DIpil Das

The Coresight Research team was in Hangzhou, China on September 23-24 for Alibaba Group’s annual investor day — which actually spanned two days. In this report, we provide insights from day one.

Core Commerce

Jiang Fan, President of Taobao and Tmall

Jiang offered an overview of the Taobao and Tmall marketplaces, and the latest developments he observed on those two channels. Some of the findings are:

- Retail growth in Alibaba’s China marketplace was 25% in FY19, higher than total retail growth in China.

- Tmall and Taobao have penetrated into less developed areas, and over 70% of new consumers now come from those areas and total user penetration in those areas is around 40%. Jiang believes there are still room to grow.

- Average revenue per user (ARPU) was over ¥2,000 ($285) in FY18 and FY19. More and more people in less developed areas are using Alipay, which also accelerated market penetration.

Jiang also talked about Tmall and Taobao’s new strategies, including:

- New product launches have been a key strategy for Tmall since 2018, when the company launched 50 million new product SKUs on Tmall. Sales growth from new product reached 80%. Many brands have chosen Tmall as their primary and exclusive channel for new product launches.

- Incubating new brands. Tmall will not launch its own private labels. However, it wants to help brand owners launch new sub brands and products exclusively for Tmall users using new media, including social media, short videos, live streaming , creating higher quality content and leveraging Tmall’s Big Data to help with products developing and positioning.

- Made to order: Via a new service on the group buying platform Juhuasuan, Alibaba shares data, such as consumer insights, with factories; the data helps factories create products with new features and functionality. Tmall can also integrate production data with sales data to help factories lower inventory.

- Idle Fish is China’s leading re-commerce app in the Alibaba ecosystem. With integration with the Taobao app and more active professional sellers on Taobao, Idle Fish is positioning itself as a C2C marketplace for people selling second-hand products.

Tmall Flagship Store 2.0: Tmall wants to helps brands and merchants better manage consumers, accelerate digitalization and drive new growth by improving the connection between online and offline

[caption id="attachment_97027" align="aligncenter" width="700"] Source: Coresight Research [/caption]

Source: Coresight Research [/caption]

Import

Tmall Import and Export business unit is aiming to help partners build brand awareness in China and successfully enter the China market.

Alibaba has three models for foreign brand partners: Alibaba is customizing import solutions for foreign brands and building a larger import partnership network to enhance import efficiency and lower the costs. These are the three models/programs:

- Overseas Warehouse Direct Buy

- This model helps “small, boutique and niche” foreign brands to gradually build brand awareness among Chinese consumers and cultivate fans base in China.

- Brands can also shorten their shipping time and costs — with more brands joining the program, Alibaba can gain leverage in negotiation with cross-border logistics companies — e.g., goods can be delivered from the US to Hangzhou in as fast as 5.2 days and it takes an average of 7.5 days for goods to be shipped from the US to China.

- Bonded Warehouse Model

- It helps brands that already enjoy awareness among China’s consumers to grow sales to a larger scale - so it can build up momentum in omnichannel in the future

- Alibaba is able to work closer with local government and help brands to shorten Customs clearance time and costs through this model

- Brands can also leverage consumer insights and industrial trends shared by Alibaba to drive higher consumer awareness.

- Direct Shipping to Local Warehouse

- It helps to bring agricultural products from the country of origin to arrive to Chinese consumers much easier.

- Alibaba has developed 120 sources of origin such as Brazil, Spain, Malaysia and Taiwan, and helps bring fresh food to Chinese consumers. It has shortened some logistics processes from 14 days to just 2 days.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Logistics

Cainiao ready for one billion package challenge through digitalization, personal service and community service

Cainiao, a logistics company launched by Alibaba Group, plays a central role in Alibaba’s ecosystem, and is focusing on three areas:

- Cainiao Smart Logistics: Hopes to build a digitalized logistics network.

- Cainiao Guo Guo: Hopes to build a stronger personal courier platform.

- Cainiao Post: Hopes to build a large network of last mile stations – and what it calls “community service centres” by providing a diverse range of community service offerings such as laundry.

Cainiao handled 100 million packages in 2017, but management says it will be ready to tackle a one-billion package challenge with the digitalization of courier management in the future.

- The Bao Guo Xia app is a smart tool for couriers, with voice assistants and recipient management.

- The Cainiao Index is now widely accepted as a tool to monitor user experience and quality control. The logistics company STO uses this index to manage its whole system.

