albert Chan

Introduction

Aldi has been in the U.S. market for four decades and is pushing ahead with an aggressive expansion strategy, with an aim to have the third-biggest chain of grocery stores in the country by 2022. Lidl entered the U.S. market in 2017 and got off to a shaky start, dramatically scaling back its store-opening plans within its first year. It has since diversified into a variety of store formats, including smaller, more traditional discount formats and shopping-center stores. It is continuing to open stores at a steady pace, and its acquisition of the 27-strong Best Market Chain in late 2018 suggests a renewed impetus to grow its footprint.

Why are these expansions significant? First, expansion by Aldi and Lidl could help consolidate the still-fragmented U.S. grocery sector — and this would have little negative impact on other major players in U.S. grocery. Second, discount formats could steal share from those legacy grocery retailers. And, so, discount formats comprise one of the twin threats we identify to traditional grocery retailers; Amazon, which is pushing into grocery online and offline, is the other. Discount formats are represented not only by Aldi and Lidl but by fast-growing dollar-store chains, which opened hundreds of stores in 2018.

We begin this report with a summary of key facts and recent developments, before discussing the real estate strategies of Aldi and Lidl. After that, we take a deep dive into consumer survey data on who shops at Aldi and why.

Key Facts and Recent Developments

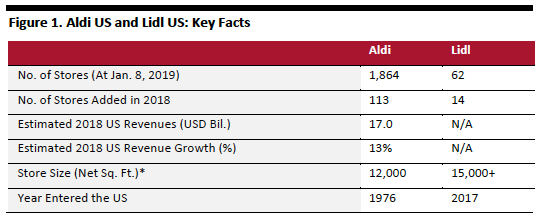

Euromonitor International estimates that Aldi U.S. generated net revenues of $17.0 billion in 2018, having grown revenues at an estimated CAGR of 12.7% over the five years ended 2018. Euromonitor places Aldi as the eighth-biggest grocery retailer in the U.S., by estimated 2018 revenues, behind Walmart, Kroger, Albertsons, Ahold Delhaize, Publix, H-E-B and Meijer.

Euromonitor estimates that Aldi overtook Amazon-owned Whole Foods Market by U.S. revenues in 2018, inadvertently pitching one growth retailer, Aldi, head to head with another, Amazon.

If Aldi maintained that (estimated) five-year CAGR and those rivals did likewise with their respective average annual growth rates, Aldi would leapfrog H-E-B in 2019 and Meijer in 2022, to become America’s sixth-biggest grocery retailer. On the same assumption, Aldi would be capturing an additional £10.5 billion in sales by 2022.

[caption id="attachment_65065" align="aligncenter" width="542"] *Store sizes that the retailers are currently advertising for.

*Store sizes that the retailers are currently advertising for.Source: Company reports/Euromonitor International/Coresight Research[/caption] [caption id="attachment_65064" align="aligncenter" width="536"]

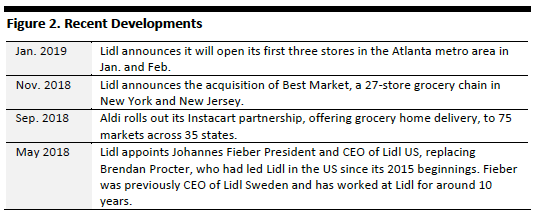

Source: Company reports[/caption]

Source: Company reports[/caption]

Store Locations and Real Estate

In June 2017, Aldi announced a $3.4 billion program of capital investment intended to grow its U.S. presence by around one-half — expanding to 2,500 stores nationwide by the end of 2022 from its store base of “more than 1,600 stores” at the time of the announcement.

In March 2018, Kohl’s announced a pilot program to downsize some stores, and in five to 10 of those stores it will carve out space for separate, adjoining stores that will be leased to Aldi. This venture will support Aldi’s expansion plans by giving it access to open-air shopping centers where high occupancy levels may mean that there may be no existing retail units available.

