Source: Company reports/Coresight Research

1Q19 Results

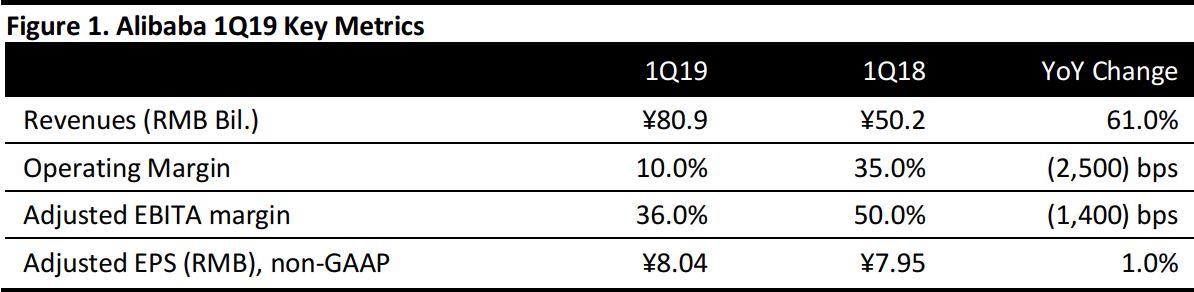

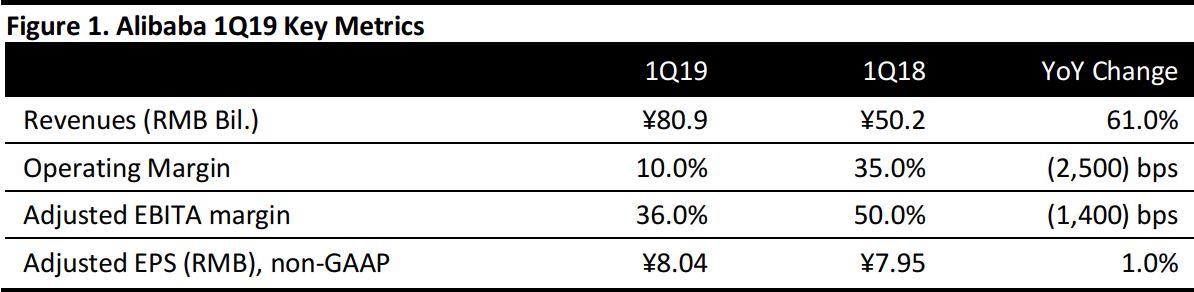

Alibaba reported 1Q19 revenues of ¥80.9 billion ($12.2 billion), up 61% year over year. The strong growth was mainly driven by robust revenue growth from its China retail business, the consolidation of Cainiao Network and Ele.me, as well as a near-doubling of revenues in the Alibaba cloud business. However, the operating margin was squeezed significantly to 10% in 1Q19, compared to 35% in 1Q18. The decrease was primarily due to an increase of ¥11.2 billion ($1.6 billion) in share-based compensation expenses related to Ant Financial share-based awards granted to its employees. Non-GAAP diluted EPS was ¥8.04 ($1.22), up 1% year over year.

