Nitheesh NH

Introduction: Gauging Amazon UK’s 2-Million-Strong Clothing Offering

Amazon is the big unknown in UK apparel, with little or no hard data on its sales and market share in the category. However, there can be little doubt that it is a major competitor in apparel and that it is growing sales fast: Amazon grew its total UK sales an estimated 23% in 2018. In this report, we uncover the scale of Amazon’s UK apparel offering. In collaboration with competitive intelligence provider DataWeave, we aggregated data on almost 2 million women’s and men’s clothing products listed on Amazon.co.uk (Amazon’s UK site). In the sections that follow, we cut and slice that data by brand, product category and type of seller (first-party versus third-party). In Brief: How We Got Our Data Our data covers women’s and men’s clothing on the UK Amazon Fashion site. We aggregated data in two stages:- First, we identified all brands included in the top 500 featured product listings for each product subcategory in the women’s clothing and men’s clothing sections on Amazon Fashion UK (e.g., the top 500 product listings for women’s tops and tees, the top 500 product listings for men’s activewear, etc). We believe these top 500 products represent around 95% of Amazon.co.uk’s clothing sales. This returned a total of 4,037 unique brands.

- We then aggregated data on all product listings in the women’s clothing and men’s clothing sections for each of the 4,037 identified brands. This returned a total of 1.9 million individually listed products, which are the basis for the analysis in this report.

