albert Chan

What’s the Story?

Grocery discounters continued their solid run in 2020, attracting a broad base of budget-conscious customers. We expect the growth of discounters to drive margin pressure across the US grocery space, forcing traditional grocers to optimize their operations.

We discuss the grocery discounter landscape in the US, focusing on Aldi, Lidl and Grocery Outlet as notable, expanding US market players and Coresight 100 companies, and the impact on traditional grocery competitors. We cover growth momentum, store expansion strategies, e-commerce as a new frontier and private-label offerings.

- Aldi: We cover Aldi Süd, the section of the Aldi empire that has expanded most beyond mainland Europe, with operations in Australia, China, the UK and the US. Aldi Nord’s operations are mainly limited to Europe, although it owns US discount grocery chain Trader Joe’s. Aldi offers a no-frills shopping experience with quality products at low prices—more than 90% of its inventory are company-exclusive products.

- Lidl: Offering a basic shopping experience, Lidl focuses on keeping its prices low, including a broad private-label assortment that comprises 80% of its stock. Lidl offers curated items in every product category and sources locally by partnering with domestic producers where possible.

- Grocery Outlet: With a network of independently operated stores, Grocery Outlook makes opportunistic stock purchases to keep prices of its branded products low. Its strategy includes buying canceled orders, factory overruns, products with packaging changes and products approaching “sell-by” dates, which allow the company to pass along savings to its customers while recording higher-than-standard gross margins.

Why It Matters

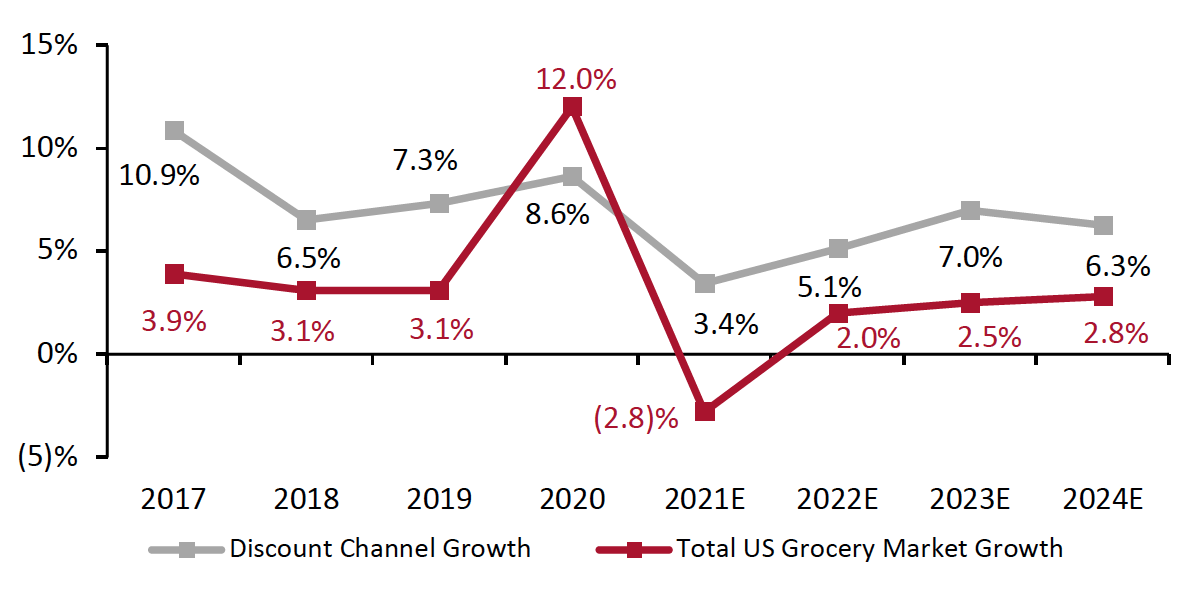

Discount retailers have seen strong growth over the last few years and were able to maintain that momentum amid the pandemic, with sales growth of 8.6% in the US in 2020—although this still underpaced the 12.0% growth in total US grocery sales.

The discount channel is likely to experience a slowdown in 2021, in part, due to demanding comparatives from 2020, but will continue to experience solid growth in 2022 and beyond. The total discount segment includes other major players such as Save A Lot, in addition to the companies focused on in this report.

We expect growth among discounters and their relentless real estate expansion to accentuate competition with traditional grocers and accelerate consolidation in the fragmented US grocery market—small and less differentiated players will likely struggle to cope with further margin pressure.

Figure 1. YoY % Growth Comparison: Grocery Discount Channel vs. Total US Grocery Market

[caption id="attachment_130122" align="aligncenter" width="700"] Grocery discount channel growth comprises store-based sales

Grocery discount channel growth comprises store-based salesRetailers included in the grocery discount channel: Aldi US), Grocery Outlet, Lidl US, Price Rite (Wakefern), Ruler Foods (Kroger), Save A Lot (Save A Lot and SuperValu), and others

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

Aldi, Lidl and Grocery Outlet To Intensify US Grocery Price Competition: A Deep Dive

