DIpil Das

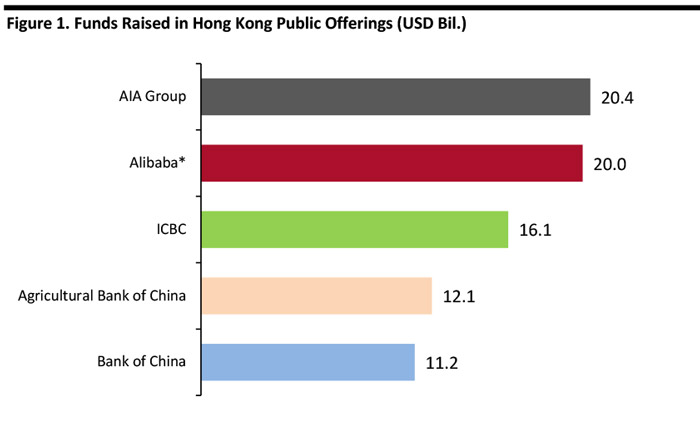

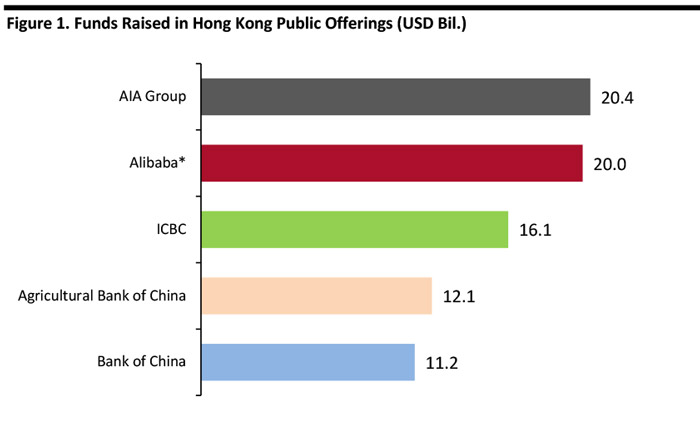

Alibaba has filed for a Hong Kong listing, potentially Hong Kong’s biggest share sale since 2010. Alibaba has picked China International Capital Corporation (CICC) and Credit Suisse Group AG as the lead banks for the Hong Kong listing. The offering could raise up to a reported $20 billion. If the figure is accurate, the fund-raising activity will be the biggest since AIA Group’s 2010 IPO. Alibaba sought to list in Hong Kong previously, but Hong Kong did not allow dual-class shares with different voting rights.

Hong Kong regulators have since eased rules for companies listed on another exchange in a bid to recapture listings lost to other exchanges, to compete with New York to encourage companies to list at home. Alibaba wants to preserve its special governance system, under which a partnership of top executives nominate the majority of its board. If the dual-class shares structure is approved, the company can preserve its existing structure.

[caption id="attachment_91011" align="aligncenter" width="700"] *The figure is an estimate.

*The figure is an estimate.

Source: Bloomberg [/caption] File for HK Second Listing Amid Rising Trade Tensions Alibaba’s filing for a second listing in Hong Kong comes amid an ongoing trade dispute between China and the US. The listing is possibly a move to avoid sanctions from US regulators in the event the dispute drags on and spills into other areas. The US has already shown it will tie trade to other issues: In negotiations with Mexico, one of the key sticking points was US insistence that Mexico stop migrants passing through the country on their way to the US. It seems unlikely, but it is possible Chinese business interests in the US could also be affected. In addition to the funds raised, the move will also give Alibaba another large market for its shares and bring in investors who are more familiar with the company and with Asia Pacific. Chinese and HK investors more familiar with the company may be more keen on trading the stock, potentially bringing a higher valuation at home. The listing is also a positive for Hong Kong as an international finance center. According to data company Refinitiv, trade in Alibaba shares averaged $2.2 billion a day in the first quarter of this year, while average daily turnover on the entire Hong Kong exchange was $12.9 billion in the same period – Alibaba’s average trade volume is already 17% of the Hong Kong market’s total. More Funds for Alibaba Alibaba has roughly $30 billion cash as of March — an amount that doesn’t suggest an urgent need for liquidity. However, the global stock market has become more volatile amid rising trade tensions between the US and China. With the potential for a devaluing of growth stocks in this context, now could be the time to tap the market.

*The figure is an estimate.

*The figure is an estimate. Source: Bloomberg [/caption] File for HK Second Listing Amid Rising Trade Tensions Alibaba’s filing for a second listing in Hong Kong comes amid an ongoing trade dispute between China and the US. The listing is possibly a move to avoid sanctions from US regulators in the event the dispute drags on and spills into other areas. The US has already shown it will tie trade to other issues: In negotiations with Mexico, one of the key sticking points was US insistence that Mexico stop migrants passing through the country on their way to the US. It seems unlikely, but it is possible Chinese business interests in the US could also be affected. In addition to the funds raised, the move will also give Alibaba another large market for its shares and bring in investors who are more familiar with the company and with Asia Pacific. Chinese and HK investors more familiar with the company may be more keen on trading the stock, potentially bringing a higher valuation at home. The listing is also a positive for Hong Kong as an international finance center. According to data company Refinitiv, trade in Alibaba shares averaged $2.2 billion a day in the first quarter of this year, while average daily turnover on the entire Hong Kong exchange was $12.9 billion in the same period – Alibaba’s average trade volume is already 17% of the Hong Kong market’s total. More Funds for Alibaba Alibaba has roughly $30 billion cash as of March — an amount that doesn’t suggest an urgent need for liquidity. However, the global stock market has become more volatile amid rising trade tensions between the US and China. With the potential for a devaluing of growth stocks in this context, now could be the time to tap the market.