DIpil Das

Introduction: Quantifying Amazon’s Position in Apparel

In our third annual consumer-survey report on Amazon’s position in the apparel sector, we explore how many shoppers are buying clothing and footwear on the e-commerce platform, why, and where (if anywhere) they are switching spending from—among many other findings. The consistency of many of the questions we asked has enabled us to build up trend data from when we first ran this survey in 2018. The basis of this report is our late-February 2020 online survey of 1,934 US consumers, a sizable proportion of whom had bought clothing or footwear on Amazon during the past 12 months. Our survey was undertaken before the coronavirus crisis deepened, prompting store closures and shifts in consumer demand—including a decline in apparel spending. This report forms part of our How the US Shops series, in which we share insights into shopping behavior from original consumer research. The main body of this report discusses our survey findings, question by question. First, though, we bring together data points from various questions in our survey as we discuss key insights from our research.Our Top Insights

Very High Rates of Shopping on Amazon.com This year, Amazon widened its lead considerably, as measured by shopper numbers. Seven in 10 US apparel shoppers now buy clothing or footwear on Amazon.com. Total shopper numbers were driven by Prime members, with around 80% of Prime members buying clothing or footwear on the site. Among consumers without Prime membership, the shopping rate was a still considerable 42.4% this year. Like other retailers, Amazon will see muted demand for clothing and footwear in the short term. However, when US shoppers return to the apparel category, our data suggests they will turn in very substantial numbers to Amazon. Signs of a Plateau in Shopper Numbers Each year, we ask respondents whether they had bought clothing or footwear on Amazon in the past 12 months and whether they expect to do so in the next 12 months. “Expect to buy” usually exceeds “have bought,” but this year we recorded virtually no difference between these metrics, suggesting that Amazon could be experiencing a plateau in shopper numbers for fashion. This would align with the now-high shopping rates for Amazon and implies that the site needs to drive up purchasing frequency and/or average basket size in order to establish further gains in market share. Amazon Shoppers Are Buying across More Apparel Categories Shoppers buying apparel on Amazon are buying across more clothing and footwear categories than they used to. Our repertoire analysis found that the average Amazon apparel shopper said they had purchased 2.7 categories on the site this year versus 2.3 in each of the prior two years we conducted this survey. Three Surprising Consumer Perceptions of Amazon Over half (57%) of Amazon apparel shoppers say the site is easy to shop, making this the second-highest ranked reason to shop on the platform. Less than 16% think that the site could be made easier to browse or search, which runs counter to frequent commentary that Amazon.com is not set up to serve fashion shoppers. At the same time, perceptions of Amazon.com appear to be that it is a borderline off-pricer. Some 42.9% always expect to pay less than full price on Amazon, making this one of the top attitude statements that we asked Amazon apparel shoppers about. This perception is likely to support further gains in market share by Amazon during and after the coronavirus crisis. Amazon is generating interest in its private-label apparel ranges. Of Amazon apparel shoppers, 27.2% are interested in trying its private labels, up from 21.5% in 2019. Furthermore, Amazon’s private labels in total jumped from the fourth most bought “brand” in 2019 to second this year.Survey Findings in Detail

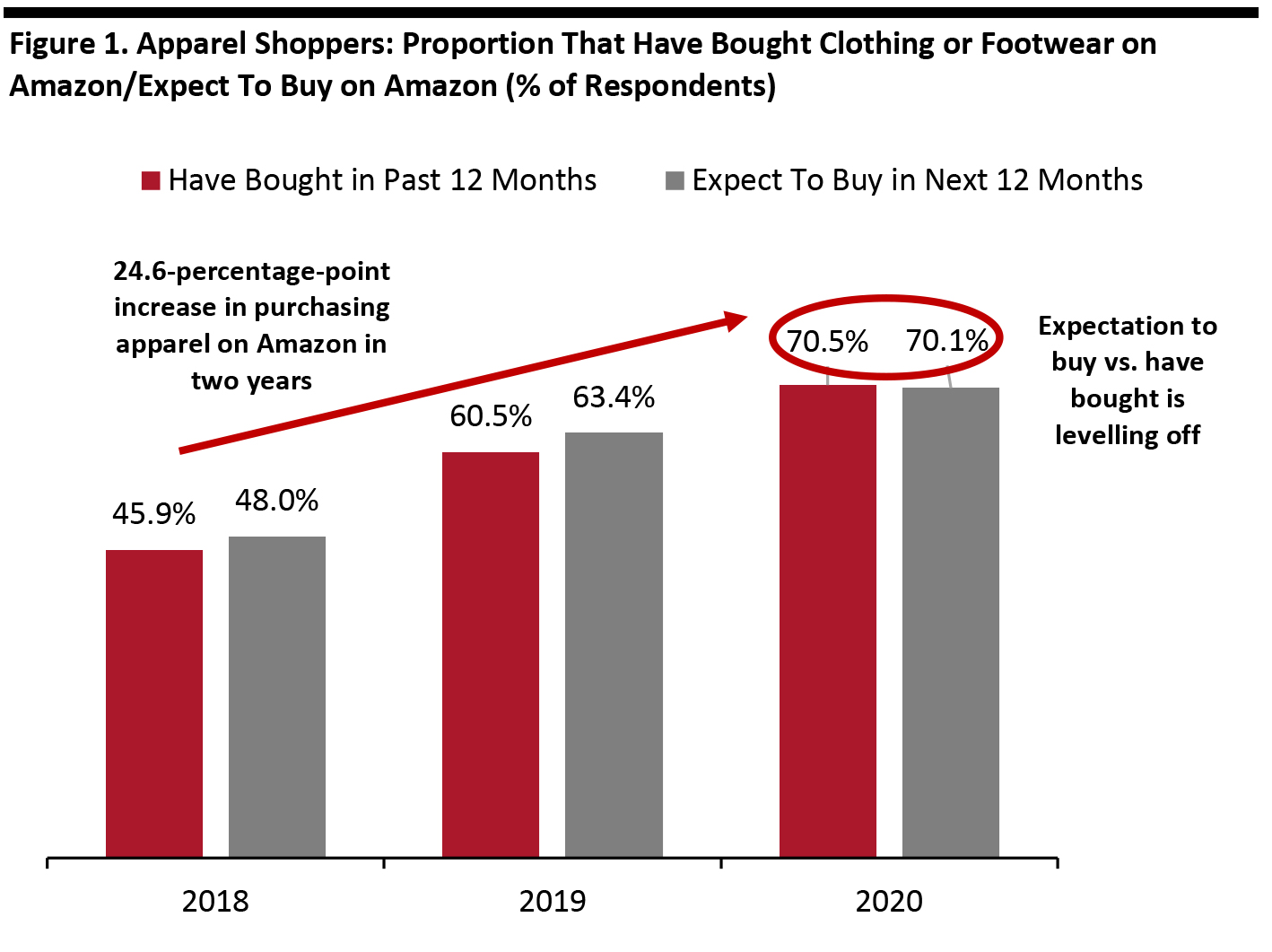

Over 70% of Shoppers Now Buy Apparel on Amazon

Fully 70.5% of apparel shoppers had bought clothing or footwear on Amazon in the past 12 months, up a full 10 percentage points from 2019 and up almost 25 percentage points from 2018. We saw a smaller one-year uplift in expectations to buy apparel on Amazon in the next 12 months. As charted below, we also recorded virtually no difference this year between the proportion of shoppers that had bought and the proportion that expect to buy on Amazon—suggesting that the platform could be experiencing a plateau in shopper numbers for fashion. This levelling off, combined with its high penetration rate, suggest that Amazon should drive up average basket sizes and purchasing frequency in order to further market-share gains. [caption id="attachment_107648" align="aligncenter" width="700"] Base: 1,855 US Internet users aged 18+ who had purchased clothing or footwear in the past 12 months

