DIpil Das

What’s the Story?

We have conducted an annual survey of US consumers since 2018, asking them about their clothing and footwear shopping habits with a focus on their propensity to buy on Amazon.com. This year’s survey of 2,006 US consumers was conducted in early March 2021. Our findings indicate that while consumers in general purchased less clothing and footwear (“apparel” throughout this report) between March 2020 and February 2021, Amazon’s clothing and footwear sales weathered the pandemic better than its competitors.Why It Matters

Amazon is the largest apparel retailer in the US:- Coresight Research estimates that Amazon sold $39 billion of clothing, footwear and apparel accessories in the US in 2020. This includes sales by third-party sellers on its marketplace. That places Amazon in first position in the market, with sales just over 40% ahead of second-place Walmart (the banner, excluding Sam’s Club), which we estimate saw category sales of around $27 billion in 2020. That gives Amazon an approximate one-third share of US apparel and footwear e-commerce sales.

- More than half of US consumers reporting that they had purchased clothing or footwear from the e-commerce platform in the 12 months ended February 2021. In a tumultuous year for apparel retailers—sales at clothing and clothing accessory stores in the US were down 26% in 2020—this survey can help identify shifting patterns in consumers’ purchasing habits, particularly as they move more spending to online channels.

Amazon Apparel Consumer Survey 2021: A Deep Dive

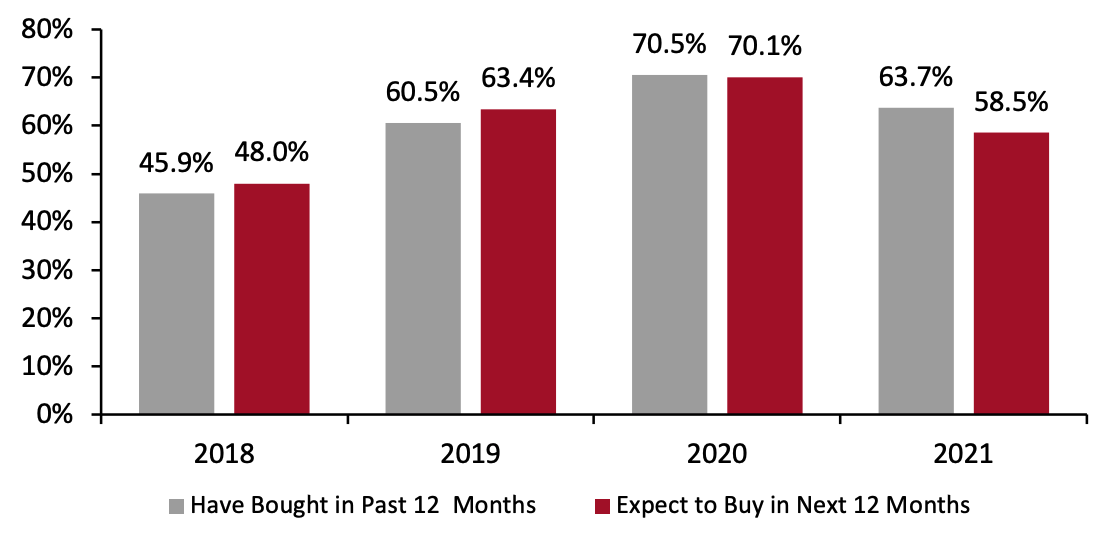

This year, we outline consumer spending behaviors on clothing and footwear products on Amazon.com and with other retailers over the past 12 months, and we compare the data against our three previous survey findings to understand longer-term trends in shopping habits and perceptions of Amazon. More than Six in 10 Apparel Shoppers Buy on Amazon After climbing in each of the past two years, the proportion of apparel shoppers purchasing clothing or footwear on Amazon.com fell by 6.8 percentage points this year, to 63.7%. Moreover, the proportion of consumers expecting to buy clothing or footwear from the retailer in the next 12 months fell by an even larger degree, dropping 11.6 percentage points to 58.5%, the lowest value since 2018—we think this may be a reflection of cautious expectations and that actual purchase levels could be higher than this as apparel spending recovers.Figure 1. Apparel Shoppers: Proportion That Have Bought Clothing or Footwear on Amazon/Expect to Buy on Amazon (% of Respondents) [caption id="attachment_130304" align="aligncenter" width="700"]

Base: US consumers aged 18+ that had bought clothing or footwear in the past 12 months

Base: US consumers aged 18+ that had bought clothing or footwear in the past 12 monthsSource: Coresight Research[/caption] The pandemic took its toll on certain consumers’ abilities to spend on discretionary products and on their need for clothing and footwear. As we continue to come out of the pandemic-driven slump, we expect both these numbers to increase, likely substantially, in next year’s survey. Amazon Loses Fashion Shoppers but Fares Better Than the Market as a Whole As a result of the Covid-19 pandemic, consumers reported buying clothes or footwear at the lowest rate we have recorded in this survey since we began fielding these questions in 2018: 90.6% of respondents reported buying clothing or footwear in the past 12 months, down from 95.9% in 2020. This contextualizes a decline in clothing and footwear shoppers on Amazon.com that may have otherwise been an alarming sign for the retailer. Compared to other major retailers, Amazon actually retained a higher share of shoppers, indicating that this decline was due to the wider socioeconomic context during the pandemic than to shortcomings of the retailer. In the table below, we show the proportion of all respondents that said that they purchased clothing or footwear at any of a selection of major retailers. We saw a downward trend across all retailers as consumers spent less on apparel during the crisis.