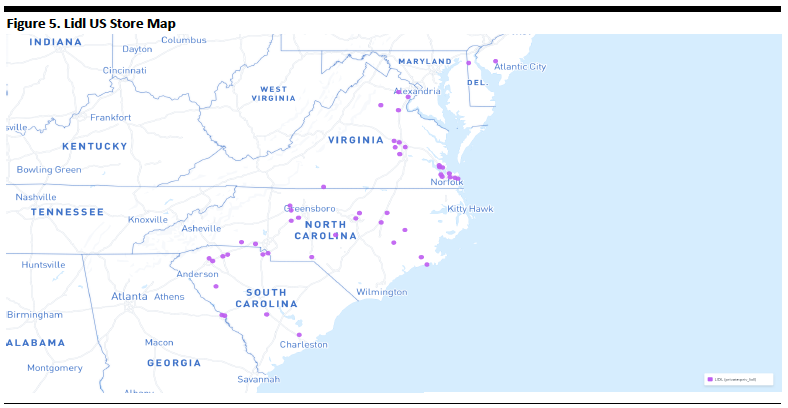

Lidl launched in the U.S. market in June 2017 with stores that were much larger than those traditionally operated by it or its rival Aldi. Lidl’s first U.S. stores typically had 21,000 square feet of net selling space. The company severely undershot its original intentions to open 100 stores on the East Coast by the summer of 2018: We found that only 48 stores were open by late January 2018, 53 locations were open as of the end of June 2018, and 61 were opened by December 11, 2018.

According to German trade publication Lebensmittel Zeitung, Klaus Gehrig, the CEO of Lidl’s parent firm, Schwarz Group, had been critical of the “glass palaces” that Lidl had planned for the U.S. since early 2017. Seven months after its first store openings, Lidl switched its real estate search to smaller stores in more densely populated areas. The company now advertises for four types of stores, suggesting a new flexibility in its approach to real estate:

- Shopping-center stores, with Lidl as a tenant or an owner, from 15,000 sq. ft. net.

- Prototype stores of the kind it first launched in the U.S., with no square-footage requirements specified.

- Metropolitan stores for high-density areas, from 15,000 sq. ft. of floor space.

- Mixed-use concepts, with sales areas from 15,000 sq. ft.

- Special stores for unique locations such as train stations, historical buildings or stadiums.

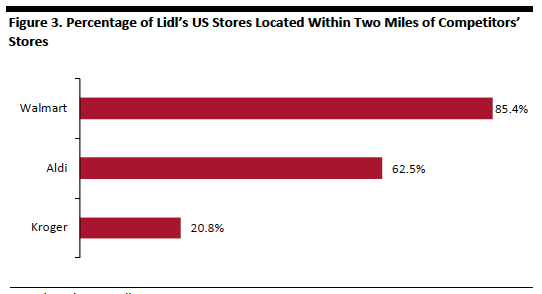

Our analysis of store-location data implies that Lidl’s U.S. market entry was predicated on locating stores close to those of budget retail rivals. Almost two-thirds of Lidl’s first 48 U.S. stores were located within two miles of an Aldi store and 85.4% were within two miles of a Walmart. While the high rate of proximity to Walmart stores may be partially attributable to that chain’s overall prominence, Lidl’s proximity to Aldi stores suggests an attempt by Lidl to piggyback on consumers’ familiarity with, and demand for, Aldi’s proposition.

[caption id="attachment_65063" align="aligncenter" width="542"] Data based on 48 Lidl stores

Data based on 48 Lidl storesSource: Thinknum/Coresight Research[/caption] [caption id="attachment_65062" align="aligncenter" width="792"]

Source: Thinknum[/caption]

[caption id="attachment_65061" align="aligncenter" width="788"]

Source: Thinknum[/caption]

[caption id="attachment_65061" align="aligncenter" width="788"] Source: Thinknum[/caption]

Source: Thinknum[/caption]

Aldi: Consumer Survey Deep Dive

In the following sections, we review consumer survey data from Prosper Insights & Analytics to consider who is shopping at Aldi, how satisfied they are, and why they shop there.

Aldi is America’s Second-Most-Shopped Grocery Chain

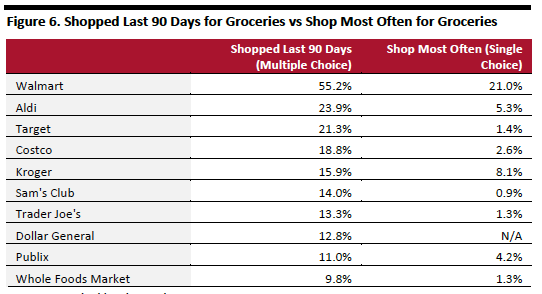

Based on the number of consumers that have shopped there in the past 90 days, Aldi is America’s second-most-shopped grocery retail behind Walmart. Nearly one-quarter of U.S. consumers have shopped at Aldi in the past 90 days, according to August 2018 survey data from Prosper — as we show later, this conceals significant regional differences.