Growth Momentum

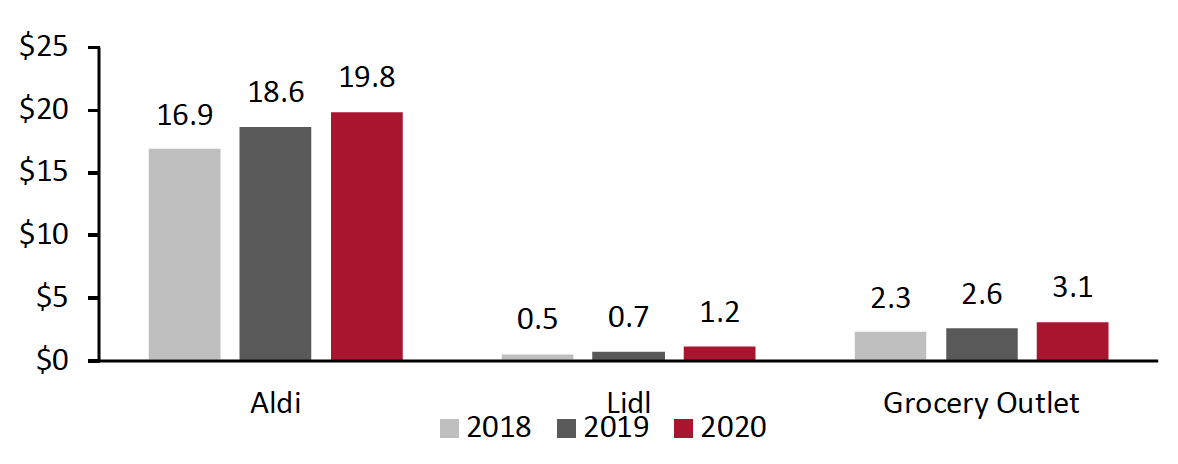

Grocery discounters continued their solid run in 2020, attracting a broad base of budget-conscious customers. Fueled by store openings, Euromonitor estimates that Aldi US generated almost $20 billion in sales in 2020, as shown in Figure 2—with growth of 6.3% year over year. This puts Aldi as the eighth-largest grocery retailer in the US. Lidl grew 57.1% year over year in 2020, as estimated by Euromonitor. Grocery Outlet recorded growth of 22.5% in its 2020 annual report.

We believe that these grocery discounters will remain a disruptive force and an increasingly competitive threat to traditional retailers in the coming years. Their growth will impact customer satisfaction among conventional retailers, likely pushing down the reference price of products for many shoppers.

Figure 2. Aldi US, Lidl US and Grocery Outlet: Annual Sales (USD Bil.)

[caption id="attachment_130123" align="aligncenter" width="700"] Aldi US and Lidl US annual sales are estimated

Aldi US and Lidl US annual sales are estimatedSource: Euromonitor International Limited 2021 © All rights reserved/Company reports[/caption]

