albert Chan

Introduction: Aldi and Lidl Continue to Flex

2019 has seen a slew of new stores, formats and e-commerce developments from global grocery disruptors Aldi and Lidl. In this report, we take stock of recent developments and assess what they tell us about these private companies’ strategies. We focus on Aldi’s and Lidl’s operations in the US, the UK and China.

- We discuss recent store expansion, e-commerce developments and growth metrics.

- We include store-tour images and observations from new Aldi formats in London and Shanghai.

- We include timelines of key developments at Aldi and Lidl worldwide.

What Do Recent Developments Mean?

Aldi is adapting its store formats to better suit new markets in China and in London. Both Aldi and Lidl are incrementally moving to more comprehensive online offerings, even though neither currently operates full-service grocery services online.

These developments underscore the retailers’ flexibility as they seek to expand further into international markets and shore up existing market positions as e-commerce moves front and center in retail. Aldi and Lidl continue to diverge from the traditional hard-discount model of cookie-cutter stores and a “take-it-or-leave-it” approach to products, channels and stores.

This shift away from a pure hard-discount model will pile on extra costs and chip away at the economics of the limited-line, no-frills discount model. But Aldi and Lidl (both privately owned companies) appear to be willing to make short-term sacrifices to build positions of strength in the long term. This continues to be bad news for nondiscount rivals, including public firms with an eye on the next quarter’s earnings.

The Aldi we discuss in this report is Aldi Süd, one half of the Aldi empire. Aldi Nord and Aldi Süd divide Germany and international markets between them. Only Aldi Süd has expanded beyond Europe, with operations in Australia, the US, the UK and China. Aldi Süd has also been more willing than Aldi Nord to soften the hard-discount model, with bigger stores, more brands and more fresh foods. Like Lidl, which pioneered a slightly softer form of discount, Aldi Süd’s approach appears to resonate with consumers more than hard-discount-focused Aldi Nord.

Lidl is owned by Schwarz Group, which also owns discount-hypermarket retailer Kaufland.

Store Expansion

While the US and UK markets are seeing mass store closures, Aldi and Lidl are leading the charge into physical retail. In the UK and China, Aldi is diverging from its traditional store models to serve local demand.

US: Best Market Boosts Lidl

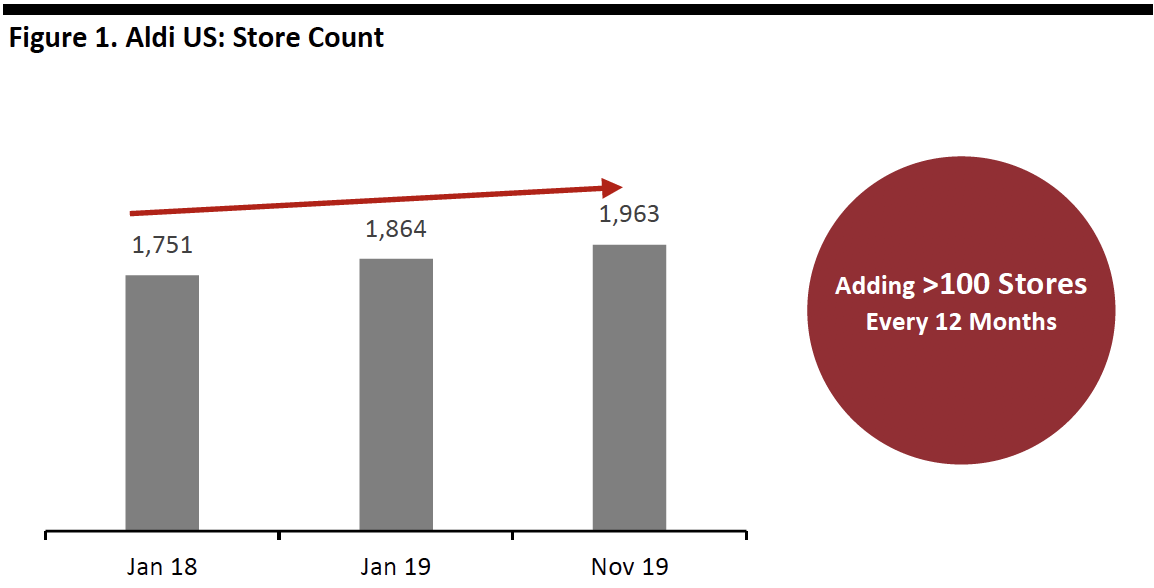

In the US, Aldi is two years into a five-year, $3.4 billion plan to open 900 stores, taking its store count from 1,600 at the time it announced the plans in June 2017 to 2,500 by 2022.

Our tracking of Aldi’s US store numbers suggests the company adds slightly more than 100 stores every 12 months.

[caption id="attachment_100586" align="aligncenter" width="700"] Source: Company website[/caption]

Source: Company website[/caption]

