DIpil Das

AI Adoption Led by Tech-Retail Hybrids

Adoption of AI in retail is being led by e-commerce firms and particularly by platform giants such as Amazon, Alibaba Group and JD.com, whose AI capabilities are strengthened by their status as tech companies as well as retailers. Perhaps not coincidentally, these companies are establishing dominant or near-dominant shares in e-commerce.

To compete against these giants, more and more store-based retailers are embracing some of the technologies that the platforms deploy. Coresight Research data, collated for the second of our Artificial Intelligence in Retail reports, found that major retailers are deploying AI in substantial numbers across multiple functions: Our analysis of 30 large retailers found the technology was being deployed most in the supply chain, as well as for in-store and e-commerce functions.

[caption id="attachment_88519" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

The CORE Framework

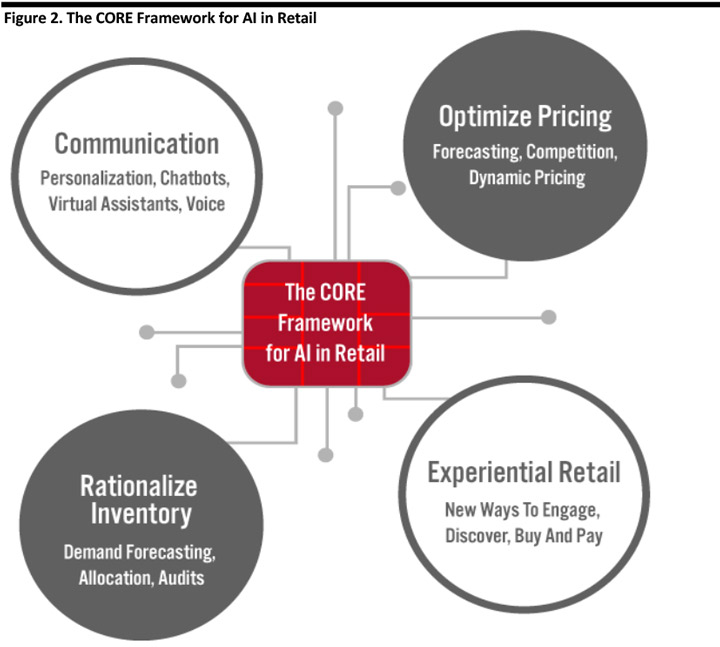

For those retailers that have deployed AI to a limited extent, and those that are yet to introduce AI to their operations, our proprietary CORE framework highlights the potential application of AI in four areas of retail. We show these in the four quadrants below and discuss them further in the subsequent sections of this report.

[caption id="attachment_88520" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

The CORE Framework

For those retailers that have deployed AI to a limited extent, and those that are yet to introduce AI to their operations, our proprietary CORE framework highlights the potential application of AI in four areas of retail. We show these in the four quadrants below and discuss them further in the subsequent sections of this report.

[caption id="attachment_88520" align="aligncenter" width="720"] Source: Coresight Research[/caption]

Communication

More and more, offering a personalized online experience is becoming a must: best-in-class retailers are already personalizing homepages, emails and apps, and this help shoppers to navigate the near-endless choice of products available online. We see the ongoing growth in browsing and shopping on mobile devices adding greater urgency to the demand for personalization, for two reasons:

Source: Coresight Research[/caption]

Communication

More and more, offering a personalized online experience is becoming a must: best-in-class retailers are already personalizing homepages, emails and apps, and this help shoppers to navigate the near-endless choice of products available online. We see the ongoing growth in browsing and shopping on mobile devices adding greater urgency to the demand for personalization, for two reasons:

