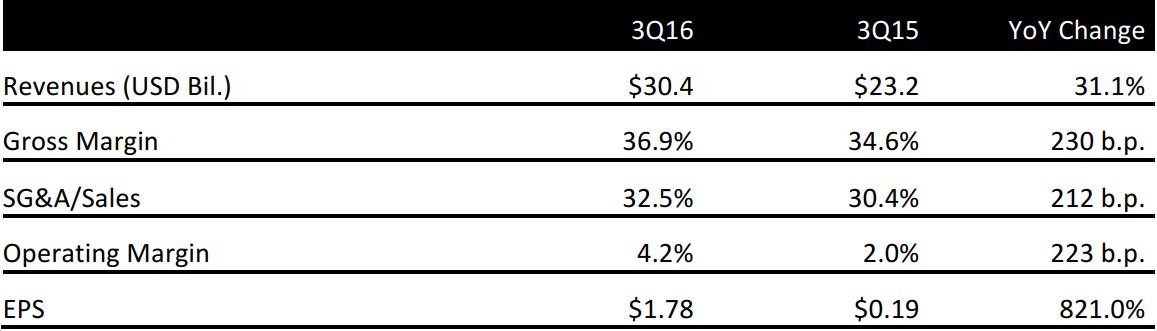

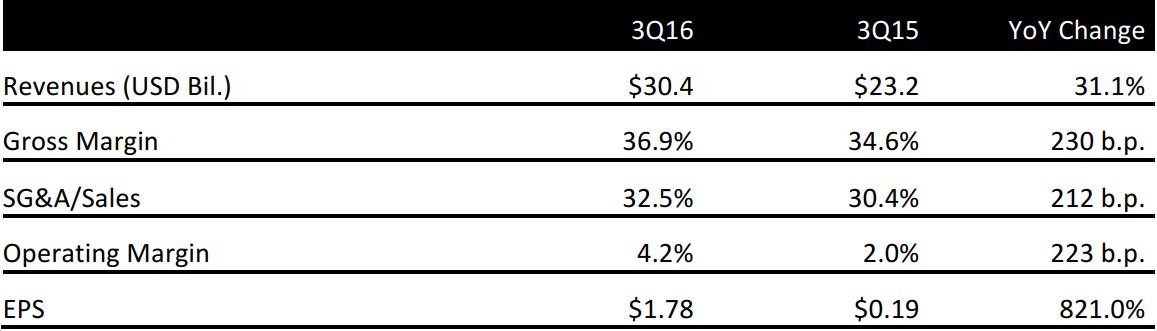

Source: Company reports

2Q16 RESULTS

Amazon reported 2Q16 revenues of $30.4 billion, up 31.1% year over year and beating the $29.6 billion consensus estimate and the high end of the guidance range of $28–$30.5 billion.

Electronics and general merchandise were the largest revenue contributors, with revenues up $5.6 billion (or 33.8%) year over year to $22.0 billion. Amazon Web Services (AWS) posted the fastest growth rate; revenues increased 58.2% to $2.9 billion and beat the consensus estimate of $2.8 billion.

In terms of geography, international revenues increased 30.1% to $9.8 billion, and North American revenues increased 28.1% to $17.7 billion. Amazon’s three segments are North America, international and AWS.

In terms of profitability, North America and AWS each generated an operating profit of about $700 million, whereas international generated a loss of $135 million.

EPS was $1.78, compared to $0.19 in the year-ago quarter and consensus of $1.11.

Amazon highlighted two post-quarter events:

- On June 28, 2016, the company made its AWS cloud computing platform available to customers in India, and on July 26, 2016, Amazon Prime launched in India.

- On July 12, 2016, the company held its second Prime Day and global orders grew by more than 60%, orders from third-party sellers nearly tripled and the savings achieved by Prime members more than doubled.

3Q16 OUTLOOK

For 3Q16, the company guided for revenues of $31.0–$33.5 billion, up 22%–32% year over year and compared to consensus of $31.7 billion.

Amazon also guided for operating income of $50–$650 million, below the consensus estimate of $830 million. These figures result in an EPS range of ($0.16) to $0.65, compared to the pre-release consensus estimate of $0.98.