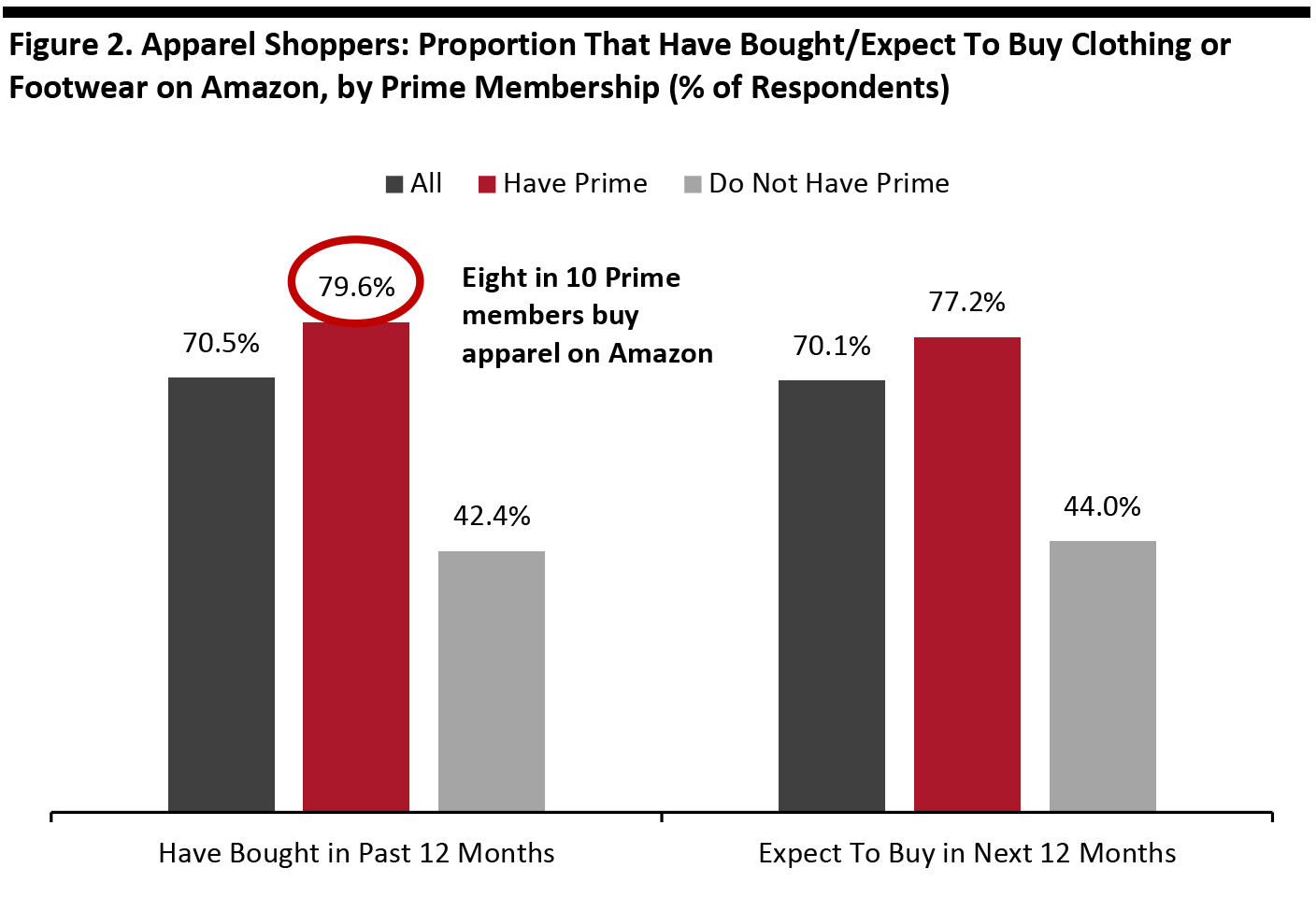

Base: 1,855 US Internet users aged 18+ who had purchased clothing or footwear in the past 12 months Source: Coresight Research [/caption] Prime members continue to drive the high rates of apparel purchasing on Amazon. This year, just under 80% of those who personally have a Prime membership said they bought clothing or footwear on the platform versus just over 42% of shoppers without a Prime membership. Comparing “have bought” with “expect to buy,” we see a slight decline among Prime members, compared to a slight increase among those without Prime, but neither are significant. [caption id="attachment_107649" align="aligncenter" width="700"]

Base: 1,855 US Internet users aged 18+ who had bought clothing or footwear in the past 12 months

Base: 1,855 US Internet users aged 18+ who had bought clothing or footwear in the past 12 months Source: Coresight Research [/caption] We estimate those who have a Prime membership account for around 58% of all Amazon apparel shoppers. This year, 56.6% of respondents had a personal Prime membership (versus 52.8% last year). On the other hand, 17.9% did not have access to a Prime membership (versus 24.2% last year). The remaining 25.4% (or 23.0% last year) did not have a personal membership but had access to Prime benefits from someone else in their household. (2020 totals do not sum due to rounding.) We examine the demographics and characteristics of Amazon shoppers in more detail later in this report, after we have reviewed further top-line findings from our survey.

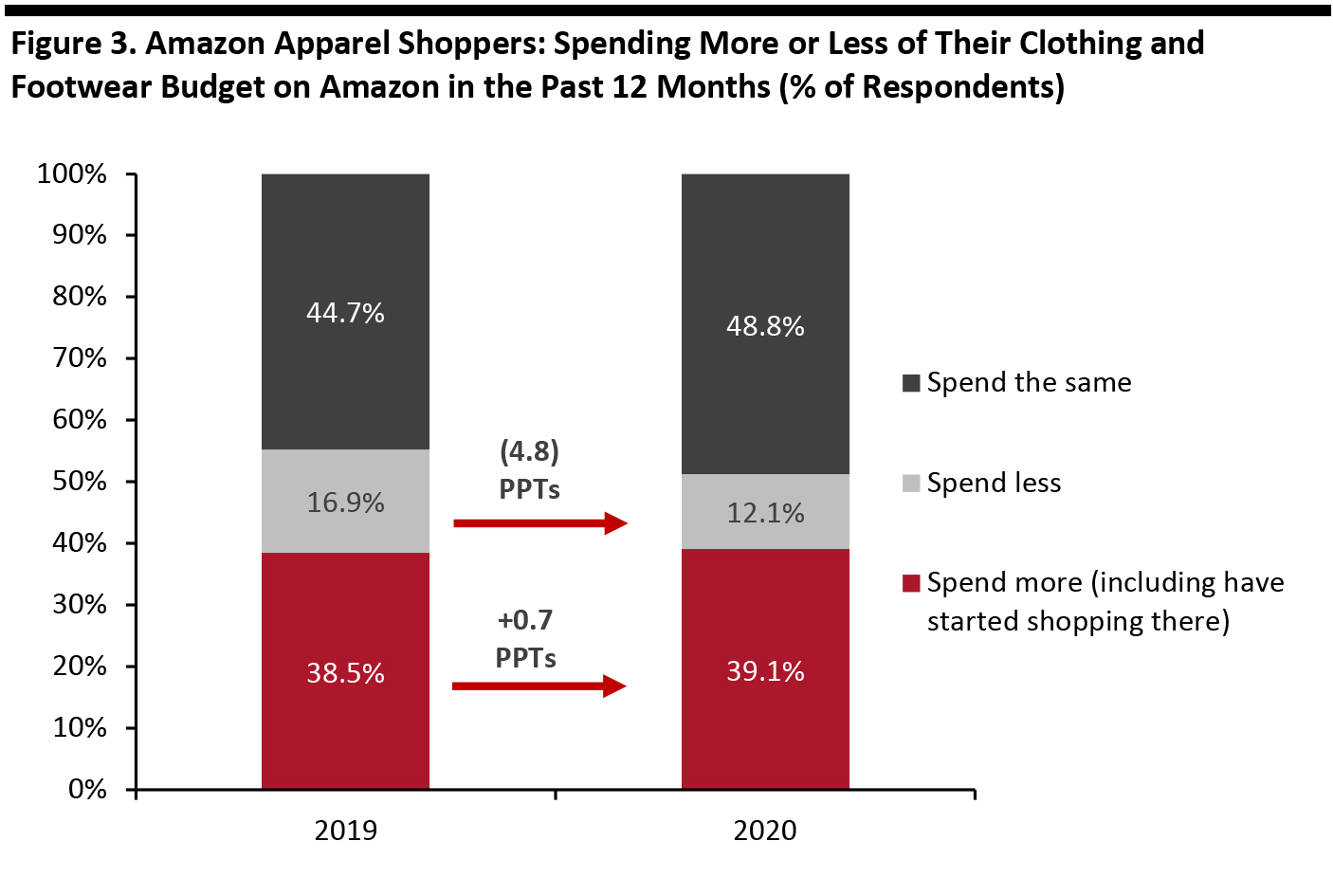

Meaningful Fall in the Proportion of Amazon Apparel Shoppers Reducing Their Spend

This year, 39.1% of Amazon apparel shoppers said they spent more of their budget on Amazon.com than they did one year earlier; this was very roughly level with the proportion we saw last year. We saw a much more sizeable shift—a near-five-percentage-point decline—in the proportion of shoppers saying they spent less on Amazon. [caption id="attachment_107650" align="aligncenter" width="700"] Base: US Internet users aged 18+ who had purchased clothing or footwear on Amazon.com in the past 12 months (985 in 2019 and 1,308 in 2020)

