Nitheesh NH

Introduction

Alibaba Group and Amazon are both innovators in retailing and technology. Leveraging technology with a hyper-focus on consumers, the two companies have led the retail industry in setting high customer expectations, from ease of product search and payment to assortment breadth and rapid delivery. Alibaba is the largest retail commerce business in the world in terms of GMV. The holding company dominates the developing Chinese retail market and has established a number of strategic partnerships and investments in Southeast Asia to increase its presence. Amazon is a multinational technology company based in Seattle, US, that focuses on e-commerce (both as retailer and as a marketplace), cloud computing, digital streaming and artificial intelligence. It conducts the bulk of its business in the relatively mature markets of Europe and North America. Both e-commerce giants have made moves into Australia and India as they seek to capitalize on the digitization of commerce systems around the world and increase their respective market penetration. We compare the evolving business models of the two companies, covering their selected financial and operating metrics and global expansion strategies. We offer insights into the next leg of growth for Alibaba and Amazon.Alibaba vs. Amazon: How Do Their Business Models Differ?

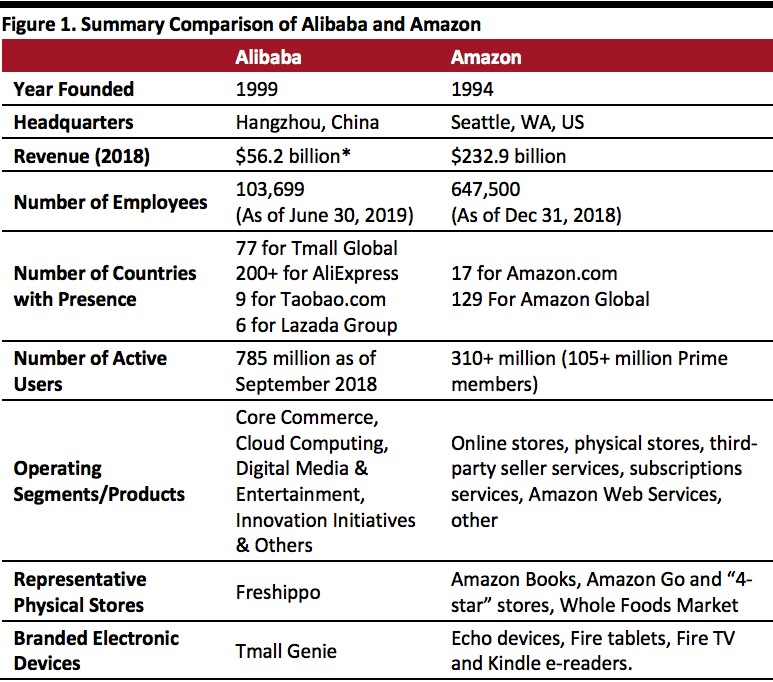

Alibaba and Amazon are competing against each other in the e-commerce industry, but they each employ different business models to achieve global success. Amazon utilizes retail and marketplace models, and leverages its Prime subscription service to create customer stickiness. Prime membership offers benefits such as one-/two-day delivery on first-party sales and selected third-party sales, as well as music and video streaming. Products are primarily offered to buyers through Amazon’s online storefront, which includes first- and third-party goods, and inventory is stored in third-party retailers’ warehouses or in Amazon’s own large network of warehouses. Amazon earns commission on third-party products sold through its marketplace, and the company offers fulfillment and warehousing services to brands and retailers for a fee as well. Unlike Amazon, Alibaba does not conduct first-party e-commerce but operates intermediary marketplaces that connect buyers and sellers. Alibaba’s core platforms are Taobao and Tmall. Both Alibaba and Amazon are involved in upscale, physical grocery retail, via Whole Foods Market and Freshippo (formerly, Hema), respectively. [caption id="attachment_102015" align="aligncenter" width="550"] *Alibaba’s fiscal year ended March 31, 2019