Store Expansion Strategies

Aldi

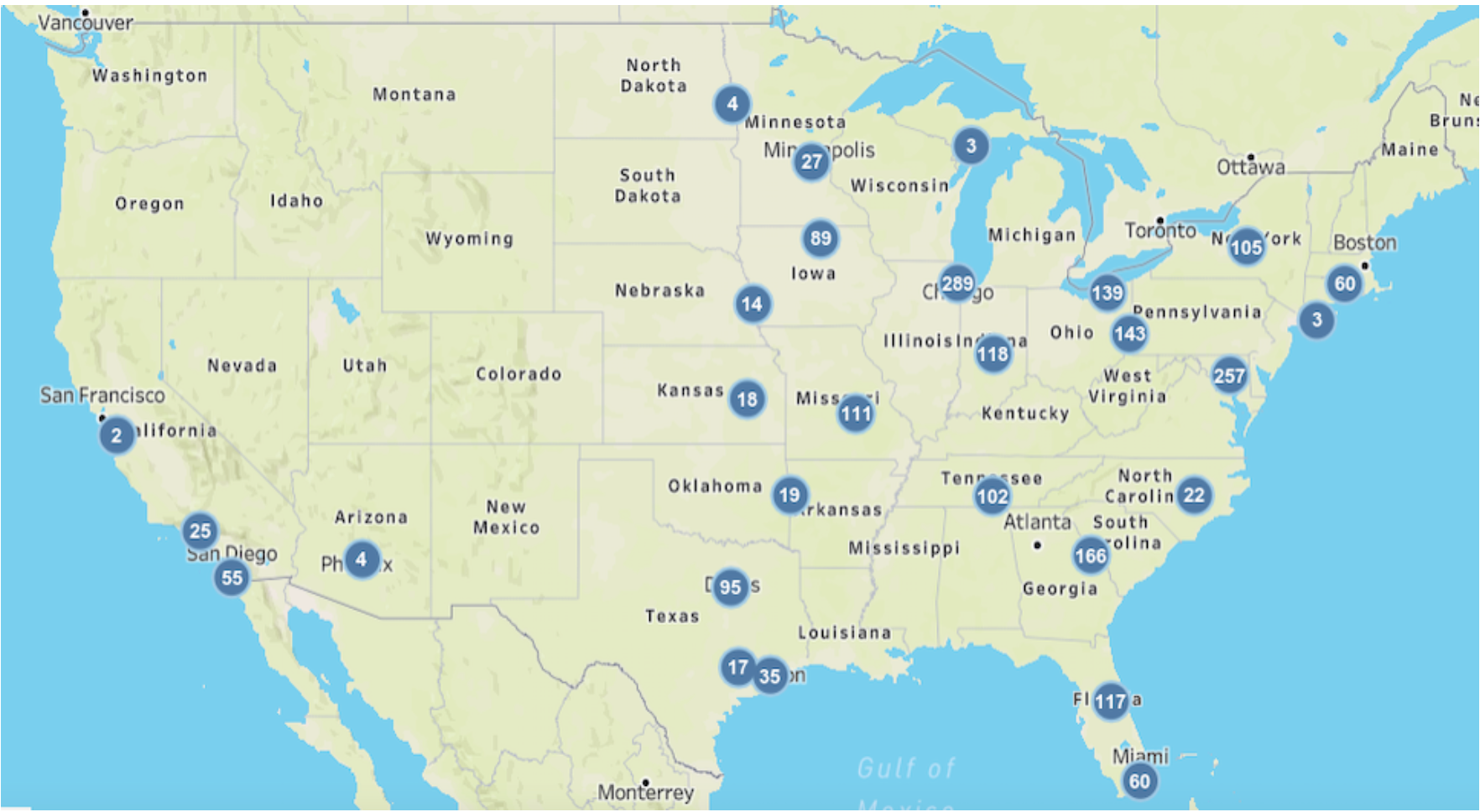

Aldi US has established a strong presence in the US, with a total of 2,071 stores as of January 2021. This follows on from Aldi’s 2017 announcement of plans to invest over $5 billion over the subsequent five years in open 900 new stores, with a target of 2,500 US stores by 2022—which would make it the third-largest grocer in the country by store numbers. This announcement came only days before rival Lidl introduced plans to enter the US market.

In February 2021, Aldi announced that it would open approximately 100 new US locations by the end of the year. The new locations will roll out “with a focus on Arizona, California, Florida and the Northeast,” according to the company. In 2022, Aldi’s plans center on expansion in the Gulf Coast region. To that end, Aldi will open a new distribution center in Alabama next year—its 26th in the US and sixth in the Southern US—giving it capacity to serve up to 100 stores in Alabama, the Florida Panhandle, Louisiana, Mississippi and Southern Georgia. The company stated that it aims to open up to 35 new Gulf Coast stores by the end of 2022.

Figure 3. Aldi US Store Map [caption id="attachment_130124" align="aligncenter" width="700"]

Source: Company reports/Tableau/Coresight Research[/caption]

Source: Company reports/Tableau/Coresight Research[/caption]

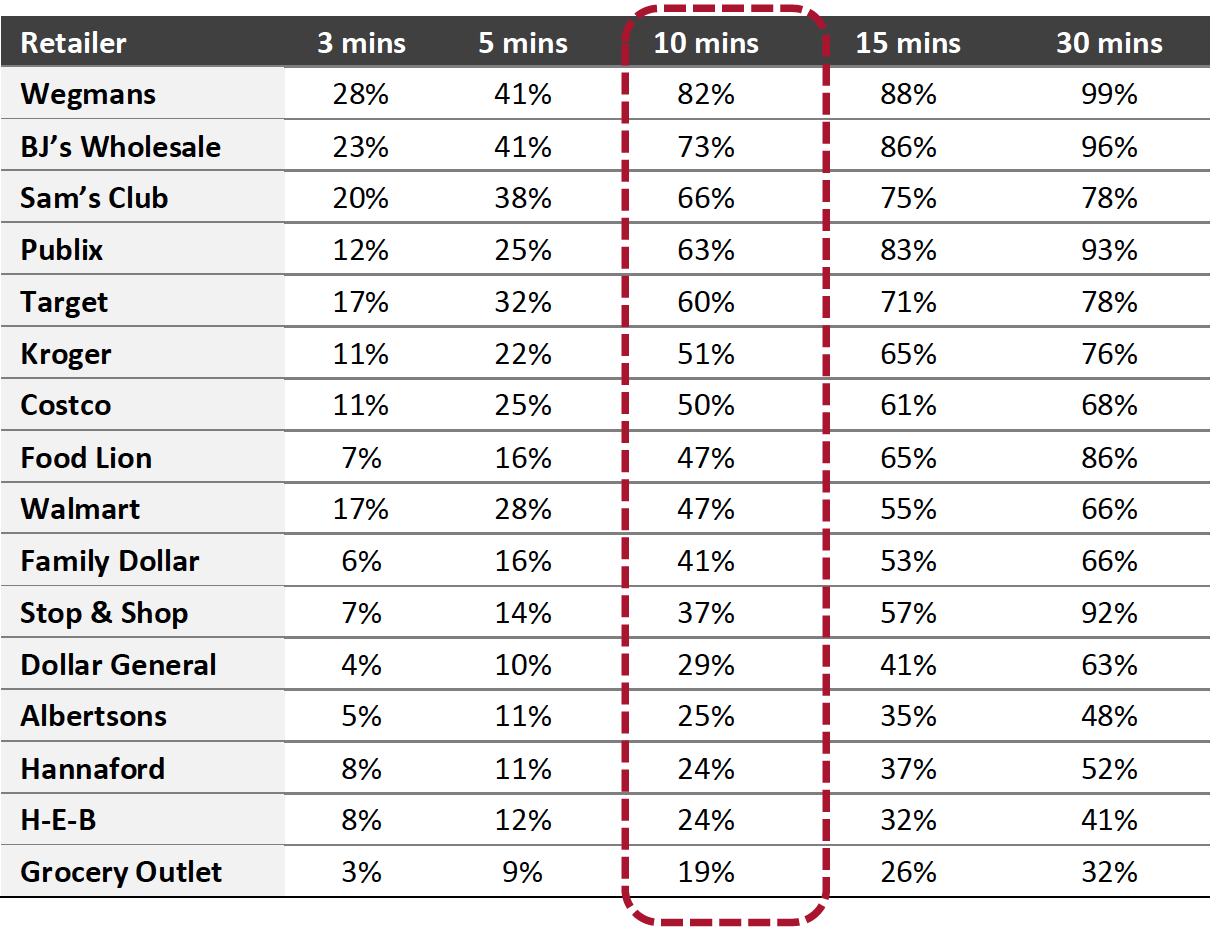

Due to its expanding physical footprint, traditional grocers are facing increasing competition from Aldi. For example, according to financial services firm UBS, more than half of Kroger’s grocery stores have at least one Aldi within a ten-minute drive radius, as shown in Figure 4.

