Web Developers

On September 17 and 18, the Coresight Research team attended Alibaba Group’s annual Investor Day event in Hangzhou, China. This flash report concentrates on two themes:

Jing listed four ways that Tmall helps brands transform their offerings:

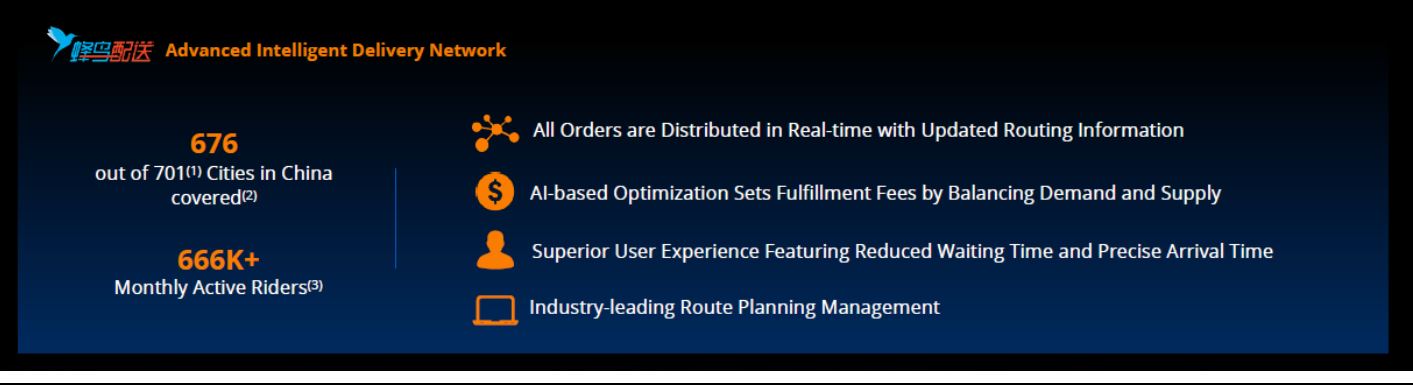

Moreover, services sectors such as restaurants are typically less digitalized than retail, deepening the potential for Alibaba to innovate in these industries. Lei noted that Ele.me already has more than 167 million annual active customers, each ordering food and beverages an average of 19.8 times per year. Serving these customers are Ele.me’s 3.5 million registered merchants and delivering their orders are more than 666,000 monthly active riders.

To serve customers on such a scale, Ele.me uses its Hummingbird advanced intelligent delivery network, which plans routes, updates customers in real time and deploys artificial intelligence to set fulfillment fees.

The Ele.me acquisition therefore represents a further strengthening of Alibaba’s capabilities in logistics. Lei concluded by noting that the Hummingbird network can now be used to provide last-mile delivery services to other companies in the Alibaba ecosystem.

Yi returned to the theme of China’s consumption upgrade, suggesting that Hema’s product and service offerings enable it to tap demand for quality and convenience from the country’s growing middle class. For instance, Hema offers a strong selection of fresh foods that are complemented by restaurant dishes for in-store dining and delivery. It also sources globally directly from farms and suppliers and has two differentiated private-label brands. In addition, it offers rapid delivery and provides greater traceability of products for customers.

Alibaba is not the only company reaping the benefits of Hema’s tech-heavy approach, according to Yi. The company is now providing New Retail services that enable other retailers to digitalize their operations; these services span the six areas shown in the image below. Yi said that this New Retail model provides retailers with low-cost traffic, allows them to offer a better customer experience and includes a community-level service infrastructure network that incorporates logistics centers and mini kitchens. The company’s retail partners have enjoyed an average 10% uplift in average monthly sales per store and typically see 1,200 daily online orders per store, according to Yi.

- Core businesses and outlook: Notes from Chairman Jack Ma’s presentation on the outlook for China and Alibaba and details on the differentiators of Alibaba’s main consumer marketplace, Tmall.

- Emerging “New Retail” businesses: Notes from presentations by executives at Ele.me, Alibaba’s newly acquired food-delivery startup; Hema, Alibaba’s supermarket chain and its flagship push into physical retail; and Cainiao Network, a logistics business that was majority acquired by Alibaba in 2017.

