albert Chan

https://youtu.be/Cxy7fT5JxXQ

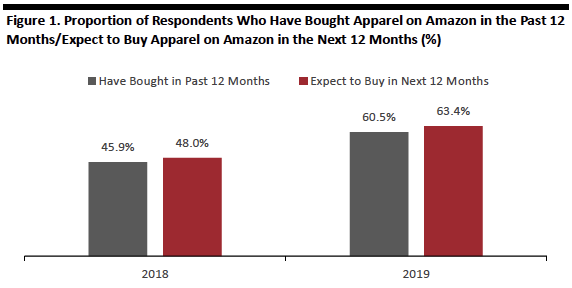

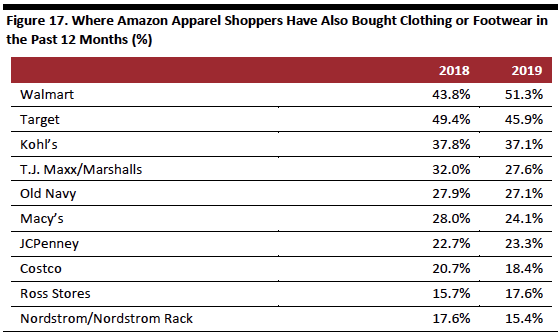

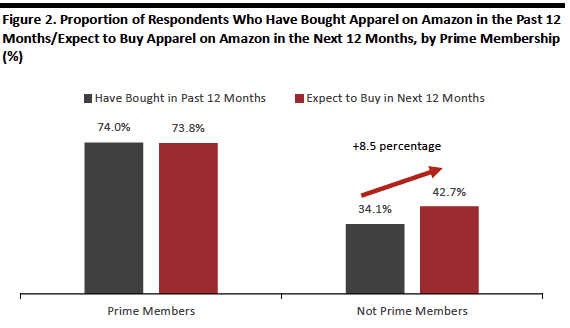

Base: US Internet users ages 18+ who have bought clothing or footwear in the past 12 months (1,628 in 2019; 1,564 in 2018)

Base: US Internet users ages 18+ who have bought clothing or footwear in the past 12 months (1,628 in 2019; 1,564 in 2018)

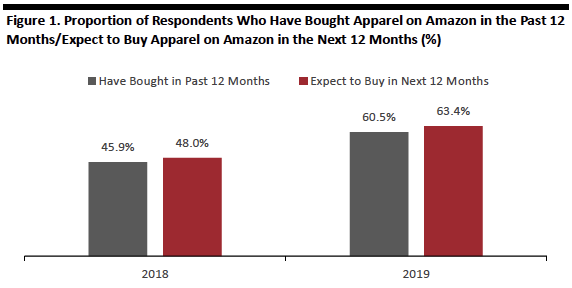

Survey questions: In the past 12 months, have you purchased any clothing or footwear on Amazon.com?/Looking ahead, do you think you are likely to purchase clothing or footwear on Amazon.com in the next 12 months?

Source: Coresight Research[/caption] Two further data points underscore the growing demand for fashion on Amazon: Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months,

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months,

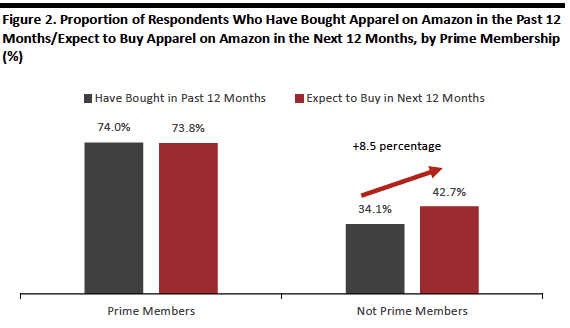

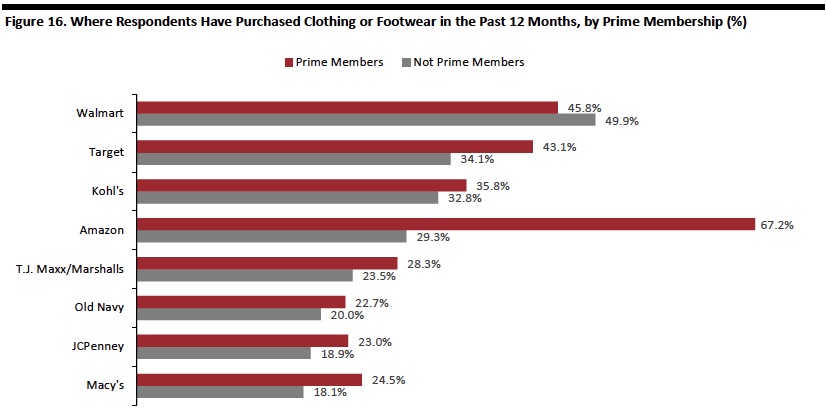

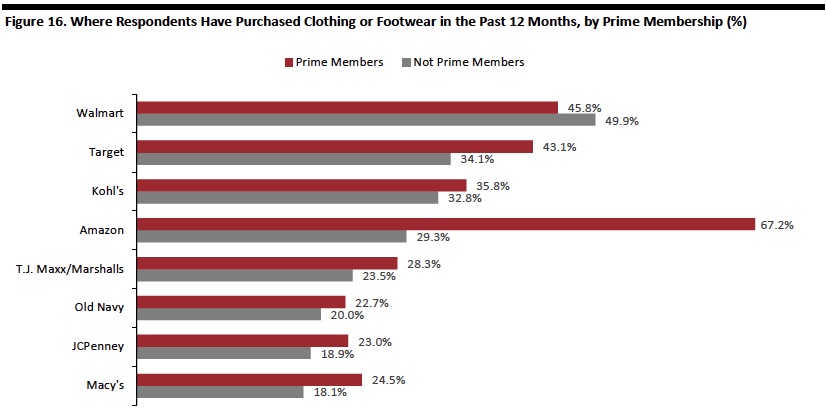

“Prime Members” have a personal Prime membership; “Not Prime Members” have no access to Prime benefits, including through a membership of someone else in their household.