We believe that retailers with significant store overlap with Aldi could be at serious risk of margin pressure in the coming years.

Figure 4. Percentage of Grocery Stores with at least One Aldi Within Specified Drive Time [caption id="attachment_130125" align="aligncenter" width="550"]

Source: UBS[/caption]

Source: UBS[/caption]

Lidl

Two years behind schedule, Lidl US reached its 100-store milestone in May 2020. Lidl opened its first stores in the US to much fanfare in 2017, but, by mid-2018, the retailer’s nascent US strategy failed to deliver the expected result: The retailer had opened around half of the planned 100 stores, and sales at existing stores were slower than anticipated.

After a spell of recalibrations, Lidl acquired Best Market and its 27 stores in New York and New Jersey in November 2018 and converted the stores to the Lidl banner. Additionally, the retailer purchased 13 Shoppers Food outlets from United Natural Foods in December 2019 and converted them to Lidl outlets.

Although Lidl got off to a shaky start in the US, it quickly refined its strategy on store design and layout—pivoting toward reusing existing space rather than building new stores. The company reached its 100-store milestone in May 2020, comfortably ahead of its revised forecast. In August 2020, Lidl announced that it would open 50 new stores by the end of 2021, bringing its total to over 150 locations. Lidl will invest over $150 million in the new stores, which will be located in Delaware, Georgia, Maryland, New Jersey, New York, North Carolina, Pennsylvania, South Carolina, and Virginia.

Lidl’s US expansion plan has been modest compared to Aldi, and it has so far been a relatively niche player in the US grocery sector. However, the retailer has made its intentions clear by announcing in April 2020 that it is building a network of distribution centers along the Eastern Coast that will service supply chain needs for around 1,500 stores.

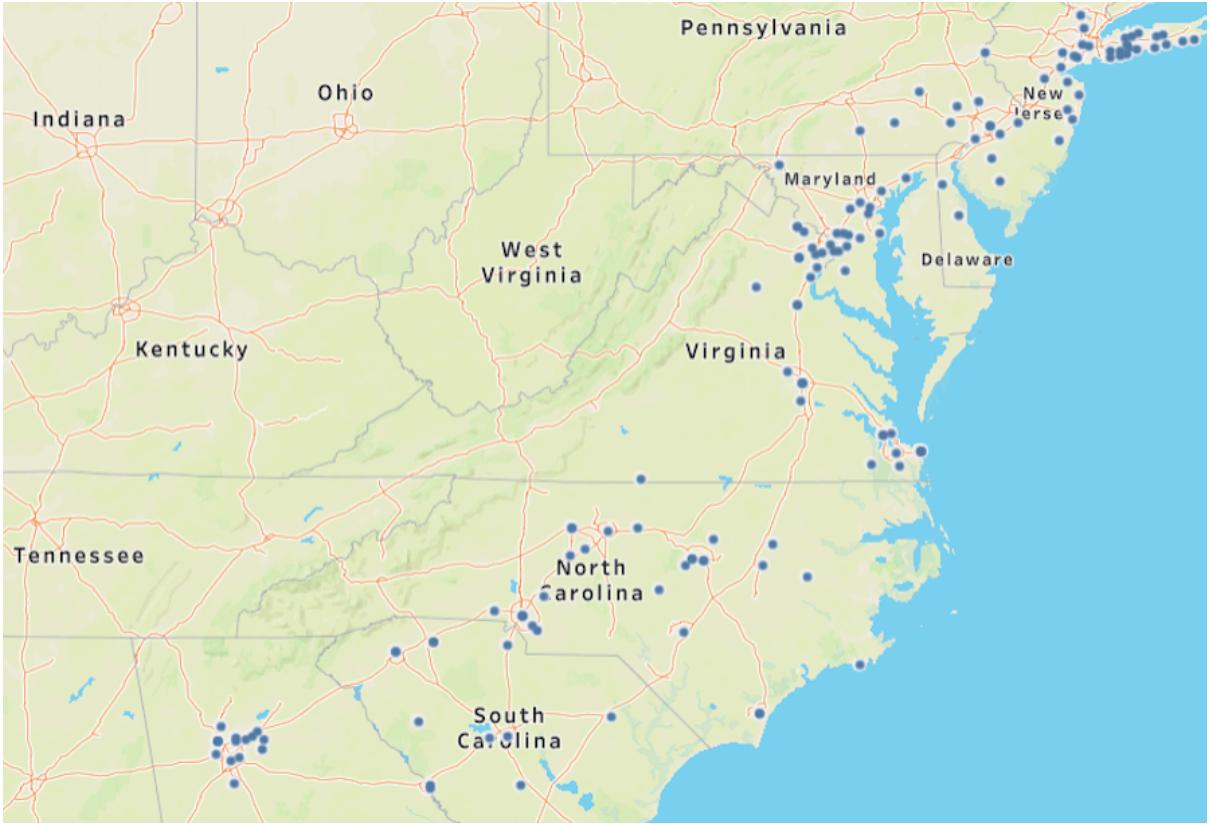

As shown in Figure 5, Lidl stores are concentrated along the East Coast, mostly in Virginia, North Carolina, South Carolina and Maryland.