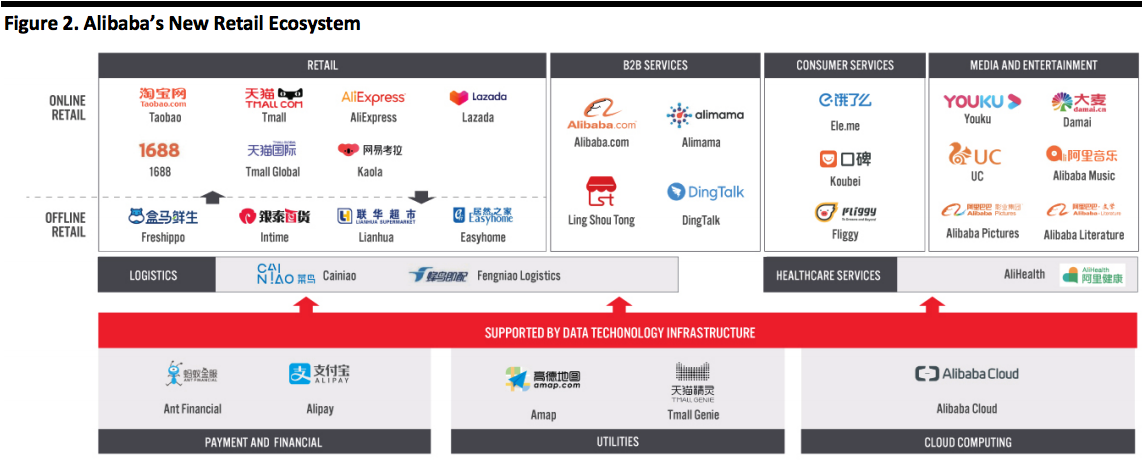

*Alibaba’s fiscal year ended March 31, 2019Source: Company reports[/caption] Alibaba has become a technology company that provides solutions to businesses and consumers. Through its “New Retail” concept, Alibaba strives to remain at the forefront of innovation in e-commerce and broaden its identity into big data, physical infrastructure and mobile payment solutions. [caption id="attachment_102016" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

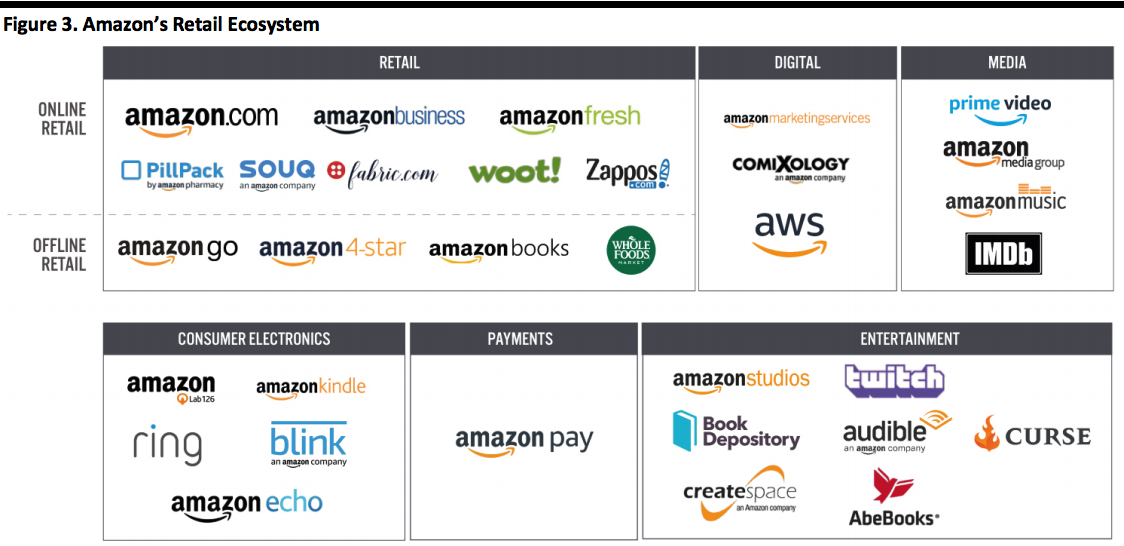

In contrast, Amazon’s ecosystem of products and services is centered around the company’s own brand. Although Amazon does not have a payment and financial platform, it manufactures technological products and invests heavily in its ebook offering.

[caption id="attachment_102017" align="aligncenter" width="700"]

Source: Company reports/Coresight Research[/caption]

In contrast, Amazon’s ecosystem of products and services is centered around the company’s own brand. Although Amazon does not have a payment and financial platform, it manufactures technological products and invests heavily in its ebook offering.