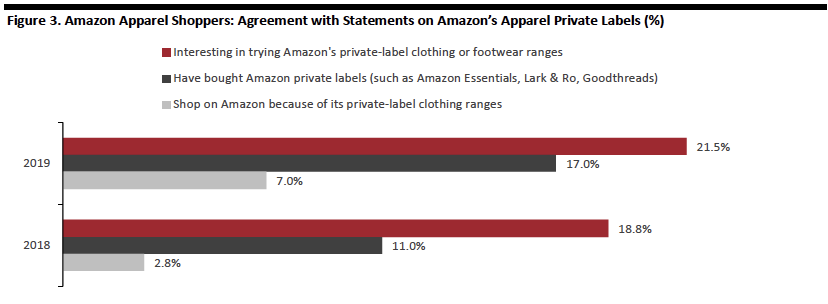

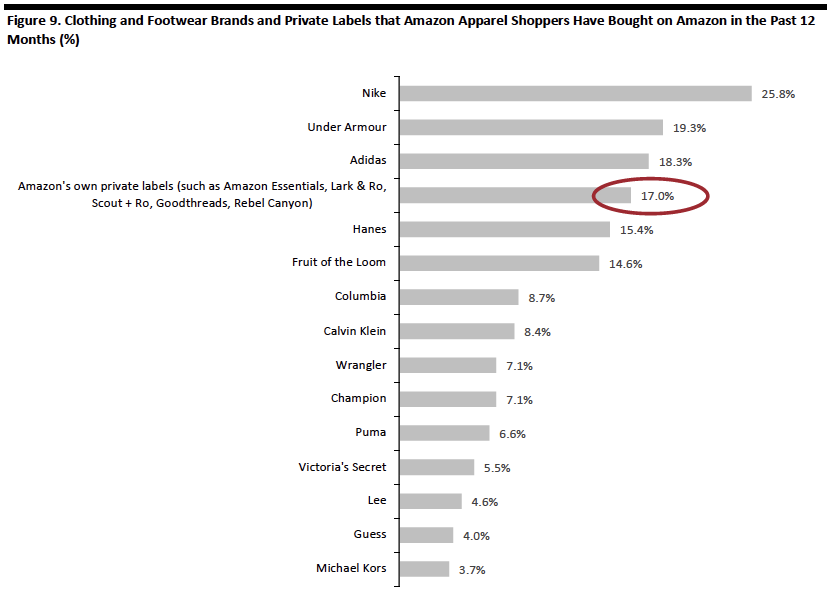

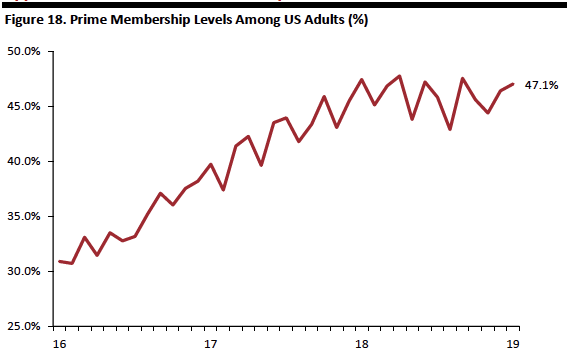

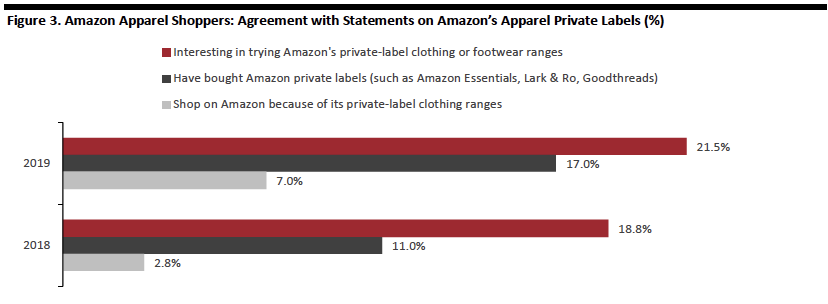

Source: Coresight Research[/caption] Further compounding the challenge in growing apparel shoppers with a Prime membership is an apparent levelling off of Prime membership rates among US consumers: See Appendix 1 for an illustration of this trend. In our 2019 survey, some 53% of those surveyed said they have a personal Prime membership and a further 23% said they have access to Prime benefits through someone else in their household. This is up from 43% and 21%, respectively, in our 2018 survey. 3. One in Six Amazon Apparel Shoppers Say They Have Bought Amazon Private-Label Clothing or Footwear Amazon continues to grow its private-label collections: Our June 2018 analysis found Amazon.com offered 4,904 private-label apparel products, and that these accounted for fully three-quarters of all Amazon private-label products. Our latest survey indicates substantial shopper demand for these collections: One in six Amazon Fashion shoppers said they have already bought from one of its growing collection of private labels and more than one in five are interested in trying Amazon’s apparel offerings. Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (985 in 2019; 719 in 2018)

Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (985 in 2019; 719 in 2018)

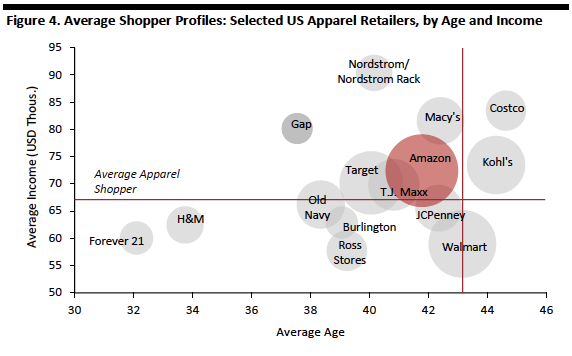

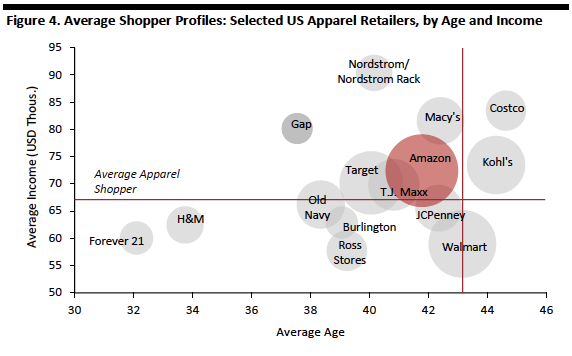

Source: Coresight Research[/caption] 4. Amazon Has Established Its #1 Position by Penetrating the Heart of the Mid-Market Our analysis indicates that the profile of average Amazon apparel shopper is very close to the profile of the average apparel shopper overall — in other words, Amazon is at the heart of the mid-market in the apparel category. By age and income, Amazon’s average shopper is similar to those at several department stores, mass merchandisers and off-pricers. As shown below, the typical Amazon apparel shopper has a household income that is similar to the average shoppers of Target, T.J.Maxx/Marshalls and Kohl’s. And the age of the average Amazon shopper is similar to that of the average shopper at T.J. Maxx/Marshalls, Macy’s and JCPenney. The average Amazon shopper is slightly younger than the average apparel shopper but slightly older than those of Target, the off-pricers and specialty stores such as Old Navy, H&M and Forever 21. [caption id="attachment_79086" align="aligncenter" width="550"] Bubble size represents shopper numbers. Note that average age excludes shoppers ages under 18, who were not surveyed. T.J. Maxx includes Marshalls.

Bubble size represents shopper numbers. Note that average age excludes shoppers ages under 18, who were not surveyed. T.J. Maxx includes Marshalls.

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months

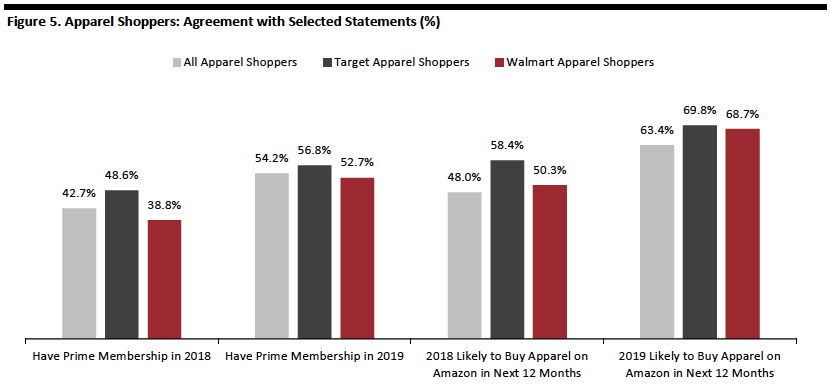

Source: Coresight Research[/caption] Confirming this mid-market positioning, our survey suggests that Amazon and Target remain head to head in apparel — and Amazon looks to be competing head-on with Walmart more than it was last year. Base: US Internet users ages 18+ who have bought clothing or footwear in the past 12 months (1,628 in 2019; 1,564 in 2018)

Base: US Internet users ages 18+ who have bought clothing or footwear in the past 12 months (1,628 in 2019; 1,564 in 2018)

Source: Coresight Research[/caption] 5. Shoppers Say the Amazon Website Is Fit for Fashion A criticism frequently made of Amazon is that its site is not equipped to cater to the desires and aspirations of fashion shoppers: Commentators frequently opine that Amazon.com may be suited to selling books and electronics but it is less equipped to sell dresses and shirts. However, our survey suggests that few of its customers perceive such a problem: Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months

Source: Coresight Research[/caption] Base: 379 US Internet users ages 18+ who spend more of their clothing and footwear budget at Amazon than they did one year ago

Base: 379 US Internet users ages 18+ who spend more of their clothing and footwear budget at Amazon than they did one year ago

Survey question: You have indicated that you spend more of your clothing and footwear budget at Amazon.com than you used to. Which retailer(s) have you switched this spending from? Select all that apply.

Source: Coresight Research[/caption] To some extent, the ranking shown above reflects the scale of these retailers and the total number of shoppers they have. It is logical that larger retailers would tend to lose the most, in absolute terms, when shoppers switch their spending from one retailer to another. But the ranking does not track scale exactly. Below, we compare the top five retailers that respondents said they had switched spending to Amazon from with the top five they said they had bought apparel from in the past 12 months. The comparison shows that Macy’s and JCPenney overindex in terms of switching to Amazon, relative to their overall strength in shopper numbers. [caption id="attachment_79090" align="aligncenter" width="546"] Source: Coresight Research[/caption]

What Apparel Brands and Categories Shoppers Buy on Amazon

Key findings:

Source: Coresight Research[/caption]

What Apparel Brands and Categories Shoppers Buy on Amazon

Key findings:

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Which, if any, of the following clothing or footwear brands and private labels have you purchased on Amazon.com in the past 12 months? Select all that apply.