Figure 5. Lidl US Store Map [caption id="attachment_130126" align="aligncenter" width="550"]

Source: Company reports/Tableau/Coresight Research[/caption]

Source: Company reports/Tableau/Coresight Research[/caption]

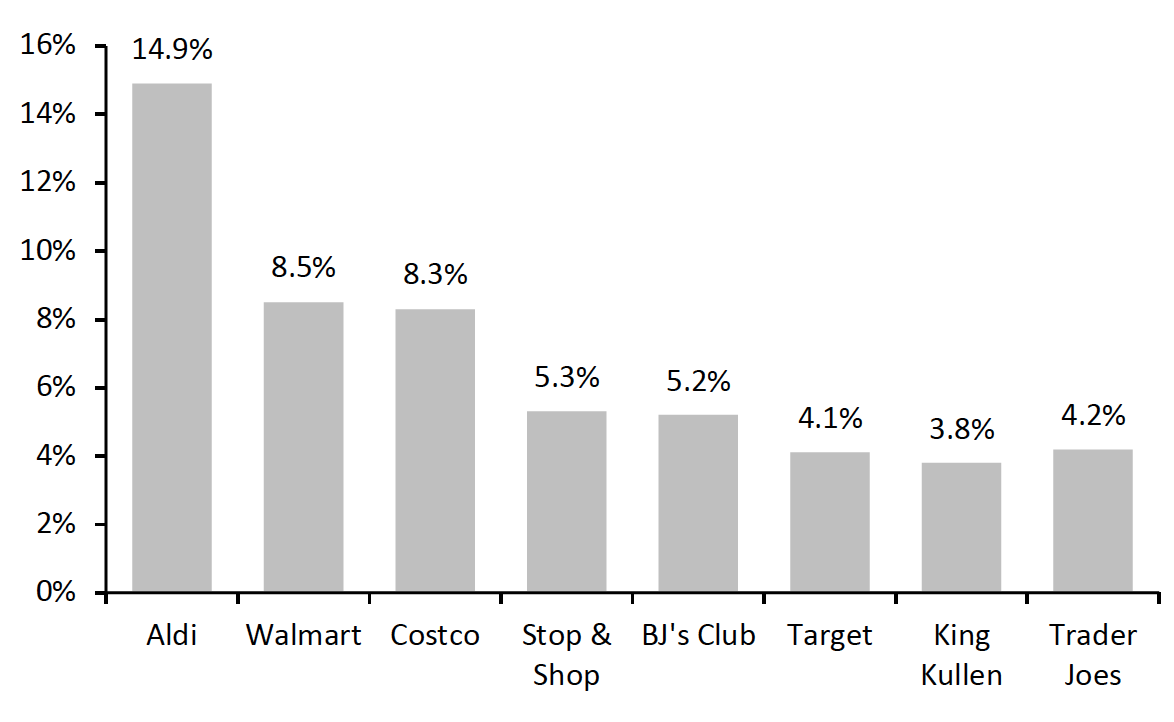

Lidl’s further expansion will likely push grocers to pursue price investments in order to preserve their market share. According to a study conducted by the University of North Carolina, Kenan-Flagler Business School released in July 2020, Lidl’s entry into the Long Island market pressured nearby grocery retailers to drop their prices by up to 15%. The study included a price analysis of 47 comparable grocery products between April 2019 and March 2020. The study found that Aldi cut its list prices by almost 15%, while Walmart cut its prices by 8.5% following Lidl’s entry.

Figure 6. Price Decreases Among Competing Retailers on Long Island After Lidl’s Entry [caption id="attachment_130127" align="aligncenter" width="550"]

Source: Kenan-Flagler Business School[/caption]

In June 2021, Coresight Research conducted spot-checks for a basket of 10 comparable grocery items at Lidl’s competitors in two locations—near and not-near a Lidl store. The results indicated that the basket price is around 1% higher at major non-discount chains’ stores that are not located near a Lidl than those that are.

