DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

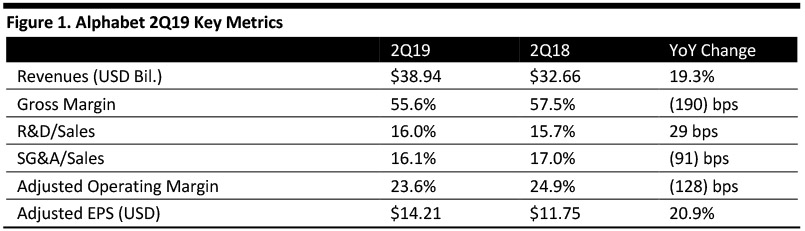

Alphabet (the parent company of Google) reported 2Q19 revenues of $38.94 billion, up 19.3% year over year and above the $38.15 billion consensus estimate. Revenues increased 23% on a currency-neutral basis.

Adjusted EPS was $14.21, up 20.9% year over year and beating the $11.10 consensus estimate. GAAP EPS was also $14.21, compared to $4.54 in the year-ago quarter.

Management commented that growth in the quarter was led by mobile search, YouTube and Cloud.

Details from the Quarter

Google Segment- Google property revenues were $27.3 billion, amounting to 70.5% of total revenues, up 17.5% year over year. Results continued to be led by mobile search, with strong contributions from YouTube and desktop search.

- Google Network Members' property revenues were $5.3 billion, amounting to 13.6% of total revenues, up 9.1% year over year, reflecting growth by Google Ad Manager followed by AdMob.

- Google other revenues were $6.2 billion, amounting to 15.9% of total revenues, up 39.7% year over year, fueled by Cloud and Play.

Paid clicks on Google properties increased 28% year over year, and impressions on Google Network Members increased 11%.

Traffic acquisition costs (TAC) for Google Network Members was $3.6 billion, up 6.2% year over year and amounting to 69% of Google Network Members’ revenue (down from 71% in the year-ago quarter), due to a favorable product mix shift.

The TAC for distribution partners was also $3.6 billion, up 20.2% year over year and amounting to 13% of Google property revenue (up 30 bps year over year.)

Total TAC were $7.2 billion, up 12.7% year over year and amounting to 22% of Google advertising revenue, reflecting a favorable mix shift from network to sites.

Other Bets Segment Google’s Other Bets segment includes Access, Calico, CapitalG, GV, Verily, Waymo, X and others. Revenues were $162 million, up 11.7% year over year, driven by Fiber and Verily. The segment generated an operating loss of $989 million, compared to a $732 million loss a year ago. Other Details:- Announcements at the Google I/O conference include YouTube Brandcast and Google marketing live.

- Search: Google redesigned its mobile search page and brought its full-coverage feature to its search platform to better organize news results. The company also added augmented reality to search, for example, enabling people searching for shoes online to visualize them in 3D or superimpose them over their wardrobe.

- Google Assistant: Advances in AI offer a 10x speed increase. The system is expected to soon start offering services such as booking a rental car or purchasing movie tickets.

- Google Maps: Consumers now can tell if a bus is delayed or provide information on the occupancy level of a train in 200 cities worldwide. The company recently added a new visual warning system to provide information on natural disasters.

- Speech AI: Google is adding caption capabilities for people with hearing disabilities, and on its Android mobile platform, adding live captions to videos, podcasts and voicemail, as well as support for users in India, Brazil and Indonesia.

- Photos: The Gallery Go app enables people living in low-connectivity areas to manage photos online.

- Other: Other revenues were $6.2 billion, up 40% year-over-year, fueled by Cloud with an ongoing strong contribution from Play. Within Cloud, growth in Google Cloud Platform was once again in the primary driver of performance with strong customer demand for compute and data analytics products.

Implications for Retail

Google commented that its cloud business has reached an $8 million annual run rate and continues to grow at a significant pace. The company mentioned that retailers such as Lowe’s are leveraging the cloud to transform their customer experience and supply chain. Google also highlighted key technologies including data management and analytics solutions, in addition to machine learning and AI.

Outlook

Google did not offer guidance but mentioned currency headwinds, ongoing strength from applying machine learnings on its sites, strength in cloud and a positive reception for its Pixel 3a smartphone.