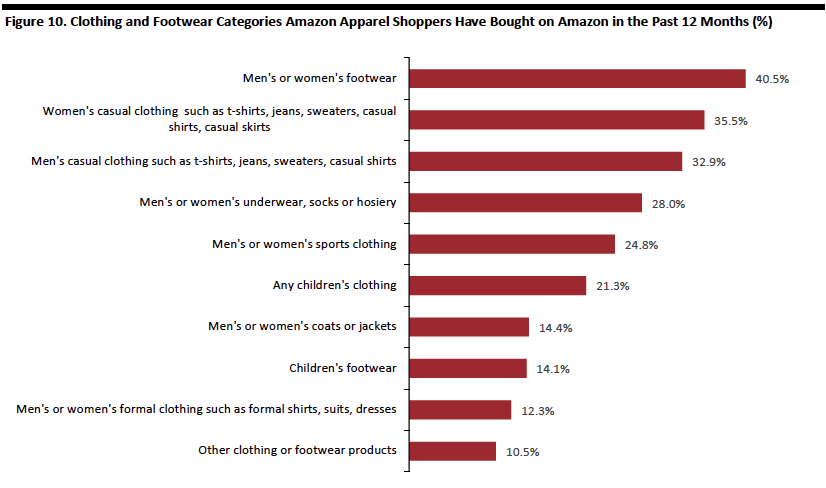

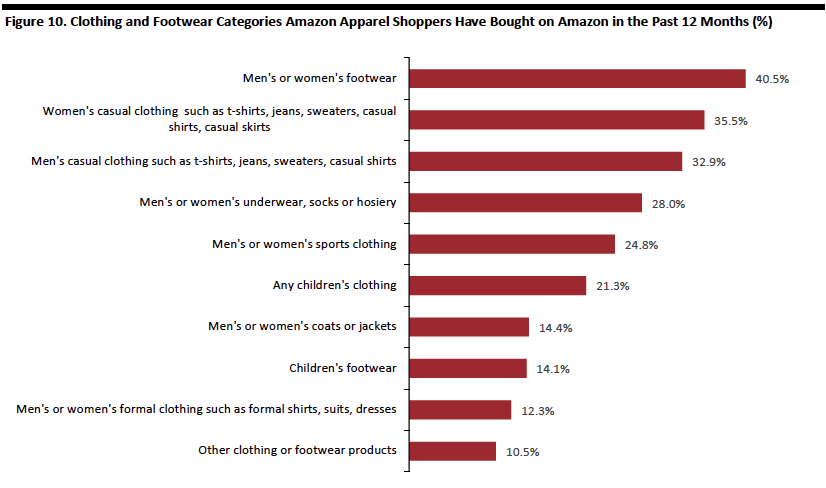

Source: Coresight Research[/caption] Footwear and Casual Clothing Are the Most-Bought Categories on Amazon Fashion Men’s and women’s footwear and adult casualwear top the categories that shoppers buy on Amazon Fashion. Underwear and sportswear are middle-ranking categories. Children’s clothing and footwear, men’s and women’s coats and jackets, and adult formal clothing are significantly less popular categories on the site. [caption id="attachment_79092" align="aligncenter" width="700"] Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Which of these categories have you bought on Amazon.com in the past 12 months?

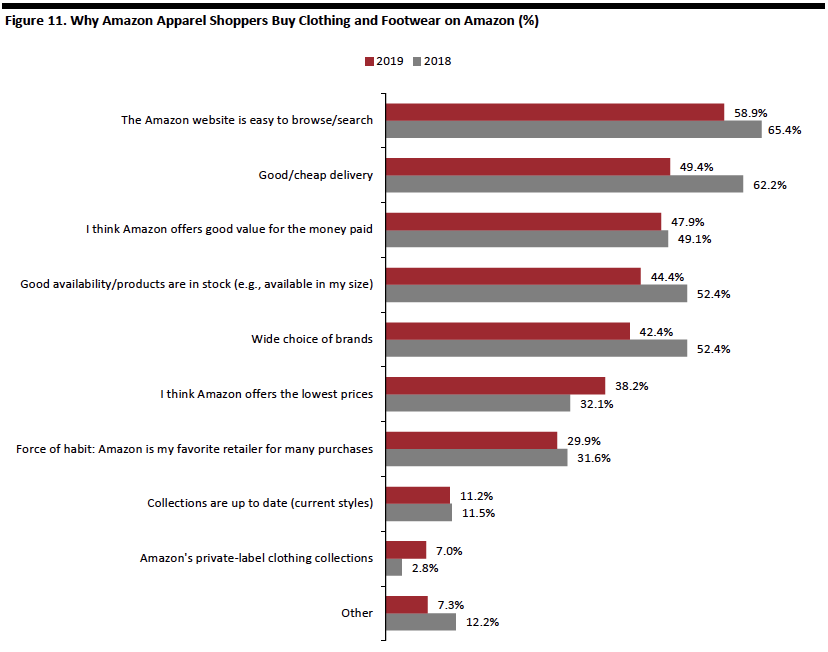

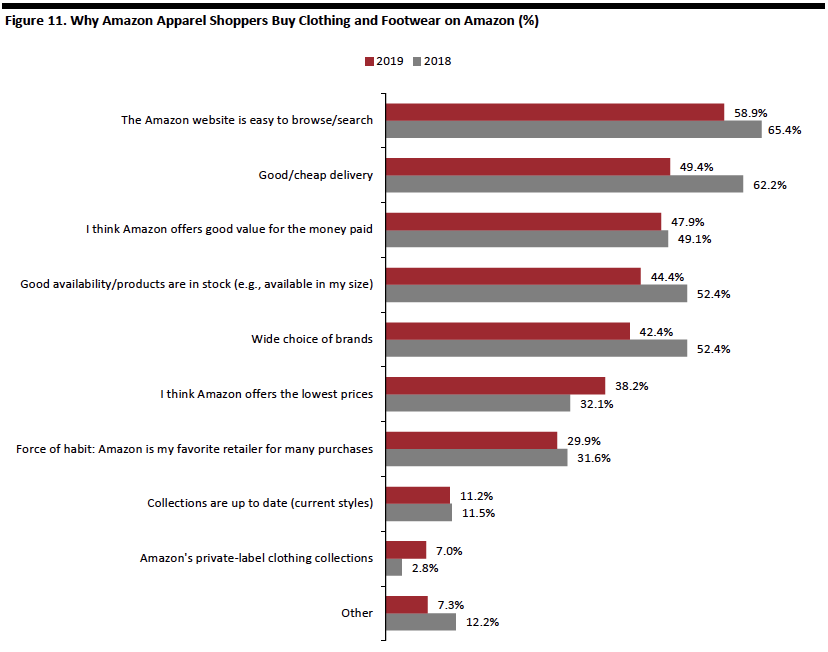

Source: Coresight Research[/caption] Why Consumers Shop on Amazon: Ease of Shopping Beats Fulfillment, Price and Choice as the Top Driver Key findings: Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (985 in 2019; 719 in 2018)

Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (985 in 2019; 719 in 2018)

Survey question: Why do you shop for clothing or footwear on Amazon.com? Select all that apply.

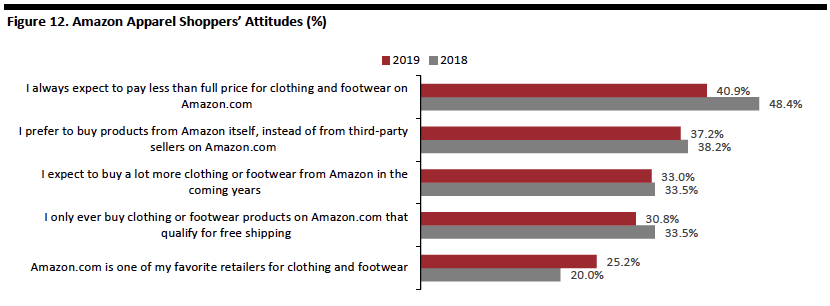

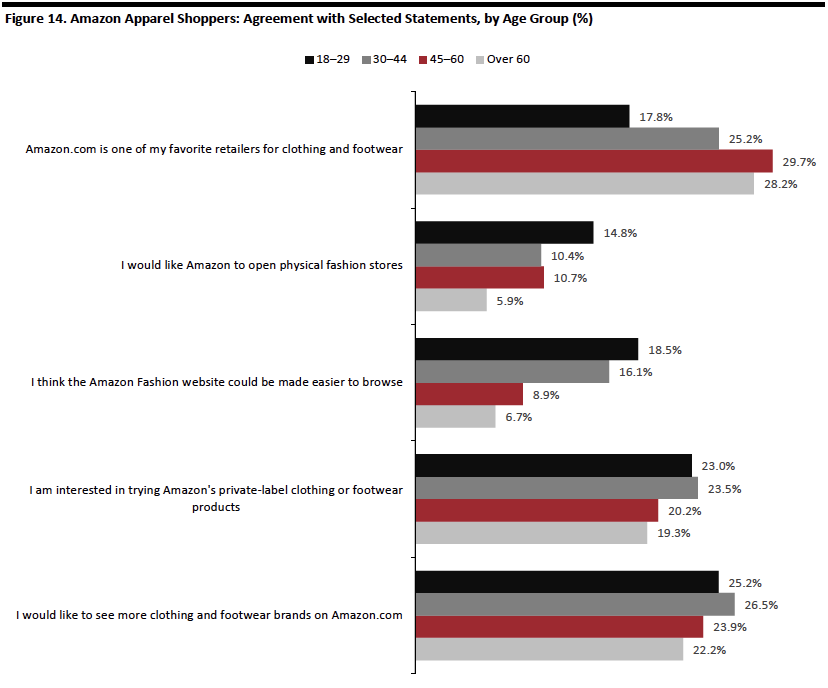

Source: Coresight Research[/caption] How Shoppers View Amazon Fashion: Younger Shoppers Want the Full Experience but Older Shoppers More Likely to Consider Amazon.com as One of Their Favorite Apparel Retailers Key findings: Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Which, if any, of the following statements about shopping for clothing and footwear on Amazon.com do you agree with? Select all that apply.