Comparison: Aldi vs. Lidl

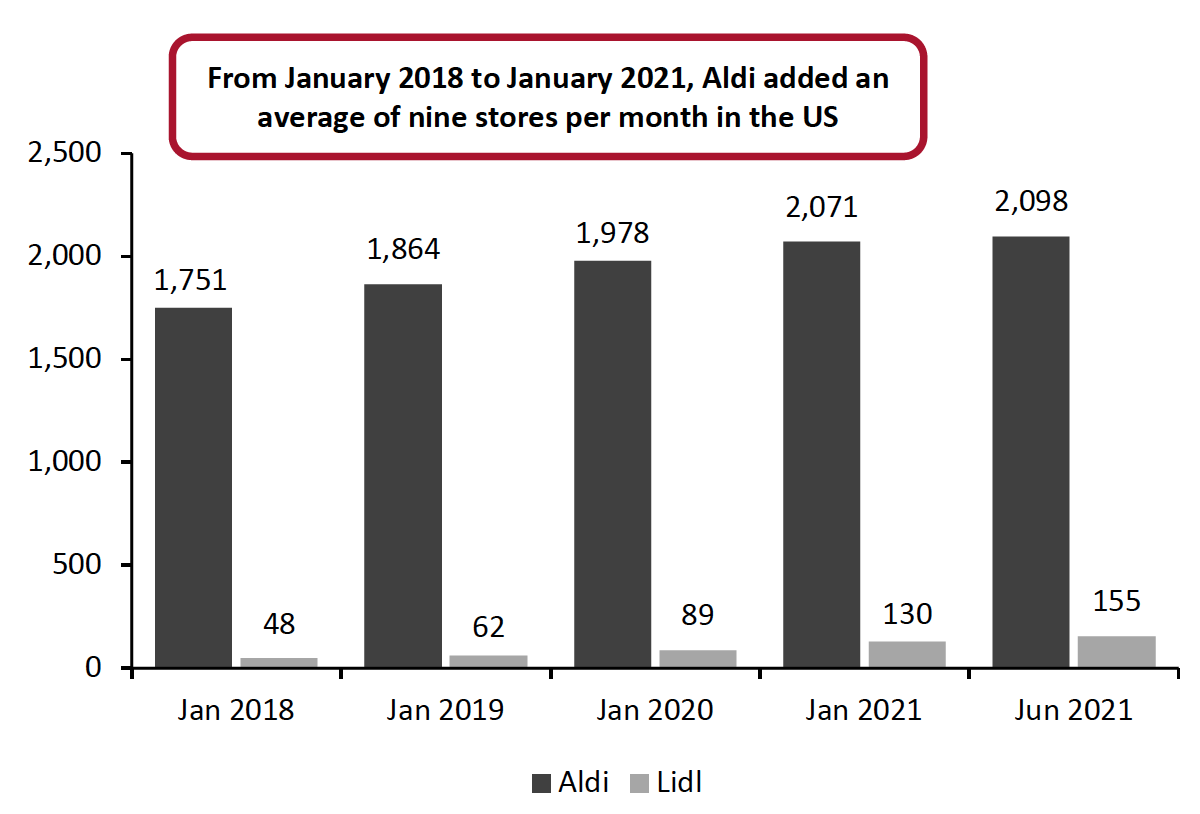

Aldi US added almost nine stores per month from January 2018 to January 2021, as shown in Figure 7, which has overshadowed Lidl’s store growth. It now appears that Aldi is unlikely to achieve the goal of reaching 2,500 US locations by the end of 2022, unless it achieves a dramatic acceleration in store expansion next year. The company will have to open, on average, 27 stores per month in 2022 to reach its target. Nevertheless, the .

Lidl’s store count stood at 155 on June 25, 2021, up by just over 50% from one year earlier.

Source: Kenan-Flagler Business School[/caption]

In June 2021, Coresight Research conducted spot-checks for a basket of 10 comparable grocery items at Lidl’s competitors in two locations—near and not-near a Lidl store. The results indicated that the basket price is around 1% higher at major non-discount chains’ stores that are not located near a Lidl than those that are.

Comparison: Aldi vs. Lidl

Aldi US added almost nine stores per month from January 2018 to January 2021, as shown in Figure 7, which has overshadowed Lidl’s store growth. It now appears that Aldi is unlikely to achieve the goal of reaching 2,500 US locations by the end of 2022, unless it achieves a dramatic acceleration in store expansion next year. The company will have to open, on average, 27 stores per month in 2022 to reach its target. Nevertheless, the .

Lidl’s store count stood at 155 on June 25, 2021, up by just over 50% from one year earlier.

Figure 7. Total US Store Count of Aldi and Lidl [caption id="attachment_130128" align="aligncenter" width="550"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Grocery Outlet

Although Aldi dominates the US discount grocery channel, its US-based rival Grocery Outlet is thriving.

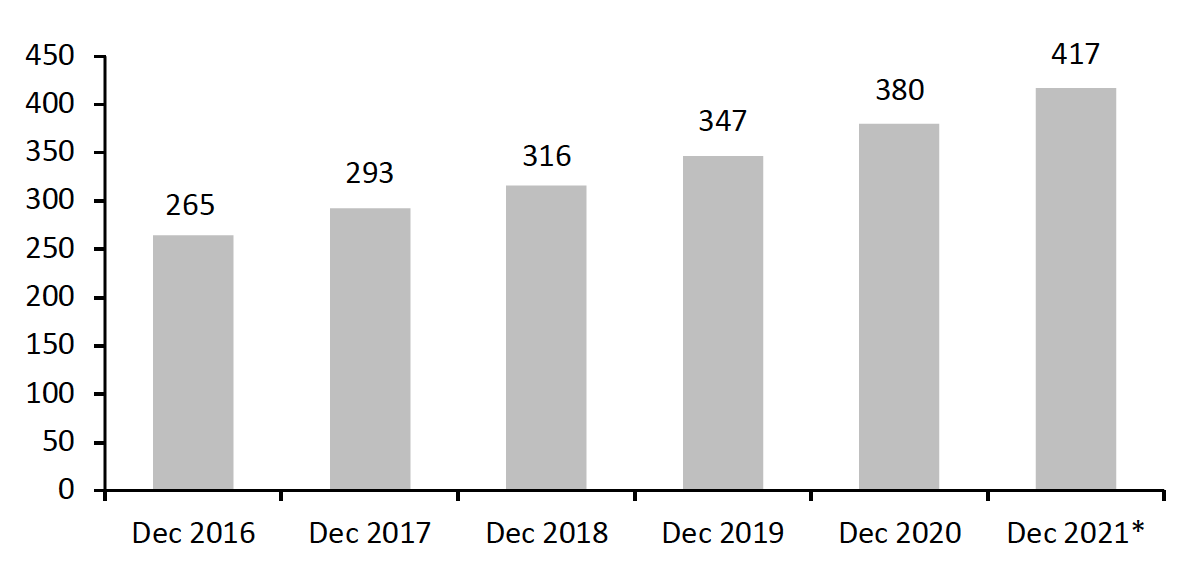

Grocery Outlet opened 35 new stores in its fiscal year ended January 2, 2021, and plans to build on growth momentum over its current fiscal year. In its fiscal 2021 earnings call, management stated that Grocery Outlet is investing in infrastructure to expand its presence in the West Coast and Mid-Atlantic region, with 36–38 store openings planned for 2021.