Core Businesses

Jack Ma on China’s Challenges and Alibaba’s Confidence

Alibaba’s Investor Day gave us the first chance to hear from Alibaba Chairman Jack Ma since the company’s recent announcement of his intention to step down in 2019. In reference to his departure plan, Ma remarked that the company started to evolve and professionalize its management in 2009, when all 18 founders were asked to resign from the company. Ma said that he did not want Alibaba to adopt the Asian business culture norm of having “gray-hair CEOs” and that fast-growing companies such as his need to have a plan for succession. Ma voiced a number of thoughts on the outlook for China’s consumer economy. He remarked that the current US-China trade war may prompt some production to move away from China. The trade war is one of three short-term challenges facing China, Ma said:- The anticorruption program undertaken by authorities represented “painful surgery,” and it will take China three to five years to recover from it. Ma said that the country needs young leaders that understand business in the wake of this crackdown on corruption.

- China is changing from an exporter to an importer, and from a focus on serving consumers in other countries to a focus on domestic consumption. Ma is urging China to open up its market and make reforms to its domestic economy.

- On tariffs, Ma said that trade wars were easy to start, but hard to stop. He also forecast that China will rely much less on one dominant export destination—the US—in the coming years: it will do business with more countries in Africa, Southeast Asia and Europe, and China’s One Belt, One Road program of infrastructure development will underpin this diversification.

- Domestic consumption will continue to rise. Today, China is home to 300 million middle-income consumers and that number will soon grow to 500 million. This middle-income segment provides meaningful opportunities to Tmall.

- At the same time, China has more than 1 billion people living below the middle-income line, although some of these consumers will move up the income scale in the years ahead. Low-income shoppers are an opportunity for Alibaba: when people have little money to spend, they head to the company’s Taobao marketplace, Ma said.

Jet Jing on Tmall Supporting Innovation and Brand Building

Jet Jing, President of Tmall, also discussed how China’s consumption upgrade is fueling Alibaba’s growth. Jing noted that there are a number of drivers of the consumption upgrade that are specifically supporting growth at Tmall, including:- New categories and new products that drive consumer excitement. These include imported products, and Tmall is opening six global procurement centers to help overseas vendors sell into China.

- New markets for brands. Jing remarked that most brands use Tmall for their launch into China. Meanwhile, Tmall Worldwide is operating in 200 countries and regions and Tmall is tapping 700 less-developed and, so, underserved counties in China.

- New experiences. These include omnichannel shopping, smart logistics and more than 100 consumer services operated by Alibaba. Financial and other services are helping remove all the friction from the shopping journey, Jing said.