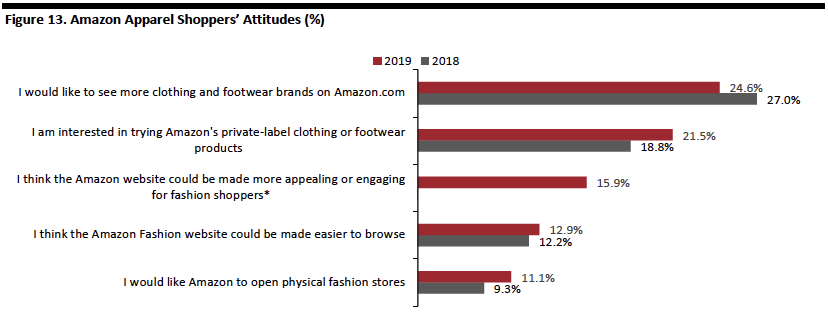

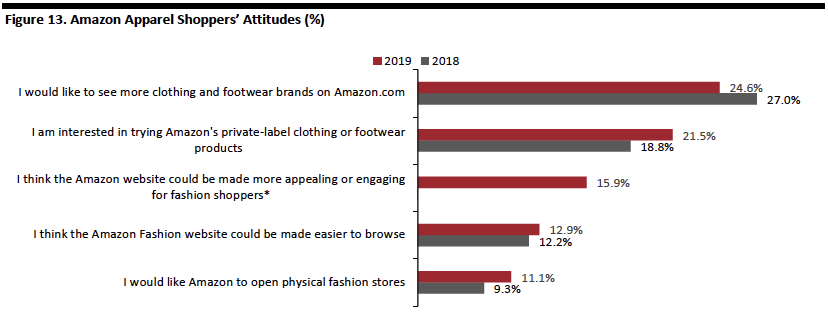

Source: Coresight Research[/caption] What Shoppers Want from Amazon Fashion One-quarter of Amazon apparel shoppers would like to see more clothing and footwear brands on the site. A meaningful 21.5% of Amazon apparel shoppers are interested in trying the retailer’s private labels, up from 18.8% last year, with the shift likely reflecting the media coverage that those private labels have garnered. Just 12.9% think that the website could be made easier to browse (broadly comparable with last year), indicating that the majority of the site’s apparel shoppers are satisified with the Amazon Fashion shopping experience. Further reinforcing the perception of satisfaction is that only 15.9% think the Amazon website could be made more appealing or engaging for fashion shoppers. [caption id="attachment_79095" align="aligncenter" width="700"] Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Survey question: Which, if any, of the following statements about shopping for clothing and footwear on Amazon.com do you agree with? Select all that apply.

*Statement not included in 2018 survey.

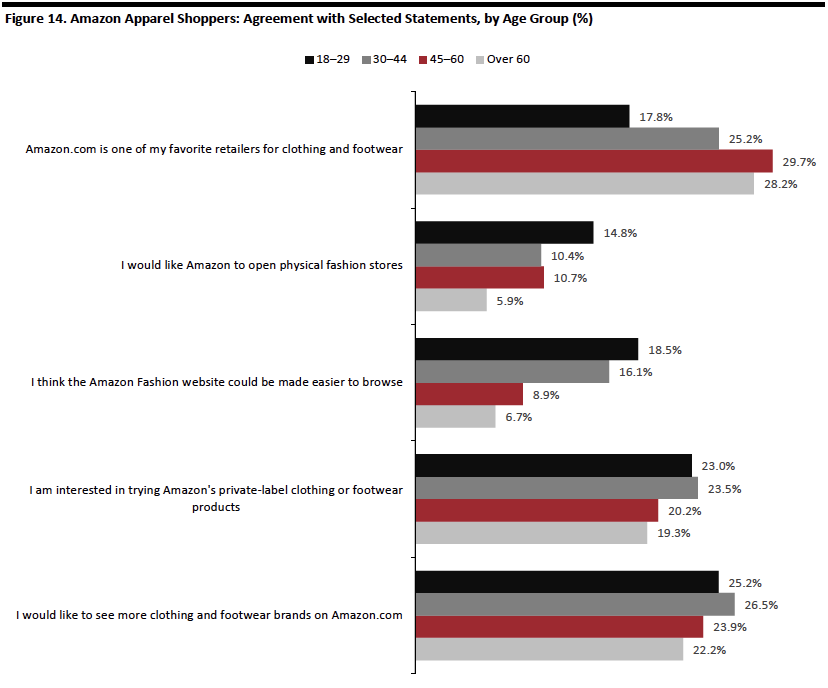

Source: Coresight Research[/caption] Younger Consumers Tend to be More Interested in Amazon Building Out Its Apparel Proposition Many younger shoppers registered higher interest than older shoppers in Amazon’s private labels and the possibility of Amazon opening physical fashion stores; they also are the cohort most faulting Amazon’s browsability. On the other hand, older consumers were more likely to consider Amazon.com as one of their favorite clothing and footwear retailers. Given Amazon’s supremacy in terms of broad assortment, ease of shopping, efficiency and speedy delivery, older shoppers, who are likely to know what brand and size they want, are more apt to choose Amazon as a top apparel retail choice. Younger shoppers exploring fashion are shopping the mall and downtown destinations to touch and feel product and discover and explore new brands; reflecting this demand for physical stores, younger shoppers are more likely than older shoppers to want Amazon to open brick-and-mortar fashion stores. [caption id="attachment_79096" align="aligncenter" width="700"] Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

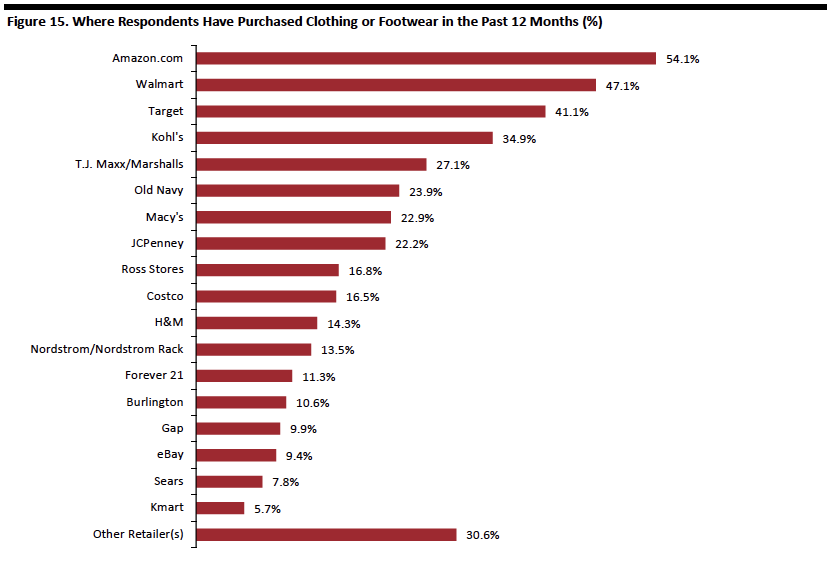

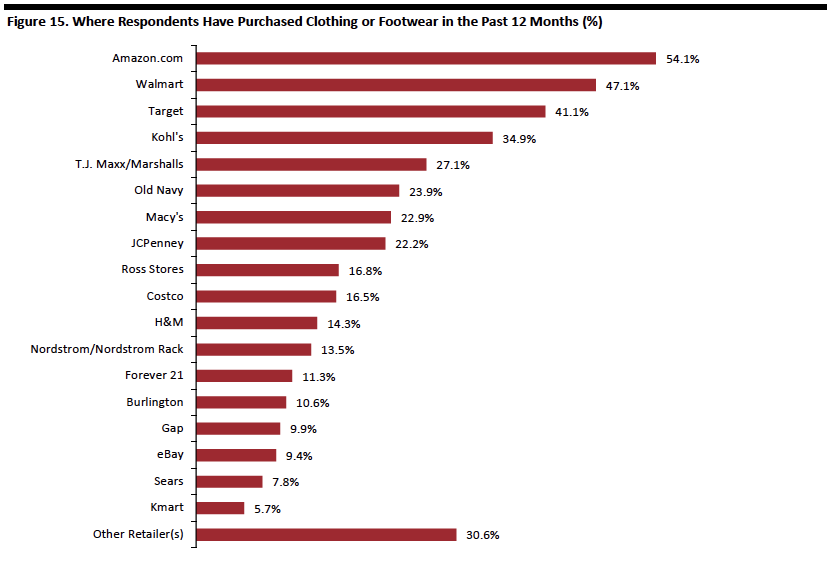

Source: Coresight Research[/caption] Prime Members Push Amazon to First Place Among America’s Clothing and Footwear Retailers Key findings: Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months

Survey question: Which retailers have you bought clothing or footwear from in the past 12 months (whether online or in-store)? Select all that apply.