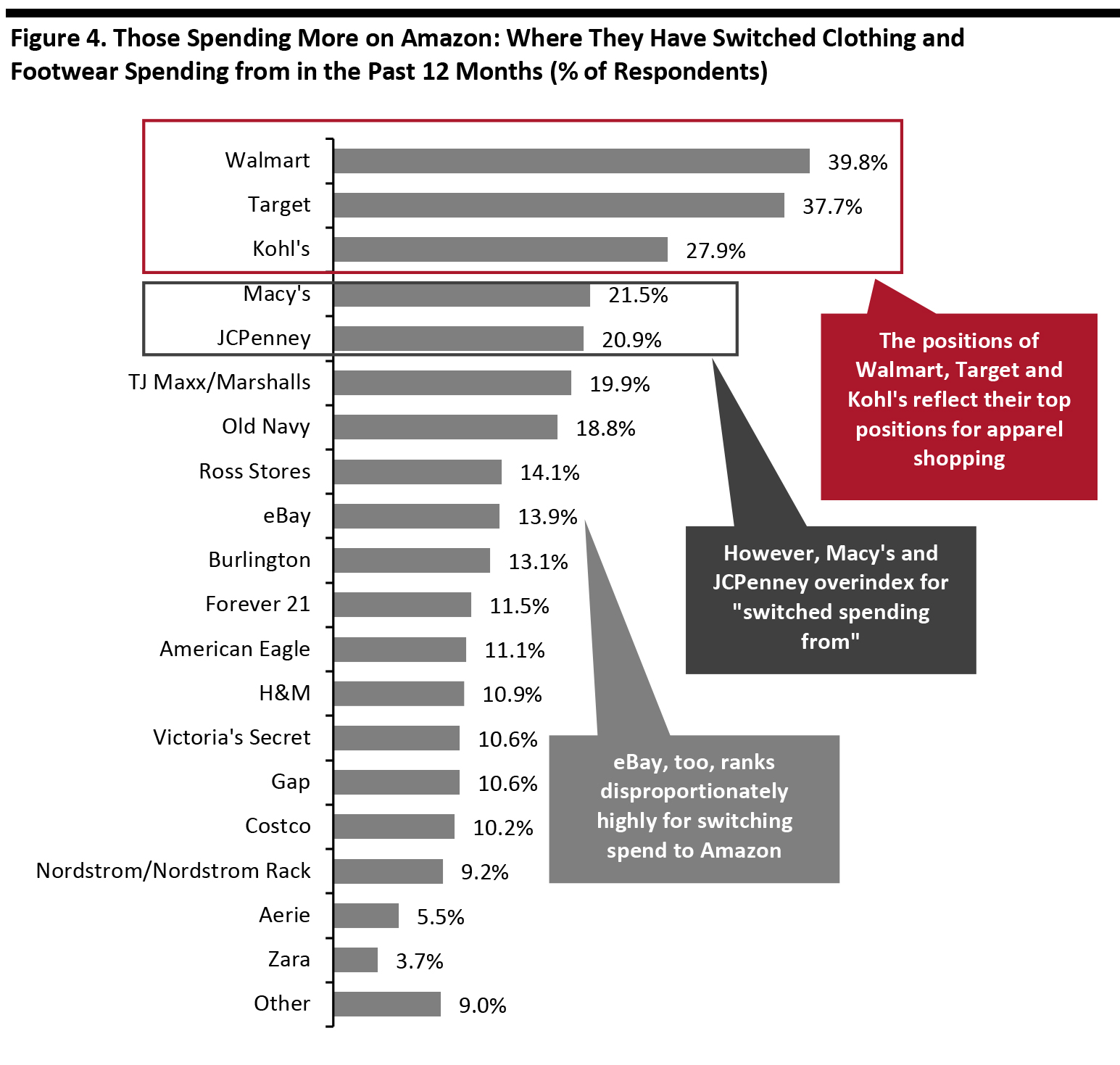

Base: US Internet users aged 18+ who had purchased clothing or footwear on Amazon.com in the past 12 months (985 in 2019 and 1,308 in 2020) Source: Coresight Research [/caption] Who Is Losing Spending to Amazon? Each year, we ask those who have increased their spend on Amazon where they have switched spending from. The most popular options broadly reflect the ranking of the most-shopped retailers for apparel—Walmart, Target and Kohl’s follow Amazon as the retailers that US consumers most purchase clothing or footwear from (as we discuss later in this report). However, we note the following:

- Macy’s and JCPenney overindex in “switched spending from” versus their position in the overall “have shopped” ranking.

- eBay also overindexes for “switched spending from”: As we show later, the company is now a relatively minor player in apparel, as measured by number of shoppers.

Base: 512 US Internet users aged 18+ who spend more of their clothing or footwear budget on Amazon.com than they did 12 months earlier

Base: 512 US Internet users aged 18+ who spend more of their clothing or footwear budget on Amazon.com than they did 12 months earlier Source: Coresight Research [/caption]

Where Do Consumers Buy Clothing and Footwear?

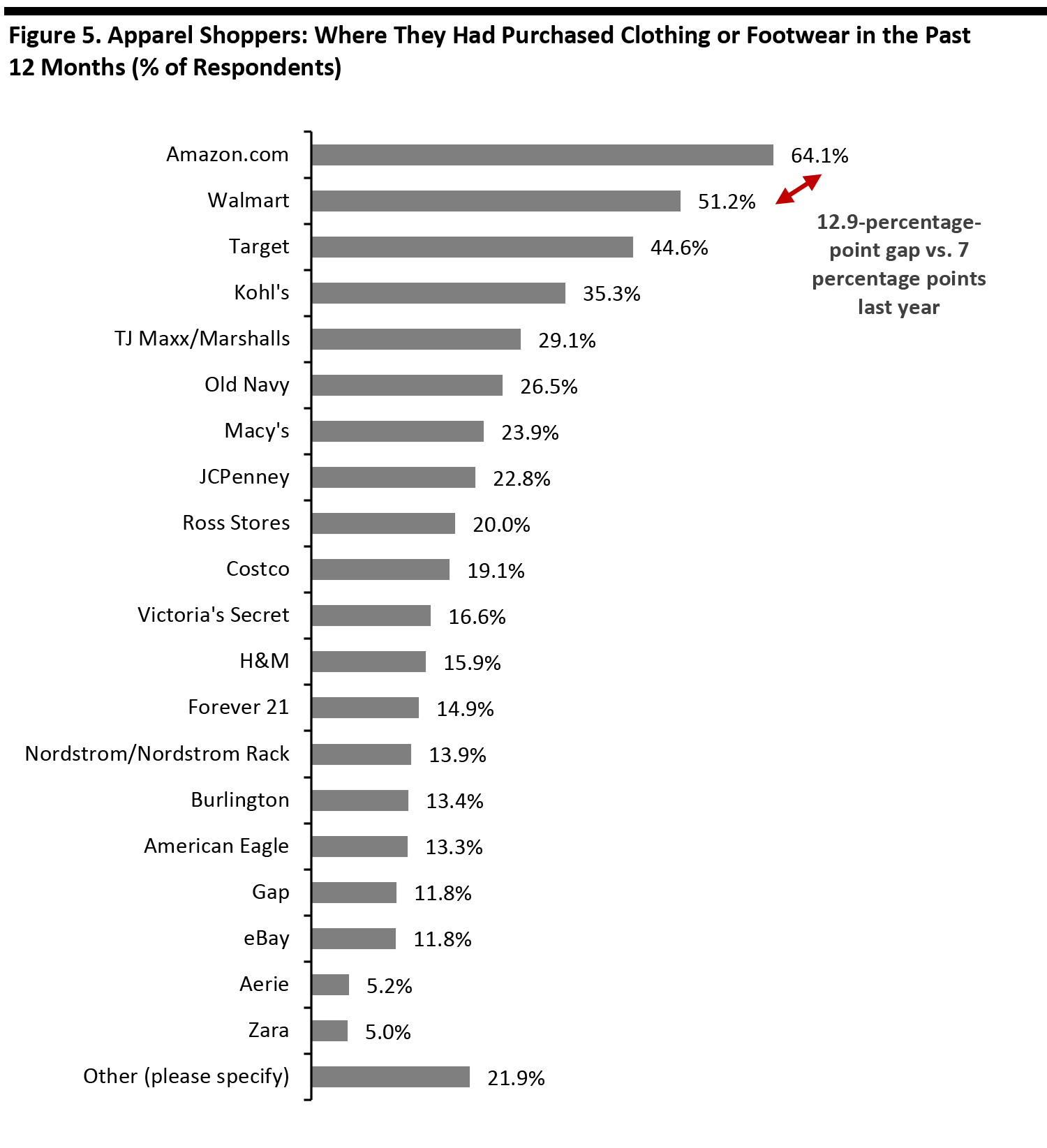

Amazon widened its lead over Walmart in the past 12 months—as measured by shopper numbers. We saw a near-13-percentage-point lead for Amazon this year, versus seven percentage points last year. Our overall ranking of where consumers had bought clothing or footwear remained largely stable year over year. As we have noted in previous years, eBay’s now relatively niche position in the market contrasts strongly with Amazon’s leadership.- For the question charted below, respondents were free to select any options from a list of major retailers; this was a different format from the forced yes/no question format used to definitively establish whether respondents had bought apparel on Amazon (shown in Figure 1).