Based on where consumers say they shop most often for groceries, Aldi drops to third place behind Walmart and Kroger.

[caption id="attachment_65060" align="aligncenter" width="542"] Data are ranked by Shopped Last 90 Days

Data are ranked by Shopped Last 90 DaysBase: 7,228 internet users ages 18+, surveyed in August 2018 (Shop Last 90 Days) and 6,978 internet users ages 18+, surveyed in December 2018 (Shop Most Often)

Source: Prosper Insights & Analytics[/caption]

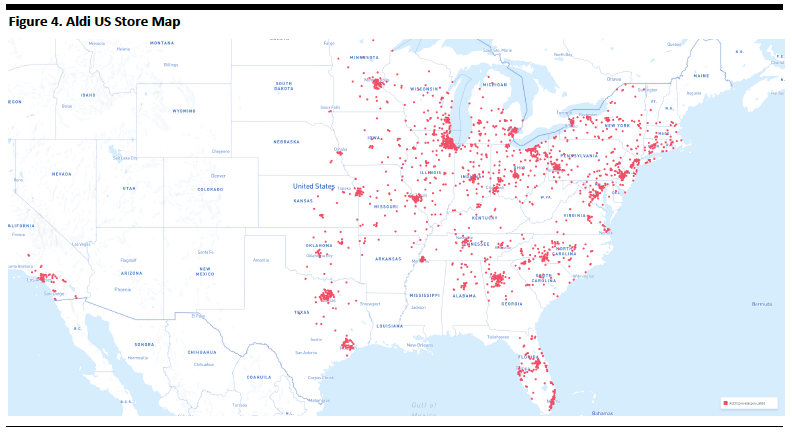

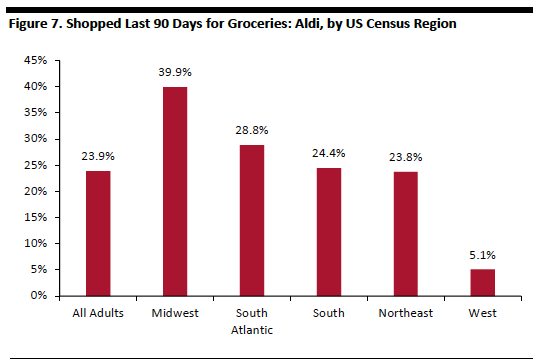

Aldi stores are clustered in the Eastern half of the U.S. as well as a few dozen stores in California. The overall average therefore conceals a substantial variation in shopper penetration. Shopping at Aldi peaks in the Midwest, with four in ten having shopped at Aldi in the past 90 days, still in second place behind Walmart as in the national average.

[caption id="attachment_65059" align="aligncenter" width="538"] Base: 7,228 internet users ages 18+, surveyed in August 2018

Base: 7,228 internet users ages 18+, surveyed in August 2018Source: Prosper Insights & Analytics[/caption]

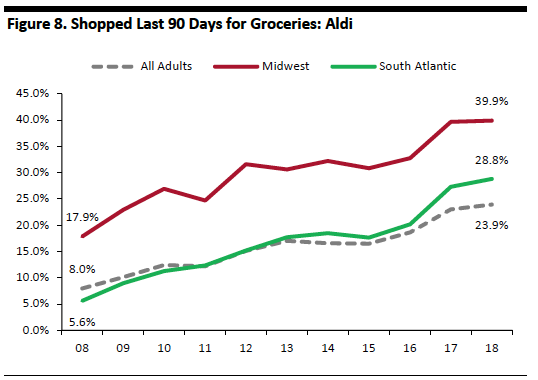

The proportion of all U.S. consumers shopping at Aldi tripled in the 10 years ended 2018. In its biggest region, the Midwest, that proportion more than doubled while in its second-biggest region, South Atlantic, the proportion heading to Aldi in 2018 was fivefold that in 2008.