Respondents were free to to select any options from the list provided; this is a different format from the forced yes/no question format used to establish whether respondents had bought apparel on Amazon, and it yields different results from those shown earlier.

Source: Coresight Research[/caption] Prime members are responsible for pushing Amazon up the “most-shopped retailer” ranking. Among Prime members, Amazon is by far the leading retailer for clothing and footwear, as measured by number of shoppers. This is balanced out by Amazon ranking relatively low among those with no access to Prime: In fact, Amazon is fourth-most-popular retailer among those who do not subscribe to Prime, behind Walmart, Target and Kohl’s. [caption id="attachment_79098" align="aligncenter" width="700"] Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months, including 914 with a personal Amazon Prime membership

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months, including 914 with a personal Amazon Prime membership

Respondents were free to to select any options from the list provided; this is a different format from the forced yes/no question format used to establish whether respondents had bought apparel on Amazon, and it yields different results from those shown earlier.

“Prime Members” have a personal Prime membership; “Not Prime Members” have no access to Prime benefits, including through a membership of someone else in their household.

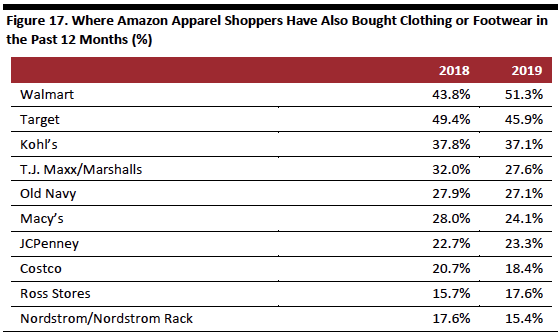

Source: Coresight Research[/caption] Where Else Do Amazon Apparel Shoppers Buy Clothing and Footwear? Walmart is the leading alternative clothing and footwear retailer for Amazon apparel shoppers according to our 2019 survey results, up from second place in 2018. Target fell from first place to second place as the alternative source for Amazon apparel shoppers. We think Walmart’s switch from second to first place highlights the incremental shift of Amazon, from a more niche or peripheral apparel destination to one shopped by mass-market consumers — such as those who shop at Walmart. A further contributing factor to the Walmart/Target switch may be Target’s launch of 20 private label apparel brands in the past three years: We believe this effort is likely to have fortified Target’s appeal among apparel shoppers. [caption id="attachment_79099" align="aligncenter" width="550"] Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (985 in 2019; 719 in 2018)

Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (985 in 2019; 719 in 2018)

Source: Coresight Research[/caption] Apparel Is the Top-Shopped Category on Amazon.com Our survey found that clothing and footwear moved to the top most-shopped category on Amazon in the past 12 months, up from #4 in 2018. Rounding out the top five categories that shoppers buy on Amazon.com are books (including e-books), beauty and personal care products, electronics, and health products (such as vitamin supplements).

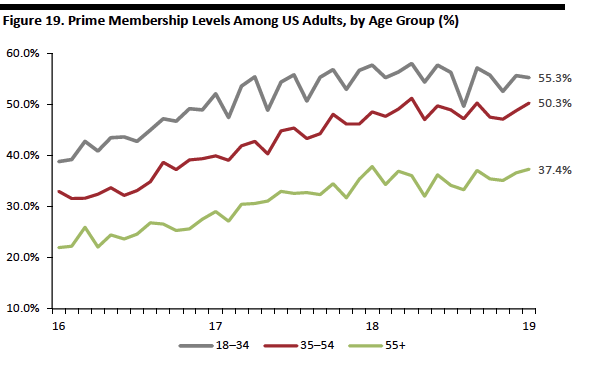

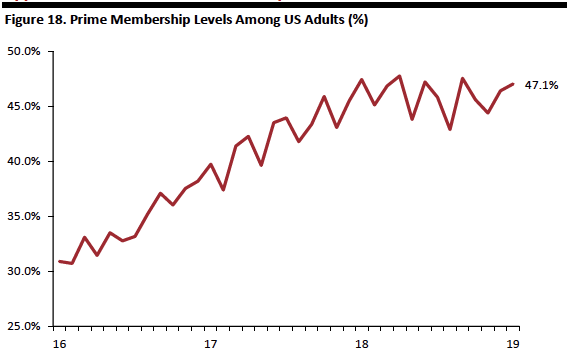

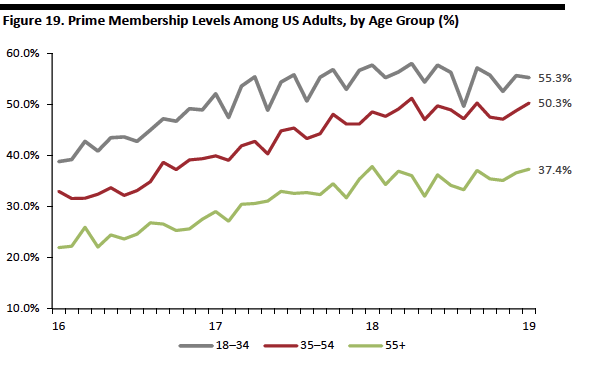

Through January 2019

Through January 2019

Base: 7,000+ US Internet users ages 18+ in each month

Survey question: Do you have an Amazon Prime membership?

Source: Prosper Insights & Analytics[/caption] [caption id="attachment_79101" align="aligncenter" width="550"] Through January 2019

Through January 2019

Base: 7,000+ US Internet users ages 18+ in each month

Survey question: Do you have an Amazon Prime membership?

Source: Prosper Insights & Analytics[/caption]

Introduction: Our Second Annual Survey of Amazon Apparel Shoppers

Pundits, consultants and Wall Street analysts all have much to say about Amazon’s expansion into apparel. A number of analysts have attempted to quantify Amazon’s apparel sales — though the resulting dollar figures are, in all cases, only best estimates. Amazon apparel sales remain difficult to quantify with any accuracy given Amazon’s limited disclosure on category sales — and it is further complicated by Amazon’s mix of first-party sales, where Amazon is the retailer, and third-party sales, where Amazon is merely an intermediary between seller and buyer. This report takes a deep dive into Amazon apparel, using the findings of our second annual online survey of US apparel shoppers, a sizable proportion of whom had bought clothing or footwear on Amazon during the past 12 months. We explore how many US consumers are buying apparel on Amazon, which retailers these shoppers have switched their spending from, what clothing and footwear brands and categories they are buying on Amazon, their attitudes toward Amazon Fashion and its offerings, and where else, besides Amazon Fashion, they shop for apparel. For some of these metrics, we present comparisons between our new findings and those from our 2018 survey. Throughout this report, “apparel” refers to both clothing and footwear. This report forms part of our How the US Shops series, in which we share insights into shopper behavior from original consumer research. Our most recent US consumer survey was carried out online among 1,732 adults between January 28 and February 5, 2019. Notes on our survey methodology can be found at the end of this report. The main body of this report discusses our survey findings, question by question. First, though, we bring together data points from various questions in our survey as we discuss six major themes that emerged from our research.Our Top Six Survey Findings

1. Amazon Has Become America’s Most-Shopped Clothing and Footwear Retailer In the 12 months since we conducted our comparable survey of US apparel shoppers, Amazon jumped from joint second place (with Target) to first place among US apparel retailers, as measured by the number of shoppers that bought clothing or footwear from the retailer in the past year. This year, fully 60.5% of all respondents said they bought clothing or footwear on Amazon, versus less than half last year. We have seen a similar jump in the proportion that expects to buy apparel on Amazon in the next 12 months, too. [caption id="attachment_79082" align="aligncenter" width="550"] Base: US Internet users ages 18+ who have bought clothing or footwear in the past 12 months (1,628 in 2019; 1,564 in 2018)

Base: US Internet users ages 18+ who have bought clothing or footwear in the past 12 months (1,628 in 2019; 1,564 in 2018)Survey questions: In the past 12 months, have you purchased any clothing or footwear on Amazon.com?/Looking ahead, do you think you are likely to purchase clothing or footwear on Amazon.com in the next 12 months?