[caption id="attachment_102017" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

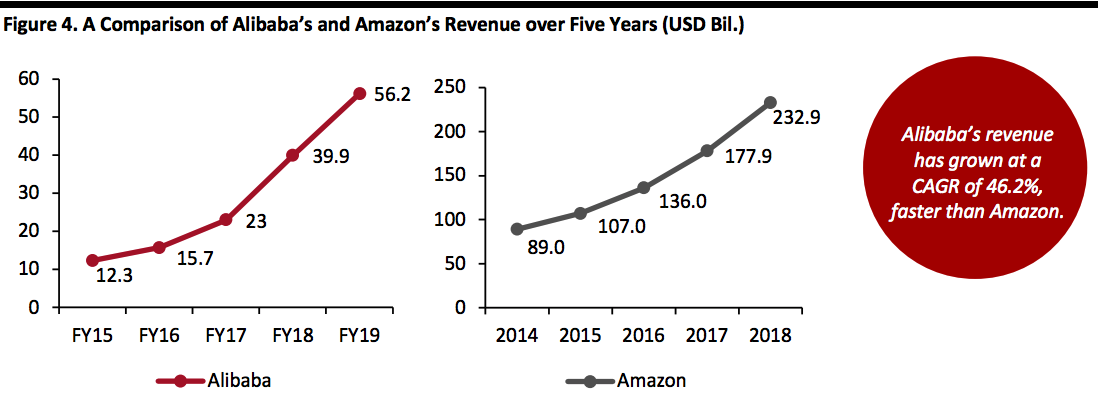

Alibaba’s Revenue Is Growing Faster Than Amazon

Amazon posted revenue of $232.9 billion in 2018, more than four times the $56.2 billion in revenue that Alibaba achieved in its fiscal year 2019. However, Alibaba’s revenue grew at a CAGR of 46.2% over the past five years, while Amazon achieved a CAGR of 27.2% over the same period. The difference in revenues is in large part a function of Alibaba’s focus on marketplaces; Alibaba books only a commission on sales rather than the full value of those sales. By contrast, Amazon’s first-party retail sales are booked at the full value of sales. Amazon reported that it generated first-party sales of $117 billion and third-party sales of $160 billion in 2018—yielding worldwide GMV of $277 billion. Alibaba reported GMV of $853 billion on its China retail marketplaces in the fiscal year ended March 31, 2019. [caption id="attachment_102018" align="aligncenter" width="700"] Note: Alibaba’s fiscal year ends March 31. Amazon’s fiscal year ends December 31.

Note: Alibaba’s fiscal year ends March 31. Amazon’s fiscal year ends December 31.Source: Company reports/Coresight Research[/caption] In addition, Amazon reported net income of $10.1 billion in 2018, while Alibaba reported $12.5 billion net income in fiscal year 2019, resulting in net margins of 4.3% and 23.3%, respectively. On this basis, and not adjusting for the differences in business models, Alibaba is over five times more profitable than Amazon.

Amazon’s Online Store Business Hurt Its Profitability

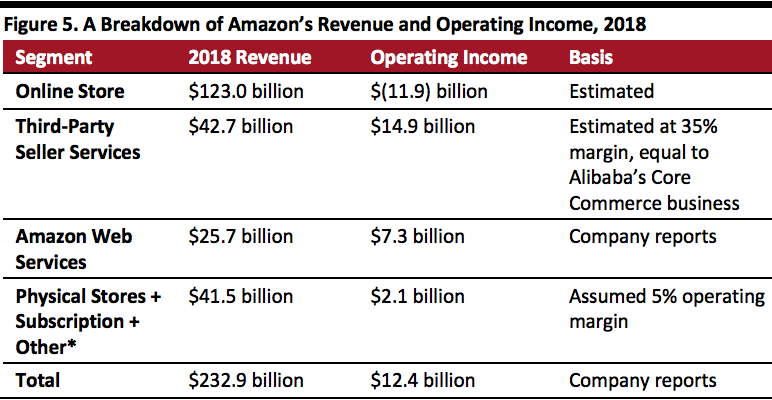

Alibaba reported an operating margin of 26.1% in fiscal year 2019, which was more than double the 12.9% figure that was reported by Amazon at the end of 2018. With Amazon’s revenue being four times that of Alibaba’s, why was it overshadowed in terms of operating margin? Comparing Alibaba’s Core Commerce business to Amazon’s third-party seller services—which share similar business functions—we found that the two companies saw roughly equally strong revenues in their latest fiscal years, of $48.2 billion and $42.7 billion, respectively. We have therefore assumed that the operating margins of these businesses were also similar: As Alibaba reported an operating margin of 35%, we have applied the same figure to Amazon, resulting in an estimated operating income of £14.9 billion for its third-party seller services (as shown in Figure 5). According to Amazon’s 2018 annual report, the Amazon Web Services (AWS) segment saw an operating income of $7.3 billion, and the company’s total operating income was $12.4 billion. We have therefore calculated that the operating margin of Amazon’s online store was negative in 2018, with an estimated loss of approximately $11.9 billion. [caption id="attachment_102019" align="aligncenter" width="550"] *“Other” segment includes sales of advertising services, as well as sales related to Amazon’s other service offerings.