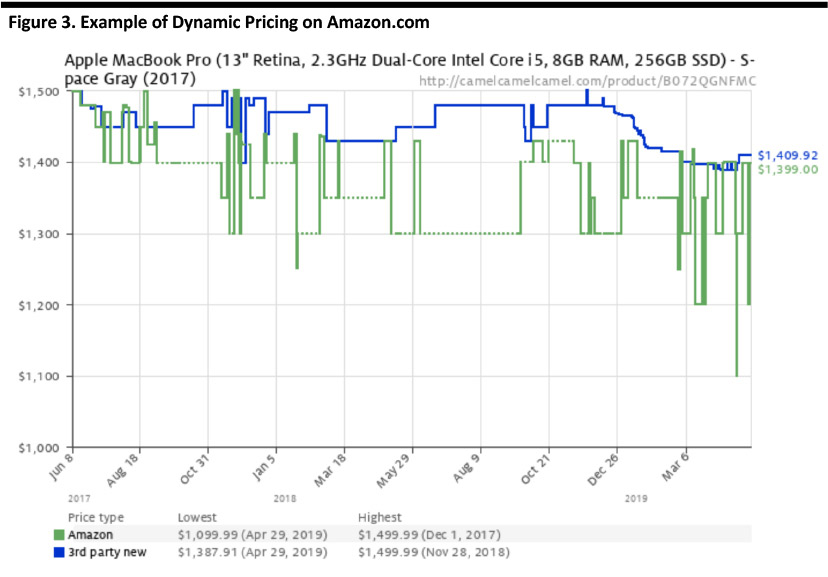

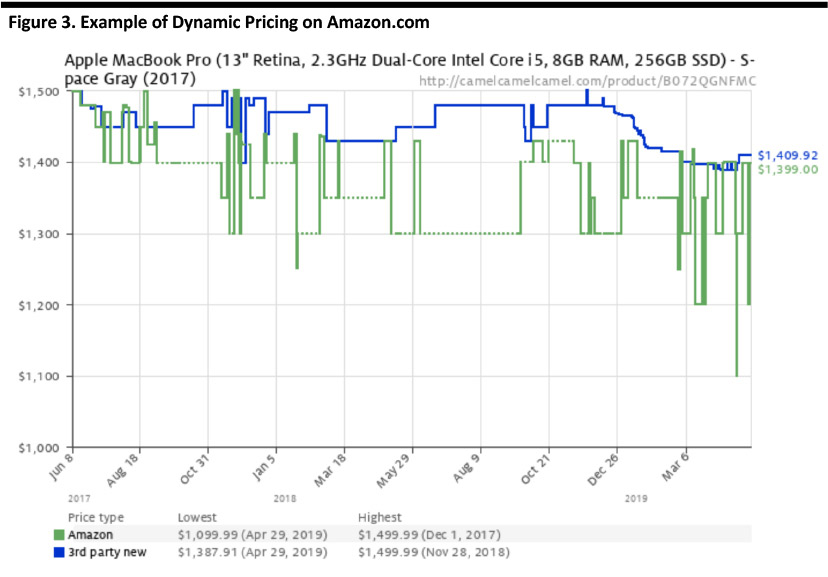

Source: CamelCamelCamel/Amazon[/caption]

AI vendors can provide retailers with price-optimization services that include:

Source: CamelCamelCamel/Amazon[/caption]

AI vendors can provide retailers with price-optimization services that include:

