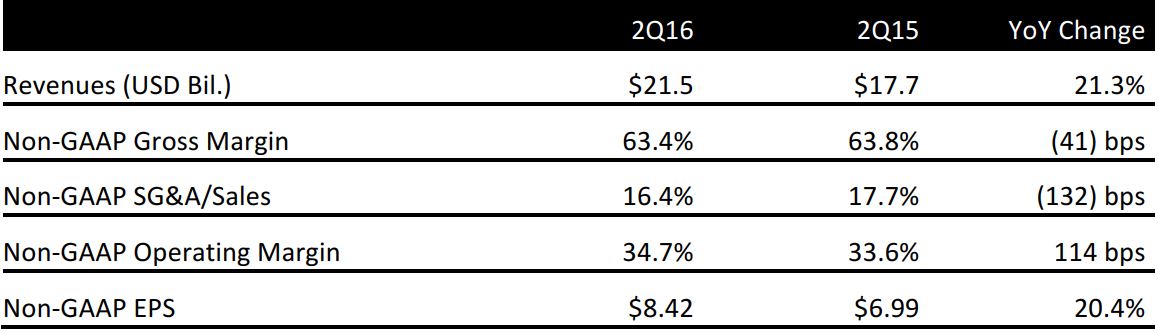

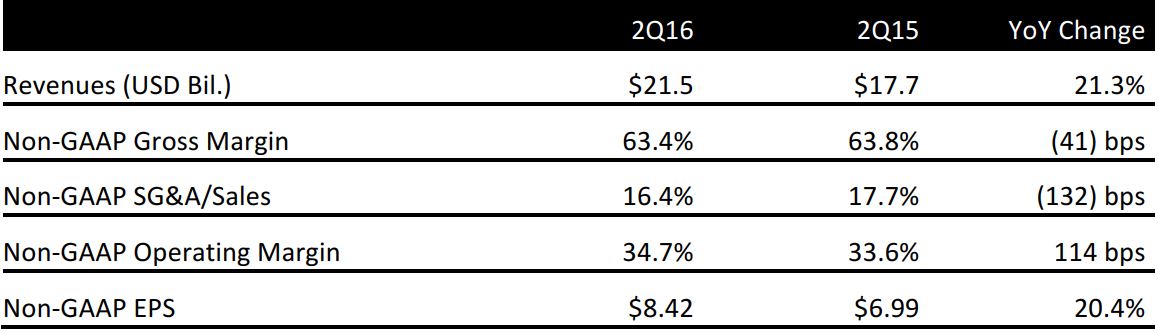

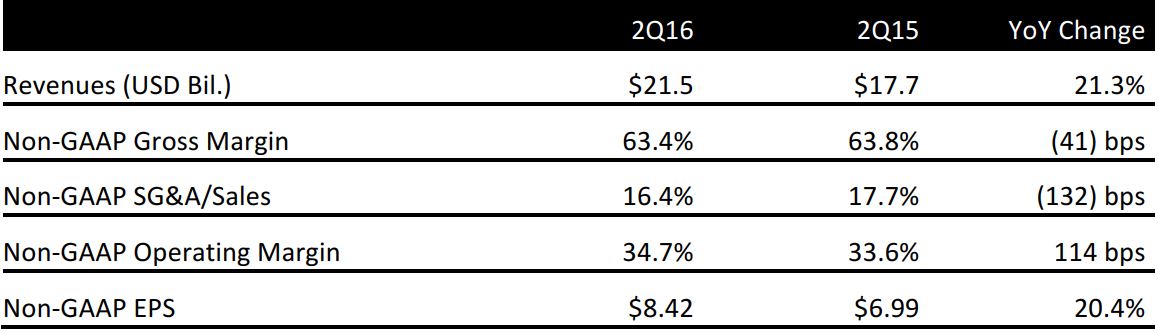

Source: Company reports

2Q16 RESULTS

Alphabet (the parent company of Google) reported 2Q16 revenues of $21.5 billion, up 21.3% year over year and ahead of the $20.7 billion consensus estimate. Revenues increased by 25% on a currency-neutral basis.

Within the Google segment, the main revenue drivers were the Google websites, with revenues of $15.4 billion, which were up 24.2% and beat the $14.8 billion consensus estimate. The websites’ growth offset the slower growth of the Google Network Members’ websites ($3.7 billion, up 3.4%). Google’s other revenues were $2.2 billion, up 33.3%. The sum of these figures represents total Google advertising revenue of $19.1 billion, up 19.5% year over year.

In the quarter, aggregate paid clicks increased by 29% year over year, beating the consensus estimate of 25% growth. Paid clicks on Google websites increased by 37%, whereas paid clicks on Google Network Members’ websites were flat.

The aggregate cost per click decreased by 7% year over year, while the cost per click on Google websites decreased by 9% and the cost per click on Google Network Members’ websites decreased by 8%.

Total traffic acquisition costs were $4.0 billion, up 17.7% year over year.

The Google segment posted operating income of $7.0 billion, up 24.7% year over year.

Google’s Other Bets segment (which includes Google Fiber, Nest, Verily and Google X) posted revenues of $185 million, up 150% year over year. However, the division’s operating loss expanded to $859 million from $660 million a year ago.

Non-GAAP EPS was $8.42, up 20.4% year over year and beating the $8.04 consensus estimate.

OUTLOOK

The company did not offer guidance, but commented that it was beginning to see the benefits of investments it had made in mobile and video and that it will continue to invest responsibly in many compelling opportunities.

Pre-results consensus estimates were for revenues of $21.5 billion and EPS of $8.35 for 3Q16 and revenues of $71.3 billion and EPS of $33.39 for the year.