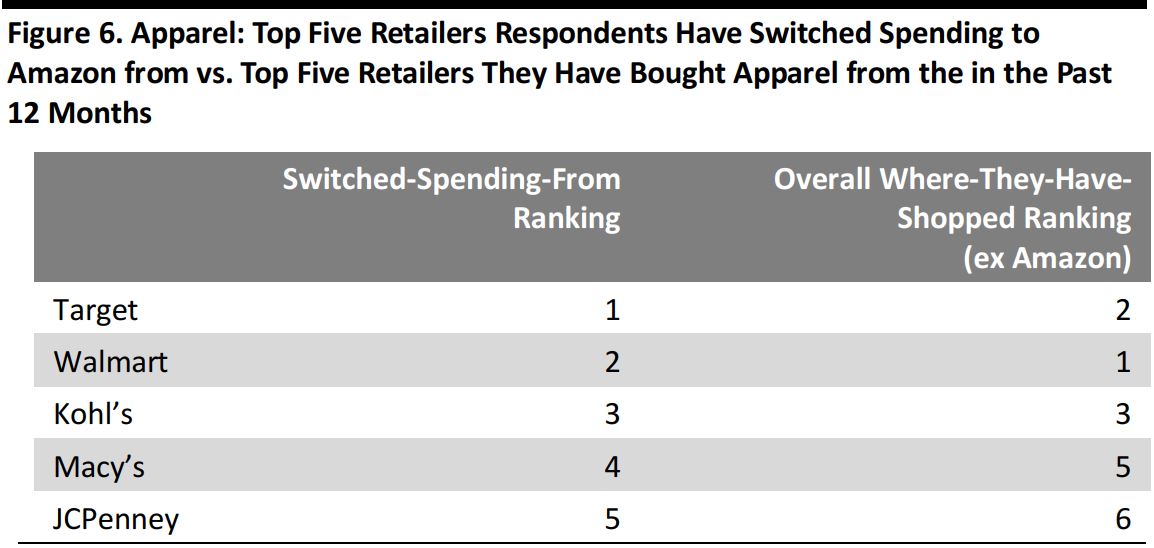

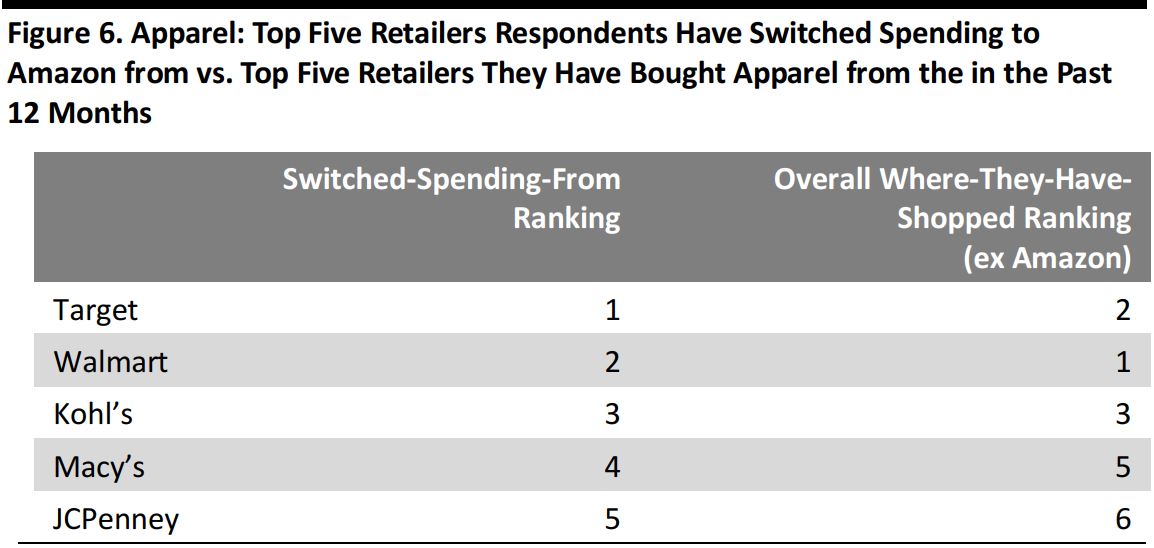

Shoppers Have Switched Spending Disproportionately from Target, Macy’s and JCPenney

Target has lost the most in terms of apparel shoppers who have switched some or all of their apparel spending to Amazon, with Walmart in second place. This is the reverse of these two retailers’ overall ranking in terms of apparel retail, as Walmart is a significantly bigger clothing and footwear retailer than Target, as measured by both sales and shopper numbers.

Less surprisingly, perhaps, department stores have also lost apparel spending to Amazon. This finding is certainly in line with the dwindling sales that some of them have reported in recent years. Macy’s and JCPenney rank disproportionately high in terms of how many apparel shoppers they have lost in part or in full to Amazon Fashion.

Base: 446 US Internet users ages 18+ who spend more of their clothing and footwear budget at Amazon than they did about three years ago

Survey question: You have indicated that you spend more of your clothing and footwear budget at Amazon.com than you used to. Which retailer(s) have you switched this spending from? Select all that apply.

Source: Coresight Research

To some extent, the ranking shown above reflects the scale of these retailers and the total number of shoppers they have. It is logical that larger retailers would tend to lose the most, in absolute terms, when shoppers switch their spending from one retailer to another. But the ranking does not track scale exactly.

Below, we compare the top five retailers that respondents said they had switched spending to Amazon from with the top five they said they had bought apparel from in the past 12 months. The comparison shows that Target, Macy’s and JCPenney overindex in terms of share of apparel spending lost to Amazon, relative to their overall strength in shopper numbers.

Source: Coresight Research

What Apparel Brands and Categories Shoppers Buy on Amazon

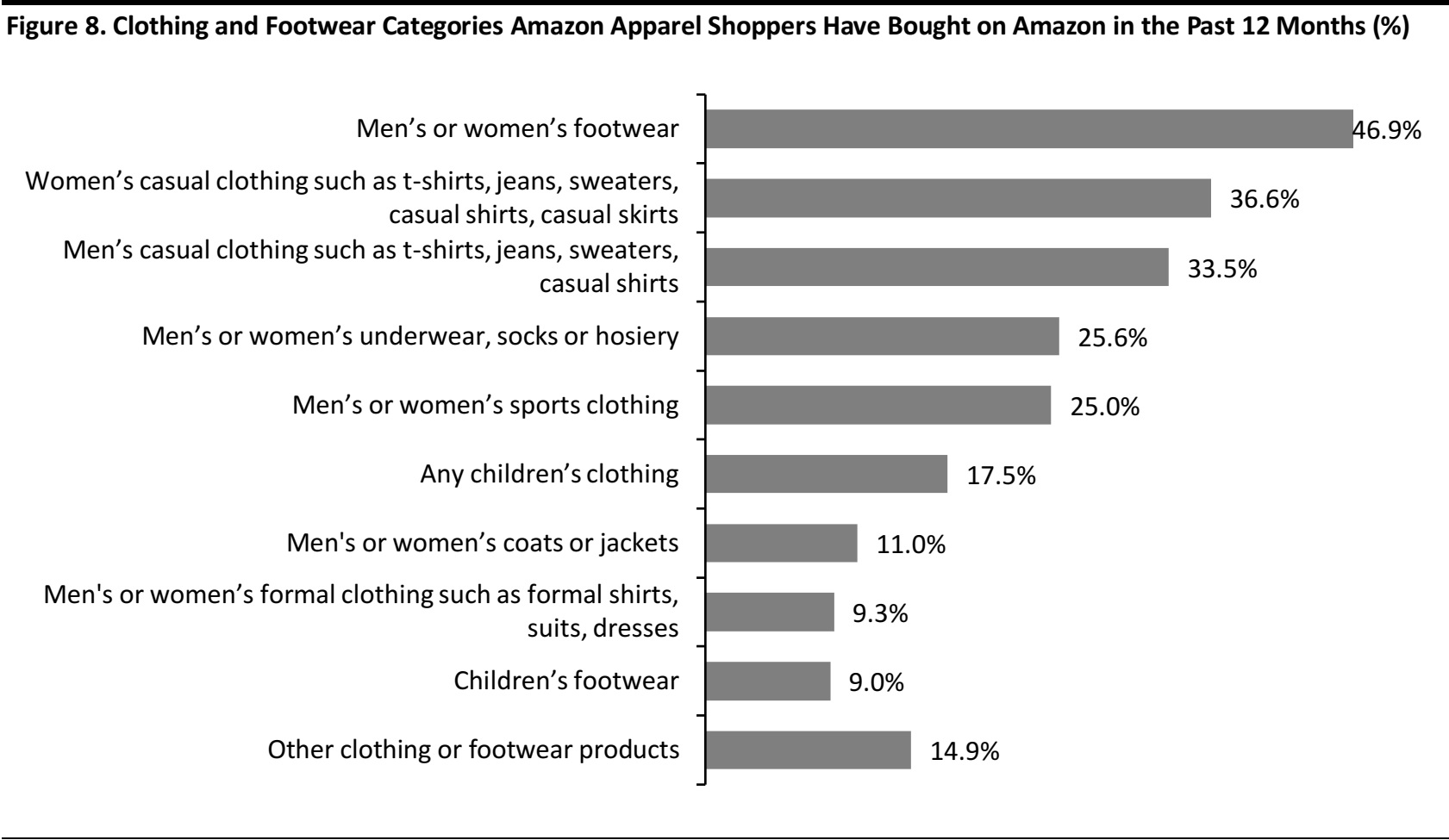

Key findings:

