DIpil Das

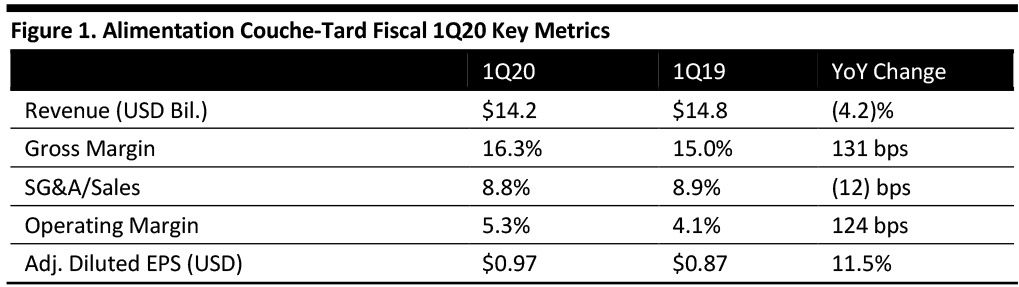

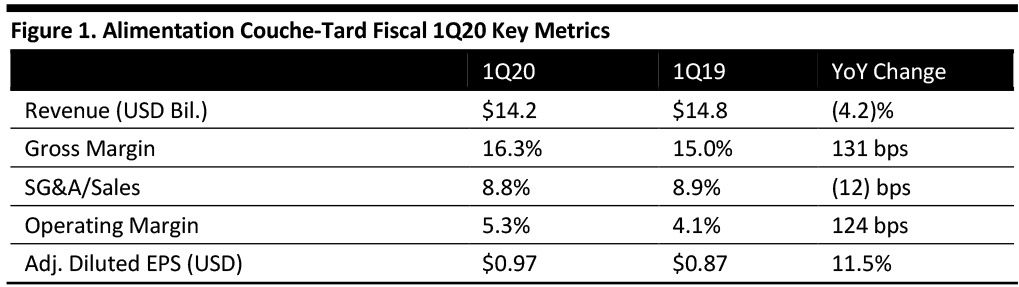

[caption id="attachment_95827" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

1Q20 Results

Alimentation Couche-Tard reported fiscal 1Q20 revenue of $14.2 billion, down 4.2% year over year and below the consensus estimate of $15.1 billion. The company reported adjusted diluted EPS of $0.97, up 11.5% year over year and beating the consensus estimate of $0.94, driven by higher road transportation fuel margins in the US and lower financing costs following deleveraging. Management commented it saw steady growth in the company’s convenience segment in the quarter and increases in same-store sales in the convenience segment in all regions. Gross margin increased 131 basis points (bps) year over year, to 16.3%, while the operating margin increased 124 bps year over year, to 5.3%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q20 Results

Alimentation Couche-Tard reported fiscal 1Q20 revenue of $14.2 billion, down 4.2% year over year and below the consensus estimate of $15.1 billion. The company reported adjusted diluted EPS of $0.97, up 11.5% year over year and beating the consensus estimate of $0.94, driven by higher road transportation fuel margins in the US and lower financing costs following deleveraging. Management commented it saw steady growth in the company’s convenience segment in the quarter and increases in same-store sales in the convenience segment in all regions. Gross margin increased 131 basis points (bps) year over year, to 16.3%, while the operating margin increased 124 bps year over year, to 5.3%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q20 Results

Alimentation Couche-Tard reported fiscal 1Q20 revenue of $14.2 billion, down 4.2% year over year and below the consensus estimate of $15.1 billion. The company reported adjusted diluted EPS of $0.97, up 11.5% year over year and beating the consensus estimate of $0.94, driven by higher road transportation fuel margins in the US and lower financing costs following deleveraging. Management commented it saw steady growth in the company’s convenience segment in the quarter and increases in same-store sales in the convenience segment in all regions. Gross margin increased 131 basis points (bps) year over year, to 16.3%, while the operating margin increased 124 bps year over year, to 5.3%.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q20 Results

Alimentation Couche-Tard reported fiscal 1Q20 revenue of $14.2 billion, down 4.2% year over year and below the consensus estimate of $15.1 billion. The company reported adjusted diluted EPS of $0.97, up 11.5% year over year and beating the consensus estimate of $0.94, driven by higher road transportation fuel margins in the US and lower financing costs following deleveraging. Management commented it saw steady growth in the company’s convenience segment in the quarter and increases in same-store sales in the convenience segment in all regions. Gross margin increased 131 basis points (bps) year over year, to 16.3%, while the operating margin increased 124 bps year over year, to 5.3%.

Performance by Segment

- Merchandise and service: 1Q20 revenue was up 1.6% year over year, to $3.6 billion, which management attributed to continued organic growth. Same-store merchandise revenue increased 2.5% in the US, 0.7% in Europe and 0.3% in Canada, driven by improved offering and various initiatives to drive traffic to stores. The segment’s 1Q20 gross margin was 34.5%, level with 1Q19.

- Road transportation fuel: 1Q20 revenue was down 4.8% year over year, to $10.4 billion. The company attributed the decline to a net lower average selling price. Same-store road transportation volume increased 0.6% in the US and 0.4% in Canada, but decreased 1.6% in Europe due to a competitive landscape and unfavorable weather.

- Other (including stationary energy and aviation fuel): 1Q20 revenue was down 44.8% year over year, to $188.5 million, driven by the company’s disposal of its marine fuel business. The segment’s gross margin increased 1,699 bps year over year, to 34.3%.

- Launched its Easy Pay loyalty program nationally in the US and expanded its digital upsell platform to cover 5,700 locations.

- Started piloting home delivery in Texas.

- Announced the closing of an investment in Fire and Flower Holdings, a leading independent cannabis retailer based in Alberta, Canada.

- Acquired eight company-operated stores through distinct transactions.

- Progressed with popular food-to-go initiatives in Europe.

- Completed the construction of 12 stores and relocation or reconstruction of 9 other stores.

- Had 32 stores under construction, which should open in the upcoming quarters.

- Had more than 5,800 stores in North America displaying its new global Circle K brand, which includes 789 stores acquired from CST.