Our Top Six Findings

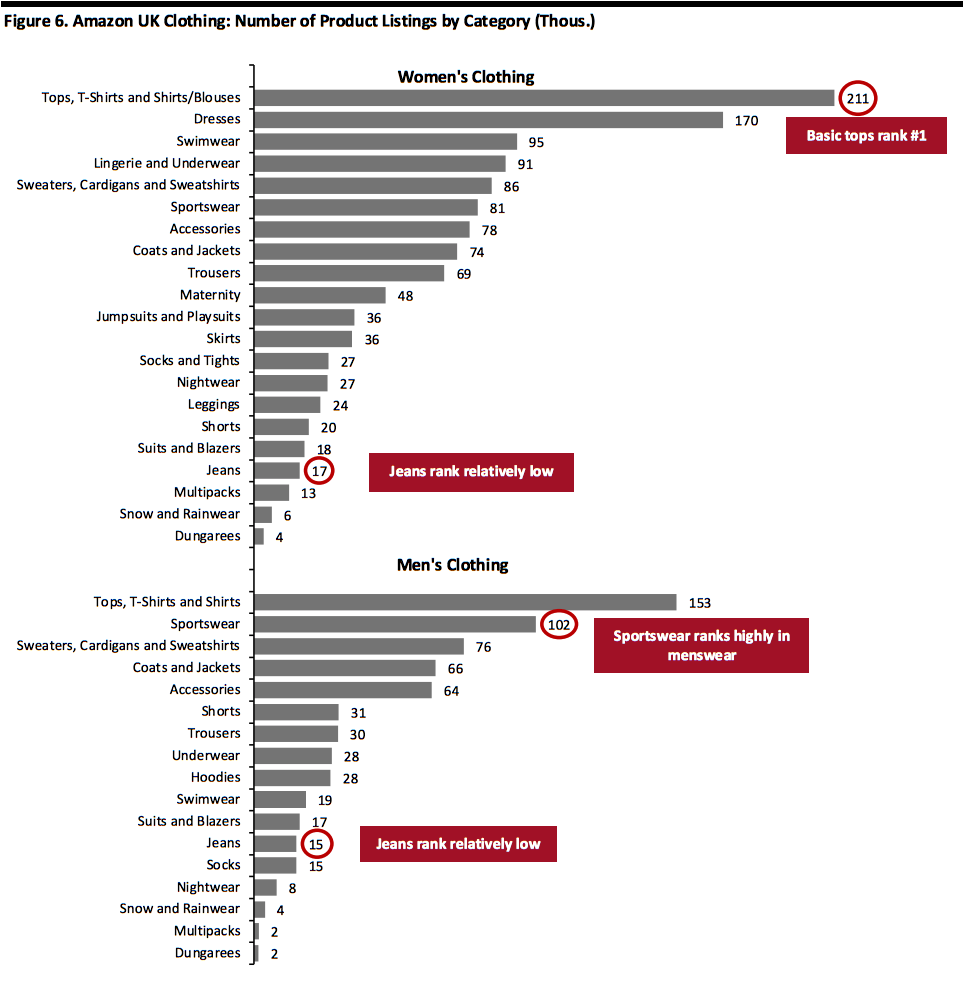

1. We identified 1.9 million women’s and men’s clothing products listed on Amazon.co.uk, almost certainly the UK’s biggest selection of apparel. For comparison, ASOS says it offers around 85,000 products and Zalando says it offers more than 400,000 products. Amazon UK offers 1.2 million women’s clothing products and 660,000 men’s clothing products, meaning womenswear accounts for around two-thirds of listings. Amazon’s 4,037 clothing brands compare to around 1,000 third-party brands at ASOS and over 2,000 brands at Zalando. 2. The scale of Amazon’s fashion offering has been supported by cheap, generic-style brands shipped from overseas sellers — mainly in China. Unknown brands such as EKU Fashion, Dahuo and ShuangRun are the most-listed brands on Amazon Fashion, with several listing tens of thousands of clothing products on the site and accounting for a large share of total listings. EKU Fashion lists almost 90,000 clothing items – nearly 5% of all Amazon UK clothing listings. We perceive a risk of shoppers browsing for apparel being overwhelmed by these low-price brands. We argue Amazon Fashion needs to place a renewed emphasis on brand curation and surfacing leading brands to shoppers — at the very least to provide assurance to major brands and retailers considering selling on the site. Amazon.co.uk already has a number of landing pages for major brands and categories, and it has introduced “Amazon Brand” product tags and, in the US, “Top Brand” product tags. However, it may need to help shoppers navigate and prevent top brands’ listings getting lost in the forest of generic-style brands. 3. Amazon also sees a large number of brands listing just a few products. Fully 2,481 brands of the 4,037 total have fewer than 100 products – and we found 711 brands with just a single-digit number of products listed. After stripping out the 10 most-listed generic-style brands, the average brand on Amazon Fashion has 366 products listed. 4. Amazon’s UK site remains predominantly a marketplace for third-party sellers. This is despite Amazon’s efforts to build its reputation as an apparel retailer, including through its development of private labels. These third-party merchants account for fully 96.6% of products listed: Amazon is the seller for just 3.4% of products listed. As first-party seller, Amazon UK offers a far smaller share of clothing products than does its US counterpart: Our 2018 analysis found that 11.1% of all clothing products on Amazon.com (US) were listed as for sale by Amazon, with 88.9% being offered by third-party sellers. Low-price imported brands on Amazon.co.uk account for the small proportion of first-party listings on the UK site. Once we focus only on the most-listed major brands (such as Adidas and Under Armour), first-party listings account for almost 14% of all products. 5. The most-listed famous brands on Amazon Fashion are Adidas, Under Armour, Nike and Puma — reflecting the strength of sportswear on the site. In menswear, sportswear is the second-most-listed category; in womenswear, it is in sixth place. 6. Amazon UK’s flagship apparel private label is called “Find,” and we identified 1,475 products under the brand, split 70% womenswear and 30% menswear. Casualwear leads the Find offering, with women’s tops and dresses accounting for around one-third of all the brand’s listings. Sportswear is prominent in the Find brand offering across women’s and men’s clothing. Other private labels, such as Amazon Essentials and Goodthreads, offer far more limited collections. [caption id="attachment_96154" align="aligncenter" width="700"] ShuangRun: an example of a low-price imported brand on Amazon.co.uk

