Nitheesh NH

Albertsons Companies

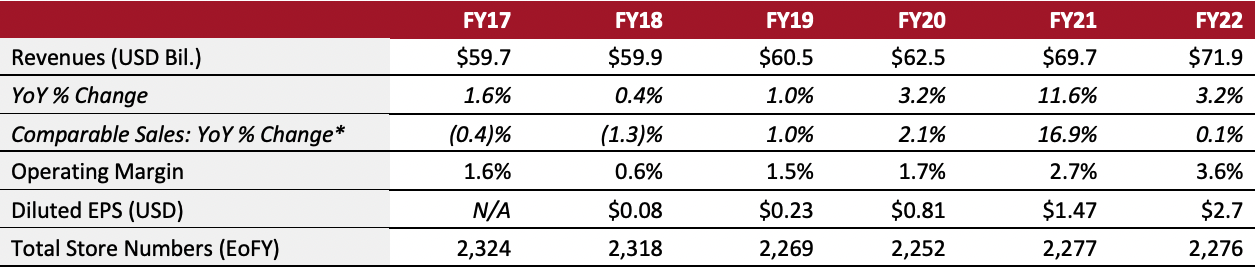

Sector: Food, drug and mass retailers Country of operation: US Key product categories: Fuel, general merchandise, grocery, health and beauty care, and pharmacy Annual Metrics [caption id="attachment_150390" align="aligncenter" width="700"] *Ex. Fuel

*Ex. FuelFiscal year ends close to February 28 of the same calendar year[/caption] Summary Albertsons Companies is a US-based retailer of fuel, general merchandise, grocery, health and beauty care, and pharmaceuticals. The company offers digital and omnichannel services, including Drive Up & Go (DUG) curbside pickup, home deliveries and online prescription refills. As of February 26, 2022, Albertsons Companies operates 2,276 stores across 34 states and the District of Columbia under 21 banners, including Acme, Albertsons Companies, Carrs, Haggen, Jewel-Osco, Market Street, Pavilions, Randalls, Safeway, Shaw’s, Star Market, Tom Thumb, United Supermarkets and Vons. The company also owns New York-based meal-kit company Plated. Company Analysis Coresight Research insight: Albertsons Companies is the second-largest traditional grocer in America by revenue. Its extensive store base and wide array of banners give it both a strong local presence and a national scale. Given that its average banner has operated for over 85 years, many of these stores are in highly desirable locations, which has helped Albertsons Companies quickly implement its DUG e-commerce offering, its fastest-growing sales channel. Additionally, Albertsons Companies is better positioned that its smaller grocery rivals to leverage costs, invest in potential efficiency-boosting initiatives like micro-fulfillment, and analytically drive store assortments and automation. However, Albertsons Companies’ prices are generally perceived to be higher than those of its peers such as Kroger or Walmart, and this positioning threatens to cost the company market share as consumers prioritize value in an inflationary environment.

| Tailwinds | Headwinds |

|

|

- Drive growth through excellence across its store fleet, by providing a compelling fresh and private-label assortments.

- Accelerate e-commerce offerings and step up digital investments.

- Drive productivity by maximizing efficiencies in its supply chain.

- Build talent and culture by attracting top talent and strategically distributing it when necessary.

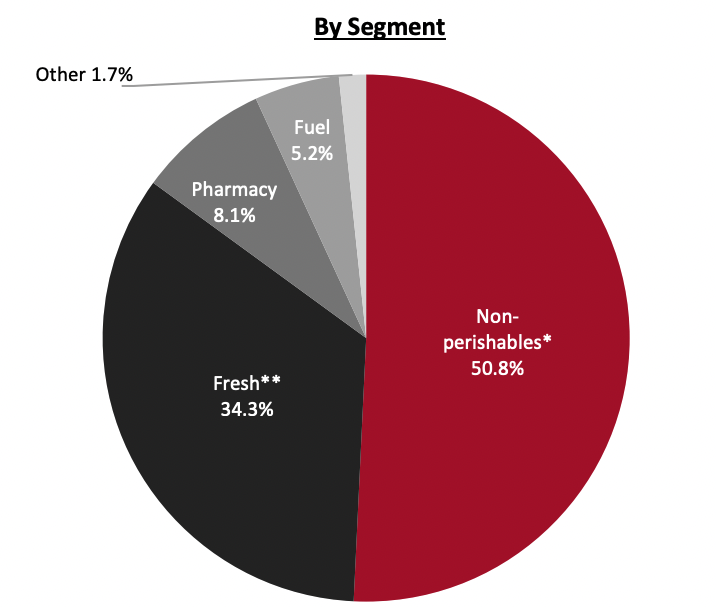

*Includes general merchandise, grocery, dairy and frozen foods.

*Includes general merchandise, grocery, dairy and frozen foods.**Includes produce, meat, deli, floral and seafood[/caption] Company Developments

| Date | Development |

| March 30, 2022 | Albertsons Companies announces that eligible customers can now use supplemental benefits to buy over-the-counter medicines and fresh produce in its stores. |

| February 28, 2022 | Albertsons Companies announces that it has started a board-led strategic review of the company’s existing businesses to enhance growth and maximize shareholder value. |

| November 11, 2021 | Albertsons Companies launches in-house retail media network Albertsons Companies Media Collective. |

| September 28, 2021 | Albertsons Companies partners with cloud-based supply chain software company Procurant for perishables order management. |

| June 21, 2021 | Albertsons Companies partners with last-mile delivery platform Doordash to expand its on-demand grocery delivery service. |

| April 22, 2021 | Albertsons Companies announces the appointment of Danielle Crop as Senior Vice President and Chief Data Officer. |

| March 30, 2021 | Albertsons Companies partners with Google to bring innovative technologies to enhance its omnichannel experience including shoppable maps, AI-powered conversational commerce and a powerful predictive grocery engine. |

| January 7, 2021 | Albertsons Companies launches an automated grocery pickup kiosk at its Jewel-Osco store in Chicago. |

| June 26, 2020 | Albertsons Companies begins trading on the New York Stock Exchange following an initial public offering (IPO), offering 50 million shares of common stock priced at $16 per share, for a total of $800 million—valuing the company at approximately $9.3 billion. It originally planned to offer 65.8 million shares at $18–20 per share, for a total of $1.18–$1.32 billion. |

| May 20, 2020 | Albertsons Companies announces that affiliates managed by Apollo Global Management have agreed to buy $1.75 billion of its convertible stock. After the deal, Apollo will hold approximately 17.5% pro-forma equity ownership of Albertsons Companies on an as-converted basis. |

| May 13, 2020 | Albertsons Companies appoints Dan Dosenbach as the Senior Vice President of Labor Relations. |

| May 6, 2020 | Albertsons Companies teams up with Nuance Communications to deploy Nuance’s virtual assistant and live chat solutions to the retailer’s online grocery platform. |

| March 23, 2020 | Albertsons Companies partners with 17 companies to provide part-time jobs to their furloughed employees. |

| March 20, 2020 | Albertsons Companies announces that it is waiving same-day and next-day delivery fees for prescription drugs, as well as for mail deliveries, until May 1, 2020. |

| March 6, 2020 | Albertsons Companies files a registration statement with the Securities and Exchange Commission for a proposed IPO. |

| December 19, 2019 | Albertsons Companies pharmacies introduces a one-to-two-hour prescription delivery service at selected locations in Louisiana, Texas and the District of Columbia. |

- Vivek Sankaran—CEO

- Sharon McCollam—CFO

- Shane Dorcheus—EVP, Retail Operations

Source: Company reports