*“Other” segment includes sales of advertising services, as well as sales related to Amazon’s other service offerings.Source: Company reports/Coresight Research[/caption]

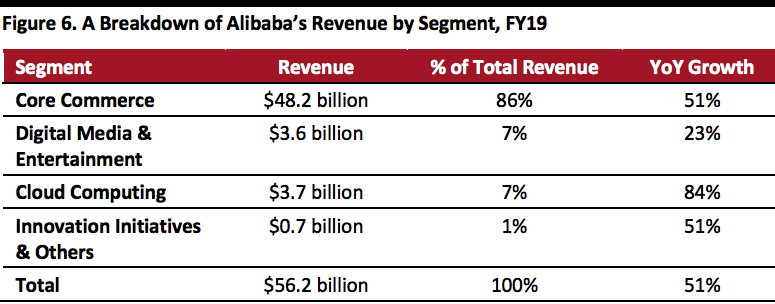

Internally Developed Technologies Are Driving the Rapid Growth of Alibaba and Amazon

While the global secular trend to online shopping remains a strong pillar of growth for both Alibaba and Amazon, the internally developed technologies that are supporting their e-commerce platforms have developed into their own substantial adjacent businesses. Rather than their core e-commerce businesses, Cloud Computing at Alibaba and AWS at Amazon are the segments that are primarily driving the rapid growth of the two companies’ e-commerce platforms. As shown in Figure 6, Alibaba’s Cloud Computing revenue grew at a rate of 84% to $3.7 billion, representing 8% of company’s total revenue. The segment’s operating loss was $821 million in fiscal year 2019. Alibaba’s cloud technology served more than half of the A-share listed companies in China, supporting data storage and network virtualization services, as well as large-scale computing, security, management and application services, big data analytics, machine learning and IoT (Internet of Things) services. [caption id="attachment_102020" align="aligncenter" width="550"] Source: Company reports[/caption]

In 2018, AWS revenue grew at a rate of 47% year over year to $25.6 billion, representing 11% of Amazon’s total revenue. As we saw in Figure 5, AWS operating income totaled $7.3 billion in 2018, which is an increase of 68% over 2017 and accounts for 59% of Amazon’s consolidated operating income. The segment supports Amazon’s retail business strategy of growing in scale and capturing further market share despite its modest profits/losses.

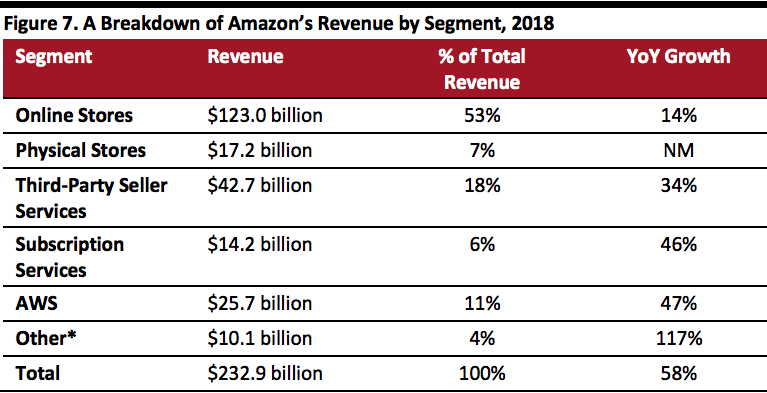

On the whole, Amazon’s revenue streams are a little more diversified than Alibaba’s, with 53% of total revenue in 2018 coming from online stores, as shown in Figure 7. Brick-and-mortar operations made up 7% of Amazon’s total revenue, driven by the company’s acquisition of Whole Foods Market in 2017.

[caption id="attachment_102021" align="aligncenter" width="550"]

Source: Company reports[/caption]

In 2018, AWS revenue grew at a rate of 47% year over year to $25.6 billion, representing 11% of Amazon’s total revenue. As we saw in Figure 5, AWS operating income totaled $7.3 billion in 2018, which is an increase of 68% over 2017 and accounts for 59% of Amazon’s consolidated operating income. The segment supports Amazon’s retail business strategy of growing in scale and capturing further market share despite its modest profits/losses.

