Nitheesh NH

Coresight Research partnered with Alibaba’s Tmall Global to host a virtual summit on March 25, 2021, entitled “Alibaba’s Tmall Global Summit: Powering Your Business to Go Global.” Deborah Weinswig, CEO and Founder of Coresight Research, moderated the event.

The summit explored the retail landscape and opportunities in China, and presented strategies for brands and retailers to enter and succeed in the market through China's largest B2C (business-to-consumer) cross-border e-commerce platform, Tmall Global.

In this report, we present three key insights from the event.

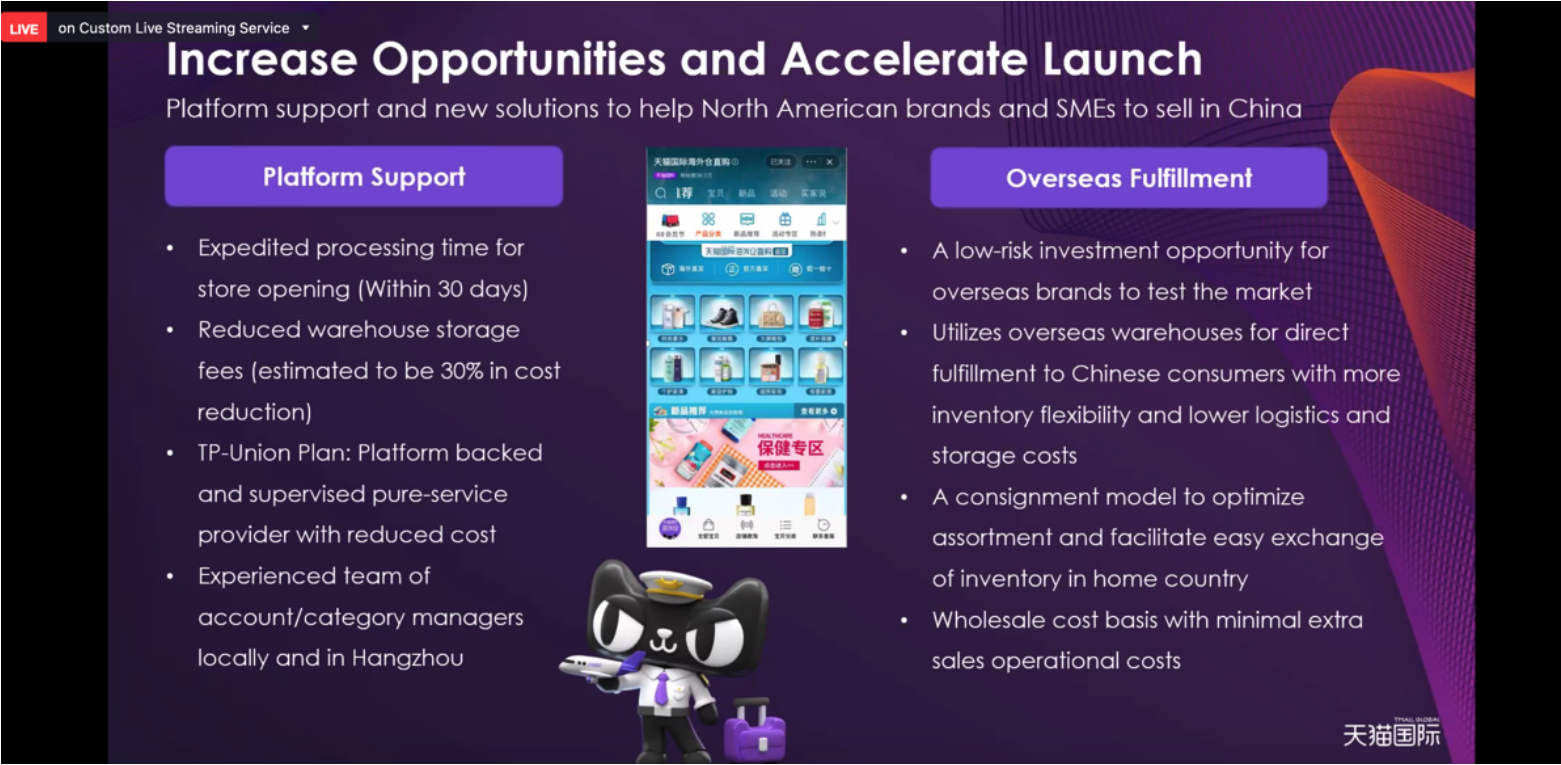

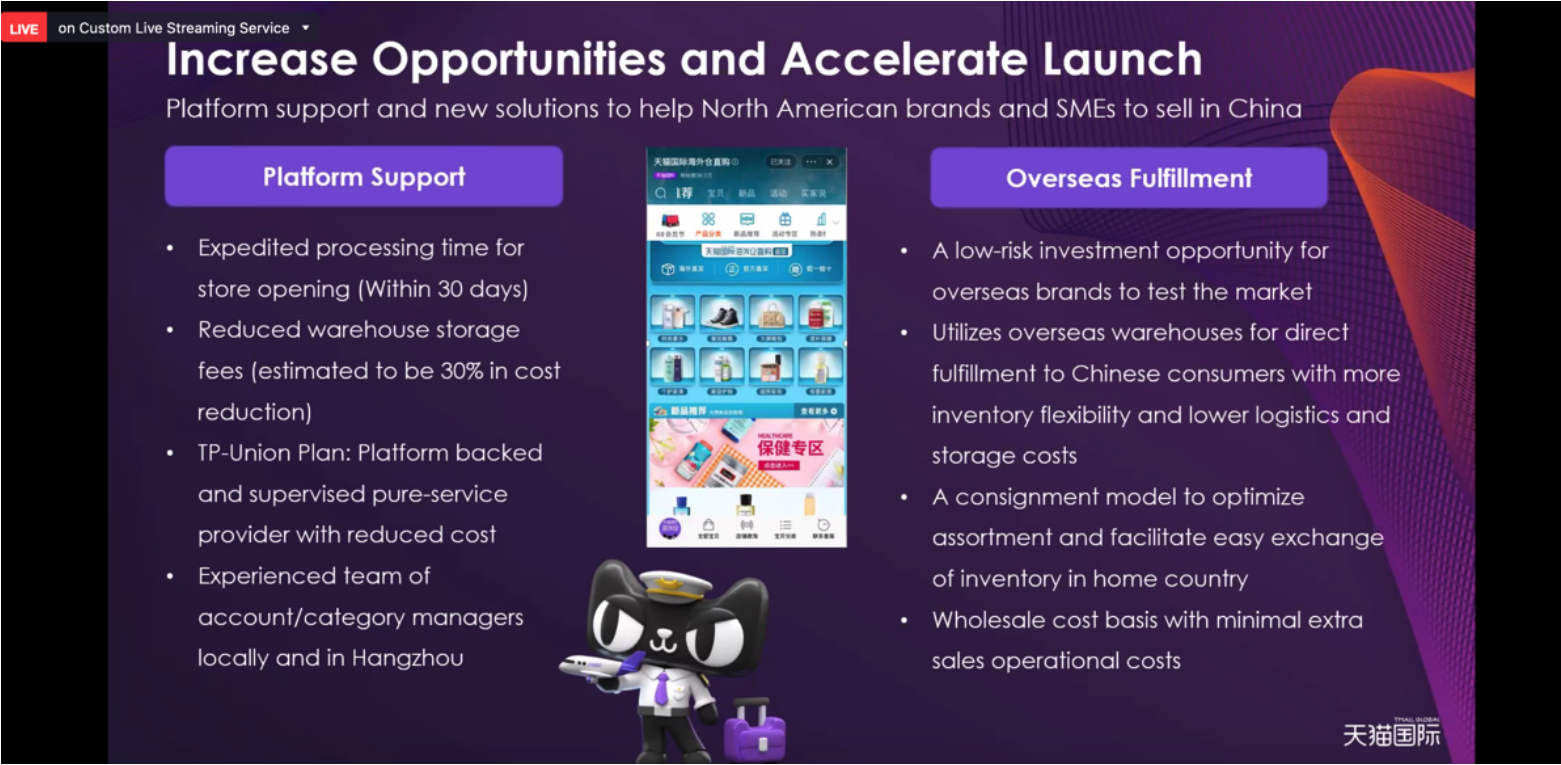

Tmall Global allows customers in China to order merchandise directly from brands’ overseas warehouses

Tmall Global allows customers in China to order merchandise directly from brands’ overseas warehouses

Source: Tmall Global[/caption] 2. Strategies for Startups To Go Global: Build a Community and Be Dynamic Josh Ghaim, CEO of Small World Brands, a startup that builds health and beauty brands, has led the success of vegan skincare brand Nuria Beauty both globally and in the China market specifically. Speaking at the Tmall Global Summit, he used Nuria Beauty as an example to illustrate the opportunities for smaller brands and startups to “go global.” He outlined three strategies for success: Deborah Weinswig, CEO and Founder of Coresight Research (top left); Tony Shan, Head of the Americas, Alibaba’s Tmall Global and Kaola (top right); Josh Ghaim, CEO of Small World Brands (bottom)