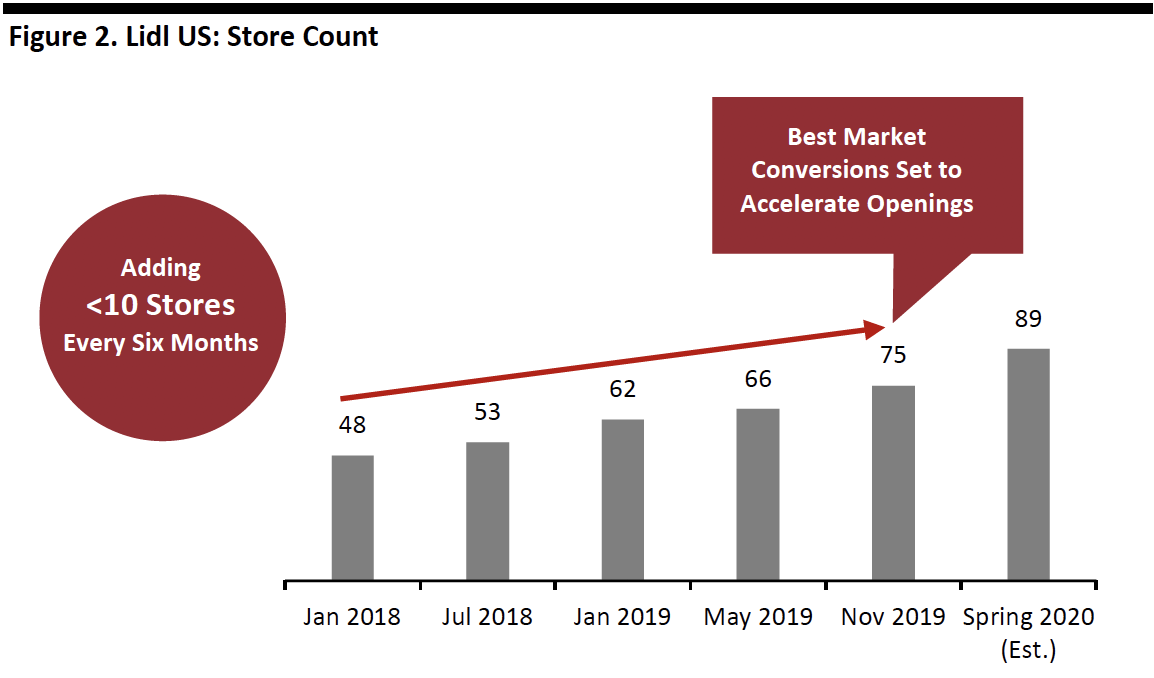

After a spell of slow progress, we are seeing renewed Lidl openings in the US, albeit at a much more sedate pace than Aldi. Lidl is increasing its store fleet partly by converting Best Market stores to the Lidl banner: Lidl acquired Best Market and its 27 stores in New York and New Jersey in November 2018.

Our tracking of Lidl’s US store numbers suggests it adds just under 10 stores every six months. In May 2019, Lidl announced it would open 25 stores and close two stores by spring 2020, a slight acceleration that we estimate would take it to a total of 89 outlets.

[caption id="attachment_100587" align="aligncenter" width="692"] Source: Company website[/caption]

Source: Company website[/caption]

UK: Aldi Leans on Convenience to Expand in London

In the UK, a move into smaller, convenience-store formats is supporting Aldi’s push into the London market. Aldi’s UK stores have traditionally been standalone, edge-of-town stores with car parks. In March 2019, the retailer opened its first Aldi Local store in south London, and opened or converted seven more stores in summer 2019 (we discuss one of these stores in greater detail later). In September 2019, Aldi indicated its intention to have 55 stores in the Greater London area by 2025.

In November 2019, Lidl announced plans to open 230 UK stores to take its store count to 1,000 by 2023. This implies around 77 store openings per year on average in each of 2020, 2021 and 2022, which would represent an acceleration from its previously stated plans for 50-60 new UK stores per year.

China: Aldi Opens Second Set of Shanghai Stores

Aldi opened its first China stores in June 2019 with two stores in Shanghai. In October 2019, it opened two more. The China stores have a more premium positioning than Aldi stores elsewhere in the world—further evidence of discounters adjusting their propositions to cater to shoppers in international markets. (We discuss one of the initial stores later in this report.)

E-Commerce Developments

Grocery e-commerce has traditionally been an Achilles heel for the discounters: the costs associated with picking, packing and delivering orders sit uneasily with their low-overhead, no-frills model.

However, Aldi and Lidl have incrementally moved into e-commerce over the past several years, with trials or partial online offerings (most often in nongrocery or in categories such as wines and spirits) in selected markets. Although far from complete, the progress toward a digital offering appears to continue, evidence that these companies have renewed willingness to adapt:

- Lidl UK could soon offer groceries online. In October 2019, the company advertised for a digital project manager, whose responsibilities would include, delivering “a new online platform,” “driving online sales” and being responsible for “multiple projects to enhance business growth and revenue.”

- In November 2019, Aldi expanded its US grocery home-delivery partnership with Instacart to include alcoholic beverages.

- In the UK, Aldi launched an online toy store in October 2018—ahead of the holiday peak and capitalizing on the demise of Toys “R” Us earlier in that year. Also in 2018, Aldi UK launched home delivery for spirits.