Figure 2. All Respondents: Retailers at Which They Have Purchased Clothing or Footwear in the Past 12 Months (% of Respondents) [wpdatatable id=1079 table_view=regular]

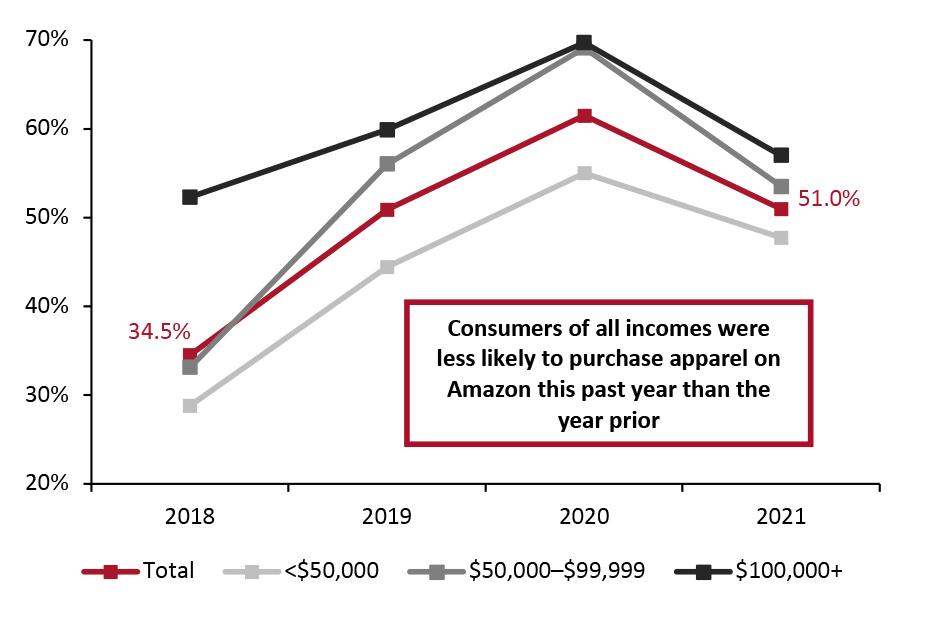

Base: US consumers aged 18+ Respondents were free to select any options from a list of major retailers; this was a different format from the yes/no question format used to definitively establish whether respondents had bought apparel on Amazon (shown in Figure 1) Source: Coresight Research Amazon was the only retailer we surveyed consumers about that managed to keep shopper numbers at higher levels than in the 2019 survey. The retailer’s comparatively modest decline in shoppers was spread relatively evenly across all three income groups (below $50,000, $50,000–$99,999 and $100,000 or more), with year-over-year declines of between 13% and 23%, as shown in Figure 2.

Figure 3. Respondents Who Had Purchased Clothing or Apparel on Amazon.com in the Past 12 Months, by Income (% of Respondents) [caption id="attachment_129546" align="aligncenter" width="725"]

Base: US consumers aged 18+

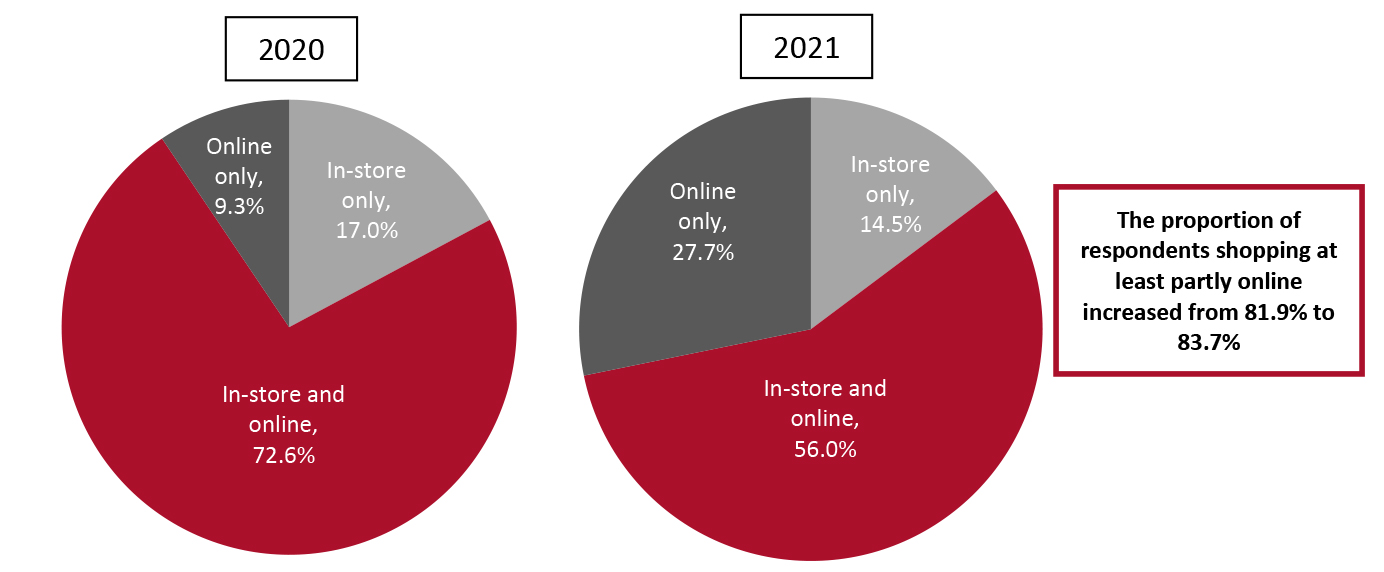

Base: US consumers aged 18+ Source: Coresight Research[/caption] Amazon Poaches Shoppers from Store-Based Clothing and Footwear Specialists Amazon was a definite beneficiary of consumers switching more of their spending online across all categories, but there were fewer first-time online clothing and footwear shoppers than one might expect in 2020. While the proportion of consumers shopping for apparel exclusively online nearly tripled in 2021, the proportion of those shopping online at all rose by just 1.8 percentage points. Some 14.5% of shoppers still reported shopping for clothing and footwear only in-store in this year’s survey—likely lost causes for Amazon and other online retailers: It will be tough to find an event more conducive to switching spending online than a global pandemic.