Cainiao app

Cainiao app Source: Apple App Store[/caption]

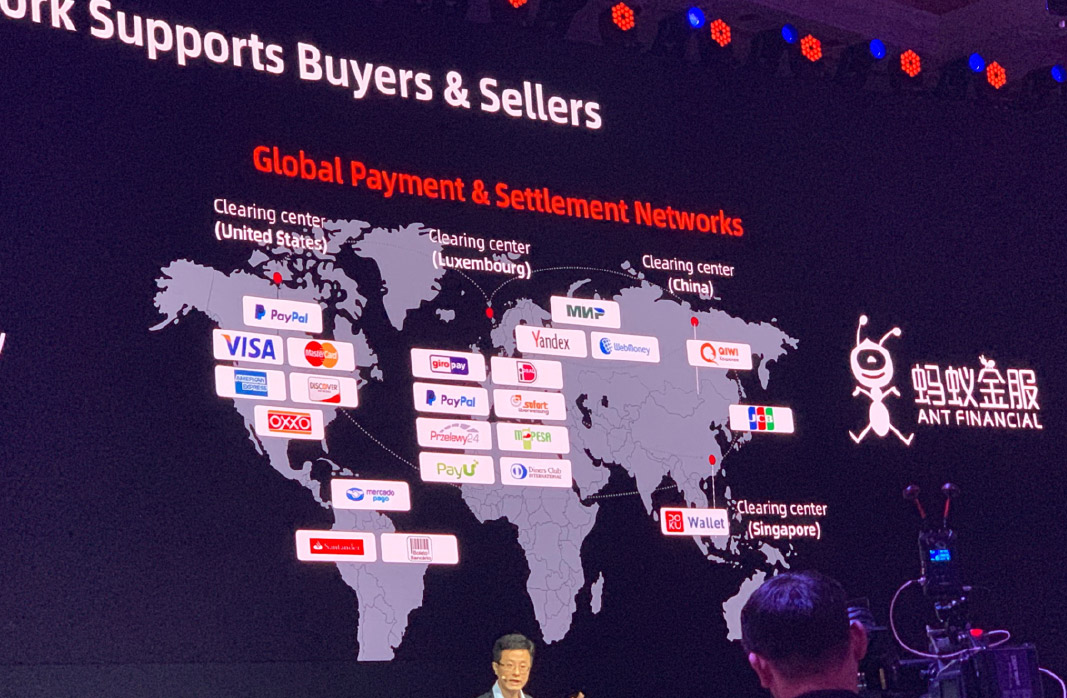

Global Commerce

AliExpress is a B2C marketplace for Chinese retailers to sell products around the world. With annual paid GMV reaching $10 billion, AliExpress has over 79 million annual active consumers from over 200 countries. Wang Mingqiang, President of AliExpress, shared what makes the company unique and his vision of the future for AliExpress.

- China has the most sufficient supply chain: It is the only country that covers all manufacturing industries, thus, sellers can optimize their supply chains. Alibaba is good at integrating sellers and manufacturers. AliExpress let sellers link directly to overseas consumers, so products on AliExpress come at a lower price.

- AliExpress can leverage Alibaba’s ecosystem. Many sellers have experience operating stores on Taobao and Tmall, thus, they understand consumers and some of them are good at marketing. They can use Taobao marketing tools, such as, live streaming and short videos to promote the products.

- Alibaba offers a global logistics and payment system. Powered by Alibaba technology, sellers offer country-specific personalization.

- Looking to the future, Wang expects AliExpress to help SMEs around the world sell products to different countries.

Source: Coresight Research [/caption]

Lazada is Alibaba’s Southeast Asia e-commerce platform, and this year was the first time Lazada participated in the investor day. Lazada CEO Pierre Poignant talked about the company’s performance: Lazada has over 50 million annual active consumers in Southeast Asia, the highest number of annual active consumers in the region. It is also the fastest growing e-commerce platform in Southeast Asia at 100% YoY order growth in three consecutive quarters. Poignant lists some of Lazada’s advantages versus its peers in the region:

Source: Coresight Research [/caption]

Lazada is Alibaba’s Southeast Asia e-commerce platform, and this year was the first time Lazada participated in the investor day. Lazada CEO Pierre Poignant talked about the company’s performance: Lazada has over 50 million annual active consumers in Southeast Asia, the highest number of annual active consumers in the region. It is also the fastest growing e-commerce platform in Southeast Asia at 100% YoY order growth in three consecutive quarters. Poignant lists some of Lazada’s advantages versus its peers in the region:

- Lazada has a comprehensive product listing with over 200 million products available across six core markets. It has strong user engagement with DAU growth rates of 100%. Some 89% of its consumers enjoy same or next-day delivery.

- Despite the challenges in the Southeast Asia retail market, Lazard has become a leading player by creating a strong logistics network: 75% of parcels are handled through one of Lazada’s facilities and can reach 70% of customers via its last mile coverage.

- The company is also using its logistics infrastructure to build the largest cash delivery network in the region, which enables the company to reach 91% of people who do not have a credit card.

- Lazada created a digitalization infrastructure in Southeast Asia by deploying Alibaba’s platform on Lazada and leveraging its connections to Alibaba’s considerable resources can localize at scale. It can also offer personalization at scale using Taobao’s search engine, feed and other products. Alibaba’s platform also accelerates Lazada’s innovation.