Respondents were free to select any options from the list provided

Respondents were free to select any options from the list provided Base: 1,855 US Internet users aged 18+ who had purchased clothing or footwear in the past 12 months

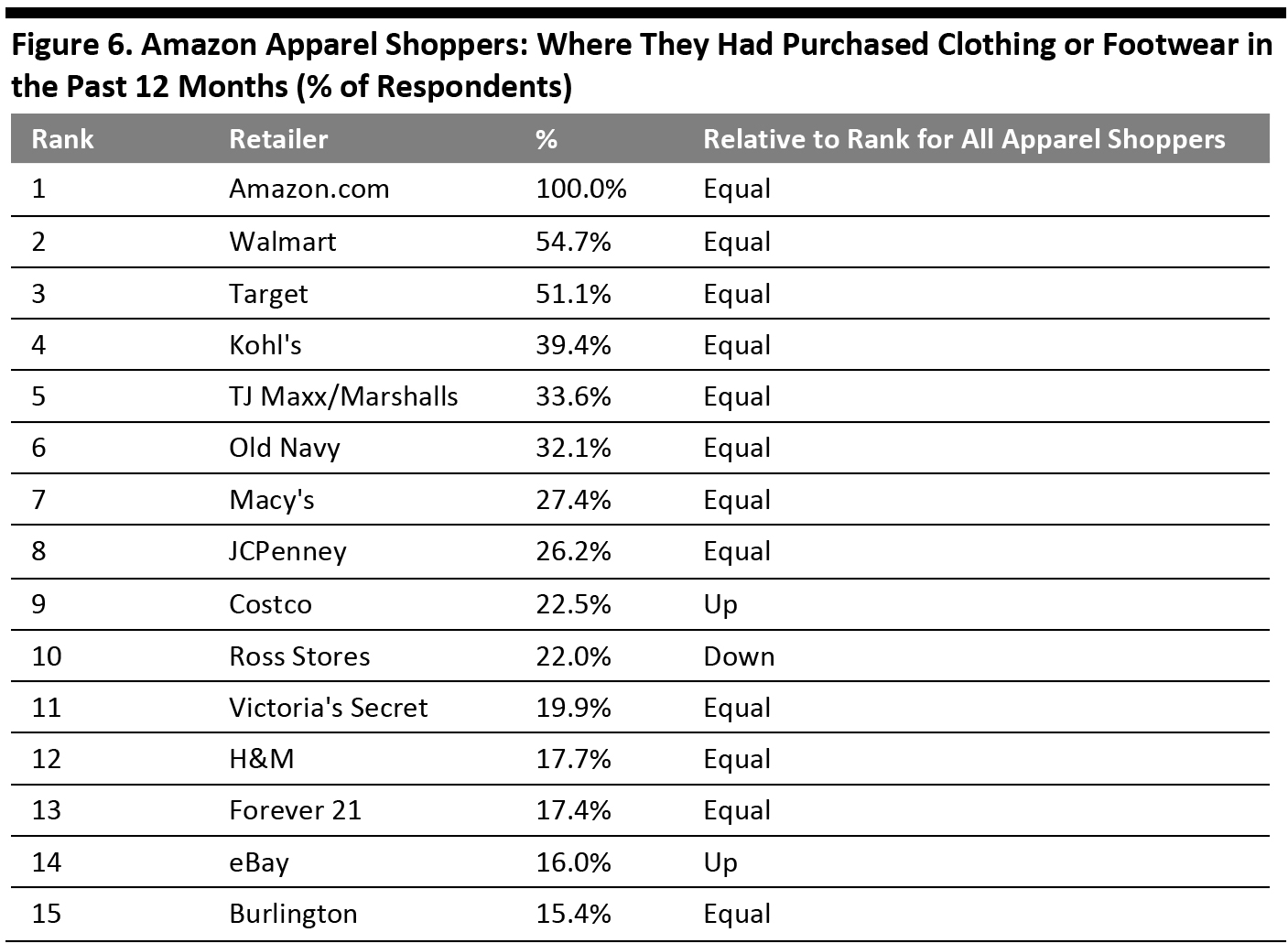

Source: Coresight Research [/caption] Among those who had bought clothing or footwear on Amazon, we see a very similar ranking, but with Costco and eBay moving up slightly, Ross Stores moving down one place and Nordstrom moving out of the top 15. [caption id="attachment_107653" align="aligncenter" width="700"]

Base: US Internet users aged 18+ who had purchased clothing or footwear on Amazon.com in the past 12 months

Base: US Internet users aged 18+ who had purchased clothing or footwear on Amazon.com in the past 12 months Source: Coresight Research [/caption]