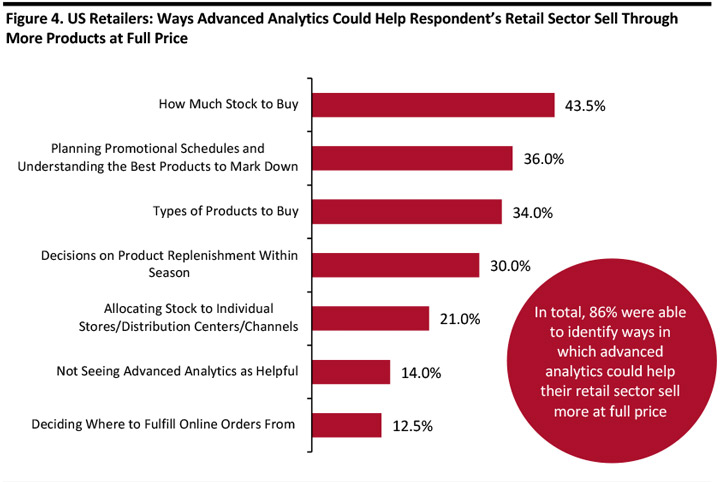

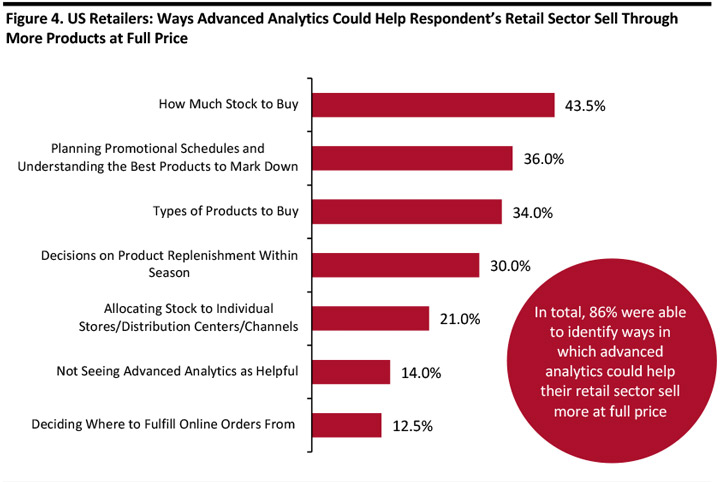

Survey question summary: In which three, if any, of the following ways do you think advanced analytics tools would most benefit your retail sector with selling through products at full price?

Survey question summary: In which three, if any, of the following ways do you think advanced analytics tools would most benefit your retail sector with selling through products at full price?

Source: Celect/Coresight Research [/caption] Experiential Retail As more and more shopping switches to e-commerce, and to that channel’s functional retailers such as Amazon, Tmall and JD.com, store-based rivals across both discretionary and nondiscretionary retail must offer better in-store experiences; they must drive out friction from the shopping process, deepen engagement with their customers and close the information gap that exists between e-commerce and physical stores. In doing so, retailers stand better placed to delight their shoppers, drive more traffic to their stores and, crucially, sell more effectively. AI offers opportunities to enhance the store experience in a number of ways. Retailers can:

Source: Company reports/Coresight Research[/caption]

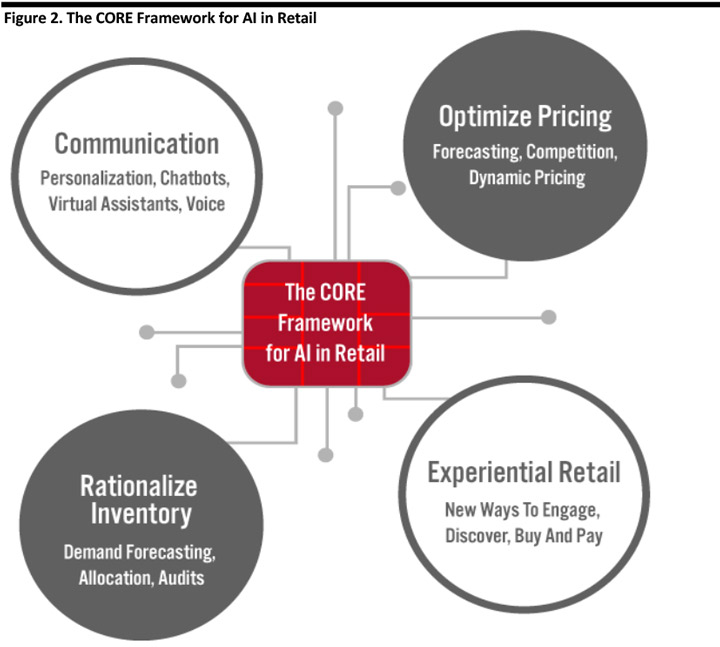

The CORE Framework

For those retailers that have deployed AI to a limited extent, and those that are yet to introduce AI to their operations, our proprietary CORE framework highlights the potential application of AI in four areas of retail. We show these in the four quadrants below and discuss them further in the subsequent sections of this report.

[caption id="attachment_88520" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

The CORE Framework

For those retailers that have deployed AI to a limited extent, and those that are yet to introduce AI to their operations, our proprietary CORE framework highlights the potential application of AI in four areas of retail. We show these in the four quadrants below and discuss them further in the subsequent sections of this report.

