DIpil Das

[caption id="attachment_92671" align="aligncenter" width="699"] Source: Company reports/Coresight Research[/caption]

4Q19 Results

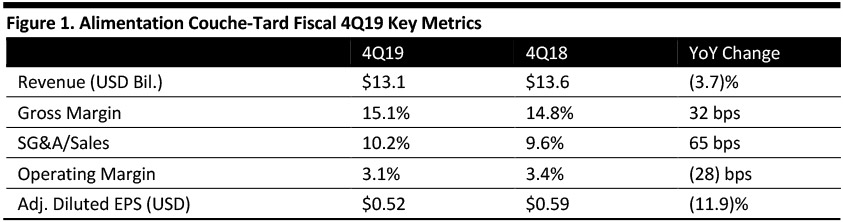

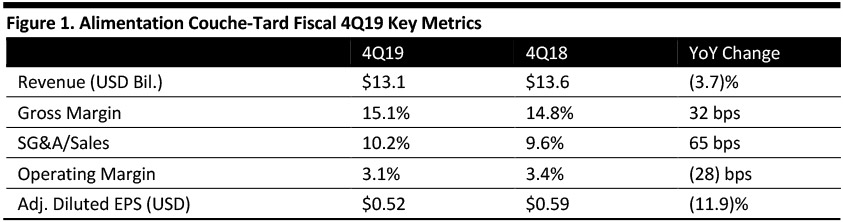

Alimentation Couche-Tard reported fiscal 4Q19 revenue of $13.1 billion, down 3.7% year over year and slightly below the consensus estimate of $13.3 billion. The company reported adjusted diluted EPS of $0.52, down 11.9% year over year and below the consensus estimate of $0.55. Management commented that in the quarter, they saw strong performance in same-store sales in all geographies and good same-store fuel gallon results in the US despite shortages in some regions. The company’s gross margin increased 32 basis points year over year, to 15.1%, and its operating margin decreased 28 basis points year over year, to 3.1%.

FY19 Results

Alimentation Couche-Tard reported fiscal FY19 revenue of $59.1 billion, up 15.0% year over year and slightly below the consensus estimate of $59.3 billion. The company also reported adjusted diluted EPS of $3.32, up 27.7% year over year and below the consensus estimate of $3.37. Management commented that a pipeline of activities focused on bringing more customers and being more strategically aligned as a company have helped bring organic growth to the company.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Alimentation Couche-Tard reported fiscal 4Q19 revenue of $13.1 billion, down 3.7% year over year and slightly below the consensus estimate of $13.3 billion. The company reported adjusted diluted EPS of $0.52, down 11.9% year over year and below the consensus estimate of $0.55. Management commented that in the quarter, they saw strong performance in same-store sales in all geographies and good same-store fuel gallon results in the US despite shortages in some regions. The company’s gross margin increased 32 basis points year over year, to 15.1%, and its operating margin decreased 28 basis points year over year, to 3.1%.

FY19 Results

Alimentation Couche-Tard reported fiscal FY19 revenue of $59.1 billion, up 15.0% year over year and slightly below the consensus estimate of $59.3 billion. The company also reported adjusted diluted EPS of $3.32, up 27.7% year over year and below the consensus estimate of $3.37. Management commented that a pipeline of activities focused on bringing more customers and being more strategically aligned as a company have helped bring organic growth to the company.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Alimentation Couche-Tard reported fiscal 4Q19 revenue of $13.1 billion, down 3.7% year over year and slightly below the consensus estimate of $13.3 billion. The company reported adjusted diluted EPS of $0.52, down 11.9% year over year and below the consensus estimate of $0.55. Management commented that in the quarter, they saw strong performance in same-store sales in all geographies and good same-store fuel gallon results in the US despite shortages in some regions. The company’s gross margin increased 32 basis points year over year, to 15.1%, and its operating margin decreased 28 basis points year over year, to 3.1%.

FY19 Results

Alimentation Couche-Tard reported fiscal FY19 revenue of $59.1 billion, up 15.0% year over year and slightly below the consensus estimate of $59.3 billion. The company also reported adjusted diluted EPS of $3.32, up 27.7% year over year and below the consensus estimate of $3.37. Management commented that a pipeline of activities focused on bringing more customers and being more strategically aligned as a company have helped bring organic growth to the company.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

4Q19 Results

Alimentation Couche-Tard reported fiscal 4Q19 revenue of $13.1 billion, down 3.7% year over year and slightly below the consensus estimate of $13.3 billion. The company reported adjusted diluted EPS of $0.52, down 11.9% year over year and below the consensus estimate of $0.55. Management commented that in the quarter, they saw strong performance in same-store sales in all geographies and good same-store fuel gallon results in the US despite shortages in some regions. The company’s gross margin increased 32 basis points year over year, to 15.1%, and its operating margin decreased 28 basis points year over year, to 3.1%.

FY19 Results

Alimentation Couche-Tard reported fiscal FY19 revenue of $59.1 billion, up 15.0% year over year and slightly below the consensus estimate of $59.3 billion. The company also reported adjusted diluted EPS of $3.32, up 27.7% year over year and below the consensus estimate of $3.37. Management commented that a pipeline of activities focused on bringing more customers and being more strategically aligned as a company have helped bring organic growth to the company.

Performance by Segment

- Merchandise and service: 4Q19 revenue was up 2.4% year over year, to $3.3 billion, which management attributed to the rollout of innovative products in tobacco and food. Same-store merchandise revenue increased 3.4% in the US, 4.7% in Europe and 4.2% in Canada. The segment’s 4Q19 gross margin decreased 29 basis points year over year, to 34.5%. For FY19, segment revenue was up 11.8% to $14.5 billion, attributable to contributions from acquisitions and organic growth.

- Road transportation fuel: 4Q19 revenue was down 4.3% year over year, to $9.6 billion. The company attributed the decline to one-time sale of compulsory stock obligation (CSO) inventory in Sweden and lower revenues in its wholesale business. Same-store road transportation fuel volume increased 0.3% in the US, decreased 1.8% in Europe and 0.4% in Canada. For FY19, segment revenue was up 16.7% to $43.3 billion, attributable to higher average road transportation fuel selling price and to organic growth.

- Other (including stationary energy and aviation fuel): 4Q19 revenue was down 40.8% year over year, to $217.9 million. The segment’s gross margin increased 654 basis points year over year, to 24.2%. For FY19, segment revenue was up 0.7% to 1.3 billion, attributable to an increase in average selling price of other fuel products.

- Acquired one company-operated store through a distinct transaction, totaling eight acquired company-operated stores since the beginning of fiscal 2019.

- Completed the construction of 19 stores, and the relocation or reconstruction of 13 stores, reaching a total of 51 and 41 stores respectively.

- Opened its first licensed cannabis retail store in Canada under the “Tweed” trademark, under a multi-year agreement with Canopy Growth Corporation.

- Had 28 stores under construction, which should open in the upcoming quarters.

- Had more than 5,600 stores in North America and more than 2,000 in Europe displaying the new Circle K global brand.

- Finalized rebranding project from CST to Circle K in Ireland, the last step in rebranding across Europe.