Source: Alibaba Group

Source: Alibaba Group

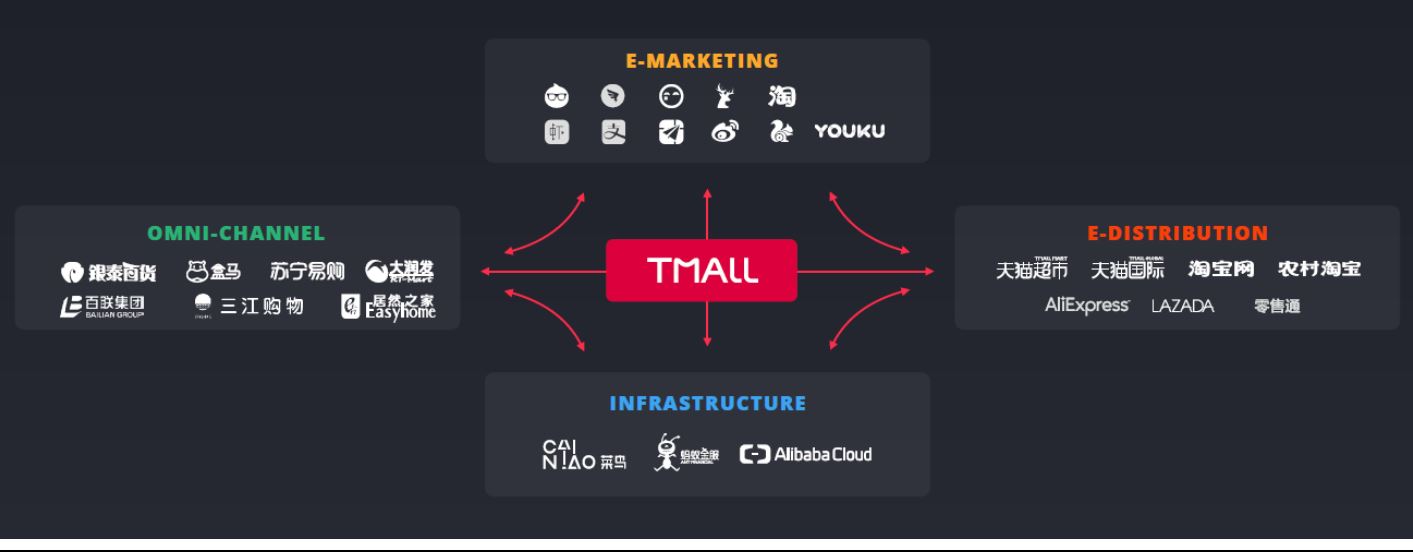

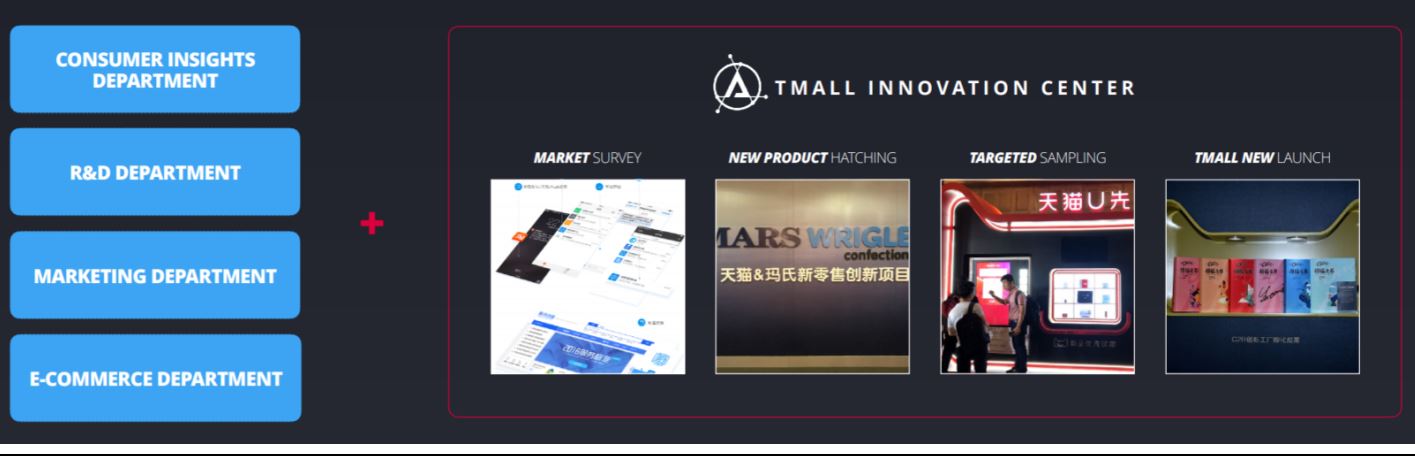

Jing listed four ways that Tmall helps brands transform their offerings:

- Its Innovation Center offers market surveys, new product hatching, targeted sampling and the ability to launch new products on Tmall.

- Tmall helps companies build brands through new product launches, brand campaigns and consumer engagement, including on its Youku video platform, and through shopping-festival marketing for events such as the 11.11 Global Shopping Festival (Singles’ Day), Super Brand Day events and 618. Tmall technology offerings such as online beauty advisors, in-store virtual fitting rooms and in-store magic mirrors further support brand building.

- Tmall supports brands in their channel management, with segmented front-end portals such as Tmall Supermarket, Tmall Global and Rural Taobao as well as with smart logistics that include Cainiao at the back end.

- Tmall tools and platforms support consumer asset management by brands in a number of ways, from driving awareness to creating interest, prompting purchase and cultivating loyalty.

Source: Alibaba Group

Source: Alibaba Group

Emerging New Retail Businesses

Digitalizing Food-Service Deliveries

We heard from Wang Lei, CEO of Ele.me, a food-delivery startup acquired by Alibaba in April 2018. Lei pointed to significant potential for Alibaba in real-world services such as in-store dining, food delivery and entertainment, and he remarked that the total Chinese consumer services market will grow at an 11% CAGR between 2017 and 2020, to reach ¥25.2 trillion ($3.7 trillion). Source: Alibaba Group

Source: Alibaba Group

Moreover, services sectors such as restaurants are typically less digitalized than retail, deepening the potential for Alibaba to innovate in these industries. Lei noted that Ele.me already has more than 167 million annual active customers, each ordering food and beverages an average of 19.8 times per year. Serving these customers are Ele.me’s 3.5 million registered merchants and delivering their orders are more than 666,000 monthly active riders.

To serve customers on such a scale, Ele.me uses its Hummingbird advanced intelligent delivery network, which plans routes, updates customers in real time and deploys artificial intelligence to set fulfillment fees.

Source: Alibaba Group

Source: Alibaba Group

The Ele.me acquisition therefore represents a further strengthening of Alibaba’s capabilities in logistics. Lei concluded by noting that the Hummingbird network can now be used to provide last-mile delivery services to other companies in the Alibaba ecosystem.

Source: Alibaba Group

Source: Alibaba Group

Hema Leading the Multichannel Effort in Grocery

Hou Yi, CEO of Alibaba’s omnichannel supermarket chain Hema, said that Hema serves as the “pathfinder of Alibaba’s New Retail,” given its heavy use of technologies to digitalize physical stores and combine online and offline retail.- Hema now has 64 stores across 14 cities in China, serving 10 million customers (a number that includes those who have downloaded the Hema app).

- The average mature Hema store turns over ¥800,000 per day, equivalent to around $116,00 per day, or $42.5 million per year based on trading a full 365 days.

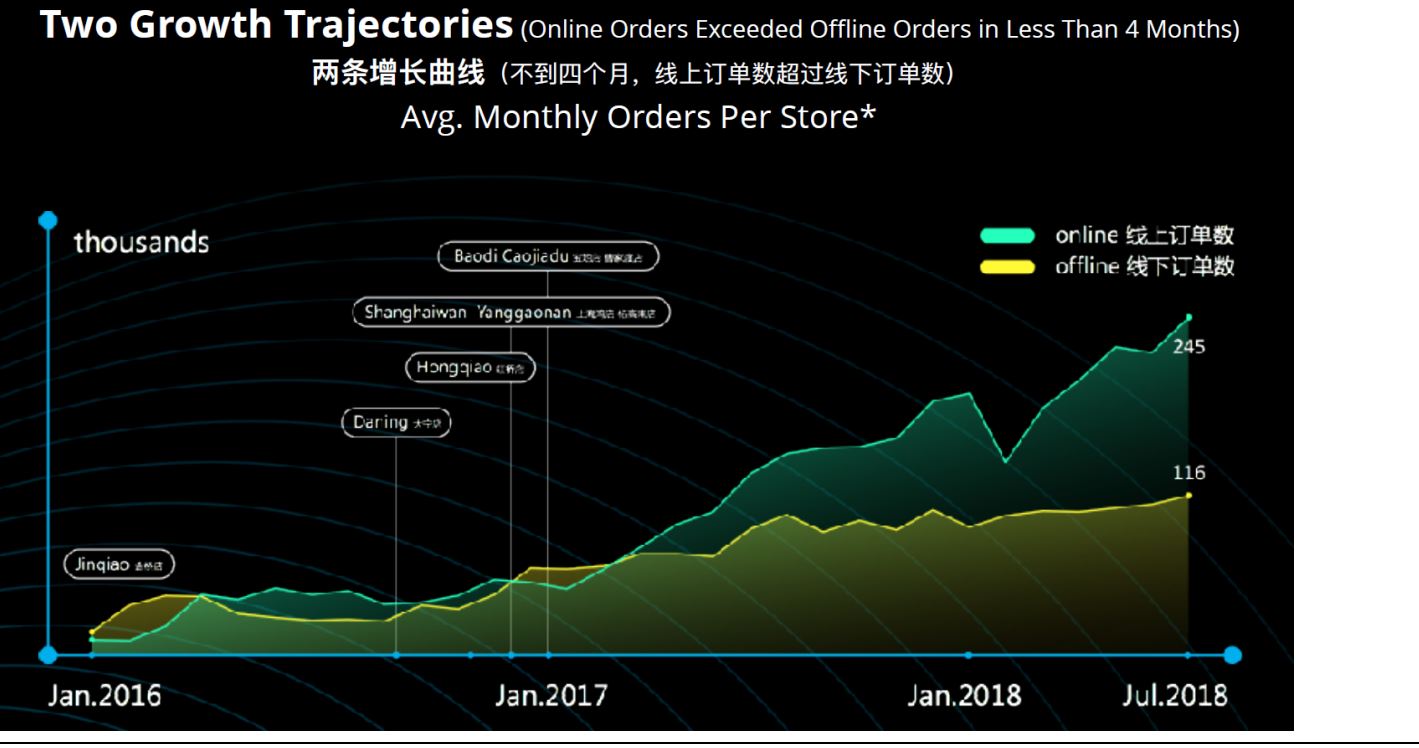

- Hema is known as Alibaba’s flagship push into brick-and-mortar retail, yet fully 60% of an average Hema store’s sales are generated online. As the graphic below shows, it typically takes some time for those online orders to gather steam once a store opens.

Source: Alibaba Group

Source: Alibaba Group Hema CEO Hou Yi lists the six types of services that Hema provides to third-party retailers.

Source: Alibaba Group/Coresight Research

Hema CEO Hou Yi lists the six types of services that Hema provides to third-party retailers.

Source: Alibaba Group/Coresight Research Source: Alibaba Group

Source: Alibaba Group