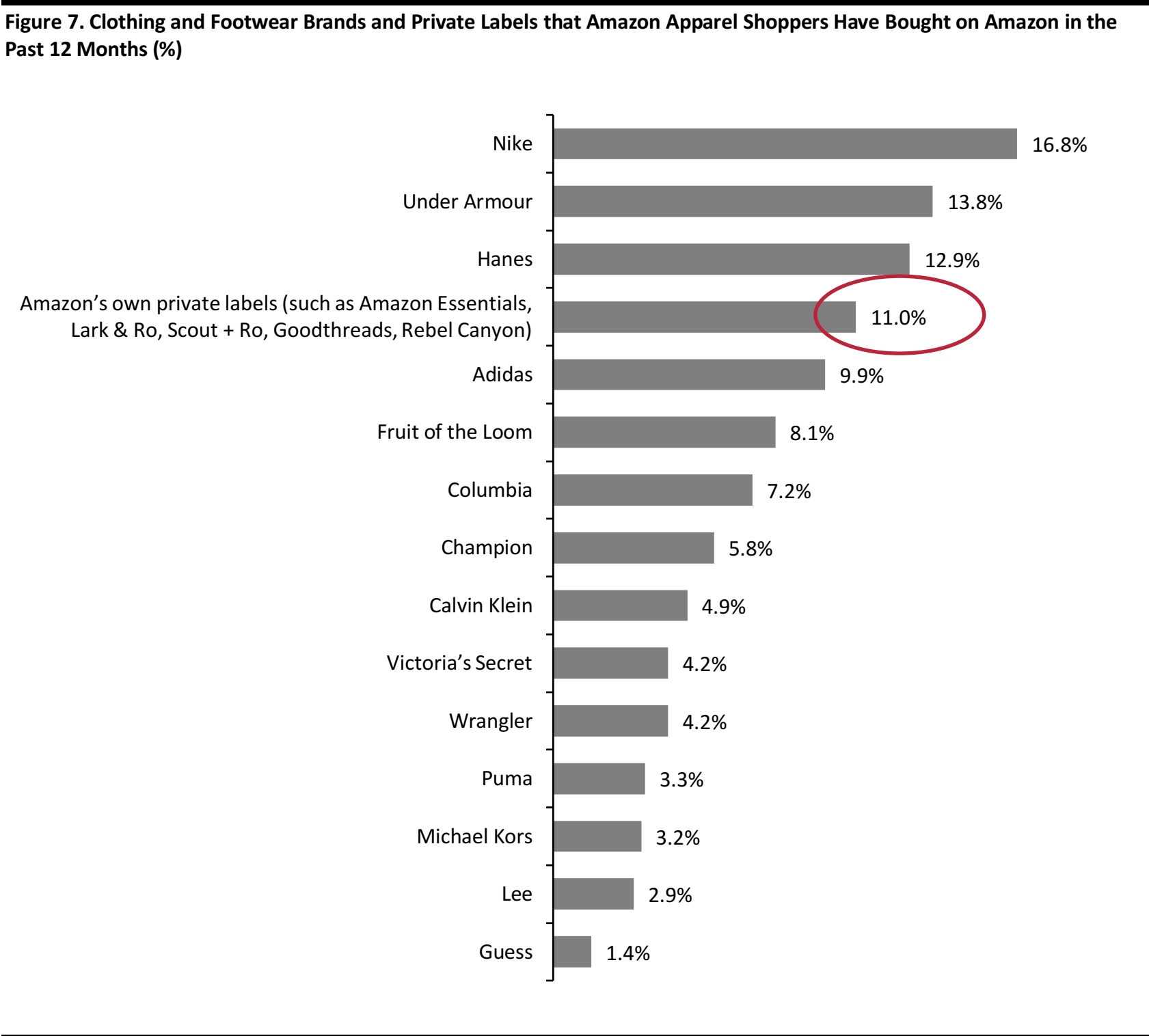

- Nike, Under Armour and Hanes are the most popular apparel brands on Amazon.

- One in nine Amazon apparel shoppers have already bought Amazon private-label apparel.

- Adult footwear and casual clothing are among the categories bought most often on Amazon.

To understand what consumers are buying on Amazon, we asked those who had bought clothing or footwear on the site in the past 12 months what apparel brands and categories they had purchased on the site during that period.

One in Nine Shoppers Have Bought Amazon Private-Label Apparel

Sports brands such as Nike, Under Armour and Adidas are among the most-bought brands bought on Amazon. These brands’ presence across both clothing and footwear likely supports their leading positions—and, as we discuss later, footwear is a very popular category on Amazon Fashion. Lower-cost casualwear also ranks highly, as do underwear brands such as Hanes and Fruit of the Loom, implying that Amazon is popular for basics.

Some 11% of the Amazon apparel shoppers we surveyed said that they had bought Amazon private-label goods in the past year, which is notable because those private-label lines are still relatively new. Our survey provided respondents with several examples of Amazon’s private labels, in order to minimize any confusion about the company’s own private labels versus other brands featured on Amazon that respondents may not have been familiar with.

Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Which, if any, of the following clothing or footwear brands and private labels have you purchased on Amazon.com in the past 12 months? Select all that apply.

Source: Coresight Research

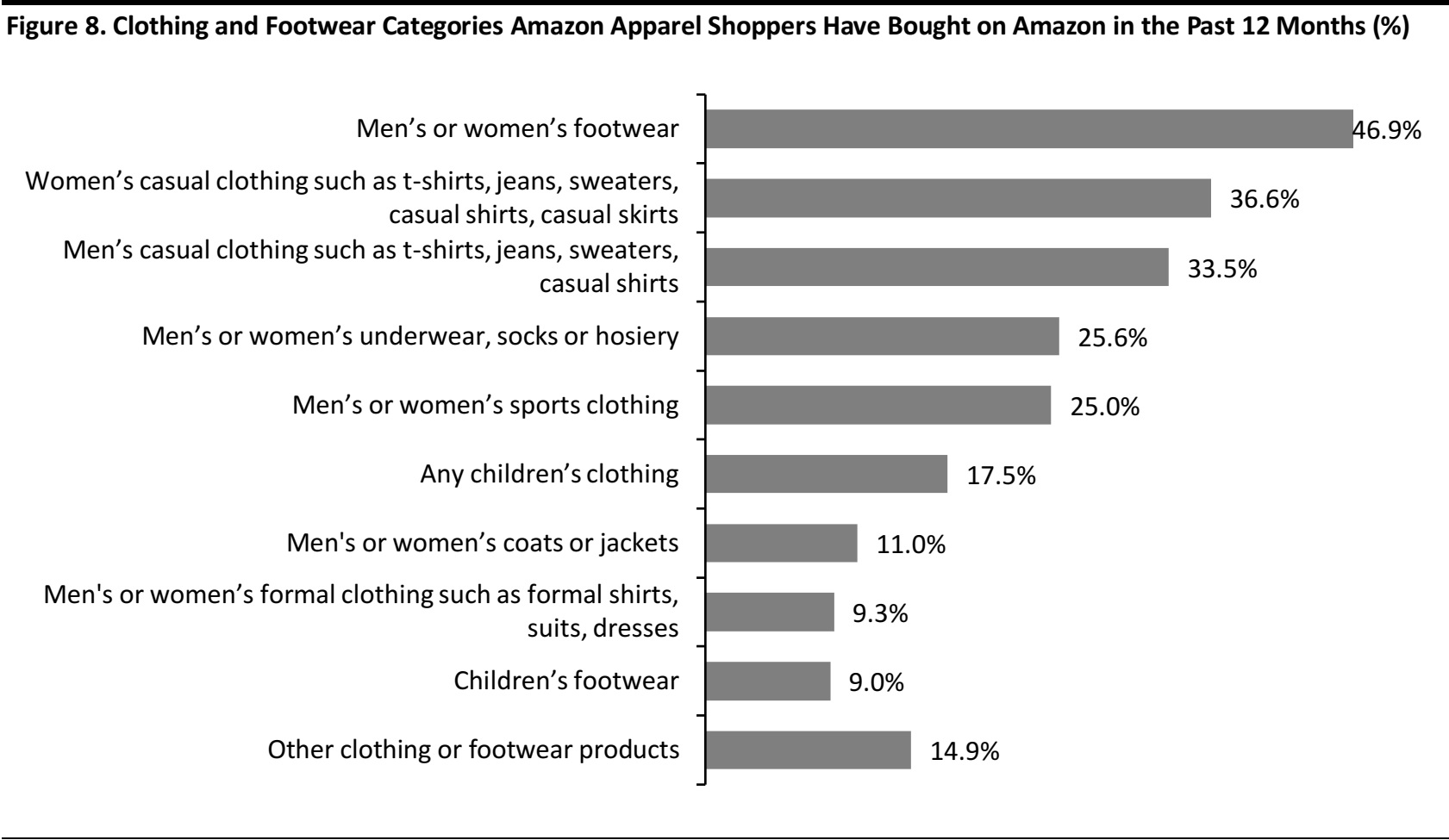

Footwear and Casual Clothing Are the Categories Amazon Apparel Shoppers Buy Most on the Site

Men’s and women’s footwear and adult casualwear top the categories that shoppers buy on Amazon Fashion. Underwear and sportswear are middle-ranking categories. Children’s clothing and footwear, men’s and women’s coats and jackets, and adult formal clothing are significantly less popular categories on the site.

Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Which of these categories have you bought on Amazon.com in the past 12 months?

Source: Coresight Research

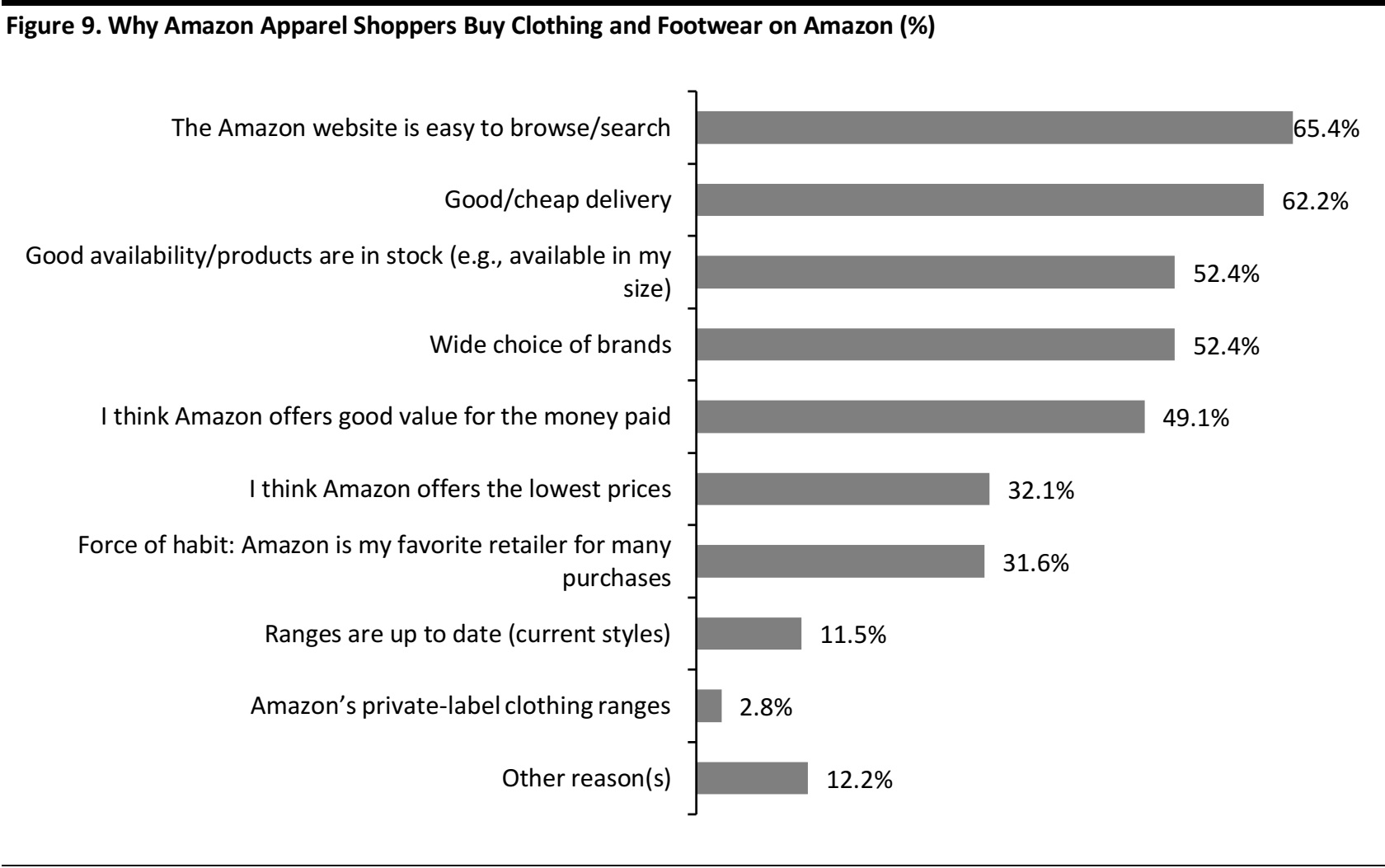

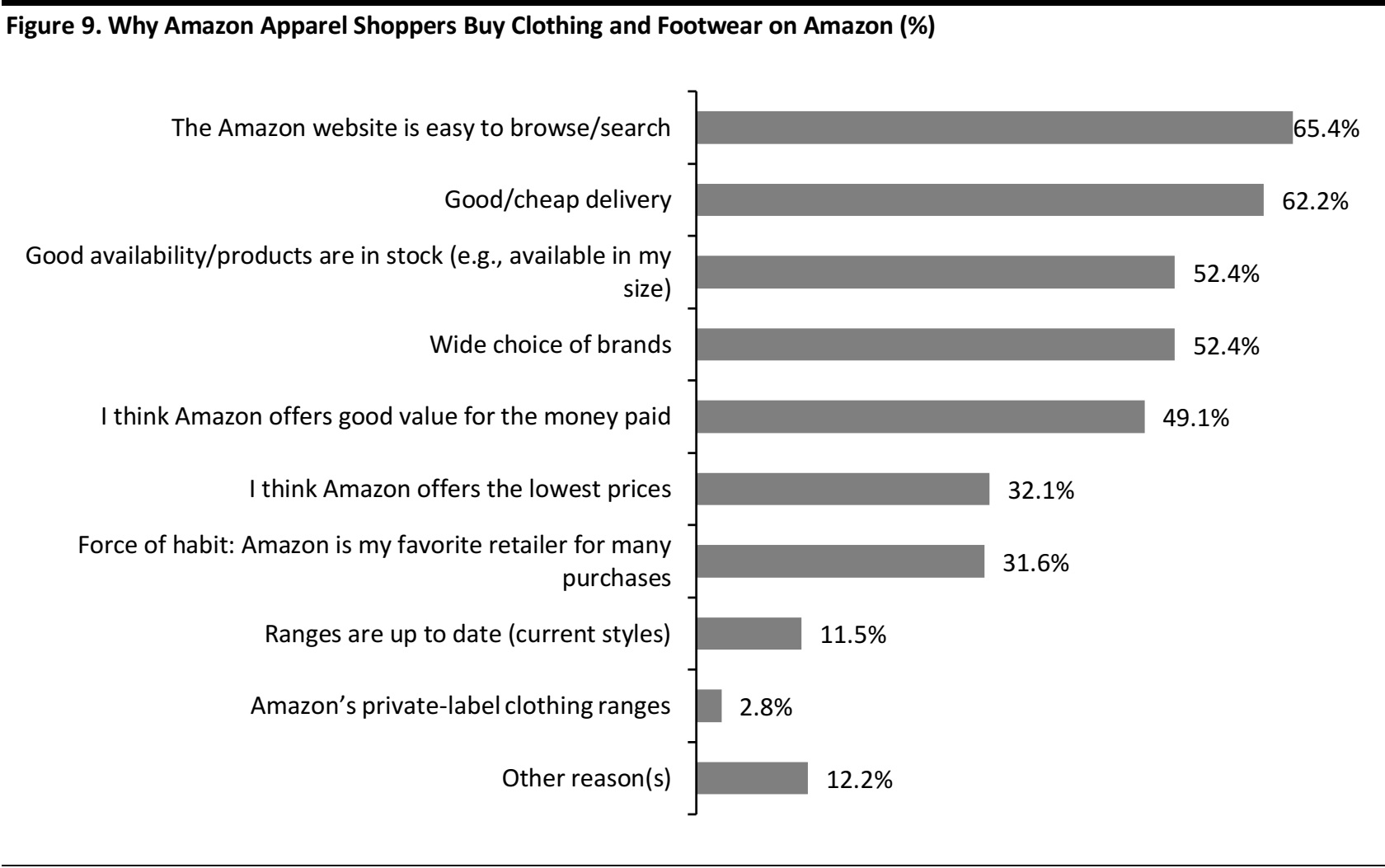

Why Consumers Shop on Amazon: Ease of Shopping Beats Fulfillment, Choice and Price as Top Driver

Key findings:

- Respondents cited ease of browsing or searching the Amazon website as the top reason for buying apparel on the site.