ShuangRun: an example of a low-price imported brand on Amazon.co.ukSource: Amazon.co.uk[/caption]

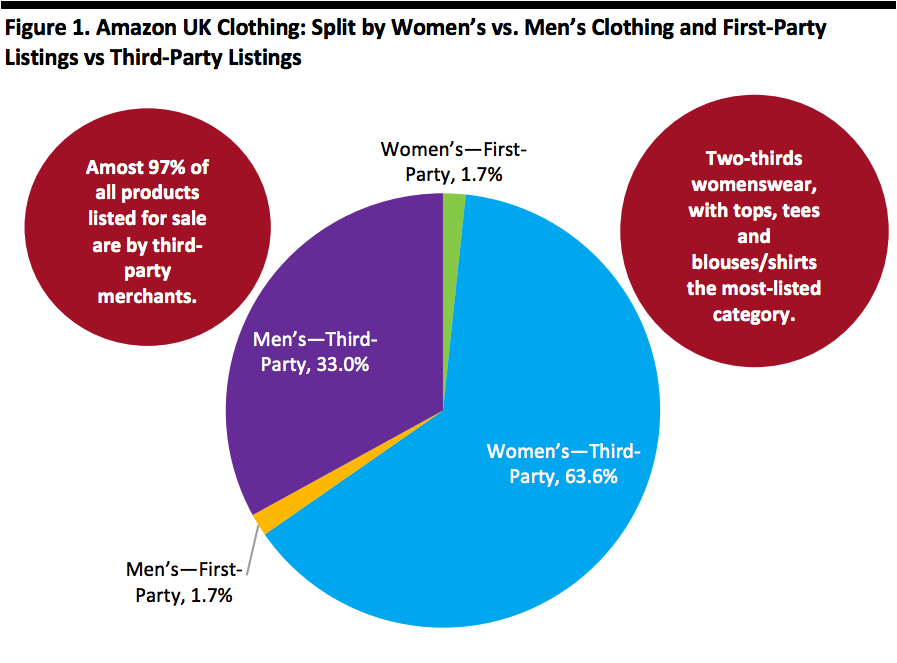

Third-Party Listings Dominate Offering; Womenswear Accounts for Two-Thirds of Products

With 1.9 million product listings, we feel confident in saying that Amazon offers the UK’s biggest choice of apparel:- With 1.2 million products, womenswear accounts for around two-thirds of Amazon’s clothing offering. The site lists around 660,000 menswear products.

- Within both categories, products for sale by third-party merchants account for the bulk of listings.

- Amazon is listed as the seller for around 63,000 clothing products, versus 1.8 million products listed for sale by third-party sellers.

Source: DataWeave/Coresight Research[/caption]