Figure 8. Grocery Outlet Store Count [caption id="attachment_130129" align="aligncenter" width="550"]

*Proposed store count

*Proposed store countSource: Company reports/Coresight Research[/caption]

E-Commerce: The New Frontier

Grocery e-commerce has traditionally been an Achilles heel for discounters—the costs associated with picking, packing and delivering orders sit uneasily with their low-overhead, no-frills model. However, Aldi and Lidl have gradually moved into e-commerce over the past several years, with trials or partial online offerings. Although the two retailers have adopted new tactics, they largely stem from the same core strategy—investments in assets that are low cost, such as a basic mobile app, or trials that are high margin, such as delivery in nongrocery or in categories such as wine. This indicates that have largely taken a conservative approach to e-commerce prior to the pandemic.

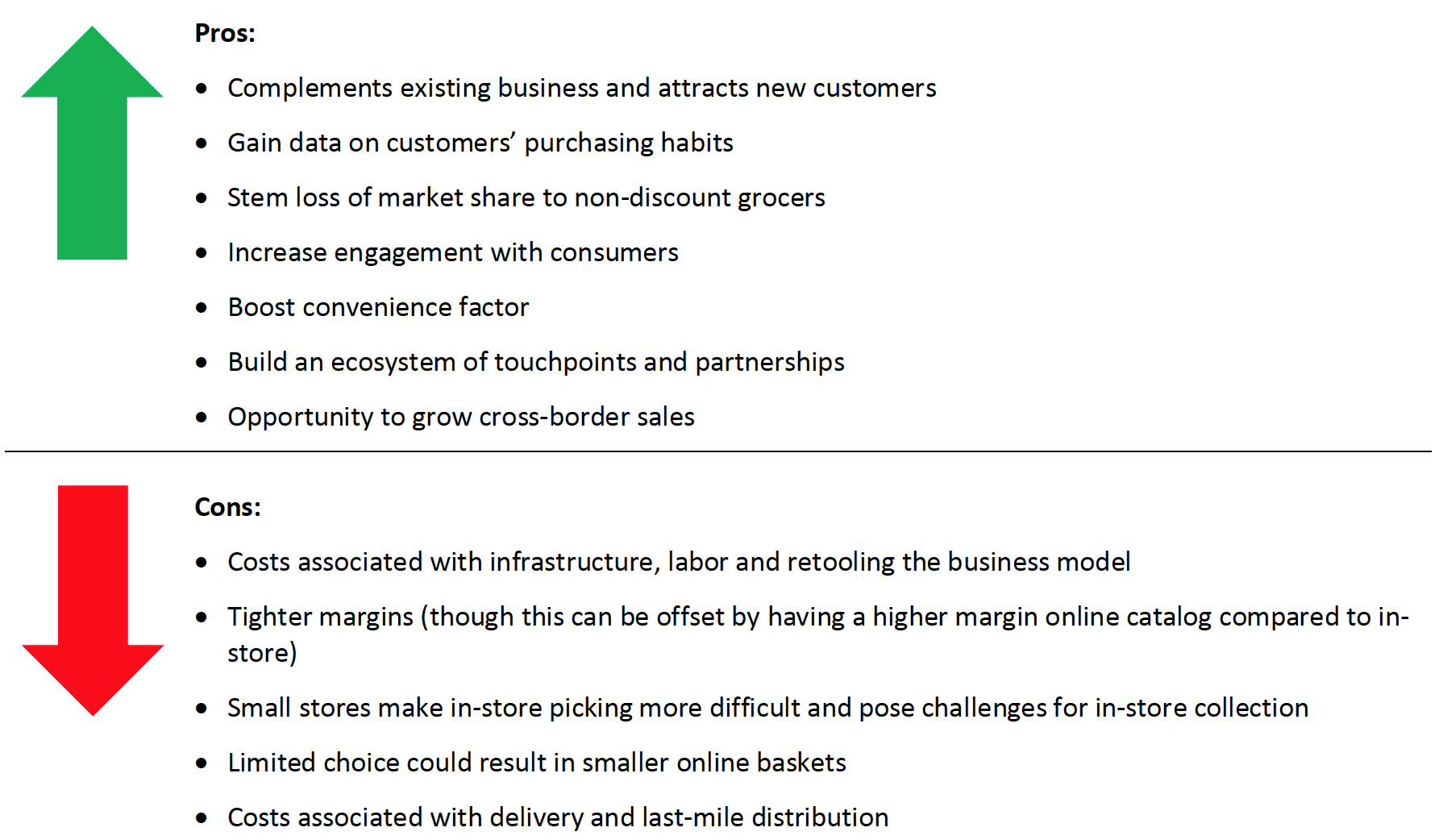

Figure 9 summarizes key benefits and challenges associated with e-commerce for grocery discounters.

Figure 9. Benefits and Challenges of E-Commerce for Grocery Discounters [caption id="attachment_130130" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

However, consumer demand for alternative shopping methods has spiked amid the pandemic, and some grocery discounters are looking toward a more aggressive omnichannel approach to stay competitive.