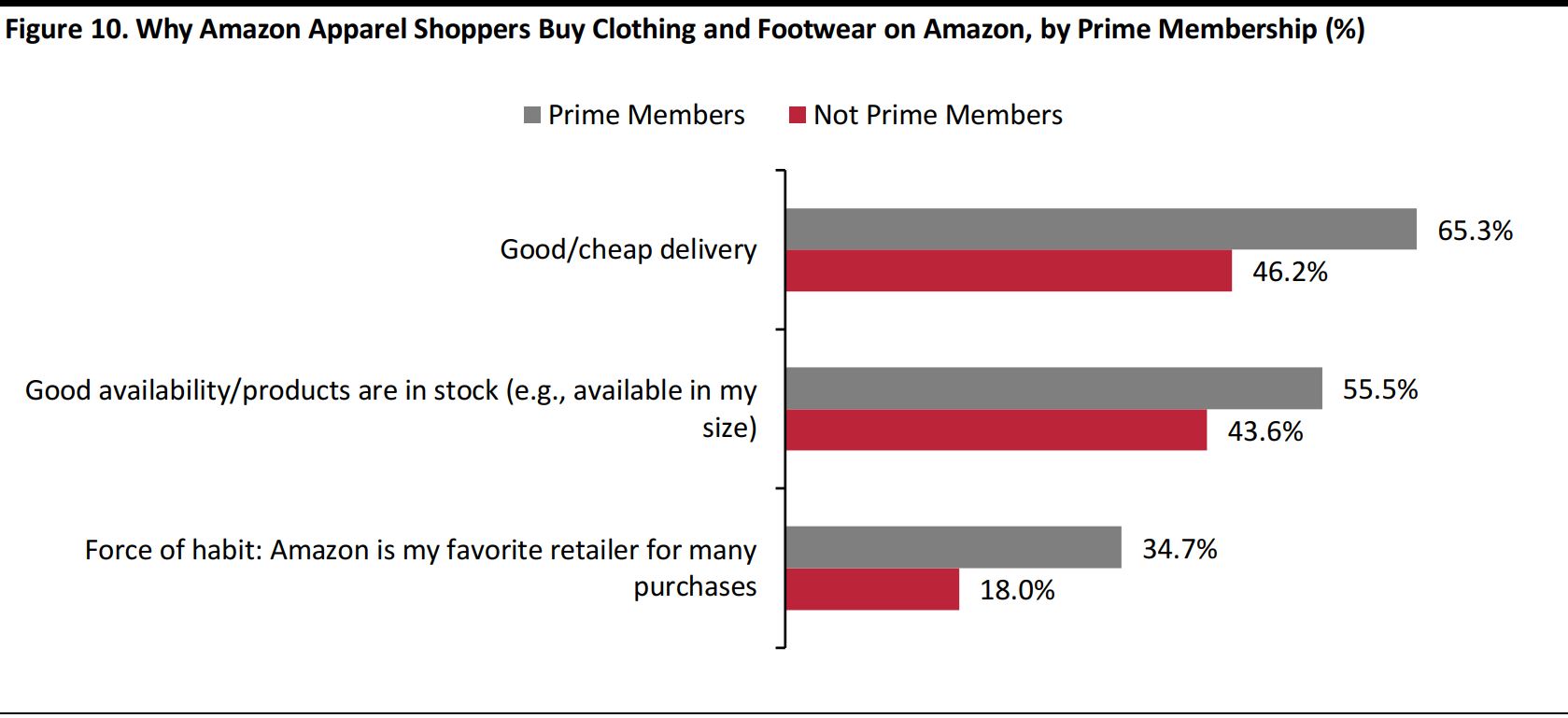

- Good or cheap delivery was the second-most-popular reason cited for buying apparel on Amazon Fashion, driven by Prime members.

To gauge why so many shoppers are opting to buy apparel on Amazon, we asked those who had bought clothing or footwear on the site in the past 12 months why they had bought apparel on the site. For most respondents, it was not simply about price or choice.

Availability, Choice and Value for Money Are Also Top Reasons to Shop on Amazon Fashion

Amazon apparel shoppers cited the ease of browsing and searching on the site as the top reason for buying clothing or footwear there. That factor came in ahead of traditionally important considerations such as price and choice.

These findings are contrary to some commentators’ perceptions that the Amazon website does not provide a quality experience when it comes to shopping for fashion because the site was designed to sell specification purchases (such as books and electronics). Responses to our survey suggest that Amazon’s website does indeed deliver the experience apparel shoppers seek.

Unsurprisingly, given Amazon’s reputation for fulfillment and its Prime membership scheme, good or cheap delivery is another key reason that apparel shoppers cite for shopping on Amazon.

However, few apparel shoppers are driven to shop on Amazon because they perceive it as offering up-to-date ranges. This may reflect the desires of shoppers looking for staples rather than on-trend designs, but it adds weight to our view that some apparel shoppers see Amazon as a retailer that sells out-of-season stock at low prices.

Amazon’s apparel private labels are not (or not yet) a meaningful driver of shopper numbers to the site, even though, as we mentioned above, a significant number of purchasers have already bought items from these ranges.

Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Why do you shop for clothing or footwear on Amazon.com? Select all that apply.

Source: Coresight Research

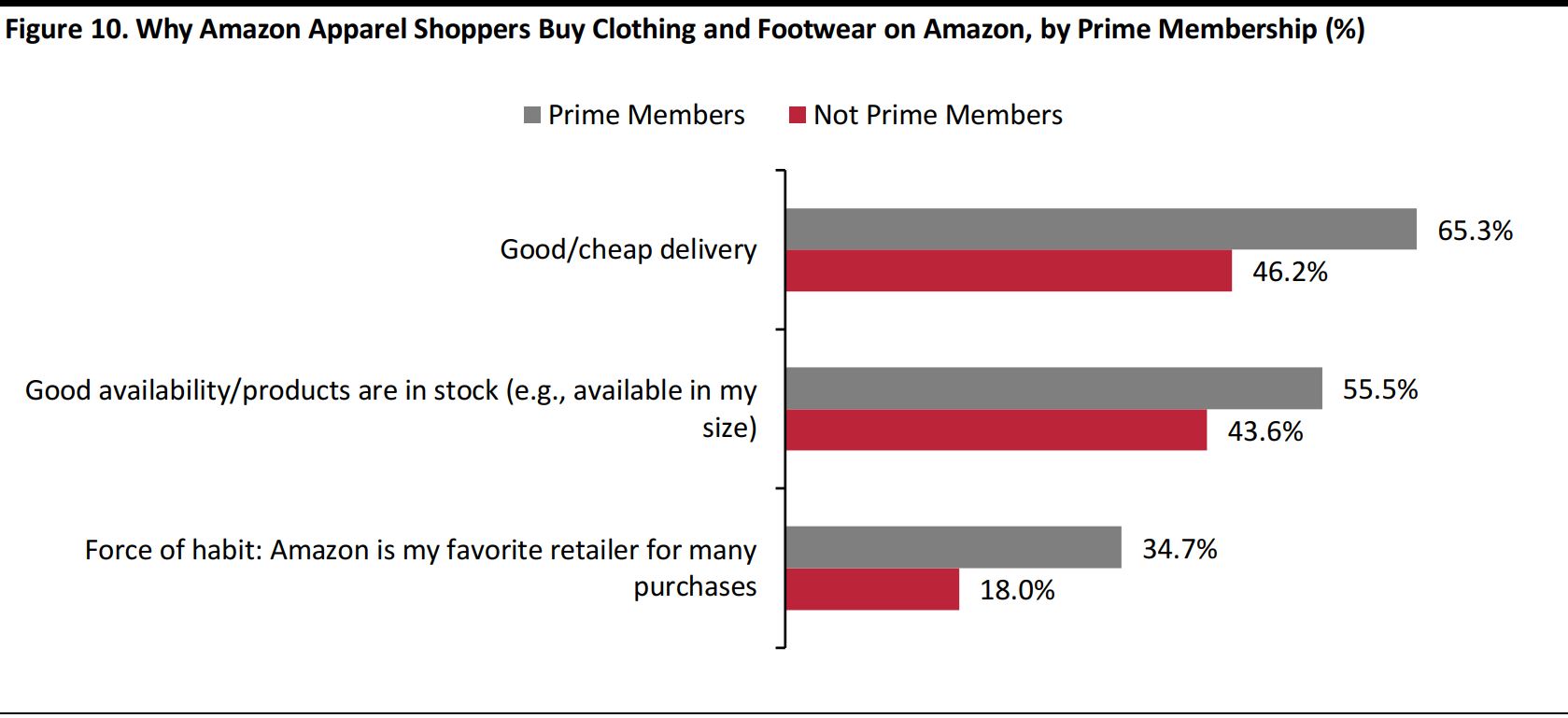

Respondents who are Prime members showed marginally higher rates of agreement with all of the reasons shown above. However, the differences between responses from Prime and non-Prime members were statistically significant for three particular statements, as highlighted in the graph below.

Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Why do you shop for clothing or footwear on Amazon.com? Select all that apply.

“Prime Members” have a personal Prime membership; “Not Prime Members” have no access to Prime benefits, including through a membership of someone else in their household.

Source: Coresight Research

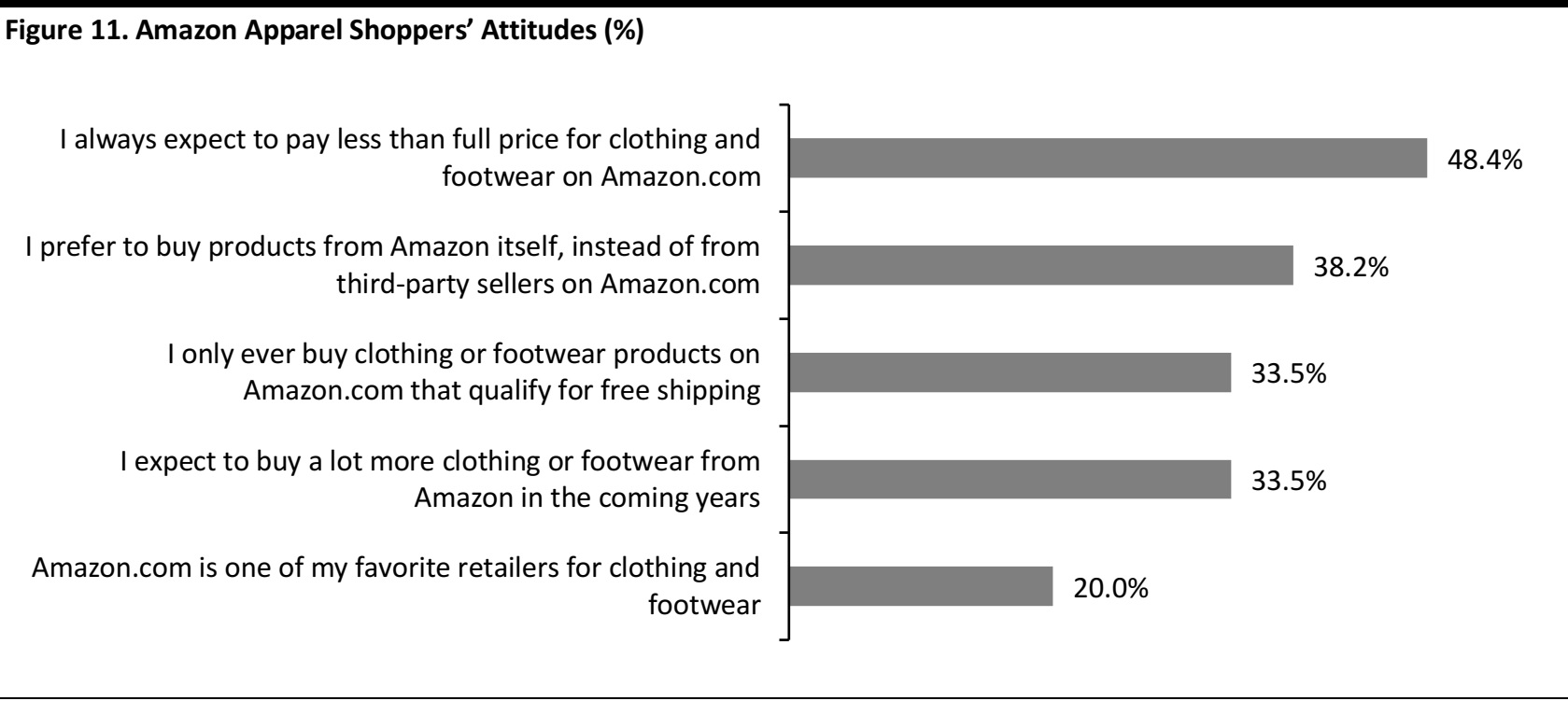

How Shoppers View Amazon Fashion: Younger Shoppers Want the Full Experience

Key findings:

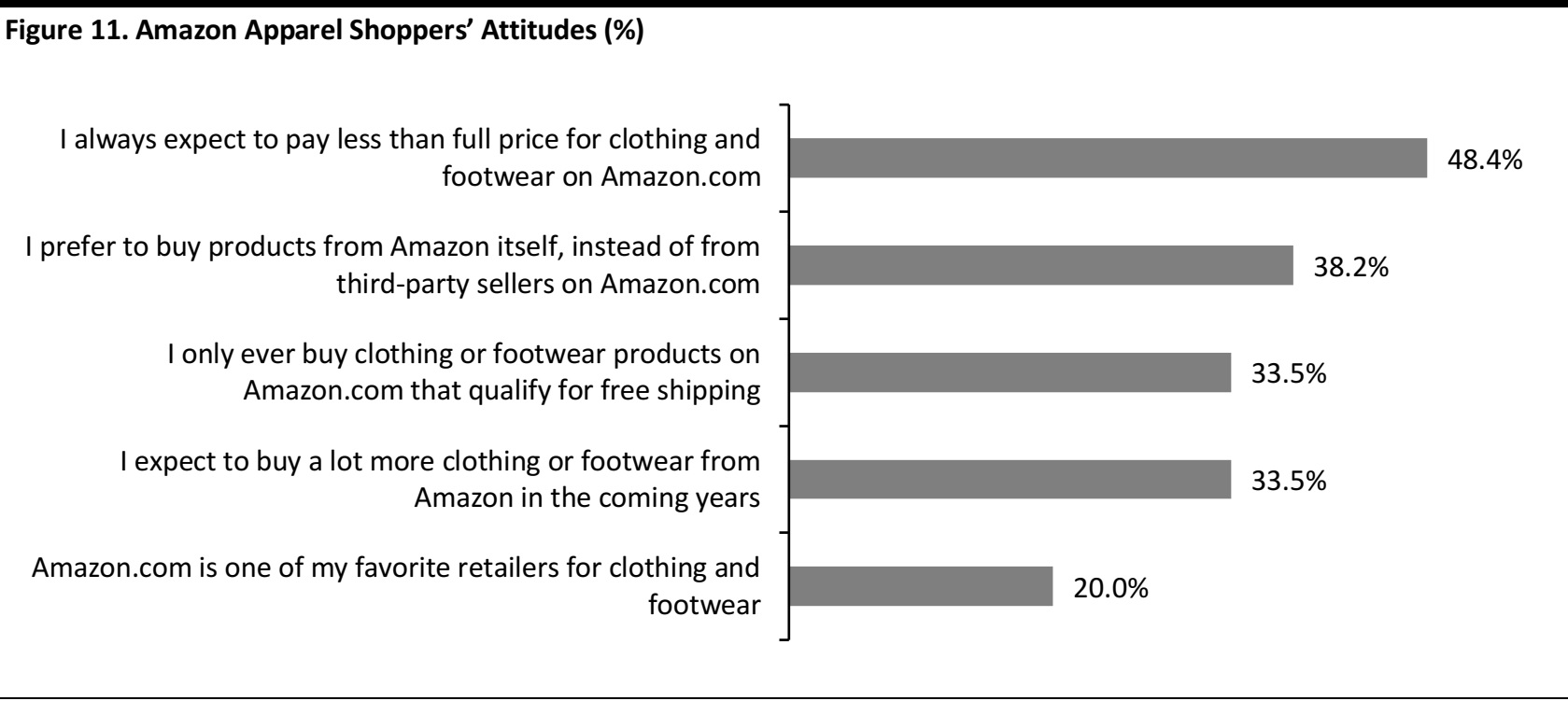

- Almost half of Amazon apparel shoppers always expect to pay less than full price on the site, and one-third buy only when their purchase qualifies for free shipping.

- Younger shoppers are by far the group most interested in trying Amazon Prime Wardrobe and Amazon private-label apparel ranges.

We wanted to gauge how Amazon apparel shoppers perceive Amazon Fashion and their interest in new offerings and potential changes. So, we presented survey respondents with a series of statements and asked them to select any that they agreed with.

Attitudes Toward Amazon Fashion

Amazon has enhanced its competitive-pricing proposition and product ranges by hosting a large number of third-party sellers on its site. But a significant percentage of Amazon apparel shoppers—38.2%—prefers to buy directly from Amazon rather than from third-party sellers on the site. This is likely due in part to perceptions that third-party sellers offer less clarity with regard to shipping fees, returns charges and the right to return items.

Amazon appears to be on a journey from discount-driven apparel outlet to full-line fashion store distinguished by its own fashion ranges and greater collaboration with major brands. But our survey found that many shoppers do not see Amazon as a full-price retailer. In fact, almost half of Amazon apparel shoppers surveyed expect to

always pay less than full price on the site.

The proportion of survey respondents expecting to buy “a lot more” clothing or footwear on Amazon in the coming years is higher among Prime members, at 37.0%, than among those with no access to Prime, at 30.6%.

Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Which, if any, of the following statements about shopping for clothing and footwear on Amazon.com do you agree with? Select all that apply.