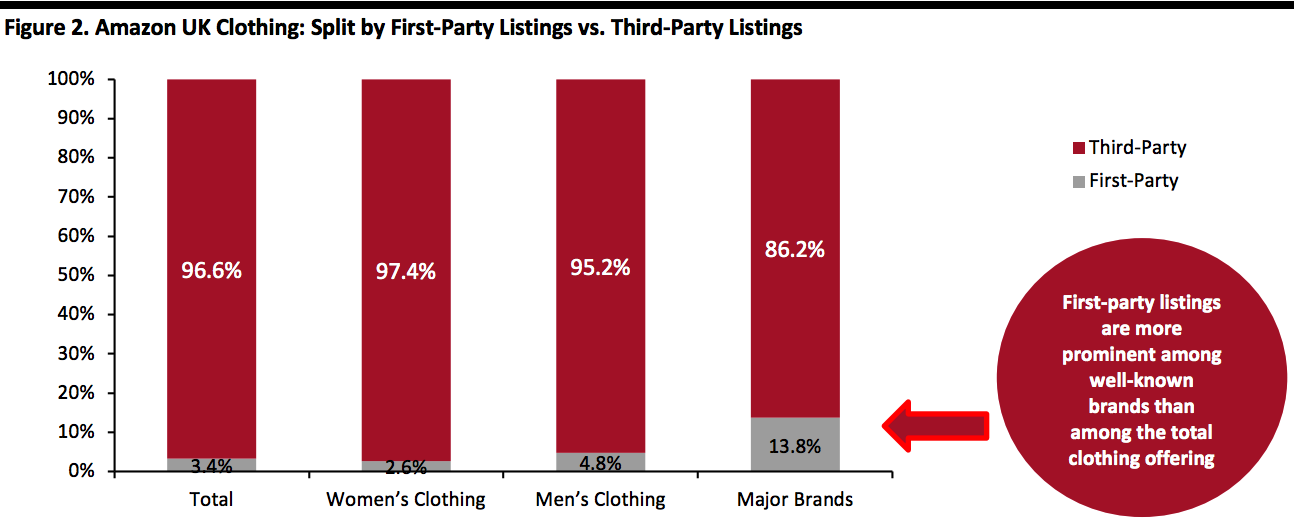

An abundance of little-known brands, predominantly imported from China and sold by third-party merchants, push down the first-party average (we discuss these brands later). And, these brands depress the proportion of first-party listings in womenswear in particular.

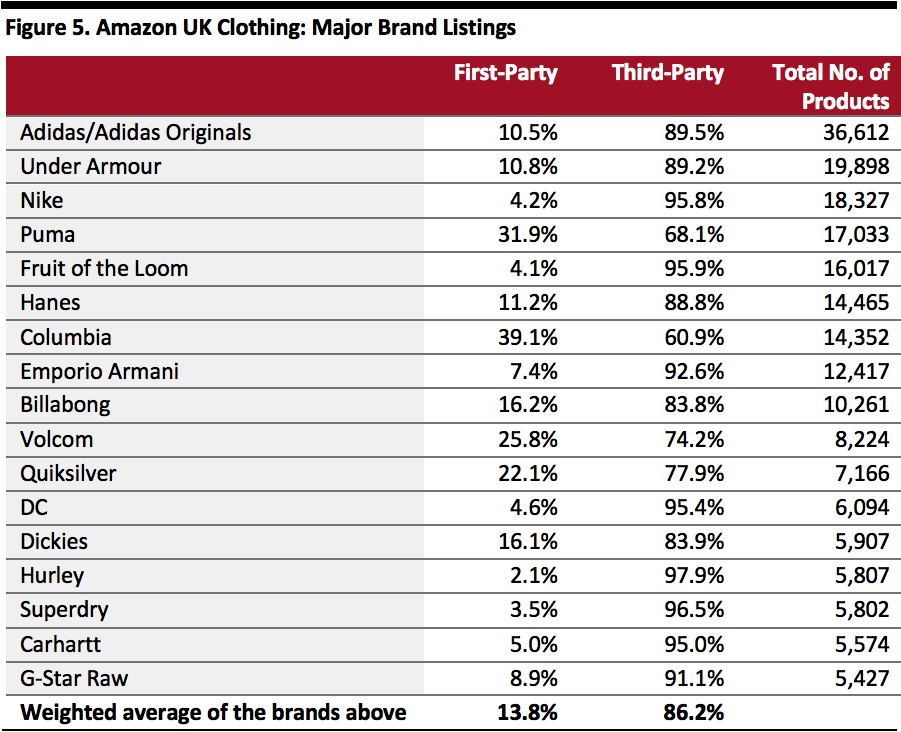

First-party listings are more prominent among leading brands: Among a handful of the most-listed major brands (such as Adidas, Nike and Under Armour), some 13.8% of listings are by Amazon and 86.2% by third-party sellers.

[caption id="attachment_96156" align="aligncenter" width="700"]

Source: DataWeave/Coresight Research[/caption]

An abundance of little-known brands, predominantly imported from China and sold by third-party merchants, push down the first-party average (we discuss these brands later). And, these brands depress the proportion of first-party listings in womenswear in particular.