Source: Company reports

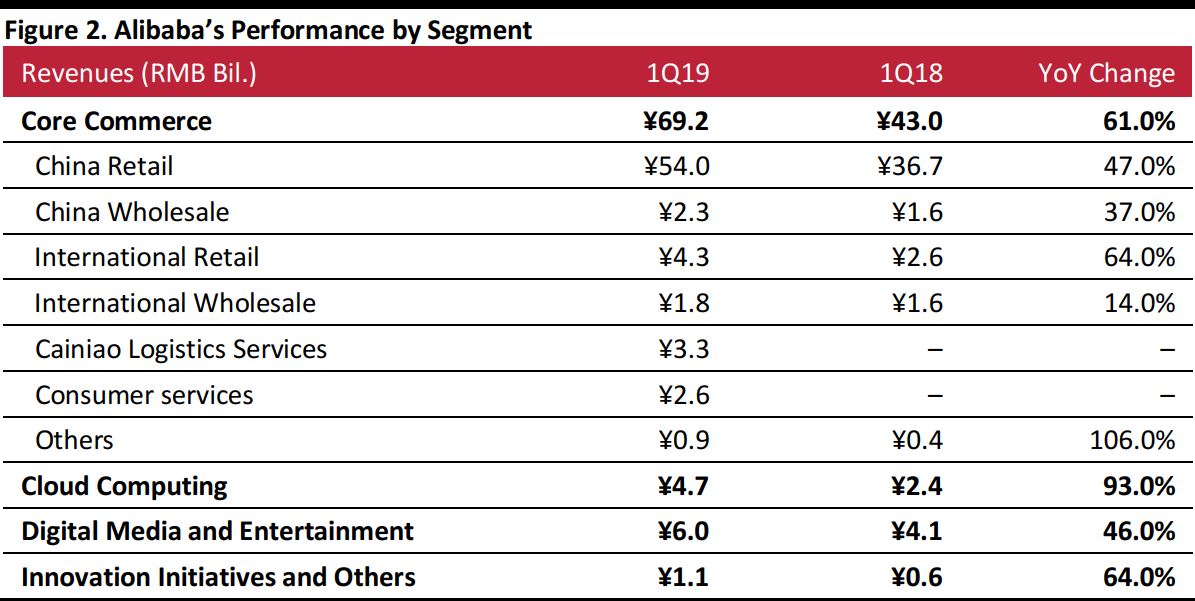

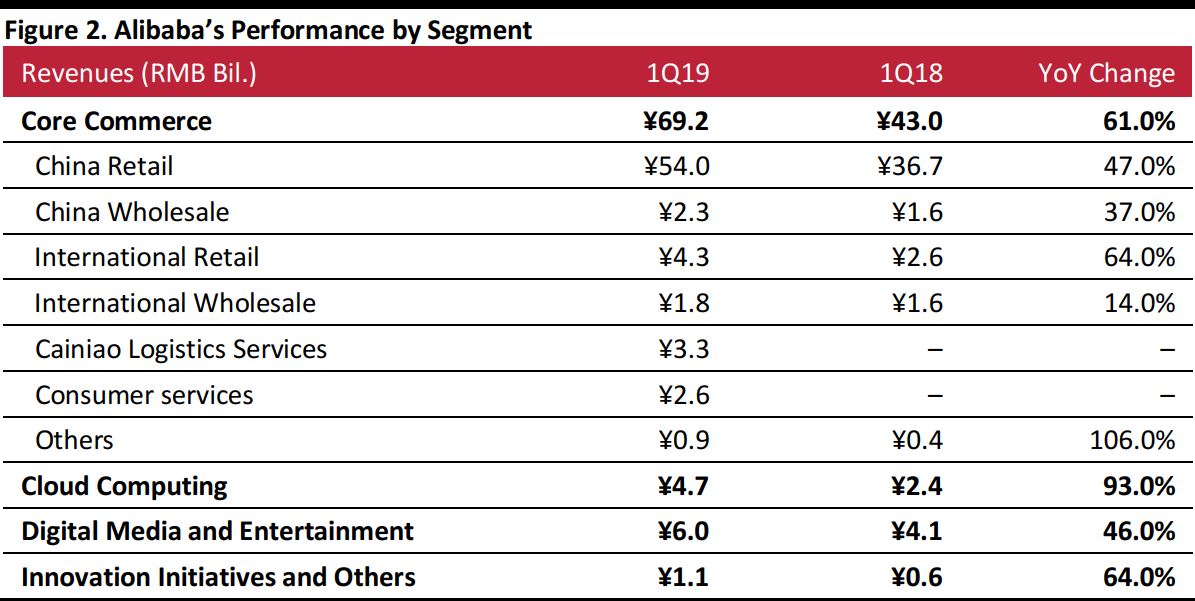

Core commerce: Core commerce revenues reached ¥69.2 billion ($10.5 billion), up 61% year over year.

- China retail revenues: Alibaba reported China retail revenues of ¥54.0 billion, up 47% year over year. Annual active consumers reached 576 million, for an increase of 24 million from the 12-month period ended March 31, 2018. During the quarter, around 80% of the growth was from lower-tier cities as Alibaba broadened its offerings and services into those areas.

- China wholesale revenues: Revenues for China wholesale were up 37% year over year to reach ¥3 billion, primarily driven by an increase in the average revenue from paying members on the 1688.com platform.

- International retail revenues: International retail revenues increased by 64% year over year to reach ¥4.3 billion ($652 million), primarily driven by the growth in revenues on the two marketplaces, Lazada and AliExpress.

- Cloud computing: Revenues from the cloud computing business in 1Q19 were ¥4.7 billion (US$710 million), up 93% year over year. The strong increase was primarily driven by an increase in the number of paying customers as well as higher value-added products and services.

- Digital media and entertainment: This segment reported revenues of ¥6.0 billion ($903 million), up 46% year over year. The growth was primarily driven by an increase in subscription revenues from Youku and an increase in revenues from mobile value-added services provided by UCWeb, such as game publishing and mobile search.

Outlook

Management did not provide guidance.