Nitheesh NH

[caption id="attachment_68906" align="aligncenter" width="600"] Source: Company reports/Coresight Research[/caption]

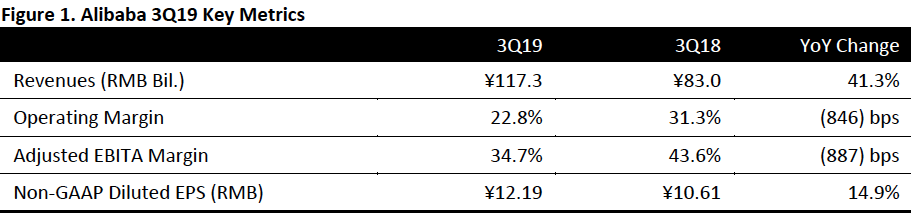

3Q19 Results

For 3Q19, ended December 31, 2018, Alibaba reported revenues of ¥117.3 billion ($17.1 billion), up 41% year over year, versus 54% in 2Q19. The revenue growth was primarily driven by growth in China retail marketplaces and cloud computing. However, 3Q19 revenues missed the consensus estimate of ¥119.4 billion recorded by Bloomberg. The operating margin shrank to 22.8% due to higher investments in local consumer services and digital media as well as increased costs of inventory and logistics from its New Retail and direct import businesses. Non-GAAP diluted EPS increased 14.9% to ¥12.19 ($1.77), beating the consensus estimate of ¥11.21.

Core commerce revenues reached ¥102.8 billion ($15.0 billion), up 40% year over year, versus 56% in 2Q19.

Source: Company reports/Coresight Research[/caption]

3Q19 Results

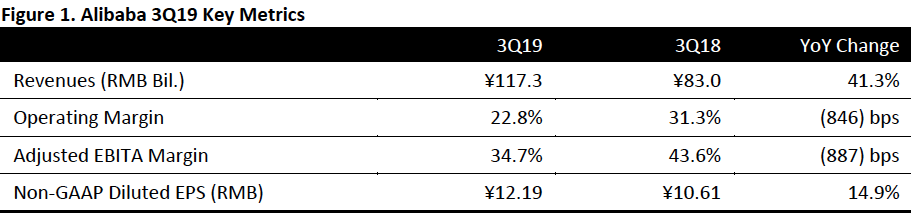

For 3Q19, ended December 31, 2018, Alibaba reported revenues of ¥117.3 billion ($17.1 billion), up 41% year over year, versus 54% in 2Q19. The revenue growth was primarily driven by growth in China retail marketplaces and cloud computing. However, 3Q19 revenues missed the consensus estimate of ¥119.4 billion recorded by Bloomberg. The operating margin shrank to 22.8% due to higher investments in local consumer services and digital media as well as increased costs of inventory and logistics from its New Retail and direct import businesses. Non-GAAP diluted EPS increased 14.9% to ¥12.19 ($1.77), beating the consensus estimate of ¥11.21.

Core commerce revenues reached ¥102.8 billion ($15.0 billion), up 40% year over year, versus 56% in 2Q19.

Source: Company reports/Coresight Research[/caption]

3Q19 Results

For 3Q19, ended December 31, 2018, Alibaba reported revenues of ¥117.3 billion ($17.1 billion), up 41% year over year, versus 54% in 2Q19. The revenue growth was primarily driven by growth in China retail marketplaces and cloud computing. However, 3Q19 revenues missed the consensus estimate of ¥119.4 billion recorded by Bloomberg. The operating margin shrank to 22.8% due to higher investments in local consumer services and digital media as well as increased costs of inventory and logistics from its New Retail and direct import businesses. Non-GAAP diluted EPS increased 14.9% to ¥12.19 ($1.77), beating the consensus estimate of ¥11.21.

Core commerce revenues reached ¥102.8 billion ($15.0 billion), up 40% year over year, versus 56% in 2Q19.

Source: Company reports/Coresight Research[/caption]

3Q19 Results

For 3Q19, ended December 31, 2018, Alibaba reported revenues of ¥117.3 billion ($17.1 billion), up 41% year over year, versus 54% in 2Q19. The revenue growth was primarily driven by growth in China retail marketplaces and cloud computing. However, 3Q19 revenues missed the consensus estimate of ¥119.4 billion recorded by Bloomberg. The operating margin shrank to 22.8% due to higher investments in local consumer services and digital media as well as increased costs of inventory and logistics from its New Retail and direct import businesses. Non-GAAP diluted EPS increased 14.9% to ¥12.19 ($1.77), beating the consensus estimate of ¥11.21.

Core commerce revenues reached ¥102.8 billion ($15.0 billion), up 40% year over year, versus 56% in 2Q19.

- China retail revenues reached ¥81.1 billion ($11.8 billion), up 35% year over year, versus 37% in 2Q19. The strong growth was driven by increased user engagement that drove purchase conversion and robust sales on Tmall. The company’s annual active consumers rose to 636 million, representing an increase of 35 million over the 12-month period ended September 30, 2018. More than 70% of the newly acquired annual active consumers came from tier three or lower cities.

- China wholesale revenues came in at ¥2.7 billion ($392 million), up 40% year over year, versus 46% in 2Q19. The increase was primarily driven by higher average revenue from paying members on 1688.com, the company’s domestic wholesale marketplace.

- International retail revenues were ¥5.8 billion ($849 million), up 23% year over year, versus 55% in 2Q19. The increase was primarily driven by the company’s consolidation of Turkey’s e-commerce platform Trendyol.

- Alibaba’s proprietary grocery retail chain Freshippo expanded to 109 self-operated stores in China, mostly located in tier 1 and tier 2 cities.

- Alibaba assisted the digitalization of around 470 Sun Art stores with its New Retail know-how.