First-party listings are more prominent among leading brands: Among a handful of the most-listed major brands (such as Adidas, Nike and Under Armour), some 13.8% of listings are by Amazon and 86.2% by third-party sellers.

[caption id="attachment_96156" align="aligncenter" width="700"] *Weighted average for 17 major brands that feature in the 50 most listed brands

*Weighted average for 17 major brands that feature in the 50 most listed brandsSource: DataWeave/Coresight Research[/caption]

The (Very) Long Tail of Brands

Amazon has almost 2 million clothing product listings in large part due to two types of brands: A small number of brands each with many products, and a very long tail of many brands each with very few products. The chart below visualizes this polarization.- Eight brands each have more than 30,000 product listings, and a further 13 brands have between 10,000 and 30,000.

- Those 21 brands that have more than 10,000 listings together account for close to one-third (31.2%) of all clothing listings on Amazon.co.uk.

- Some 2,481 brands of the 4,037 total each have fewer than 100 products.

- As we show later, obscure generic-style brands, mainly despatched on order from China, dominate the most-listed brands ranking.

Source: DataWeave/Coresight Research[/caption]

Source: DataWeave/Coresight Research[/caption]

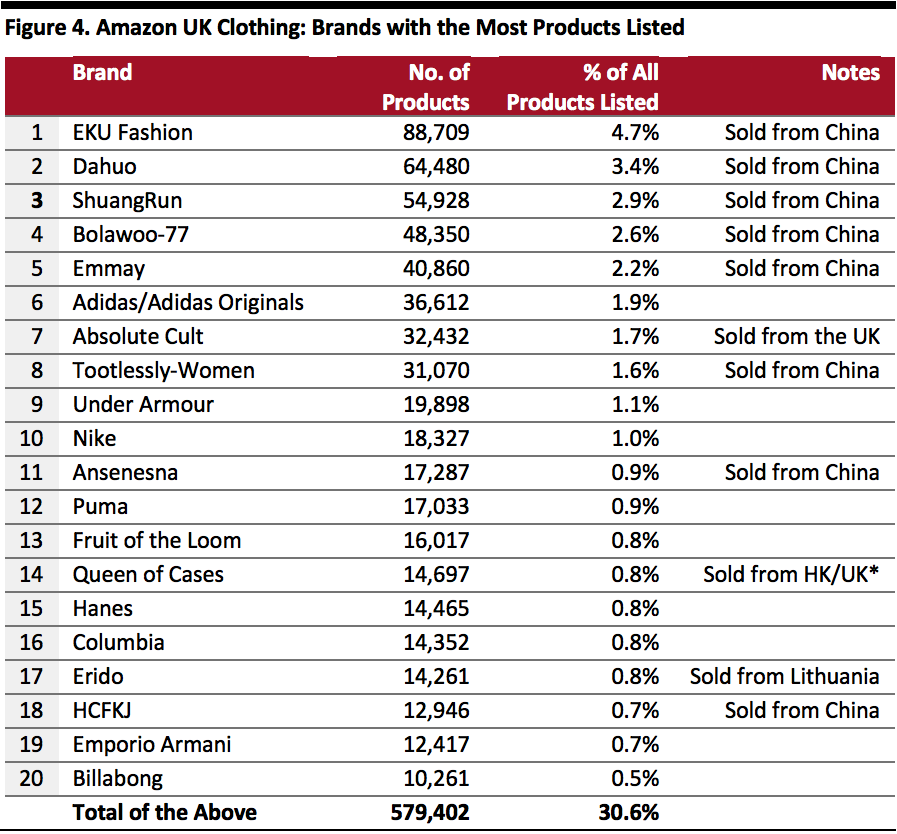

20 Most-Listed Brands: Obscure Brands from China Lead the Pack

Major names are among the most-listed brands on Amazon Fashion — but they are joined by cheap, imported brands.- The 20 most-listed brands together account for over 30% of all clothing listings on Amazon.co.uk.

