DIpil Das

[caption id="attachment_88251" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

4Q19 Results

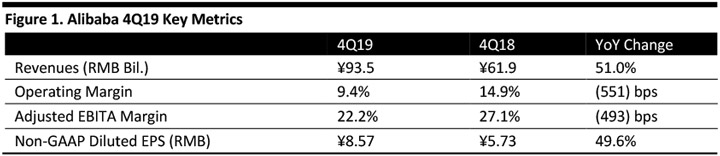

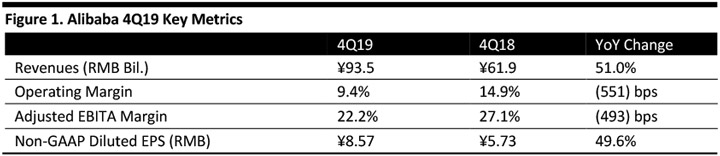

For 4Q19, ended March 31, 2019, Alibaba reported revenues of ¥93.5 billion ($13.9 billion), up 51% year over year and beating the consensus estimate of ¥91.7 billion ($13.3 billion). This revenue increase was primarily driven by growth in China retail marketplaces and cloud computing. Operating margin fell to 9.4%, primarily due to the impact of the settlement of a US federal class-action lawsuit. Non-GAAP diluted EPS increased 49.6% to ¥8.57 ($1.28), beating the consensus estimate of ¥6.50.

For the fiscal year 2019, Alibaba reported revenues of ¥376.8 billion ($56.2 billion), up 51% year over year.

Core commerce revenues reached ¥58.4 billion ($8.7 billion), up 45% from 4Q18. It was primarily driven by strong revenue growth from customer management and commission in the retail marketplaces segment.

Source: Company reports/Coresight Research[/caption]

4Q19 Results

For 4Q19, ended March 31, 2019, Alibaba reported revenues of ¥93.5 billion ($13.9 billion), up 51% year over year and beating the consensus estimate of ¥91.7 billion ($13.3 billion). This revenue increase was primarily driven by growth in China retail marketplaces and cloud computing. Operating margin fell to 9.4%, primarily due to the impact of the settlement of a US federal class-action lawsuit. Non-GAAP diluted EPS increased 49.6% to ¥8.57 ($1.28), beating the consensus estimate of ¥6.50.

For the fiscal year 2019, Alibaba reported revenues of ¥376.8 billion ($56.2 billion), up 51% year over year.

Core commerce revenues reached ¥58.4 billion ($8.7 billion), up 45% from 4Q18. It was primarily driven by strong revenue growth from customer management and commission in the retail marketplaces segment.

Source: Company reports/Coresight Research[/caption]

4Q19 Results

For 4Q19, ended March 31, 2019, Alibaba reported revenues of ¥93.5 billion ($13.9 billion), up 51% year over year and beating the consensus estimate of ¥91.7 billion ($13.3 billion). This revenue increase was primarily driven by growth in China retail marketplaces and cloud computing. Operating margin fell to 9.4%, primarily due to the impact of the settlement of a US federal class-action lawsuit. Non-GAAP diluted EPS increased 49.6% to ¥8.57 ($1.28), beating the consensus estimate of ¥6.50.

For the fiscal year 2019, Alibaba reported revenues of ¥376.8 billion ($56.2 billion), up 51% year over year.

Core commerce revenues reached ¥58.4 billion ($8.7 billion), up 45% from 4Q18. It was primarily driven by strong revenue growth from customer management and commission in the retail marketplaces segment.

Source: Company reports/Coresight Research[/caption]

4Q19 Results

For 4Q19, ended March 31, 2019, Alibaba reported revenues of ¥93.5 billion ($13.9 billion), up 51% year over year and beating the consensus estimate of ¥91.7 billion ($13.3 billion). This revenue increase was primarily driven by growth in China retail marketplaces and cloud computing. Operating margin fell to 9.4%, primarily due to the impact of the settlement of a US federal class-action lawsuit. Non-GAAP diluted EPS increased 49.6% to ¥8.57 ($1.28), beating the consensus estimate of ¥6.50.

For the fiscal year 2019, Alibaba reported revenues of ¥376.8 billion ($56.2 billion), up 51% year over year.

Core commerce revenues reached ¥58.4 billion ($8.7 billion), up 45% from 4Q18. It was primarily driven by strong revenue growth from customer management and commission in the retail marketplaces segment.

- China commerce wholesale reached ¥2.5 billion ($380 million), up 35% year over year. The growth was propelled by an increase in the average revenue from paying members on 1688.com, Alibaba’s domestic wholesale marketplace.

- International commerce retail reached ¥4.9 billion ($737 million), up 25% year over year. The consolidation of Trendyol, Turkey’s leading e-commerce platform, and AliExpress contributed to this revenue growth.

- Local consumer services recorded ¥5.3 billion ($785 million). The segment mainly consists of revenues from platform commissions and food delivery and other services provided by on-demand food-delivery platform Ele.me.