Figure 4. Respondents Who Had Purchased Clothing or Apparel in the Past 12 Months: Whether They Shopped In-Store and/or Online (% of Respondents) [caption id="attachment_129548" align="aligncenter" width="726"]

Base: US consumers aged 18+

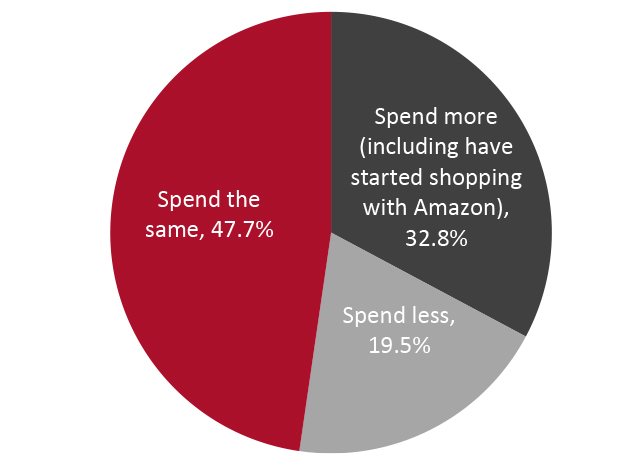

Base: US consumers aged 18+ Source: Coresight Research [/caption] Despite failing to attract die-hard in-store shoppers, Amazon was able to keep shopper numbers high by attracting customers from other retailers. Around one in three consumers reported that they currently spend more of their clothing and footwear budget on Amazon.com now compared to one year prior (just before the pandemic), while less than one in five consumers indicated that they were spending less of their budget with the retailer, as shown in the figure below.

Figure 5. Respondents Who Had Purchased Clothing or Footwear on Amazon.com in the Past 12 Months: Changes in Apparel Spending on Amazon.com Compared to One Year Ago (% of Respondents) [caption id="attachment_129550" align="aligncenter" width="626"]