- The ranking of most-listed brands is led by obscure brands, mainly shipped from China-based sellers. The scale of these brands, in and beyond the top 20, helps explain the dominance of third-party listings on Amazon apparel, because Amazon is not the seller for these little-known brands. Many more such brands appear further down the ranking, outside of the scope of the table.

- These brands sell at very low prices: ShuangRun sells men’s shirts for around £10 and women’s jackets for less than £15. Many of these products are offered in Chinese sizes. HCFKJ sells leather wallets for a penny.

- Confirming the strength of sportswear in Amazon’s apparel offering, the most-listed famous brands are Adidas, Under Armour, Nike and Puma. Indeed, Adidas is the only major apparel brand with more than 30,000 product listings on Amazon.co.uk.

- Lower-price brands that have traditionally wholesaled to retailers, such as Fruit of the Loom and Hanes, also rank highly in terms of number of product listings.

*Queen of Cases is a UK-registered company, but orders are shipped from Hong Kong.

*Queen of Cases is a UK-registered company, but orders are shipped from Hong Kong.Percentages may not sum due to rounding.

Source: DataWeave/Coresight Research[/caption] [caption id="attachment_96160" align="aligncenter" width="700"]

ShuangRun: An example of a low-price imported brand on Amazon.co.uk

ShuangRun: An example of a low-price imported brand on Amazon.co.ukSource: Amazon.co.uk[/caption]

Most-Listed Big-Name Brands: Sportswear in the Lead

The table below aggregates data for major brands that appear among the 50 most-listed brands on Amazon Fashion. It shows the first-party/third-party split, with Puma and Columbia showing notably high proportions of first-party listings. A high proportion of first-party listings implies strong brand relationships — not simply because Amazon would have access to inventory direct from the brand, but also because some deals with brands such as Nike involve Amazon placing restrictions on unsanctioned sales. [caption id="attachment_96162" align="aligncenter" width="700"] Source: DataWeave/Coresight Research[/caption]

Source: DataWeave/Coresight Research[/caption]

Listings by Category

The highly listed brands from China, such as EKU Fashion, Dahuo and ShuangRun typically have substantial numbers of listings for categories such as dresses, coats and jackets, and sweaters, cardigans and sweatshirts, boosting these categories’ presence in the ranking. These brands also tend to have a much more limited offering in categories such as jeans, which helps explain the relatively low ranking of jeans in womenswear and menswear — even though Amazon.co.uk offers almost 17,000 different jeans in womenswear and over 15,000 in menswear. [caption id="attachment_96164" align="aligncenter" width="700"] Source: DataWeave/Coresight Research[/caption]

Source: DataWeave/Coresight Research[/caption]