Growth Update

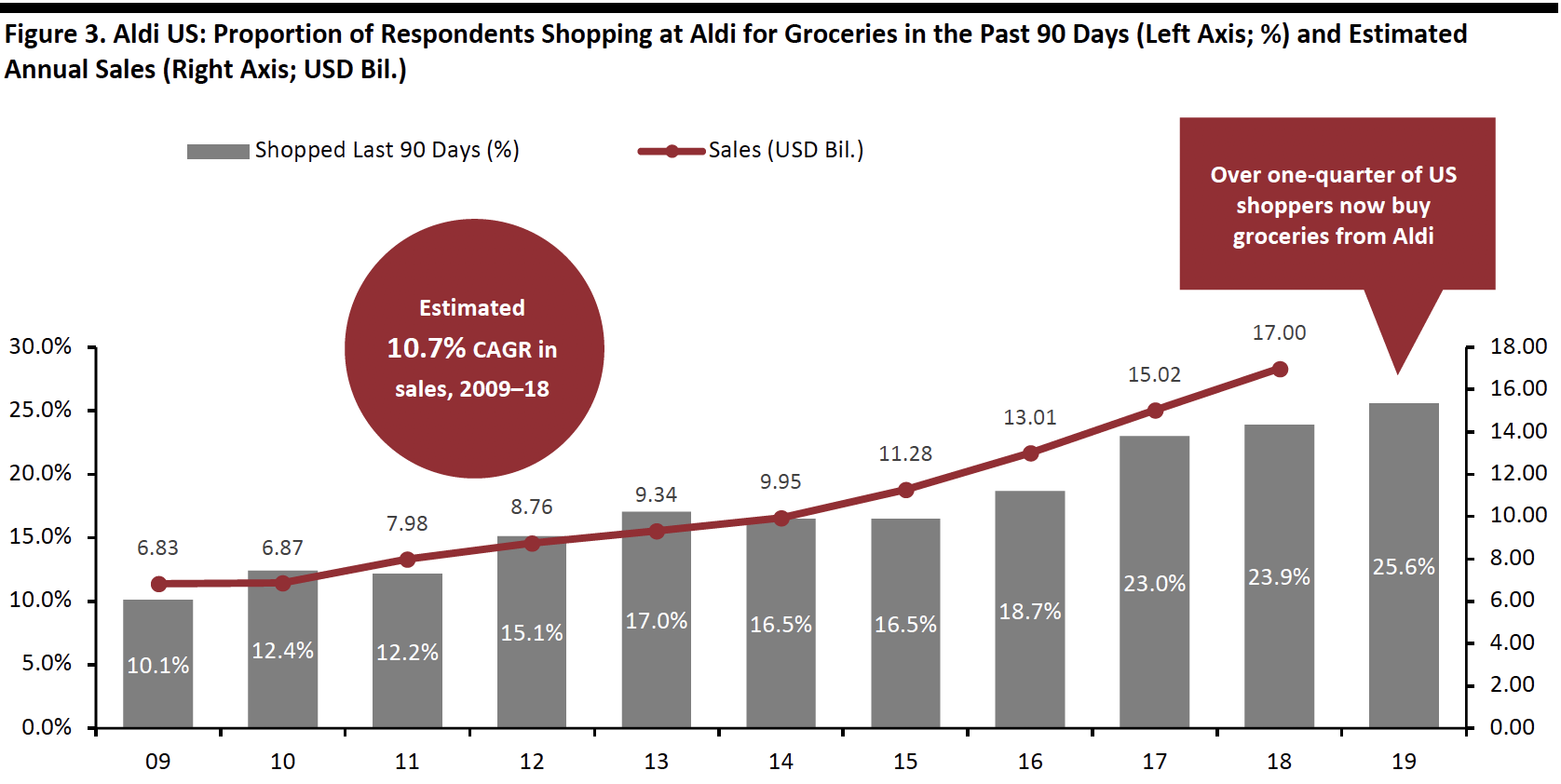

As private companies (in both senses of the word), there is little concrete data on sales for Aldi and Lidl. In the chart below, we aggregate sales estimates and survey data.

- Fueled by store openings, Euromonitor International estimates Aldi US generated $17 billion of sales in 2018, up 13.1% and representing a nine-year CAGR of 10.7%. Euromonitor places Aldi in eighth place in the US grocery market.

- Data from a July 2019 Prosper Insights & Analytics survey found 25.6% of US shoppers had bought groceries from Aldi in the prior 90 days—the first time this metric had passed one-quarter for Aldi. On its separate question of which retailers consumers “shop most often” for groceries, Prosper found Aldi was third, behind only Walmart and Kroger.

Lidl does not yet appear on the radar of either Euromonitor or Prosper.

[caption id="attachment_100588" align="aligncenter" width="700"] Survey base: 6,000+ US Internet users aged 18 and above, surveyed in July each year

Survey base: 6,000+ US Internet users aged 18 and above, surveyed in July each yearSource: Prosper Insights & Analytics/Euromonitor International Limited 2019 © All rights reserved[/caption]