On the whole, Amazon’s revenue streams are a little more diversified than Alibaba’s, with 53% of total revenue in 2018 coming from online stores, as shown in Figure 7. Brick-and-mortar operations made up 7% of Amazon’s total revenue, driven by the company’s acquisition of Whole Foods Market in 2017.

[caption id="attachment_102021" align="aligncenter" width="550"] Totals do not sum to 100% due to rounding.

Totals do not sum to 100% due to rounding.*“Other” segment includes sales of advertising services, as well as sales related to Amazon’s other service offerings.

Source: Company reports[/caption]

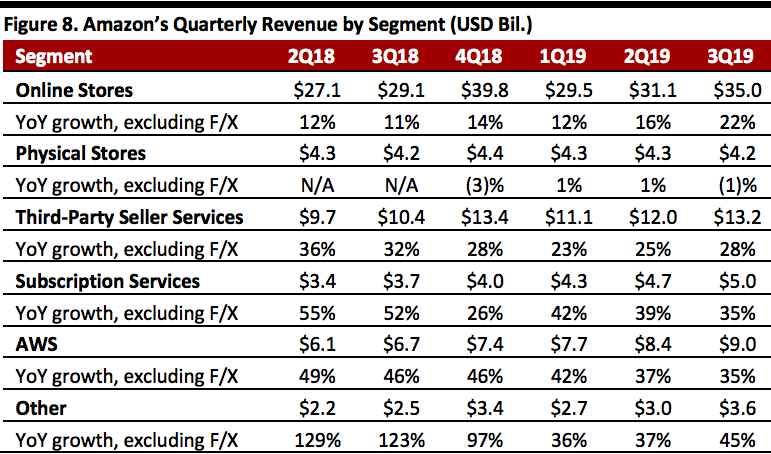

Amazon Was Less Profitable in its Third Quarter of 2019

Reviewing Amazon’s financial performance in its third quarter of 2019 (latest at time of writing), sales were up 24% year over year to $70.0 billion, representing a slightly slower growth rate than that of operating expenses, which was 26.4%. As a result, operating income decreased to $3.2 billion, compared with $3.7 billion in the year-ago quarter. Amazon has been spending billions of dollars on the expansion of its one-day delivery service for Prime members in the US. By channel, sales in physical stores declined by 1% in the third quarter of 2019, to $4.2 billion. Furthermore, subscription services and AWS experienced a slowdown in year-over-year growth in the third quarter of 2019, both sequentially and versus the prior year: Both segments saw a 35% growth rate compared to 52% and 46%, respectively, one year earlier. Notably, Microsoft’s Azure cloud computing software grew at a rate of 59% year over year in its first quarter of fiscal year 2020, directly competing against Amazon’s AWS. Amazon gave fourth-quarter revenue guidance in the range of $80–86.5 billion, which is below the consensus estimate of $87.4 billion. This indicates that the all-important holiday shopping season may be underwhelming in 2019. [caption id="attachment_102022" align="aligncenter" width="550"] Source: Company reports[/caption]

Source: Company reports[/caption]