Source: Coresight Research

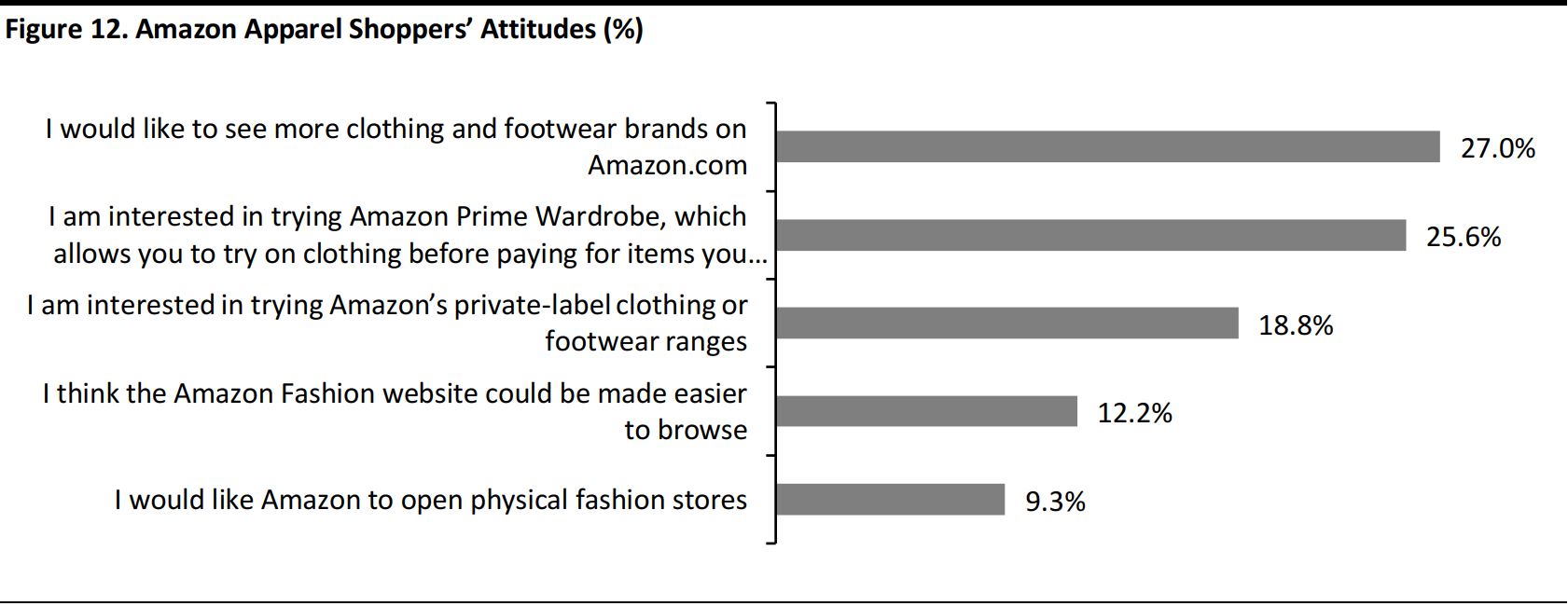

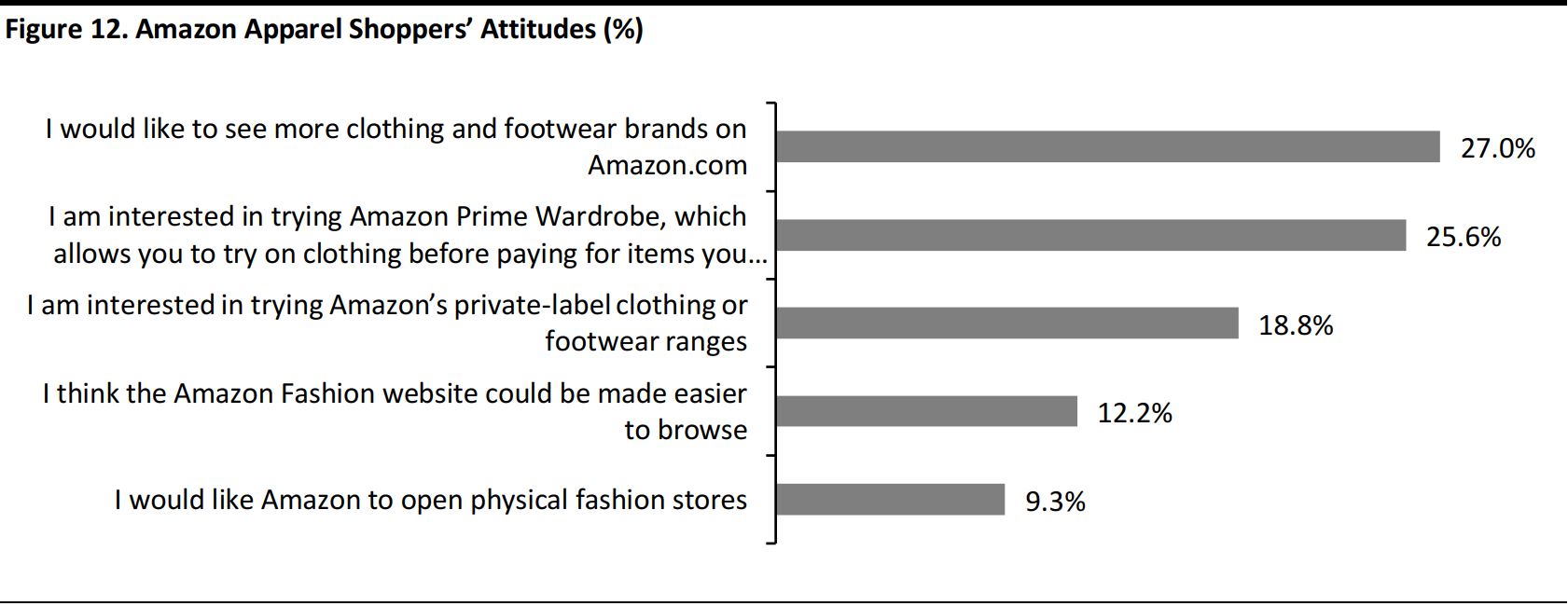

What Shoppers Want from Amazon Fashion

A meaningful 18.8% of Amazon apparel shoppers are interested in trying the retailer’s still-new private-label fashion ranges. Just 12% think that the website could be made easier to browse, indicating that the majority of the site’s apparel shoppers are satisified with the Amazon Fashion shopping experience. Younger consumers we surveyed registered higher-than-average responses to each of the statements below, reflecting a higher level of interest in trying new Amazon Fashion products and services.

Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Which, if any, of the following statements about shopping for clothing and footwear on Amazon.com do you agree with? Select all that apply.

Source: Coresight Research

Prime Members Push Amazon to Second Place Among America’s Clothing and Footwear Retailers

Key findings:

- Amazon is America’s second-most-shopped apparel retailer.

- The site’s popularity is driven by Prime members.

- For Amazon apparel shoppers, Target is the most popular alternative retailer for clothing and footwear.

To put Amazon in context, we asked survey respondents (all of whom had bought clothing or footwear in the past 12 months) to choose which, if any, of the retailers listed they had bought apparel from during that period. Respondents were free to choose any of the retailers listed and were asked to choose all that apply.