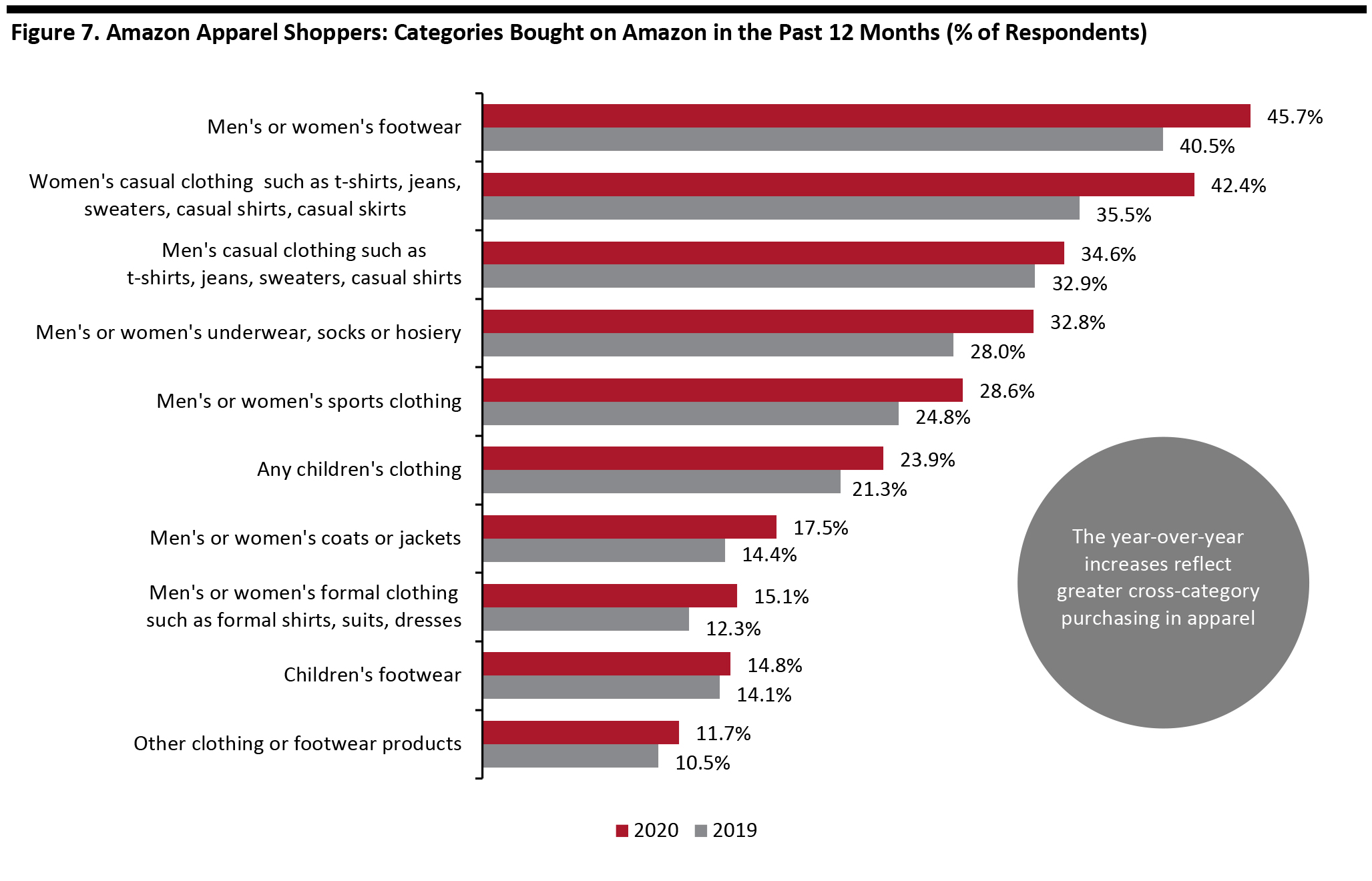

What Apparel Brands and Categories Shoppers Buy on Amazon

To understand what consumers are buying on Amazon, we asked those who had bought clothing or footwear on the site in the past 12 months what apparel brands and categories their purchases comprised. Footwear and Casual Wear Top the List of Most-Popular Purchases on Amazon Fashion Our survey found year-over-year upticks in the proportion of Amazon apparel shoppers buying across all categories, which reflects increased cross-category purchasing within clothing and footwear on Amazon.com. Confirming this, our repertoire analysis found that the average Amazon apparel shopper this year said they had purchased 2.7 clothing and footwear categories on the site versus 2.3 in each of the prior two years we conducted this survey. Apparel demand is more than just clothing: In fact, each year, our survey finds that adult footwear is the most-shopped category of the options we offer respondents. This year, women’s and men’s casual wear retained second and third positions, respectively. Versus 2019, adult footwear increased by 5.2 percentage points to 45.7%, while women’s casual wear showed a very substantial 6.8-percentage-point uptick. Children’s clothing and footwear, formalwear and coats and jackets are significantly less popular categories on the site. [caption id="attachment_107654" align="aligncenter" width="700"] Not all year-over-year differences are statistically significant

Not all year-over-year differences are statistically significant US Internet users aged 18+ who had purchased clothing or footwear on Amazon.com in the past 12 months (985 in 2019 and 1,308 in 2020)

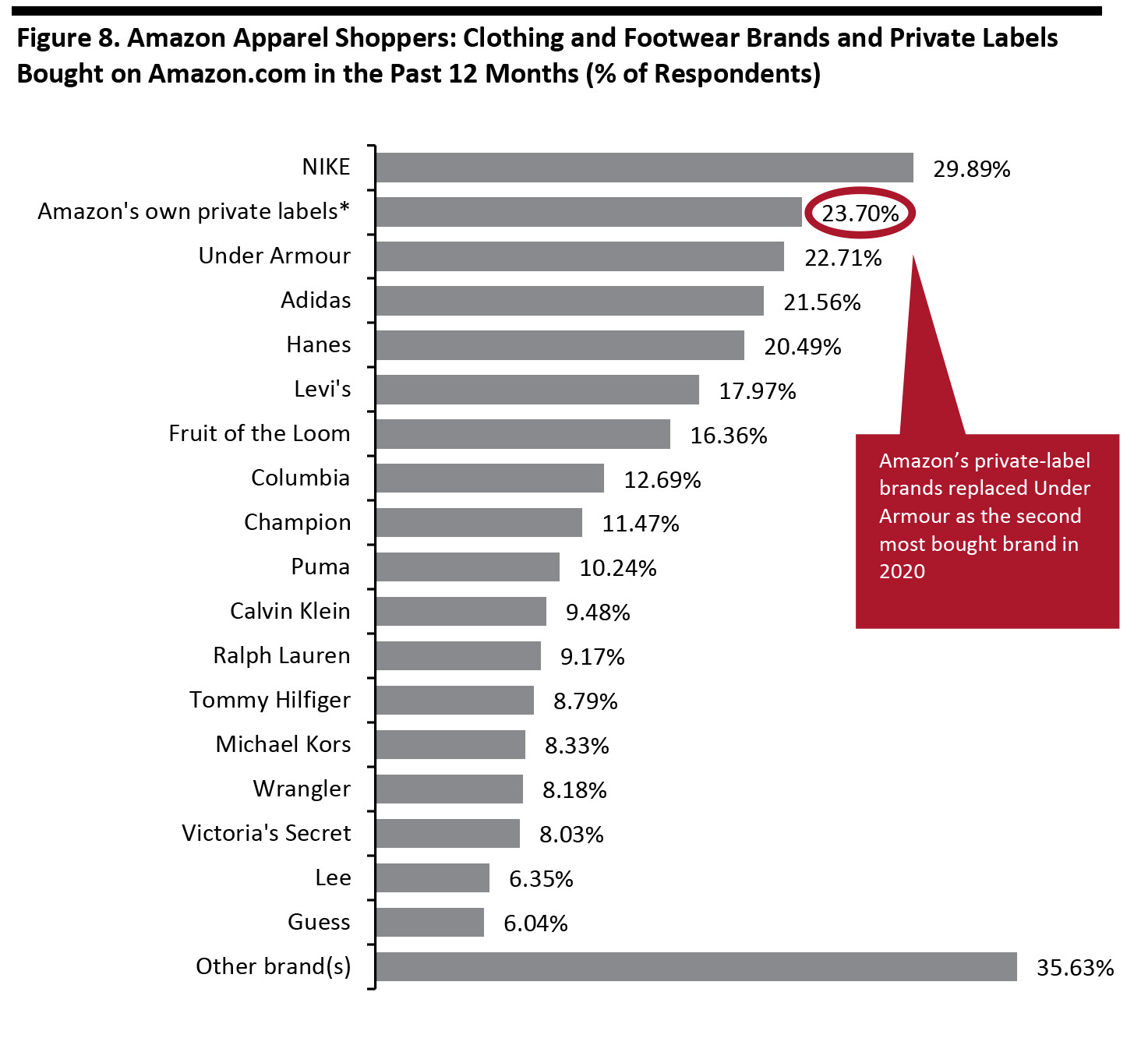

Source: Coresight Research [/caption] Amazon Charges Ahead with Private Labels NIKE remains the most-bought apparel brand on Amazon, reflecting its presence across both apparel and footwear and demand for the brand overall. NIKE recently announced that it will no longer directly sell on Amazon’s platform, but we expect that this will have minimal impact on Amazon.com’s offering, because according to our recent analysis of the platform’s US clothing offering, 92% of NIKE clothing items on the e-commerce site are listed by third-party sellers. Amazon’s apparel private labels are showing significant momentum, jumping from the fourth most bought brand in 2019 to second this year. By leveraging its online shelf space to sell private-label apparel, Amazon is changing the dynamics for category leaders by putting itself in direct competition with them. Brands can no longer view Amazon as solely an online intermediary but need to acknowledge the company as a competitor. Our survey provided respondents with several examples of Amazon’s private labels, in order to minimize any confusion about the company’s own private labels versus other brands featured on Amazon that respondents may not have been familiar with. [caption id="attachment_107656" align="aligncenter" width="700"]

*Including but not limited to Amazon Essentials, Lark & Ro, Scout + Ro, Goodthreads and Rebel Canyon

*Including but not limited to Amazon Essentials, Lark & Ro, Scout + Ro, Goodthreads and Rebel Canyon Base: 1,308 US Internet users aged 18+ who had bought clothing or footwear on Amazon.com in the past 12 months

Source: Coresight Research [/caption]

