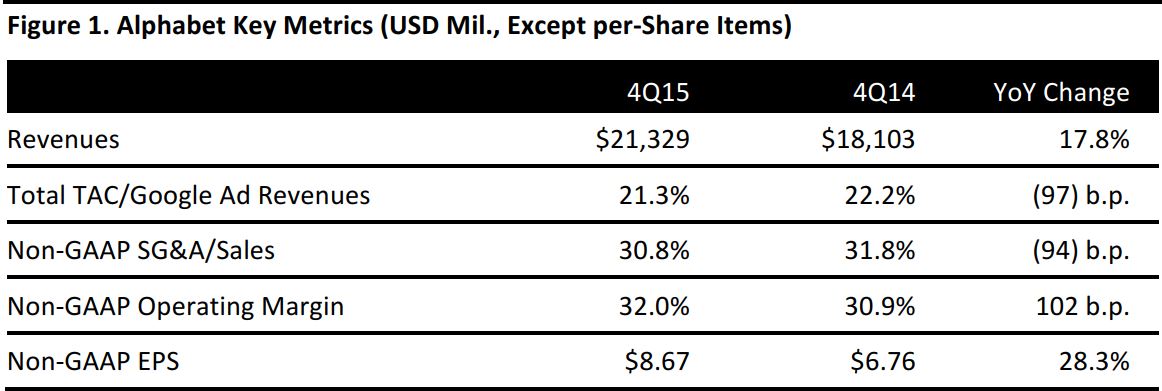

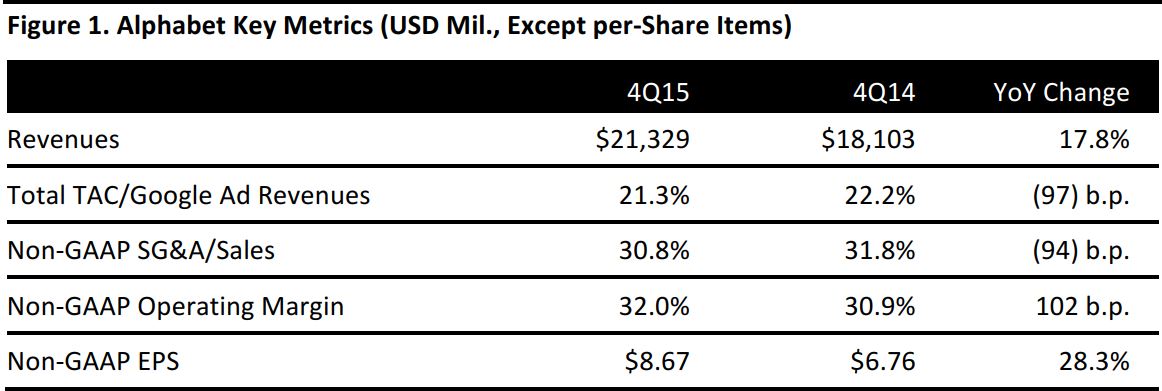

Source: Company reports

In 4Q15, the former Google split into two operating units: the main Google business (which retains the prior name) and the emerging businesses (called “Other Bets”), held within a company called Alphabet.

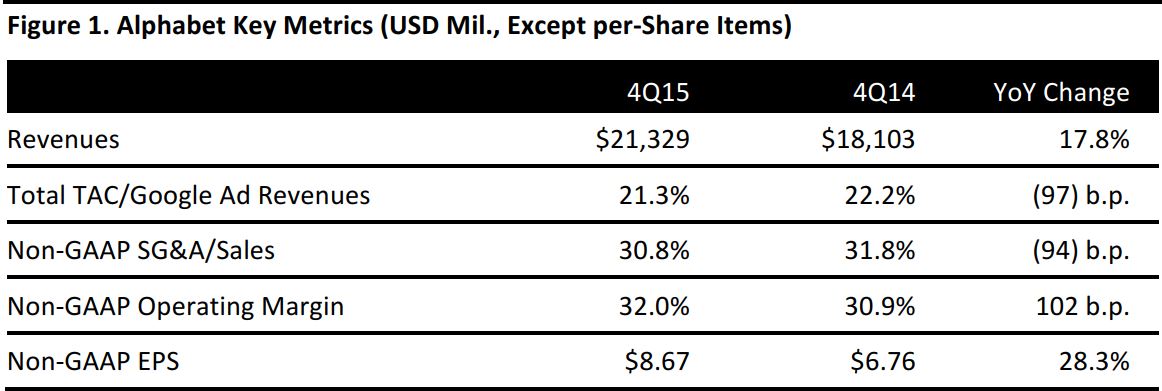

Quarterly revenues increased by 24% year over year in constant-currency terms. Within the Google segment, the main revenue drivers were the Google websites ($14.9 billion, up 20%). Their growth offset the slower growth of the Google Network Members’ websites ($4.1 billion, up 7%). Google’s other revenues were $2.1 billion, up 24%.

In the quarter, aggregate paid clicks increased by 31% year over year. Paid clicks on Google websites increased by 40%, whereas paid clicks on Google Network Members’ websites increased just 2%. Year over year, the aggregate cost per click decreased by 13%, while the cost per click on Google websites decreased by 16% and the cost per click on Google Network Members’ websites decreased by 8%.

For the full year, Alphabet reported revenues of $75.0 billion, up 13.6% year over year, of which the Google businesses contributed $74.5 billion (99.4% of total revenues and up 13.5%). The Other Bets businesses contributed $448 million (0.6% and up 37.0%). Headcount increased to 61,814 from 53,600 at the end of the prior year. On a GAAP basis, the Google segment reported operating income of $23.4 billion and the Other Bets businesses reported an operating loss of $3.6 billion.

Net income grew faster than revenues in 4Q15, driven by a decrease of nearly 100 basis points in operating expenses as a percentage of sales, whereas the non-GAAP cost-of-revenue margin remained flat year over year.