Source: Coresight Research[/caption] Two further data points underscore the growing demand for fashion on Amazon:

- This year, one-quarter of respondents agreed with the statement “Amazon.com is one of my favorite retailers for clothing and footwear,” up from one in five last year.

- Apparel is now the most-bought category on Amazon, by number of shoppers: We asked respondents which categories they had bought on Amazon.com and clothing and footwear leapt from fourth most popular category last year to #1 this year, pushing it ahead of books, beauty and electronics.

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months,

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months,“Prime Members” have a personal Prime membership; “Not Prime Members” have no access to Prime benefits, including through a membership of someone else in their household.

Source: Coresight Research[/caption] Further compounding the challenge in growing apparel shoppers with a Prime membership is an apparent levelling off of Prime membership rates among US consumers: See Appendix 1 for an illustration of this trend. In our 2019 survey, some 53% of those surveyed said they have a personal Prime membership and a further 23% said they have access to Prime benefits through someone else in their household. This is up from 43% and 21%, respectively, in our 2018 survey. 3. One in Six Amazon Apparel Shoppers Say They Have Bought Amazon Private-Label Clothing or Footwear Amazon continues to grow its private-label collections: Our June 2018 analysis found Amazon.com offered 4,904 private-label apparel products, and that these accounted for fully three-quarters of all Amazon private-label products. Our latest survey indicates substantial shopper demand for these collections: One in six Amazon Fashion shoppers said they have already bought from one of its growing collection of private labels and more than one in five are interested in trying Amazon’s apparel offerings.

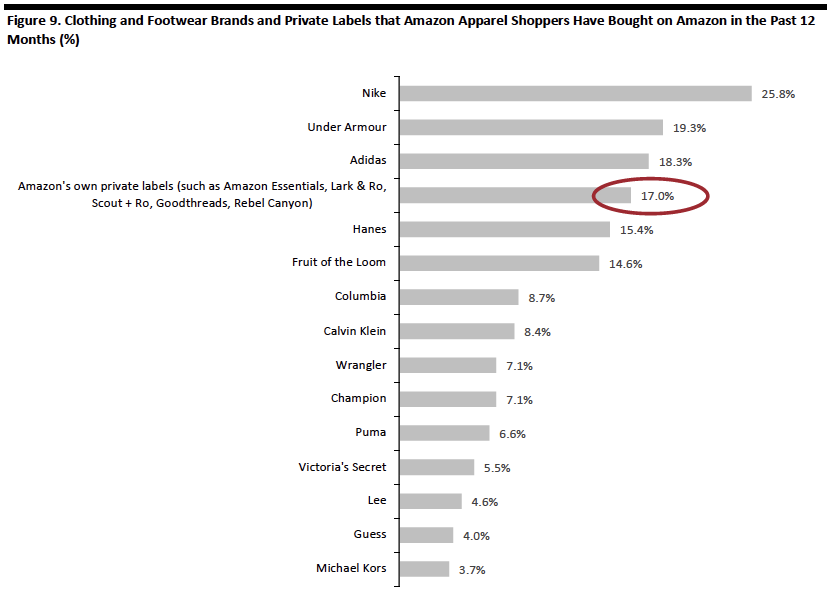

- Amazon’s private-label ranges are the fourth-most-bought clothing or footwear “brand” on Amazon.com. Among the brand options we asked respondents to choose from, only Nike, Under Armour and Adidas ranked higher than Amazon’s private labels, collectively.

- The 17.0% who said they bought those private labels compared to 11.0% when we surveyed Amazon apparel shoppers last year.

- More than one in five Amazon apparel shoppers are interested in trying the retailer’s apparel private labels. While only 7% of those we surveyed said that those labels were what specifically attracted them to shop on Amazon, this is up meaningfully from just under 3% last year.

Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (985 in 2019; 719 in 2018)

Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (985 in 2019; 719 in 2018)Source: Coresight Research[/caption] 4. Amazon Has Established Its #1 Position by Penetrating the Heart of the Mid-Market Our analysis indicates that the profile of average Amazon apparel shopper is very close to the profile of the average apparel shopper overall — in other words, Amazon is at the heart of the mid-market in the apparel category. By age and income, Amazon’s average shopper is similar to those at several department stores, mass merchandisers and off-pricers. As shown below, the typical Amazon apparel shopper has a household income that is similar to the average shoppers of Target, T.J.Maxx/Marshalls and Kohl’s. And the age of the average Amazon shopper is similar to that of the average shopper at T.J. Maxx/Marshalls, Macy’s and JCPenney. The average Amazon shopper is slightly younger than the average apparel shopper but slightly older than those of Target, the off-pricers and specialty stores such as Old Navy, H&M and Forever 21. [caption id="attachment_79086" align="aligncenter" width="550"]

Bubble size represents shopper numbers. Note that average age excludes shoppers ages under 18, who were not surveyed. T.J. Maxx includes Marshalls.

Bubble size represents shopper numbers. Note that average age excludes shoppers ages under 18, who were not surveyed. T.J. Maxx includes Marshalls.Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months

Source: Coresight Research[/caption] Confirming this mid-market positioning, our survey suggests that Amazon and Target remain head to head in apparel — and Amazon looks to be competing head-on with Walmart more than it was last year.

- When we asked Amazon clothing and footwear shoppers which retailers they had switched apparel spending from, the number one answer this year was Walmart, closely followed by Target (see later for full data). We believe this reflects Amazon’s incremental shift toward the very heart of the apparel market, given Walmart has long been the biggest retailer of apparel in the US.

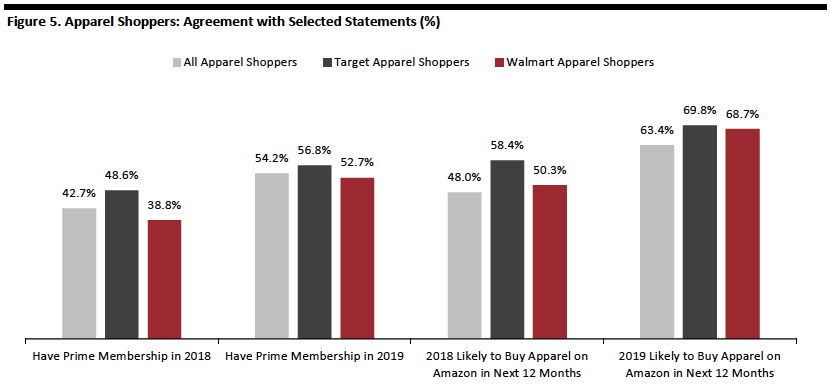

- Target shoppers continue to overindex versus the average and versus Walmart shoppers in terms of expecting to buy clothing or footwear on Amazon in the next 12 months, as we chart below. Target apparel shoppers are also more likely than average to have an Amazon Prime membership — and our survey confirms that Prime membership drives apparel shopping on Amazon.

- In addition to Old Navy and Target shoppers, shoppers at T.J. Maxx/Marshalls, JCPenney, Macy’s and Kohls are more likely than the average shopper to say they expect to buy apparel on Amazon in the next 12 months.

Base: US Internet users ages 18+ who have bought clothing or footwear in the past 12 months (1,628 in 2019; 1,564 in 2018)

Base: US Internet users ages 18+ who have bought clothing or footwear in the past 12 months (1,628 in 2019; 1,564 in 2018)Source: Coresight Research[/caption] 5. Shoppers Say the Amazon Website Is Fit for Fashion A criticism frequently made of Amazon is that its site is not equipped to cater to the desires and aspirations of fashion shoppers: Commentators frequently opine that Amazon.com may be suited to selling books and electronics but it is less equipped to sell dresses and shirts. However, our survey suggests that few of its customers perceive such a problem:

- Just 15.9% of all Amazon apparel shoppers agreed with the statement “I think the Amazon website could be made more appealing or engaging for fashion shoppers.”

- And only 12.9% of Amazon apparel shoppers agreed with the statement “I think the Amazon Fashion website could be made easier to browse.” This statement saw a similarly low response rate in last year’s survey.

- Meanwhile, fully 59.9% cited the ease of browsing or searching the Amazon website as a reason for buying apparel there — in fact, this was the number one reason for buying apparel on Amazon.com. This was the top reason last year, too, though with a slightly higher 65.5% stating it as a reason for shopping on Amazon.