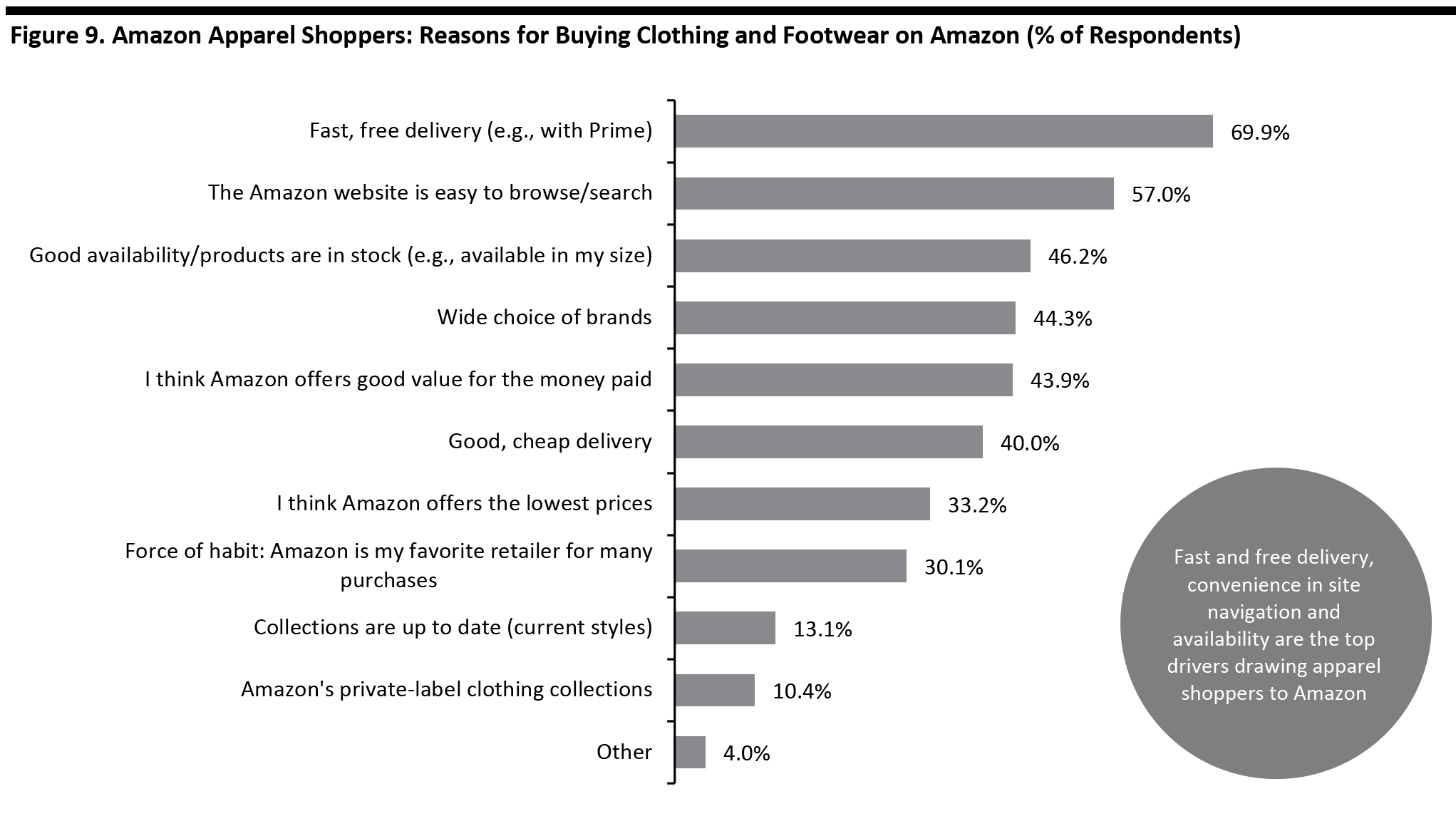

Why Consumers Shop on Amazon

To gauge why so many shoppers are opting to buy apparel on Amazon, we asked those who had bought clothing or footwear on the site in the past 12 months why they had made these apparel purchases. Free and Fast Shipping Outweighs Other Drivers Amazon apparel shoppers cited fast and free delivery, especially offered through Prime membership, as the top reason for buying clothing and footwear. More than two-thirds of the respondents who purchased clothing or footwear on Amazon (69.9%) said they valued this feature above all others. Ease of browsing/searching is the next most important driver in turning shoppers to Amazon, with 57% of the surveyed respondents citing this reason. This suggests that Amazon’s website delivers a quality experience—and runs counter to frequently observed commentary that Amazon.com is not set up to delivery such an experience for apparel shoppers. Lower price, another key factor that motivates shoppers to shop on Amazon, dropped by five percentage points versus last year, to 33.2%. The percentage of shoppers citing Amazon’s private labels increased from 7.0% in 2019 to 10.4% this year. [caption id="attachment_107657" align="aligncenter" width="700"] Base: 1,308 US Internet users aged 18+ who had bought clothing or footwear on Amazon.com in the past 12 months

Base: 1,308 US Internet users aged 18+ who had bought clothing or footwear on Amazon.com in the past 12 months Source: Coresight Research [/caption]

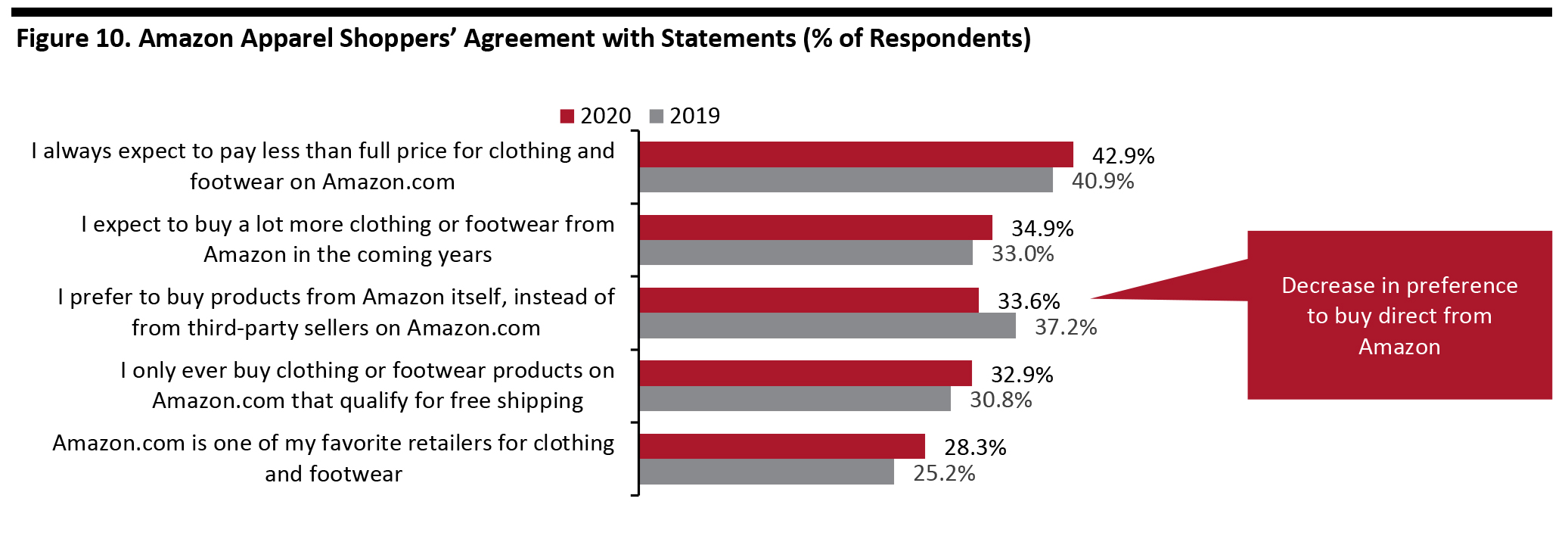

How Shoppers Perceive Amazon Fashion

In order to gauge Amazon apparel shoppers’ perception toward Amazon Fashion and their interest in new offerings and potential changes, we presented survey respondents with a series of statements and asked them to select any that they agreed with. Shopper’s Perceptions of Amazon Fashion Despite making efforts to establish itself as a full-line fashion store, Amazon is not yet able to shake off the discounter tag, as nearly 43% of survey respondents indicated that they expect to always pay less than full price for apparel items when shopping on the platform. This could support market-share gains by Amazon during and after the coronavirus crisis. Suggesting increased trust in third-party sellers on Amazon.com than previously, the percentage of respondents who prefer to buy directly from Amazon rather than from third-party sellers on the site dropped from 37.2% in 2019 to 33.6% in 2020. [caption id="attachment_107658" align="aligncenter" width="700"] Base: US Internet users aged 18+ who had purchased clothing or footwear on Amazon.com in the past 12 months (985 in 2019 and 1,308 in 2020)

