Web Developers

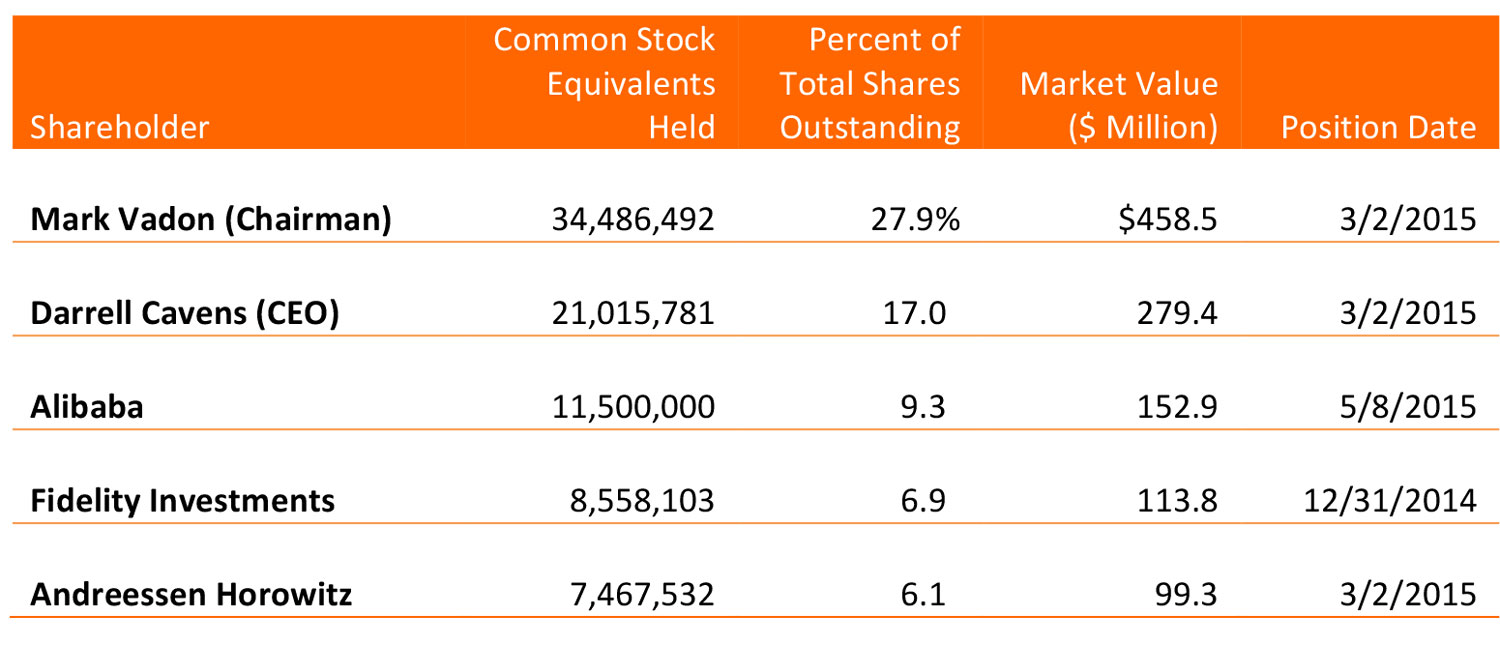

Alibaba recently disclosed the purchase of 4.8 million Class A shares of Seattle-based e-tailer Zulily for about $56.2 million during May 6-8. The company also stated that it had already held a sub-5% stake, or 6.7 million shares, in Zulily. Alibaba now owns 11.5 million shares, or 9.3%, of Zulily. The most recent stock purchases were made at prices in the range of $10.63 to $12.70 per share.