[caption id="attachment_65058" align="aligncenter" width="538"] Base: 5,679+ internet users ages 18+, surveyed in August of each year

Base: 5,679+ internet users ages 18+, surveyed in August of each yearSource: Prosper Insights & Analytics[/caption]

Profiling Aldi’s Shoppers

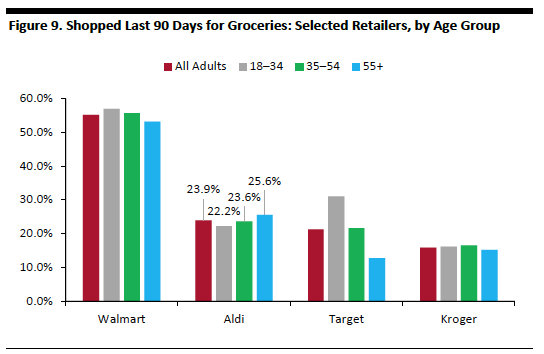

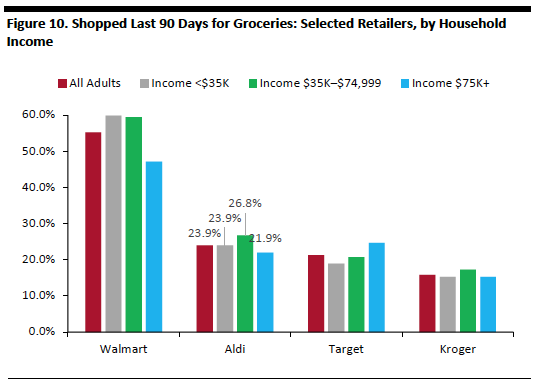

Prosper data suggest that Aldi’s greatest appeal is among older, middle-income shoppers. By both measures, Aldi registers similar metrics to Kroger.

Unlike price-focused Target and Walmart, Aldi sees no peak among younger consumers. Instead, shopping at Aldi increases modestly but steadily with age.

[caption id="attachment_65057" align="aligncenter" width="544"] Base: 7,228 internet users ages 18+, surveyed in August 2018

Base: 7,228 internet users ages 18+, surveyed in August 2018Source: Prosper Insights & Analytics[/caption]

By broad income group, Aldi’s shopper penetration is reasonably balanced, with a slight peak among middle earners — it is not heavily dependent on the lowest-income households and its income profile is similar to Kroger’s. Again, this is different from the peaks seen at Walmart (which has a stronger low-income contingent) and Target (where tendency to shop increases with income).

[caption id="attachment_65056" align="aligncenter" width="540"] Base: 7,228 internet users ages 18+, surveyed in August 2018

Base: 7,228 internet users ages 18+, surveyed in August 2018Source: Prosper Insights & Analytics[/caption]

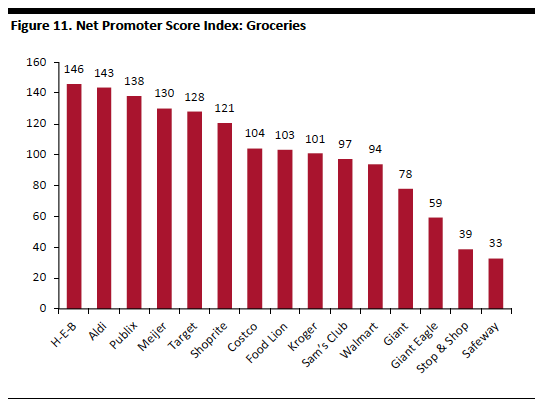

Aldi Shopper Satisfaction, and Why They Shop at Aldi

Aldi shoppers are highly satisfied with the supermarket. Of 15 retailers tracked by Prosper for the groceries category, Aldi comes second only to H-E-B in terms of Net Promoter Score Index. The Index compares a specific retailer’s Net Promoter Score in a certain category to the Net Promoter Score for the channel in which the retailer competes for that category.

With an index score of 143, Aldi’s Net Promoter Score ranks 43% above the average for grocery stores.

[caption id="attachment_65055" align="aligncenter" width="540"] The Net Promoter Score Index compares a specific retailer’s Net Promoter Score in a certain category to the Net Promoter Score for the channel in which the retailer competes for that category. The retailers shown above span the grocery stores, discount stores and membership clubs sectors. Net Promoter, NPS, and Net Promoter Score are trademarks of Satmetrix Systems, Inc., Bain & Company, and Fred Reichheld.