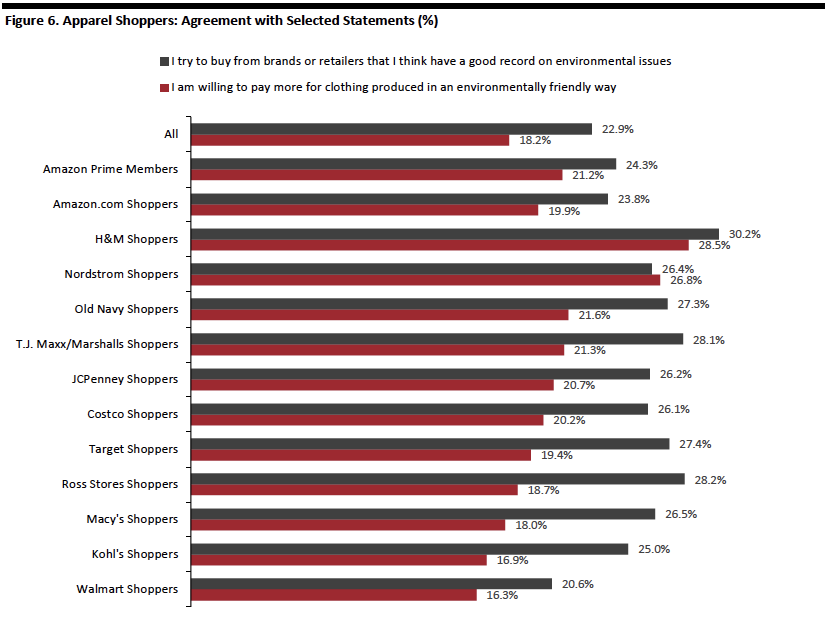

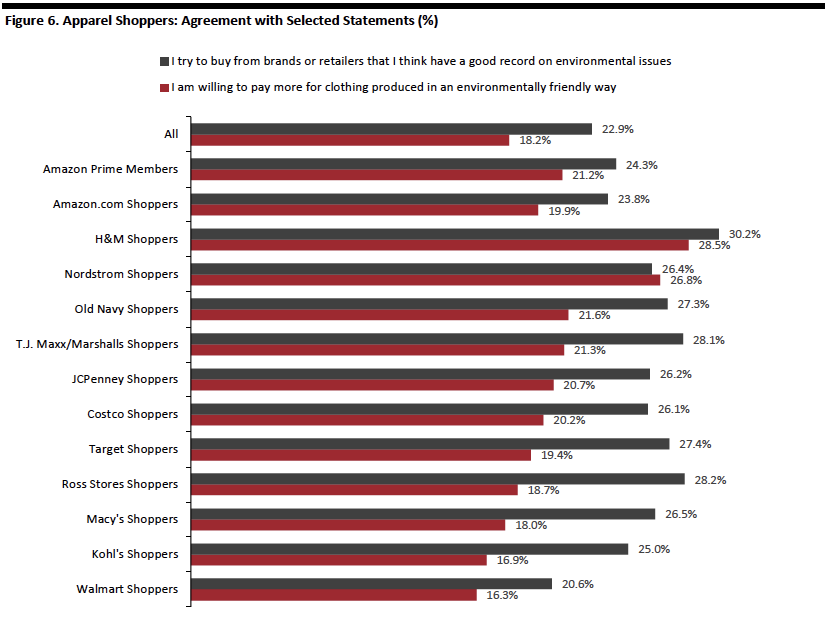

- Among customers of the 12 most-shopped retailers, Amazon shoppers recorded the second-lowest level of agreement with the statement “I try to buy from brands or retailers that I think have a good record on environmental issues”; only Walmart shoppers recorded lower rates of agreement.

- Amazon shoppers show slightly above-average agreement with the statement “I am willing to pay more for clothing produced in an environmentally friendly way,” though agreement levels are far below those of several major store-based competitors, such as H&M and Nordstrom.

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 monthsSource: Coresight Research[/caption]

Survey Findings in Detail

More than 60% of Apparel Shoppers and 74% of Prime Members Buy Apparel on Amazon Key findings:- Some 60.5% of all apparel shoppers said that they had bought apparel on Amazon in the past 12 months.

- Some 63.3% said that they expect to buy apparel on Amazon in the coming 12 months.

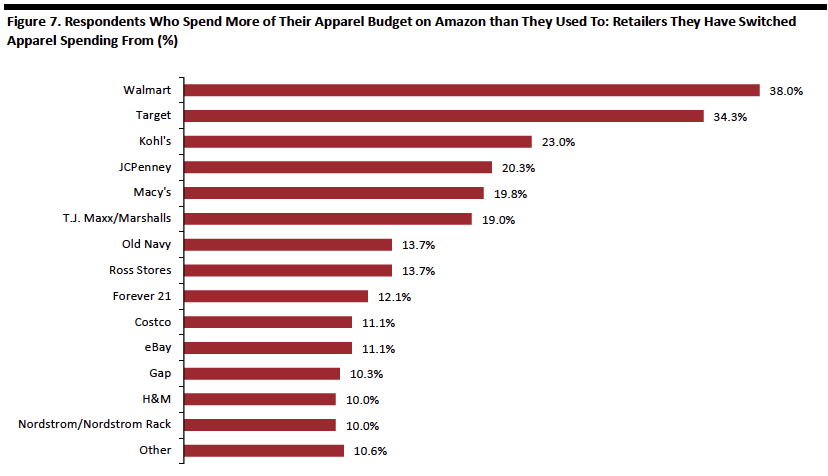

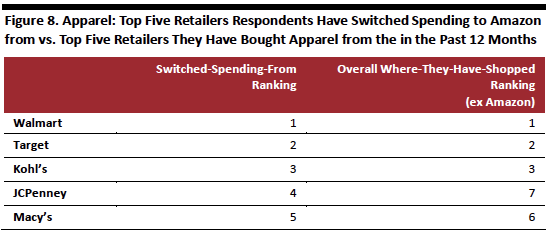

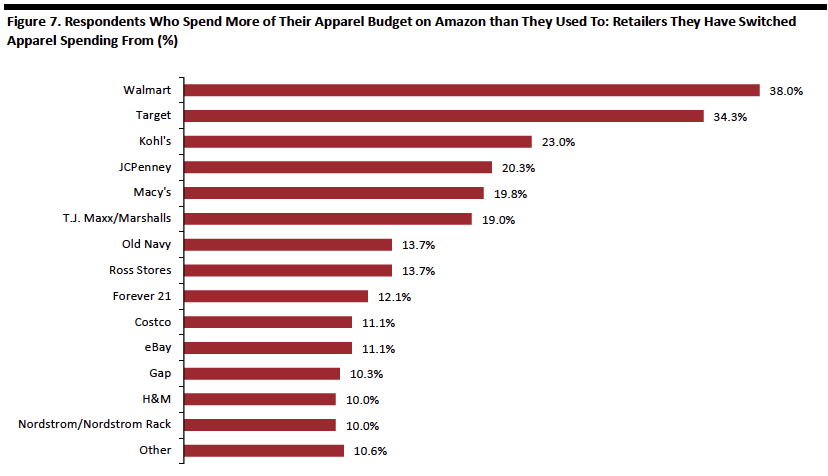

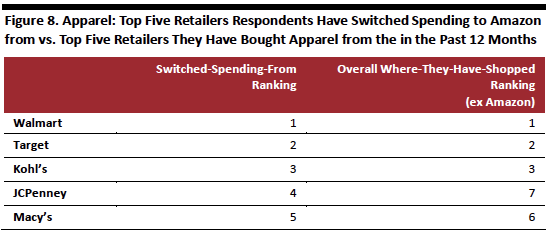

- Walmart (closely followed by Target) is the top retailer from which Amazon apparel shoppers have switched some or all of their apparel spending.

- Macy’s and JCPenney overindex in terms of switching spending to Amazon, relative to their scale.

Base: 379 US Internet users ages 18+ who spend more of their clothing and footwear budget at Amazon than they did one year ago

Base: 379 US Internet users ages 18+ who spend more of their clothing and footwear budget at Amazon than they did one year agoSurvey question: You have indicated that you spend more of your clothing and footwear budget at Amazon.com than you used to. Which retailer(s) have you switched this spending from? Select all that apply.

Source: Coresight Research[/caption] To some extent, the ranking shown above reflects the scale of these retailers and the total number of shoppers they have. It is logical that larger retailers would tend to lose the most, in absolute terms, when shoppers switch their spending from one retailer to another. But the ranking does not track scale exactly. Below, we compare the top five retailers that respondents said they had switched spending to Amazon from with the top five they said they had bought apparel from in the past 12 months. The comparison shows that Macy’s and JCPenney overindex in terms of switching to Amazon, relative to their overall strength in shopper numbers. [caption id="attachment_79090" align="aligncenter" width="546"]

Source: Coresight Research[/caption]

What Apparel Brands and Categories Shoppers Buy on Amazon

Key findings:

Source: Coresight Research[/caption]

What Apparel Brands and Categories Shoppers Buy on Amazon

Key findings:

- Nike, Under Armour and Adidas are the most popular apparel brands on Amazon with Adidas replacing Hanes this year.

- One in six Amazon apparel shoppers have already bought Amazon private-label apparel.