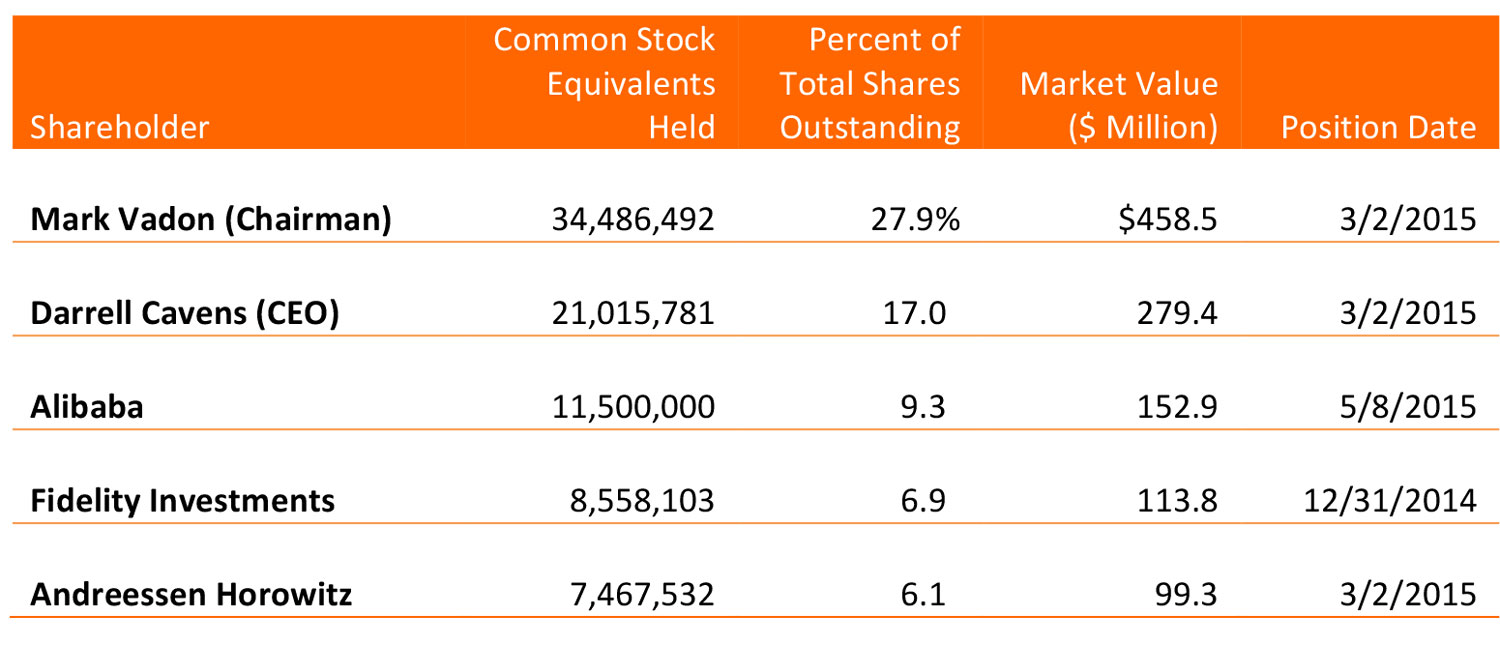

Due to Zulily’s dual-class share structure, management still holds most of the Class B shares, which have 10x the voting power of Class A shares. Alibaba is now Zulily’s third-largest investor, after Chairman Mark Vadon and CEO Darrell Cavens.

Zulily’s stock had declined more than 80% this year from its peak of $72.75 on February 27, 2014. Prior to the Alibaba disclosure, Zulily’s stock hit a record low of $10.82 on May 6, however the share price subsequently increased 23.7% to $13.29 on May 8. The decline in Zulily’s share price is likely due its difficulty in retaining customers due to long fulfilment cycles.

Source: S&P Capital IQ

About Zulily

Zulily is a Seattle-based, flash-sale e-commerce site that sells clothing, accessories and home decor items, primarily to moms in the US, Canada, Australia and the UK. Zulily markets merchandise to moms buying for their children, husbands and homes. The company was founded in 2009 and went public four years later, in November 2013. It’s currently listed at number 39 in Internet Retailer’s 2015 Top 500 Guide. The company has 4.9 million active customers as of 2014, and over 50% of its orders come from mobile devices.

