Source: Company reports

Source: Company reports

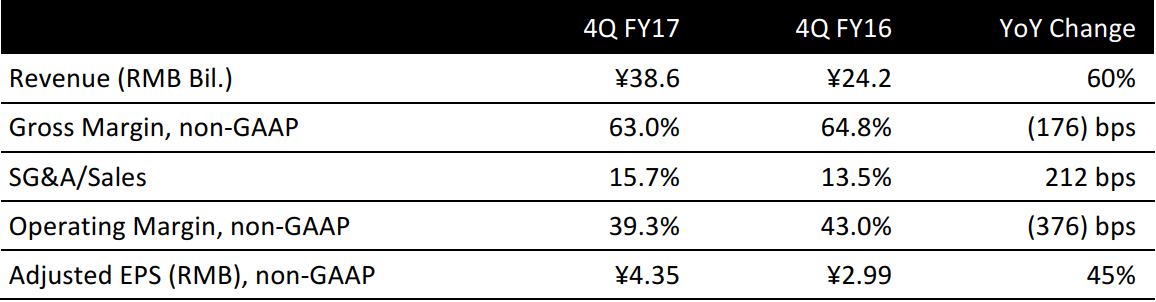

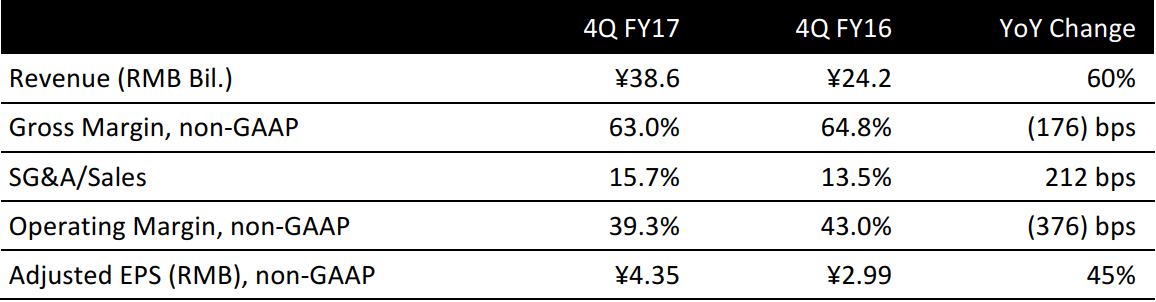

4Q FY17 Results

Alibaba reported strong 4Q FY17 results on May 18. Reported revenue was ¥38.6 billion ($5.6 billion), up 60% year over year, and beat consensus estimates by 7%. The strong revenue growth was primary driven by solid growth of its core commerce segment and accelerating growth in emerging businesses, including cloud computing, digital media and entertainment. Non-GAAP diluted EPS was ¥4.35 ($0.63), up 45% year over year.