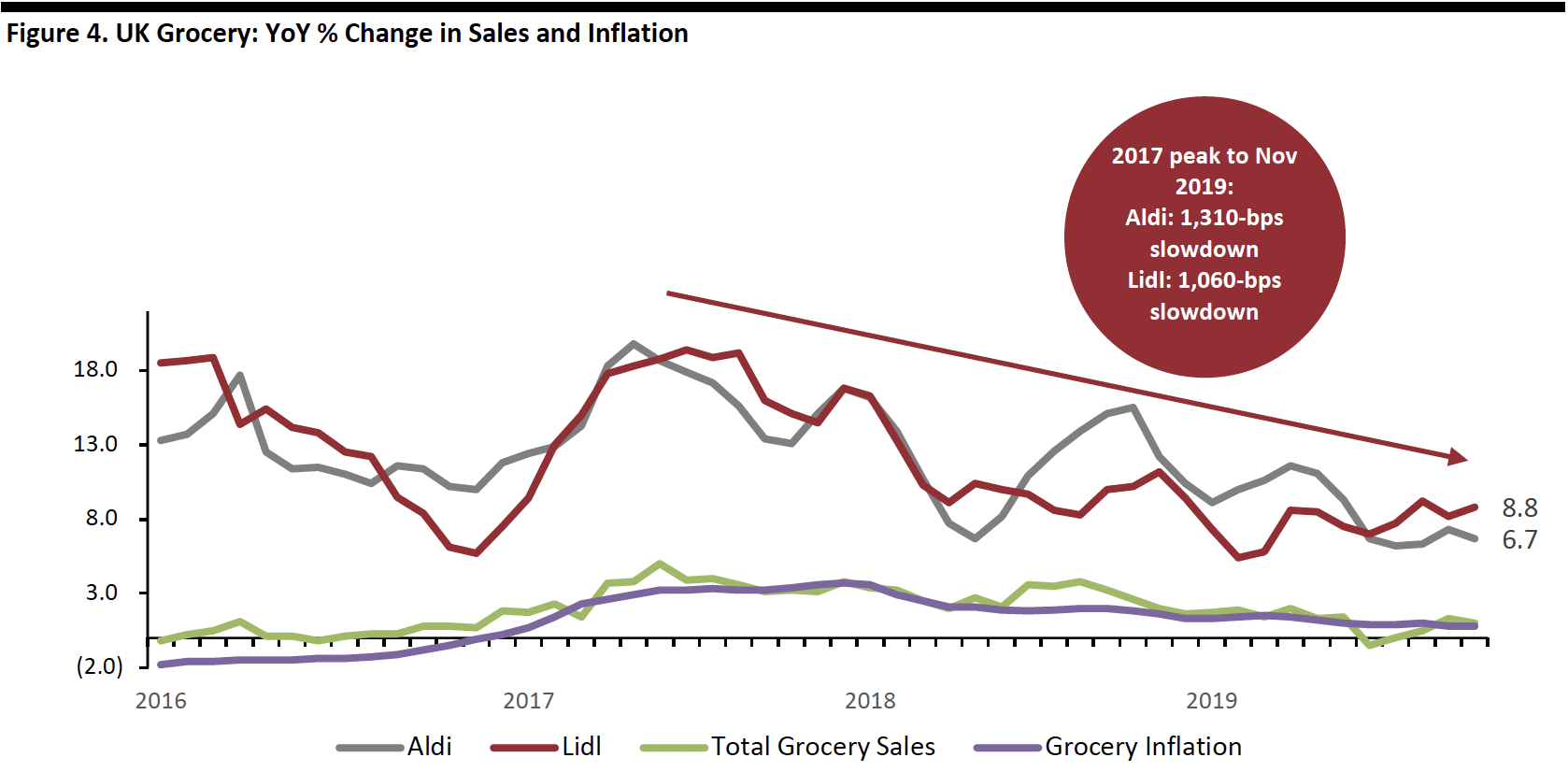

In the UK, the most consistently available metric is Kantar Worldpanel’s dataset on grocery sales growth and market share, which showed:

- Between January 2016 and November 2019 (latest), Aldi grew its UK grocery market share from 5.5% to 8.0%.

- Over the same period, Lidl grew its share from 4.2% to 5.9%.

We chart the Kantar-recorded year-over-year sales growth for these two retailers below, including sector sales and inflation as benchmarks.

- In the UK, Aldi and Lidl outperform in an inflationary environment as shoppers look to offset rising prices by switching retailers. This pattern is seen in the data for 2017, when UK grocery inflation peaked.

- In part due to softening inflation, Aldi and Lidl have each seen quadruple-basis-point (bps) slowdowns in year-over-year growth from their near-20% peaks in 2017, according to our analysis of Kantar data. As of November 2019, Aldi’s and Lid’s year-over-year sales growth was down to the single digits, per Kantar.

- However, we think inflation is not the only factor: The UK’s “big four” incumbent grocery retailers have slashed costs, simplified their propositions and lowered prices to compete more aggressively with Aldi and Lidl, and this looks to have slowed the progress of the discounters. We discussed the strategies of the nondiscount retailers in depth in an April 2019 report.

Data is for overlapping 12-week periods, reported every four weeks, the latest of which ended November 3, 2019

Data is for overlapping 12-week periods, reported every four weeks, the latest of which ended November 3, 2019Source: Kantar Worldpanel/Coresight Research[/caption]

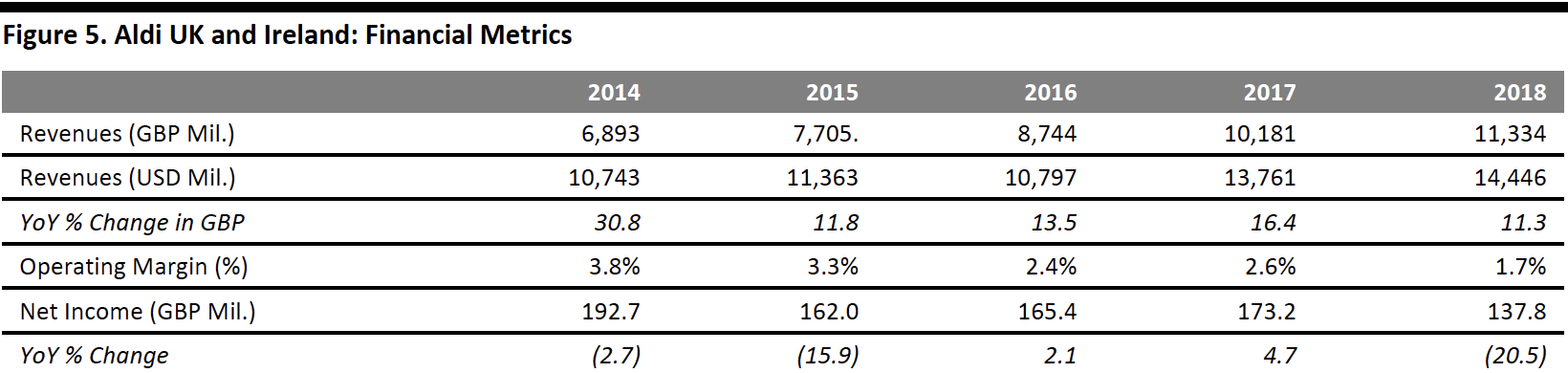

Aldi UK and Ireland is one regional division of these private companies that reports financial metrics.

In 2018 (latest), Aldi UK and Ireland grew revenues 11.3%, but its operating margin dropped 90 bps to 1.7% in a highly competitive grocery market. The sporadic deep declines in net income reveal the impact of large store-opening programs as well as the costs of substantial price investment.

[caption id="attachment_100590" align="aligncenter" width="696"] Source: S&P Capital IQ/Coresight Research[/caption]

Source: S&P Capital IQ/Coresight Research[/caption]

In the year ended February 28, 2019, Lidl owner Schwarz Group reported global revenues of €104 billion ($122 billion), up 7.4% year over year. Lidl’s revenues grew 8.8% to €81 billion ($95 billion). Its sister company Kaufland grew revenues 1.6% to €23 billion ($27 billion).