New Retail

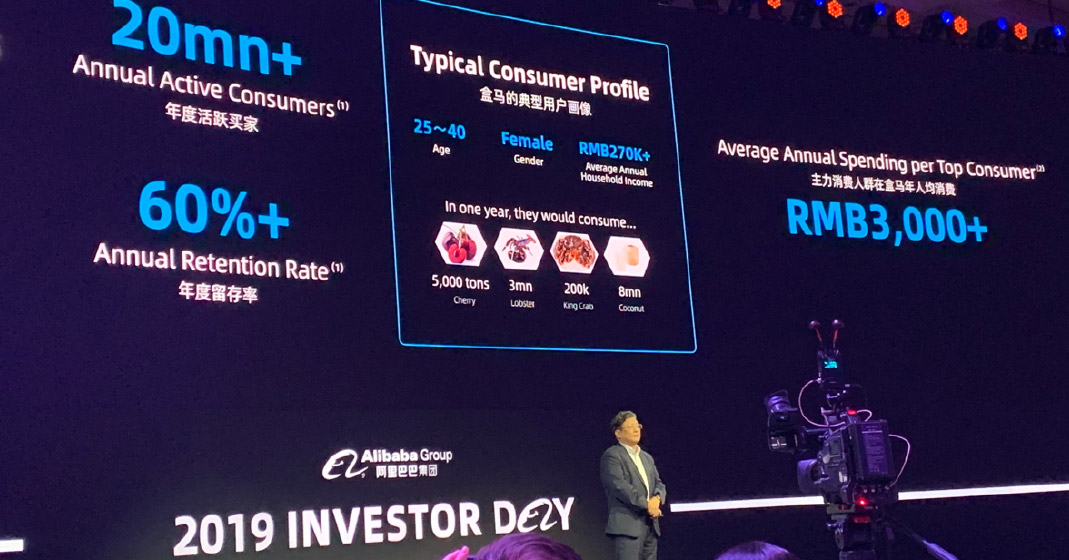

Freshippo is accelerating omni-channel offerings

Hou Yi, President of Alibaba’s supermarket chain Freshippo (also known as Hema), offered highlights of the year, including that Freshippo now has 175 stores in 22 cities. Stores open for more than 12 months have generated positive adjusted EBITDA. Same store sales have grown 13% while operating costs have decreased 30% year-over-year, driven by higher sales per square meter by using stores as fulfillment centers to drive efficiency; better labor management powered by big data; shorter time frames to source and deliver products; and, improved logistical efficiency.

Freshippo continues to accelerate efforts to meet demand for fresh groceries:

- Freshippo provides support in supply chain vertical integration for agricultural procurement, lowering procurement costs and improving freshness and diversity of products. The company has forged partnerships with 483 agricultural goods companies so far.

- Freshippo’s current private label penetration is only 10%. Freshippo continues to expand its private label offering to differentiate itself: Consumers can find products there they can’t find elsewhere.

- Freshippo is improving its cold chain logistics, with 48 multi-temperature and multifunctional warehouses already built. This holistic supply chain network can fulfill orders in all Freshippo stores, as well as for Alibaba’s other services such as Ele.me.

Source: Coresight Research [/caption]

Source: Coresight Research [/caption]

Taoxianda provides solutions to transform offline retailers

Li Yonghe, President of Tmall Supermarket, discussed how Taoxianda, part of Alibaba’s New Retail concept and a complement to Freshippo, digitalizes and transforms existing offline traditional grocers. Customers can access Taoxianda on the Taobao app and have products from retailers such as RT-Mart, Auchan and LOTUS delivered within an hour within a five kilometer (about 2 miles) radius. Taoxianda now provides solutions for 23 brands in 278 cities and has digitalized more than 800 stores.

Li shared how Taoxianda provides solutions to traditional retailers by:

- Helping traditional retailers create their own online Taoxianda store sites, increasing their online sales penetration to more than 25% and creating new demand.

- Digitalizing product inventory and store layout to improve turnover and efficiency.

- Leveraging data gathered online and location-based technology to provide personalized and localized product recommendations, as well as to empower retailers to enrich product assortments.

- Integrating online and offline marketing across all customer touch points before and after the transaction, as well as providing delivery capacity to improve the overall customer shopping experience.

- Leveraging Alibaba’s digital economy to acquire new customers.

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Local Consumer Services

Alibaba’s Local Consumer Services companies include Ele.me, an online food delivery ordering app; Koubei, formerly part of Alipay, a Groupon alike online to offline entertainment and leisure activities app; Amap, an online and mobile map service; and, Fengniao, a short-distance delivery service. Alibaba Local Consumer Services’ President Wang Lei said the group is bringing all those companies together to create one Alibaba local consumer services operating system. Each local consumer service company can enhance the synergy of Alibaba’s digital economy, leverage Alibaba’s existing ecosystem and improve efficiency. Some examples include:

- Merchants on Ele.me can use the same marketing tools on Taobao, namely, live streaming, research results, recommendations, etc.

- Amap can display coupons from Koubei in search results by identifying user location; Amap can also provide more information on merchants from Ele.me and Koubei when users are searching for things nearby.

- Fengniao can collect food deliverymen’s working hours and integrate that with Taoxianda, then use algorithms to optimize delivery time.

Source: Coresight Research [/caption]

Source: Coresight Research [/caption]