DIpil Das

[caption id="attachment_94851" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

1Q20 Results

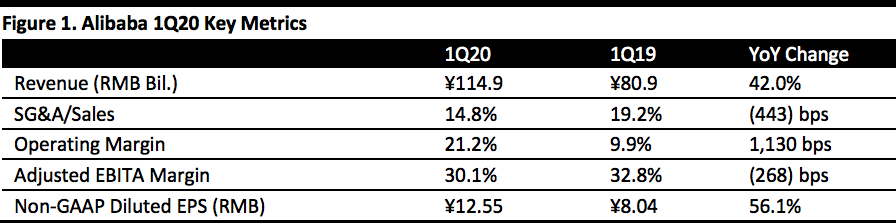

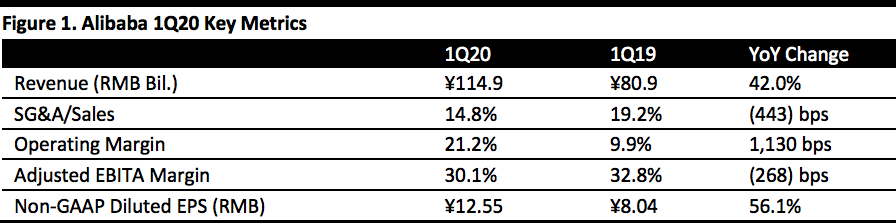

For 1Q20, ended June 30, 2019, Alibaba reported revenue of ¥114.9 billion ($16.7 billion), up 42% year over year. Growth was primarily driven by growth in cloud computing and China retail marketplaces, which benefited from the 6.18 midyear shopping festival. However, revenue missed the consensus estimate of ¥115.6 billion. Operating income for the quarter increased 204% year over year, yielding an operating margin of 21.2%. Growth in operating income would have been 27% excluding share-based compensation expense from Ant Financial’s awards to employees incurred in 1Q19. Non-GAAP diluted EPS increased 56.1% to ¥12.55 ($1.83), beating the consensus estimate of ¥10.28.

Core commerce revenues reached ¥99.5 billion ($14.5 billion), up 44% from 1Q19. The increase was driven primarily by solid revenue growth from its direct sales business and commissions from delivery services.

Source: Company reports/Coresight Research[/caption]

1Q20 Results

For 1Q20, ended June 30, 2019, Alibaba reported revenue of ¥114.9 billion ($16.7 billion), up 42% year over year. Growth was primarily driven by growth in cloud computing and China retail marketplaces, which benefited from the 6.18 midyear shopping festival. However, revenue missed the consensus estimate of ¥115.6 billion. Operating income for the quarter increased 204% year over year, yielding an operating margin of 21.2%. Growth in operating income would have been 27% excluding share-based compensation expense from Ant Financial’s awards to employees incurred in 1Q19. Non-GAAP diluted EPS increased 56.1% to ¥12.55 ($1.83), beating the consensus estimate of ¥10.28.

Core commerce revenues reached ¥99.5 billion ($14.5 billion), up 44% from 1Q19. The increase was driven primarily by solid revenue growth from its direct sales business and commissions from delivery services.

Source: Company reports/Coresight Research[/caption]

1Q20 Results

For 1Q20, ended June 30, 2019, Alibaba reported revenue of ¥114.9 billion ($16.7 billion), up 42% year over year. Growth was primarily driven by growth in cloud computing and China retail marketplaces, which benefited from the 6.18 midyear shopping festival. However, revenue missed the consensus estimate of ¥115.6 billion. Operating income for the quarter increased 204% year over year, yielding an operating margin of 21.2%. Growth in operating income would have been 27% excluding share-based compensation expense from Ant Financial’s awards to employees incurred in 1Q19. Non-GAAP diluted EPS increased 56.1% to ¥12.55 ($1.83), beating the consensus estimate of ¥10.28.

Core commerce revenues reached ¥99.5 billion ($14.5 billion), up 44% from 1Q19. The increase was driven primarily by solid revenue growth from its direct sales business and commissions from delivery services.

Source: Company reports/Coresight Research[/caption]

1Q20 Results

For 1Q20, ended June 30, 2019, Alibaba reported revenue of ¥114.9 billion ($16.7 billion), up 42% year over year. Growth was primarily driven by growth in cloud computing and China retail marketplaces, which benefited from the 6.18 midyear shopping festival. However, revenue missed the consensus estimate of ¥115.6 billion. Operating income for the quarter increased 204% year over year, yielding an operating margin of 21.2%. Growth in operating income would have been 27% excluding share-based compensation expense from Ant Financial’s awards to employees incurred in 1Q19. Non-GAAP diluted EPS increased 56.1% to ¥12.55 ($1.83), beating the consensus estimate of ¥10.28.

Core commerce revenues reached ¥99.5 billion ($14.5 billion), up 44% from 1Q19. The increase was driven primarily by solid revenue growth from its direct sales business and commissions from delivery services.

- China commerce retail reached ¥6 billion ($11.0 billion), up 40% year over year. The strong growth was driven by contributions from direct sales business, including Tmall Supermarket and Freshippo. Revenue from customer management and commission also increased 27% and 23%, respectively, year over year, thanks to user growth and higher Tmall physical good GMV.

- China commerce wholesale reached ¥0 billion ($436 million), up 33% year over year. The growth was propelled by an increase in average revenue from paying members on 1688.com, Alibaba’s domestic wholesale marketplace.

- International commerce retail reached ¥5.6 billion ($811 million), up 29% year over year. The consolidation of Trendyol, Turkey’s leading e-commerce platform, and AliExpress, contributed to the revenue growth.

- Local consumer services revenues were ¥6.2 billion ($900 million), up 137% year over year. The segment consists of revenues from platform commissions, food delivery and other services provided by on-demand food-delivery platform Ele.me.