New Aldi Store Formats: London and Shanghai

Aldi Local, London

When Aldi Local opened on London’s Camden High Street in July 2019, it was the second convenience-store opening in London under the Aldi Local banner. Aldi has operated a small number of convenience stores under the regular Aldi banner for a number of years. The store is considerably smaller than the average Aldi supermarket: a reported 6,400 square feet versus the average of 13,500 square feet for new Aldi UK stores. However, 6,400 square feet is slightly more than twice the size of a typical UK convenience store (in the UK, 3,000 square feet is the upper limit to be able to open all day on Sundays). Its high-street location differs from Aldi’s typical standalone, edge-of-town sites in the UK.

[caption id="attachment_100591" align="aligncenter" width="700"] Aldi Local on London’s Camden High Street

Aldi Local on London’s Camden High StreetSource: Coresight Research[/caption]

Reflecting its format and urban location, Aldi Local features Food To Go and Food For Tonight chillers at the front of the store.

[caption id="attachment_100592" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Aldi supermarkets offer fast-changing “Specialbuys” in general merchandise and apparel. However, Aldi Local offers Specialbuys in food only. These food Specialbuys include a rotating selection of big-name grocery brands and Aldi private labels that are not usually stocked in Aldi Local.

[caption id="attachment_100593" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Aldi UK has traditionally used its wine offering to draw in nontraditional (middle-class) shoppers. Aldi Local uses wood fixtures to feature premium wines.

[caption id="attachment_100594" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Aldi Local features an in-store bakery. Like all Aldi UK stores, bakery is the only fresh food counter/in-store food prep.

[caption id="attachment_100595" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Like all Aldi UK stores, customer-facing technology is minimal. But, unlike most Aldi UK supermarkets, Aldi Local in Camden features self-service checkouts.

[caption id="attachment_100596" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Aldi Local has a substantial fresh-food offering—we estimate 20% of store selling space is devoted to fresh fruit, vegetables, meat and fish.

Like all Aldi UK stores, Aldi Local emphasizes UK provenance for fruit, vegetables, meat and dairy.

[caption id="attachment_100597" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Aldi Local features recurring promotions in fresh food: Super 6 in fruit and vegetables and weekly offers in meat.

[caption id="attachment_100598" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Branded free-standing display units are a common site in regular Aldi supermarkets, reflecting major brand owners’ willingness to tap discount as a distribution channel. Aldi Local features few such units, creating a cleaner shopping experience—though major brands from firms such as Coca-Cola, Colgate-Palmolive, Mars, Mondelez and Unilever feature prominently on shelves.

[caption id="attachment_100599" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Like all Aldi UK stores, Aldi Local features lines from the retailer’s premium Specially Selected private label, in distinctive black packaging, across chilled (e.g., deli) and ambient foods.

[caption id="attachment_100600" align="aligncenter" width="396"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Aldi Shanghai

Aldi opened its first stores in China with two locations in Shanghai, one in Jing’an district and one in Minhang district. The Coresight Research team visited the Jing’an store, located in a downtown mall. The mall is surrounded by offices and apartments, providing solid foot traffic.

The store is smaller than a typical Aldi store elsewhere in the world, at around 6,996-7,535 square feet (650-700 square meters).

The store reportedly stocks around 1,300 SKUs and includes fruits and vegetables, meat and seafood, bean products, frozen food, ready-to-eat and ready-to-cook food, wine and spirits, and a “Super Saver” promotion area.

[caption id="attachment_100601" align="aligncenter" width="400"] Aldi Shanghai

Aldi ShanghaiSource: Coresight Research[/caption]

The store has a more premium look than typical Aldi stores in Europe. For example, lower-level shelving means stock densities (e.g., per square foot) are lower.

[caption id="attachment_100602" align="aligncenter" width="391"] Source: Coresight Research[/caption]

[caption id="attachment_100603" align="aligncenter" width="399"]

Source: Coresight Research[/caption]

[caption id="attachment_100603" align="aligncenter" width="399"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Aldi Shanghai features a substantial number of imported goods that include over 100 products from Aldi Australia. Products imported from Germany feature, too: German products have a reputation for quality among some Chinese shoppers.

Store signage features the strapline “Buy Global, Sell Local.”

[caption id="attachment_100604" align="aligncenter" width="398"] Milk imported from Australia on sale at Aldi Shanghai

Milk imported from Australia on sale at Aldi ShanghaiSource: Coresight Research[/caption]

Aldi Shanghai stocks some major brands, such as Lay's and Cheetos in snacks, Budweiser and Tsingtao in beer, and Maotai and Tian Zhi Lan in spirits.

[caption id="attachment_100605" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

In beers, wines and spirits, both domestic and international products are flagged by origin.

[caption id="attachment_100606" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

The store includes a fresh-food counter serving steamed buns, stuffed buns, sweet potatoes, German sausages and sandwiches.

The store also sells a variety of ready-to-heat mealboxes such as German ham hock with sauerkraut, targeting nearby office workers.

[caption id="attachment_100607" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Aldi Shanghai uses more in-store technology than do Aldi stores in other countries. For example, a welcome screen allows shoppers to access information about Aldi, current promotions and the store.

[caption id="attachment_100608" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

A scan-and-discover screen provides detailed information about Aldi wines.

[caption id="attachment_100609" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Shoppers can also skip the checkout line using the Aldi WeChat mini program.

[caption id="attachment_100610" align="aligncenter" width="403"] Source: Coresight Research[/caption]

[caption id="attachment_100611" align="aligncenter" width="400"]

Source: Coresight Research[/caption]

[caption id="attachment_100611" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Aldi's WeChat mini program also automatically signs up consumers for a digital membership in the Aldi Member Club. Shoppers earn points through purchases or by signing in every day. Points can be redeemed for coupons.