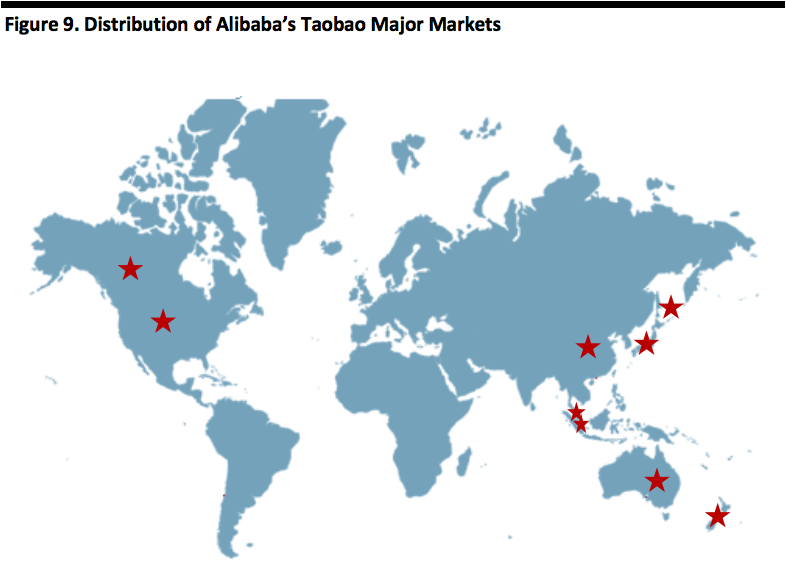

Alibaba’s Global Expansion Strategy: Digitize the Entire Retail Value Chain

In 1999, Alibaba launched a China marketplace (currently known as 1688.com) for the Chinese domestic wholesale trade. In May 2003, online shopping website Taobao Marketplace was founded. Since then, the company has expanded its ecosystem by developing platforms across multiple sectors—procurement, sales, delivery, payment, financial and others. Alibaba’s global expansion strategy involves digitizing the entire retail value chain, and its mission is to make it easy to do business anywhere. In 2019, Alibaba stepped up the competition against Amazon in the global e-commerce market through its AliExpress e-commerce business. AliExpress sells goods from Chinese retailers to customers in more than 200 countries, and it has now opened its platform to vendors overseas, allowing small and medium-sized businesses in Italy, Russia, Spain and Turkey to register and sell their products to customers in other countries in the AliExpress network. In June 2019, Alibaba launched an English-language portal on Tmall Global, China’s largest cross-border online shopping platform. The company’s goal is to attract more merchants and businesses from around the world to sell high-quality imported products to consumers in China. Alibaba is also increasing its market dominance through its 11.11 Global Shopping Festival, which takes place annually on November 11. The event sees the company tap into a global supply chain to meet the growing demands of Chinese consumers for new brands and products. More than 22,000 international brands from 78 regions participated in the 2019 11.11 festival. Alibaba currently operates in more than 200 countries, and the key markets for Taobao are Australia, Canada, China, Japan, Malaysia, New Zealand, Singapore, South Korea and the US. [caption id="attachment_102023" align="aligncenter" width="550"] Source: Company reports[/caption]

Source: Company reports[/caption]

Prime Is the Key to Amazon’s Global Expansion

Amazon’s influence in the US e-commerce market is undeniable. Prime, Amazon’s subscription-based service, has been a major driver behind its success in the US and is also the key to the company’s global expansion. Members receive a number of benefits: fast shipping for eligible purchases; movie, TV show and music streaming services; exclusive shopping deals on Prime Day; and more. Amazon now operates in 17 markets: Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Netherlands, Singapore, Spain, Turkey, the UAE, the UK and the US. (As we discuss below, the company announced its exit from China in April 2019.) [caption id="attachment_102024" align="aligncenter" width="550"] Source: Company reports[/caption]

Source: Company reports[/caption]

Amazon Announces Exit from China, yet Opens a Pop-Up Store on China’s Pinduoduo Marketplace

Amazon announced in April 2019 that it plans to shut down its China marketplace business. The company entered the Chinese market in 2004 through the acquisition of Joyo, a domestic online shopping market, but faced stiff competition from e-commerce giants Alibaba and JD.com. Customers in China will still be able to buy items from Germany, Japan, the UK and the US through Amazon’s global website, as the company remains focused on cross-border sales. AWS will reportedly continue to operate in China. In November, Amazon announced that it would launch pop-up store on Chinese e-commerce platform Pinduoduo. The store will carry a selection of about 1,000 products from overseas and will remain open until the end of December. Despite Amazon’s decision to stop operating a marketplace in China for domestic merchants, the Pinduoduo store opening is in line with the company’s strategy to focus on selling international goods to China.Key Insights

- Alibaba and Amazon operate different business models in e-commerce. Amazon functions as both a retailer and a marketplace, driven by its membership program, while Alibaba operates as an intermediary between buyers and sellers.

- Alibaba’s revenue has been growing fast, at a five-year CAGR of 46.2%. Reflecting Alibaba’s focus on marketplaces, its revenue is still much lower than Amazon’s, while Alibaba’s GMV is higher.

- Amazon now operates in 17 markets, with its most recently entered countries including Australia, Singapore and the UAE. For Alibaba, Taobao.com operates in nine countries. Lazada Group focuses on Southeast Asia, where it operates in six markets. AliExpress has footprints in over 200 countries.

- Amazon announced its exit from China in April 2019, but then opened a pop-up store on China’s Pinduoduo e-commerce platform, with a goal of increasing cross-border sales.