Source: Company reports

Source: Company reports

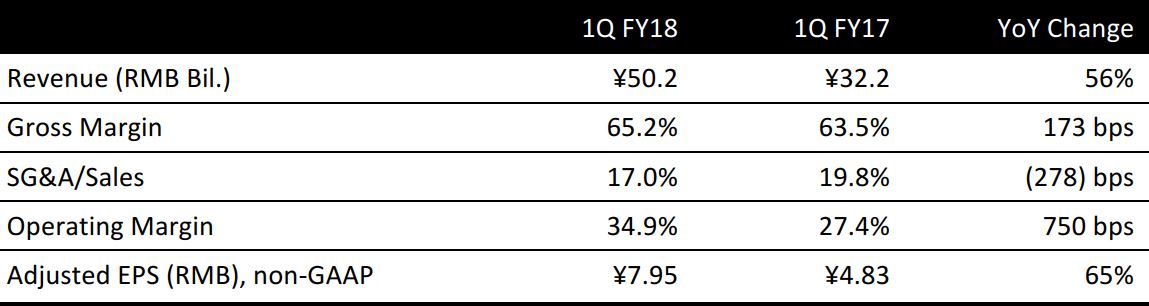

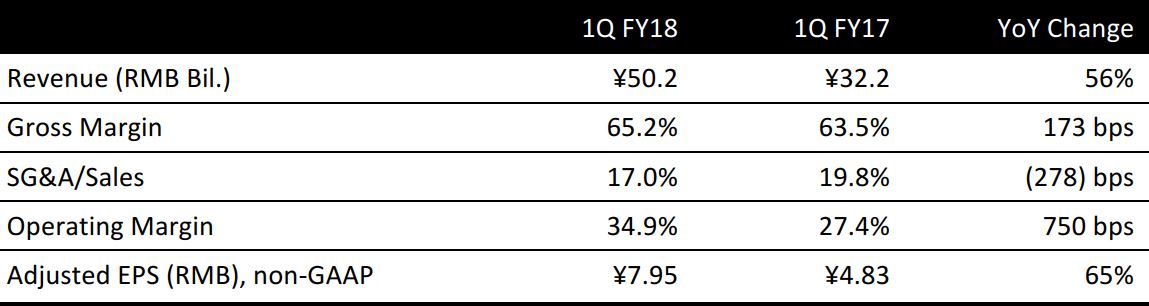

1Q FY18 Results

Alibaba reported 1Q FY18 revenues of ¥50.2 billion (US$7.4 billion), up 56% year over year, and beat the consensus estimate by 4.8%. The strong growth was mainly driven by the steady increase of revenue from its core commerce segment, as well as the strong growth in its emerging businesses, including cloud computing, digital media and entertainment.

Non-GAAP diluted EPS was ¥7.95 (US$1.17), ahead of the ¥6.25 (US$0.94) consensus estimate and up 65% year over year.