[caption id="attachment_100612" align="aligncenter" width="400"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

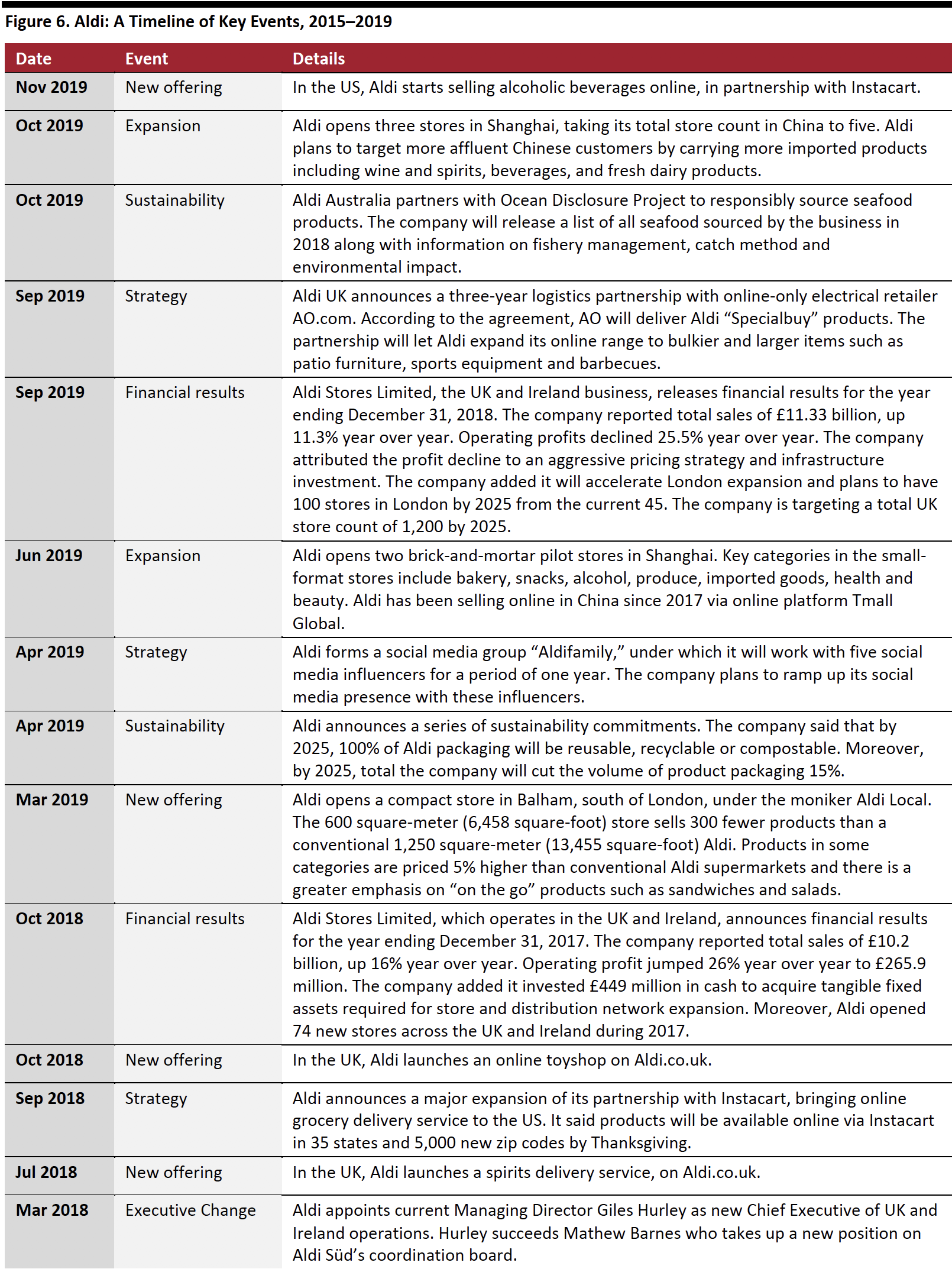

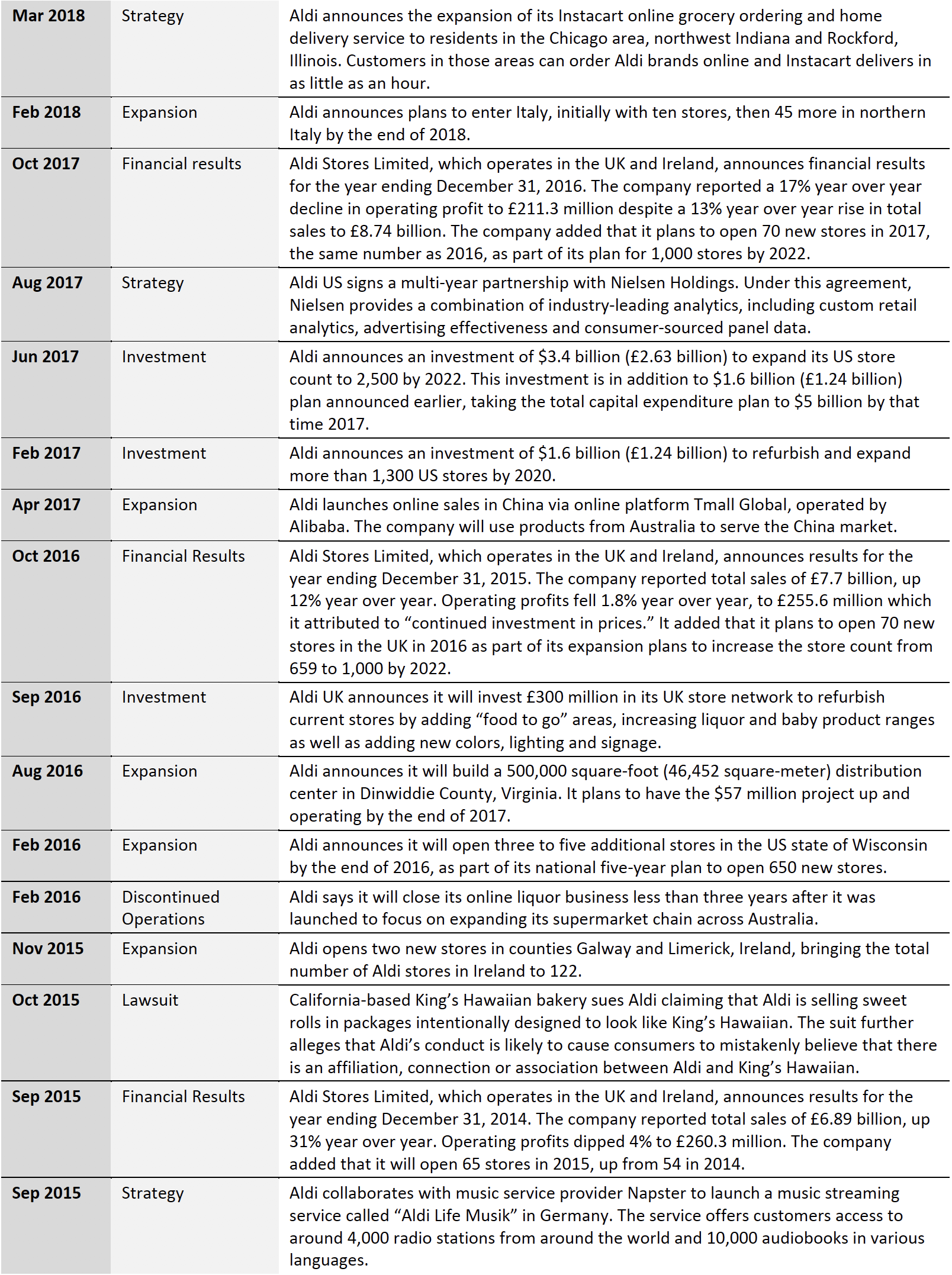

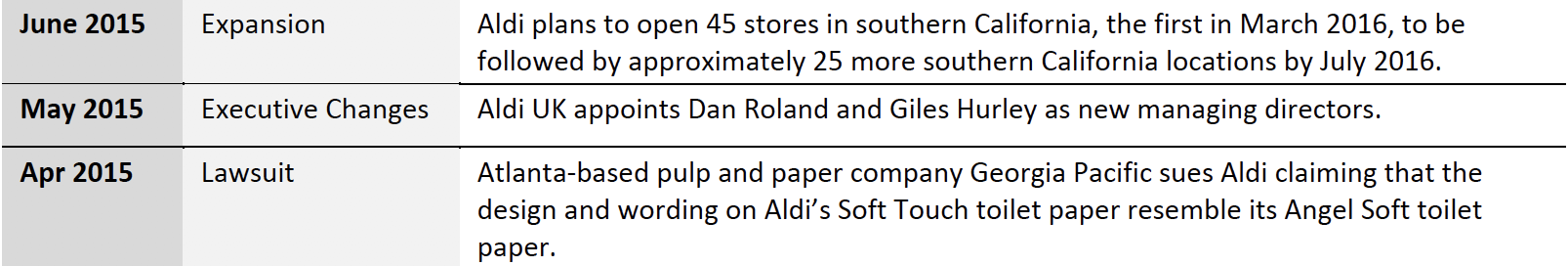

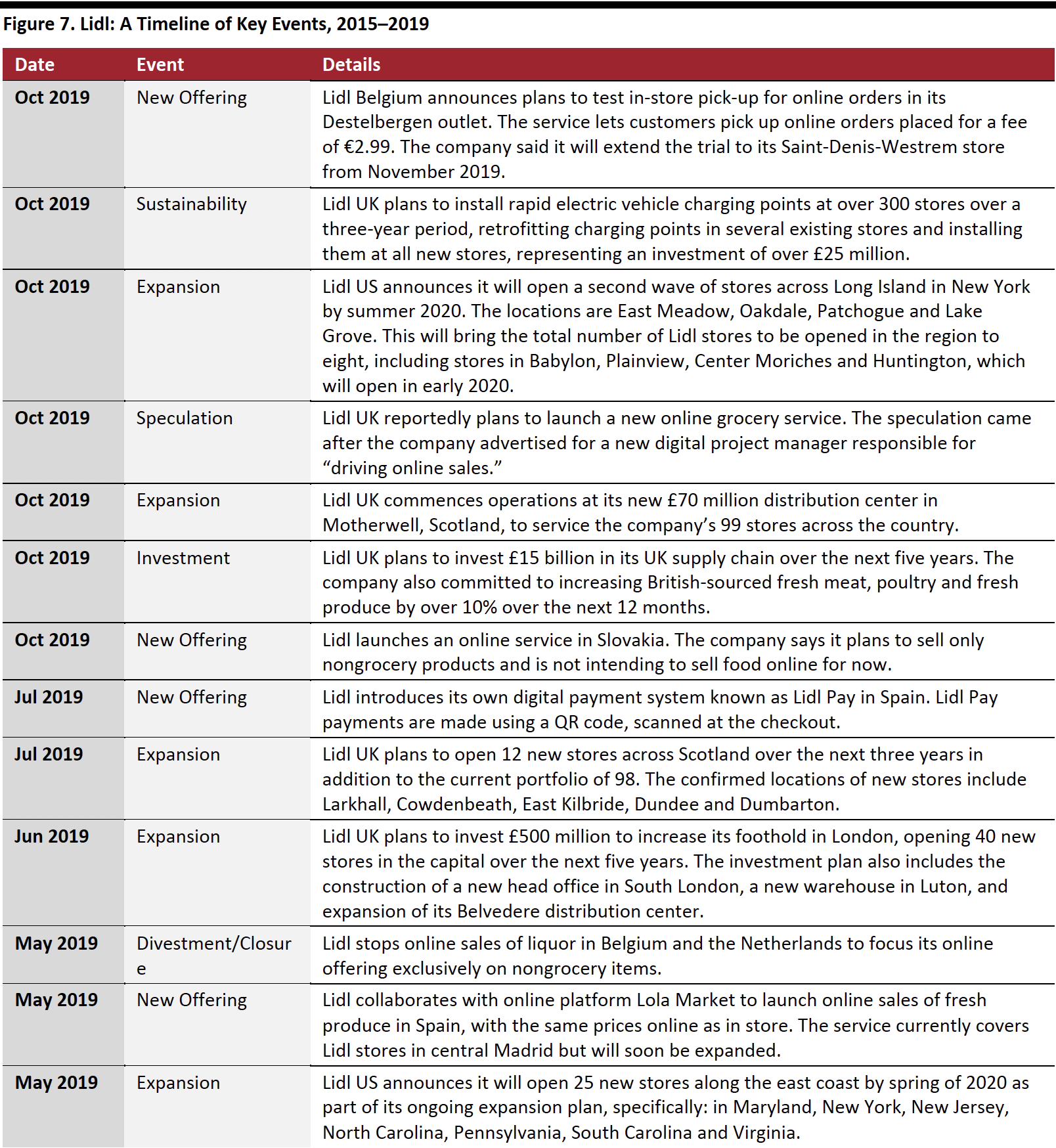