Deborah Weinswig, CEO and Founder of Coresight Research (top left); Tony Shan, Head of the Americas, Alibaba’s Tmall Global and Kaola (top right); Josh Ghaim, CEO of Small World Brands (bottom)

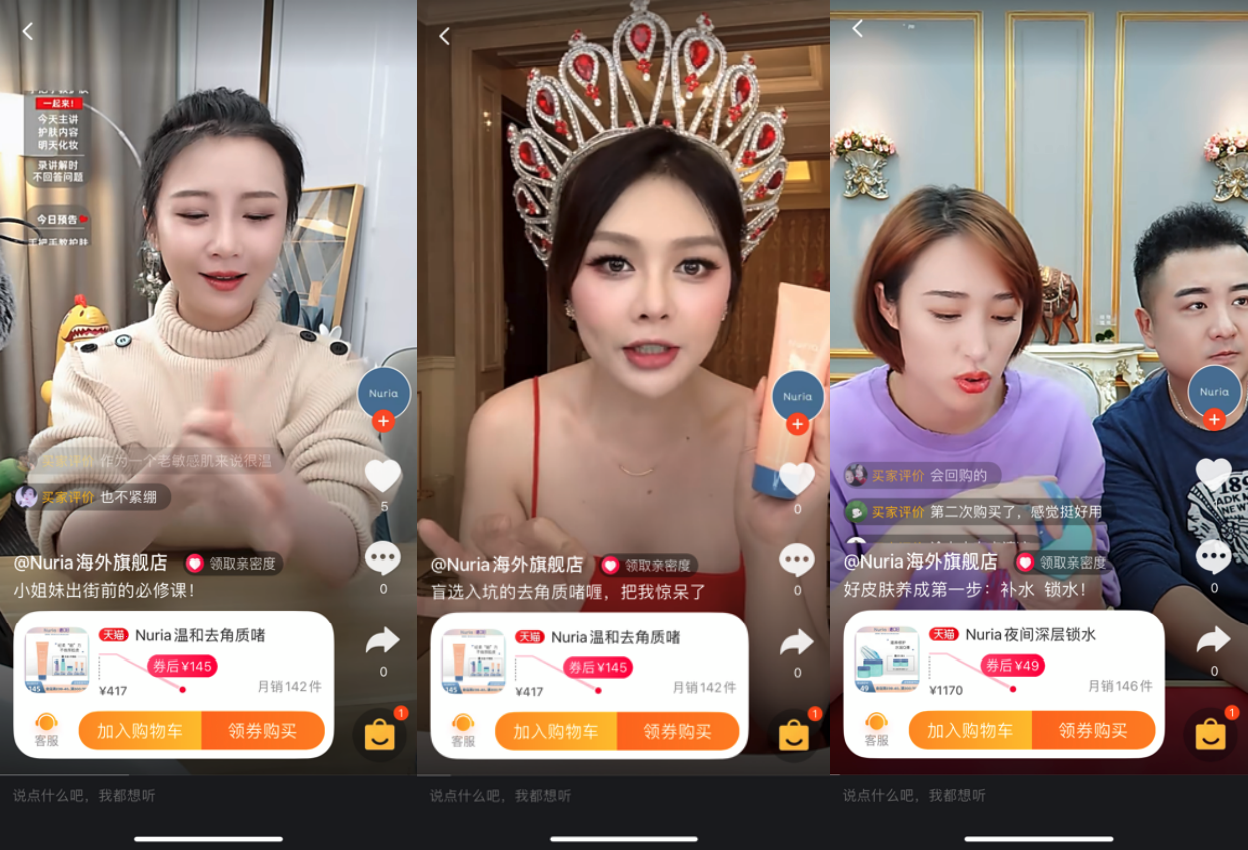

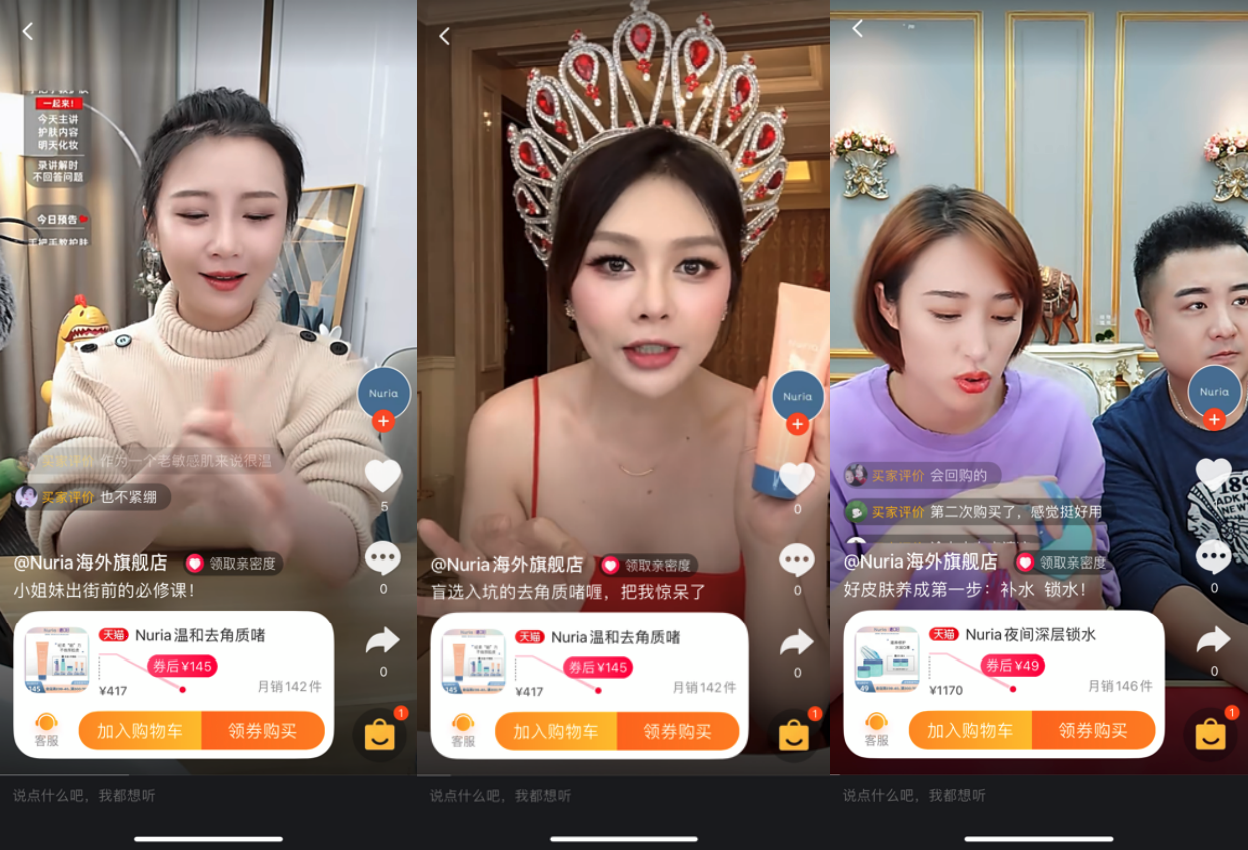

Source: Tmall Global/Coresight Research[/caption] 3. Recommendations for Brands To Succeed in China: Build a Digital Presence and Focus on a Few SKUs First Ghaim offered two recommendations to small brands that are looking to succeed in China’s e-commerce market specifically: KOLs promote Nuria Beauty’s hero products through livestreaming

KOLs promote Nuria Beauty’s hero products through livestreaming

Source: Tmall Global[/caption]

Alibaba’s Tmall Global Summit: Key Insights

1. Framework for Brands to Enter the China Market: Develop a Digital Mindset Weinswig was joined by Tony Shan, Head of the Americas, Alibaba’s Tmall Global and Kaola, to discuss the opportunities for global brands to enter the China market in 2021. Shan explained that there are three primary drivers of e-commerce growth in the China market that present opportunities for brands of different sizes and reach to enter and expand:- With China’s consumer market continuing to grow, demand is increasing for global, reputable brands and quality products.

- Digital transformation, which has been accelerated by the Covid-19 pandemic, has enabled China to become the largest e-commerce market in the world—with the highest e-commerce penetration.

- There are more than 350 million middle-class consumers in China, and this number is set to grow in 2021. This demographic will be important because these shoppers have strong purchasing power with more disposable income, and they are looking for the highest-quality products from around the world.

- Understand the market landscape, trends and opportunities.

- Define China objectives and strategy.

- Determine initial product portfolio, key items, pricing and team structure.

