albert Chan

[caption id="attachment_81396" align="aligncenter" width="672"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

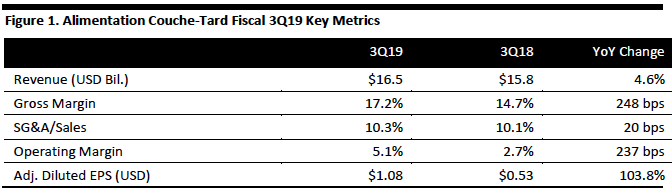

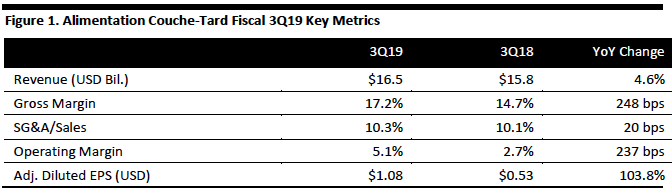

Alimentation Couche-Tard reported fiscal 3Q19 revenue of $16.5 billion, up 4.6% year over year but below the consensus estimate of $16.8 billion. The company reported adjusted diluted EPS of $1.08, up 103.8% year over year but below the consensus estimate of $1.16. Management attributed the strong growth in diluted EPS to higher road transportation fuel margins in the US, organic growth and the contribution from acquisitions. The company’s gross margin increased 248 basis points year over year, to 17.2%, and its operating margin increased 237 basis points year over year, to 5.1%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Alimentation Couche-Tard reported fiscal 3Q19 revenue of $16.5 billion, up 4.6% year over year but below the consensus estimate of $16.8 billion. The company reported adjusted diluted EPS of $1.08, up 103.8% year over year but below the consensus estimate of $1.16. Management attributed the strong growth in diluted EPS to higher road transportation fuel margins in the US, organic growth and the contribution from acquisitions. The company’s gross margin increased 248 basis points year over year, to 17.2%, and its operating margin increased 237 basis points year over year, to 5.1%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Alimentation Couche-Tard reported fiscal 3Q19 revenue of $16.5 billion, up 4.6% year over year but below the consensus estimate of $16.8 billion. The company reported adjusted diluted EPS of $1.08, up 103.8% year over year but below the consensus estimate of $1.16. Management attributed the strong growth in diluted EPS to higher road transportation fuel margins in the US, organic growth and the contribution from acquisitions. The company’s gross margin increased 248 basis points year over year, to 17.2%, and its operating margin increased 237 basis points year over year, to 5.1%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Alimentation Couche-Tard reported fiscal 3Q19 revenue of $16.5 billion, up 4.6% year over year but below the consensus estimate of $16.8 billion. The company reported adjusted diluted EPS of $1.08, up 103.8% year over year but below the consensus estimate of $1.16. Management attributed the strong growth in diluted EPS to higher road transportation fuel margins in the US, organic growth and the contribution from acquisitions. The company’s gross margin increased 248 basis points year over year, to 17.2%, and its operating margin increased 237 basis points year over year, to 5.1%.

Performance by Segment

- Merchandise and Service: 3Q19 revenue was up 8.8% year over year, to $4.2 billion, which management attributed to the contribution from acquisitions and continuous organic growth. Same-store merchandise revenue increased 4.5% in the US, 2.9% in Europe and 4.9% in Canada. Management attributed the growth to its focus on promotional traffic-driving campaigns, improved product mixes, tactical loyalty programs and the success of the company’s rebranding activities. The segment’s gross margin increased 11 basis points year over year, to 34.3%.

- Road Transportation Fuel: 3Q19 revenue was up 3.4% year over year, to $11.9 billion. The company attributed the growth to falling product costs, the contribution from acquisitions and the higher selling price of fuel. Total road transportation fuel volumes grew 1.6%, while same-store volumes increased 0.8% in the US. Road transportation fuel volumes decreased 0.6% in Canada and 1.4% in Europe due to a competitive landscape and unfavorable weather in the Baltics and Poland. The segment’s gross margin increased 312 basis points, to 11.2%.

- Other (including stationary energy and aviation fuel): 3Q19 revenue was down 2.3% year over year, to $404.7 million. The segment’s gross margin decreased 168 basis points year over year, to 16.9%.

- Acquired three company-operated stores through distinct transactions.

- Added two company-operated stores through RDK, a joint venture.

- Completed the construction, relocation or reconstruction of 11 stores, for a total of 32 stores since the beginning of fiscal year 2019.

- As of Feb. 3, 2019, 42 stores were under construction and scheduled to open in the upcoming quarters.