Base: US consumers aged 18+

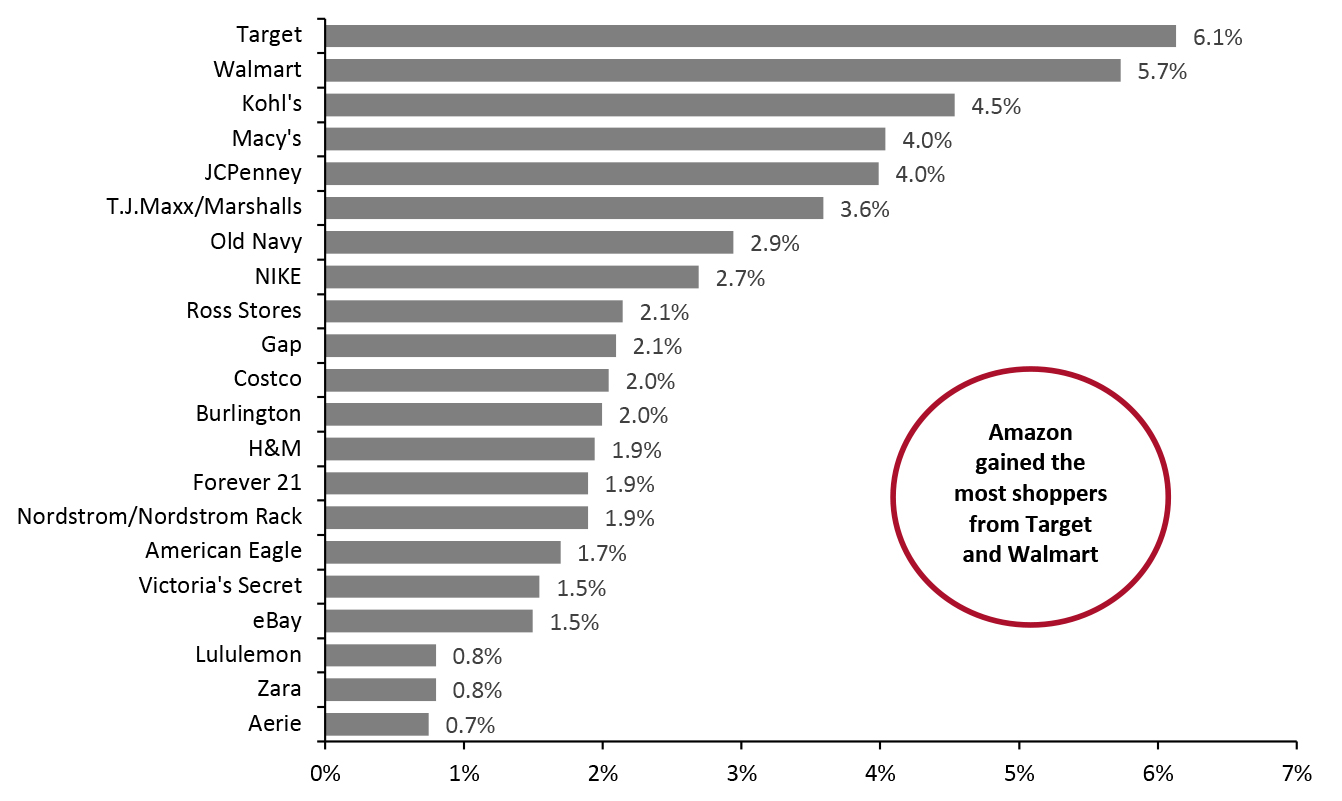

Base: US consumers aged 18+ Source: Coresight Research [/caption] In line with these findings, some 23.3% of consumers reported shifting clothing and footwear spending from any other retailers to Amazon over the past 12 months, mostly from the company’s largest competitors, Target and Walmart. In the figure below, we show the proportions of all respondents that switched their spending to Amazon, by the retailer from which they did so.

Figure 6. Retailers from Which Consumers Had Switched Spending to Amazon in the Past Year (% of Respondents) [caption id="attachment_129552" align="aligncenter" width="725"]