The Net Promoter Score Index compares a specific retailer’s Net Promoter Score in a certain category to the Net Promoter Score for the channel in which the retailer competes for that category. The retailers shown above span the grocery stores, discount stores and membership clubs sectors. Net Promoter, NPS, and Net Promoter Score are trademarks of Satmetrix Systems, Inc., Bain & Company, and Fred Reichheld.Source: Prosper Insights & Analytics[/caption]

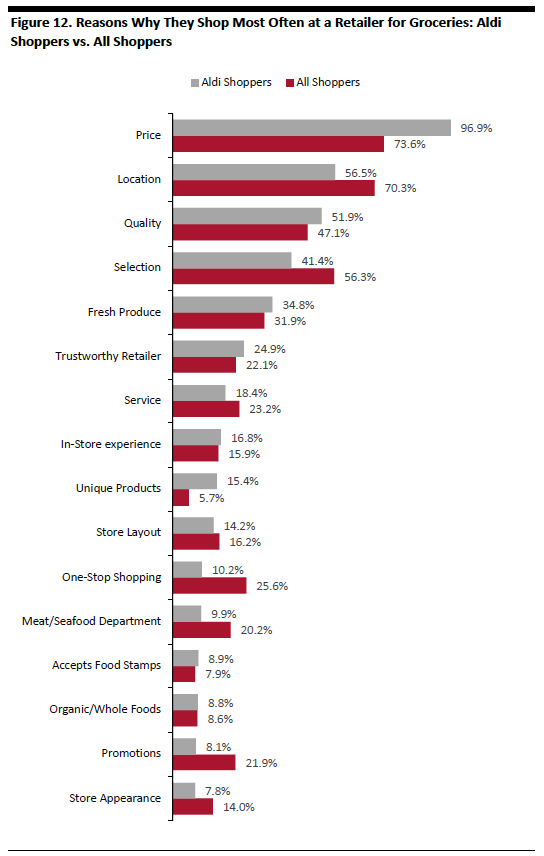

We chart below the reasons given for shopping at Aldi by those who say they shop for groceries most often at this retailer, and we compare those to the reasons given by U.S. consumers on average.

- Unsurprisingly, price ranks much more highly for Aldi shoppers, with fully 97% saying it motivates them to shop at Aldi.

- However, “quality,” “fresh produce” and “unique products” also rank more highly among Aldi shoppers than among shoppers in average — confirming that Aldi’s appeal is more than low prices.

- Aldi falls short on “one-stop shopping,” reflecting that many of its customers will feel it necessary to undertake top-up shops elsewhere for the brands or products they could not get at Aldi.

Base: 7,228 internet users ages 18+ including 369 who shop for groceries most often at Aldi, surveyed in August 2018

Base: 7,228 internet users ages 18+ including 369 who shop for groceries most often at Aldi, surveyed in August 2018Source: Prosper Insights & Analytics[/caption] Key Takeaways

- Aldi could climb from being America’s eighth-biggest grocery retailer in 2018 to sixth-biggest in 2022, should recent (estimated) revenue trajectories continue. Survey data show that Aldi is the country’s second-most-shopped grocery retailer, by the number of consumers that have shopped there in the past 90 days. Almost one-quarter of U.S. consumers have shopped for groceries at Aldi in a 90-day period, rising to 40% in the Midwest.

- Aldi shoppers are highly satisfied with the retailer, as reflected in its Net Promoter Score. Moreover, factors such as “quality” and “unique products” rank disproportionately highly as reasons for shopping at Aldi — confirming that its appeal is more than low prices.

- Lidl got off to a shaky start in the U.S. and the company appears to have considered this due to real estate decisions and particularly its early focus on larger stores. Lidl has since diversified into a range of store formats, including smaller formats that will be more familiar to current shoppers at rival Aldi. Lidl is continuing to open stores at a modest pace. The adoption of different store formats and its recent acquisition of the 27-strong Best Market Chain suggests a renewed impetus to grow its footprint in the U.S.

- Given Aldi’s success, we see few reasons why Lidl should not capture meaningful share over the long term — once it has put down store formats that more closely align with shopper expectations and once it has raised its profile in the market.

- The U.S. grocery sector remains highly fragmented, suggesting opportunities for both Aldi and Lidl to help consolidate the market. At the same time, incumbent market leaders will be keenly aware of the potential threat from the discounters. We identify discount formats — including dollar stores as well as Aldi and Lidl — and Amazon as potential twin pressures on midmarket legacy grocery retailers in the coming few years