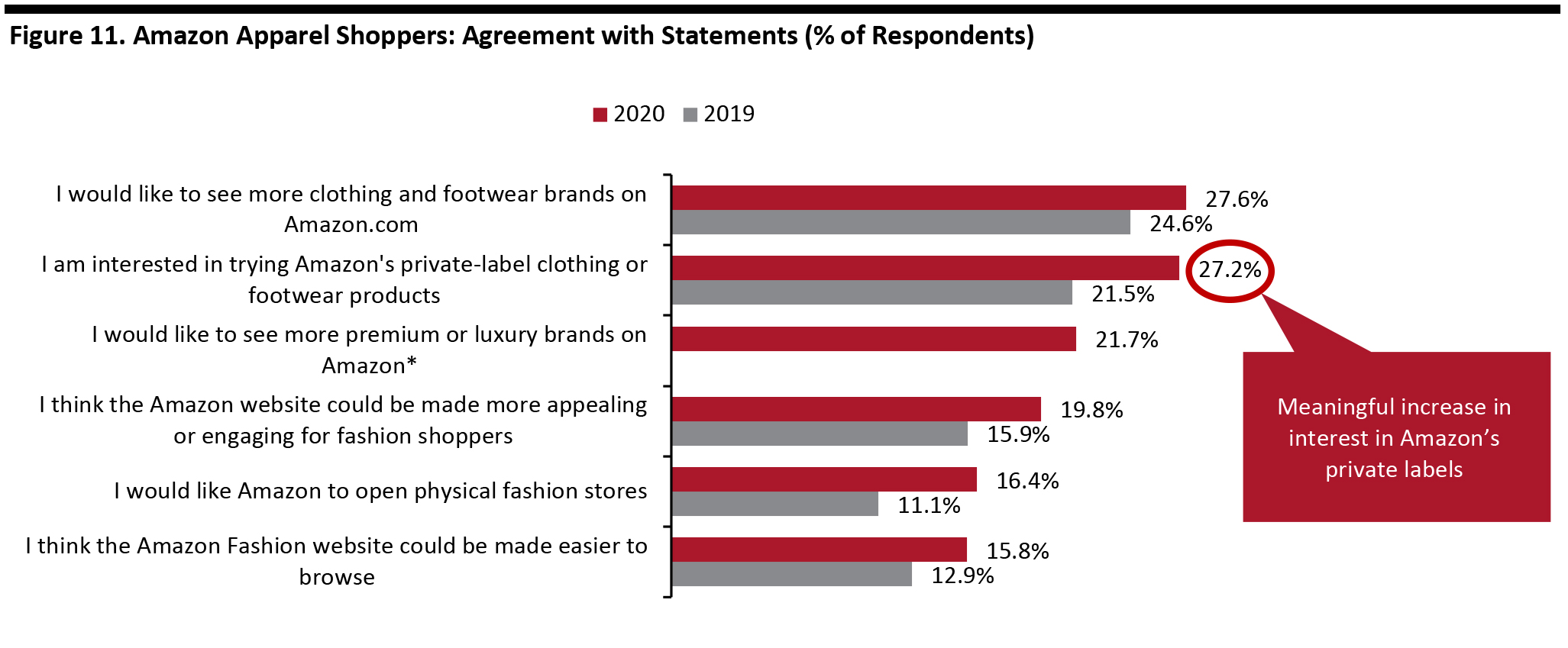

Base: US Internet users aged 18+ who had purchased clothing or footwear on Amazon.com in the past 12 months (985 in 2019 and 1,308 in 2020) Source: Coresight Research [/caption] Shoppers’ Expectation from Amazon Fashion The appeal of Amazon’s private-label clothing and footwear products is growing. More than one-quarter of respondents (27.22%) said they are interested in trying the online marketplace’s private-label apparel and footwear products, up by 5.7 percentage points from last year. Amazon apparel shoppers want the platform to incorporate more high-end fashion brands in its product mix, with a significant percentage of respondents (21.7%) indicating that they want to see more premium or luxury brands on the site. Just 15.8% of shoppers think that the website could be made easier to browse, which supports our earlier findings that the majority of the site’s apparel shoppers are satisfied with the online shopping experience provided by Amazon. Further reinforcing the perception of satisfaction is that only 19.8% of shoppers think the Amazon website could be made more appealing or engaging for fashion shoppers. [caption id="attachment_107659" align="aligncenter" width="700"]

*Not asked in 2019 survey

*Not asked in 2019 survey Base: US Internet users aged 18+ who had purchased clothing or footwear on Amazon.com in the past 12 months (985 in 2019 and 1,308 in 2020)

Source: Coresight Research [/caption]

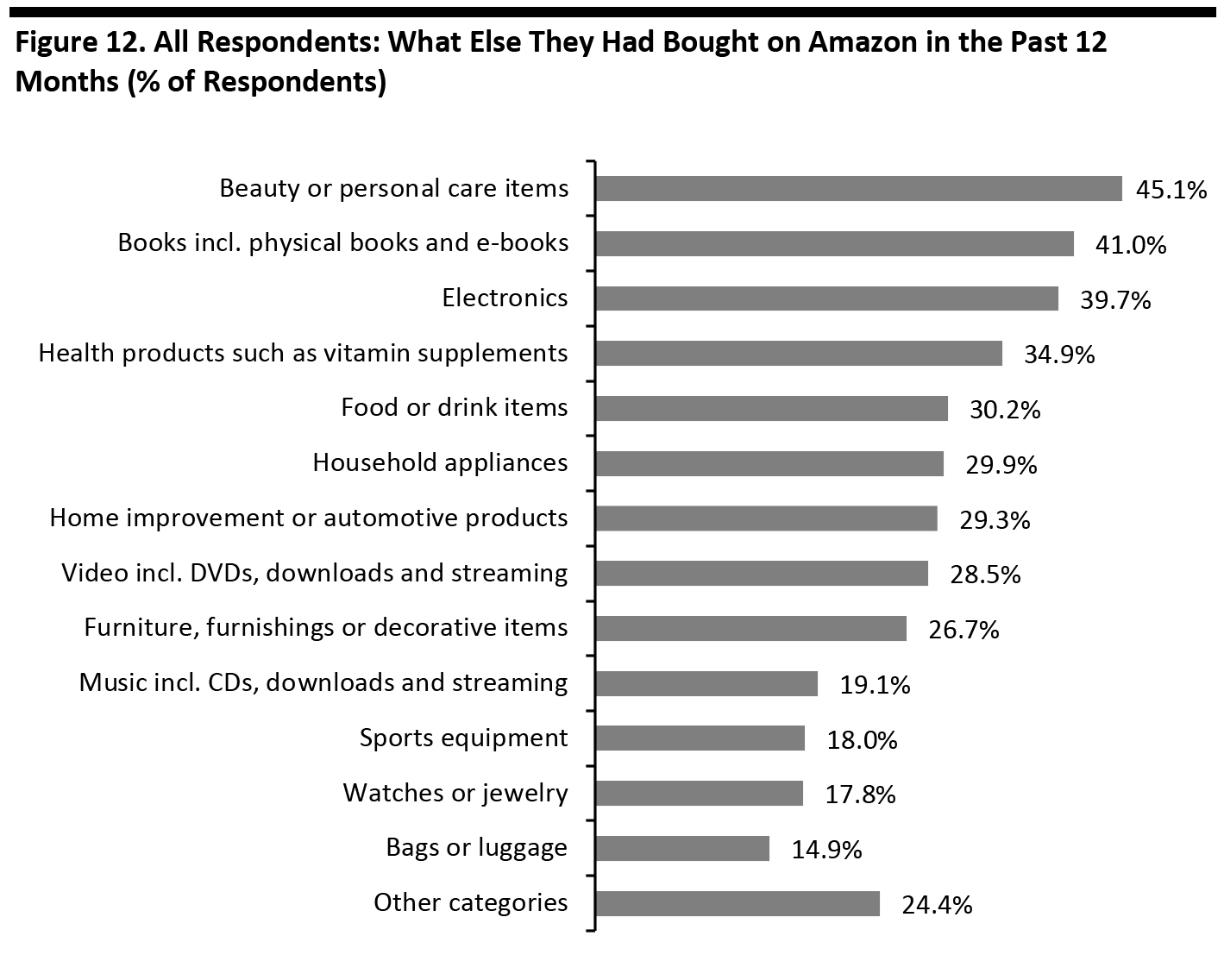

Apparel Remains the Most-Bought Category on Amazon

Measured by number of shoppers, clothing and footwear is comfortably the most bought category on Amazon. This is in line with our findings from 2019. Beauty and personal care follows in second place. Overall, 95% of respondents said they had bought something on Amazon in the past 12 months.- Note, the figure below shows the percentage of all respondents, while a number of earlier charts were of apparel or Amazon apparel shoppers.

