Web Developers

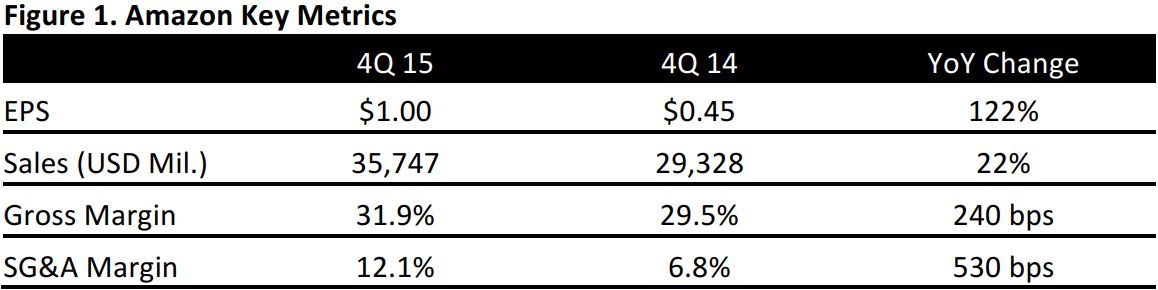

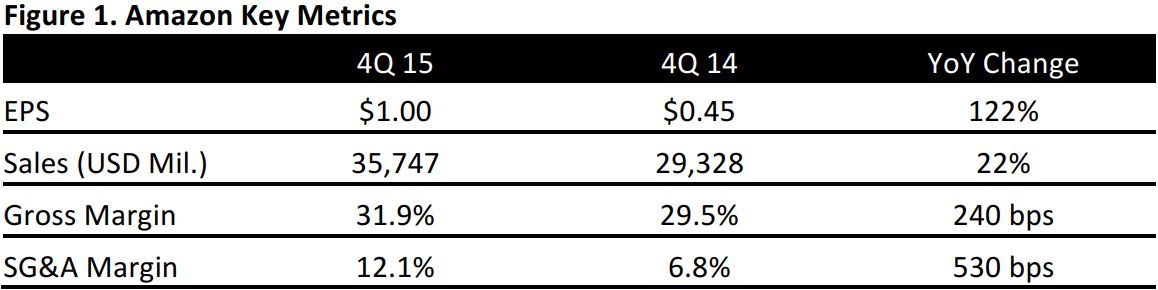

Amazon reported fourth-quarter 2015 EPS of $1.00, well below the consensus estimate of $1.55. Total sales increased by 22%, to $35.7 billion, versus consensus of $35.9 billion. In the US, sales were up 24%, to $21.5 billion, versus expectations of $21.88 billion. Internationally, sales were up 12%, to $11.84 billion, versus consensus of $11.66 billion. Sales for Amazon Web Services were up 69%, to $2.41 billion, as compared to consensus of $2.38 billion.

By category, media revenues were $7.22 billion versus consensus of $7.20 billion, while electronics and other general merchandise revenues were $25.82 billion versus consensus of $25.84 billion. Other sales totaled $303.0 million versus consensus of $360.4 million.

In 2015, worldwide Prime memberships increased by 51%. They increased by 47% in the US and even faster internationally. Paid units were up 26% versus consensus of 23.8% and versus an increase of 26% in the third quarter of 2015. Worldwide customer count was 304 million. Amazon added 3 million Prime members in the third week of December alone. Sales of Amazon devices doubled compared to the same period a year ago.

Free cash flow increased to $7.3 billion for the full year versus $1.9 billion for the prior year.

For the first quarter of 2016, management expects total sales of $26.5–$29.0 billion representing growth of 17%–28%, versus consensus of $27.68 billion. Operating income is expected to be between $100 million and $700 million versus consensus of $665.3 million.