Base: US consumers aged 18+

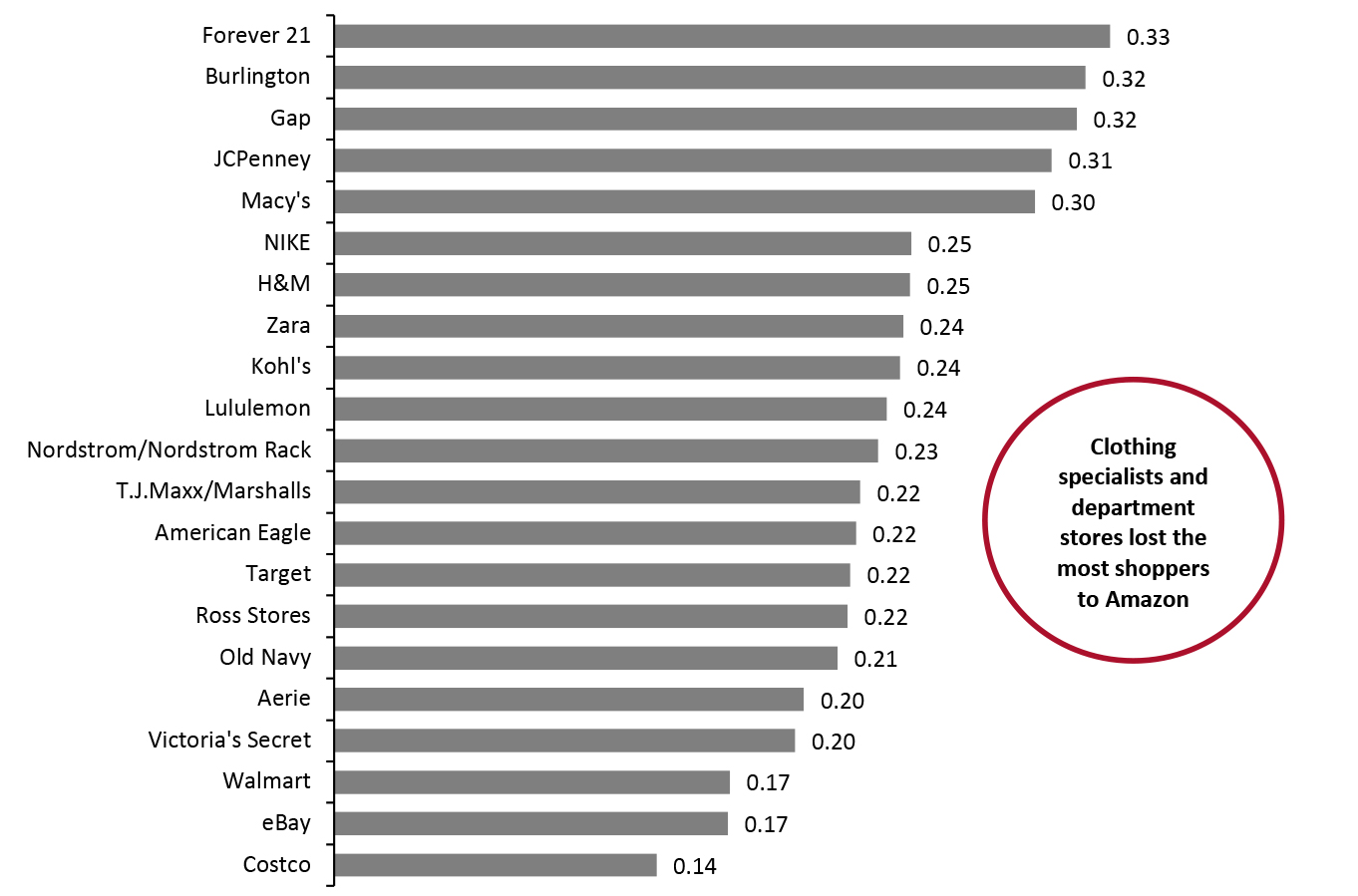

Base: US consumers aged 18+ Source: Coresight Research [/caption] The story these data seem to tell is one of Amazon scooping up disproportionate numbers of shoppers from Target and Walmart. Around 6% of all respondents reported redirecting clothing and footwear spending from each of these two store-based retail giants to Amazon over the past year, higher proportions than we saw for any other retailer. However, these data can be somewhat deceiving: While in absolute terms, Amazon saw more of its converted shoppers switch from Target and Walmart, this does not indicate that the highest proportions of shoppers at those retailers switched their spending to Amazon. To gain a better understanding of which retailers have lost the most business to Amazon, we examine the ratio of respondents who switched spending to consumers who reported shopping at each retailer within the past year. This reveals results that are more telling of which retailers have seen Amazon make the largest dents in their business. In this proportional analysis, Target and Walmart both move to the bottom half of the table, while five retailers—Forever 21, Burlington, Gap, JCPenney and Macy’s—clustered at ratios of just above 0.3 to lead the pack. One common factor among these retailers is their long-time focus on store-based rather than online sales, likely explaining why they struggled in a year defined by a pandemic that slashed store sales and drove record e-commerce growth.

Figure 7. Ratio of Consumers Who Switched Spending from Another Retailer to Amazon to Consumers Who Shop at Other Retailers [caption id="attachment_129554" align="aligncenter" width="726"]

The higher the number, the more of each retailer’s customer base switched their spending to Amazon Base: US consumers aged 18+

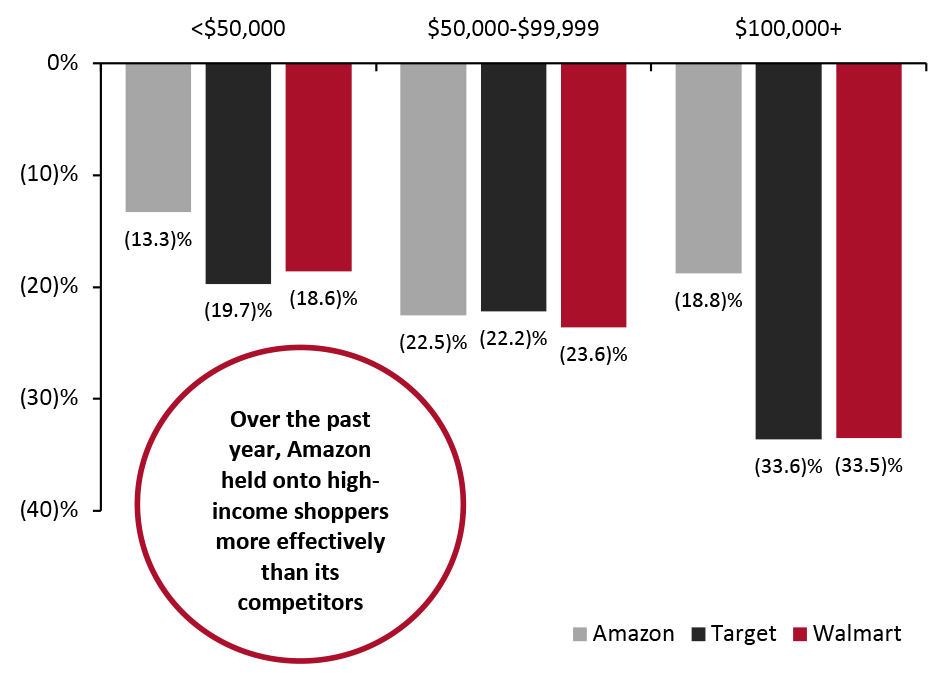

The higher the number, the more of each retailer’s customer base switched their spending to Amazon Base: US consumers aged 18+ Source: Coresight Research [/caption] Despite not gaining as many shoppers proportionally from Target and Walmart as it appeared on first glance, Amazon did outperform its two largest competitors with a key demographic: high-income consumers. Between 2020 and 2021, the proportion of consumers with incomes of $100,000 and above who reported shopping at Target and Walmart each fell by just over 33%; Amazon, on the other hand, saw the proportion of high-income consumers shopping on the platform decline by just 18.8% in the same period (see Figure 7). Amazon also outperformed its rivals in the lower- and middle-income brackets but by a much smaller degree. Holding onto a strong base of high-income consumers—even as Target and Walmart disproportionately lost clothing and footwear business from wealthy consumers—likely helped Amazon keep sales strong despite an overall decrease in shopper numbers.

Figure 8. Respondents Who Bought From Amazon, Target and Walmart in the Past 12 Months vs. 2020 Survey Findings (Change, Percentage Points) [caption id="attachment_129556" align="aligncenter" width="725"]

Base: US consumers aged 18+

Base: US consumers aged 18+ Source: Coresight Research [/caption] All Categories Suffer, but Sportswear Is a Comparative Bright Spot Despite Underperformance of Major Brands Compared to last year’s survey, a lower proportion of respondents reported purchasing items on Amazon.com across all of the categories we asked about. Unsurprisingly, formal wear was hit hard by the Covid-19 pandemic: The proportion of consumers purchasing this category fell by 4.0 percentage points this year—the largest decline of any category. Sports clothing fared the best, with the proportion of consumers purchasing this category on Amazon.com falling by just 1.6 percentage points compared to last year, as consumers searched for comfortable clothing and many began to work out more frequently in the home.

Figure 9. All Respondents: Product Categories They Have Purchased on Amazon.com in the Past 12 Months (% of Respondents) [wpdatatable id=1080 table_view=regular]

Base: US consumers aged 18+ Source: Coresight Research Amazon’s private labels were the most frequently purchased brands on Amazon this year, overtaking NIKE.