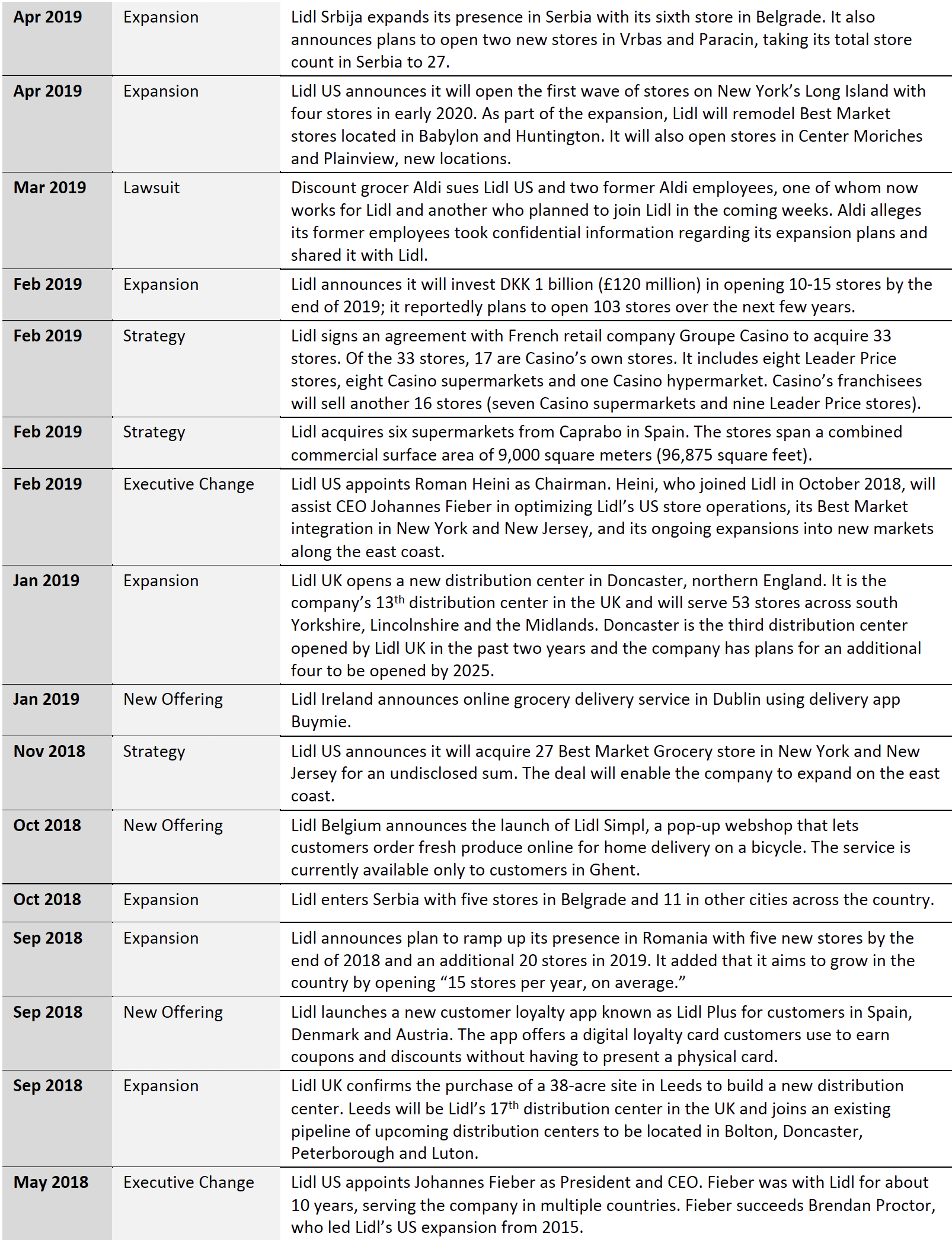

Company Timelines

[caption id="attachment_100615" align="aligncenter" width="699"]

[caption id="attachment_100615" align="aligncenter" width="699"] Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

[caption id="attachment_100618" align="aligncenter" width="700"]

[caption id="attachment_100618" align="aligncenter" width="700"] Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

Source: Company reports/S&P Capital IQ/Coresight Research[/caption]

Source for Euromonitor data: Euromonitor International Limited 2019 © All rights reserved