- Adult footwear and casual clothing are among the categories bought most often on Amazon.

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 monthsSurvey question: Which, if any, of the following clothing or footwear brands and private labels have you purchased on Amazon.com in the past 12 months? Select all that apply.

Source: Coresight Research[/caption] Footwear and Casual Clothing Are the Most-Bought Categories on Amazon Fashion Men’s and women’s footwear and adult casualwear top the categories that shoppers buy on Amazon Fashion. Underwear and sportswear are middle-ranking categories. Children’s clothing and footwear, men’s and women’s coats and jackets, and adult formal clothing are significantly less popular categories on the site. [caption id="attachment_79092" align="aligncenter" width="700"]

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 monthsSurvey question: Which of these categories have you bought on Amazon.com in the past 12 months?

Source: Coresight Research[/caption] Why Consumers Shop on Amazon: Ease of Shopping Beats Fulfillment, Price and Choice as the Top Driver Key findings:

- Respondents cited ease of browsing or searching the Amazon website as the top reason for buying apparel on the site.

- Good or cheap delivery was the second-most-popular reason cited for buying apparel on Amazon Fashion, driven by Prime members.

Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (985 in 2019; 719 in 2018)

Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (985 in 2019; 719 in 2018)Survey question: Why do you shop for clothing or footwear on Amazon.com? Select all that apply.

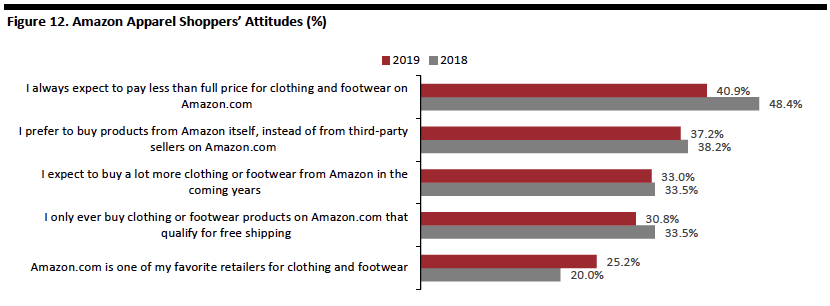

Source: Coresight Research[/caption] How Shoppers View Amazon Fashion: Younger Shoppers Want the Full Experience but Older Shoppers More Likely to Consider Amazon.com as One of Their Favorite Apparel Retailers Key findings:

- About 40% of Amazon apparel shoppers always expect to pay less than full price on the site, and one-third buy only when their purchase qualifies for free shipping.

- Younger shoppers are most interested in Amazon’s private-label apparel assortments.

- This year, 40.9% of Amazon apparel shoppers said they expect to always pay less than full price on the site; this is down from 48.4% in 2018, suggesting that Amazon may be incrementally shifting consumer perceptions of it closer toward that of a full-range, full-price retailer.

- This year, one-quarter of Amazon apparel shoppers told us the retailer is one of their favorites for clothing and footwear, representing a meaningful uptick from the one-in-five that claimed this in our 2018 survey.

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 monthsSurvey question: Which, if any, of the following statements about shopping for clothing and footwear on Amazon.com do you agree with? Select all that apply.

Source: Coresight Research[/caption] What Shoppers Want from Amazon Fashion One-quarter of Amazon apparel shoppers would like to see more clothing and footwear brands on the site. A meaningful 21.5% of Amazon apparel shoppers are interested in trying the retailer’s private labels, up from 18.8% last year, with the shift likely reflecting the media coverage that those private labels have garnered. Just 12.9% think that the website could be made easier to browse (broadly comparable with last year), indicating that the majority of the site’s apparel shoppers are satisified with the Amazon Fashion shopping experience. Further reinforcing the perception of satisfaction is that only 15.9% think the Amazon website could be made more appealing or engaging for fashion shoppers. [caption id="attachment_79095" align="aligncenter" width="700"]

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 monthsSurvey question: Which, if any, of the following statements about shopping for clothing and footwear on Amazon.com do you agree with? Select all that apply.

*Statement not included in 2018 survey.

Source: Coresight Research[/caption] Younger Consumers Tend to be More Interested in Amazon Building Out Its Apparel Proposition Many younger shoppers registered higher interest than older shoppers in Amazon’s private labels and the possibility of Amazon opening physical fashion stores; they also are the cohort most faulting Amazon’s browsability. On the other hand, older consumers were more likely to consider Amazon.com as one of their favorite clothing and footwear retailers. Given Amazon’s supremacy in terms of broad assortment, ease of shopping, efficiency and speedy delivery, older shoppers, who are likely to know what brand and size they want, are more apt to choose Amazon as a top apparel retail choice. Younger shoppers exploring fashion are shopping the mall and downtown destinations to touch and feel product and discover and explore new brands; reflecting this demand for physical stores, younger shoppers are more likely than older shoppers to want Amazon to open brick-and-mortar fashion stores. [caption id="attachment_79096" align="aligncenter" width="700"]

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months

Base: 985 US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 monthsSource: Coresight Research[/caption] Prime Members Push Amazon to First Place Among America’s Clothing and Footwear Retailers Key findings:

- Amazon is America’s most-shopped apparel retailer.

- The site’s popularity is driven by Prime members.

- For Amazon apparel shoppers, Walmart is the most popular alternative retailer for clothing and footwear.

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 monthsSurvey question: Which retailers have you bought clothing or footwear from in the past 12 months (whether online or in-store)? Select all that apply.

Respondents were free to to select any options from the list provided; this is a different format from the forced yes/no question format used to establish whether respondents had bought apparel on Amazon, and it yields different results from those shown earlier.

Source: Coresight Research[/caption] Prime members are responsible for pushing Amazon up the “most-shopped retailer” ranking. Among Prime members, Amazon is by far the leading retailer for clothing and footwear, as measured by number of shoppers. This is balanced out by Amazon ranking relatively low among those with no access to Prime: In fact, Amazon is fourth-most-popular retailer among those who do not subscribe to Prime, behind Walmart, Target and Kohl’s. [caption id="attachment_79098" align="aligncenter" width="700"]

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months, including 914 with a personal Amazon Prime membership

Base: 1,628 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months, including 914 with a personal Amazon Prime membershipRespondents were free to to select any options from the list provided; this is a different format from the forced yes/no question format used to establish whether respondents had bought apparel on Amazon, and it yields different results from those shown earlier.

“Prime Members” have a personal Prime membership; “Not Prime Members” have no access to Prime benefits, including through a membership of someone else in their household.

Source: Coresight Research[/caption] Where Else Do Amazon Apparel Shoppers Buy Clothing and Footwear? Walmart is the leading alternative clothing and footwear retailer for Amazon apparel shoppers according to our 2019 survey results, up from second place in 2018. Target fell from first place to second place as the alternative source for Amazon apparel shoppers. We think Walmart’s switch from second to first place highlights the incremental shift of Amazon, from a more niche or peripheral apparel destination to one shopped by mass-market consumers — such as those who shop at Walmart. A further contributing factor to the Walmart/Target switch may be Target’s launch of 20 private label apparel brands in the past three years: We believe this effort is likely to have fortified Target’s appeal among apparel shoppers. [caption id="attachment_79099" align="aligncenter" width="550"]

Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (985 in 2019; 719 in 2018)

Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (985 in 2019; 719 in 2018)Source: Coresight Research[/caption] Apparel Is the Top-Shopped Category on Amazon.com Our survey found that clothing and footwear moved to the top most-shopped category on Amazon in the past 12 months, up from #4 in 2018. Rounding out the top five categories that shoppers buy on Amazon.com are books (including e-books), beauty and personal care products, electronics, and health products (such as vitamin supplements).

What We Think

A key finding of our research is that Prime membership is the principal support for Amazon’s apparel expansion, as Prime members show a much higher tendency than the average consumer to buy apparel on the site. However, Prime membership growth appears to have stalled (see Appendix 1). Moreover, our survey recorded no meaningful increase from “have purchased” to “expect to purchase” on Amazon Fashion among Prime members. To sustain solid growth in clothing and footwear sales, we think Amazon will need to drive up average spend and frequency of purchase among Prime members while attracting more non-members to its apparel offering.Appendix 1: Amazon Prime Membership Rates

[caption id="attachment_79100" align="aligncenter" width="550"] Through January 2019

Through January 2019Base: 7,000+ US Internet users ages 18+ in each month

Survey question: Do you have an Amazon Prime membership?

Source: Prosper Insights & Analytics[/caption] [caption id="attachment_79101" align="aligncenter" width="550"]

Through January 2019

Through January 2019Base: 7,000+ US Internet users ages 18+ in each month

Survey question: Do you have an Amazon Prime membership?

Source: Prosper Insights & Analytics[/caption]