Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

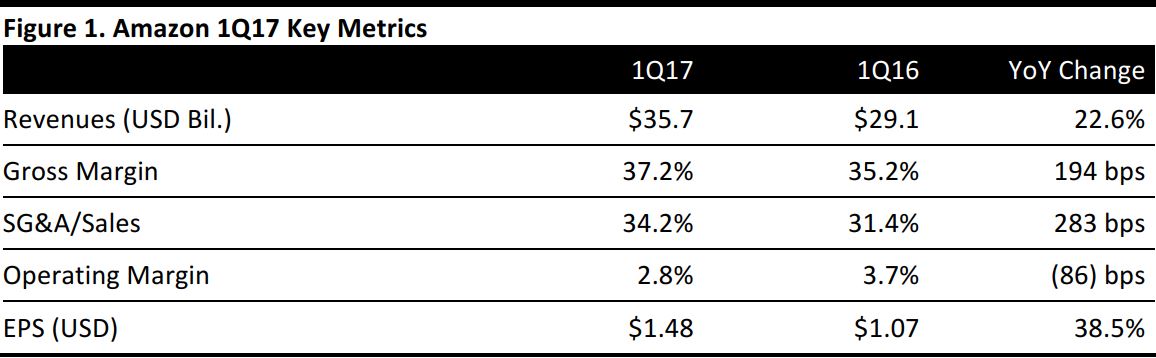

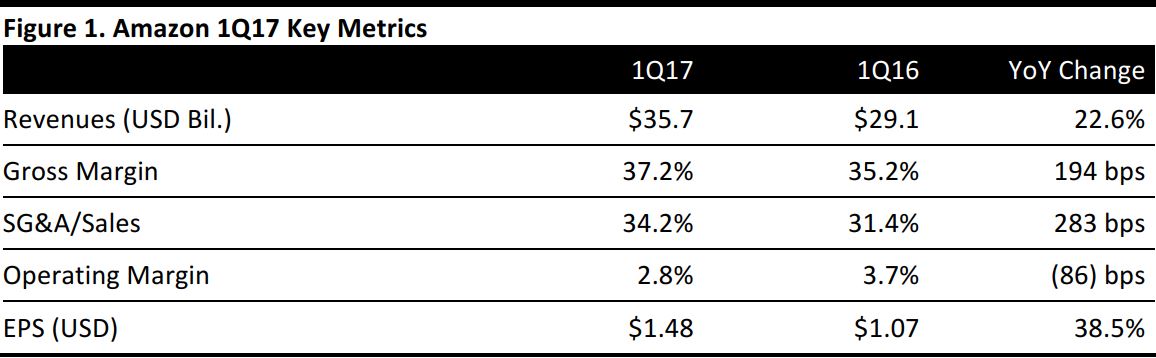

1Q17 Results

Amazon reported 1Q17 net sales of $35.7 billion, up 22.6% year over year and beating the $35.3 billion consensus estimate. Sales would have increased by 24% if the $492 million impact from unfavorable foreign exchange rate changes were excluded.

Fulfillment costs were $4.7 billion, up 27.4% year over year, meaning they grew faster than sales.

EPS was $1.48, compared with $1.07 in the year-ago quarter and beating the $1.08 consensus estimate.

Management highlighted revenue growth in the quarter, particularly in India, which saw 75% growth in Prime product selection, a 26% increase in fulfillment capacity and the announcement of 18 Indian original TV series.

Details from the Quarter

Amazon introduced a new revenue breakdown methodology in the quarter; it no longer classifies revenue by media, international and AWS.

Results were as follows:

- Retail products (product sales and digital media content) revenue was $22.8 billion, up 16% year over year excluding currency effects.

- Retail third-party seller services (commissions, related fulfillment and shipping fees, and other third-party seller services) revenue was $6.4 billion, up 34% excluding currency effects.

- Retail subscription services (annual and monthly fees associated with Amazon Prime membership, as well as audiobook, e-book, digital video, digital music and other subscription services) revenue was $1.9 billion, up 52% excluding currency effects.

- AWS revenue was $3.7 billion, up 43% year over year. The segment reported an operating profit of $890 million, up 47% year over year, and accounted for 89% of corporate operating profit.

On a geographic basis:

- Revenue from North America was $21.0 billion, up 23.5% year over year.

- Revenue from International was $11.1 billion, up 29.1% year over year.

Outlook

For 2Q17, Amazon expects:

- Net sales of $35.25–$37.75 billion, up 16%–24% year over year, which includes a negative impact of $720 million, or 240 basis points, from unfavorable exchange rates. The consensus estimate is for net sales of $37.0 billion.

Operating income of $425 million–$1.075 billion, compared with $1.07 billion in the year-ago quarter and below the $1.46 billion consensus estimate. This translates to EPS of roughly $0.55–$1.55, below the consensus estimate of $1.81.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology