What’s the Story?

On September 28–30, the Coresight Research team attended Alibaba Group’s annual Investor Day virtually. In this report, we present insights from the event, covering the performance and outlook of Alibaba’s key businesses, as well as the company’s overall strategies.

Core Commerce

Taobao and Tmall

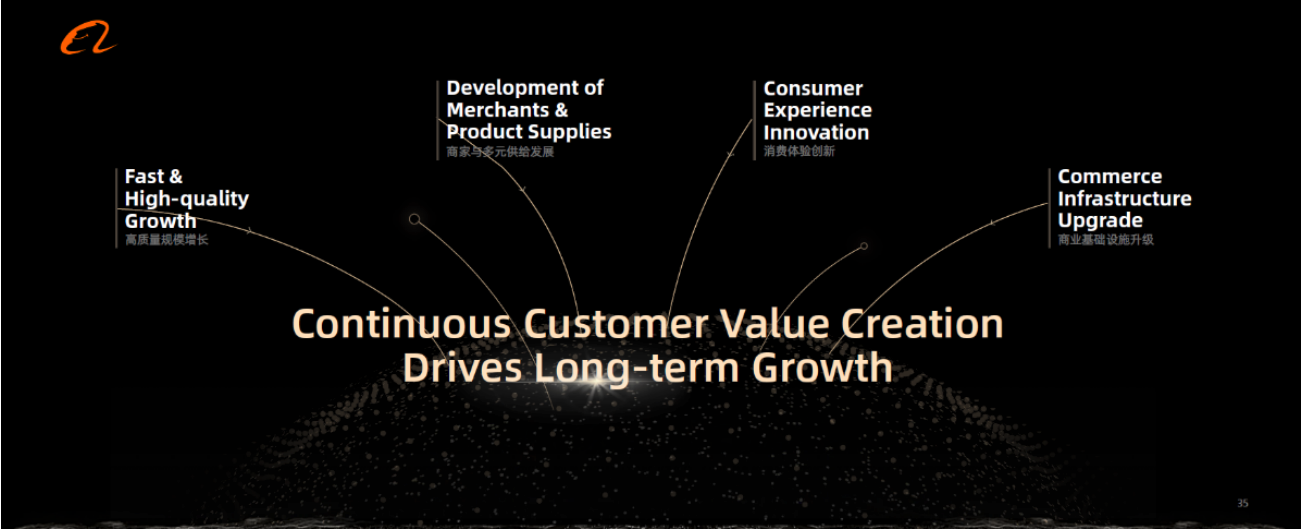

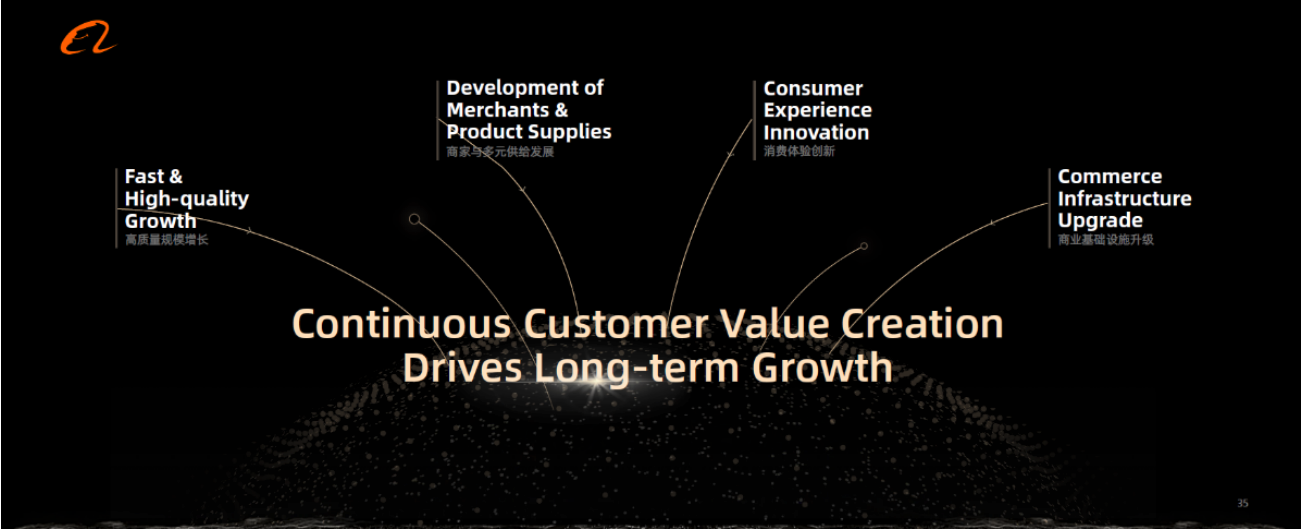

Jiang Fan, President of Alimama, Taobao and Tmall, discussed the key milestones and latest developments of Alibaba’s Tmall and Taobao platforms. He believes that both platforms are poised for continuous long-term growth, driven by new brands and products, ongoing innovation, enhanced user experience and commerce infrastructure upgrade.

Tmall is driving the retail sales recovery and growth in China. In its first quarter of fiscal 2021 (1Q21, ended June 30, 2020), Tmall online GMV grew 27% year over year, compared to a 4% decline in China retail sales in the same period. Alibaba presented some highlights of Tmall, which we outline below:

- Tmall Flagship 2.0 better helps brands to reach and engage with consumers. Value generated by each unique visitor after adopting Tmall Flagship 2.0 increased by 15%.

- Tmall is a destination for new brands. The number of new brands launched on the platform for the 12-month period ended June 30, 2020 grew 70% year over year. Tmall also unveiled a new program called Tmall New Superstar, which aims to enable over 1,000 new brands to achieve annual GMV of ¥100 million ($14.7 million) each and over 100 new brands to achieve GMV of more than ¥1 billion ($147 million) each in the next three years.

- More luxury brands are choosing to launch on Tmall, with over 400 having opened a flagship store on the platform. GMV from Tmall Luxury Pavilion also increased four times in 1Q21, compared to 1Q19.

Taobao’s GMV also recovered quickly, and its GMV growth in August stood at around 20%, even higher than the pre-pandemic level. Taobao offers a wide variety of products to meet all consumer demands.

- Taobao Deals, a new marketplace targeting lower-tier markets, has been growing rapidly since it launched in March. As of August, total monthly active users (MAUs) on the platform reached 55 million.

Jiang also talked about tools that provide a better user shopping experience on Taobao and Tmall:

- Search functions are becoming more sophisticated, with location-based search, profile-based smart search and enhanced category search.

- Recommendation feeds help drive more traffic. Page views from recommendation feeds jumped 30% year over year in 1Q21.

- Taobao Live is experiencing rapid growth. GMV continued to grow by over 100% year over year in 1Q21, and unique visitors to the platform surged 160% year over year.

- Adoption of short-form videos to showcase products helps merchants attract more users. It is becoming the mainstream way of displaying content within the Taobao app, both in storefronts and recommendation feeds. The number of unique video views increased by 170% year over year in 1Q21.

- In-app games allow brands to engage with consumers and increase brand visibility. In July 2020, total MAUs of games within the Taobao app grew by 40% year over year.

[caption id="attachment_117039" align="aligncenter" width="700"]

Source: Alibaba Group

Source: Alibaba Group[/caption]

Tmall Import

Liu Peng, President of Tmall Import and Export, pointed to huge potential in China’s online import business. Online imports account for only 6% of China’s consumer goods import in 2019 but grew at a 59% CAGR from 2015 to 2019, much higher than the growth rate of the total consumer goods import market.

In addition, Covid-19 accelerated the online shopping trend, with outbound travel being brough to a halt. As a result, outbound tourist spending has been shifting back to domestic, driving the cross-border e-commerce market.

Alibaba leads China’s cross-border business-to-consumer (B2C) market, with Tmall Global and Kaola accounting for 63.3% of the total market in 1Q21.

- As of June 2020, more than 30,000 brands are selling 6,000 product categories on both platforms. In the first half of the year, 2,300 new brands launched on both platforms.

- In the first half of 2020, number of new merchants with monthly sales over ¥100,000 ($14,655) increased by 64% year over year.

- More than 150 merchants achieved annual sales of over ¥100 million ($14.7 million) in the 12-month period ended June 30, 2020.

Alibaba has a well-established import infrastructure, including direct procurement centers on six continents, overseas warehouses in five regions, over 1.7 million square meters of bonded warehouses and over 1,300 import freight routes.

Going forward, Tmall Global will continue to be the top destination for foreign brands to enter the China market, providing assistance for expedited registration, brand exposure through various marketing tools, and other services such as finance and insurance.

New Retail

Freshippo

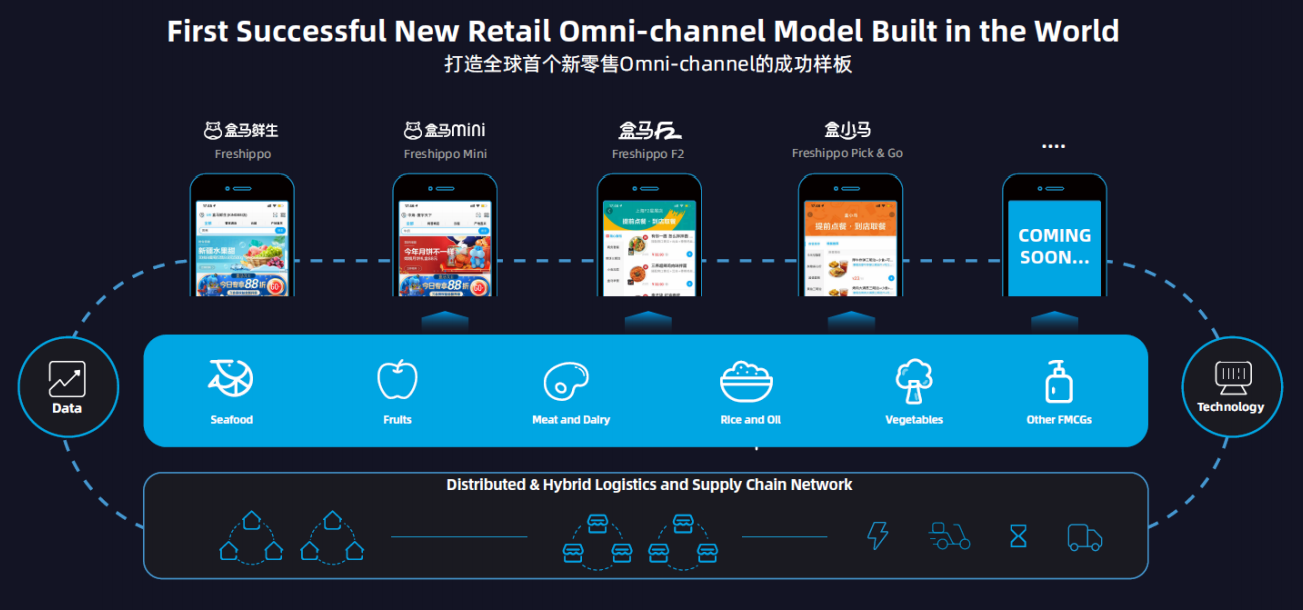

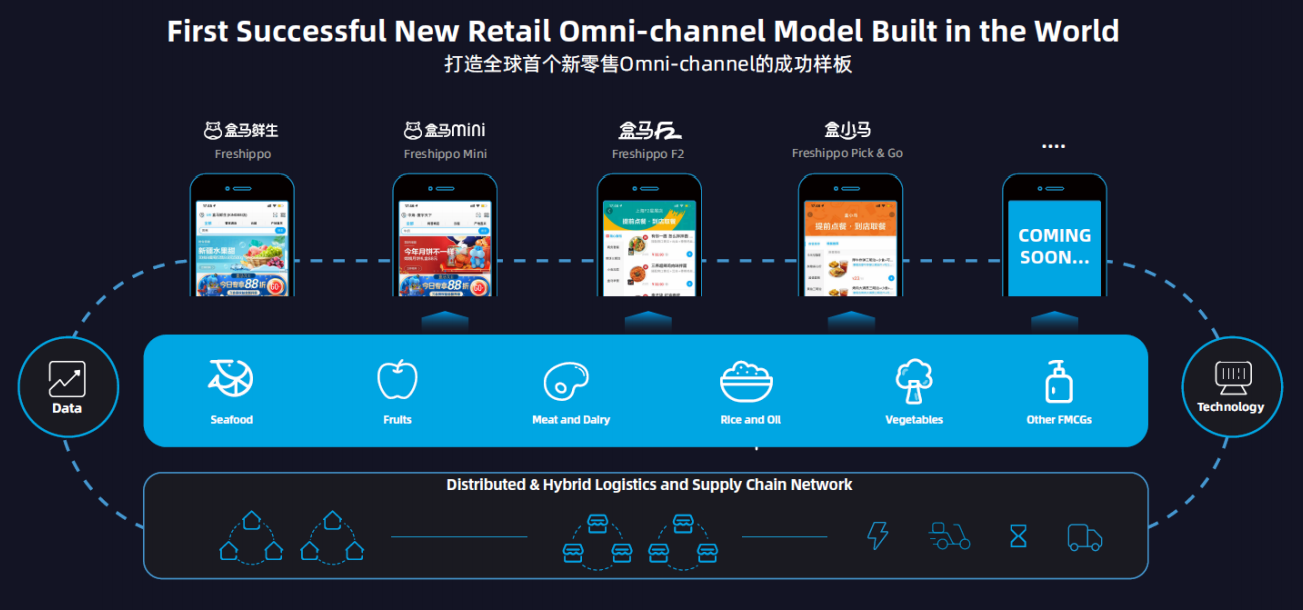

Hou Yi, President of grocery retailer Freshippo, offered highlights of the chain, including that Freshippo has 227 stores and 25 million annual active consumers as of June 2020. For the 130 stores that opened before April 2019, same-store sales jumped 32% year over year in 1Q21. In June, online share reached a new high—65% of total GMV came from online. Hou expects that online will remain the mainstream shopping channel in the future.

Freshippo continues to build core competencies to better serve customers:

- Freshippo has been accelerating the development of direct procurement sources, achieving 555 sources as of June 2020.

- The chain now has more than 1,000 private labels and exclusive products, and more than 30% of its product mix is imported. In the 12-month period ended June 30, Freshippo introduced more than 6,000 new brands.

- Freshippo continues to enhance its cold-chain network and logistics capabilities and now offers multi-mode fulfillment, including 30-minute, next-day and 72-hour delivery options. Hou also announced that the chain plans to step into the community group-buying market.

- Freshippo is building its social community based on locations. As of June, there are more than 5,000 social groups, and Freshippo incubated more than 7,000 key opinion consumers.

- Freshippo will explore different store formats and expand existing ones, including Freshippo Pick & Go, Freshippo Mini and Freshippo B2C.

[caption id="attachment_117040" align="aligncenter" width="700"]

Source: Alibaba Group

Source: Alibaba Group[/caption]

Local Services

Alibaba’s Local Services include Ele.me, an online on-demand food-delivery platform; Koubei, a Groupon-like reviewing and group-buying site; Taopiaopiao, a ticket-buying site; and Fliggy, a travel service platform; and map service Amap. Alibaba Local Services’ President Wang Lei said that annual active consumers under the group reached 290 million as of 1Q21.

The Local Services’ on-demand delivery business has regained growth after being hit by Covid-19. Thanks to its continued efforts in improving merchant mix, leveraging data and enhancing logistics, unit economics of on-demand delivery turned positive in 1Y21. Wang discussed several of the group’s strategies:

- Ele.me will further leverage Alibaba’s digital economy. In June, 45% of Ele.me’s new customers came from the Alipay app.

- The group will continue to recruit high-quality merchants and support merchants’ digitalization. It will also help improve merchants’ middle-office operating efficiency, empowered by the newly acquired software company Keruyun.

- The group has been expanding its on-demand capability to a variety of merchants to satisfy consumer demand for new services after Covid-19, such as pharmacy stores, department stores, pet supplies stores and more. The Ele.me app has been upgraded and integrated with Koubei, becoming a one-stop shop for all local services.

- The group will continue to leverage data technology to provide more personalized customer services and improve the efficiency of dispatching riders.

Cainiao Logistics

Alibaba made an announcement that Cainiao Logistics is expected to generate positive operating cash flow in the current fiscal year 2021. Wan Lin, President of Cainiao Network, provided business highlights of Cainiao Logistics in terms of consumers, merchants and logistics partners:

Consumer logistics:

- Cainiao Post is a digitalized community service that enables consumers to pick up and drop off packages at over 80,000 stations, as of July 31. The volume of packages through the service surged 110% year over year in June. In the next two to three years, Cainiao is aiming to increase the number of stations to 200,000.

- Cainiao has been launching value-added services to cater local consumers, such as laundry and recycling services. With AI (artificial intelligence) and IoT, the average time needed for a consumer to pick up a package is improved by 33%, and staff productivity has increased by 70% after implementation.

- Cainiao Guoguo is a crowdsourcing parcel-delivery platform. Its service has been upgraded to include one-hour pickup at doorstep, international shipping and self-service mailing machines. In June, package volume grew 70% year over year.

Merchants logistics:

- Cainiao offers a variety of domestic and global logistic services for merchants. Revenue of domestic and global fulfillment services went up by 50% year over year in 1Q21.

Logistics partners:

- Cainiao provides infrastructure as a service to its logistics partners. Services include building logistics parks across the world and leveraging logistics technology—such as AI, IoT and unmanned vehicles—to help logistics partners accelerate digitalization.

[caption id="attachment_117041" align="aligncenter" width="700"]

Source: Alibaba Group

Source: Alibaba Group[/caption]

Alibaba Cloud

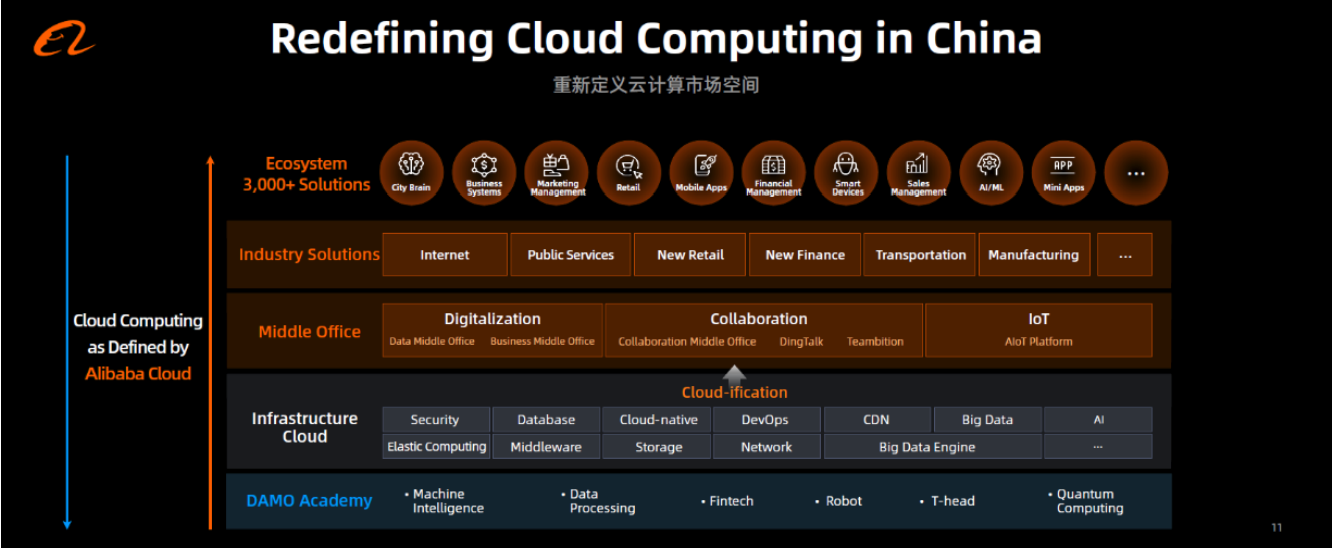

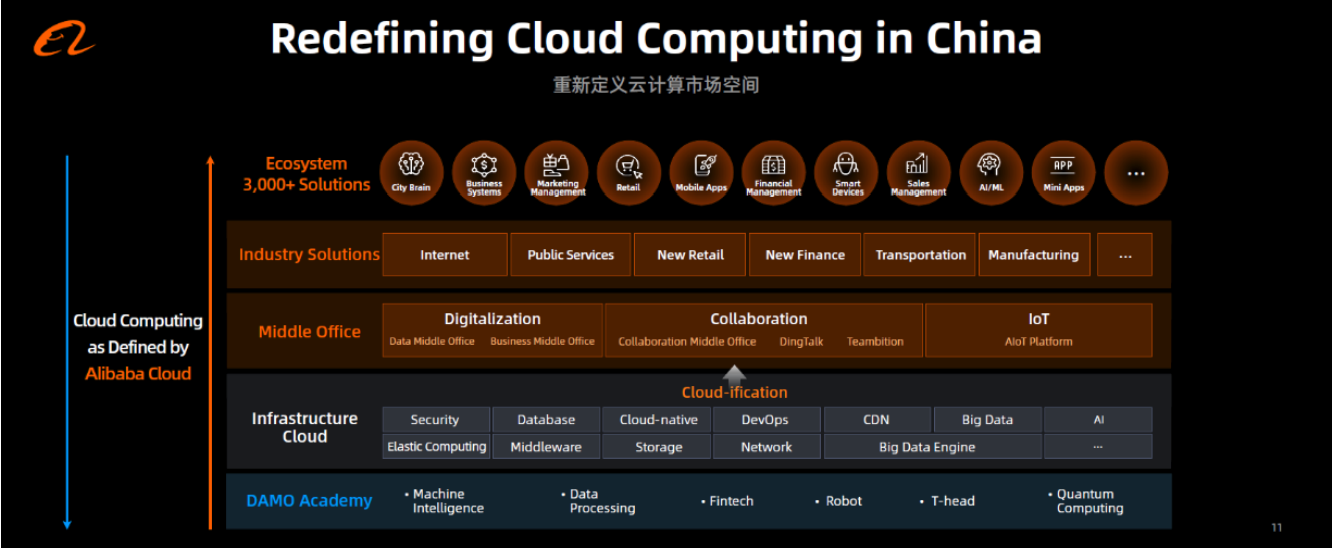

Alibaba’s CFO, Wu Wei, announced that Alibaba Cloud is expected to turn profitable in its current fiscal year. Zhang Jianfeng, President of Alibaba Cloud Intelligence, said that cloud penetration in China is still in an early stage and has massive potential. Alibaba Cloud is the market leader of public cloud service in China and had more than 3 million paying customers for the 12-month period ended June 30, 2020. Zhang discussed how Alibaba Cloud is redefining China’s cloud computing, starting with building a cloud infrastructure. Alibaba Cloud launched middle-office solutions of big data, mobile collaboration and IoT.

- Alibaba Cloud is able to develop a full range of technologies for different industries, thanks to years of data processing experience gained on Alibaba’s marketplace. This year, due to Covid-19, it has developed over 130 data-driven smart applications, including CT image analysis for medical patients.

- Alibaba Cloud has been integrating with DingTalk to create an enterprise mobile office platform with various capabilities—including video conferencing, documentation and teamwork tools. Alibaba Cloud also supports an industry-tailored system, providing a comprehensive end-to-end service for companies.

- Alibaba Cloud IoT connects devices through data transmission. Its applications range from smart cities and smart manufacturing to smart lifestyles. For example, IoT collects data on road conditions, streetlights and more, which can be processed through an algorithm to improve urban transportation and safety.

As one of the highest-growing business, Zhang said that Alibaba Cloud will continue expanding and upgrading its offerings, as well as building a strong ecosystem with partners and developers.

[caption id="attachment_117042" align="aligncenter" width="700"]

Source: Alibaba Group

Source: Alibaba Group[/caption]

Alibaba’s Overall Business Strategies

Zhang Yong, Alibaba’s Chairman and CEO, outlined the company’s key business strategies and long-term vision. Zhang stated that 2020 has been a challenging year across the world, and China’s economy has been the first to recover from the impact of Covid-19. The pandemic-induced digitalization trend presents enormous opportunities for Alibaba. He outlined three core growth engines and strategies:

- Domestic consumption—Alibaba will continue to grow its digital economy user base by expanding product categories and consumer wallet share, and it will develop new supply categories based on consumer insights. The company will also continue to redefine online and offline retail formats using technology, and upgrade Alipay with more capabilities and service offerings.

- Cloud computing and data intelligence—Through the integration of cloud and data intelligence, Alibaba will help brands achieve end-to-end digital operations using the Alibaba Business Operating System. The company also aims to transform the entire logistics supply chain to digital and intelligent operation, help upgrade all enterprise IT infrastructure to cloud, transform the approach to work into cloud-based collaboration and provide the capability to build industry solutions for all traditional sectors.

- Globalization: Alibaba will continue to expand its digital ecosystem to the global market.

Zhang also provided Alibaba’s long-term vision through fiscal year 2036: Globally, Alibaba expects to serve 2 billion consumers, create 100 million jobs and enable 10 million businesses to become profitable.

Source: Alibaba Group[/caption]

Tmall Import

Liu Peng, President of Tmall Import and Export, pointed to huge potential in China’s online import business. Online imports account for only 6% of China’s consumer goods import in 2019 but grew at a 59% CAGR from 2015 to 2019, much higher than the growth rate of the total consumer goods import market.

In addition, Covid-19 accelerated the online shopping trend, with outbound travel being brough to a halt. As a result, outbound tourist spending has been shifting back to domestic, driving the cross-border e-commerce market.

Alibaba leads China’s cross-border business-to-consumer (B2C) market, with Tmall Global and Kaola accounting for 63.3% of the total market in 1Q21.

Source: Alibaba Group[/caption]

Tmall Import

Liu Peng, President of Tmall Import and Export, pointed to huge potential in China’s online import business. Online imports account for only 6% of China’s consumer goods import in 2019 but grew at a 59% CAGR from 2015 to 2019, much higher than the growth rate of the total consumer goods import market.

In addition, Covid-19 accelerated the online shopping trend, with outbound travel being brough to a halt. As a result, outbound tourist spending has been shifting back to domestic, driving the cross-border e-commerce market.

Alibaba leads China’s cross-border business-to-consumer (B2C) market, with Tmall Global and Kaola accounting for 63.3% of the total market in 1Q21.

Source: Alibaba Group[/caption]

Source: Alibaba Group[/caption]

Source: Alibaba Group[/caption]

Source: Alibaba Group[/caption]

Source: Alibaba Group[/caption]

Source: Alibaba Group[/caption]