Base: 1,934 US Internet users aged 18+

Base: 1,934 US Internet users aged 18+ Source: Coresight Research [/caption]

The Amazon Apparel Shopper

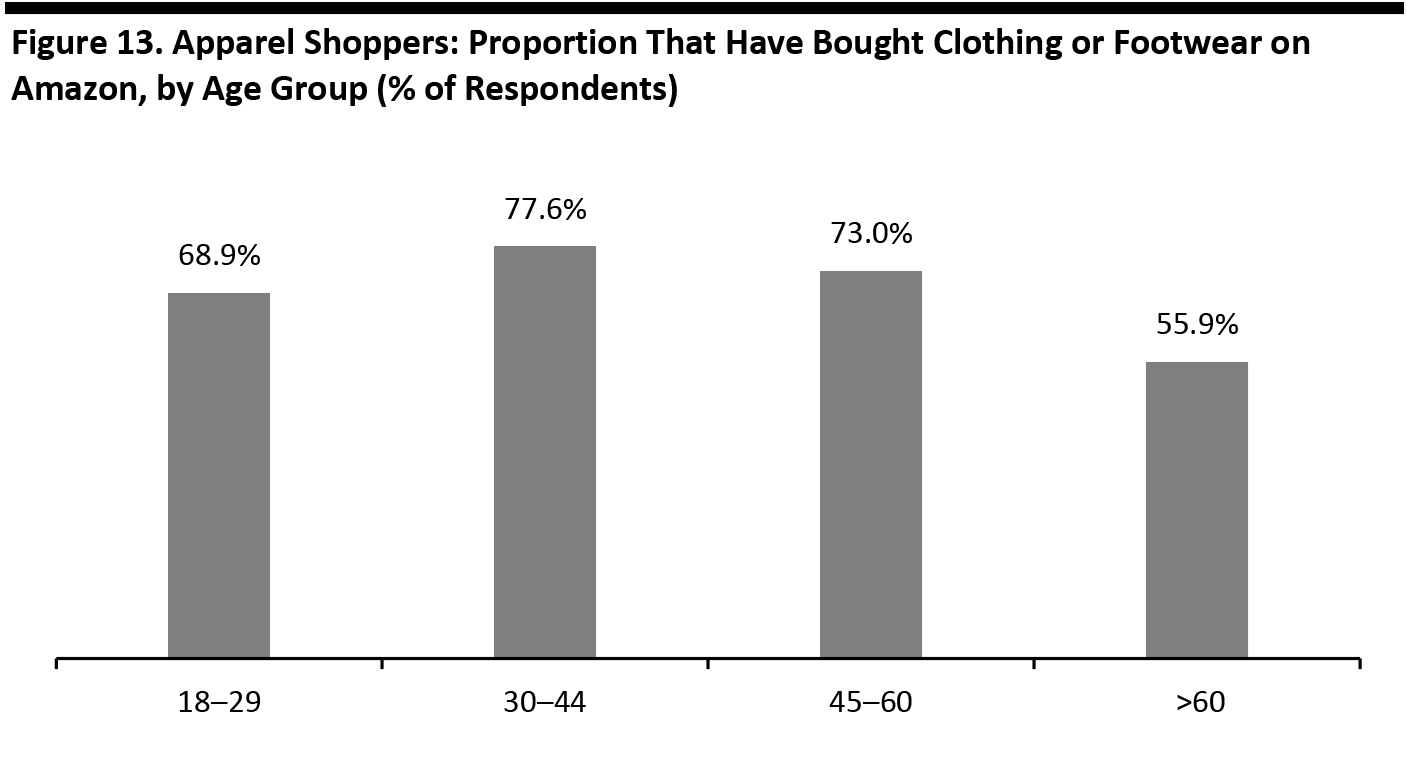

In addition to the analysis above, we conclude with further data on consumers who purchase clothing or footwear on Amazon.com. By age, the peak for shopping on Amazon.com is among those aged 30–44—very roughly, older millennials. Shopping for clothing or footwear on Amazon.com tails off for shoppers aged over 60. The base for this question is Internet users who have bought apparel in the past 12 months—so this tail-off by age cannot be accounted for by lower levels of Internet usage nor lower levels of apparel shoppers among this older age group. [caption id="attachment_107661" align="aligncenter" width="700"] Base: 1,855 US Internet users aged 18+ who had purchased clothing or footwear in the past 12 months

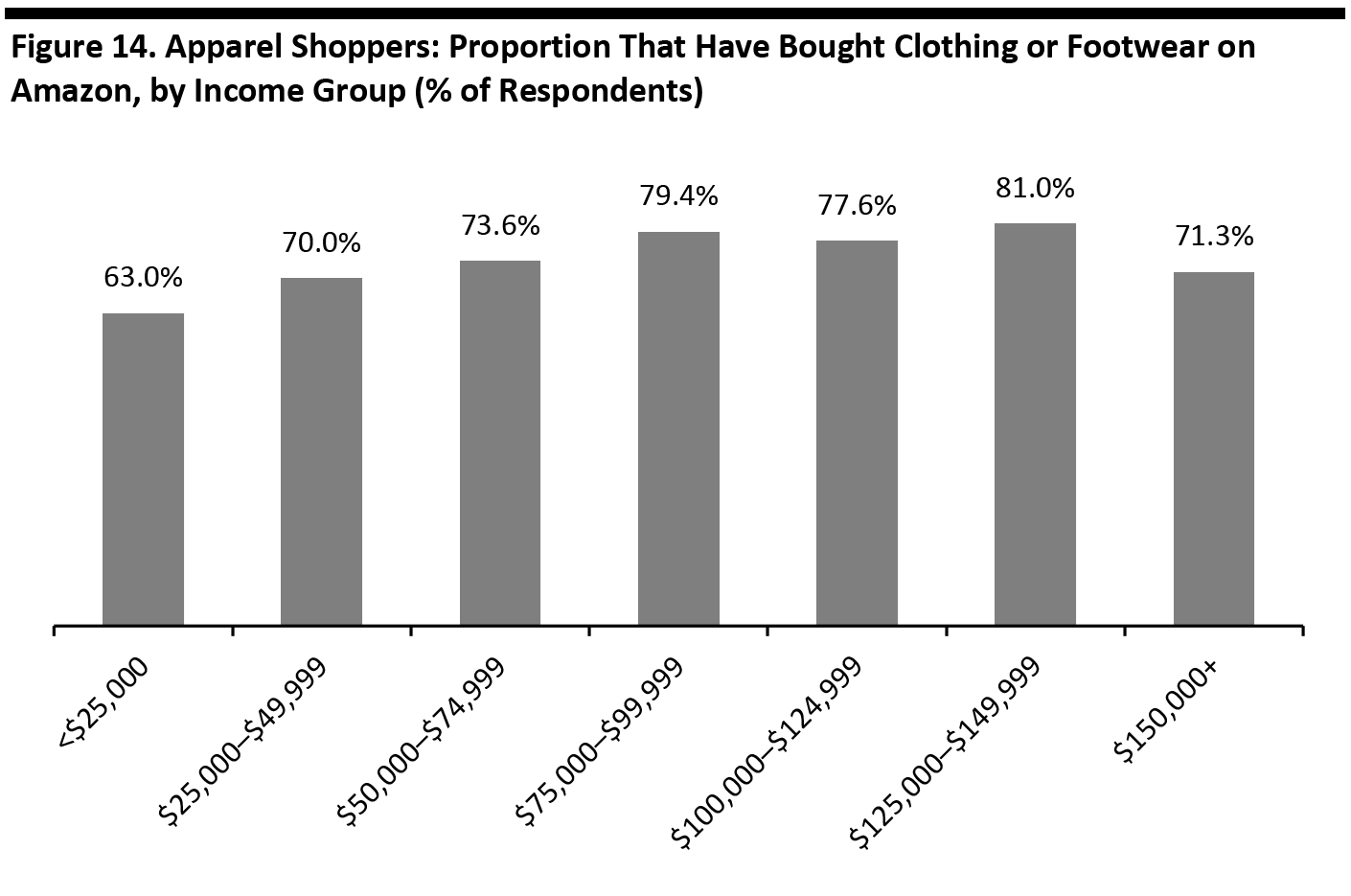

Base: 1,855 US Internet users aged 18+ who had purchased clothing or footwear in the past 12 months Source: Coresight Research [/caption] By income, we see a tail-off at either end of the income spectrum, but with penetration rates peaking among the more affluent $125,000–149,999 income bracket. [caption id="attachment_107662" align="aligncenter" width="700"]

Base: 1,855 US Internet users aged 18+ who had purchased clothing or footwear in the past 12 months

Base: 1,855 US Internet users aged 18+ who had purchased clothing or footwear in the past 12 months Source: Coresight Research [/caption]