- Evaluate different platform solutions based on own investment capacity and resources.

- Select appropriate partners such as Tmall Global that offer support in logistics, marketing and cloud computing.

- Align on operational plan and services provided.

- Brand building and customer acquisition are critical for initial market entry.

- Identify target consumer demographics, marketing channels and KOL (key opinion leader) collaboration.

- The equivalent of 15–30% of total annual sales should be invested into marketing.

- Provide brand qualification, product details, brand story, and imagery for online page design and product detail pages.

- Establish expectations and check-in cadence with partners.

- Time the launch with a ramp-up period to a special promotional campaign.

- Collect data and consumer feedback to continue optimizing the operational plan.

Tmall Global allows customers in China to order merchandise directly from brands’ overseas warehouses

Tmall Global allows customers in China to order merchandise directly from brands’ overseas warehousesSource: Tmall Global[/caption] 2. Strategies for Startups To Go Global: Build a Community and Be Dynamic Josh Ghaim, CEO of Small World Brands, a startup that builds health and beauty brands, has led the success of vegan skincare brand Nuria Beauty both globally and in the China market specifically. Speaking at the Tmall Global Summit, he used Nuria Beauty as an example to illustrate the opportunities for smaller brands and startups to “go global.” He outlined three strategies for success:

- Through direct conversation with consumers, develop dynamic products that are adapted to different markets. Nuria Beauty collected insights from consumers from different markets through focus-group interviews with millennials from China, Korea, Japan and the US. The brand adjusted its product packaging and marketing strategies based on different consumer preferences.

- Build a community to communicate corporate social values. According to Ghaim, Nuria Beauty is committed to building an engaged community around shared beauty wisdom and support of the next generation. The brand announced in April 2020 that it would donate 100% of its April revenue to nonprofit organization Save the Children’s Covid-19 response program, supporting schools and communities in keeping vulnerable children eating and learning during the pandemic.

- Leverage social media to deliver the right messages to consumers: Nuria Beauty has been active on Facebook and Instagram, posting about the brand’s use of key natural ingredients and modern science to address skin concerns and promote skin health. The brand also engages in social activities that promote gender equality.

Deborah Weinswig, CEO and Founder of Coresight Research (top left); Tony Shan, Head of the Americas, Alibaba’s Tmall Global and Kaola (top right); Josh Ghaim, CEO of Small World Brands (bottom)

Deborah Weinswig, CEO and Founder of Coresight Research (top left); Tony Shan, Head of the Americas, Alibaba’s Tmall Global and Kaola (top right); Josh Ghaim, CEO of Small World Brands (bottom)Source: Tmall Global/Coresight Research[/caption] 3. Recommendations for Brands To Succeed in China: Build a Digital Presence and Focus on a Few SKUs First Ghaim offered two recommendations to small brands that are looking to succeed in China’s e-commerce market specifically:

- Build a digital presence. Ghaim suggested that brands enter the China market through digital channels, leveraging the power of Tmall Global as the largest cross-border e-commerce platform. He added that building a digital presence is not only about showcasing the brand but also about communicating with customers through chats, promoting products through online advertisements and livestreaming, and building customer loyalty with effective customer service. Ghaim explained that he had the idea of introducing Nuria Beauty to the China market in February 2020 when US stores started to shut down due to the pandemic, while China began to recover. The brand moved quickly and successfully launched a store on Tmall Global in July. Nuria Beauty then worked with a local marketing agency and launched livestreaming commerce quickly on its official store on Tmall, partnering with KOLs to boost consumer engagement; according to Ghaim, 40% of Nuria Beauty’s 2020 sales in China were via livestreaming. Weinswig added that Chinese consumers have 12 touchpoints to convert while US consumers only have four, indicating that Chinese consumers research more before buying a product and are more digitally dependent. Reiterating this, Ghaim said, “China is not a market that you just show up and everything will work out.” Weinswig and Ghaim agreed that it is important for brands to launch interesting marketing content and livestreaming to engage with customers and develop their awareness and understanding of the brand’s products.

- Focus on a few SKUs first. Ghaim emphasized that brands should gradually build their business in China—they should not be focused on short-term profits if they want to be successful in the long run. Nuria Beauty’s strategy is to launch only a few SKUs, compared to its larger offering in the US, and focus on these hero products to build trust with consumers.

KOLs promote Nuria Beauty’s hero products through livestreaming

KOLs promote Nuria Beauty’s hero products through livestreamingSource: Tmall Global[/caption]