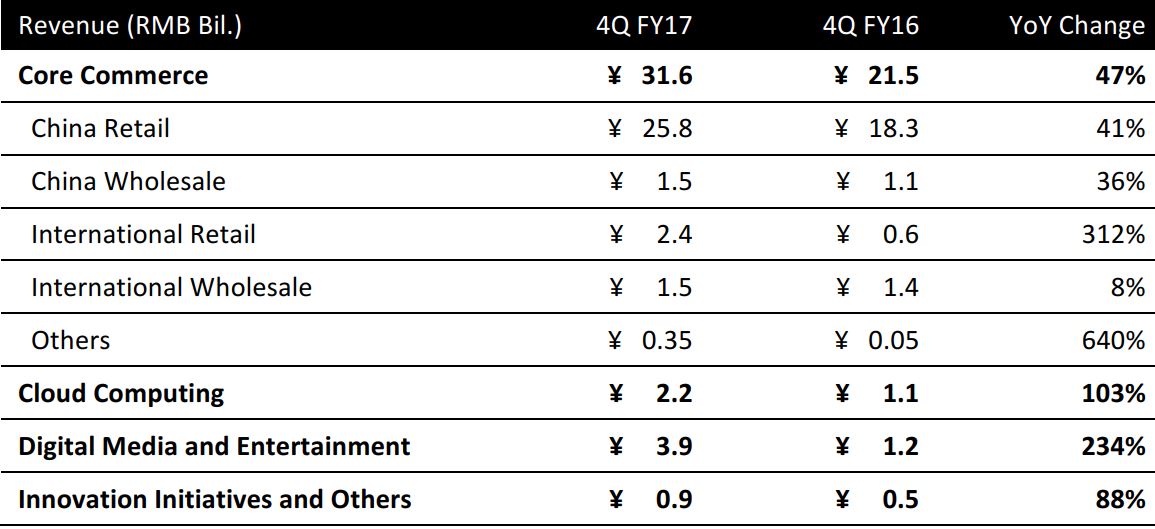

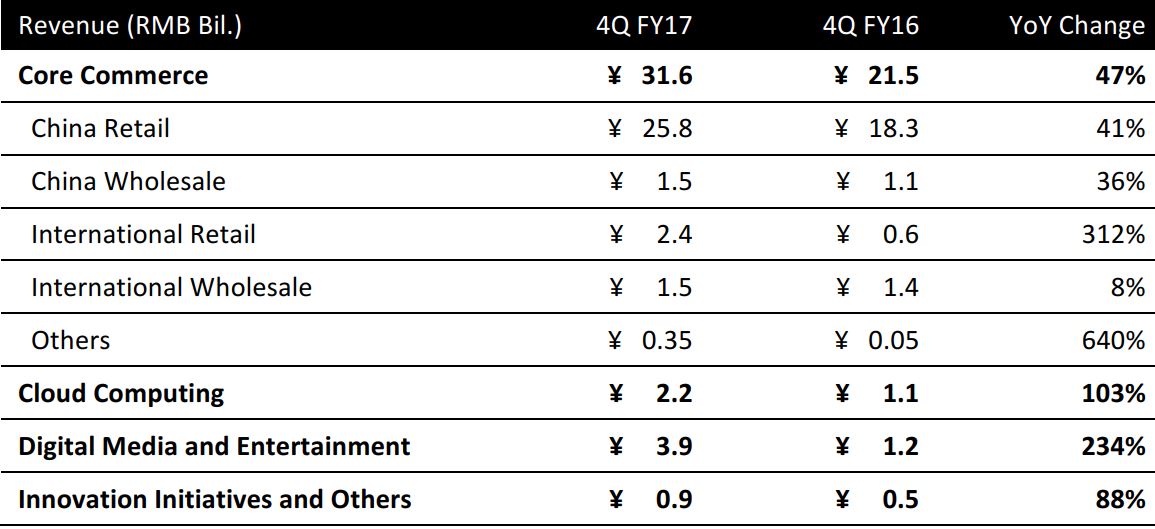

Performance by Segment

Source: Company reports

Source: Company reports

Core Commerce: Core commerce revenue reached ¥31.6 billion, up 47% year over year. China retail and wholesale together contributed 86% of revenue. International retail revenue continued to see triple-digit growth.

- China retail revenue: Alibaba reported China retail revenue of ¥25.8 billion, up 41% year over year. Annual active buyers saw re-accelerated growth to 454 million, up 2.5% from last quarter, and up 7% year over year. Revenue per user increased by 4% quarter over quarter to ¥251. Mobile monthly active users (MAU) continued its momentum and reached 507 million, up 2.8% quarter over quarter. Revenue per mobile MAU was ¥179, up 7.8% quarter over quarter.

- China wholesale revenue: Revenue for China wholesale was up 36% year over year to reach ¥1.5 billion.

- International retail revenue: International retail revenue also accelerated, up 312% year over year, and reached ¥2.4 billion, primarily driven by improving revenue from AliExpress and Lazada, whose annual active users grew to 83 million for the 12 months ended March 31, 2017.

- Management emphasized that international expansion will be its core strategy for the next 5–10 years. Alibaba has already made solid progress in Southeast Asia where it joined forces with the government to launch an e-hub for trade clearance and logistics in Malaysia. This digital free trade zone will offer simple and straightforward regulations, lower barriers for entry into new markets and provide small businesses with easier access to financing.

Cloud computing: Sales for cloud computing reached ¥2.2 billion, up 103% year over year, driven by an increase in the number of paying customers, as well as an increase in their usage of cloud computing. The number of paying customers of the cloud computing business grew to 874,000 from 513,000, as of March 31, 2017.

Digital media and entertainment: Consisting mainly of the advertising and subscription business including Youku Tudou and mobile, this segment reported revenue of ¥3.9 billion, up 234% year over year, mainly due to the consolidation of Youku and growth of mobile value-added services by UCWeb. During the quarter, UC News Feeds reached 100 million MAUs in India and Indonesia combined. Management sited synergies between digital media and core commerce, driven by consumer reach and payment service, as the reasons for the seamless user experience. On top of that, data generated from the entertainment segment helped to drive better personalized recommendations on the core commerce platforms.

Outlook by Segments—International Business the Foundation for Long-Term Growth

Management is “very excited” about the prospects for FY18. Alibaba maintains a policy of not providing earnings guidance with its quarterly reports. Instead, management will provide revenue guidance for FY18 at Alibaba’s Investor Day to be held on June 8–9.

As mentioned on the earnings call, Alibaba will continue to innovate and realize the synergies of its various platforms in commerce, digital entertainment, logistics and cloud computing. Given its more diversified revenue base, management expects future revenue to be driven by multiple growth drivers including international business, cloud computing, digital media and entertainment.

- Core commerce: Management expects “healthy and sustainable growth” from its China commerce retail business.

- International business: Going international will be Alibaba’s core strategy for the next 5–10 years. The company targets gross merchandise volume (GMV) of ¥6 billion by FY20, and to serve 2 billion consumers in the long term, according to CEO Daniel Zhang. Management views China’s One Belt One Road initiative will be an opportunity for the company. Alibaba is in the initial stage of globalizing its business, beginning with Southeast Asia. The company has made “concrete progress” in Southeast Asia, with its investment in Lazada in April 2016, and AliExpress, its cross border export business.

- Cloud computing: Management’s top priority for the cloud computing segment is to expand its lead in market share, through new customer acquisitions and the launch of more sophisticated products.

- Digital media and entertainment: Management expects to maintain the fast growth of this segment and targets to reduce the negative EBITA margin.

New Retail: Digitizing Offline Retail

On the earnings call, management provided an update on its New Retail initiative. With the rise of the mobile shopper, the company believes the distinction between online and offline retail will disappear, changing the way customer traffic, retail space, inventory location and logistics are perceived. Data integration across the different platforms will allow brands to track, engage and manage the entire life cycle of their customers in the ecosystem.

Management believes that Alibaba, given its huge online presence, is the partner of choice for operators with a physical retail footprint, and plans to continue to digitally transform existing business models with data technology.

Source: Company reports

Source: Company reports Source: Company reports

Source: Company reports