Figure 10. All Respondents: Clothing or Footwear Brands and Private Labels They Have Purchased on Amazon.com in the Past 12 Months (% of Respondents) [wpdatatable id=1081 table_view=regular]

Base: US consumers aged 18+ Source: Coresight Research NIKE’s drop-off in its share of apparel shoppers this year was expected, since the company announced in the fall of 2019 that it would no longer be selling directly through Amazon. Substantial year-over-year declines in purchases of Under Armour and Adidas products are more surprising. During the pandemic, consumers spending more time in the home likely looked for comfortable clothing, something these activewear brands endeavor to provide through their athleisure offerings. Furthermore, these brands looked poised to gain market share on Amazon following NIKE’s ending of direct sales through the site. However, despite losing shoppers on Amazon.com, Adidas and Under Armour fared no worse than most other brands. Every brand we surveyed consumers about saw a lower proportion of consumers shop for their products on Amazon.com in this year’s survey iteration than in last year’s. Notably, respondents did report purchasing “other brands” on Amazon.com at record rates. Across all categories, one-third of consumers tried a new brand during the pandemic, according to Salesforce data. Lesser-known brands on Amazon likely benefited from these shifts in consumer purchasing habits. Delivery Cost and Speed Matters Most, While Website Ease of Use Now Matters Mostly to Older Consumers For the second consecutive year, fast, free delivery was the number-one reason reported by consumers for shopping clothing and footwear on Amazon.com. In 2018 and 2019, when we did not include fast, free delivery as an option respondents could select, the most common selection was ease of use of the Amazon website, which clocked in as the second-most popular option in 2020 and 2021, as shown in Figure 10.

Figure 11. Respondents Who Had Purchased Clothing or Footwear on Amazon.com in the Past 12 Months: Reasons for Shopping the Category on Amazon.com [wpdatatable id=1082 table_view=regular]

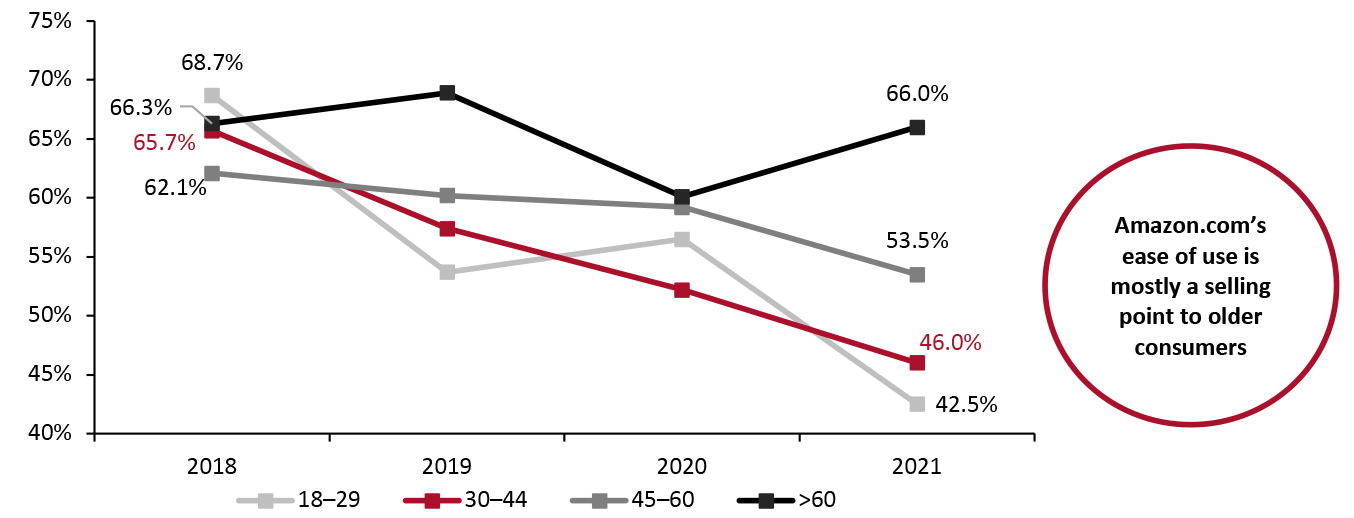

Respondents could select more than one option Base: US consumers aged 18+ Source: Coresight Research While ease of use does remain the second most commonly selected category, it has decreased in importance each year we have conducted the survey, falling more than 14 percentage points in 2021 from its high point in 2018. This change has been sparked largely by younger consumers deprioritizing ease of use of the Amazon website in recent years. Consumers over the age of 60 are the only age group that continue to report ease of use as a reason for shopping on the Amazon website at nearly the same rate that they did in 2018. Consumers between the ages of 18 and 29 saw the sharpest decline, with the proportion of this age group citing ease of use as a reason to shop with Amazon declining by just over 26 percentage points between 2018 and 2021—making this age group the least likely to attribute their use of the Amazon platform to make clothing purchases to the ease of shopping via the website.