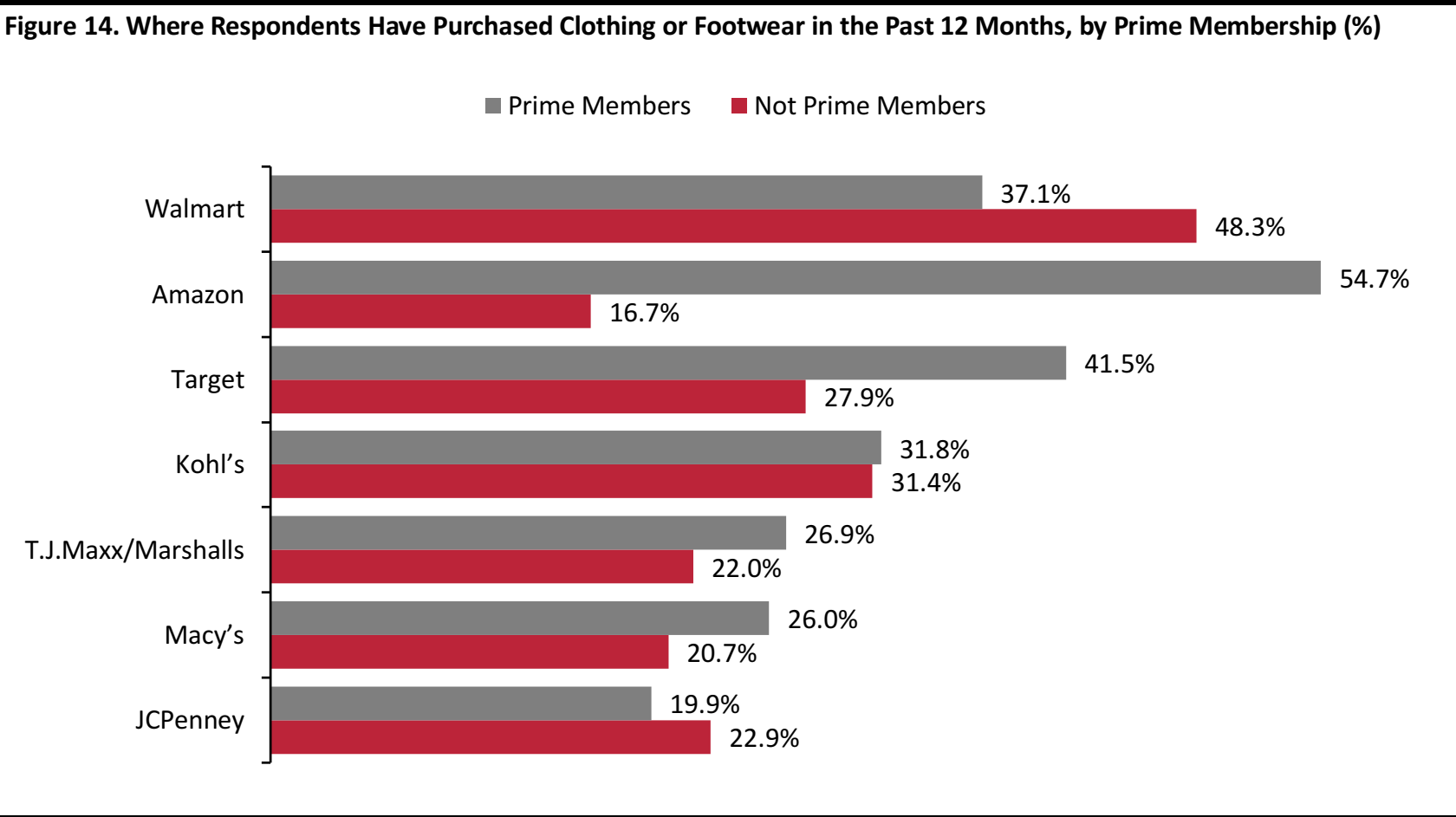

By Total Number of Apparel Shoppers, Only Walmart Beats Amazon

Our survey confirmed that Walmart was the most-shopped retailer for clothing and footwear over the past 12 months. Amazon is neck and neck with Target as America’s second-most-shopped retailer for clothing and footwear. That does not directly imply that Amazon is America’s second-biggest apparel retailer

by sales, however, as shoppers’ average spend and frequency of purchase both factor into this metric.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months

Survey question: Which retailers have you bought clothing or footwear from in the past 12 months (whether online or in-store)? Select all that apply.

Respondents were free to to select any options from the list provided; this is a different format from the forced yes/no question format used to establish whether respondents had bought apparel on Amazon, and it yields different results from those shown earlier.

Source: Coresight Research

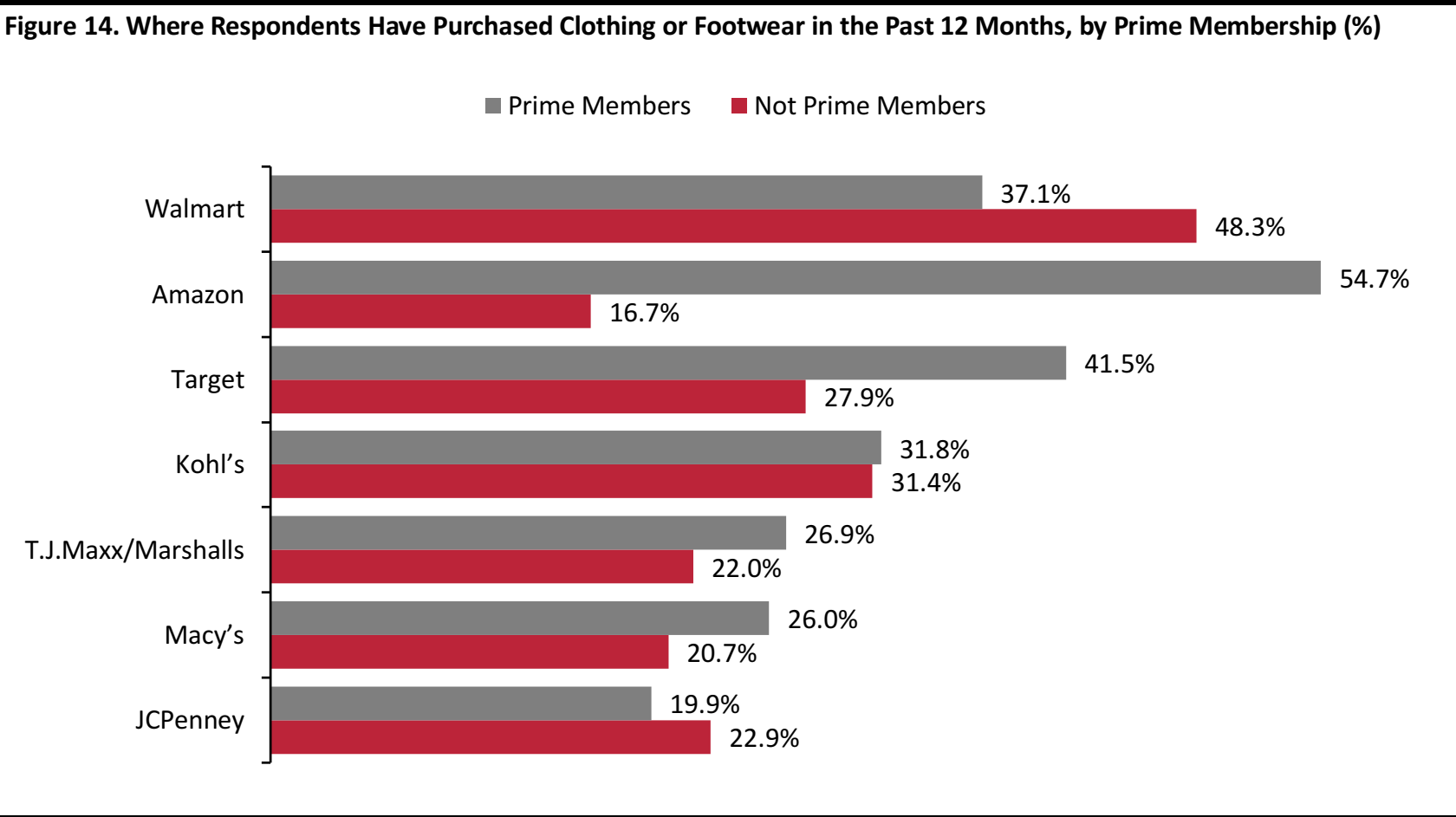

Prime members are responsible for pushing Amazon up the “most-shopped retailer” ranking. Among Prime members, Amazon is by far the leading retailer for clothing and footwear, as measured by number of shoppers. This is balanced out by Amazon ranking relatively low among those with no access to Prime: in fact, Amazon is just the

seventh-most-popular retailer among those who do not subscribe to Prime.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months, including 685 with a personal Amazon Prime membership

“Prime Members” have a personal Prime membership; “Not Prime Members” have no access to Prime benefits, including through amembership of someone else in their household.

Source: Coresight Research

Where Else Do Amazon Apparel Shoppers Buy Clothing and Footwear?

Confirming an Amazon-Target shopper overlap, Target is the leading alternative clothing and footwear retailer for Amazon apparel shoppers.

Base: 719 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Source: Coresight Research

Apparel Is the Fourth-Most-Shopped Category on Amazon.com

Our survey found that clothing and footwear is the fourth-most-shopped category on Amazon. In the past 12 months, only books (including e-books), beauty and personal care products, and electronics attracted greater shopper numbers on the site.