[caption id="attachment_88520" align="aligncenter" width="720"] Source: Coresight Research[/caption]

Communication

More and more, offering a personalized online experience is becoming a must: best-in-class retailers are already personalizing homepages, emails and apps, and this help shoppers to navigate the near-endless choice of products available online. We see the ongoing growth in browsing and shopping on mobile devices adding greater urgency to the demand for personalization, for two reasons:

Source: Coresight Research[/caption]

Communication

More and more, offering a personalized online experience is becoming a must: best-in-class retailers are already personalizing homepages, emails and apps, and this help shoppers to navigate the near-endless choice of products available online. We see the ongoing growth in browsing and shopping on mobile devices adding greater urgency to the demand for personalization, for two reasons:

- First, mobile sees low conversion rates, so retailers must work harder to convert a visitor to a customer.

- Second, small screens limit browsing of products, so shoppers see fewer products on each visit, compared to when they use a laptop or desktop computer.

- Generate millions of personalized homepage and email variations and personalize in-app experiences.

- Test alternative options for website design based on the conversion rate generated by each variant.

- Adjust what products are displayed in real time, based on individual consumer behavior.

- Aggregate data on buying habits, lifestyles and preferences to form a single view of each customer. The experience can be personalized using data from inside and outside the business.

- AI voice assistants such as Amazon Echo and Google Home are moving AI-powered consumer engagement from text to voice. As shown in Figure 1, more than half of 30 major retailers we reviewed are already using voice to reach shoppers. However, voice also sees the retailer-customer relationship disrupted, as tech giants manage the interactions—shoppers speak to Alexa or Google instead of to the retailer.

- Chatbots are well established, with many retailers using them to answer customer queries, and some are going beyond offering basic responses to detect users’ moods based on the words they use and the tone of their messages—enabling personalization in tone as well as content. Our analysis of 30 major retailers found half are using chatbots (see Figure 1).

- Personal shopping apps allow shoppers to send virtual assistants on “missions” to search out a specific product or seek out the best price online.

Source: CamelCamelCamel/Amazon[/caption]

AI vendors can provide retailers with price-optimization services that include:

Source: CamelCamelCamel/Amazon[/caption]

AI vendors can provide retailers with price-optimization services that include:

- Automated price decisions for each product, by channel, drawing on market conditions and details such as sales, promotions, weather and events.

- Real-time monitoring of localized market conditions and in-store metrics, translated into recommended actions that help retailers offer products at optimal price points.

- Optimal entry price points for newly launched products that have no sales history.

- Offering retailers prescriptive plan, buy, allocation and fulfillment recommendations.

- Automating store replenishment to reduce out-of-stock rates.

- Recommending actions to adjust the buy or reallocate by pairing under-allocated stores to over-allocated stores, based on real-time sales data.

- Providing an overview of consumer demand and market supply using data across social influencer buzz, online product searches, consumer shopping patterns and SKU data.

- Powering robots that undertake in-store shelf audits based on visual recognition.

- Formulating planograms to ensure that items are displayed optimally, including with other items that can be cross-promoted.

Survey question summary: In which three, if any, of the following ways do you think advanced analytics tools would most benefit your retail sector with selling through products at full price?

Survey question summary: In which three, if any, of the following ways do you think advanced analytics tools would most benefit your retail sector with selling through products at full price? Source: Celect/Coresight Research [/caption] Experiential Retail As more and more shopping switches to e-commerce, and to that channel’s functional retailers such as Amazon, Tmall and JD.com, store-based rivals across both discretionary and nondiscretionary retail must offer better in-store experiences; they must drive out friction from the shopping process, deepen engagement with their customers and close the information gap that exists between e-commerce and physical stores. In doing so, retailers stand better placed to delight their shoppers, drive more traffic to their stores and, crucially, sell more effectively. AI offers opportunities to enhance the store experience in a number of ways. Retailers can:

- Engage shoppers with online assistance and recommendations, as well as in-store robot advisors.

- Use facial recognition to flag “VIP” shoppers to store associates, provide personalized, tailored in-store experiences, and authenticate payments.

- Help shoppers discover products, through visual search, shoppable video, magic mirrors and personalized advice on everything from skincare to fashion.

- Make it simpler to buy, with automated, checkout-free stores. This is one of the more nascent uses of AI: As we showed in Figure 1, only 13% of 30 major retailers are using AI to operate cashier-free stores or other online-to-offline (O2O) store formats.