- In May 2020, Aldi US announced the expansion of its curbside pickup service to 600 stores across 35 states, moving beyond delivery for the first time. The company extended the service to a further 500 stores in February 2021, bringing the total number of locations that offer curbside service to more than 1,200. Aldi has partnered with Instacart to offer grocery delivery since 2017, but has typically shied away from pickup services, despite wide adoption among other grocers in the last few years.

- The US is among few markets where Lidl provides e-commerce services to its customers—offering home delivery in partnership with Shipt and Boxed. In addition to third-party delivery, Lidl may soon offer curbside pickup as part of its offering as it is currently testing the service in Poland and Germany.

- Grocery Outlet management stated on its fiscal 2021 earnings call in January this year that the company is keeping e-commerce in mind while making broader technology and IT infrastructure investments. The company stated that this will provide the right foundation if for any future e-commerce plans.

US Private Label

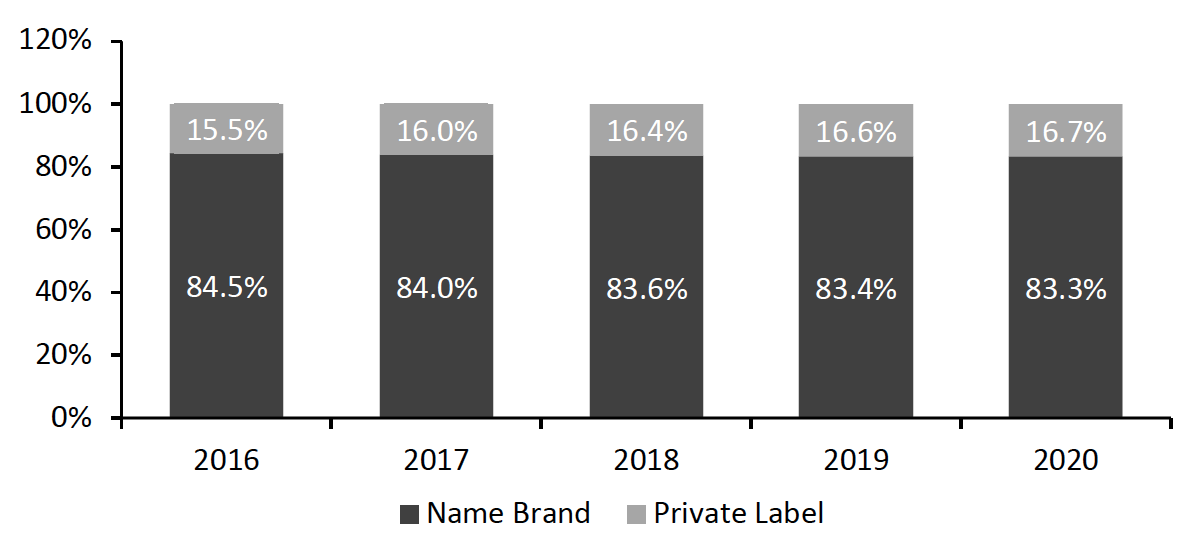

Grocery private-label sales outpaced national brands in 2020 as shoppers sought more cost-effective ways to keep their grocery budgets under control. Many retailers cited a shortage of name brands amid supply chain disruptions as pushing consumers toward private-label products for the first time—along with price considerations.

While the US private-label penetration rate trails a number of comparable Western markets, it is on an upward trend, as shown in Figure 10.

There is significant opportunity in the US for private-label product sales to increase market share, and relentless store expansion by Aldi and Lidl will give US shoppers more access to private labels. It will also spur established retailers to strengthen their own private-label offerings.

Figure 10. US: Breakdown of Food and Beverage Market Share, by Name Brands and Private Labels [caption id="attachment_130131" align="aligncenter" width="550"]

Source: IRI E-Market Insights™/Coresight Research[/caption]

Source: IRI E-Market Insights™/Coresight Research[/caption]

What We Think

The sustained growth of these discounters will continue to reshape the US grocery landscape. The aggressive expansion of grocery discounters will put tremendous growth and profitability pressure on conventional retailers.

Implications for Retailers

- The impact of grocery discounters on conventional grocers’ sales varies by store format. Premium retailers might actually benefit from a potential for symbiosis between the two formats. Continuing trends that we have seen since the global financial crisis, some consumers adopt “mix-and-match” habits, purchasing staples at the discounters and spending the money saved on specialty, culinary, ready-to-eat and other high-margin products at premium retailers.

- Mainstream retailers are likely to most feel the competitive pressures from hard discounters’ expansion as they are in the middle on price and added value. Within this large category, Everyday Low Price retailers are more at risk because of easy comparison on price.

Implications for Grocery Discounters

- Aldi and Lidl have made a big bet on their value-priced and tailored assortments to win over American consumers. However, as other retailers enhance their private labels and a growing percentage of grocery categories shift online, Aldi and Lidl will become more exposed to competition. At their most ambitious, these retailers’ options could include acquiring a delivery startup or tech startup to overhaul their entire online operations and stay competitive in a post-pandemic era.

- Click-and-collect may initially look like a lower-cost way of moving into grocery e-commerce. However, we see real challenges for store picking and collection, given that Aldi and Lidl typically operate small stores. If discounters are willing to invest in building scale in grocery e-commerce, using “dark stores” dedicated to picking online orders looks like a better option than in-store picking. Micro-fulfillment centers can also fit well with discounters’ limited assortment model and enable a fast picking rate, thus driving down labor costs.

- Grocery Outlet can enhance its private-label portfolio to exert more control over its supply chain and stay competitive with other discounters. At the same time, it should ensure that this does not dilute its unique selling proposition of selling off-price branded groceries.

IRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information