DIpil Das

[caption id="attachment_90676" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

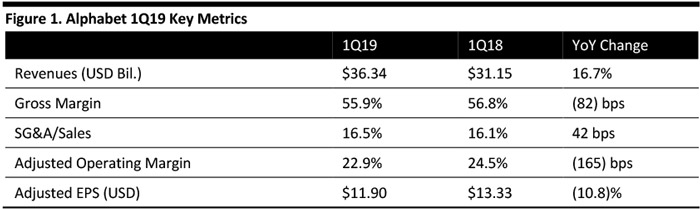

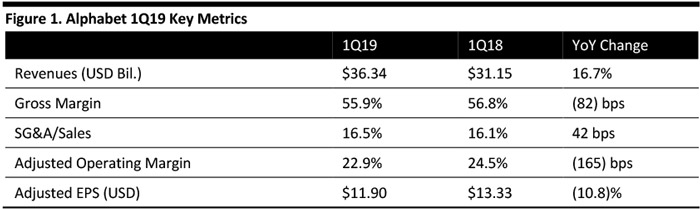

Alphabet (the parent company of Google) reported 1Q19 revenues of $36.34 billion, up 16.7% year over year and below the $37.3 billion consensus estimate. Revenues increased 19% on a currency-neutral basis.

Non-GAAP EPS was $11.90, down 10.8% year over year and beating the $10.60 consensus estimate. GAAP EPS was $9.50, with the difference arising from the fine levied by the European Commission (EC).

On March 20, 2019, the EC declared that certain contractual provisions in agreements that Google had with AdSense for Search partners infringed European competition law and levied a €1.5 billion ($1.7 billion) fine.

Management commented that growth in the quarter was led by mobile search, YouTube and Cloud.

Details from the Quarter

Google Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Alphabet (the parent company of Google) reported 1Q19 revenues of $36.34 billion, up 16.7% year over year and below the $37.3 billion consensus estimate. Revenues increased 19% on a currency-neutral basis.

Non-GAAP EPS was $11.90, down 10.8% year over year and beating the $10.60 consensus estimate. GAAP EPS was $9.50, with the difference arising from the fine levied by the European Commission (EC).

On March 20, 2019, the EC declared that certain contractual provisions in agreements that Google had with AdSense for Search partners infringed European competition law and levied a €1.5 billion ($1.7 billion) fine.

Management commented that growth in the quarter was led by mobile search, YouTube and Cloud.

Details from the Quarter

Google Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Alphabet (the parent company of Google) reported 1Q19 revenues of $36.34 billion, up 16.7% year over year and below the $37.3 billion consensus estimate. Revenues increased 19% on a currency-neutral basis.

Non-GAAP EPS was $11.90, down 10.8% year over year and beating the $10.60 consensus estimate. GAAP EPS was $9.50, with the difference arising from the fine levied by the European Commission (EC).

On March 20, 2019, the EC declared that certain contractual provisions in agreements that Google had with AdSense for Search partners infringed European competition law and levied a €1.5 billion ($1.7 billion) fine.

Management commented that growth in the quarter was led by mobile search, YouTube and Cloud.

Details from the Quarter

Google Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Alphabet (the parent company of Google) reported 1Q19 revenues of $36.34 billion, up 16.7% year over year and below the $37.3 billion consensus estimate. Revenues increased 19% on a currency-neutral basis.

Non-GAAP EPS was $11.90, down 10.8% year over year and beating the $10.60 consensus estimate. GAAP EPS was $9.50, with the difference arising from the fine levied by the European Commission (EC).

On March 20, 2019, the EC declared that certain contractual provisions in agreements that Google had with AdSense for Search partners infringed European competition law and levied a €1.5 billion ($1.7 billion) fine.

Management commented that growth in the quarter was led by mobile search, YouTube and Cloud.

Details from the Quarter

Google Segment

- Google properties revenues were $25.7 billion, amounting to 71.0% of total revenues, up 16.7% year over year. Results continued to be led by mobile search, with strong contributions from YouTube and desktop search.

- Google Network Members' property revenues were $5.0 billion, amounting to 13.9% of total revenues, up 8.5% year over year, reflecting growth from AdMob, followed by Google Ad Manager.

- Google other revenues were $5.4 billion, amounting to 15.1% of total revenues, up 25.1% year over year, fueled by Cloud and Play and partially offset by hardware.

- Waymo’s announcement of an expansion of its activities in Michigan, the first factory dedicated to the production of L4 autonomous vehicles.

- Loon announced a long-term strategic relationship to advance the use of high-altitude vehicles with HAPSMobile, which will invest $125 million.

- Wing became the first drone delivery company to receive certification from the FAA.

- Google Cloud Platform remains one of the fastest growing businesses in Alphabet, with strong customer momentum due to demand for compute and data analytics products.

- Strong growth in Play was driven particularly by performance in Asia Pacific.

- Hardware results reflect lower year-on-year sales of Pixel, reflecting in part heavy promotional activity given the recent pressures in the premium smartphone market.