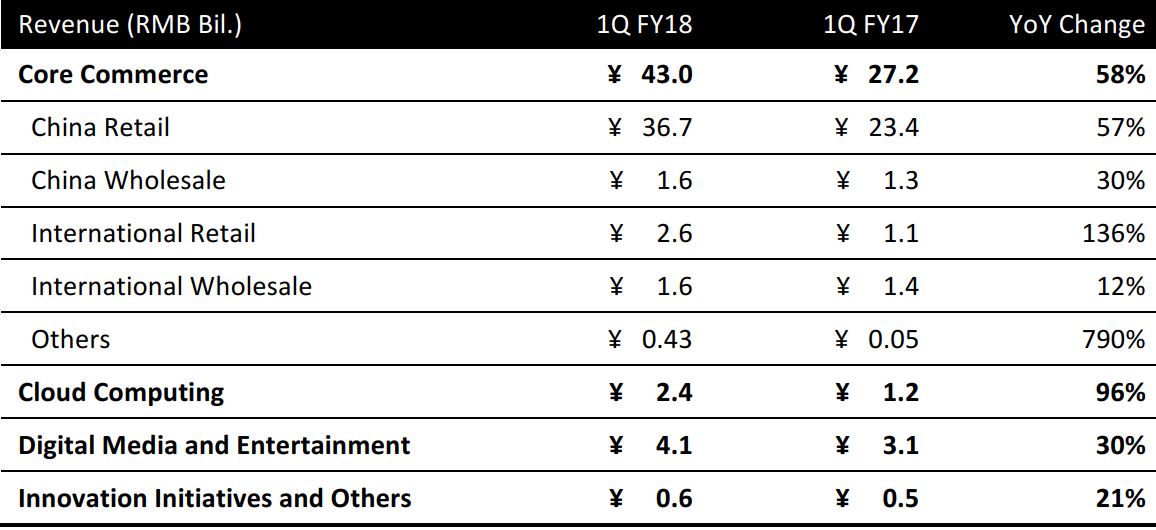

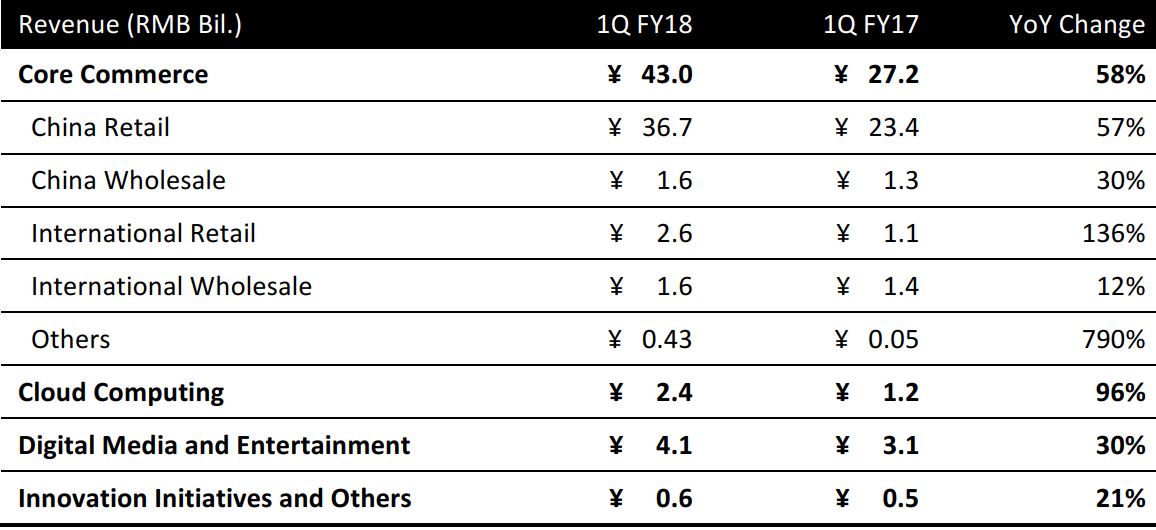

Performance by Segment

Source: Company reports

Source: Company reports

Core Commerce: Core commerce revenues reached ¥43.0 billion, up 58% year over year. China retail and wholesale together contributed 76% of total revenues. International retail revenues continued to see triple-digit growth.

- China retail revenues: Alibaba reported China retail revenues of ¥36.7 billion, up 58% year over year. Annual active consumers reached 466 million, up 2.6% from last quarter, and up 7.4% year over year. Revenue per consumer increased by 7.2% quarter over quarter to ¥273. Mobile monthly active users (MAU) grew to 529 million, up 4.3% quarter over quarter. Revenue per mobile MAU was ¥196, up 7.8% quarter over quarter.

- China wholesale revenues: Revenues for China wholesale were up 30% year over year to reach ¥1.6 billion.

- International retail revenues: International retail revenues continued to see triple-digit growth, up 136% year over year, and reached ¥2.6 billion, primarily driven by increasing revenues from AliExpress and Lazada, with both marketplaces recording robust GMV growth.

Management emphasized again that international expansion will be its long-term core strategy. Alibaba made significant progress in educating the US market about its platforms, hosting a conference in Detroit where 3,000 business owners and entrepreneurs learned how to sell to China using Alibaba as the gateway. The company will host a similar event in Canada in September. In Southeast Asia, Alibaba increased its stake in Lazada to 83%.

Cloud computing: Sales for cloud computing reached ¥2.4 billion, up 96% year over year, driven by robust growth in paying customers, as well as an improving revenue mix of higher valued-added services. The number of paying customers of the cloud computing business reached the 1 million milestone, recording 1,011,000, up 75% on a year-over-year basis.

Digital media and entertainment: Consisting mainly of the advertising and subscription business, including Youku Tudou and mobile, this segment reported revenues of ¥4.1 billion, up 30% year over year. The slower growth of revenues this quarter quarter reflected the full effect of the consolidation of Youku Tudou in May 2016.

Outlook

Alibaba maintains a policy of not providing earnings guidance with its quarterly results. Management reiterated its FY18 revenue growth guidance range of 45%–49%, which was provided during its Investor Day held on June 8–9. Readers may find our coverage of the event below:

Takeaways from 2017 Alibaba Investor Day 1

Takeaways from 2017 Alibaba Investor Day 2

As mentioned on the earnings call, Alibaba remains optimistic about the growth prospects for fiscal year 2018, driven primarily by robust growth of the core business and cloud computing. The company expects to see more synergies between digital media, entertainment and its core commerce business that complement each other in terms of consumers, content and commercialization.

Source: Company reports

Source: Company reports Source: Company reports

Source: Company reports