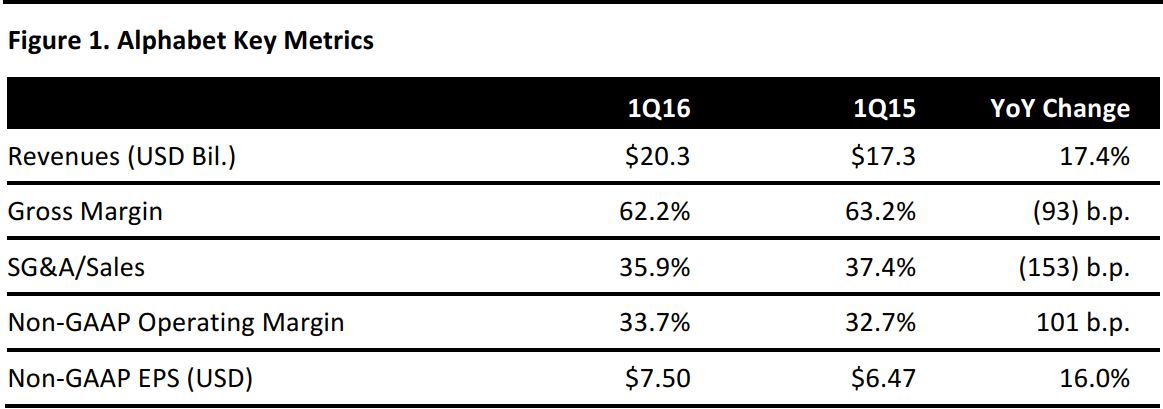

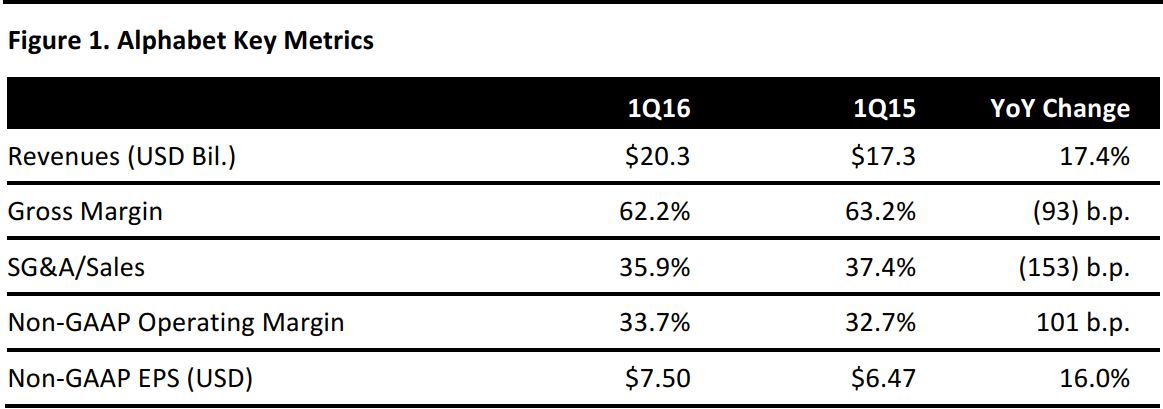

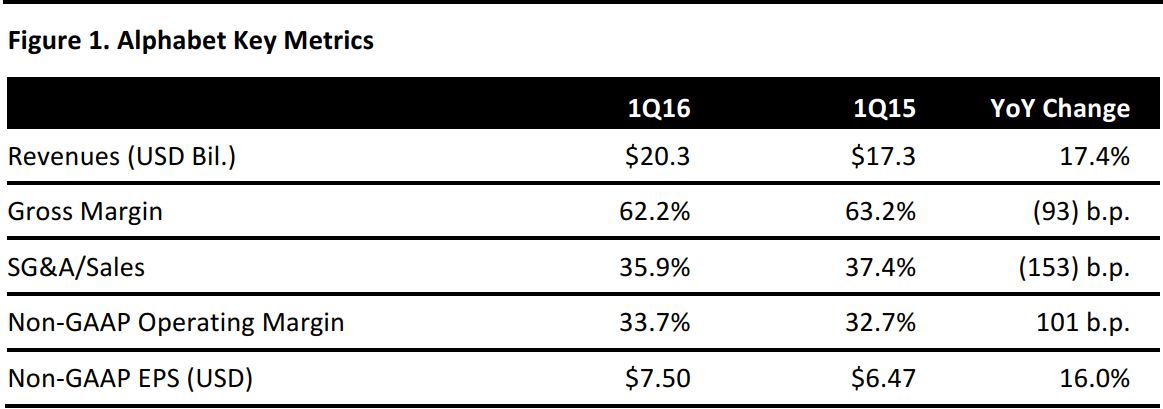

Source: Company reports

In 4Q15, the former Google split into two operating units: the main Google business (which retains the prior name) and the emerging businesses (called “Other Bets”), held within a company called Alphabet.

1Q16 RESULTS

Alphabet’s quarterly revenues increased by 17.4% year over year and by 23% year over year in constant-currency terms. Within the Google segment, the main revenue driver was the Google websites ($14.3 billion, up 20%). Growth of the Google Network Members’ websites was significantly slower ($3.7 billion, up 3%). Google’s other revenues were $2.1 billion, up 24%.

In the quarter, aggregate paid clicks increased by 29% year over year. Paid clicks on Google websites increased by 38%, whereas paid clicks on Google Network Members’ websites increased by just 2%. Year over year, the aggregate cost per click decreased by 9%, while the cost per click on Google websites decreased by 12% and the cost per click on Google Network Members’ websites decreased by 8%.

The Other Bets segment—which includes emerging technologies such as Google Fiber, Nest, self-driving cars and other ventures—reported revenues of $166 million (up 108%) and an operating loss of $802 million, compared to a loss of $633 million in the year-ago quarter.

Non-GAAP EPS was $7.50, below the $7.96 consensus estimate, compared to $6.47 in the year-ago quarter. GAAP EPS was $6.02, compared to $5.10 in the year-ago quarter.