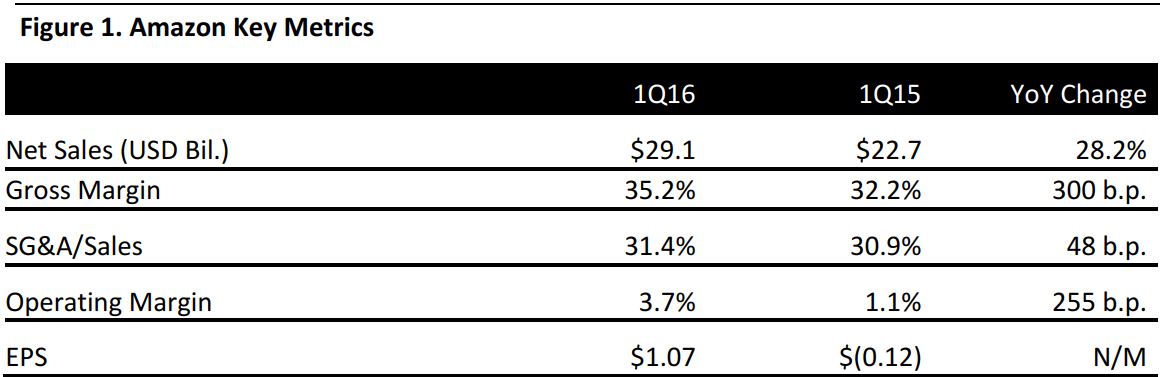

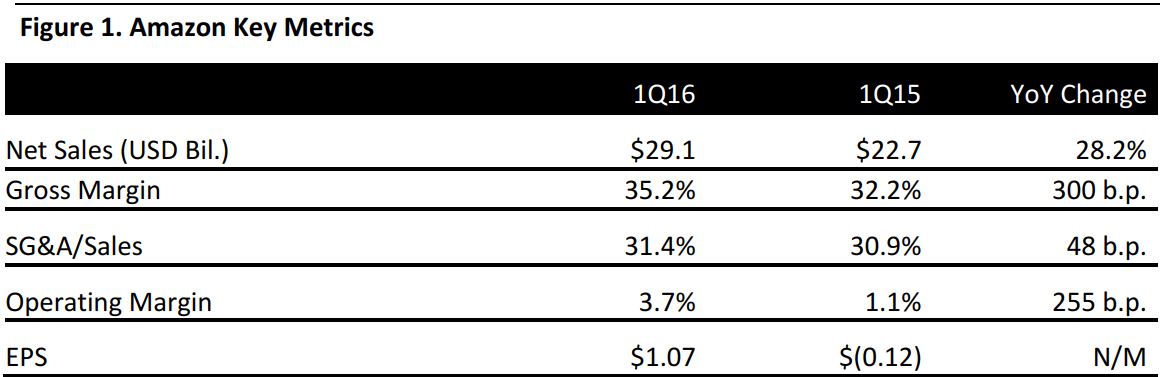

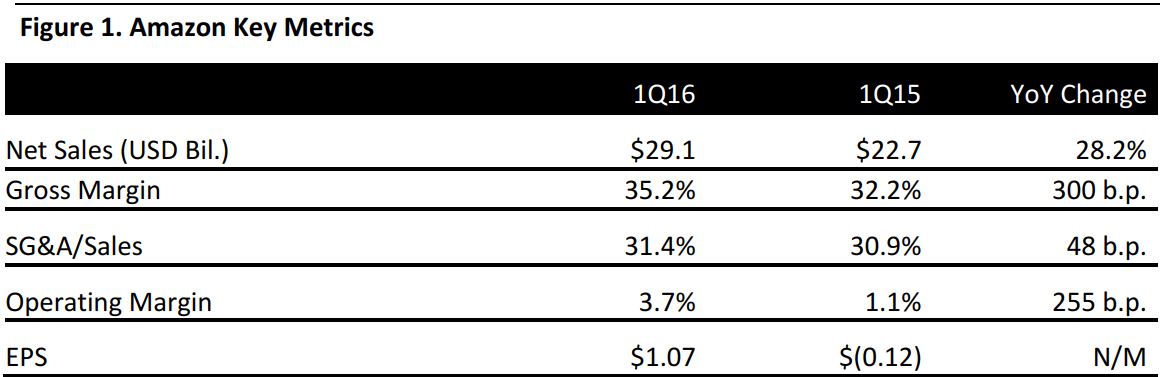

Source: Company reports

Amazon reported 1Q16 revenues of $29.1 billion, up 28.2% year over year and ahead of the $28.0 billion consensus estimate. Excluding a $210 million headwind from unfavorable exchange rates, revenues increased by 29% year over year.

Electronics and other general merchandise represented 71% of total sales, and the segment’s revenues grew by 31% year over year, to $20.5 billion. Media accounted for 20% of sales, with revenues growing by 8% year over year, to $5.7 billion. Revenues from AWS represented 9% of total sales and grew by an explosive 64% year over year, to nearly $2.6 billion.

Sales in North America accounted for 60% of total revenues and grew by 27% year over year, to $17 billion. International sales represented 11% of total sales and grew by 11% year over year, to $8.6 billion. The remaining geographic segment is AWS, as mentioned above.

Management commented that Amazon devices are the top-selling products on Amazon.com, and that customers purchased twice as many Fire tablets as in the year-ago quarter. Moreover, the Echo was characterized as being off to an incredible start; the company cannot yet keep it in stock.

EPS was $1.07, compared to a loss of $0.12 in the year-ago quarter and versus the $0.60 consensus estimate.

OUTLOOK

For 2Q16, Amazon expects revenues of $28.0–$30.5 billion, representing 21%–32% growth, in line with the current consensus estimate of $28.3 billion. The company expects operating income of $375–$975 million in 2Q16, compared to $464 million in the year-ago quarter.