Figure 12. Respondents Who Had Purchased Clothing or Footwear on Amazon.com in the Past 12 Months: Proportion Who Cite Amazon.com’s Ease of Use as a Reason They Shop Clothing or Footwear on the Website (% of Respondents) [caption id="attachment_129559" align="aligncenter" width="725"]

Base: US consumers aged 18+

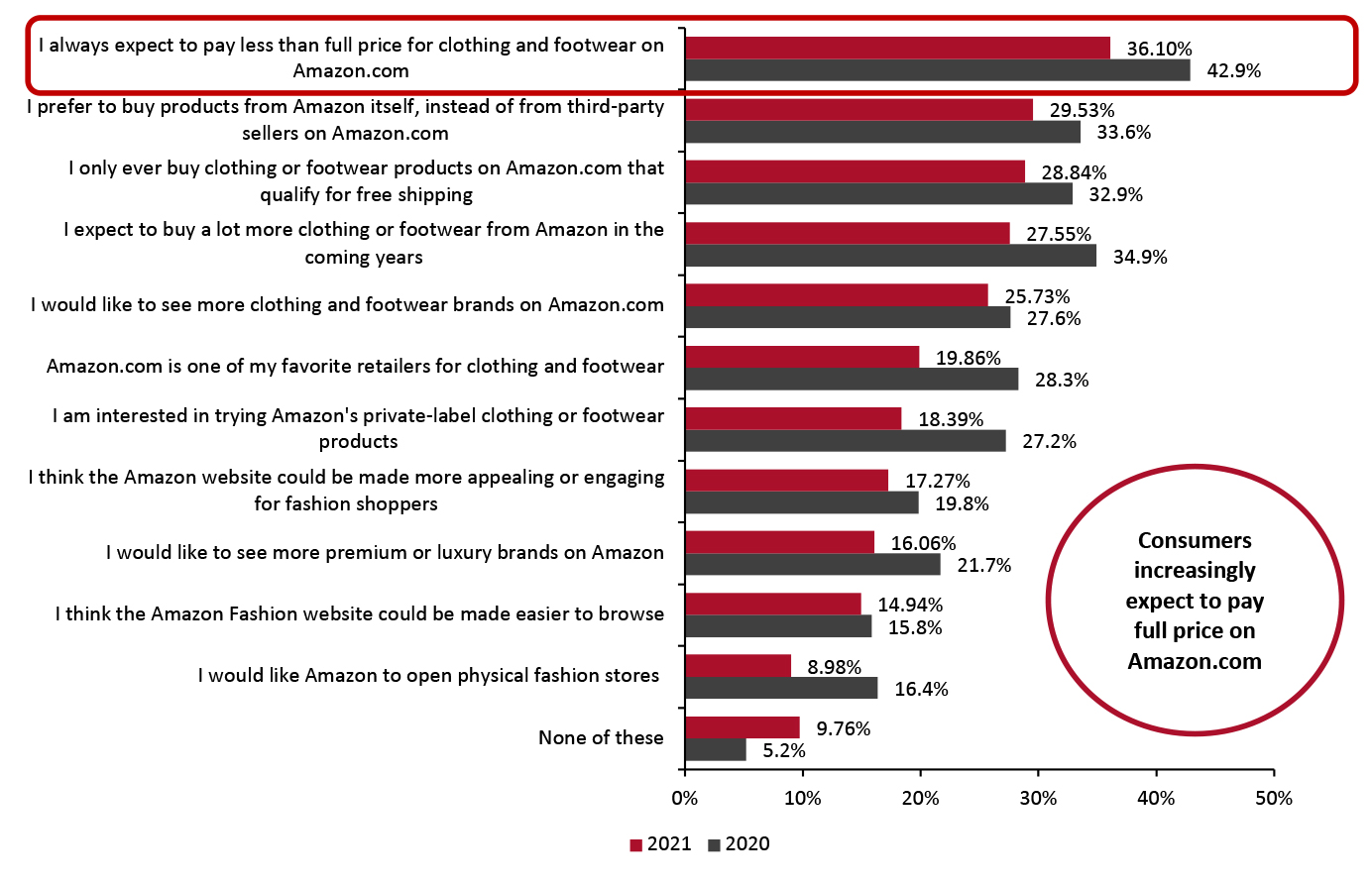

Base: US consumers aged 18+ Source: Coresight Research [/caption] At first glance, this downward trend in consumers reporting ease of use as a reason for shopping with Amazon is concerning—particularly since it is concentrated among younger consumers. Among a growing number of online competitors, Amazon could lose out to store-based mass merchandisers such as Target and Walmart if it is not perceived as offering a superior online experience. Fortunately for Amazon, the falling proportion of young consumers whose shopping decisions are based on ease of website use does not appear to correlate with Amazon’s share of young shoppers overall. This year, 63.4% of consumers between the ages of 18 and 44 reported that they shopped on Amazon.com for clothing or footwear in the past 12 months—essentially level with last year’s 66.3% and up from 59.5% in 2019. It is likely that younger consumers now expect a certain level of ease of use on websites and are no longer as impressed by online retailers who make it simple to order—there may no longer be a major difference in perceived ease of shopping across all retailers who have now achieved at least a baseline ease of use for their online platforms. Most encouraging for Amazon in the current context is its continued appeal to older shoppers. During the pandemic, older consumers moved online at record rates; the fact that our survey found that two in three shoppers over the age of 60 shopped on Amazon for its ease of use is a strong indicator that the e-commerce platform has done well to cultivate a shopping experience that is not just appealing to digitally familiar young shoppers but also to store-native older consumers. Consumers Generally View Amazon Less Favorably Than They Have Previously As part of our annual survey, we ask Amazon apparel shoppers whether they agree with a variety of statements about their expectations and perceptions of Amazon’s clothing and footwear offerings. This year, the proportions of respondents that agree with each statement dropped compared to last year, as shown in Figure 12.

- The proportion of apparel shoppers that always expect to pay less than full price on Amazon.com for clothing and footwear fell by 6.8 percentage points.

- The proportions of consumers indicating that they plan to buy a lot more clothing on the platform in the coming years and those who said the e-commerce giant was one of their favorite retailers for clothing and footwear both fell by more than eight percentage points.

Figure 13. Respondents Who Had Purchased Clothing or Footwear on Amazon.com in the Past 12 Months: Proportion That Agree with Selected Statements (% of Respondents) [caption id="attachment_129560" align="aligncenter" width="725"]

Base: US consumers aged 18+

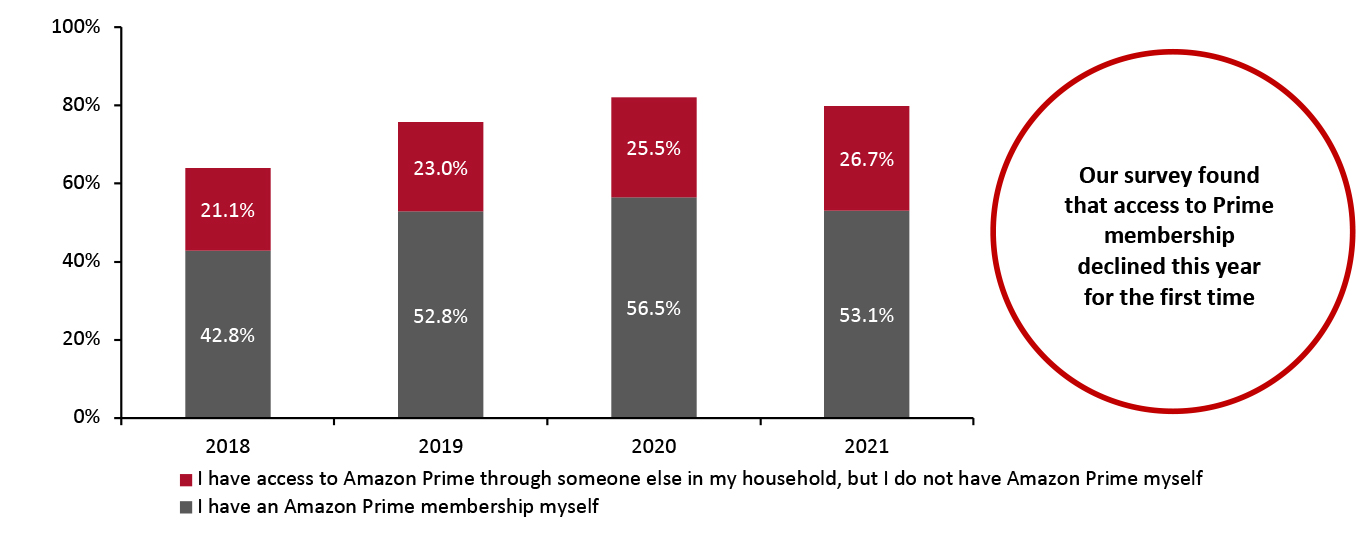

Base: US consumers aged 18+ Source: Coresight Research [/caption] Amazon Prime Memberships Plateau Even as More Consumers Make Recurring Online Purchases Overall, Amazon Prime membership—which enables the fast, free delivery that consumers look to Amazon for—has plateaued this year after rising in 2019 and 2020.

- The proportion of consumers who reported having their own Amazon Prime account dropped to roughly the levels we recorded in 2019.

- The proportion of consumers who said they had access to Prime through someone else in their household rose very slightly to a record high of 26.7%.

Figure 14. All Respondents: Whether They Have an Amazon Prime Account or Access to an Amazon Prime Account Through Someone Else in Their Household (% of Respondents) [caption id="attachment_129561" align="aligncenter" width="725"]

Base: US consumers aged 18+

Base: US consumers aged 18+ Source: Coresight Research [/caption] Unsurprisingly, those that do invest in an Amazon Prime account are almost guaranteed to shop on Amazon—99% of Prime members reported purchasing products on Amazon.com in the past 12 months, compared to just 71% of consumers who do not have access to a Prime membership.

What We Think

An overall decrease in spending on apparel and footwear mars an otherwise solid year for Amazon fashion. The e-commerce platform’s ability to keep shopper numbers high in a sector that was challenged for the previous 12 months points to its higher levels of resilience than store-based clothing and footwear specialists. We expect that in the coming 12 months, Amazon will see a significant increase in clothing and footwear purchases, as consumers release pent-up spending, become more financially secure and return to pre-pandemic social activities that require a wardrobe refresh. The major disappointment from this survey was the lack of growth in Prime memberships during the pandemic. As consumers overwhelmingly switched to online channels, Amazon seemed well positioned to grow its base of members—Prime’s flat-fee structure should have incentivized customers who order repeatedly on the platform to pay for a membership. The presumptive conclusion of these findings: Amazon has fully captured the potential market for Prime access. The company’s next step may be to crack down on access to membership by those consumers who rely on other’s accounts, which account for about one-third of total Prime users. Implications for Brands/Retailers- Clothing and apparel specialists continue to fall further behind Amazon, further highlighting the importance of a strong e-commerce presence for these retailers, even as the pandemic subsides.

- Amazon’s easy-to-use website gives it a leg up with older shoppers, a growing online segment for which other retailers could also do well to optimize their sales channels.

- This year’s survey again underlined the importance of Prime’s fast, free delivery for Amazon customers. Other retailers may benefit from offering similar subscription packages, as Walmart already has with Walmart+. However, this may only be a viable strategy for mass merchandisers rather than clothing and footwear specialists.