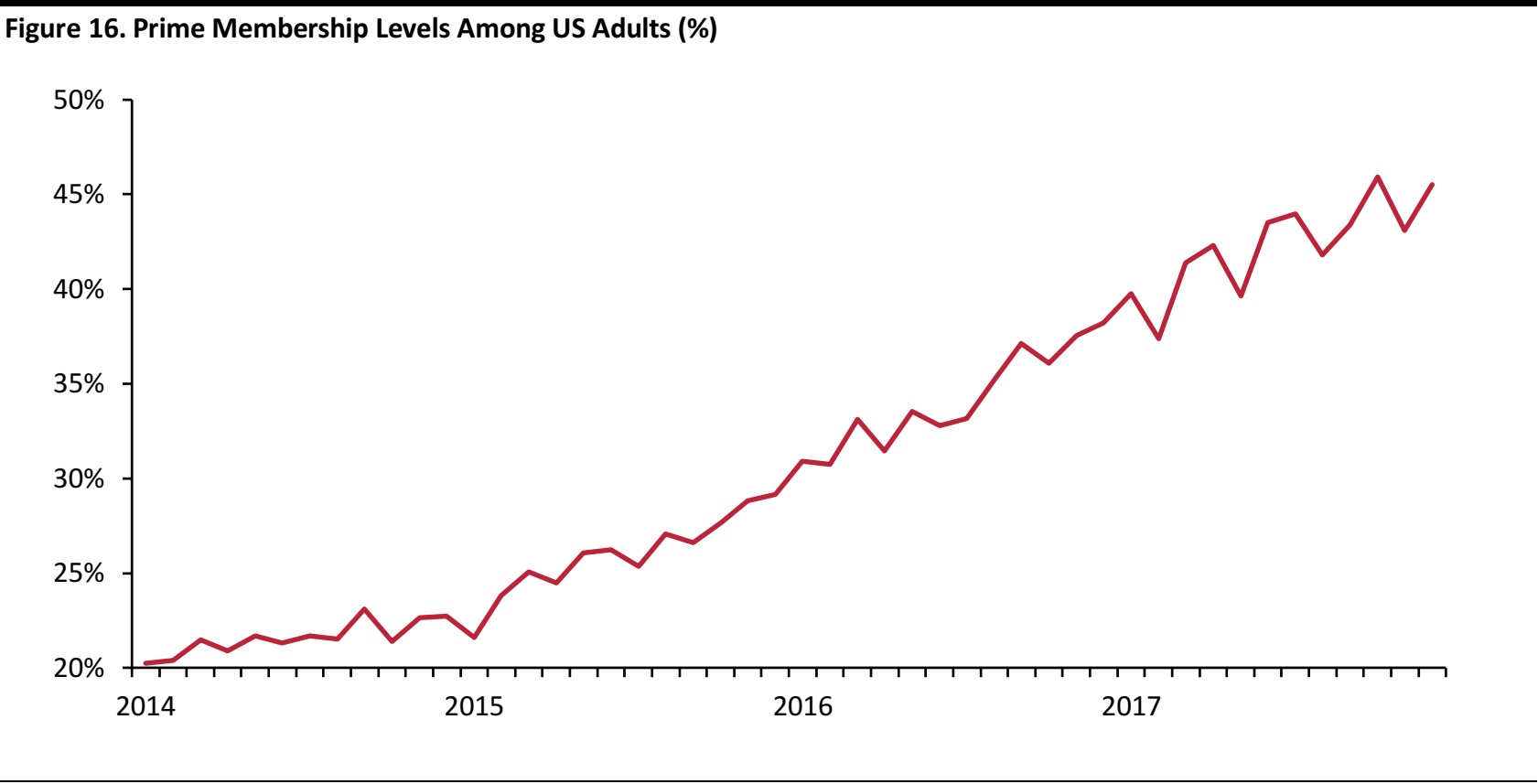

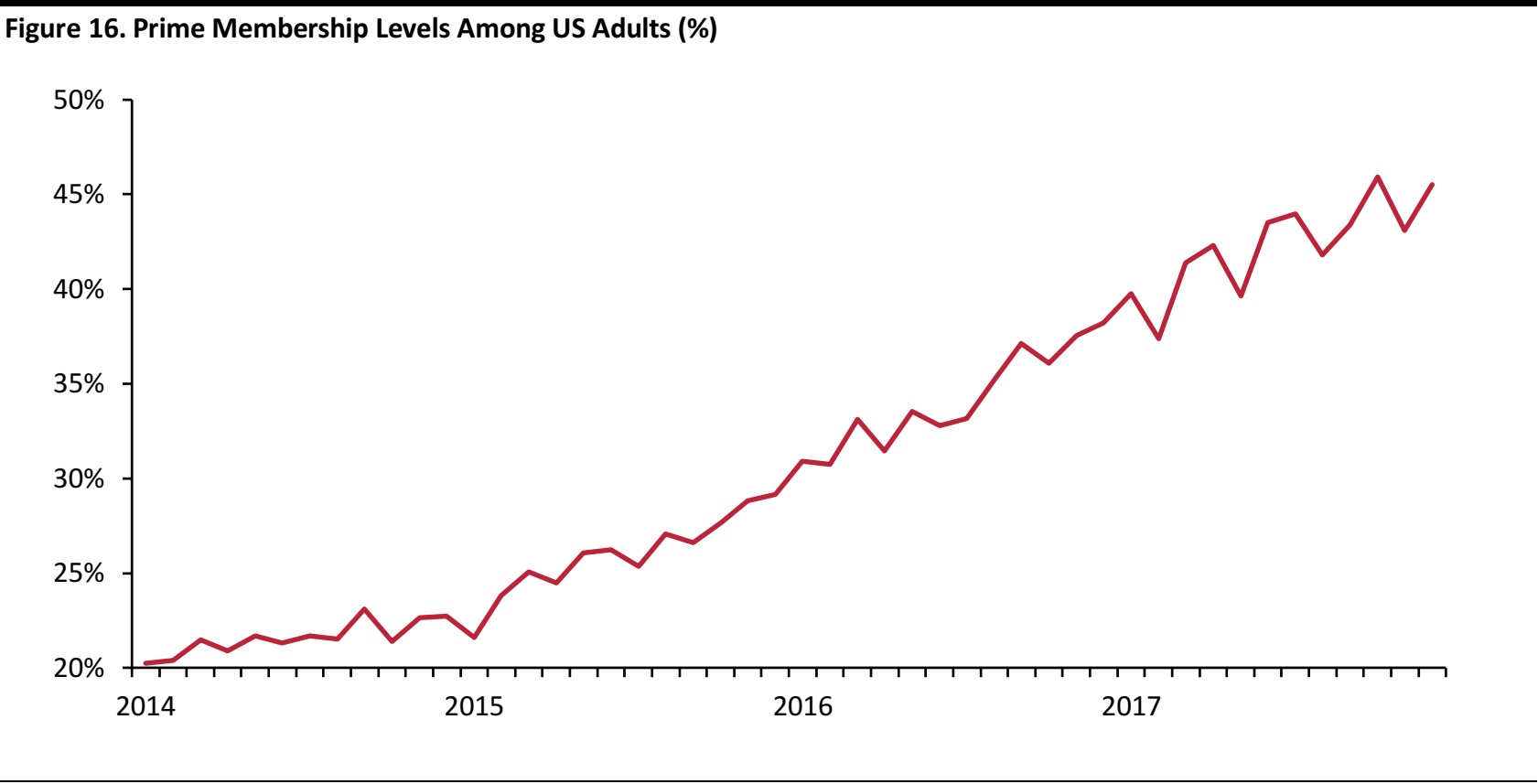

What We Think

One key finding of our research is that Prime membership is the principal support for Amazon’s apparel expansion, as Prime members show a much higher tendency than the average consumer to buy apparel on the site. As we show below, Prime membership has trended strongly upward in the recent past. The inference must be that further growth in Prime membership will, in the near term at least, be the foundation on which Amazon will build greater share in the apparel category.

Through December 2017

Base: 6,000+ US Internet users ages 18+ in each month

Survey question: Do you have an Amazon Prime membership?

Source: Prosper Insights & Analytics

Appendix: How Big Is Amazon in Apparel? Bringing Estimates Together

This report has focused on our proprietary survey findings. For completeness, we conclude by bringing together estimates of Amazon’s US apparel sales from third-party research firms. All the figures noted below are for gross merchandise volume, which includes sales by third-party sellers on Amazon.

- Euromonitor International estimates that Amazon US sold $24.6 billion of clothing and footwear in 2017, of which $20 billion was sold by third-party sellers. We estimate that this total would place Amazon roughly level with Walmart, America’s biggest apparel seller—although we note that Walmart achieves this position primarily through first-party sales while Amazon is largely transacting third-party sales.

- In October 2016, Cowen and Company estimated that Amazon’s 2017 US apparel sales would reach $28.4 billion, rising to $35.0 billion in 2018. These figures put Amazon as the top seller of apparel in the US.

- In 2017, Wells Fargo estimated that Amazon’s 2017 US apparel sales totaled $18.5 billion. According to the firm’s analysts, that figure placed Amazon as the second-biggest seller of apparel in the US.

- In January 2018, Instinet estimated that Amazon’s global apparel sales in 2016 were somewhere between $18 billion and $36 billion, based on the category accounting for between 10% and 20% of Amazon’s total gross merchandise volume.

We present these figures with the caution that no research firm truly knows how much clothing and footwear is sold on Amazon. We also note that some research firms have enjoyed substantial media coverage on the back of estimates that have placed Amazon as one of the very largest retailers of apparel in the US. We further note the risk of a herding effect, whereby some research firms may be reluctant to estimate figures that vary susbtantially from those published by other firms and that are already in the public domain.

Survey Methodology

For this report, we conducted an online survey of 1,699 demographically representative, Internet-using American adults between January 18 and January 24, 2018. Of the respondents, 1,564, or 92%, had bought clothing or footwear in the past 12 months.

Online surveys represent Internet users and, according to the Pew Research Center’s latest published data, 88% of Americans were Internet users in 2016. The proportion of the total US population using the Internet has been climbing by around two percentage points per year, according to Pew data. So, in January 2018, when we undertook our survey, it is likely that approximately 90%–91% of Americans were Internet users.