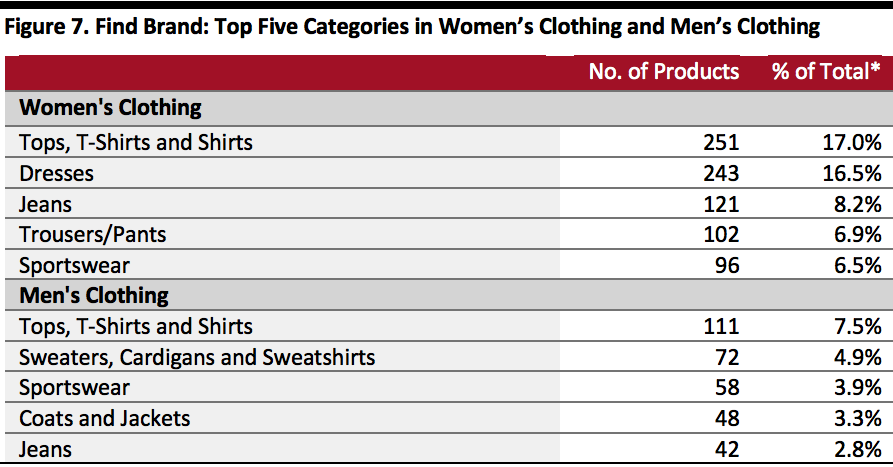

Private Label: A Focus on Find

Launched in 2017, Find is Amazon UK’s flagship apparel private label. We identified 1,475 Find products, 70% in womenswear (1,037 products) and 30% menswear (438 products). This split is very approximately in line with that for Amazon UK’s overall clothing offering. Casualwear leads the Find offering, with tops, dresses and jeans the most-listed categories in womenswear, accounting for around one-third of all Find items. Jeans rank more highly in Find’s collection than among the overall clothing offering on Amazon. Sportswear is prominent in the Find brand offering across women’s and men’s clothing, and accounts for an aggregate 10.4% of all Find clothing listings. [caption id="attachment_96166" align="aligncenter" width="700"] *% of 1,475 total Find product listings

*% of 1,475 total Find product listingsSource: DataWeave/Coresight Research[/caption] [caption id="attachment_96167" align="aligncenter" width="700"]

Find on Amazon.co.uk

Find on Amazon.co.ukSource: Amazon.co.uk[/caption]

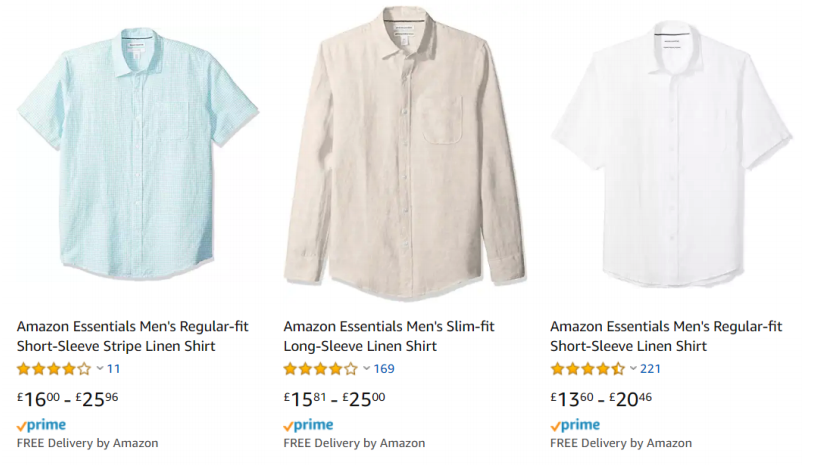

- Amazon Essentials is another private label, spanning 191 clothing products. Of these, 111 (or 58%) are in menswear and 80 (or 42%) in womenswear.

- And we found 172 products in Amazon’s menswear private label Goodthreads.

Amazon Essentials products on Amazon.co.uk

Amazon Essentials products on Amazon.co.ukSource: Amazon.co.uk[/caption]

Key Insights

We see two opportunities for Amazon in apparel in the UK:- Amazon should continue to find ways to surface known brands and its private labels to avoid shoppers being overwhelmed. It needs to avoid major brands being lost amid an ocean of product — not least because this could threaten Amazon’s apparently improving relationships with major brands, which it is building on its growing credibility as a fashion retailer. Amazon already flags up its private labels with “Amazon Brand” tags and it is currently introducing “Top Brand” tags on its US site. Further innovations and navigation aids may be needed.

- We think Amazon’s reliance on third-party sellers underscores its opportunity to grow apparel sales by bringing more inventory in-house. If Amazon held more first-party clothing inventory, more products would be eligible for Prime delivery (while third-party listings can be Prime-eligible, that is optional). And we think shoppers feel greater reassurance on issues such as product authenticity, shipping and returns when they buy directly from Amazon than from (often-unknown) third-party sellers. Moreover, greater first-party inventory would imply a strengthening of relationships between Amazon and brands.