About Alibaba’s Business Strategy

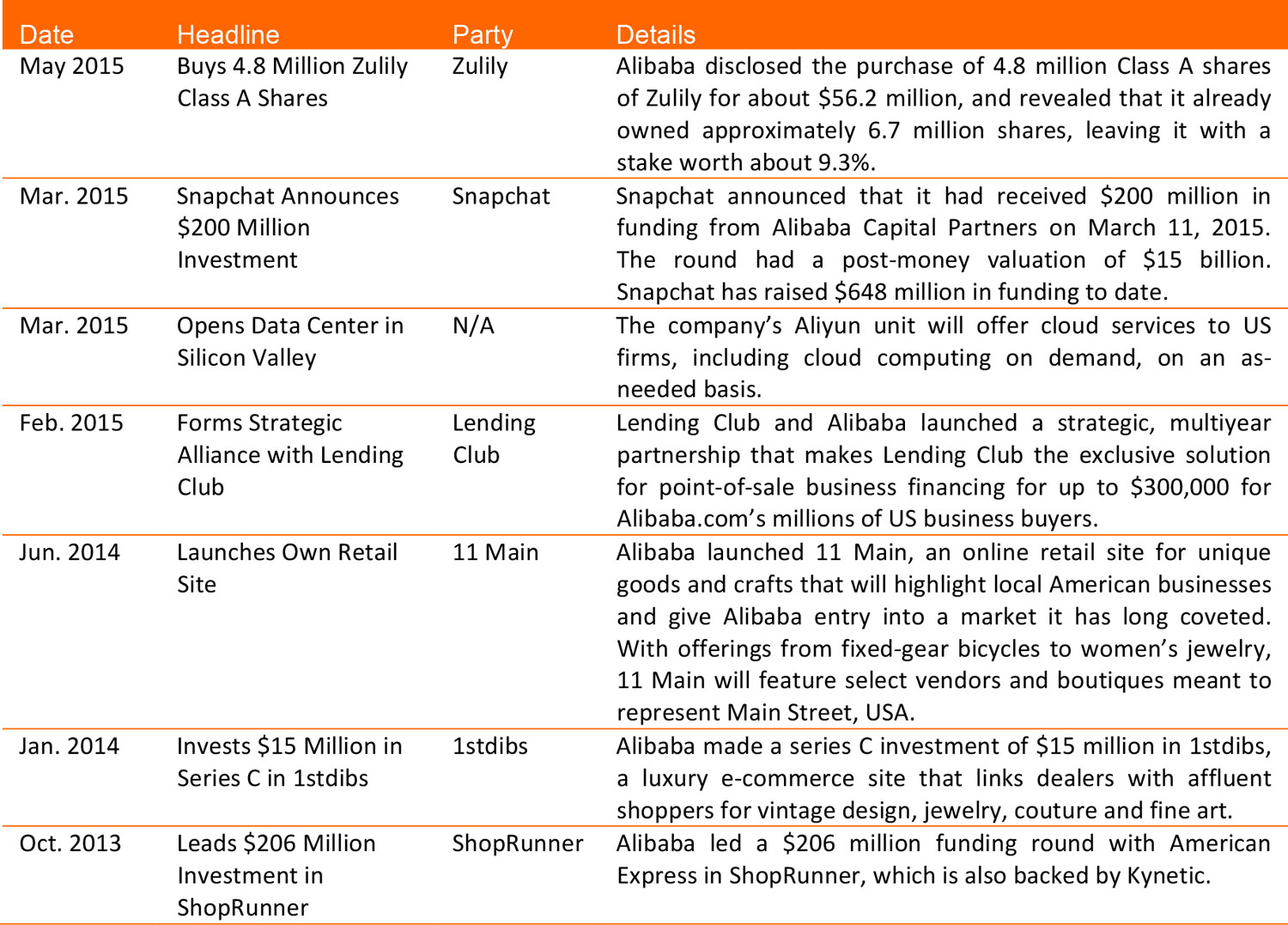

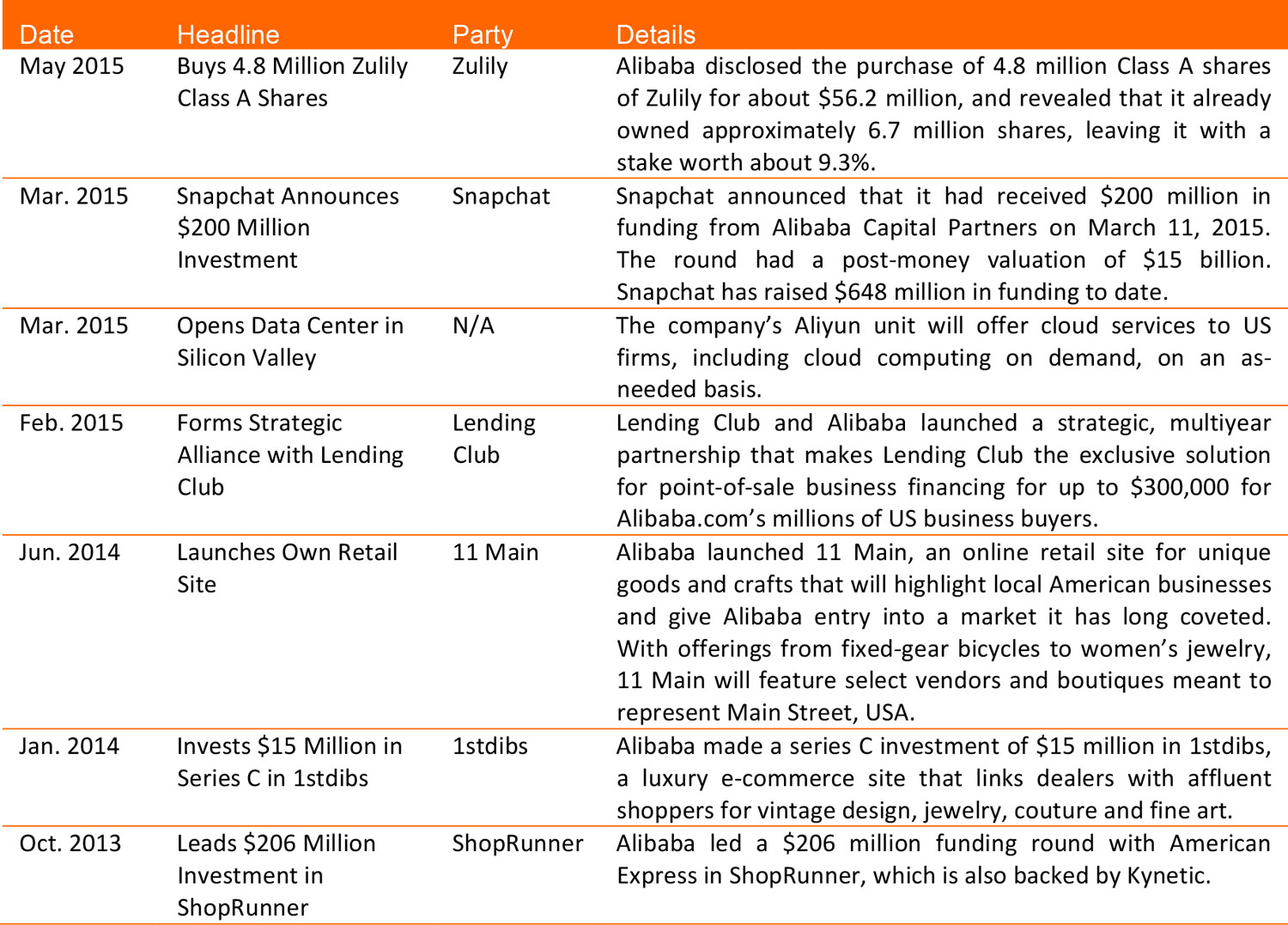

Alibaba’s chairman Jack Ma has set a goal of generating 50% of sales outside China. China commerce accounted for 83% of its total revenue in fiscal 2015, versus 9% from international commerce (the rest of its revenue comes from cloud service and Internet). As China’s growth slows, Alibaba continues to seek expansion overseas, especially in large markets such as the US and India. Alibaba has actively sought stakes in US e-tailers, and Zulily is the third US e‑commerce site in which it has invested. In 2013, it led a $206 million funding investment round in ShopRunner, a site that provides Amazon Prime-like membership for brands such as Toys“R”Us, Brooks Brothers, Calvin Klein, Tommy Hilfiger, GNC, American Eagle Outfitters, Drugstore.com, Blue Nile and hundreds of others. ShopRunner has 2.5 million active members. In January 2014, Alibaba invested $15 million in luxury site 1stdibs. Acquiring existing e-commerce businesses has become a regular strategy for Alibaba in its effort to increase presence in the US, particularly after the less-than-successful launch of its own US e-commerce site 11 Main. Other than e-commerce sites, Alibaba has also been investing in cloud services and business-financing solutions in order to diversify its US business portfolio. In 2014, it announced a partnership with Lending Club that shows its intention to provide point-of-sale financing for US businesses selling on Alibaba’s platform. Most recently in March 2015, the company revealed plans to open a data center to provide US firms with on-demand cloud service.Select Alibaba Investments in the US